Europe Animal Feed Additives Market Outlook to 2030

Region:Europe

Author(s):Shreya

Product Code:KROD11332

November 2024

93

About the Report

Europe Animal Feed Additives Market Overview

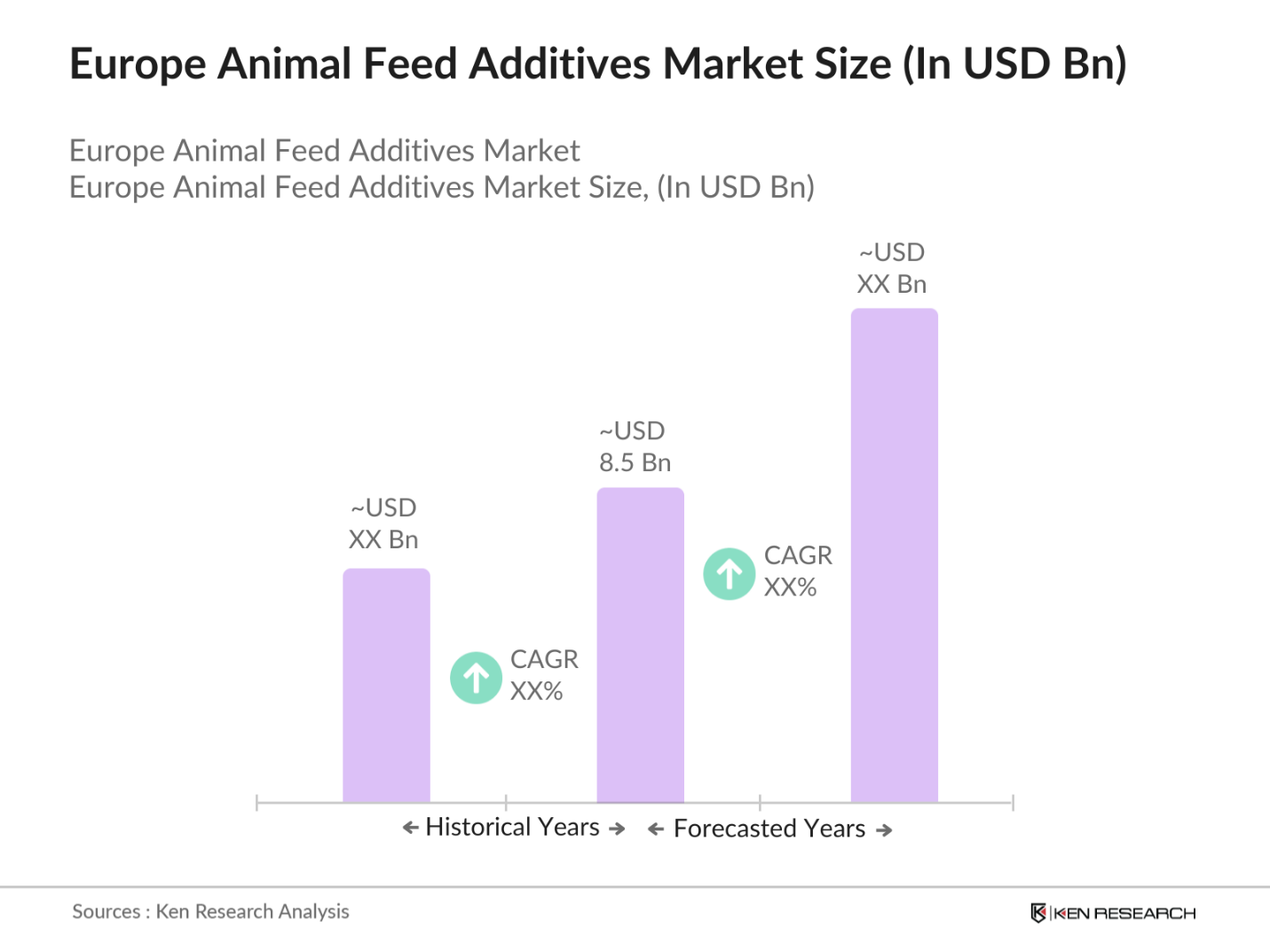

The Europe animal feed additives market is valued at USD 8.5 billion, driven by the increasing demand for high-quality animal products and the need to enhance livestock health and productivity. The rising consumption of meat and dairy products, coupled with stringent regulations on animal nutrition, has led to a surge in the adoption of feed additives to improve feed efficiency and animal performance.

Germany, France, and the United Kingdom are dominant players in the European animal feed additives market. Germany's leadership is attributed to its advanced livestock farming practices and significant investments in animal nutrition research. France's dominance stems from its large-scale poultry and swine industries, while the UK's market strength is due to its stringent animal welfare regulations and high consumer demand for quality meat products.

The European Union's Regulation (EC) No 1831/2003 establishes a comprehensive framework for the authorization, marketing, and use of feed additives within member states. This regulation mandates a thorough evaluation of additives to ensure they are safe for animals, consumers, and the environment. The European Food Safety Authority (EFSA) plays a pivotal role in assessing these additives, providing scientific opinions that inform regulatory decisions. As of April 2023, the European Commission has implemented an online version of the EU Register of Feed Additives, enhancing transparency and accessibility for stakeholders.

Europe Animal Feed Additives Market Segmentation

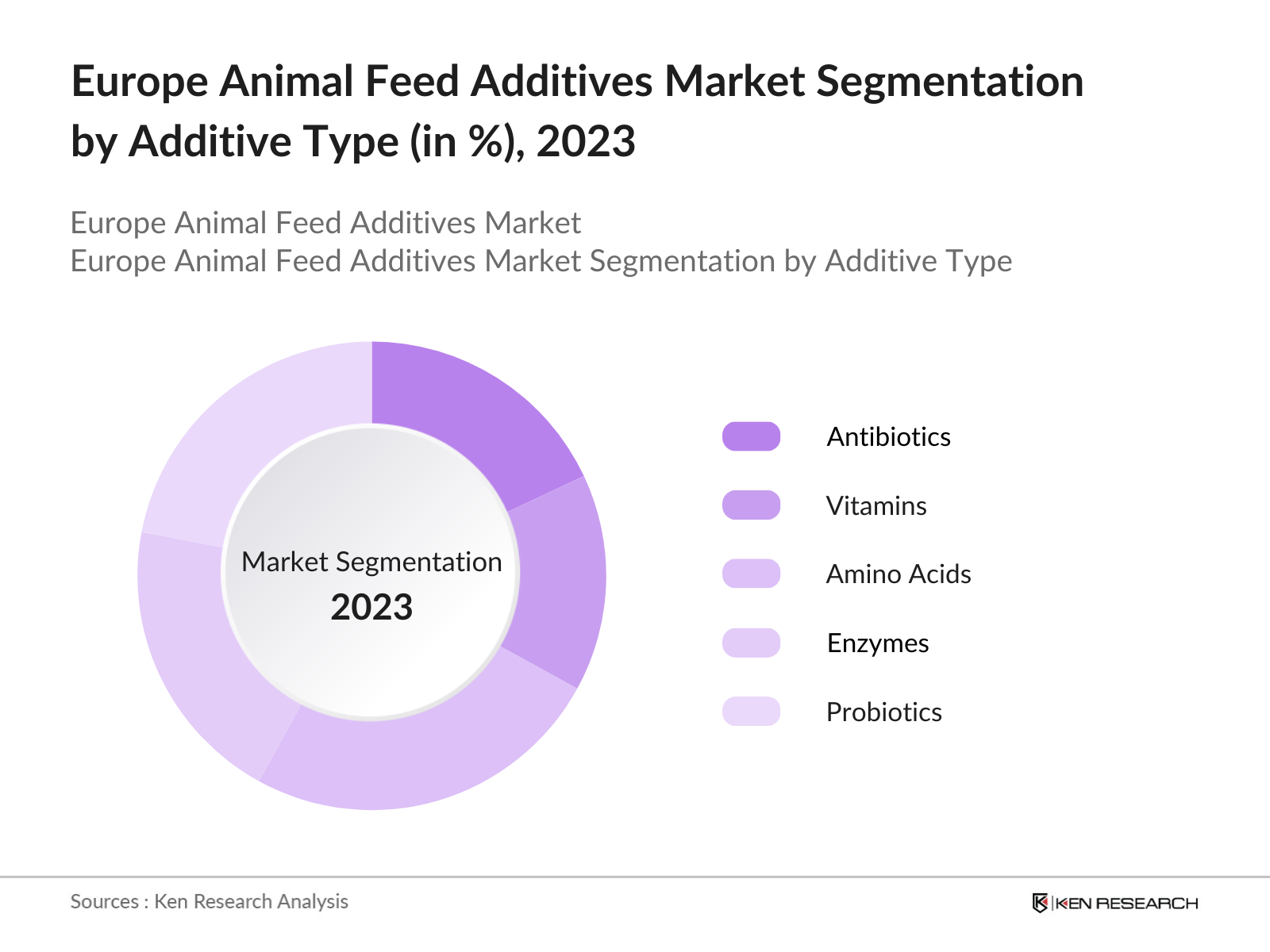

By Additive Type: The market is segmented by additive type into antibiotics, vitamins, antioxidants, amino acids, enzymes, acidifiers, mycotoxin detoxifiers, prebiotics, probiotics, flavors and sweeteners, pigments, binders, minerals, and emulsifiers. Amino acids hold a dominant market share due to their essential role in protein synthesis and overall animal growth. The inclusion of amino acids in feed formulations enhances feed efficiency and supports optimal animal health, making them indispensable in modern livestock nutrition.

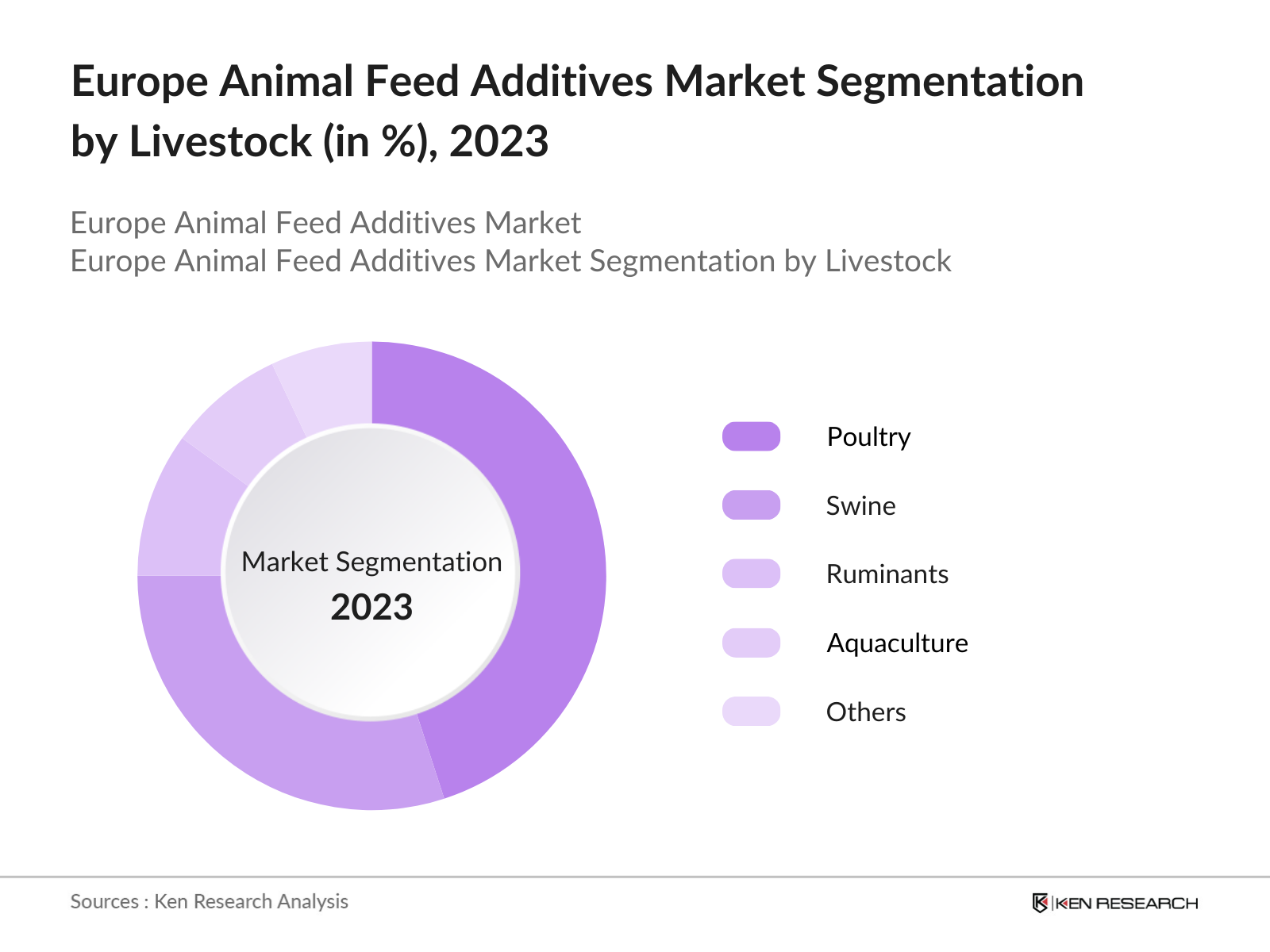

By Livestock: The market is also segmented by livestock into poultry, swine, ruminants, aquaculture, and others. The poultry segment dominates the market, driven by the high consumption of poultry products and the intensive nature of poultry farming. Feed additives are crucial in poultry diets to ensure rapid growth rates, improve feed conversion ratios, and maintain health, thereby meeting the increasing consumer demand for poultry meat and eggs.

Europe Animal Feed Additives Market Competitive Landscape

The Europe animal feed additives market is characterized by the presence of several key players who contribute to its competitive dynamics. These companies are engaged in continuous research and development to introduce innovative products and expand their market presence.

Europe Animal Feed Additives Industry Analysis

Growth Drivers

Increasing Livestock Production: The global livestock sector has experienced significant growth, with the World Bank reporting that livestock production accounts for approximately 40% of the global agricultural output. In 2022, the livestock production index (2014-2016 = 100) for the United States was recorded at 101.5, indicating a steady increase in production levels. This expansion is driven by rising consumer demand for meat and dairy products, particularly in developing countries where income growth is leading to dietary shifts. For instance, Tanzania's cattle population reached 36.6 million, making it the second-largest in Africa, highlighting the region's growing livestock industry.

Rising Demand for Quality Meat and Dairy Products: As global populations grow and urbanize, there is an increasing demand for high-quality meat and dairy products. The World Bank's Food Security Update from October 2024 notes that food price inflation has exceeded overall inflation in 58.9% of 168 countries, underscoring the heightened demand and value placed on food products, including meat and dairy. This surge in demand necessitates enhanced livestock production practices, including the use of effective feed additives to ensure product quality and safety.

Technological Advancements in Feed Additives: The feed additives industry has seen notable technological advancements aimed at improving animal health and productivity. Innovations include the development of phytogenic feed additives derived from herbs and spices, which serve as natural growth promoters. These additives have been shown to enhance feed efficiency and support animal health, offering sustainable alternatives to traditional antibiotics.

Market Challenges

Regulatory Compliance Issues: Navigating the complex regulatory landscape for feed additives poses challenges for manufacturers. The European Food Safety Authority (EFSA) provides detailed guidance on the assessment of feed additives, including safety evaluations for target species, consumers, and the environment. Ensuring compliance with such stringent regulations requires significant investment in research and development, as well as thorough documentation, which can be resource-intensive.

Fluctuating Raw Material Prices: The feed additives industry is susceptible to fluctuations in raw material prices, which can affect production costs and profitability. The World Bank's report on raw material commodity prices indicates that the Agriculture Raw Material Price Index increased marginally in January 2024, following a 1% decline in the fourth quarter of 2023. Such volatility necessitates strategic sourcing and cost management to maintain market stability.

Europe Animal Feed Additives Market Future Outlook

Over the next five years, the Europe animal feed additives market is expected to experience significant growth. This expansion will be driven by increasing consumer awareness regarding animal health, advancements in feed additive technologies, and the implementation of stringent regulations aimed at ensuring food safety and quality. The shift towards natural and organic feed additives is also anticipated to create new opportunities for market players.

Future Market Opportunities

Expansion into Emerging Markets: Emerging markets present significant growth opportunities for the feed additives industry. For instance, Tanzania's livestock sector, with its substantial cattle population, offers potential for increased adoption of feed additives to enhance productivity and meet rising domestic and regional demand. Investing in these markets can lead to substantial returns as livestock production scales up to meet consumer needs.

Strategic Collaborations and Partnerships: Collaborations between feed additive manufacturers, research institutions, and livestock producers can lead to innovative solutions and expanded market reach. Such partnerships facilitate the sharing of knowledge and resources, driving advancements in feed additive technologies and their application in livestock production. This collaborative approach can enhance product development and market penetration, benefiting all stakeholders involved.

Scope of the Report

|

Segment |

Sub-segments |

|---|---|

|

Additive Type |

Antibiotics |

|

Livestock |

Poultry |

|

Form |

Dry |

|

Source |

Natural |

|

Country |

Germany |

Products

Key Target Audience

Livestock Farmers

Animal Nutritionists

Feed Manufacturers

Veterinary Clinics

Government and Regulatory Bodies (e.g., European Food Safety Authority)

Research and Development Institutes

Investors and Venture Capitalist Firms

Agricultural Cooperatives

Companies

Major Players

Cargill, Incorporated

Archer Daniels Midland Company

BASF SE

Evonik Industries AG

Nutreco N.V.

Alltech, Inc.

Kemin Industries, Inc.

Novozymes A/S

DSM Nutritional Products AG

DuPont de Nemours, Inc.

Phibro Animal Health Corporation

Lallemand Inc.

Adisseo France SAS

Sumitomo Chemical Company, Limited

Elanco Animal Health Incorporated

Table of Contents

Market Overview

Definition and Scope

Market Taxonomy

Market Growth Rate

Market Segmentation Overview

Market Size (In USD Billion)

Historical Market Size

Year-On-Year Growth Analysis

Key Market Developments and Milestones

Market Analysis

Growth Drivers

Increasing Livestock Production

Rising Demand for Quality Meat and Dairy Products

Technological Advancements in Feed Additives

Stringent Animal Health Regulations

Market Challenges

High Cost of Additives

Regulatory Compliance Issues

Fluctuating Raw Material Prices

Opportunities

Expansion into Emerging Markets

Development of Natural and Organic Additives

Strategic Collaborations and Partnerships

Trends

Shift Towards Probiotics and Prebiotics

Adoption of Sustainable Feed Practices

Integration of Digital Technologies in Feed Management

Government Regulations

European Union Feed Additives Regulation

National Animal Feed Laws

Import and Export Policies

Compliance and Certification Requirements

SWOT Analysis

Stakeholder Ecosystem

Porters Five Forces Analysis

Competitive Landscape

Market Segmentation

By Additive Type (In Value %)

Antibiotics

Vitamins

Antioxidants

Amino Acids

Enzymes

Acidifiers

Mycotoxin Detoxifiers

Prebiotics

Probiotics

Flavors and Sweeteners

Pigments

Binders

Minerals

Emulsifiers

By Livestock (In Value %)

Poultry

Swine

Ruminants

Aquaculture

Others

By Form (In Value %)

Dry

Liquid

By Source (In Value %)

Natural

Synthetic

By Country (In Value %)

Germany

United Kingdom

France

Spain

Italy

Russia

Rest of Europe

Competitive Analysis

Detailed Profiles of Major Companies

Cargill, Incorporated

Archer Daniels Midland Company

BASF SE

Evonik Industries AG

Nutreco N.V.

Alltech, Inc.

Kemin Industries, Inc.

Novozymes A/S

DSM Nutritional Products AG

DuPont de Nemours, Inc.

Phibro Animal Health Corporation

Lallemand Inc.

Adisseo France SAS

Sumitomo Chemical Company, Limited

Elanco Animal Health Incorporated

Cross Comparison Parameters

Number of Employees

Headquarters Location

Year of Establishment

Annual Revenue

Product Portfolio

Market Share

Recent Developments

Strategic Initiatives

Market Share Analysis

Strategic Initiatives

Mergers and Acquisitions

Investment Analysis

Venture Capital Funding

Government Grants

Private Equity Investments

Regulatory Framework

European Food Safety Authority (EFSA) Guidelines

Registration and Approval Processes

Labeling and Packaging Regulations

Compliance and Monitoring Mechanisms

Future Market Size (In USD Billion)

Future Market Size Projections

Key Factors Driving Future Market Growth

Future Market Segmentation

By Additive Type (In Value %)

By Livestock (In Value %)

By Form (In Value %)

By Source (In Value %)

By Country (In Value %)

Analysts Recommendations

Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

Customer Segmentation and Targeting Strategies

Marketing and Branding Initiatives

Identification of Untapped Market Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Europe animal feed additives market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Europe animal feed additives market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple feed additive manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Europe animal feed additives market.

Frequently Asked Questions

How big is the Europe animal feed additives market?

The Europe animal feed additives market is valued at USD 8.5 billion, driven by the increasing demand for high-quality animal products and the need to enhance livestock health and productivity.

What are the challenges in the Europe animal feed additives market?

Challenges in the Europe animal feed additives market include high costs of additives, regulatory compliance issues, and fluctuating raw material prices. Additionally, the growing consumer preference for natural and organic products poses a challenge for synthetic additive manufacturers.

Who are the major players in the Europe animal feed additives market?

Key players in the Europe animal feed additives market include Cargill, Incorporated; Archer Daniels Midland Company; BASF SE; Evonik Industries AG; and Nutreco N.V. These companies dominate the market due to their extensive product portfolios, advanced research capabilities, and strong distribution networks across Europe.

What are the growth drivers of the Europe animal feed additives market?

The Europe animal feed additives market is propelled by increasing livestock production, the rising demand for high-quality meat and dairy products, and stringent regulations on animal health and nutrition. Additionally, advancements in feed additive formulations and a growing emphasis on animal welfare are boosting market demand.

What are the emerging trends in the Europe animal feed additives market?

Emerging trends in the Europe animal feed additives market include the shift towards natural and organic feed additives, the increasing adoption of sustainable feed practices, and the integration of digital technologies for precision feeding. These trends align with the broader movement towards sustainable agriculture in Europe, driven by consumer demand and regulatory pressures.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.