Europe Auto Finance Market Outlook to 2030

Region:Europe

Author(s):Shubham Kashyap

Product Code:KROD9332

December 2024

86

About the Report

Europe Auto Finance Market Overview

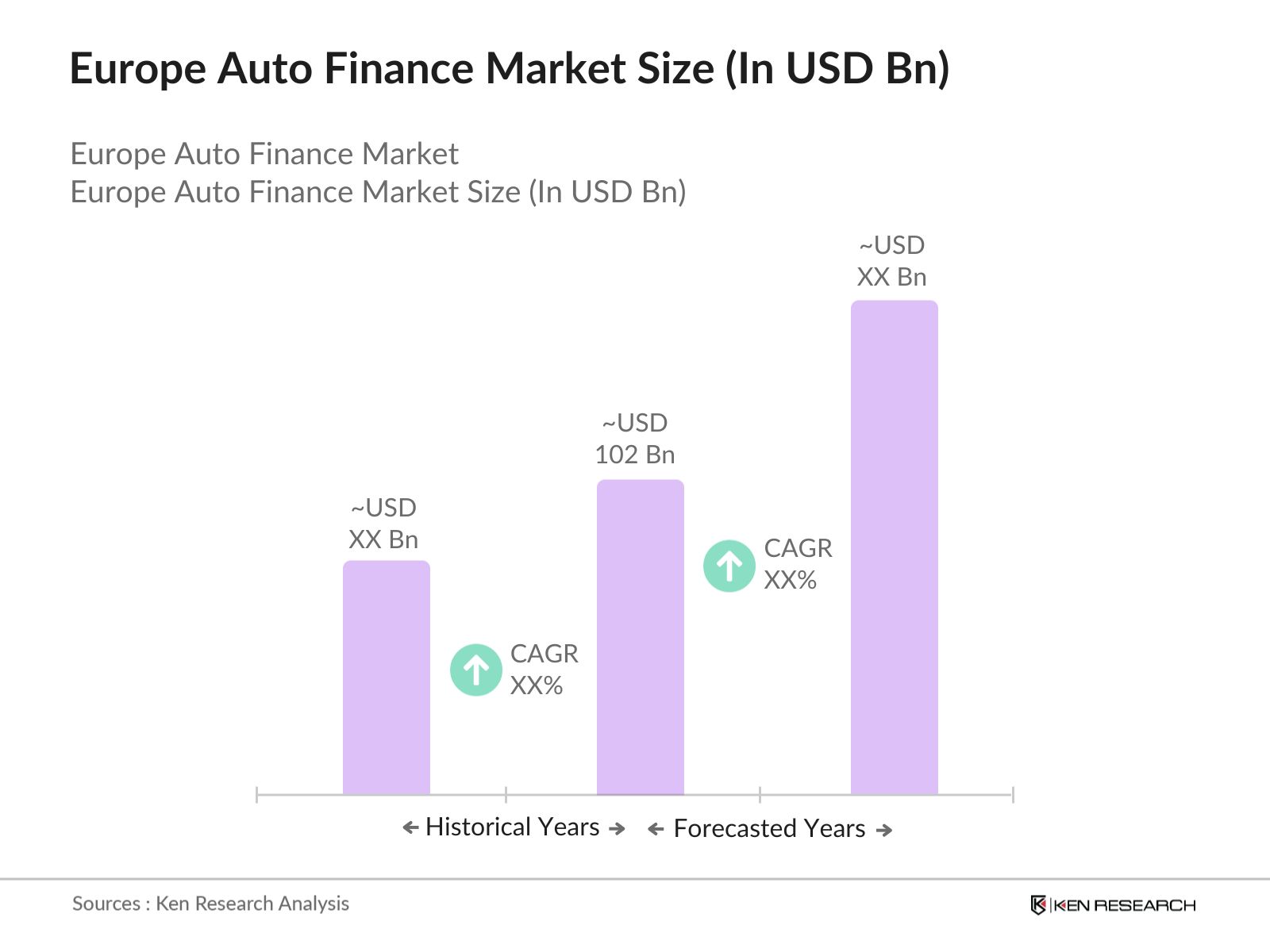

- The Europe auto finance market is experiencing substantial growth reaching a market size of USD 102 Bn, primarily driven by the rising trend in vehicle ownership, a robust used car market, and increasing adoption of digital lending solutions. The expansion of electric vehicles (EVs) further boosts the demand for flexible financing options tailored to meet evolving consumer needs in both new and used car segments. As the market matures, financial institutions, nonbanking financial companies (NBFCs), and auto manufacturers captive finance arms are playing significant roles in providing a range of financing solutions to meet diverse consumer and business requirements.

- Key regions, including Germany, France, and the United Kingdom, lead the market, benefiting from high vehicle ownership rates and wellestablished financial infrastructure. These countries exhibit strong demand for personal and business vehicle financing due to rising disposable incomes and favorable regulatory environments. For instance, Germanys robust automotive industry, coupled with advanced financing options, drives its dominance, while the U.K.'s digital financing innovations have fueled significant growth in online auto finance applications.

- The European Union's stringent emission standards, requiring automakers to limit average emissions, impact auto financing by influencing vehicle costs. Compliance costs passed onto consumers increase financing needs, as seen with electric vehicles where upfront costs are offset by financing. This regulation supports the financing industry as consumers increasingly turn to loans to afford cleaner vehicles.

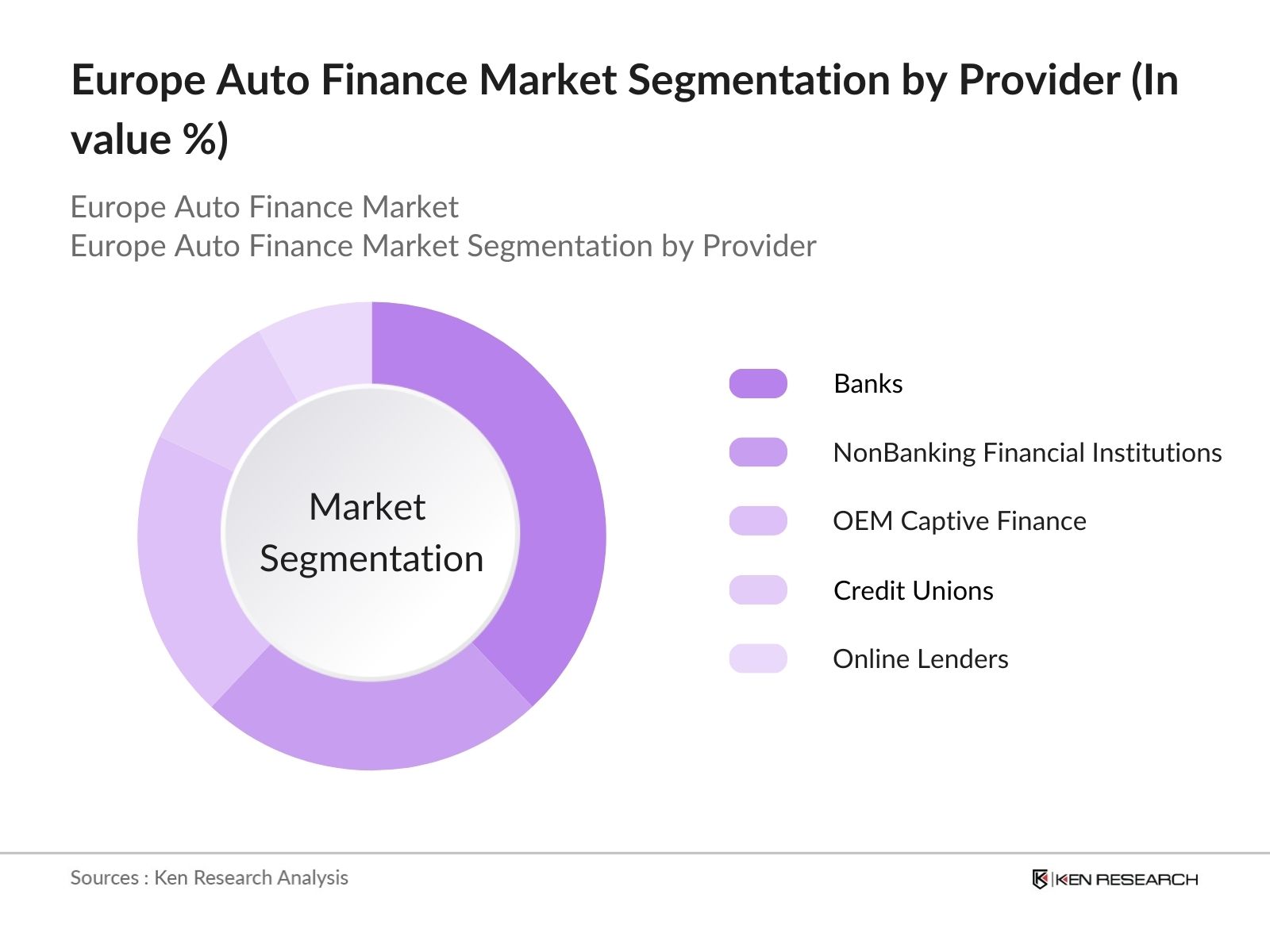

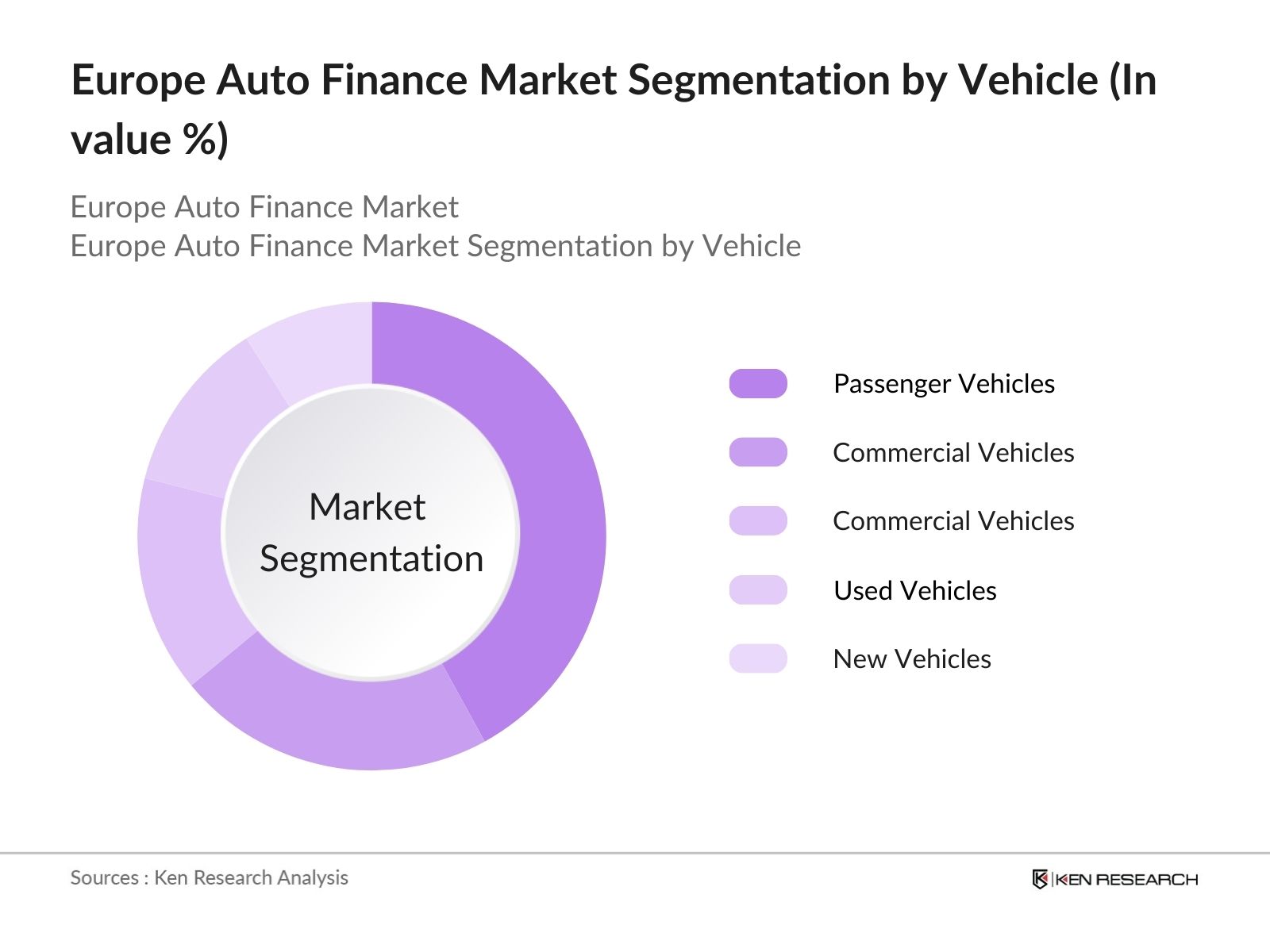

Europe Auto Finance Market Segmentation

- By Provider Type: The market is segmented by provider type into banks, nonbanking financial institutions (NBFIs), OEM captive finance, credit unions, and online lenders. Banks dominate this segment due to their extensive branch networks, trust in traditional financial institutions, and the ability to offer competitive interest rates through economies of scale. This dominance is further reinforced by banks partnerships with car dealerships, allowing them to streamline loan approval processes and offer lowinterest rates. The rise of online lenders and fintech companies is increasingly significant, particularly for younger demographics that value convenience and digital accessibility.

- By Vehicle Type: The market is further segmented by vehicle type into passenger vehicles, commercial vehicles, electric vehicles, used vehicles, and new vehicles. Passenger vehicles hold the majority market share, attributed to high demand for personal transportation and the increasing trend of vehicle ownership in Europe. Within this segment, financing for used vehicles is experiencing rapid growth due to the affordability and quality of preowned cars available in the market. The rise of electric vehicles is also driving demand, as many financing institutions introduce ecofriendly financing solutions to support EV purchases in alignment with Europes sustainability goals.

Europe Auto Finance Market Competitive Landscape

The Europe auto finance market is competitive, with several key players holding significant market shares. Traditional banks, OEM captive finance providers, and emerging fintech platforms contribute to a dynamic competitive environment. Established players leverage their vast customer bases, brand reputation, and comprehensive financing products, while fintech entrants drive innovation with streamlined digital solutions tailored to techsavvy consumers. Major companies in the sector have established partnerships with automotive manufacturers to provide endtoend financing solutions, further strengthening their market positions.

Europe Auto Finance Market Analysis

Growth Drivers

- Increasing Vehicle Ownership Rates: Vehicle ownership in Europe has been steadily increasing, with over 260 million vehicles registered as of 2024. According to the European Automobile Manufacturers Association (ACEA), this upward trend is fueled by economic recovery and rising consumer confidence, leading to increased loan demand for vehicle financing. In key markets like Germany, the number of vehicles per capita stands at 0.58, indicating high penetration, while in France, 39 million registered vehicles reflect a robust market for auto finance. These trends support the growth in auto finance options as more individuals seek financial products tailored to vehicle acquisition.

- Expansion of Electric Vehicle (EV) Market: Electric vehicle ownership has surged in Europe, reaching around 14 million electric cars as of 2024, supported by government incentives and a growing network of charging stations. The European Green Deal aims to cut emissions, driving up the adoption of EVs, which, in turn, boosts demand for financing options tailored to these vehicles. In Norway, more than half of new vehicles registered in 2024 are electric, showing the effectiveness of incentives that increase demand for specialized financing options. This push for EVs provides a significant growth driver for auto financing firms.

- Advancements in Digital Lending Platforms: Digital lending has grown in Europe, with majority of consumers preferring online channels for auto financing in 2024, driven by enhanced accessibility and streamlined loan application processes. Major banks in France and Germany report that over half of auto loan applications are now processed digitally, underscoring a shift towards efficient, accessible platforms. This transition is facilitated by improvements in digital ID verification and AI-based risk assessment, making digital platforms crucial for growth in auto financing.

Challenges

- Rising Interest Rates: The European Central Bank has been increasing interest rates since 2022, significantly impacting loan affordability in the auto finance market. As interest rates rise, auto loans become more costly, which reduces consumer purchasing power and may lead to slower demand for vehicle financing. This challenge is more pronounced in Southern Europe, where the increased borrowing costs have affected consumer credit growth, presenting a critical barrier for the auto financing industry.

- High Loan Default Rates: Loan default rates have been on the rise across Europe, particularly in countries with higher levels of consumer debt. This trend poses a significant concern for lenders as it reflects the growing risk in the market and pressures on auto financing institutions' profitability. To address this challenge, lenders may need to implement stricter credit assessments and reconsider financing terms, which could influence the broader market dynamics and impact the availability of auto finance options.

Europe Auto Finance Market Future Outlook

The Europe auto finance market is poised for substantial growth over the next five years, driven by increased adoption of electric vehicles, advancements in digital lending platforms, and favorable regulatory support for green financing initiatives. Companies are likely to introduce more flexible loan options and subscriptionbased models to cater to changing consumer preferences. Investments in digital finance technology are anticipated to increase, enabling more streamlined loan approvals, enhanced customer experiences, and improved risk assessment capabilities. As the automotive industry moves towards sustainability, financing for EVs and hybrid vehicles will gain prominence, supported by government incentives and growing consumer interest in ecofriendly options.

Future Market Opportunities

- Expansion in Digital Finance Solutions: The increasing adoption of digital solutions in auto finance, including AIpowered credit scoring and realtime loan approvals, presents a significant growth opportunity. Financial institutions are likely to invest in advanced digital platforms to cater to the techsavvy customer base and reduce loan processing times. This trend aligns with the broader digitization goals across Europe, which emphasizes efficiency and improved customer experiences.

- Growth in Sustainable Auto Financing: With Europes focus on achieving netzero emissions, the demand for sustainable auto financing options is set to rise. Financing providers are expected to introduce green auto loans specifically for electric and hybrid vehicles, with lower interest rates to incentivize ecofriendly purchases. This trend is supported by government initiatives aimed at reducing carbon footprints and promoting sustainable transport across Europe.

Scope of the Report

|

By Provider Type |

Banks |

|

By Vehicle Type |

Passenger Vehicles |

|

By Finance Type |

Loan |

|

By Distribution Channel |

Direct Lending |

|

By Region |

Germany |

Products

Key Target Audience

Automotive Manufacturers

Financial Institutions

NonBanking Financial Companies (NBFCs)

Credit Unions

Online Lending Platforms

Government and Regulatory Bodies (e.g., European Banking Authority)

Investors and Venture Capitalist Firms

Automotive Dealerships

Companies

Players Mentioned in the Report

Santander Consumer Finance

Volkswagen Financial Services

BNP Paribas Personal Finance

ALD Automotive

RCI Banque

MercedesBenz Financial Services

Ford Credit Europe

Opel Bank

Toyota Financial Services

Crdit Agricole Consumer Finance

Socit Gnrale Auto Leasing Solutions

UniCredit Leasing

LeasePlan Corporation

Arval (BNP Paribas Group)

Sixt Leasing

Table of Contents

Europe Auto Finance Market Overview

Definition and Scope

Market Taxonomy

Market Growth Rate

Market Segmentation Overview

Europe Auto Finance Market Size (In EUR Billion)

Historical Market Size

Year-On-Year Growth Analysis

Key Market Developments and Milestones

Europe Auto Finance Market Analysis

Growth Drivers

Increasing Vehicle Ownership Rates

Expansion of Electric Vehicle (EV) Market

Advancements in Digital Lending Platforms

Favorable Government Policies and Incentives

Market Challenges

Rising Interest Rates

High Loan Default Rates

Regulatory Compliance Complexities

Opportunities

Integration of Fintech Solutions

Growth in Used Car Financing

Expansion into Emerging Markets

Trends

Adoption of Artificial Intelligence in Credit Assessment

Shift Towards Subscription-Based Vehicle Ownership Models

Rise of Green Financing Options

Government Regulations

EU Emission Standards and Their Impact on Auto Financing

Consumer Protection Laws in Financial Services

Subsidies and Incentives for Electric Vehicles

SWOT Analysis

Stakeholder Ecosystem

Porters Five Forces Analysis

Competitive Landscape

Europe Auto Finance Market Segmentation

By Provider Type (In Value %)

Banks

Non-Banking Financial Institutions

Original Equipment Manufacturers (OEM) Captive Finance

Credit Unions

Online Lenders

By Vehicle Type (In Value %)

Passenger Vehicles

Commercial Vehicles

Electric Vehicles

Used Vehicles

New Vehicles

By Finance Type (In Value %)

Loan

Lease

Hire Purchase

Personal Contract Purchase (PCP)

Personal Contract Hire (PCH)

By Distribution Channel (In Value %)

Direct Lending

Indirect Lending

Online Platforms

Dealership Financing

Peer-to-Peer Lending

By Region (In Value %)

Germany

United Kingdom

France

Italy

Spain

Rest of Europe

Europe Auto Finance Market Competitive Analysis

Detailed Profiles of Major Companies

Santander Consumer Finance

Volkswagen Financial Services

BNP Paribas Personal Finance

ALD Automotive

RCI Banque

Mercedes-Benz Financial Services

Ford Credit Europe

Opel Bank

Toyota Financial Services

Crdit Agricole Consumer Finance

Socit Gnrale Auto Leasing Solutions

UniCredit Leasing

LeasePlan Corporation

Arval (BNP Paribas Group)

Sixt Leasing

Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Market Share, Product Offerings, Geographic Presence, Strategic Initiatives)

Market Share Analysis

Strategic Initiatives

Mergers and Acquisitions

Investment Analysis

Venture Capital Funding

Government Grants

Private Equity Investments

Europe Auto Finance Market Regulatory Framework

Financial Conduct Authority (FCA) Guidelines

European Banking Authority (EBA) Regulations

General Data Protection Regulation (GDPR) Compliance

Anti-Money Laundering (AML) Directives

Basel III Accord Implications

Europe Auto Finance Future Market Size (In EUR Billion)

Future Market Size Projections

Key Factors Driving Future Market Growth

Europe Auto Finance Future Market Segmentation

By Provider Type (In Value %)

By Vehicle Type (In Value %)

By Finance Type (In Value %)

By Distribution Channel (In Value %)

By Region (In Value %)

Europe Auto Finance Market Analysts Recommendations

Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

Customer Cohort Analysis

Marketing Initiatives

White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Europe auto finance market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industrylevel information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Europe auto finance market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computerassisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple auto finance providers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottomup approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Europe auto finance market.

Frequently Asked Questions

01. How big is the Europe auto finance market?

The Europe auto finance market is valued at USD 102 billion, driven by the rising trend in vehicle ownership, a robust used car market, and increasing adoption of digital lending solutions.

02. What are the challenges in the Europe auto finance market?

Challenges in the Europe auto finance market include rising interest rates, high loan default rates, and complexities in regulatory compliance. These factors can impact the profitability and operational efficiency of finance providers.

03. Who are the major players in the Europe auto finance market?

Key players in the Europe auto finance market include Santander Consumer Finance, Volkswagen Financial Services, BNP Paribas Personal Finance, ALD Automotive, and RCI Banque. These companies dominate due to their extensive distribution networks, strong brand presence, and diverse product portfolios.

04. What are the growth drivers of the Europe auto finance market?

The Europe auto finance market is propelled by factors such as increasing vehicle ownership rates, expansion of the electric vehicle market, advancements in digital lending platforms, and favorable government policies and incentives. Additionally, the growing used car market and a preference for customizable loan options are boosting market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.