Europe Automated Guided Vehicle (AGV) Market Outlook to 2030

Region:Europe

Author(s):Shreya Garg

Product Code:KROD3534

November 2024

87

About the Report

Europe Automated Guided Vehicle (AGV) Market Overview

- The Europe Automated Guided Vehicle (AGV) market is currently valued at USD 1.3 billion, driven primarily by the increasing need for automation in industries such as manufacturing, warehousing, and logistics. AGVs offer operational efficiency, reduce labor costs, and ensure safety in workplaces. A historical analysis of the market shows strong growth due to the adoption of Industry 4.0 and the rise in e-commerce, which has necessitated the use of automated vehicles for material handling in warehouses. Technological advancements in AGVs, such as improved navigation systems and integration with Artificial Intelligence (AI), have further propelled market demand, especially in automotive and food & beverage industries.

- Germany, France, and the UK dominate the AGV market in Europe due to their advanced industrial infrastructure, heavy reliance on automation, and strong presence of automotive manufacturing. Germany leads the market with its extensive use of AGVs in automotive production lines, driven by a focus on increasing productivity and efficiency. The UK's e-commerce boom has also accelerated demand for AGVs in warehouses, while Frances logistics sector leverages AGVs to streamline operations and reduce human error.

- European safety standards for automation systems, including AGVs, have been a key regulatory focus to ensure operational safety. According to the European Safety and Health Commission, over 90% of AGVs used in Europe comply with the stringent ISO 10218 standard for robot safety. These regulations mandate the integration of fail-safe systems, emergency stop functions, and regular maintenance checks to minimize the risk of accidents in industrial settings

Europe Automated Guided Vehicle (AGV) Market Segmentation

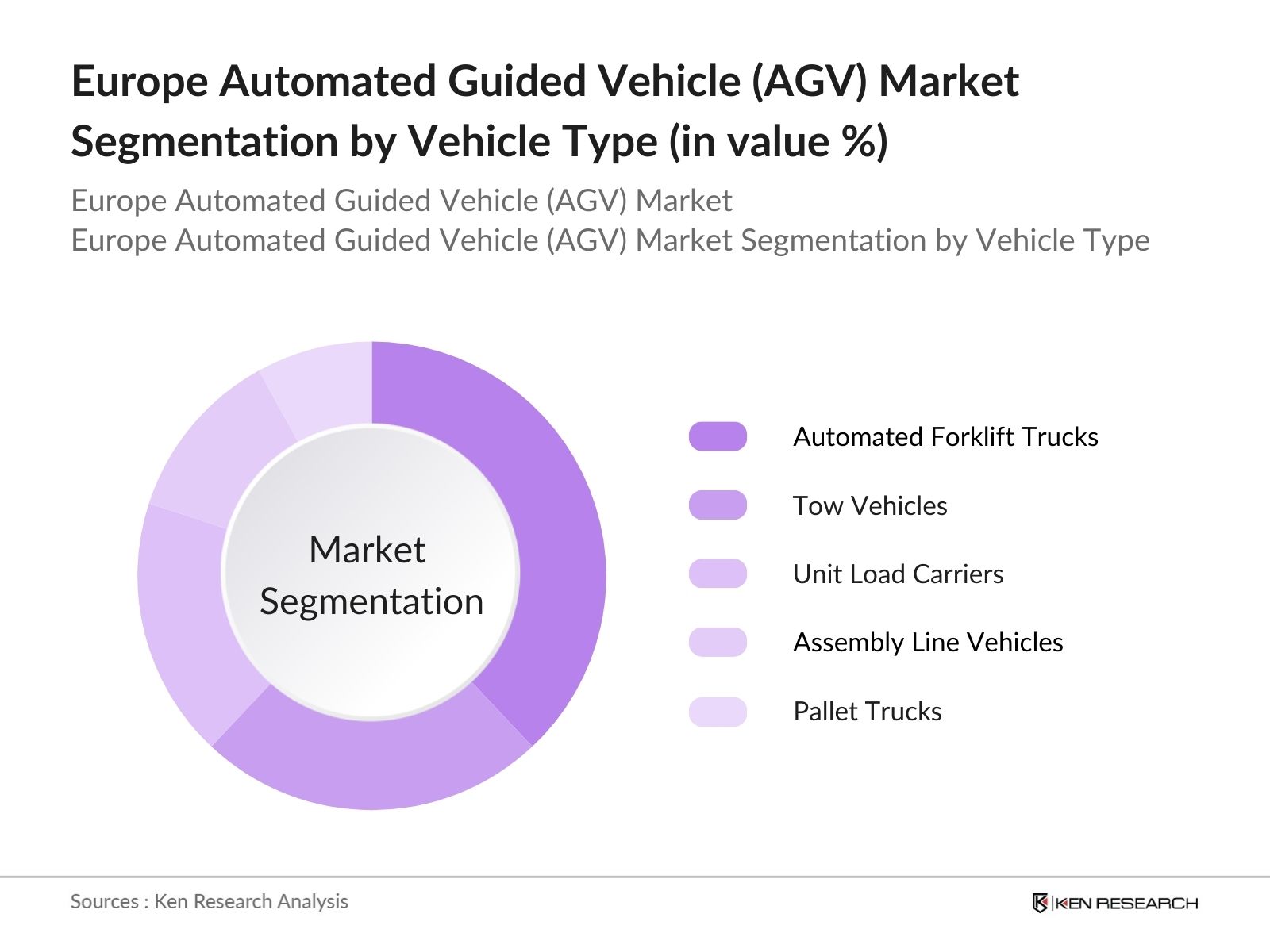

By Vehicle Type: The market is segmented by vehicle type into automated forklift trucks, tow vehicles, unit load carriers, assembly line vehicles, and pallet trucks. Automated forklift trucks have a dominant market share in Europe under the vehicle type segmentation, primarily due to their versatility in handling various materials in industrial environments. They are widely used in industries like automotive and logistics, where material handling efficiency is crucial. The flexibility, ease of use, and relatively low operational costs have made automated forklifts a preferred choice for companies looking to integrate automation into their workflows.

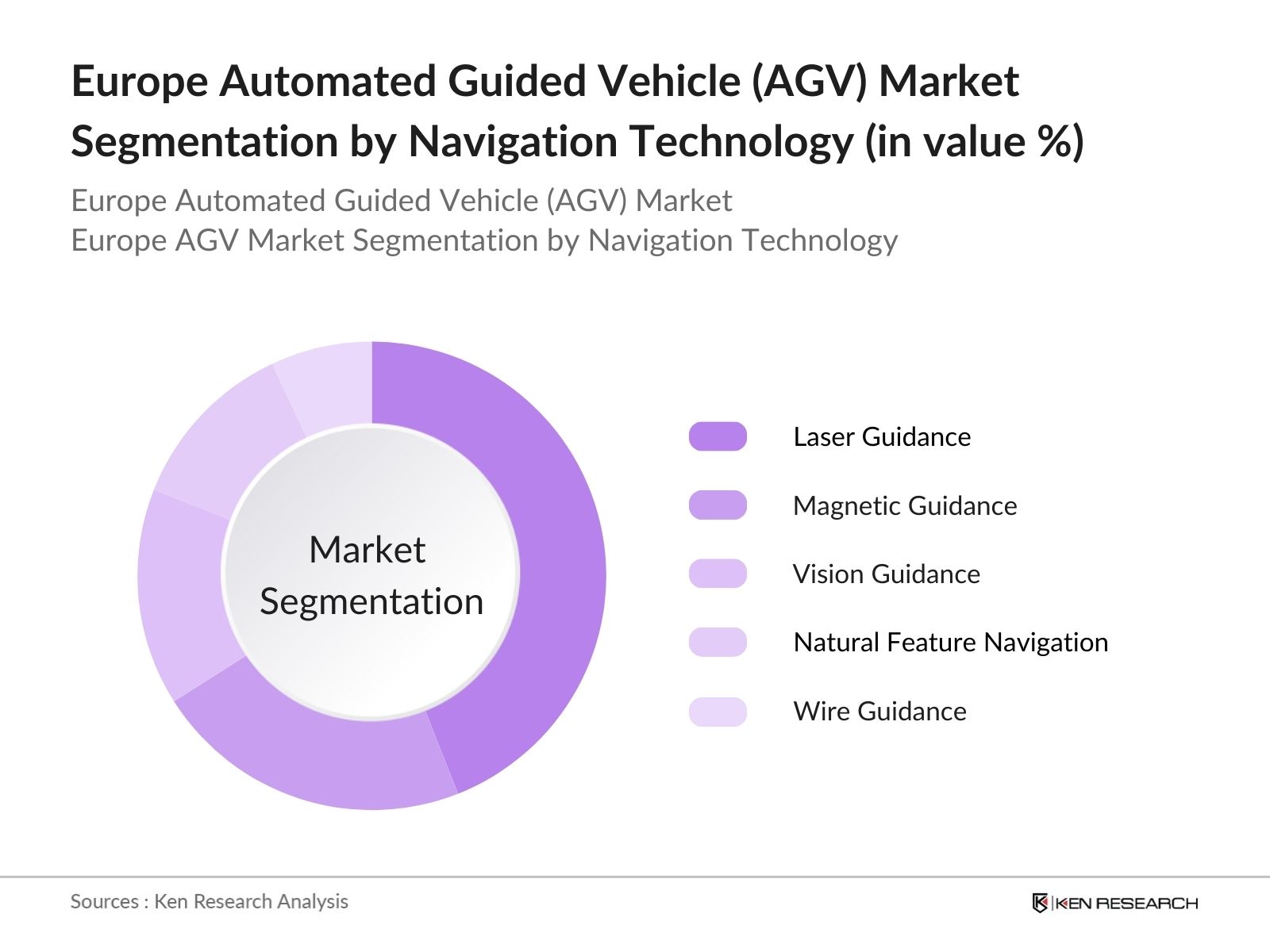

By Navigation Technology: The market is also segmented by navigation technology, including laser guidance, magnetic guidance, vision guidance, natural feature navigation, and wire guidance. Laser guidance technology dominates the market share in this segment because it provides high precision and flexibility. The growing need for precise and efficient automation in sectors such as automotive and logistics has led to increased adoption of laser-guided AGVs. This technology allows for complex routes and is easily adaptable to different environments, making it ideal for warehouses and production facilities that require high accuracy in material movement.

Europe Automated Guided Vehicle (AGV) Market Competitive Landscape

The Europe AGV market is dominated by a mix of global leaders and regional players. These companies focus on technological innovation, strategic partnerships, and expansions to maintain their market positions. The consolidation of a few key players has led to higher competition in terms of pricing and service offerings, while smaller companies often focus on niche applications or specific industries. The market is seeing increased investments in research and development, aimed at improving AGV performance and expanding their application areas.

|

Company |

Established |

Headquarters |

Revenue (2023) |

R&D Investment |

Employees |

Global Reach |

Product Portfolio |

Partnerships |

|

KION Group AG |

1904 |

Frankfurt, Germany |

USD 11.2 billion |

|||||

|

Jungheinrich AG |

1953 |

Hamburg, Germany |

USD 4.8 billion |

|||||

|

Toyota Industries Corporation |

1926 |

Kariya, Japan |

USD 20.3 billion |

|||||

|

Daifuku Co., Ltd. |

1937 |

Osaka, Japan |

USD 4.2 billion |

|||||

|

Swisslog Holding AG |

1900 |

Buchs, Switzerland |

USD 1.5 billion |

Europe Automated Guided Vehicle (AGV) Industry Analysis

Growth Drivers

- Increased Adoption of Automation in Warehousing: The demand for automated guided vehicles (AGVs) has surged due to increased automation in warehousing sectors across Europe. The continent's warehousing automation market has seen a substantial rise, driven by e-commerce expansion and demand for real-time inventory management. In Germany, 35,000 new warehousing jobs were added in 2022, but the automation rate has kept pace, with the European Union reporting a 20% increase in automated systems in warehouses since 2021. This trend has reduced reliance on manual labor while increasing efficiency. Automation initiatives have received 250 million in EU-backed grants in 2023 to further enhance this transition.

- Labor Shortages in Industrial Sectors: Labor shortages have become a pressing issue across Europes industrial sectors, accelerating the adoption of AGVs to fill gaps. In 2023, the European Labor Authority reported a shortage of over 1.5 million industrial workers in key economies such as France, Germany, and the UK, with industries looking to AGVs to manage the gap. As a result, the European Commission has directed 500 million to incentivize the use of automation in industries, including government-backed programs for AGV deployment in production lines and warehouses.

- Technological Advancements in Sensors and Navigation Systems: Technological breakthroughs in sensor technologies and navigation systems have enabled AGVs to perform more efficiently in various industrial environments. By 2024, European AGVs are expected to integrate advanced LIDAR and RFID technologies, allowing them to navigate complex environments with greater precision. The European Union invested 350 million in research for these systems in 2023, particularly focusing on improving the safety and adaptability of AGVs in hazardous environments like chemical plants and construction sites. These technological advancements have made AGVs more cost-efficient, while reducing the potential for human error in complex operations.

Market Challenges

- High Initial Investment Costs: Despite long-term gains, high initial investment remains a barrier for small and medium-sized enterprises (SMEs) across Europe. The average cost of implementing AGV systems ranges from 200,000 to 500,000, according to a 2023 report by the European Investment Bank. SMEs, which make up 90% of European enterprises, often struggle with these high upfront costs, even as they stand to benefit from increased productivity. To mitigate this, EU governments have launched various funding programs to help SMEs integrate automation technologies.

- Need for Skilled Workforce for Maintenance: The introduction of AGVs into industrial settings creates a demand for a skilled workforce capable of maintaining and troubleshooting the advanced machinery. A report from the European Skills Index in 2023 indicated that there is a deficit of over 500,000 workers with the necessary technical expertise to service and maintain automated systems, including AGVs. This gap has caused delays in deployment for companies that cannot easily access these specialized skills, especially in countries like Spain and Italy.

Europe Automated Guided Vehicle (AGV) Market Future Outlook

Over the next five years, the Europe Automated Guided Vehicle (AGV) market is projected to see robust growth driven by advancements in AI and robotics, as well as increasing adoption of Industry 4.0 practices across various industries. Automation in warehousing and logistics is expected to be a key driver, as companies aim to optimize operations and improve efficiency. The growing e-commerce sector and the need for cost-effective solutions for material handling will also fuel demand for AGVs. Additionally, innovations such as battery advancements and hybrid AGVs are anticipated to create new opportunities in the market.

Future Market Opportunities

- Growing Demand for Flexible Manufacturing Systems: As industries in Europe shift toward more flexible manufacturing systems, AGVs are playing an essential role in enabling adaptive and modular production lines. In 2024, Europe is expected to witness a 15% increase in demand for reconfigurable AGV systems that can adapt to different tasks in real time. German car manufacturers like Volkswagen have adopted flexible AGV systems in their production lines, which led to a reduction of setup times by 25%. This has prompted similar interest from manufacturers across Europe.

- Integration with Artificial Intelligence and Machine Learning: The integration of AGVs with artificial intelligence (AI) and machine learning (ML) offers new capabilities for predictive maintenance, real-time decision-making, and autonomous operations. By 2024, over 40% of AGVs in Europe are expected to be equipped with AI-driven navigation and maintenance systems, as noted by the European Artificial Intelligence Initiative. This integration enables AGVs to adapt and respond to changing environments without human intervention, which has proven particularly useful in industries such as pharmaceuticals and food processing.

Scope of the Report

|

Vehicle Type |

Automated Forklift Trucks Tow Vehicles Unit Load Carriers Assembly Line Vehicles Pallet Trucks |

|

Navigation Technology |

Laser Guidance Magnetic Guidance Vision Guidance Natural Feature Navigation Wire Guidance |

|

Industry Vertical |

Automotive Logistics and Warehousing Healthcare Food & Beverage Retail |

|

Load Capacity |

Up to 1 ton 1-2 tons 2-5 tons Above 5 tons |

|

Region |

West East North South |

Products

Key Target Audience

Automated Vehicle Manufacturers

Warehousing & Logistics Providers

Automotive Manufacturers

Food & Beverage Industries

Banks and Financial Institutes

Healthcare Sector

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (European Automation Safety Agency, EU Robotics Council)

Technology Integrators & OEMs

Companies

Major Players

KION Group AG

Jungheinrich AG

Toyota Industries Corporation

Daifuku Co., Ltd.

Swisslog Holding AG

Elettric80 S.p.A.

SSI Schaefer Group

Murata Machinery, Ltd.

Dematic

Bastian Solutions, Inc.

JBT Corporation

Egemin Automation Inc.

Kollmorgen

Oceaneering International, Inc.

BOWE Group

Table of Contents

Europe Automated Guided Vehicle Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy (Automated Navigation Technologies, Vehicle Types)

1.3. Market Growth Rate (Increased Use of AGVs in E-Commerce Warehousing, Automation in Manufacturing)

1.4. Market Segmentation Overview (By Vehicle Type, Navigation Technology, Industry Vertical, Load Capacity, Region)

Europe Automated Guided Vehicle Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones (Rising Demand for AGVs in Logistics, Integration with Industry 4.0)

Europe Automated Guided Vehicle Market Analysis

3.1. Growth Drivers

3.1.1. Increased Adoption of Automation in Warehousing

3.1.2. Labor Shortages in Industrial Sectors

3.1.3. Technological Advancements in Sensors and Navigation Systems

3.1.4. Cost Efficiency and Productivity Gains

3.2. Market Challenges

3.2.1. High Initial Investment Costs

3.2.2. Technical Limitations in Complex Environments

3.2.3. Need for Skilled Workforce for Maintenance

3.3. Opportunities

3.3.1. Growing Demand for Flexible Manufacturing Systems

3.3.2. Expansion of E-Commerce and Third-Party Logistics (3PL)

3.3.3. Integration with Artificial Intelligence and Machine Learning

3.4. Trends

3.4.1. Autonomous Mobility and Increased Usage in SMEs

3.4.2. Rise of Battery-Powered and Environmentally Friendly AGVs

3.4.3. Increased Use in Non-Manufacturing Sectors

3.5. Government Regulation

3.5.1. European Automation Safety Standards

3.5.2. Environmental Regulations for AGV Battery Use

3.5.3. EU Regulations on Automated Systems in the Workplace

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Manufacturers, Logistics Providers, Technology Vendors)

3.8. Porters Five Forces (Supplier Bargaining Power, Threat of Substitution)

3.9. Competition Ecosystem

Europe Automated Guided Vehicle Market Segmentation

4.1. By Vehicle Type (In Value %)

4.1.1. Automated Forklift Trucks

4.1.2. Tow Vehicles

4.1.3. Unit Load Carriers

4.1.4. Assembly Line Vehicles

4.1.5. Pallet Trucks

4.2. By Navigation Technology (In Value %)

4.2.1. Laser Guidance

4.2.2. Magnetic Guidance

4.2.3. Vision Guidance

4.2.4. Natural Feature Navigation

4.2.5. Wire Guidance

4.3. By Industry Vertical (In Value %)

4.3.1. Automotive

4.3.2. Logistics and Warehousing

4.3.3. Healthcare

4.3.4. Food & Beverage

4.3.5. Retail

4.4. By Load Capacity (In Value %)

4.4.1. Up to 1 ton

4.4.2. 1-2 tons

4.4.3. 2-5 tons

4.4.4. Above 5 tons

4.5. By Region (In Value %)

4.5.1. West

4.5.2. East

4.5.3. North

4.5.4. South

Europe Automated Guided Vehicle Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. KION Group AG

5.1.2. Jungheinrich AG

5.1.3. Toyota Industries Corporation

5.1.4. Daifuku Co., Ltd.

5.1.5. Hyster-Yale Materials Handling, Inc.

5.1.6. Swisslog Holding AG

5.1.7. Elettric80 S.p.A.

5.1.8. SSI Schaefer Group

5.1.9. Murata Machinery, Ltd.

5.1.10. Dematic

5.1.11. Bastian Solutions, Inc.

5.1.12. JBT Corporation

5.1.13. Egemin Automation Inc.

5.1.14. Kollmorgen

5.1.15. Oceaneering International, Inc.

5.2. Cross Comparison Parameters (Revenue, Global Presence, Product Portfolio, Technological Innovations, Number of Employees, Headquarters Location, R&D Spending, Industry Experience)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Partnerships, Expansions, Collaborations)

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

Europe Automated Guided Vehicle Market Regulatory Framework

6.1. Workplace Automation Safety Standards

6.2. Industry Compliance Requirements

6.3. Certification and Licensing Processes

Europe Automated Guided Vehicle Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

Europe Automated Guided Vehicle Future Market Segmentation

8.1. By Vehicle Type (In Value %)

8.2. By Navigation Technology (In Value %)

8.3. By Industry Vertical (In Value %)

8.4. By Load Capacity (In Value %)

8.5. By Region (In Value %)

Europe Automated Guided Vehicle Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Market Entry Strategies

9.3. Technology and Innovation Recommendations

9.4. Customer Segmentation Strategies

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

This step involves mapping out the ecosystem of the Europe Automated Guided Vehicle (AGV) market by identifying major stakeholders and market variables. Extensive desk research is conducted to gather insights on market dynamics, using a combination of secondary sources such as government databases, industry reports, and proprietary resources.

Step 2: Market Analysis and Construction

In this phase, we analyze historical data on AGV deployment across various industries, assessing revenue generation, penetration rates, and demand patterns. A comparison of market factors is conducted to provide an accurate estimate of the current market landscape.

Step 3: Hypothesis Validation and Expert Consultation

To validate our findings, expert consultations with industry professionals are conducted through telephone interviews and email correspondence. These insights from AGV manufacturers, technology providers, and logistics managers help to refine the market forecasts and trends.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing data from both primary and secondary sources to develop a comprehensive, validated analysis of the AGV market. This stage ensures that all figures are accurate and supported by reliable data points, including direct feedback from industry leaders.

Frequently Asked Questions

01 How big is the Europe Automated Guided Vehicle Market?

The Europe Automated Guided Vehicle market is valued at USD 1.3 billion, driven by the growing demand for automation in industrial and logistics sectors.

02 What are the challenges in the Europe Automated Guided Vehicle Market?

Key challenges in the Europe Automated Guided Vehicle market include high initial investment costs, technical limitations in navigating complex environments, and the need for a skilled workforce for maintenance.

03 Who are the major players in the Europe Automated Guided Vehicle Market?

Leading players in the Europe Automated Guided Vehicle market include KION Group AG, Jungheinrich AG, Toyota Industries Corporation, Daifuku Co., Ltd., and Swisslog Holding AG.

04 What are the growth drivers of the Europe Automated Guided Vehicle Market?

Growth in the Europe Automated Guided Vehicle market is driven by increasing automation in warehouses, the rise of Industry 4.0, labor shortages, and technological advancements in navigation systems.

05 What are the trends in the Europe Automated Guided Vehicle Market?

Key trends in the Europe Automated Guided Vehicle market include the adoption of AI-driven AGVs, increased use of AGVs in non-manufacturing sectors, and the rise of battery-powered AGVs for environmental sustainability.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.