Europe Battery Recycling Market Size, Segments, Outlook and Revenue Forecast 2022-2027 by Source (Automotive Batteries, Industrial Batteries, and Consumer Electronic Appliance Batteries), Chemistry (Lithium-ion, Lead-acid, Nickel, and Others), Recycling Methods (Hydrometallurgy, Mechanical Processes, Pyrometallurgy, and Direct Recycling), End-User (Transportation, Industrial, and Consumer Electronics) and Major Countries (Germany, U.K., Italy, France, Spain, Sweden, and Rest of Europe)

Region:Europe

Author(s):Tulika Mathur and Jyothika Borah

Product Code:KRBR18

September 2022

140

About the Report

Market Overview

Battery recycling is the technique of reusing and reprocessing batteries with the goal of minimizing the number of batteries disposed away as material waste. The Europe battery recycling market is expected to record a positive CAGR of ~40.0% during the forecast period (2022-2027) and reach approximately US$3.5 Bn by 2027, primarily driven by the depleting availability of fresh raw materials for the production of batteries which is increasingly growing in demand in both household electronics as well as industrial use. The ongoing Covid-19 pandemic has benefited the battery recycling industry as the demand for electric vehicles (EV) in the region experienced a growing trend with remarkable rise in sales in the year 2020.

- Augmenting demand from industries for batteries has in turn posed pressure on raw material production at an advanced rate. It is directly affecting the ratio proportion of the ability to produce raw materials like lithium to meet the demand for the same. This has focused the attention on recycling processes to meet up with the rise of battery requirements in industries.

- Lithium-ion batteries accounted for ~30% of the market in 2021 which is expected to grow at a high rate of above 40% in the coming years owing to the increase in demand from automotive industry which is experiencing a trend of electrification of vehicles.

- Furthermore, due to growing environmental problems such as contamination of the soil, water, air, and rise in global warming, European Union is pushing for the construction of battery recycling infrastructure. All such factors are likely to enhance the battery recycling market's trajectory for growth.

- However, due to the market's uncertainty and immaturity, there are few barriers. For example, most of the electric vehicles in the market have yet not reached the end-of-life stage which raises numerous questions related to battery lifespans, collection, condition, and compatibility to recycling procedures.

The availability of 100-200 gigawatt hours of batteries that will soon need to be retired due to their incapacity to meet the requirements for use in an EV is predicted to result from the development of EVs by 2030.

- According to the International Council on Clean Transportation, the European electric vehicle (EV) market experienced remarkable growth in 2020, posting a 143% increase in sales of passenger electric cars from 2019. The sales in 2020 made Europe the biggest EV market globally, surpassing China and the US.

- Although sales of all new cars in Europe decreased by 20%, the increase in EV sales boosted the EV share to 11%. Both battery electric vehicles (BEV) and plug-in hybrid electric vehicles (PHEV) have jumped into the air, not only in terms of market share but also in overall terms. In Germany, sales of PHEV vehicles from January to June increased from 47,584 in 2019 to 93,848 in 2020. Similar trends were observed across other countries in Europe.

Scope of the Report

The Battery Recycling Market is segmented by Source, Chemistry, Recycling Methods, and End-User. In addition, the report also covers market size and forecasts for the region's six major countries' battery recycling markets. The revenue used to size and forecast the market for each segment is US$ million.

|

By Source |

|

|

|

By Chemistry |

|

|

|

By Recycling Methods |

|

|

|

By End-User |

|

|

|

By Geography |

|

|

Key Trends by Market Segment

By Source: Automotive batteries source holds the largest share of Europe’s battery recycling market.

- Increasing adoption of batteries in the automotive sector for electric vehicles has increased the number of waste batteries from the sector in turn opening opportunities for extracting valuable metals from the product for further usage.

- Lead oxide paste, solid sponge lead, and sulfuric acid make up the battery's chemical composition. These three compounds are made to chemically react with one another to create a current flow.

- The metals attained after the recycling includes stainless steel, lead, nickel, lithium, and others.

- For instance, in November, 2020, BMW and Off Grid Energy formed a partnership with a purpose of finding solutions to sustainable second-life for the end-of-life electric and hybrid models of BMW.

By Chemistry: Lead-acid battery chemistry segment accounts for the majority share of the Europe Battery Recycling Market.

Due to the rising energy costs of pyrometallurgical lead recovery, the associated CO2 emissions, and the dire health effects from lead-to-air emissions, it is becoming increasingly necessary to develop novel procedures to recover lead from end-of-life lead-acid batteries.

- For instance, in September, 2022, Recyclus receives an approval for a new battery recycling facility. The company will be able to disassemble lead-acid batteries at a facility in Tipton (U.K.) and find new Chemistries for its component parts. The decision will enable the business to manually recycle lead-acid batteries, such as those that are frequently seen in automobiles.

By Recycling Methods: Pyrometallurgy segment holds the largest market share in the Europe Battery Recycling Market as trusted and widely used method in the region.

- In June, 2022, Aurubis, a German company had begun its construction of a recycling plant in Augusta, Georgia. The plant will recycle up to 90,000 tons of cables, circuit boards, and electronics into blister copper and other metals preferably through pyrometallurgy recycling method.

- The hydrometallurgy segment is expected to grow at a faster rate during the forecast period, as with hydrometallurgical battery recycling, more elements with a high purity grade can be recovered while using less energy and emitting no emissions into the atmosphere.

By End-User: Consumer electronics end-user segment holds the highest market share in the European battery recycling market.

- Battery usage is rapidly rising due to the rise in energy demand for electric and electronic consumer gadgets, and as a result, more materials are being used that will result in an increase in the long-term production of hazardous waste.

- According to the CEO of SolidEnergy, new lithium metal batteries might double the lifespan of smartphones, drones, and electric vehicles.

- In the absence of suitable legislation and technological solutions that make battery recycling practicable and cost-effective, electronic and electrical gadgets, as well as lithium-ion batteries, have been abandoned at the end of their useful lives which is promoting the need for recycled batteries in the industry.

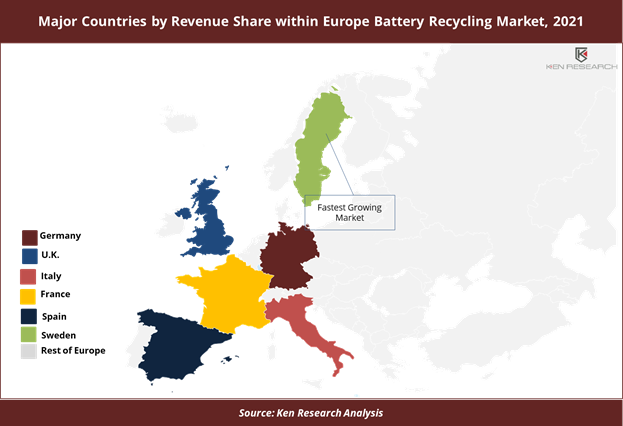

By Geography: Germany accounts for the largest share within the total Europe battery recycling market, accounting for a significant share of total market revenue due to rising government regulations on the same.

- Sweden is expected to have the second highest CAGR after rest of Europe during the forecast period, due to the increasing adoption of electric battery buses in the country due to government support like European Environment Agency.

- Gothenburg in Sweden is a home to various electric vehicle manufacturers like Stena Recycling and more who are taking initiatives in electric vehicle market and in turn promoting battery recycling.

- The battery recycling market in Spain is also expected to grow significantly in the coming years, as EV incentive schemes launched by the government of Spain like Renove, is expected to boost its adoption in the country and will benefit the battery recycling market.

- France is supporting the adoption of electric vehicles through making it a convenient option to drive, for example, set up of approximately 30,000 charging points across the country. It is therefore increasing the demand for EVs as well lithium-ion battery.

Competitive Landscape

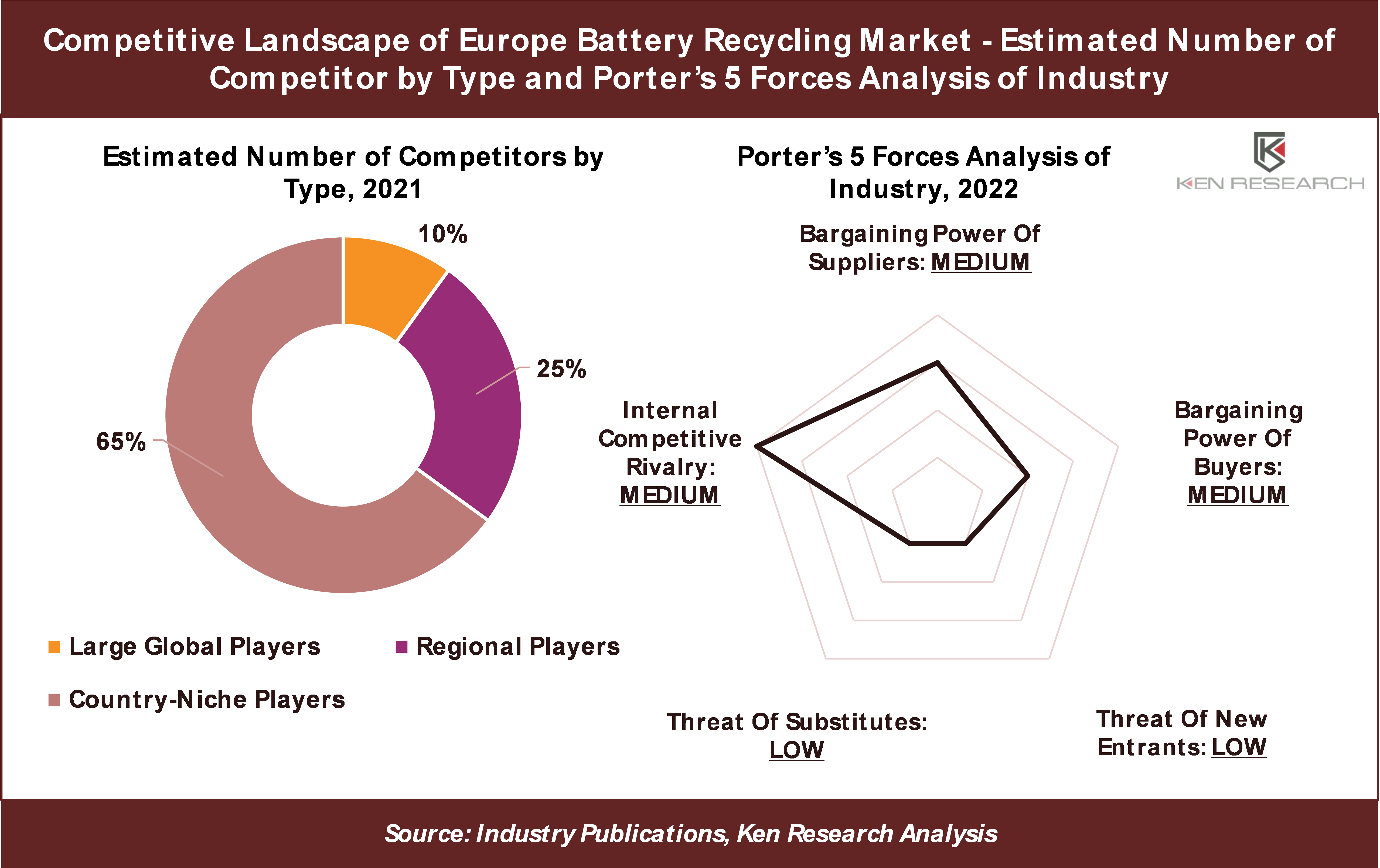

The battery recycling market is highly competitive with ~100 players which include globally diversified players, regional players as well as a large number of country-niche players having their own niche in battery recycling. Most of the country-niche players are renewable energy and equipment suppliers.

Large global players control about 40% of the market revenue, while regional players hold the second largest share in the market revenue. Some of the major players in the market include Accurec Recycling GmbH, Umicore, Volkswagen Group, BASF Group, REDUX Recycling GmbH, Li-Cycle, Saft Groupe SA, SNAM, Stena Recycling, Erament, Glencore, Hydrovolt and others. The leading global specialist companies such as REDUX Recycling GmbH and Accurec Recycling GmbH, are highly focused on battery recycling.

Recent Developments Related to Major Players

- BASF is reported to be building a facility, slated to start in 2024, that would disassemble and shred batteries to create black mass. By the middle of the decade, the corporation also intends to construct a hydrometallurgical refinery on a commercial scale in Europe. The materials would then be sent back to BASF's battery cathode materials factory in Schwarzheide, which is expected to begin manufacturing by the end of the year.

- In July, 2022, Nyobolt Limited (UK) and H.C. Starck Tungsten Powders (Germany), have signed an agreement which will enable new Chemistrys into automation (robotics), industrial vehicles, consumer appliances, mobile rapid charging, stationary storage, and cordless

- Ford stated that it was thinking about implementing LFP (lithium iron phosphate) in 2021, mostly for commercial purposes. The company revealed a significant supply agreement with China's CATL in July 2022, with the supply of LFP cells set to start in 2023.

- In November 2021, A preliminary lithium supply agreement was inked by German-Australian company Vulcan with automaker Stellantis (STLA.MI), shortly after a similar agreement was reached with Renault (RENA.PA), amid a boom in demand for electric vehicles.

- Around 2027, Stora Enso (Finland) and Northvolt will make batteries out of sustainable wood. Hard carbon with lignin as its base will be used in the process and will be manufactured with wood in Nordic greens.

- Started in June 2022, GigafactoryX is being built by Clean Power Source S.A. (ICPT). The investment will increase the company's manufacturing capacity from its present 1 MWh per day to up to 5 GWh annually. Lithium-ion cells with LTO, LFP, and NMC chemistry will constitute the basis of all battery systems. Production is expected to begin in 2024.

Conclusion

The Europe Battery Recycling Market is forecasted to continue an exponential growth that is witnessed since 2017, primarily driven by rising demand for electric vehicle and escalating environmental issues arising from carbon emissions. Though the market is highly competitive with around 100 participants, few global players control the dominant share and regional players also hold a significant share.

Key Topics Covered in the Report: -

- Snapshot of Europe Battery Recycling Market

- Industry Value Chain and Ecosystem Analysis

- Market size and Segmentation of Europe Battery Recycling Market

- Historic Growth of Overall Europe Battery Recycling Market and Segments

- Competition Scenario of the Market and Key Developments of Competitors

- Porter’s 5 Forces Analysis of Europe Battery Recycling Industry

- Overview, Product Offerings, and SWOT Analysis of Key Competitors

- Covid 19 Impact on the Overall Europe Battery Recycling Market

- Future Market Forecast and Growth Rates of the Total Europe Battery Recycling Market and by Segments

- Market Size of Source / End-User Segments with Historical CAGR and Future Forecasts

- Analysis of Battery Recycling Market in Major European Countries

- Major Production / Consumption Hubs in the Major European Countries

- Major Production/Supply and Consumption/Demand Hubs in Each Major Country

- Major Country-wise Historic and Future Market Growth Rates of the Total Market and Segments

- Overview of Notable Emerging Competitor Companies within Each Major Country

Major Companies Profiled in the Report

- Accurec Recycling GmbH

- Umicore

- Volkswagen Group

- BASF Battery Materials and Recycling

- REDUX Recycling GmbH

- Li-Cycle

- Saft Groupe SA

- SNAM

- Stena Recycling

- Erament

- Hydrovolt

Notable Emerging Companies Mentioned in the Report

- Primobius GmbH

- Saperatec GmbH

- Duesenfeld

- Recover

- BatRecycle

- Portable Battery Recycling Limited

- STC Srl

- Sovema Group

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report

- Battery Recycling Companies

- Recycled Battery Providers

- Recycled Battery Manufacturers

- Recycled Battery Suppliers

- Electric Vehicle Manufacturers

- Battery Cell Manufacturers

- Battery Raw Material Producers

- Battery Waste Managers and Recyclers

- Waste Batteries Collectors

- Waste Batteries Aggregators

- Waste Batteries Treatment Service Companies

- Waste Batteries Transport Companies

- Waste Batteries Logistics Companies

- Waste Batteries Supply Chain Solution Providers

- Battery Allied Industries

- Renewable Energy Companies

- Electric Vehicle Battery Suppliers

- Electric Vehicle Battery Manufacturers

- Automotive Industry Associations

- Environment Control and Emission Regulatory Organizations

- Potential Investors in Electric Vehicle Companies

Time Period Captured in the Report

- Historical Period: 2017-2021

- Forecast Period: 2022-2027F

Frequently Asked Questions

- What is the Study Period of this Market Report?

The Europe Battery Recycling Market is covered from 2017 – 2021 in this report, which includes a forecast for the period 2022-2027.

- What is the Future Growth Rate of Europe Battery Recycling Market?

The Europe Battery Recycling Market is expected to witness a CAGR of about 40% over the next 5 years.

- What are the Key Factors Driving the Europe Battery Recycling Market?

Rising demand for electric vehicles and escalating environmental issues arising from carbon emissions are expected to be the primary drivers of this market.

- Which is the Largest Source Segment within the Europe Battery Recycling Market?

Automotive Batteries source holds the largest share of Europe’s Battery Recycling Market.

- Who are the Key Players in Europe Battery Recycling Market?

Accurec Recycling GmbH, Umicore, Volkswagen Group, BASF Group, REDUX Recycling GmbH, Li-Cycle, Saft Groupe SA, SNAM, Stena Recycling, Erament, Glencore, Hydrovolt among others are the major companies operating in Europe Battery Recycling Market.

Products

Companies

Major Companies Profiled in the Report

Accurec Recycling GmbH

Umicore

Volkswagen Group

BASF Battery Materials and Recycling

REDUX Recycling GmbH

Li-Cycle

Saft Groupe SA

SNAM

Stena Recycling

Erament

Hydrovolt

Notable Emerging Companies Mentioned in the Report

Primobius GmbH

Saperatec GmbH

Duesenfeld

Recover

BatRecycle

Portable Battery Recycling Limited

STC Srl

Sovema Group

Table of Contents

- 1. Executive Summary

1.1 Highlights of Europe Battery Recycling Market Historic Growth & Forecast

1.2 Highlights of Market Trends, Challenges, and Competition

1.3 Highlights of Market Revenue Share by Segments

- 2. Market Overview and Key Trends Impacting Growth

2.1 Europe Battery Recycling Market Taxonomy

2.2 Industry Value Chain

2.3 The Ecosystem of Major Entities in Europe’s Battery Recycling Market

2.4 Government Regulations & Developments

2.5 Key Growth Drivers & Challenges Impacting the Market

2.6 COVID-19 Impact on Europe’s Battery Recycling Market

2.7 Total Europe Battery Recycling Market Historic Growth by Segment Type, 2017-2021

2.7.1 By Source

2.7.2 By Chemistry

2.7.3 By Recycling Methods

2.7.4 By End-User

2.7.5 By Major Countries

2.8 Total Europe Battery Recycling Market Revenue Historic Growth and Forecast, 2017-2027

2.9 Key Takeaways

- 3. Total Europe - Market Segmentation by Source, Historic Growth, Outlook & Forecasts

3.1 Market Definition - Segmentation by Source

3.2 Market Revenue Share, Historic Growth, Outlook and Forecasts by Source, 2017-2027

3.2.1 Automotive Batteries

3.2.2 Industrial Batteries

3.2.3 Consumer Electronic Appliance Batteries

3.2.4 Key Takeaways from Market Segmentation by Source

- 4. Total Europe- Market Segmentation by Chemistry, Historic Growth, Outlook & Forecasts

4.1 Market Definition - Segmentation by Chemistry

4.2 Market Revenue Share, Historic Growth, Outlook, and Forecasts by Chemistry, 2017-2027

4.2.1 Lithium-ion

4.2.2 Lead-acid

4.2.3 Nickel

4.2.4 Others

4.2.5 Key Takeaways from Market Segmentation by Chemistry

- 5. Total Europe- Market Segmentation by Recycling Methods, Historic Growth, Outlook & Forecasts

5.1 Market Definition - Segmentation by Recycling Methods

5.2 Market Revenue Share, Historic Growth, Outlook, and Forecasts by Recycling Methods, 2017-2027

5.2.1 Hydrometallurgy

5.2.2 Mechanical Processes

5.2.3 Pyrometallurgy

5.2.4 Direct Recycling

5.2.5 Key Takeaways from Market Segmentation by Recycling Methods

6. Industry / Competition Analysis - Competitive Landscape

6.1 Types of Players (Competitors) & Business Models

6.2 Porter’s 5 Forces Analysis of Europe’s Battery Recycling Competitors

6.3 Key Developments in the Europe Battery Recycling Sector Impacting Market Growth

6.4 Comparison of Leading Competitors within Europe’s Battery Recycling Market, 2021

6.5 Comparison of Leading Competitors within Europe Battery Recycling Market by Coverage of Source Segments, 2021

6.6 Comparison of Leading Competitors within Europe Battery Recycling Market by Coverage of Chemistry, 2021

6.7 Comparison of Leading Competitors within Europe Battery Recycling Market by Coverage of Recycling Methods, 2021

6.8 Comparison of Leading Competitors within Europe Battery Recycling Market by Coverage of End-Users, 2021

6.9 Key Takeaways from Competitive Landscape

7. Key Competitor Profiles (Company Overview, Product Offerings, SWOT Analysis)

7.1 Accurec Recycling GmbH

7.2 Umicore

7.3 Volkswagen Group

7.4 BASF Battery Materials and Recycling

7.5 REDUX Recycling GmbH

7.6 Li-Cycle

7.7 Saft Groupe SA

7.8 SNAM

7.9 Stena Recycling

7.10 Erament

7.11 Hydrovolt

8. Geographic Analysis & Major Countries Market Historic Growth, Outlook, and Forecasts

8.1 Major Countries Comparison of Macroeconomic Factors

8.2 Total Europe- Market Revenue Share, Historic Growth, Outlook and Forecasts by Geography, 2017-2027

8.3 Major Countries Market Analysis, Historic Growth, Outlook & Forecasts

8.4 Germany – Battery Recycling Market Analysis

8.4.1 Major Production and Consumption Hubs in Germany

8.4.2 Notable Emerging Battery Recycling Companies in Germany

8.4.3 Market Revenue Share, Historic Growth, Outlook and Forecasts by Source, 2017-2027

8.4.4 Market Revenue Share, Historic Growth, Outlook, and Forecasts by Chemistry, 2017-2027

8.4.5 Market Revenue Share, Historic Growth, Outlook, and Forecasts by Recycling Methods, 2017-2027

8.4.6 Market Revenue Share, Historic Growth, Outlook, and Forecasts by End-User, 2017-2027

8.5 U.K. – Battery Recycling Market Analysis

8.5.1 Major Production and Consumption Hubs in Germany

8.5.2 Notable Emerging Battery Recycling Companies in Germany

8.5.3 Market Revenue Share, Historic Growth, Outlook and Forecasts by Source, 2017-2027

8.5.4 Market Revenue Share, Historic Growth, Outlook, and Forecasts by Chemistry, 2017-2027

8.5.5 Market Revenue Share, Historic Growth, Outlook, and Forecasts by Recycling Methods, 2017-2027

8.5.6 Market Revenue Share, Historic Growth, Outlook, and Forecasts by End-User, 2017-2027

8.6 Italy – Battery Recycling Market Analysis

8.6.1 Major Production and Consumption Hubs in Italy

8.6.2 Notable Emerging Battery Recycling Companies in Italy

8.6.3 Market Revenue Share, Historic Growth, Outlook and Forecasts by Source, 2017-2027

8.6.4 Market Revenue Share, Historic Growth, Outlook, and Forecasts by Chemistry, 2017-2027

8.6.5 Market Revenue Share, Historic Growth, Outlook, and Forecasts by Recycling Methods, 2017-2027

8.6.6 Market Revenue Share, Historic Growth, Outlook, and Forecasts by End-User, 2017-2027

8.7 France– Battery Recycling Market Analysis

8.7.1 Major Production and Consumption Hubs in France

8.7.2 Notable Emerging Battery Recycling Companies in France

8.7.3 Market Revenue Share, Historic Growth, Outlook and Forecasts by Source, 2017-2027

8.7.4 Market Revenue Share, Historic Growth, Outlook, and Forecasts by Chemistry, 2017-2027

8.7.5 Market Revenue Share, Historic Growth, Outlook, and Forecasts by Recycling Methods, 2017-2027

8.7.6 Market Revenue Share, Historic Growth, Outlook, and Forecasts by End-User, 2017-2027

8.8 Spain– Battery Recycling Market Analysis

8.8.1 Major Production and Consumption Hubs in Spain

8.8.2 Notable Emerging Battery Recycling Companies in Spain

8.8.3 Market Revenue Share, Historic Growth, Outlook and Forecasts by Source, 2017-2027

8.8.4 Market Revenue Share, Historic Growth, Outlook, and Forecasts by Chemistry, 2017-2027

8.8.5 Market Revenue Share, Historic Growth, Outlook, and Forecasts by Recycling Methods, 2017-2027

8.8.6 Market Revenue Share, Historic Growth, Outlook, and Forecasts by End-User, 2017-2027

8.9 Sweden– Battery Recycling Market Analysis

8.9.1 Major Production and Consumption Hubs in Sweden

8.9.2 Notable Emerging Battery Recycling Companies in Sweden

8.9.3 Market Revenue Share, Historic Growth, Outlook and Forecasts by Source, 2017-2027

8.9.4 Market Revenue Share, Historic Growth, Outlook, and Forecasts by Chemistry, 2017-2027

8.9.5 Market Revenue Share, Historic Growth, Outlook, and Forecasts by Recycling Methods, 2017-2027

8.9.6 Market Revenue Share, Historic Growth, Outlook, and Forecasts by End-User, 2017-2027

- 9. Industry Expert’s Opinions/Perspectives

9.1 Notable Statements/Quotes from Industry Experts and C-Level Executives on Current Status and Future Outlook of the Market

- 10. Analyst Recommendation

10.1 Analyst Recommendations on Identified Major Opportunities and Potential Strategies to Gain from Opportunities

- 11. Appendix

11.1 Research Methodology - Market Size Estimation, Forecast, and Sanity Check Approach

11.2 Sample Discussion Guide

11.3 Disclaimer

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.