Europe Breast Pumps Market Outlook to 2030

Region:Europe

Author(s):Sanjna Verma

Product Code:KROD9290

December 2024

95

About the Report

Europe Breast Pumps Market Overview

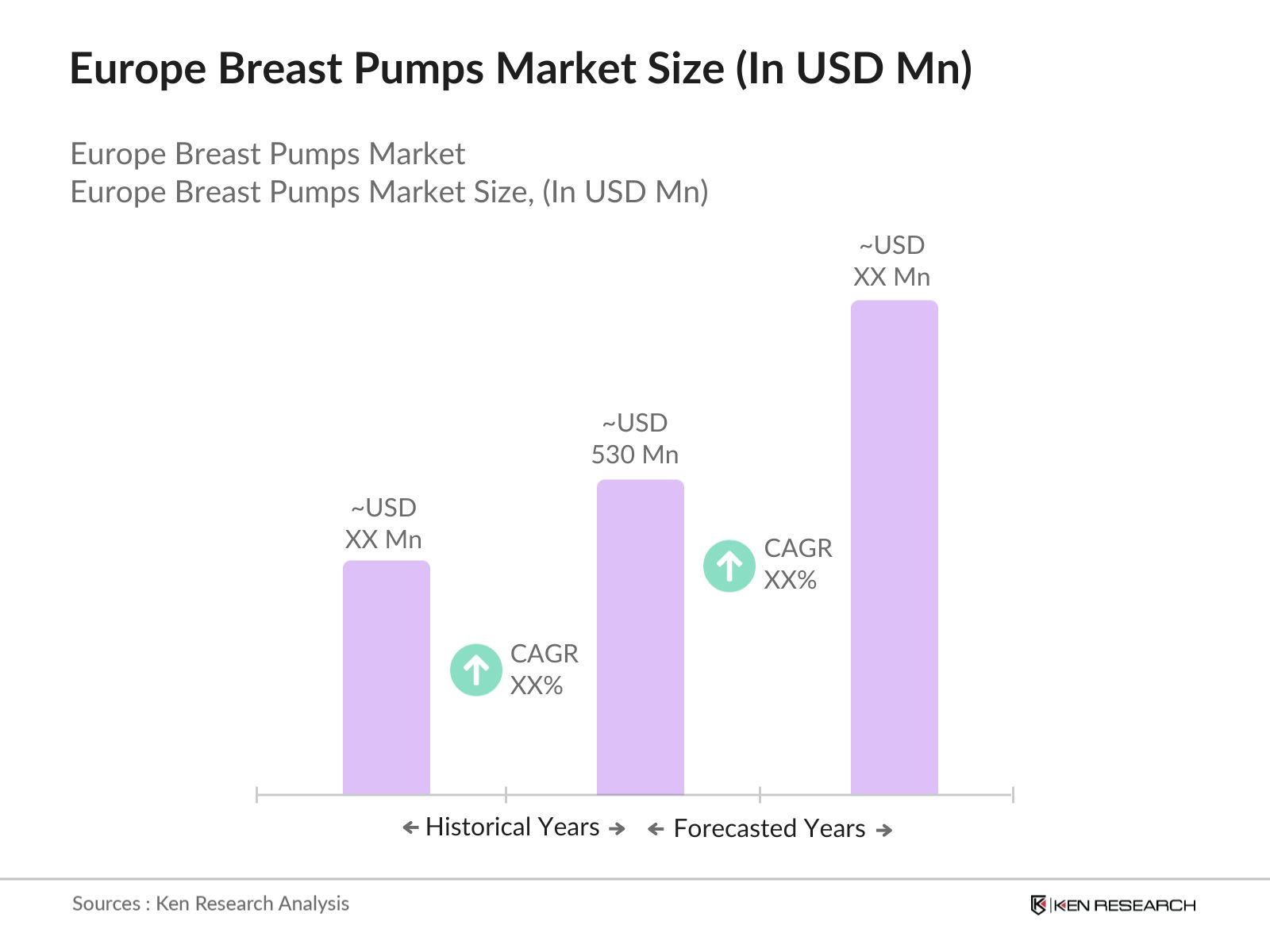

- The Europe breast pumps market is valued at USD 530 million, with demand driven by the increasing awareness surrounding breastfeeding benefits, along with rising female workforce participation and advancements in product technology. The market is also supported by government health initiatives aimed at promoting breastfeeding across several European countries.

- Germany, the United Kingdom, and France dominate the breast pumps market in Europe due to their large populations, high healthcare spending, and well-established healthcare infrastructures. In Germany, strong insurance coverage for breast pumps supports widespread adoption, while the United Kingdom's government-led initiatives encourage breastfeeding.

- Breast pumps in Europe are subject to stringent health and safety standards under the European Union's Medical Devices Regulation (MDR). Products must meet CE certification requirements before they can be marketed, ensuring that they comply with health, safety, and environmental protection standards. The MDR came into effect in May 2021, and by 2024, all medical devices, including breast pumps, must undergo rigorous testing and approval processes.

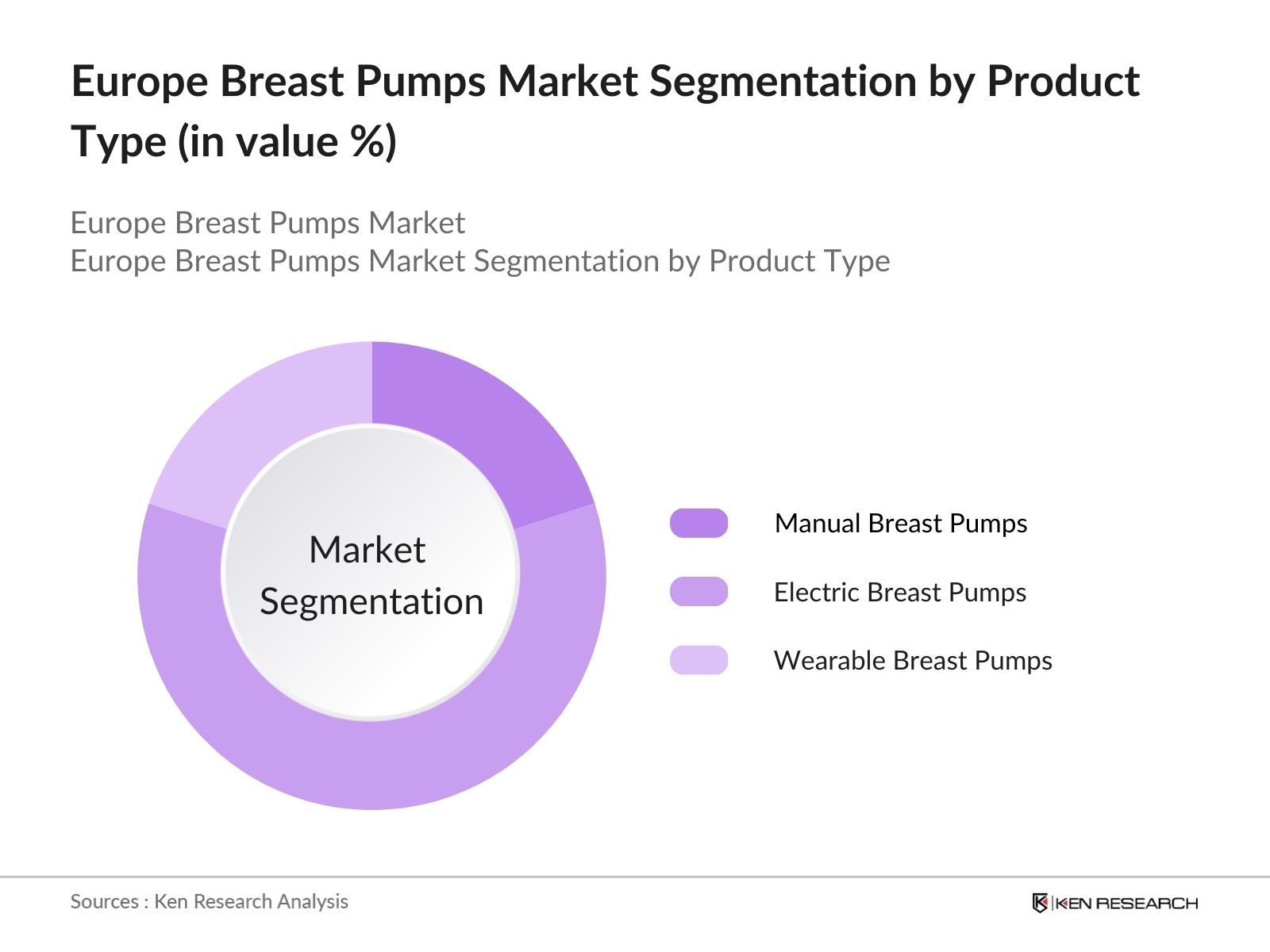

Europe Breast Pumps Market Segmentation

By Product Type: The Europe breast pumps market is segmented by product type into manual breast pumps, electric breast pumps, and wearable breast pumps. Electric breast pumps have the dominant market share under this segmentation due to their efficiency and convenience for working mothers. This segment is popular among mothers who pump frequently, as electric pumps offer faster milk extraction and hands-free options, catering to consumer demand for time-efficient solutions.

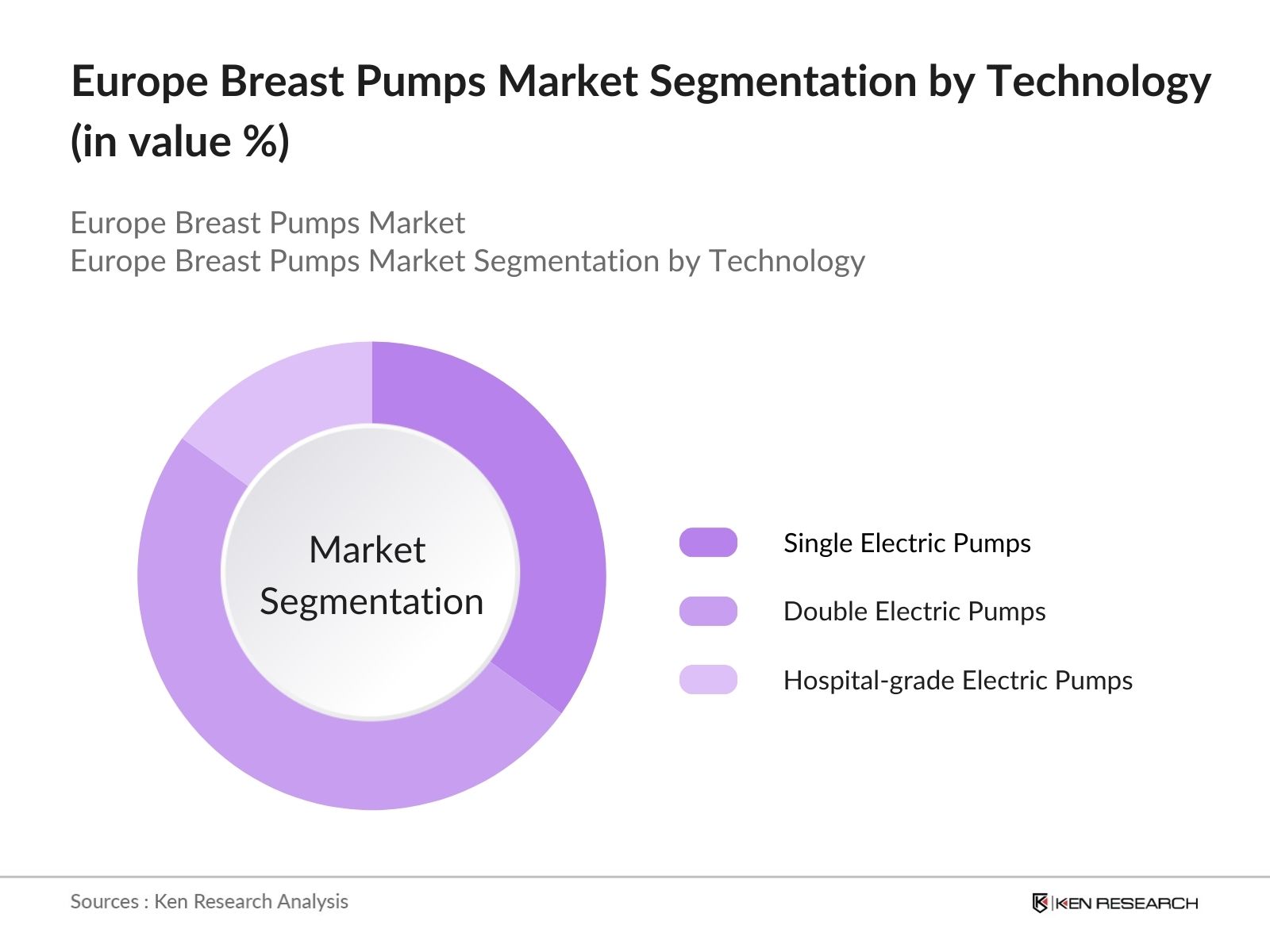

By Technology: By technology, the market is segmented into single electric pumps, double electric pumps, and hospital-grade electric pumps. Double electric pumps dominate the market because they allow simultaneous pumping from both breasts, reducing the time required for milk expression. They are widely preferred by mothers who need to pump frequently or in professional settings, where time efficiency is crucial. Additionally, these pumps are considered ideal for maintaining or increasing milk supply.

Europe Breast Pumps Market Competitive Landscape

Europe Breast Pumps Market Competitive Landscape

The European breast pumps market is dominated by a few key players who have established strong brand loyalty and have robust distribution networks. These companies are known for continuously innovating and releasing new products that align with customer needs. The competition is primarily driven by the innovation of hands-free, wireless pumps and partnerships with healthcare providers.

|

Company Name |

Establishment Year |

Headquarters |

Revenue (2023) |

Product Portfolio |

Number of Employees |

R&D Investment |

Distribution Network |

Customer Segments |

|

Medela AG |

1961 |

Switzerland |

- |

- |

- |

- |

- |

- |

|

Philips Avent |

1984 |

Netherlands |

- |

- |

- |

- |

- |

- |

|

Ameda Inc. |

1942 |

USA |

- |

- |

- |

- |

- |

- |

|

Pigeon Corporation |

1957 |

Japan |

- |

- |

- |

- |

- |

- |

|

Lansinoh Laboratories |

1984 |

USA |

- |

- |

- |

- |

- |

- |

Europe Breast Pumps Market Analysis

Growth Drivers

- Rise in Female Workforce Participation: The increase in female workforce participation is a significant driver for breast pumps' demand across Europe. As of 2023, the female labor participation rate in the European Union stood at approximately 67%, with notable increases in countries like Sweden and Germany. Working mothers rely heavily on breast pumps to continue breastfeeding while managing their work commitments. This demographic shift has created a steady demand for breast pumps, as more women enter the workforce.

- Increasing Awareness About Breastfeeding: With a growing awareness of the health benefits of breastfeeding, public health campaigns and organizations like the World Health Organization (WHO) emphasize exclusive breastfeeding for the first six months of life. Countries like the United Kingdom and Spain have seen substantial initiatives to promote breastfeeding, with over 70% of new mothers choosing to breastfeed. Breast pumps enable this process for working mothers, boosting the market further.

- Technological Advancements in Breast Pump Designs: Breast pump manufacturers have made significant advancements in design and efficiency, contributing to the growth of the market. Companies are focusing on noise reduction and comfort, which has resulted in increasing consumer satisfaction. EU regulations supporting innovation, like the CE marking requirements for medical devices, ensure that technologically advanced products meet the highest safety standards.

Market Challenges

- High Costs of Advanced Breast Pumps: One of the biggest challenges in the breast pump market is the high cost of advanced models. For instance, premium brands like Elvie can cost upwards of USD 318, making them less accessible to lower-income families. Even in countries with relatively higher incomes, such as Germany, where the average household income is around USD 46,640. The cost of such devices can be a significant investment for many families.

- Limited Awareness in Rural Areas: Breast pump usage in rural areas across Europe is hindered by limited awareness and accessibility. In countries like Romania and Bulgaria, where rural populations represent 46% and 25% of the total population respectively, there is still a knowledge gap regarding breast pump benefits. Additionally, healthcare infrastructure in these regions lacks adequate breastfeeding support programs.

Europe Breast Pumps Market Future Outlook

Europe breast pumps market is expected to grow steadily, driven by increasing awareness of breastfeeding's health benefits and expanding healthcare infrastructures across the region. Government support programs, especially in Northern Europe, will continue to promote breastfeeding through financial subsidies for breast pumps and extended maternity leave programs. Furthermore, advancements in wearable and hands-free pump technologies are likely to shape the future market, catering to the evolving needs of working mothers and ensuring their ease of use.

Market Opportunities

- Expansion into Emerging Markets: The expansion of breast pump manufacturers into Eastern European markets presents significant opportunities for growth. Countries like Poland, where the female employment rate has risen to 66%, are seeing increasing demand for breast pumps as more women enter the workforce. This untapped market is also supported by improving healthcare infrastructure and awareness programs.

- Innovations in Wearable Breast Pumps: Wearable breast pumps are becoming a popular product category in Europe, as they offer increased mobility and ease of use. Manufacturers are heavily investing in R&D to produce smaller, quieter, and more efficient wearable pumps. Companies such as Philips and Elvie are leading the charge with products that allow mothers to pump discreetly while performing other activities. As of 2024, wearable devices account for nearly 25% of breast pump sales in the UK, driven by consumer demand for convenience and efficiency.

Scope of the Report

|

By Product Type |

Manual Breast Pumps Electric Breast Pumps Wearable Breast Pumps |

|

By Technology |

Single Electric Pump Double Electric Pump Hospital-grade Electric Pump |

|

By Application |

Personal Use Hospital Use |

|

By Distribution Channel |

Online Retail Offline Retail Specialty Stores Hospital Pharmacies |

|

By Country |

Germany France United Kingdom Italy Spain Netherlands Sweden Poland Belgium Switzerland |

Products

Key Target Audience

Breast pump manufacturers

Hospitals and maternity clinics

Pharmacies and retail chains

E-commerce platforms (Amazon, Zalando, etc.)

Medical device distributors

Maternity support organizations

Investors and venture capitalist firms

Government and regulatory bodies (European Medicines Agency, European Commission)

Table of Contents

1. Europe Breast Pumps Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Europe Breast Pumps Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Europe Breast Pumps Market Analysis

3.1 Growth Drivers

3.1.1 Rise in Female Workforce Participation (Employment Rate, Female Participation Ratio)

3.1.2 Increasing Awareness About Breastfeeding (Health Campaigns, Breastfeeding Guidelines)

3.1.3 Technological Advancements in Breast Pump Designs (Innovation in Pump Technology, Efficiency Metrics)

3.1.4 Shift Towards Reusable and Eco-friendly Products (Sustainability Standards, Consumer Preferences)

3.2 Market Challenges

3.2.1 High Costs of Advanced Breast Pumps (Price Analysis, Consumer Spending Power)

3.2.2 Limited Awareness in Rural Areas (Accessibility, Awareness Programs)

3.2.3 Regulatory Barriers and Compliance Issues (EU Health Standards, Compliance Requirements)

3.2.4 Social Stigma and Cultural Resistance (Cultural Trends, Consumer Behavior)

3.3 Opportunities

3.3.1 Expansion into Emerging Markets (Regional Demand Analysis, Market Penetration)

3.3.2 Growing Online Sales Channels (E-commerce Trends, Digital Sales Data)

3.3.3 Innovations in Wearable Breast Pumps (Wearable Device Growth, R&D Investments)

3.3.4 Collaboration with Healthcare Providers (Hospital Partnerships, Awareness Programs)

3.4 Trends

3.4.1 Increasing Adoption of Hands-free and Wireless Pumps (Product Innovation, User Convenience)

3.4.2 Rise in Hospital-grade Pumps for Home Use (Product Adoption Trends, Homecare Solutions)

3.4.3 Growth of Subscription-based Models (Subscription Service Adoption, Customer Retention)

3.4.4 Personalized Pumping Solutions with App Integration (Smart Devices, App Usage Trends)

3.5 Government Regulation

3.5.1 European Breastfeeding Promotion Policies (Government Support, Subsidies)

3.5.2 Health and Safety Standards for Breast Pumps (Product Certifications, EU Regulations)

3.5.3 Environmental Regulations on Single-use Plastic (Sustainability Regulations, Product Impact)

3.5.4 Support for Working Mothers (Maternity Leave Laws, Workplace Breastfeeding Support)

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

4. Europe Breast Pumps Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Manual Breast Pumps

4.1.2 Electric Breast Pumps

4.1.3 Wearable Breast Pumps

4.2 By Technology (In Value %)

4.2.1 Single Electric Pump

4.2.2 Double Electric Pump

4.2.3 Hospital-grade Electric Pump

4.3 By Application (In Value %)

4.3.1 Personal Use

4.3.2 Hospital Use

4.4 By Distribution Channel (In Value %)

4.4.1 Online Retail

4.4.2 Offline Retail

4.4.3 Specialty Stores

4.4.4 Hospital Pharmacies

4.5 By Country (In Value %)

4.5.1 Germany

4.5.2 France

4.5.3 United Kingdom

4.5.4 Italy

4.5.5 Spain

4.5.6 Netherlands

4.5.7 Sweden

4.5.8 Poland

4.5.9 Belgium

4.5.10 Switzerland

5. Europe Breast Pumps Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Medela AG

5.1.2 Ameda Inc.

5.1.3 Philips Avent

5.1.4 Pigeon Corporation

5.1.5 Lansinoh Laboratories Inc.

5.1.6 NUK (Newell Brands)

5.1.7 Spectra Baby USA

5.1.8 Ardo Medical AG

5.1.9 Tommee Tippee

5.1.10 Hygeia Health

5.2 Cross Comparison Parameters (Revenue, Number of Employees, Market Share, Product Portfolio)

5.3 Market Share Analysis

5.4 Strategic Initiatives (Product Launches, Marketing Strategies, Partnerships)

5.5 Mergers and Acquisitions (Company Acquisitions, Joint Ventures)

5.6 Investment Analysis (Venture Capital Investments, Funding)

5.7 Private Equity Investments

5.8 Government Grants and Subsidies

6. Europe Breast Pumps Market Regulatory Framework

6.1 EU Health and Safety Regulations (Product Safety Standards, Compliance)

6.2 Certification Processes (CE Marking, ISO Standards)

6.3 Environmental Regulations (Eco-friendly Product Regulations)

6.4 Industry Guidelines for Hospital-grade Products

7. Europe Breast Pumps Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Europe Breast Pumps Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Technology (In Value %)

8.3 By Application (In Value %)

8.4 By Distribution Channel (In Value %)

8.5 By Region (In Value %)

9. Europe Breast Pumps Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Marketing Initiatives for Penetration into Untapped Markets

9.3 White Space Opportunity Analysis

9.4 Customer Cohort Analysis

Research Methodology

Step 1: Identification of Key Variables

In the first phase of research, a detailed map of the European breast pump markets ecosystem is developed, incorporating manufacturers, healthcare providers, distributors, and regulatory bodies. This process is supported by secondary research to capture trends and operational factors in the market.

Step 2: Market Analysis and Construction

The second phase involves analyzing historical data to understand the market trends, revenue growth, and distribution channels within the European breast pump market. Market penetration levels are assessed based on healthcare policies and the role of insurance coverage for breast pumps.

Step 3: Hypothesis Validation and Expert Consultation

To validate market assumptions, primary interviews are conducted with key industry players, including manufacturers and distributors. This step includes consultations with hospitals and maternity clinics to gain insights into product demand and preferences across different regions.

Step 4: Research Synthesis and Final Output

The final step consolidates findings from primary and secondary research to generate comprehensive market insights. Interviews with healthcare providers and manufacturers are instrumental in understanding product differentiation, customer segments, and sales channels, ensuring an accurate portrayal of the market landscape.

Frequently Asked Questions

01. How big is the Europe Breast Pumps Market?

The Europe breast pumps market is valued at USD 530 million, driven by factors such as increasing female workforce participation, rising awareness around breastfeeding, and growing demand for technological advancements in breast pump designs.

02. What are the challenges in the Europe Breast Pumps Market?

Challenges of Europe breast pumps market include the high costs of advanced breast pumps, limited awareness in rural areas, and regulatory barriers in compliance with EU safety standards. These challenges affect the overall market penetration and growth.

03. Who are the major players in the Europe Breast Pumps Market?

Key players of Europe breast pumps market include Medela AG, Philips Avent, Ameda Inc., Pigeon Corporation, and Lansinoh Laboratories. These companies dominate due to their strong product portfolios, extensive distribution networks, and partnerships with healthcare providers.

04. What are the growth drivers of the Europe Breast Pumps Market?

Europe breast pumps market is propelled by rising awareness of the health benefits of breastfeeding, increasing government support for breastfeeding programs, and advancements in wearable and hands-free pump technology.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.