Europe Bulletproof Glass Market Outlook to 2030

Region:Europe

Author(s):Meenakshi Bisht

Product Code:KROD1920

December 2024

92

About the Report

Europe Bulletproof Glass Market Overview

- The Europe Bulletproof Glass market is valued at USD 3 billion, supported by a robust five-year analysis highlighting steady growth. The expansion of high-security requirements across sectors like defense, banking, and automotive drives market size. Increasing incidences of threats, rising demand for high-quality ballistic protection, and advancements in glass manufacturing are primary drivers.

- Germany, the United Kingdom, and France dominate the European bulletproof glass market, primarily due to high demand for security solutions in these regions. Germany leads due to its advanced automotive industry and strong defense sector; the UK and France follow with substantial demand across financial institutions and governmental buildings needing enhanced protection.

- European safety standards mandate strict criteria for ballistic glass products, including impact resistance and transparency levels. In 2023, the European Chemicals Agency (ECHA) specifically conducted 301 compliance checks related to REACH registration dossiers, which covered 1,750 registrations and 274 substances.

Europe Bulletproof Glass Market Segmentation

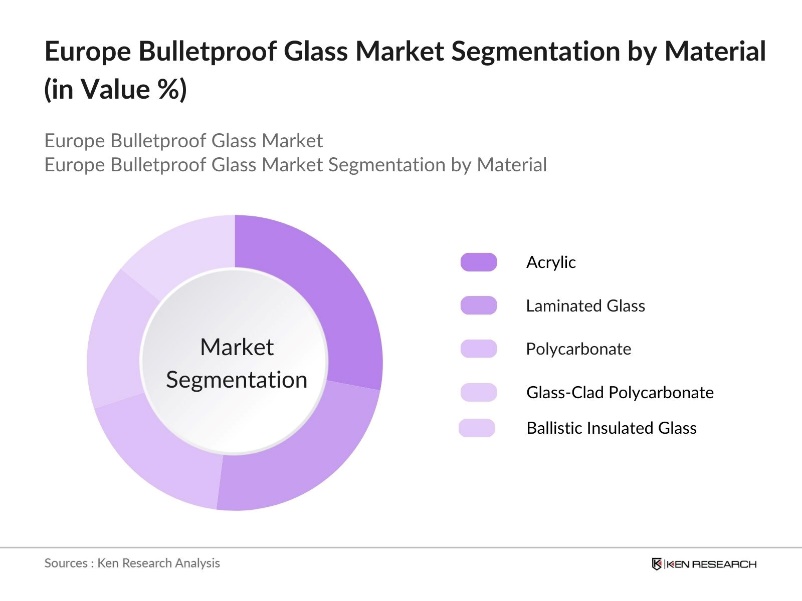

By Material: The market is segmented by material into Acrylic, Laminated Glass, Polycarbonate, Glass-Clad Polycarbonate, and Ballistic Insulated Glass. The acrylic has a dominant market share under the material segmentation. Its lightweight nature, coupled with cost-effectiveness, makes it highly favorable in applications where weight considerations are essential, such as vehicle armoring. Its easy machinability and optical clarity also contribute to its preference in commercial and banking settings.

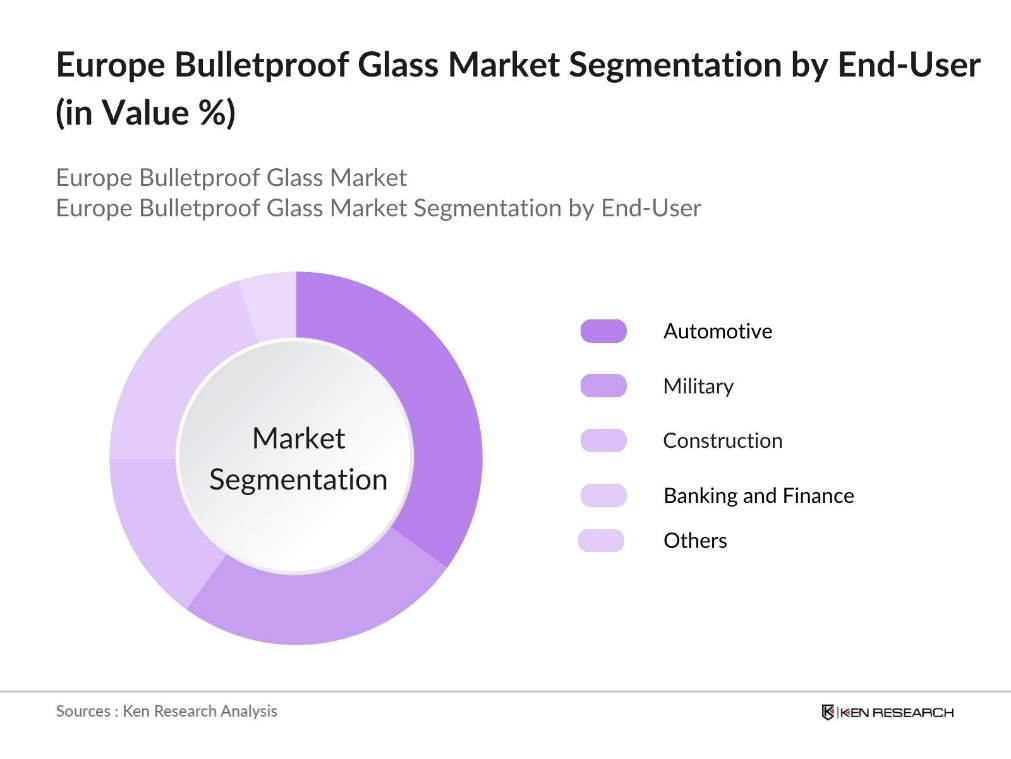

By End-User: The market is segmented by end-user into Automotive, Military, Construction, Banking and Finance, and Others. The automotive sector dominates, attributed to the increased use of bulletproof glass in luxury and government vehicles. Manufacturers emphasize high ballistic protection due to rising security concerns among high-profile clients. Military and law enforcement agencies also contribute significantly, with growing investments in armored vehicle fleets.

Europe Bulletproof Glass Market Competitive Landscape

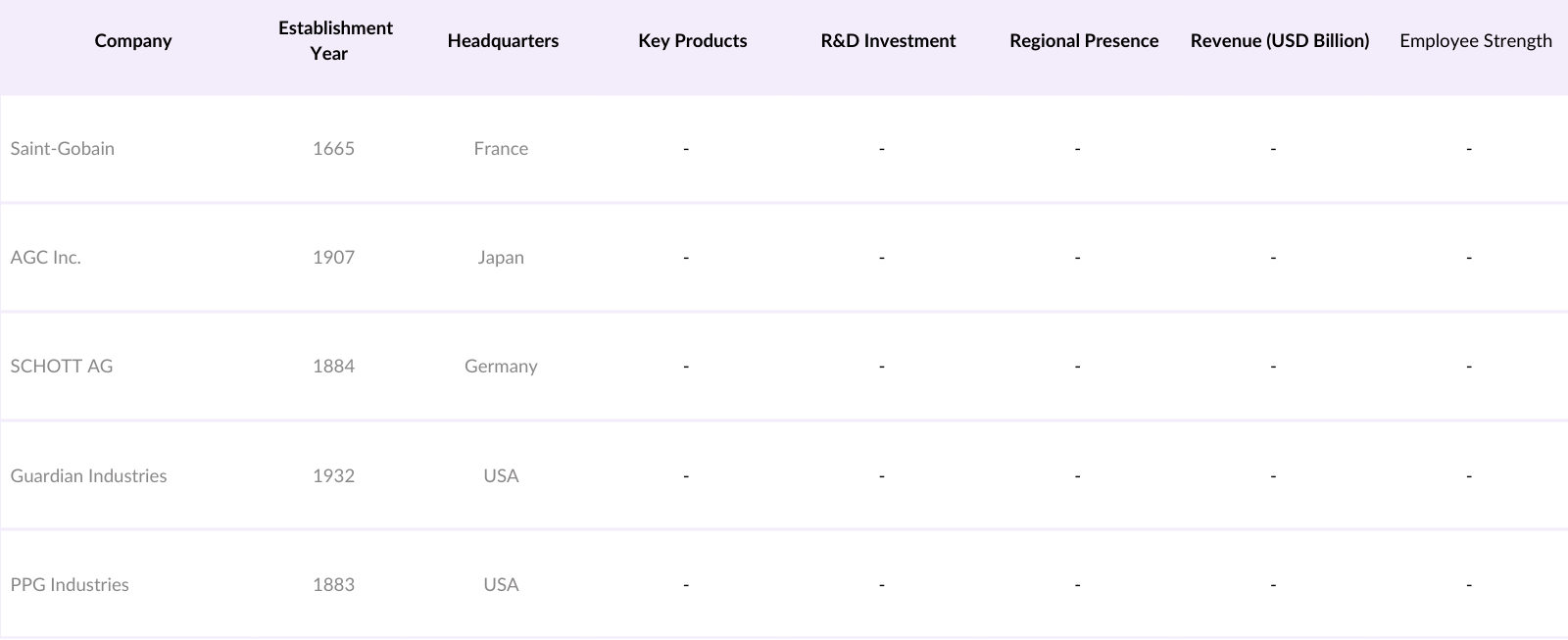

The Europe Bulletproof Glass market is dominated by several key players who focus on innovation and strategic alliances to enhance market presence. Key players such as Saint-Gobain, AGC Inc., and SCHOTT AG have established market strongholds through advanced R&D, collaborations, and a strong distribution network.

Europe Bulletproof Glass Industry Analysis

Growth Drivers

- Rising Security Concerns: The rising security concerns across Europe, driven by geopolitical tensions and increased crime rates, have intensified the demand for protective solutions like bulletproof glass. For instance, there is increase in a firearm incidents in specific regions, such as South East Europe, where a 17% increase in incidents in 2023 across the EU, highlighting the need for enhanced security in public and private spaces. The heightened security risks have led to an upsurge in security spending across multiple sectors, including banking, defense, and public buildings.

- Increased Defense Expenditure: Europes defense spending reached $588 billion in 2023, with significant allocations toward protective materials and defense infrastructure to safeguard military and civilian facilities. Bulletproof glass is a key part of these security initiatives, used extensively in armored vehicles, military installations, and government buildings. This rise in defense investment is a critical driver, as countries prioritize homeland security amidst global tensions.

- Expansion in Banking and Financial Sectors: The banking and financial sector in Europe is increasingly adopting bulletproof glass to enhance security at banks and ATMs. This shift responds to heightened concerns over theft and robberies, with institutions prioritizing the protection of personnel and assets. The use of protective glass underscores a commitment to creating safer environments in financial facilities through proactive security investments.

Market Challenges

- High Production Costs: The production of bulletproof glass is expensive due to the use of specialized materials like polycarbonate and acrylic, which are essential for its durability and effectiveness. These high material costs add financial strain on manufacturers, limiting accessibility and making it challenging for widespread adoption, particularly in markets sensitive to pricing.

- Regulatory Hurdles: Stringent regulations, especially compliance mandates from the European Union for ballistic-resistant products, create challenges for manufacturers. These regulations often delay or require modifications for new products, slowing down the markets ability to introduce innovations swiftly and hindering broader market growth.

Europe Bulletproof Glass Market Future Outlook

The Europe Bulletproof Glass market is expected to witness substantial growth in the upcoming years, driven by increased investments in defense and the rising demand for high-security solutions across sectors. Technological advancements, such as integration with smart glass technologies and the development of lightweight materials, are anticipated to propel market expansion, alongside government support for enhanced security measures.

Market Opportunities

- Integration with Smart Technologies: Integrating smart technologies like self-healing and impact-detection sensors with bulletproof glass presents a promising opportunity. This innovation allows real-time monitoring of impacts, improving security and reducing long-term maintenance needs. The adoption of such advanced protective glass is increasingly aligned with the development of smart infrastructure, enhancing both resilience and functionality in commercial and government applications.

- Expansion into Residential Applications: The use of bulletproof glass in residential spaces is expanding, particularly among high-net-worth homeowners and luxury developments. As security concerns grow, more affluent households are opting for ballistic-resistant windows, adding an extra layer of protection to their homes. This trend reflects a rising demand for high-security installations in the European housing market.

Scope of the Report

|

Material |

Acrylic Laminated Glass Polycarbonate Glass-Clad Polycarbonate Ballistic Insulated Glass Others |

|

End-User |

Automotive Military Construction Banking and Finance Others |

|

Application |

Defense and VIP Vehicles Government and Law Enforcement Cash-In-Transit Vehicles Commercial Buildings ATM Booths and Teller Stations Others |

|

Security Level |

Level-1 Level-2 Level-3 Level-4 to 8 Others |

|

Country |

Germany France United Kingdom Netherlands Switzerland Belgium Russia Italy Spain Turkey Rest of Europe |

Products

Key Target Audience

Automotive Manufacturers

Defense Contractors

Construction Companies

Law Enforcement Agencies

Government and Regulatory Bodies (European Safety and Standards Association, EN1063 Certification Authority)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Saint-Gobain

AGC Inc.

SCHOTT AG

Guardian Industries

PPG Industries

Nippon Sheet Glass Co., Ltd.

Taiwan Glass Industry Corporation

Asahi India Glass Limited

Guangzhou Topo Glass Co., Ltd.

Xinyi Glass Holdings Limited

Table of Contents

1. Europe Bulletproof Glass Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Europe Bulletproof Glass Market Size (in USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Europe Bulletproof Glass Market Analysis

3.1 Growth Drivers

3.1.1 Rising Security Concerns

3.1.2 Technological Advancements in Glass Manufacturing

3.1.3 Increased Defense Expenditure

3.1.4 Expansion in Banking and Financial Sectors

3.2 Market Challenges

3.2.1 High Production Costs

3.2.2 Regulatory Hurdles

3.2.3 Limited Awareness in Emerging Markets

3.3 Opportunities

3.3.1 Integration with Smart Technologies

3.3.2 Expansion into Residential Applications

3.3.3 Strategic Partnerships and Collaborations

3.4 Trends

3.4.1 Adoption of Lightweight Materials

3.4.2 Customization and Aesthetic Enhancements

3.4.3 Sustainable Manufacturing Practices

3.5 Government Regulations

3.5.1 European Safety Standards

3.5.2 Import and Export Policies

3.5.3 Environmental Compliance

3.5.4 Subsidies and Incentives

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape

4. Europe Bulletproof Glass Market Segmentation

4.1 By Material (in Value %)

4.1.1 Acrylic

4.1.2 Laminated Glass

4.1.3 Polycarbonate

4.1.4 Glass-Clad Polycarbonate

4.1.5 Ballistic Insulated Glass

4.1.6 Others

4.2 By End-User (in Value %)

4.2.1 Automotive

4.2.2 Military

4.2.3 Construction

4.2.4 Banking and Finance

4.2.5 Others

4.3 By Application (in Value %)

4.3.1 Defense and VIP Vehicles

4.3.2 Government and Law Enforcement

4.3.3 Cash-In-Transit Vehicles

4.3.4 Commercial Buildings

4.3.5 ATM Booths and Teller Stations

4.3.6 Others

4.4 By Security Level (in Value %)

4.4.1 Level-1

4.4.2 Level-2

4.4.3 Level-3

4.4.4 Level-4 to 8

4.4.5 Others

4.5 By Country (in Value %)

4.5.1 Germany

4.5.2 France

4.5.3 United Kingdom

4.5.4 Netherlands

4.5.5 Switzerland

4.5.6 Belgium

4.5.7 Russia

4.5.8 Italy

4.5.9 Spain

4.5.10 Turkey

4.5.11 Rest of Europe

5. Europe Bulletproof Glass Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Nippon Sheet Glass Co., Ltd.

5.1.2 Saint-Gobain

5.1.3 SCHOTT AG

5.1.4 AGC Inc.

5.1.5 Taiwan Glass Industry Corporation

5.1.6 Asahi India Glass Limited

5.1.7 Guangzhou Topo Glass Co., Ltd.

5.1.8 PPG Industries, Inc.

5.1.9 Xinyi Glass Holdings Limited

5.1.10 Total Security Solutions

5.1.11 Qingdao Tsing Glass Co. Limited

5.1.12 Dellner Romag

5.1.13 Guardian Industries Holdings

5.1.14 ESG

5.1.15 Glasstronn India Private Limited

5.2 Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Market Share, R&D Investment, Regional Presence)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Europe Bulletproof Glass Market Regulatory Framework

6.1 Safety Standards and Certifications

6.2 Compliance Requirements

6.3 Certification Processes

7. Europe Bulletproof Glass Future Market Size (in USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Europe Bulletproof Glass Future Market Segmentation

8.1 By Material (in Value %)

8.2 By End-User (in Value %)

8.3 By Application (in Value %)

8.4 By Security Level (in Value %)

8.5 By Country (in Value %)

9. Europe Bulletproof Glass Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

An ecosystem map for the Europe Bulletproof Glass Market was constructed, capturing all major stakeholders. Extensive desk research and databases were used to determine variables driving market dynamics.

Step 2: Market Analysis and Construction

Historical data was analyzed to assess market growth, penetration, and revenue generation. Further, the ratio of material adoption was evaluated to validate the data.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through interviews with industry experts from leading companies, offering critical insights into operational and financial metrics that substantiate our findings.

Step 4: Research Synthesis and Final Output

Engagements with multiple bulletproof glass manufacturers provided in-depth insights on product performance, sales, and consumer preferences, ensuring a comprehensive and validated analysis.

Frequently Asked Questions

01 How big is the Europe Bulletproof Glass Market?

The Europe Bulletproof Glass Market, valued at USD 3 billion, is largely driven by rising demand for security solutions across sectors, especially in the automotive and banking industries.

02 What are the key challenges in the Europe Bulletproof Glass Market?

Challenges in Europe Bulletproof Glass Market includes high production costs and regulatory compliance requirements pose significant challenges, impacting product pricing and market adoption rates.

03 Who are the major players in the Europe Bulletproof Glass Market?

Key players in Europe Bulletproof Glass Market include Saint-Gobain, AGC Inc., SCHOTT AG, Guardian Industries, and PPG Industries, recognized for their robust distribution networks and product innovations.

04 What factors drive the Europe Bulletproof Glass Market?

The Europe Bulletproof Glass Market growth is propelled by heightened security concerns, technological advancements in glass, and increased demand in high-risk sectors like banking and defense.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.