1. Europe Camping and Caravanning Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

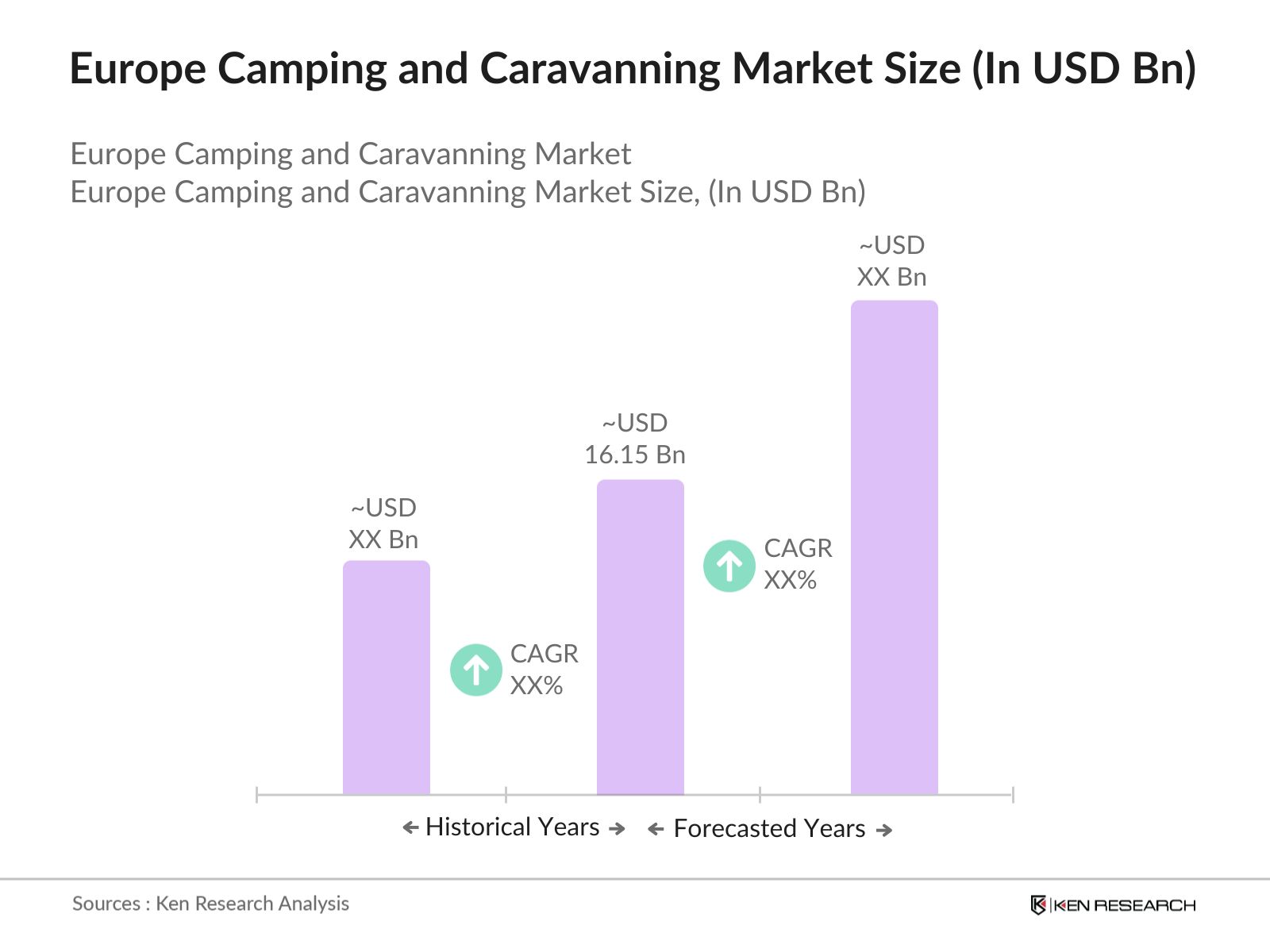

2. Europe Camping and Caravanning Market Size (in USD Billion)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Europe Camping and Caravanning Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Popularity of Outdoor Recreational Activities

3.1.2 Expansion of Eco-Tourism

3.1.3 Rising Demand for Affordable Vacation Options

3.1.4 Post-Pandemic Shift Towards Domestic Tourism

3.2 Market Challenges

3.2.1 Seasonal Dependence

3.2.2 Regulatory Complexities

3.2.3 Environmental Concerns

3.2.4 Competition from Alternative Accommodations

3.3 Opportunities

3.3.1 Technological Advancements in Camping Equipment

3.3.2 Development of Glamping Sites

3.3.3 Integration with Adventure Tourism

3.3.4 Expansion into Emerging Markets

3.4 Trends

3.4.1 Adoption of Sustainable Practices

3.4.2 Digital Transformation in Booking and Services

3.4.3 Customization and Personalization of Camping Experiences

3.4.4 Growth of RV Rentals and Sharing Economy

3.5 Government Regulations

3.5.1 Environmental Protection Policies

3.5.2 Safety and Health Standards

3.5.3 Land Use and Zoning Laws

3.5.4 Taxation and Licensing Requirements

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape

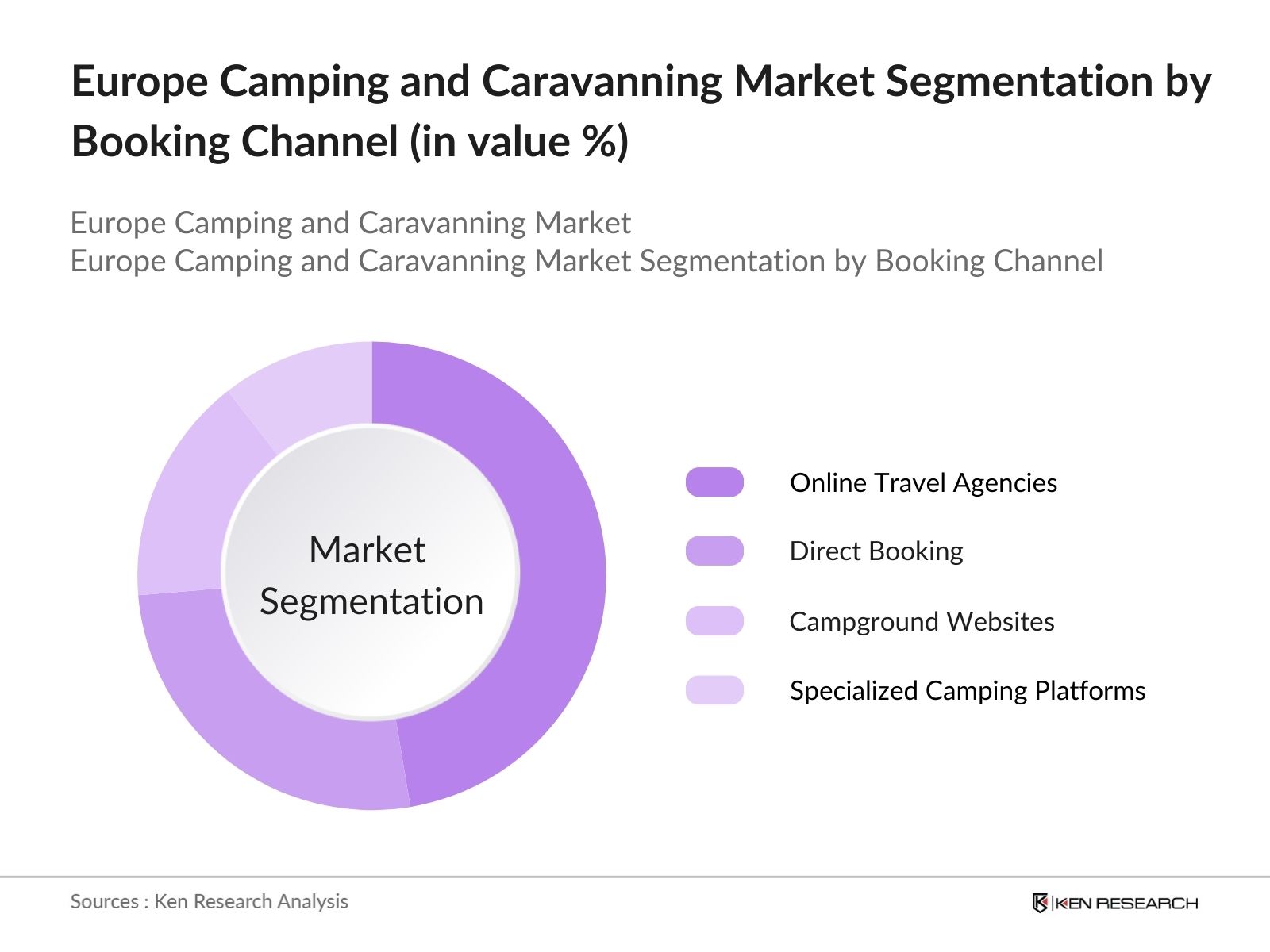

4. Europe Camping and Caravanning Market Segmentation

4.1 By Destination Type (in Value %)

4.1.1 State or National Park Campgrounds

4.1.2 Privately Owned Campgrounds

4.1.3 Public or Privately Owned Land Other Than a Campground

4.1.4 Backcountry, National Forest, or Wilderness Areas

4.1.5 Parking Lots

4.2 By Type of Camper (in Value %)

4.2.1 Car Camping

4.2.2 RV Camping

4.2.3 Backpacking

4.2.4 Glamping

4.3 By Distribution Channel (in Value %)

4.3.1 Direct Sales

4.3.2 Online Travel Agencies

4.3.3 Traditional Travel Agencies

4.3.4 Specialty Retailers

4.4 By Age Group (in Value %)

4.4.1 Below 30

4.4.2 30-54

4.4.3 55 & Above

4.5 By Country (in Value %)

4.5.1 Germany

4.5.2 France

4.5.3 United Kingdom

4.5.4 Italy

4.5.5 Spain

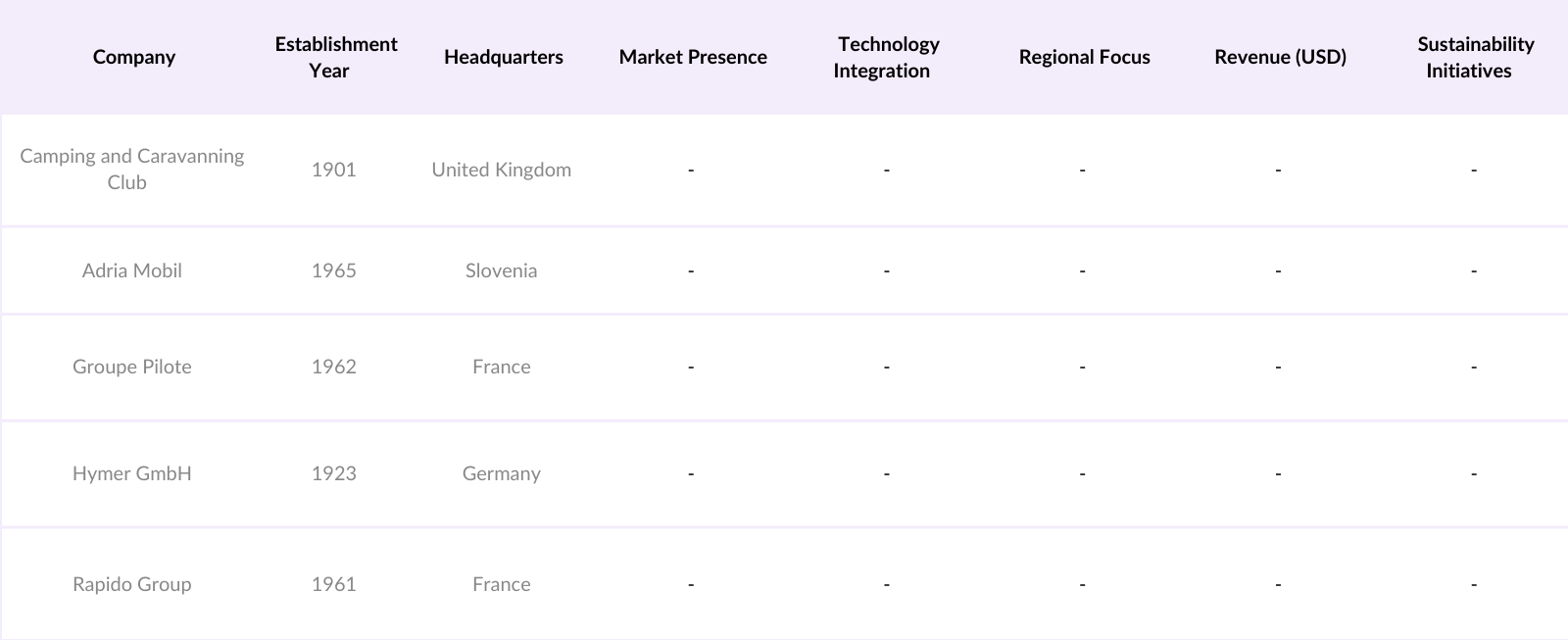

5. Europe Camping and Caravanning Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Camping and Caravanning Club

5.1.2 Eurocamp

5.1.3 Canvas Holidays

5.1.4 Adria Mobil

5.1.5 Groupe Pilote

5.1.6 Kabe AB

5.1.7 Laika Caravans

5.1.8 SoliferPolar AB

5.1.9 Swift Group

5.1.10 Trigano SA

5.1.11 Hymer GmbH & Co. KG

5.1.12 Dethleffs GmbH & Co. KG

5.1.13 Brstner GmbH & Co. KG

5.1.14 Hobby-Wohnwagenwerk Ing. Harald Striewski GmbH

5.1.15 Rapido Group

5.2 Cross Comparison Parameters

5.2.1 Number of Employees

5.2.2 Headquarters

5.2.3 Inception Year

5.2.4 Revenue

5.2.5 Market Share

5.2.6 Product Portfolio

5.2.7 Geographic Presence

5.2.8 Recent Developments

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.6.1 Venture Capital Funding

5.6.2 Government Grants

5.6.3 Private Equity Investments

6. Europe Camping and Caravanning Market Regulatory Framework

6.1 Environmental Standards

6.2 Compliance Requirements

6.3 Certification Processes

7. Europe Camping and Caravanning Future Market Size (in USD Billion)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Europe Camping and Caravanning Future Market Segmentation

8.1 By Destination Type (in Value %)

8.2 By Type of Camper (in Value %)

8.3 By Distribution Channel (in Value %)

8.4 By Age Group (in Value %)

8.5 By Country (in Value %)

9. Europe Camping and Caravanning Market Analysts Recommendations

9.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer

Contact Us