Europe Cat Litter Market Outlook to 2030

Region:Europe

Author(s):Paribhasha Tiwari

Product Code:KROD10407

November 2024

85

About the Report

Europe Cat Litter Market Overview

- The Europe Cat Litter Market is valued at USD 46 billion, driven by the increasing number of pet owners, especially in urban areas, where apartment living necessitates the use of cat litter products. Rising awareness of pet hygiene and the convenience of products like clumping and silica-based litter are also contributing to this market's growth. Major companies are continuously innovating in terms of eco-friendly, biodegradable products, addressing consumer demand for sustainable options, which is accelerating market adoption.

- Key countries dominating the Europe cat litter market include Germany, the United Kingdom, and France. Germany leads the market due to its robust pet care industry, while the United Kingdom has a high adoption rate of premium cat litter products. France benefits from a well-established pet retail network, with a significant focus on organic and biodegradable options, making it a dominant player in the European market.

- The European Union has introduced incentives under the Circular Economy Action Plan (CEAP) to support the development of sustainable and biodegradable pet products, including cat litter. In 2023, over 100 million was allocated to companies developing eco-friendly solutions.

Europe Cat Litter Market Segmentation

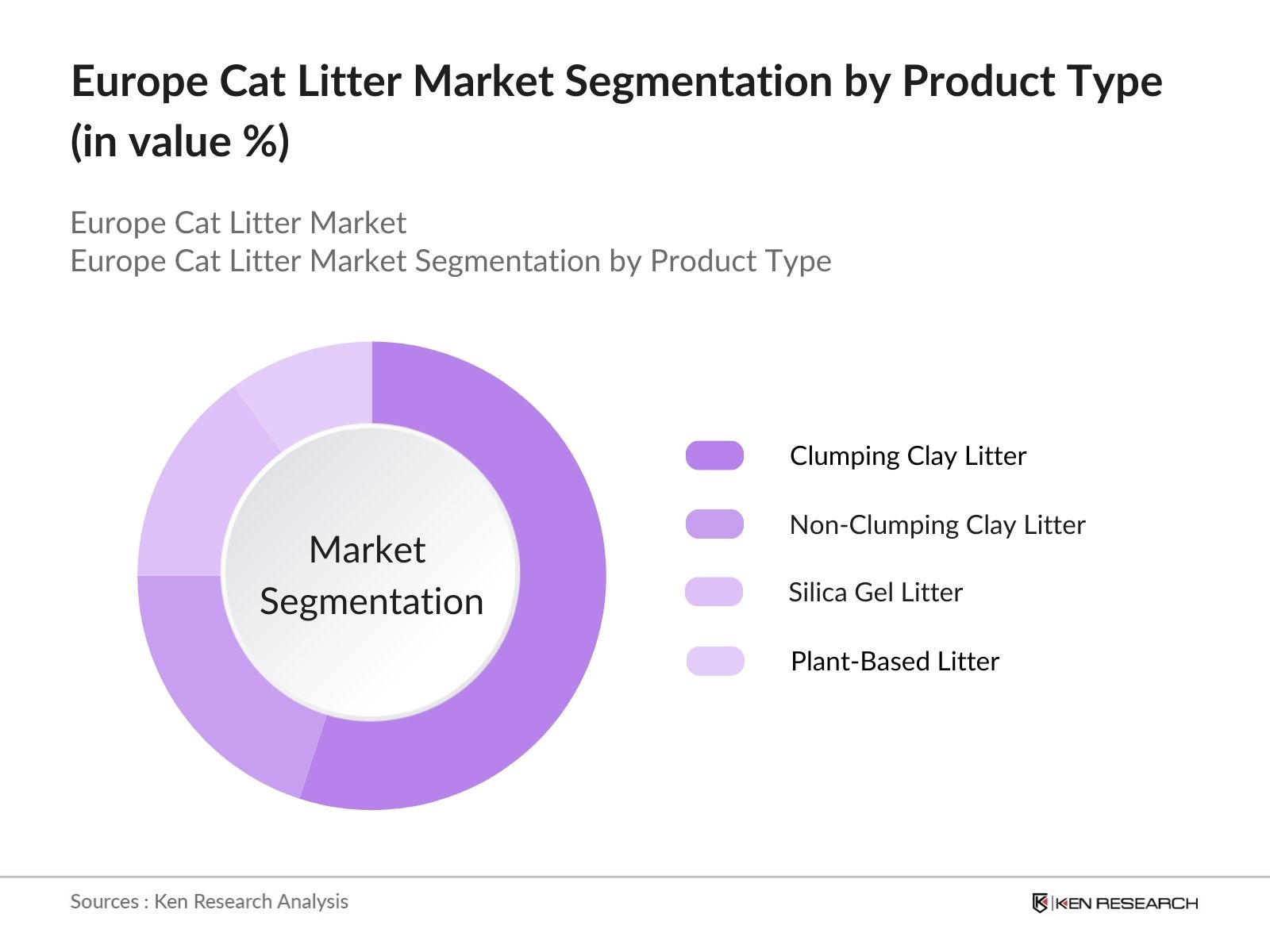

By Product Type: The Europe Cat Litter Market is segmented by product type into clumping clay litter, non-clumping clay litter, silica gel litter, and plant-based litter. Clumping clay litter holds a dominant market share in the product type segmentation, as it provides superior odor control and ease of cleaning. This convenience appeals to consumers, especially in urban environments, where time-saving solutions are prioritized. Additionally, the affordability of clumping clay compared to newer alternatives solidifies its strong market position.

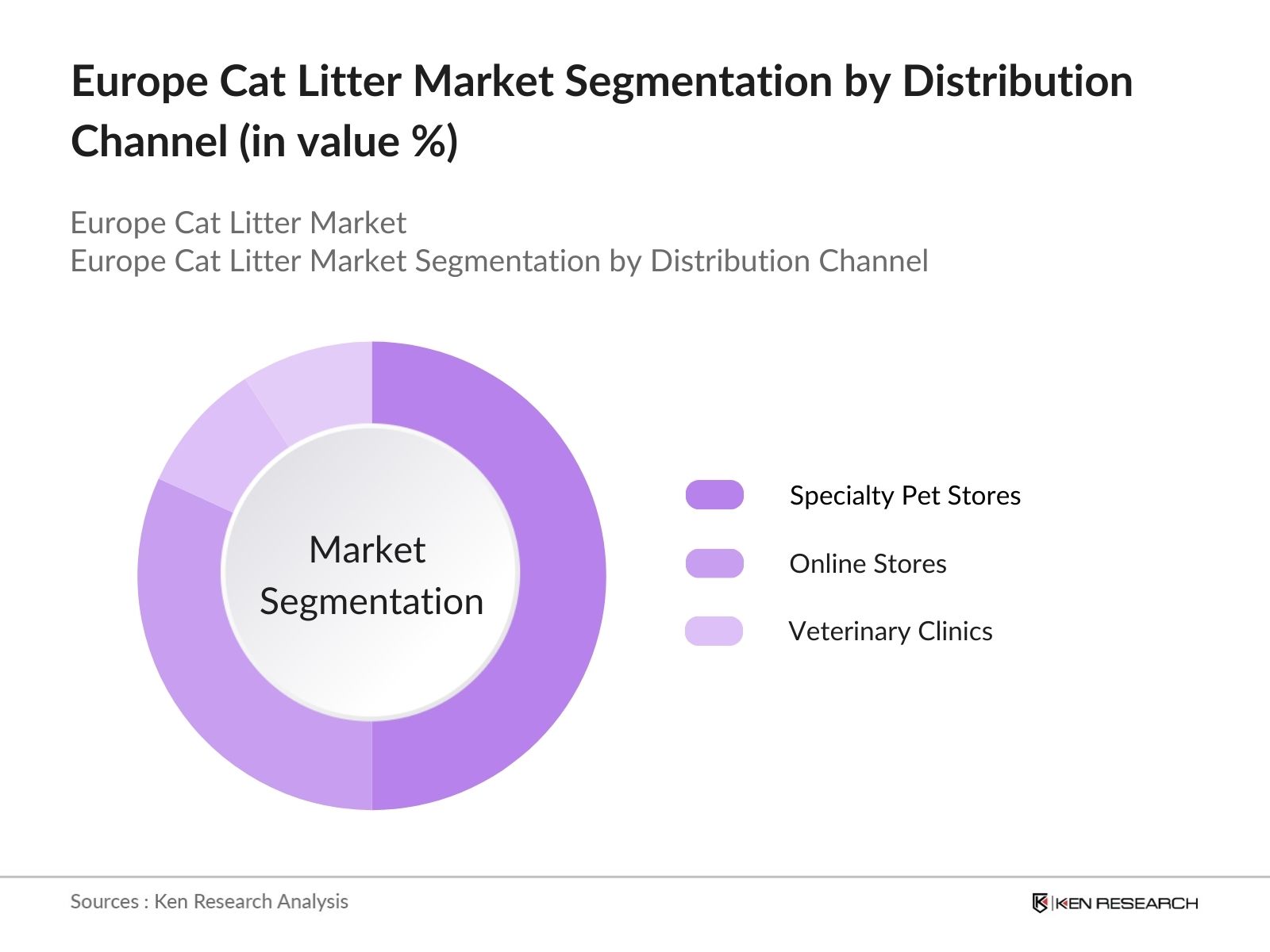

By Distribution Channel: The market is segmented by distribution channel into supermarkets/hypermarkets, specialty pet stores, online stores, and veterinary clinics. Specialty pet stores dominate this segmentation due to the personalized service and expert advice available to customers, which influences purchasing decisions. These stores offer a wide range of premium products, which appeal to pet owners seeking high-quality and eco-friendly options for their pets.

Europe Cat Litter Market Competitive Landscape

The Europe Cat Litter Market is dominated by a combination of international players and regional specialists. Companies such as Nestl Purina and Mars Petcare have a significant presence due to their extensive product portfolios and strong distribution networks. The rise of eco-friendly and sustainable products has led to increased competition, with players like JRS Rettenmaier (Cats Best) gaining market traction.

Europe Cat Litter Market Analysis

Growth Drivers

- Pet ownership trends: As of 2024, Europe has witnessed a growing number of households adopting pets, with over 129 million pet cats across the continent. This rising trend, driven by changing family structures and increasing companionship needs, has significantly expanded the demand for cat litter products. This trend is particularly strong in Western Europe, where Germany alone accounts for more than 15 million pet cats.

- Rising urban population: The urban population in Europe is expected to grow by over 7 million people by 2025, according to data from Eurostat. As more people shift to city living, smaller living spaces and apartment complexes drive the need for efficient, odor-controlling cat litter solutions. Cities like Paris and London, with high urban density, are key areas where demand for cat litter is projected to increase significantly.

- Increasing focus on pet hygiene: With 70% of European pet owners viewing their pets as family members, according to a 2024 government survey, there is a heightened awareness of maintaining pet hygiene. Cat litter products, especially those with antibacterial properties, are becoming essential for households to ensure cleanliness, particularly in multi-pet environments.

Market Challenges

- Supply chain constraints: Disruptions in global supply chains, particularly for raw materials like bentonite and silica gel, have affected the availability of cat litter in Europe. Import restrictions from countries such as Turkey, one of the leading suppliers of bentonite, have led to delays and shortages in 2024, impacting retailers' inventories across Europe.

- Rising raw material costs: Bentonite clay and silica gel, the primary raw materials for cat litter, have seen a price surge in 2023 due to increased mining costs and stricter environmental regulations. As reported by the European Raw Materials Alliance, extraction costs for these materials have risen by nearly 500 per ton, pushing manufacturers to pass costs on to consumers.

Europe Cat Litter Market Future Outlook

The Europe Cat Litter Market is expected to experience continued growth over the next five years, driven by increasing awareness of sustainable products, growing pet ownership, and innovations in odor control technology. The demand for plant-based and biodegradable litter options is anticipated to rise significantly, as consumers become more environmentally conscious. Additionally, e-commerce growth will further enhance product availability, leading to market expansion.

Market Opportunities

- Eco-friendly product innovation: With growing environmental concerns, manufacturers are capitalizing on the shift towards eco-friendly litter solutions. In 2024, over 2 million European households opted for biodegradable cat litter made from materials such as corn, wheat, and wood. This trend offers significant growth potential for companies developing sustainable alternatives to traditional clay-based products.

- E-commerce penetration: The rise in e-commerce adoption, with over 80 million Europeans purchasing pet care products online in 2023, presents an opportunity for manufacturers to reach a broader customer base. The convenience of doorstep delivery, combined with subscription models, is driving online sales of cat litter, especially in urban areas like Paris and Milan.

Scope of the Report

|

By Product Type |

Clumping Clay Litter Non-Clumping Clay Litter Silica Gel Litter Plant-Based Litter (Corn, Wheat, Pine) |

|

By Distribution Channel |

Supermarkets/Hypermarkets Specialty Pet Stores Online Stores Veterinary Clinics |

|

By Packaging Type |

Paper Bags Plastic Bags Sustainable Packaging |

|

By User Type |

Single Cat Households Multi-Cat Households |

|

By Region |

West East North South Central |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (EU Commission, European Food Safety Authority)

Manufacturers and Suppliers

Pet Care Retailers and Distributors

Online Pet Product Retailers

Veterinary Clinics and Animal Hospitals

Product Development Teams

Sustainability Organizations

Companies

Players Mentioned in the Report:

Nestl Purina Petcare

Mars Petcare

JRS Rettenmaier (Cats Best)

Church & Dwight Co., Inc. (Arm & Hammer)

Intersand

Clorox Company (Fresh Step)

Tolsa Group

Pettex

Litter-Robot

Table of Contents

1. Europe Cat Litter Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Europe Cat Litter Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Europe Cat Litter Market Analysis

3.1 Growth Drivers (Pet ownership trends, rising urban population, increasing focus on pet hygiene, environmental awareness)

3.2 Market Challenges (Supply chain constraints, rising raw material costs, environmental regulations)

3.3 Opportunities (Eco-friendly product innovation, e-commerce penetration, premiumization, increasing adoption of non-clay litters)

3.4 Trends (Sustainable packaging, silica gel and plant-based litter popularity, subscription-based sales models, growing demand for multi-cat products)

3.5 Government Regulation (Animal welfare regulations, pet product safety standards, environmental disposal guidelines, import-export restrictions)

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. Europe Cat Litter Market Segmentation

4.1 By Product Type (In Value %)

4.1.1. Clumping Clay Litter

4.1.2. Non-Clumping Clay Litter

4.1.3. Silica Gel Litter

4.1.4. Plant-Based Litter (Corn, Wheat, Pine)

4.2 By Distribution Channel (In Value %)

4.2.1. Supermarkets/Hypermarkets

4.2.2. Specialty Pet Stores

4.2.3. Online Stores

4.2.4. Veterinary Clinics

4.3 By Packaging Type (In Value %)

4.3.1. Paper Bags

4.3.2. Plastic Bags

4.3.3. Sustainable Packaging

4.4 By User Type (In Value %)

4.4.1. Single Cat Households

4.4.2. Multi-Cat Households

4.5 By Region (In Value %)

4.5.1. Western Europe

4.5.2. Eastern Europe

4.5.3. Northern Europe

4.5.4. Southern Europe

4.5.5. Central Europe

5. Europe Cat Litter Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Nestl Purina Petcare

5.1.2. Mars Petcare

5.1.3. Clorox Company (Fresh Step)

5.1.4. Church & Dwight Co., Inc. (Arm & Hammer)

5.1.5. JRS Rettenmaier (Cats Best)

5.1.6. Tolsa Group

5.1.7. Intersand

5.1.8. Pettex

5.1.9. Litter-Robot

5.1.10. Vitakraft

5.1.11. Ultra Pet (Ultracat)

5.1.12. kocat

5.1.13. Tigerino

5.1.14. Breeders Choice

5.1.15. Feline Pine

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Revenue, Regional Presence, Product Portfolio, R&D Investment, Market Penetration, Strategic Alliances)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers And Acquisitions

5.6 Investment Analysis

5.7 Joint Ventures

5.8 Key Product Launches

6. Europe Cat Litter Market Regulatory Framework

6.1 Environmental Standards (Waste management and recycling requirements, biodegradability standards)

6.2 Compliance Requirements (Product safety certifications, labeling standards)

6.3 Import and Export Regulations (EU pet product standards, customs duties, trade agreements)

6.4 Certification Processes (Eco-friendly certifications, health and safety certifications)

7. Europe Cat Litter Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Europe Cat Litter Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Distribution Channel (In Value %)

8.3 By Packaging Type (In Value %)

8.4 By User Type (In Value %)

8.5 By Region (In Value %)

9. Europe Cat Litter Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Strategies

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In this phase, the critical stakeholders in the Europe Cat Litter Market are identified through a combination of primary and secondary research. Key variables, such as market drivers, regulatory factors, and consumer preferences, are mapped for further analysis.

Step 2: Market Analysis and Construction

A comprehensive review of historical data from 2018 to 2023 is conducted to evaluate growth patterns. This involves analyzing sales trends, revenue generation by key players, and market penetration rates across various distribution channels and regions.

Step 3: Hypothesis Validation and Expert Consultation

Interviews with industry experts and market participants are conducted to validate the initial hypotheses formed during desk research. Insights on product preferences, brand loyalty, and technological advancements are gathered.

Step 4: Research Synthesis and Final Output

The final stage involves consolidating findings from both top-down and bottom-up approaches to ensure a comprehensive market overview. This synthesis phase guarantees data accuracy and the representation of market dynamics based on validated sources.

Frequently Asked Questions

1. How big is the Europe Cat Litter Market?

The Europe Cat Litter Market is valued at USD 46 billion, driven by the rising pet ownership and growing preference for premium and eco-friendly products.

2. What are the challenges in the Europe Cat Litter Market?

Challenges in the Europe Cat Litter Market include rising raw material costs, stringent environmental regulations, and increasing competition from plant-based and biodegradable litter products.

3. Who are the major players in the Europe Cat Litter Market?

Key players in the Europe Cat Litter Market include Nestl Purina Petcare, Mars Petcare, Church & Dwight Co. (Arm & Hammer), JRS Rettenmaier (Cats Best), and Intersand, which dominate the market with their strong brand presence and wide distribution networks.

4. What are the growth drivers of the Europe Cat Litter Market?

The Europe Cat Litter Market is propelled by growing urbanization, increasing awareness of pet hygiene, and the rising trend of adopting sustainable and eco-friendly products.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.