Europe Center Console Market Outlook to 2030

Region:Europe

Author(s):Shreya

Product Code:KROD7985

December 2024

86

About the Report

Europe Center Console Market Overview

- The Europe Center Console Market is valued at USD 31 billion, underpinned by the increasing demand for ergonomic and technologically advanced vehicle interiors. This growth is driven by consumer preferences for enhanced in-car connectivity and integration of advanced infotainment systems, which are now considered essential by many automotive buyers. Additionally, technological advancements in electronics and a surge in electric vehicle sales are boosting the adoption of innovative center console designs, further driving the markets expansion.

- Germany, France, and the United Kingdom are key markets within Europe, contributing to the market's dominance due to their strong automotive manufacturing sectors and substantial consumer demand for premium and electric vehicles. Germany, in particular, is home to major automotive OEMs and suppliers focused on technological innovation, which has spurred continuous demand for advanced center console solutions in both the luxury and electric vehicle segments.

- The European Unions safety and ergonomic regulations have a significant impact on the design and functionality of center consoles. The EU Safety Standards Directive states that all automotive interiors must adhere to guidelines that reduce driver distractions, leading to ergonomic console layouts and non-reflective screens. In 2023, the EU mandated that all new console designs meet specific criteria to enhance driver comfort and minimize visual strain, which manufacturers must comply with to avoid penalties.

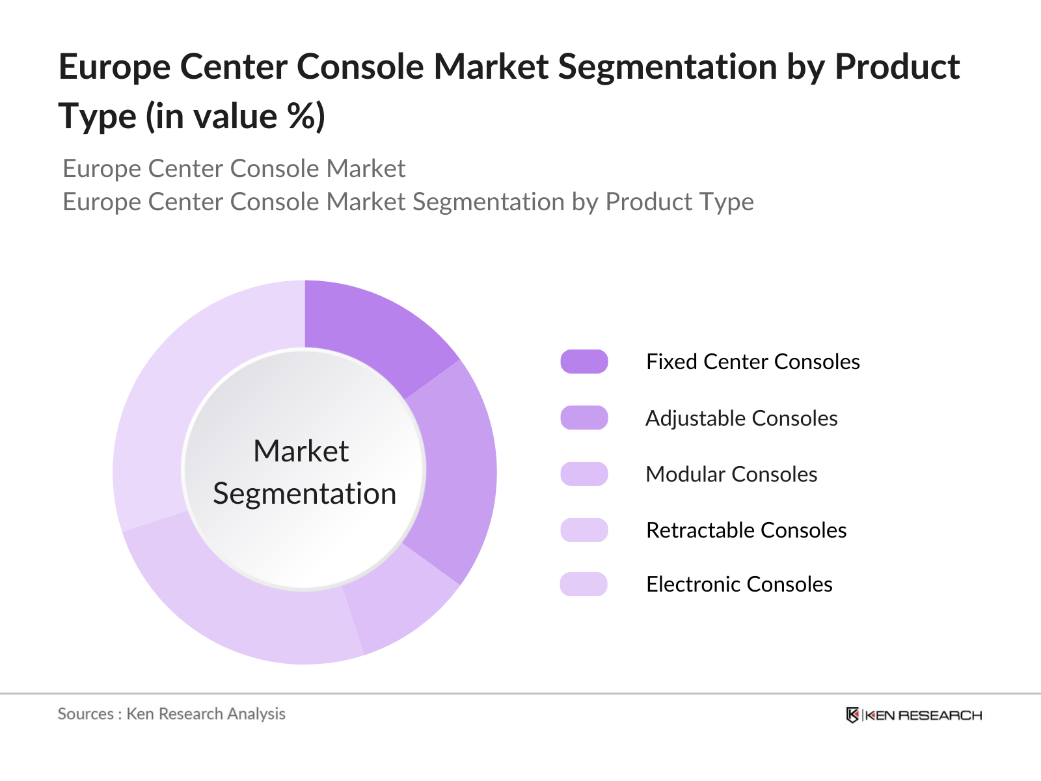

Europe Center Console Market Segmentation

By Product Type: The market is segmented by product type into Fixed Center Consoles, Adjustable Consoles, Modular Consoles, Retractable Consoles, and Electronic Consoles. Adjustable consoles hold a significant share due to their versatility and increasing demand for customizable vehicle interiors. These consoles allow users to modify the layout and storage options, enhancing convenience and adapting to different usage scenarios.

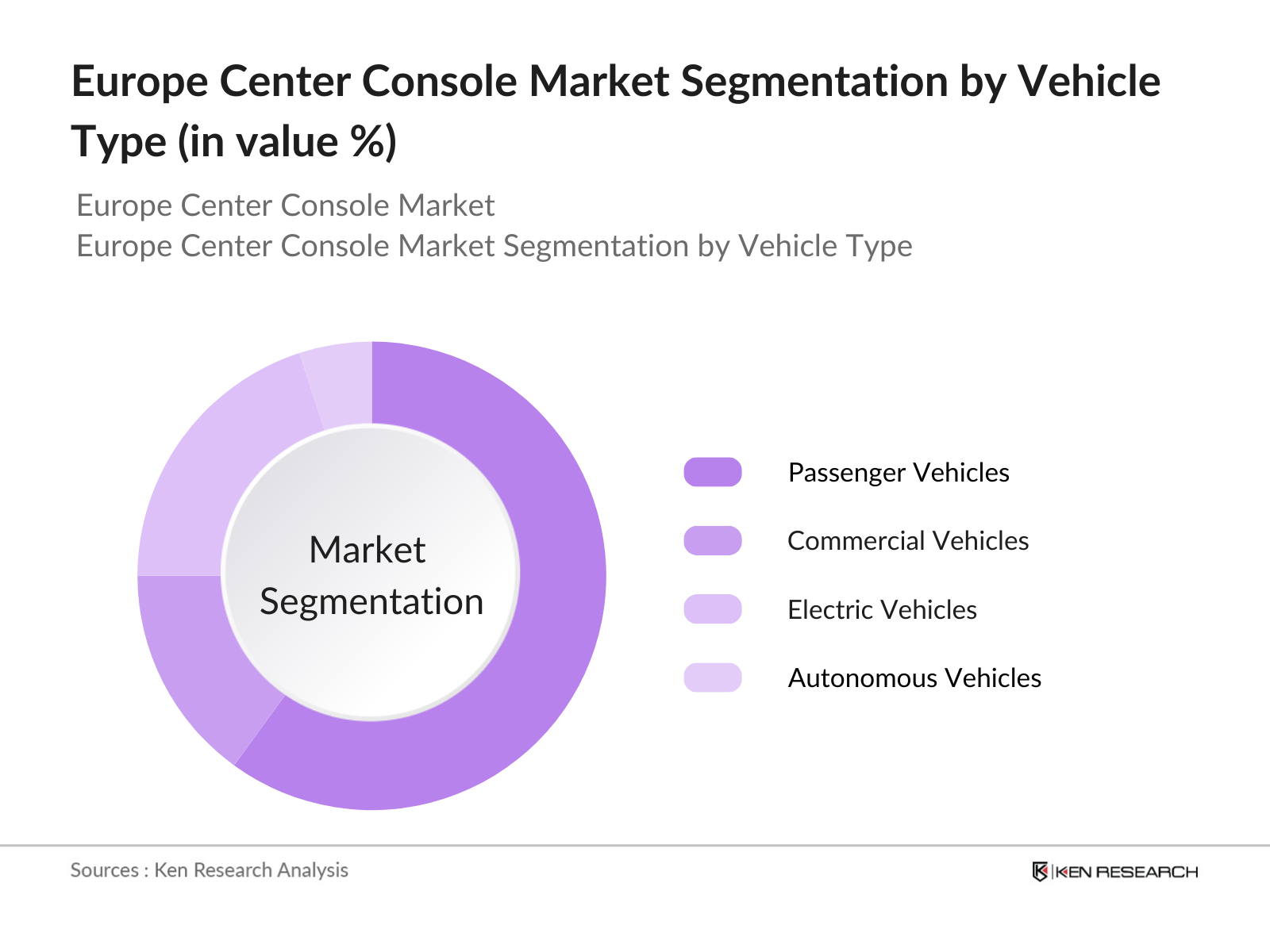

By Vehicle Type: In the vehicle type segment, the market is categorized into passenger vehicles, commercial vehicles, electric vehicles, and autonomous vehicle. Passenger vehicles hold the largest market share within this segment. The higher sales volume of passenger vehicles, combined with increased demand for advanced interior features, has positioned this segment as the largest contributor. The integration of multifunctional consoles in passenger vehicles appeals to consumers looking for comfort and utility, making it the leading segment.

Europe Center Console Market Competitive Landscape

The Europe Center Console Market is characterized by the presence of prominent global players and innovative local manufacturers. The market is highly competitive, with major companies competing on technology integration, material innovation, and ergonomic design improvements. Key players maintain their positions through continuous product development and strategic alliances.

Europe Center Console Market Analysis

Growth Drivers

Increased Vehicle Electrification: The growing electrification of vehicles in Europe is driving the adoption of advanced center console technologies. According to the International Energy Agency, Europe accounted for 40% of global electric vehicle (EV) sales, with 2 million units sold in 2023. This electrification trend requires more sophisticated console designs to support unique EV functionalities, such as battery status indicators, advanced navigation for optimal charging station locations, and system diagnostics.

Rising Demand for In-Car Connectivity: Consumer preference for digital connectivity has increased the demand for in-car connectivity features integrated within center consoles. A report from the European Commission indicates that in 2023, approximately 60% of European cars offered internet connectivity features, which enhances access to real-time traffic data, entertainment, and voice-assisted controls. This demand is fueled by a highly digital-savvy European consumer base, where 78% of people aged 18-54 used mobile internet in 2023, driving demand for seamless integration between smartphones and in-car systems.

Enhanced User Interface Technology: Europes center console market is advancing rapidly with the integration of cutting-edge user interface (UI) technologies such as haptic feedback, touch-based controls, and multi-function touchscreens. A 2023 study by Eurostat highlights that European automotive manufacturer invested 15 billion in R&D on vehicle electronics, which includes advanced UI technologies. This is partly in response to consumers desire for more intuitive, responsive, and safe in-car interfaces

Market Challenges

High Manufacturing Costs: The production costs of advanced center consoles remain high due to the need for high-quality electronic components, touch screens, and durable materials. According to the European Automobile Manufacturers Association, the cost of integrating touchscreen components increased by 18% in 2023 due to material shortages and inflation, putting pressure on profit margins. This cost barrier is particularly challenging for mid-tier automotive brands aiming to integrate these advanced features while maintaining affordability for consumers.

Limited Availability of Advanced Materials: The center console market is facing material availability challenges, particularly for components that require rare earth metals and high-grade plastics. A European Commission report in 2024 noted that over 30% of automotive manufacturers cited difficulty in sourcing lithium and cobalt, essential for EVs and electronic consoles, due to supply chain disruptions. This scarcity restricts production capabilities and slows down the integration of advanced, durable materials essential for innovative console designs.

Europe Center Console Market Future Outlook

Over the next five years, the Europe Center Console Market is expected to experience robust growth. This growth trajectory is attributed to rising demand for advanced infotainment systems, increased consumer focus on vehicle interiors, and the steady rise in electric vehicle production. Additionally, the shift toward smart consoles equipped with AI and IoT technologies will further bolster the market as manufacturers invest in more sophisticated console solutions.

Future Market Opportunities

Advancements in Autonomous Driving Technologies: The development of autonomous driving technology is creating new opportunities for center console innovation. According to a 2023 report from the European Parliament, autonomous vehicle R&D funding reached 4 billion, driving the need for consoles that can support a partially autonomous driving experience. These consoles are being designed with AI-based navigation controls, advanced driver-assistance systems (ADAS), and even personalized infotainment options that can operate autonomously, catering to a futuristic in-car experience.

Integration with Smart Technologies: Europes commitment to smart city initiatives is encouraging automotive manufacturers to incorporate smart technology into center consoles. The European Investment Banks 2023 report shows that 25 billion was allocated to smart infrastructure projects, creating opportunities for smart vehicle technology integration. Center consoles now feature real-time connectivity with city infrastructure, supporting applications like smart parking, traffic signal updates, and environmental data collection, enhancing the value of these consoles for urban commuters.

Scope of the Report

|

Product Type |

Standard Center Consoles |

|

Vehicle Type |

Passenger Vehicles |

|

Material |

Plastic |

|

Sales Channel |

OEM (Original Equipment Manufacturer) |

|

Application |

Display Interface Consoles |

Products

Key Target Audience

Automotive Manufacturers

Tier-1 and Tier-2 Automotive Suppliers

Center Console Component Suppliers

Interior Design Solution Providers

Automotive Electronics Manufacturers

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., European Commission, UNECE)

Automotive Testing and Certification Agencies

Companies

Players Mentioned in the Report

Faurecia

Continental AG

Magna International Inc.

Yanfeng Automotive

Grupo Antolin

Grammer AG

Toyota Boshoku Corporation

Draexlmaier Group

ZF Friedrichshafen AG

Lear Corporation

TS Tech Co., Ltd.

Tachi-S Co., Ltd.

Johnson Controls International

Adient PLC

Novem Car Interior Design

Table of Contents

1 Europe Center Console Market Overview

Definition and Scope

Market Taxonomy

Key Industry Insights

Market Growth Rate and Projections

2 Europe Center Console Market Size (In USD Bn)

Historical Market Size

Year-On-Year Growth Analysis

Key Developments and Milestones

3 Europe Center Console Market Dynamics

Growth Drivers

Increased Vehicle Electrification

Rising Demand for In-Car Connectivity

Enhanced User Interface Technology

Consumer Preference for Ergonomic Designs

Market Challenges

High Manufacturing Costs

Limited Availability of Advanced Materials

Integration and Compatibility Issues

Opportunities

Advancements in Autonomous Driving Technologies

Integration with Smart Technologies

Growing Aftermarket Opportunities

Trends

Adoption of Digital Displays

Multi-Functional Console Design

Integration with Artificial Intelligence and IoT

Regulatory and Compliance Factors

Safety and Ergonomic Standards

Environmental Regulations

Material and Manufacturing Standards

4 Europe Center Console Market Segmentation

By Product Type (In Value %)

Standard Center Consoles

Customizable Center Consoles

Modular Center Consoles

Premium Center Consoles

Integrated Console Systems

By Vehicle Type (In Value %)

Passenger Vehicles

Commercial Vehicles

Electric Vehicles

Luxury Vehicles

Off-Road Vehicles

By Material (In Value %)

Plastic

Leather

Metal Alloys

Carbon Fiber

Sustainable and Eco-friendly Materials

By Sales Channel (In Value %)

OEM (Original Equipment Manufacturer)

Aftermarket

By Application (In Value %)

Display Interface Consoles

Storage and Utility Consoles

Integrated Charging Consoles

Touchscreen and Infotainment Consoles

5 Europe Center Console Market Competitive Analysis

Detailed Profiles of Major Companies

Faurecia

Magna International Inc.

Continental AG

Yanfeng Automotive Interiors

Grammer AG

Toyota Boshoku Corporation

Grupo Antolin

Novem Car Interior Design

Draexlmaier Group

ZF Friedrichshafen AG

Lear Corporation

TS Tech Co., Ltd.

Tachi-S Co., Ltd.

Johnson Controls International

Adient PLC

Cross Comparison Parameters (Revenue, Headquarters, Product Offering, Innovation Index, Manufacturing Footprint, Production Capacity, Market Share, Workforce Size)

Market Share Analysis

Strategic Initiatives and Innovations

Mergers and Acquisitions

Investment and Funding Landscape

Government Grants and Support

6 Europe Center Console Market Regulatory Framework

Industry Standards and Certifications

Compliance Requirements by Material and Manufacturing Process

Ergonomic and Safety Standards

Environmental and Sustainability Guidelines

7 Europe Center Console Future Market Size (In USD Bn)

Future Market Size Projections

Key Factors Driving Future Market Growth

8 Europe Center Console Market Segmentation - Future Projections

By Product Type (In Value %)

By Vehicle Type (In Value %)

By Material (In Value %)

By Sales Channel (In Value %)

By Application (In Value %)

9 Europe Center Console Market Analysts Recommendations

TAM/SAM/SOM Analysis

Consumer Demographics and Preferences

Market Entry Strategies

Investment Opportunities and Risk Analysis

Emerging Markets and White Space Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial step involves mapping the automotive and interior design ecosystem specific to the Europe Center Console Market. Key industry stakeholders are identified using both secondary and proprietary databases to gather comprehensive data on the industry structure and significant market variables.

Step 2: Market Analysis and Construction

This phase includes a thorough analysis of historical data on the Europe Center Console Market, covering market penetration, product type adoption, and application segments. The resulting data is evaluated to ensure the reliability and accuracy of the market estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are constructed based on gathered data and then validated through industry expert consultations conducted via structured interviews and CATIs. These insights help confirm key findings and refine market data for better accuracy.

Step 4: Research Synthesis and Final Output

The final step involves detailed engagements with automotive manufacturers and suppliers to gain specific insights into product segment trends, consumer preferences, and sales performance. This step verifies and complements the data from a bottom-up approach, ensuring a well-rounded analysis of the Europe Center Console Market.

Frequently Asked Questions

01 How big is the Europe Center Console Market?

The Europe Center Console Market is valued at USD 31 billion, supported by increased demand for advanced vehicle interiors and in-car technology integration.

02 What are the challenges in the Europe Center Console Market?

Challenges in the Europe Center Console Market include high production costs for premium consoles, difficulties in integrating complex infotainment systems, and adherence to stringent automotive regulations.

03 Who are the major players in the Europe Center Console Market?

Major players in the Europe Center Console Market include Faurecia, Continental AG, Magna International, Yanfeng Automotive, and Grupo Antolin, known for their extensive portfolios and strong market presence.

04 What factors are driving growth in the Europe Center Console Market?

Growth in the Europe Center Console Market is driven by rising consumer expectations for luxury features, advancements in vehicle connectivity, and an increased focus on electric vehicle interior technology

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.