Europe Cloud Gaming Market Outlook to 2030

Region:Europe

Author(s):Sanjna

Product Code:KROD3415

December 2024

83

About the Report

Europe Cloud Gaming Market Overview

- The Europe Cloud Gaming market is valued at USD 1.5 billion, driven by the rapid expansion of high-speed internet infrastructure and the increasing adoption of cloud-based gaming services. The market growth is further propelled by advancements in cloud computing technologies and the rising demand for seamless gaming experiences across multiple devices.

- Germany, the United Kingdom, and France dominate the Europe Cloud Gaming market due to their robust technological infrastructure, high internet penetration rates, and a large base of gaming enthusiasts. These countries benefit from significant investments in cloud gaming platforms and have established strong partnerships between telecom providers and gaming studios, fostering an environment conducive to market growth.

- The General Data Protection Regulation (GDPR) continues to have a profound impact on cloud gaming services in Europe. In 2024, cloud gaming providers are required to adhere to stringent data privacy laws, including the protection of user data and consent management. Fines for non-compliance with GDPR can reach up to USD 21 million, or 4% of global revenue, whichever is higher. These regulations have led to an increased focus on data encryption and security protocols in cloud gaming, as providers must ensure that they are compliant while delivering high-quality gaming experiences.

Europe Cloud Gaming Market Segmentation

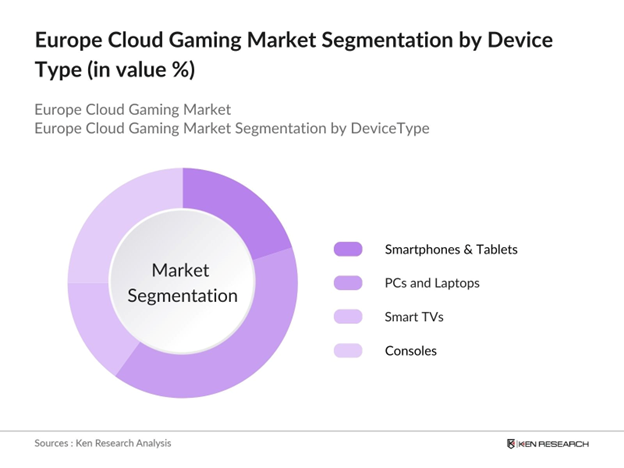

By Device Type: The Europe Cloud Gaming market is segmented by device type into smartphones and tablets, PCs and laptops, smart TVs, and consoles. Recently, PCs and laptops have secured the dominant market share, accounting for 40% in 2023. This dominance is attributed to the high performance and flexibility these devices offer, allowing gamers to access a vast library of titles with superior graphics and minimal latency. Additionally, the widespread availability of high-speed internet connections in Europe enhances the gaming experience on these platforms.

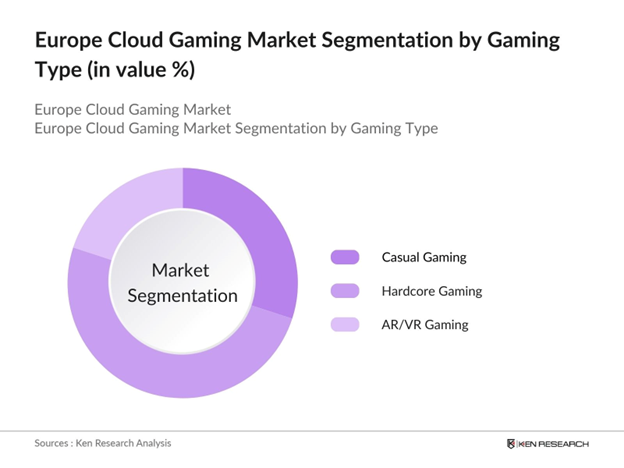

By Gaming Type: The market is further segmented by gaming type into casual gaming, hardcore gaming, and AR/VR gaming. Hardcore gaming leads the segmentation with a 50% market share in 2023. This segment dominates due to the high demand for immersive and graphically intensive games that require substantial computational power, which cloud gaming platforms effectively provide. The integration of advanced technologies such as AI and machine learning enhances the gaming experience, attracting a dedicated user base that seeks high-quality and competitive gaming environments.

Europe Cloud Gaming Market Competitive Analysis

The Europe Cloud Gaming market is dominated by a few major players, including global giants such as Google Stadia, Microsoft xCloud, Nvidia GeForce Now, Sony PlayStation Now, and Amazon Luna. This consolidation highlights the significant influence of these key companies, which leverage their extensive technological expertise, vast gaming libraries, and strategic partnerships to maintain a competitive edge in the market.

|

Company |

Establishment Year |

Headquarters |

Revenue (2023) |

Subscription Growth |

Data Center Infrastructure |

Game Library Size |

|

Google Stadia |

2019 |

Mountain View, USA |

- |

- |

- |

- |

|

Microsoft xCloud |

2020 |

Redmond, USA |

- |

- |

- |

- |

|

Nvidia GeForce Now |

2017 |

Santa Clara, USA |

- |

- |

- |

- |

|

Sony PlayStation Now |

2014 |

Tokyo, Japan |

- |

- |

- |

- |

|

Amazon Luna |

2020 |

Seattle, USA |

- |

- |

- |

- |

Europe Cloud Gaming Market Analysis

Growth Drivers

- Expanding Broadband Connectivity: The rapid expansion of broadband infrastructure across Europe, including advancements in fiber optics and the deployment of 5G networks, is driving the adoption of cloud gaming. 5G network coverage reached 62% of the European population in early 2024, with average download speeds of 150 Mbps, enhancing the potential for cloud-based gaming experiences that demand high bandwidth and low latency. These improvements in broadband connectivity are crucial for reducing lag, improving gaming performance, and supporting real-time gameplay.

- Adoption of Edge Computing in Gaming Infrastructure: The integration of edge computing into the gaming infrastructure is another significant growth driver. By processing data closer to the user, edge computing helps reduce latency issues, which is crucial for cloud gaming. In 2024, Europe has seen over 850 edge data centers, with several major tech companies partnering with telecom operators to enhance the gaming experience. This infrastructure enables faster processing of game data, leading to smoother performance and an improved gaming experience.

- Rise in Subscription-based Gaming Services: Subscription-based gaming services are gaining momentum in Europe, with the number of gaming subscribers surpassing 30 million in early 2024. These services provide gamers with access to a vast library of games for a monthly fee, eliminating the need for expensive hardware. Leading cloud gaming platforms are increasingly offering these subscription models, making gaming more accessible to the average European consumer.

Challenges

- Latency and Bandwidth Limitations: Despite the advancements in broadband and 5G, latency and bandwidth limitations continue to pose challenges to the cloud gaming experience. As of early 2024, rural areas in Europe still experience slower broadband speeds, with average download rates of around 20 Mbps, compared to 100 Mbps or higher in urban regions. Latency issues, particularly in remote or less developed areas, hinder the performance of cloud games that require real-time responsiveness.

- High Data Costs: The high cost of data consumption remains a barrier to the widespread adoption of cloud gaming in Europe. In 2024, mobile data costs in several European countries remained significantly high, with prices ranging from $2 to $10 per GB. Cloud gaming requires substantial data usage, often exceeding 10 GB per hour of high-definition gameplay, which can lead to considerable expenses for gamers, particularly those relying on mobile networks.

Europe Cloud Gaming Future Market Outlook

Europe Cloud Gaming market is expected to exhibit substantial growth, driven by continuous advancements in cloud computing technologies, increasing consumer demand for high-quality gaming experiences, and the expansion of 5G networks. The integration of virtual reality (VR) and augmented reality (AR) into cloud gaming platforms will further enhance user engagement, while strategic partnerships between technology providers and game developers will foster innovation and market expansion.

Market Opportunities

- Integration with VR and AR Platforms: Virtual and Augmented Reality (VR and AR) integration presents a significant opportunity for the cloud gaming market in Europe. The overall global VR gaming market was estimated at$11.6 billionin 2023, with expectations of further growth as hardware becomes more accessible. Cloud gaming platforms that integrate VR and AR capabilities can offer immersive experiences without requiring high-end local hardware, making these technologies more accessible.

- Growing Demand for Cross-Platform Play: The demand for cross-platform play continues to grow in Europe, as gamers increasingly seek the flexibility to play on multiple devices. The European gaming market is characterized by a diverse user base that often utilizes multiple platforms for gaming. This is supported by the growing popularity of mobile games alongside traditional console and PC gaming. Cloud gaming allows seamless transition between these platforms without requiring users to own multiple devices.

Scope of the Report

|

Device Type |

Smartphones and Tablets PCs and Laptops Smart TVs Consoles |

|

Gaming Type |

Casual Gaming Hardcore Gaming AR/VR Gaming |

|

Service Model |

Business-to-Consumer (B2C) Business-to-Business (B2B) |

|

Subscription Model |

Free-to-Play Subscription-Based Pay-Per-Play |

|

Region |

Germany France United Kingdom Italy Spain Netherlands Switzerland Sweden |

Products

Key Target Audience

Telecommunications Companies

Cloud Service Providers

Technology Hardware Manufacturers

Game Development Companies

Media and Entertainment Companies

Gaming Console Manufacturers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., European Commission, OFCOM)

Companies

Major Players in the Europe Cloud Gaming Market

Google Stadia

Microsoft xCloud

Nvidia GeForce Now

Sony PlayStation Now

Amazon Luna

Shadow

Vortex Cloud Gaming

LiquidSky

GameFly

Parsec

Boosteroid

Playkey

Blacknut

Ubitus

Blade SAS

Table of Contents

1. Europe Cloud Gaming Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Europe Cloud Gaming Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Europe Cloud Gaming Market Analysis

3.1 Growth Drivers

3.1.1 Expanding Broadband Connectivity (Fiber, 5G)

3.1.2 Adoption of Edge Computing in Gaming Infrastructure

3.1.3 Rise in Subscription-based Gaming Services

3.1.4 Increased Mobile Gaming Penetration

3.2 Market Challenges

3.2.1 Latency and Bandwidth Limitations (Network Performance)

3.2.2 High Data Costs (Mobile and Fixed Broadband)

3.2.3 Content Licensing and Ownership Restrictions

3.3 Opportunities

3.3.1 Integration with VR and AR Platforms

3.3.2 Growing Demand for Cross-Platform Play (PC, Console, Mobile)

3.3.3 Partnerships Between Telecom Providers and Gaming Studios

3.4 Trends

3.4.1 Emergence of Cloud-based Esports

3.4.2 Increased Adoption of AI for Gaming Enhancements

3.4.3 Cloud-based Game Streaming on Social Media Platforms

3.5 Regulatory Landscape

3.5.1 Data Privacy and Security Regulations (GDPR Impact on Cloud Services)

3.5.2 Content Moderation Laws (Europes Digital Services Act)

3.5.3 Cross-border Gaming Licensing Agreements

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem (Cloud Providers, Game Studios, Hardware Vendors)

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. Europe Cloud Gaming Market Segmentation

4.1 By Device Type (In Value %)

4.1.1 Smartphones and Tablets

4.1.2 PCs and Laptops

4.1.3 Smart TVs

4.1.4 Consoles

4.2 By Gaming Type (In Value %)

4.2.1 Casual Gaming

4.2.2 Hardcore Gaming

4.2.3 AR/VR Gaming

4.3 By Service Model (In Value %)

4.3.1 Business-to-Consumer (B2C)

4.3.2 Business-to-Business (B2B)

4.4 By Subscription Model (In Value %)

4.4.1 Free-to-Play

4.4.2 Subscription-Based

4.4.3 Pay-Per-Play

4.5 By Region (In Value %)

4.5.1 Germany

4.5.2 France

4.5.3 United Kingdom

4.5.4 Italy

4.5.5 Spain

4.5.6 Netherlands

4.5.7 Switzerland

4.5.8 Sweden

5. Europe Cloud Gaming Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Google Stadia

5.1.2 Microsoft xCloud

5.1.3 Nvidia GeForce Now

5.1.4 Sony PlayStation Now

5.1.5 Amazon Luna

5.1.6 Shadow

5.1.7 Vortex Cloud Gaming

5.1.8 LiquidSky

5.1.9 GameFly

5.1.10 Parsec

5.1.11 Boosteroid

5.1.12 Playkey

5.1.13 Blacknut

5.1.14 Ubitus

5.1.15 Blade SAS

5.2 Cross Comparison Parameters (Revenue, Subscription Growth, Data Center Infrastructure, Game Library Size, Latency Metrics, Regional Availability, Service Scalability, Hardware Requirements)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Europe Cloud Gaming Market Regulatory Framework

6.1 Data Security Compliance (GDPR, ISO/IEC 27001)

6.2 Content Streaming Regulations (Streaming Rights Management)

6.3 Licensing and Cross-Border Gaming Compliance

7. Europe Cloud Gaming Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Europe Cloud Gaming Future Market Segmentation

8.1 By Device Type (In Value %)

8.2 By Gaming Type (In Value %)

8.3 By Service Model (In Value %)

8.4 By Subscription Model (In Value %)

8.5 By Region (In Value %)

9. Europe Cloud Gaming Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Europe Cloud Gaming Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Europe Cloud Gaming Market. This includes assessing market penetration, the ratio of service providers to gaming studios, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATI) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple cloud gaming service providers to acquire detailed insights into service segments, user preferences, technological advancements, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Europe Cloud Gaming market.

Frequently Asked Questions

01. How big is the Europe Cloud Gaming Market?

The Europe Cloud Gaming market is valued at USD 1.5 billion in 2023, driven by the expansion of high-speed internet infrastructure and the increasing adoption of cloud-based gaming services across the region.

02. What are the key growth drivers of the Europe Cloud Gaming Market?

Key growth drivers include the rapid advancement of cloud computing technologies, the proliferation of high-speed internet and 5G networks, and the rising demand for seamless, cross-platform gaming experiences among consumers.

03. Who are the major players in the Europe Cloud Gaming Market?

Major players include Google Stadia, Microsoft xCloud, Nvidia GeForce Now, Sony PlayStation Now, and Amazon Luna. These companies dominate the market through their extensive gaming libraries, robust technological infrastructure, and strategic partnerships.

04. What are the main challenges facing the Europe Cloud Gaming Market?

Challenges include latency and bandwidth limitations in certain regions, high data costs, and content licensing and ownership restrictions, which can impede the seamless delivery of cloud gaming services.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.