Europe Coffee Market Outlook to 2030

Region:Europe

Author(s):Paribhasha Tiwari

Product Code:KROD9495

December 2024

80

About the Report

Europe Coffee Market Overview

- The Europe Coffee Market is valued at USD 46.15 billion, driven by a strong coffee culture, particularly in Western and Northern Europe, where consumer preferences lean toward high-quality and specialty coffee. Demand for both premium and sustainable coffee products has surged, with brands actively incorporating organic and ethically sourced beans to meet consumer expectations. This growth is bolstered by increased disposable incomes and the rise of specialty coffee shops.

- Cities such as Milan, Paris, and Berlin, along with countries like Italy, France, and Germany, dominate the European coffee market. This dominance is due to deep-rooted coffee traditions, a burgeoning caf culture, and high consumption rates. Italys espresso culture, France's caf culture, and Germanys demand for high-quality beans are key drivers that reinforce these regions as market leaders.

- European trade policies, particularly import tariffs, significantly impact coffee costs and availability. The EU imposes varying tariffs on coffee beans and processed coffee, which in 2023 reached 450 million in collected tariffs across member states. This trade revenue supports EU countries but affects consumer prices, influencing retail strategies within the market.

Europe Coffee Market Segmentation

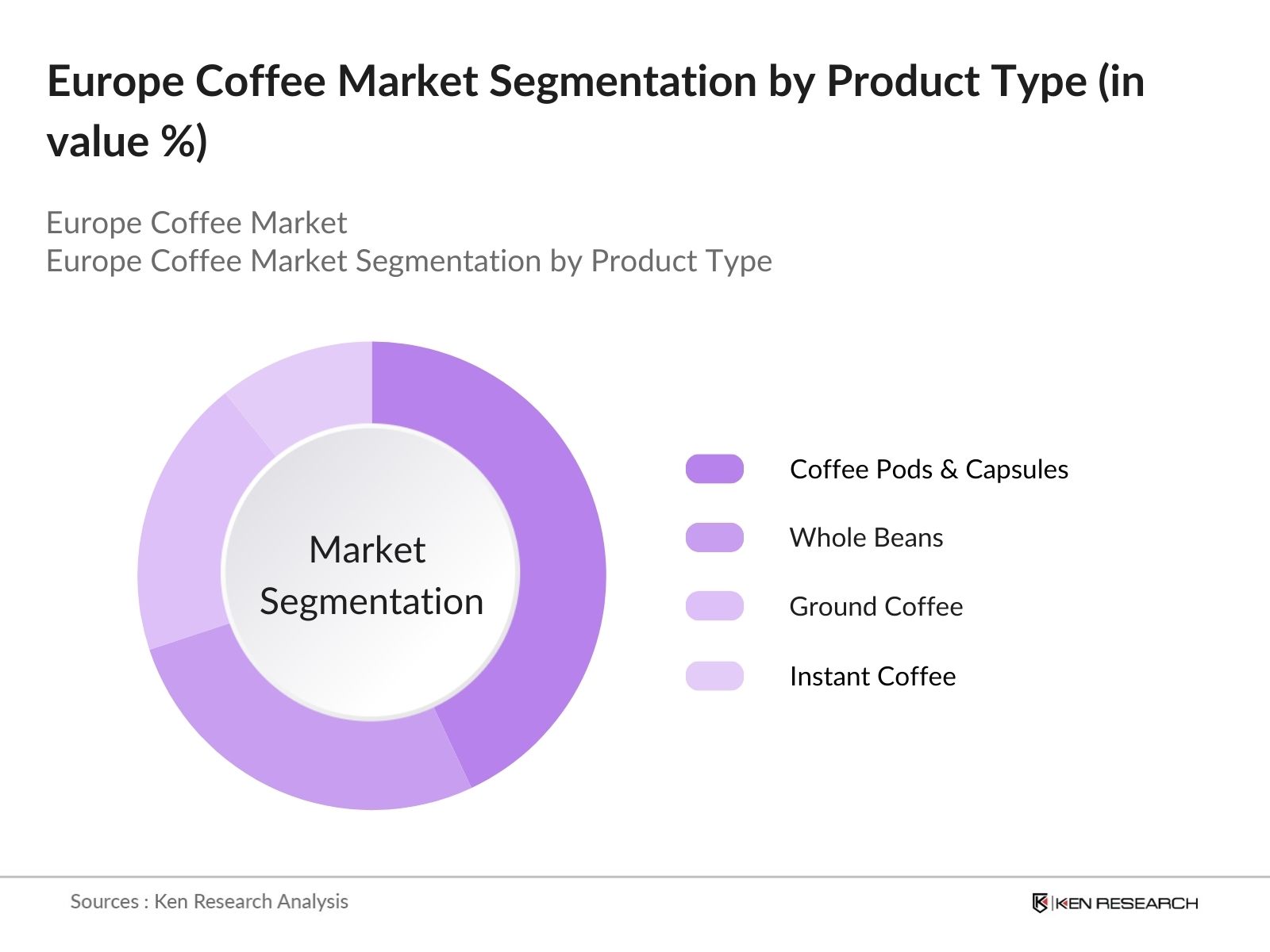

By Product Type: The Market is segmented by product type into whole beans, ground coffee, instant coffee, and coffee pods & capsules. Coffee pods and capsules dominate the market due to their convenience, consistent quality, and brand offerings that cater to diverse flavor preferences. Brands like Nespresso and Keurig have established strong market loyalty with premium products, influencing the adoption rate of this segment.

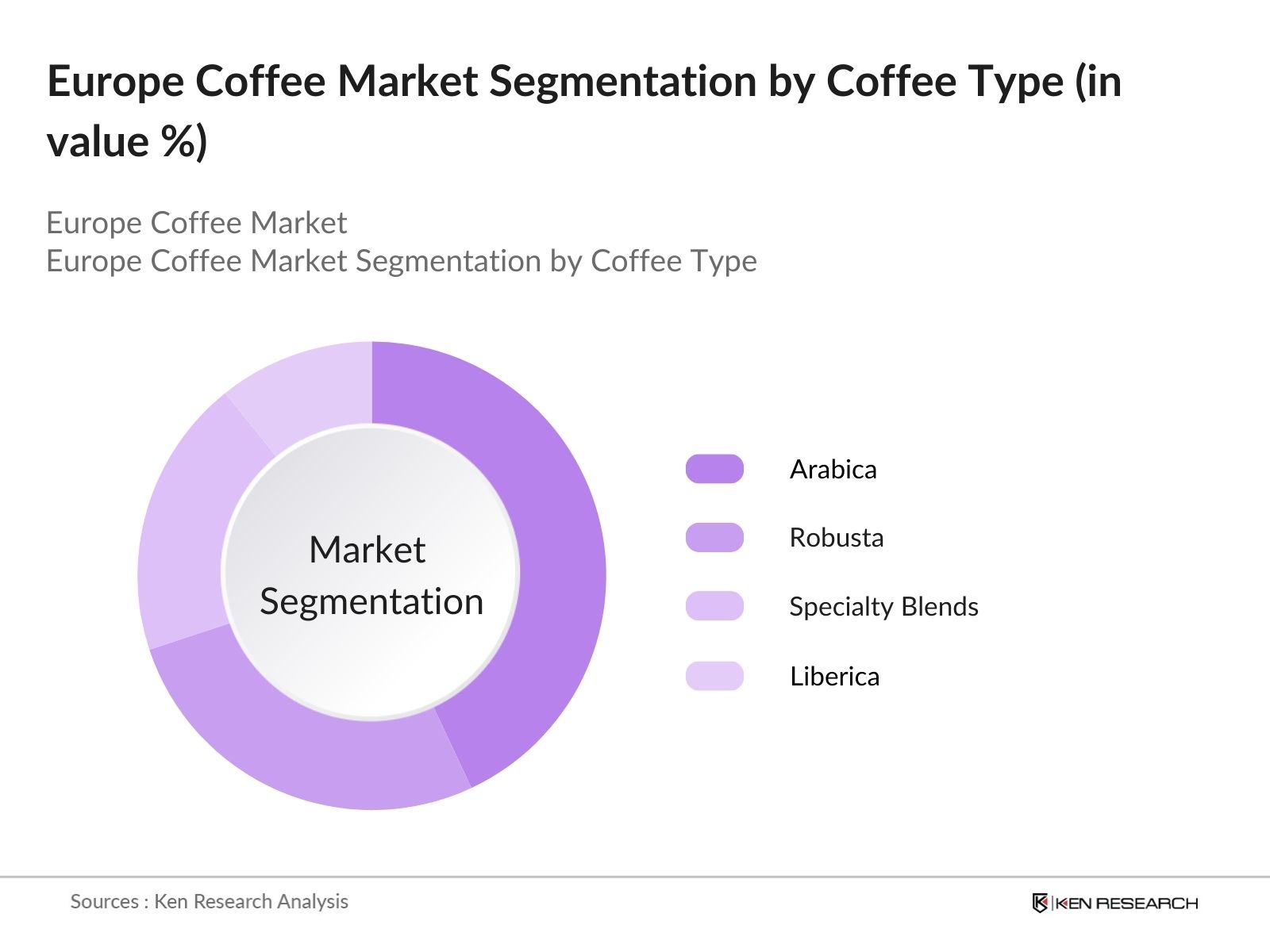

By Coffee Type: The coffee type segment includes Arabica, Robusta, Liberica, and specialty blends. Arabica coffee holds a dominant market share due to its smoother, less bitter flavor profile, which is preferred by European consumers. The increased awareness of Arabica's quality and its alignment with premium and specialty coffee trends in Europe contribute significantly to its market dominance.

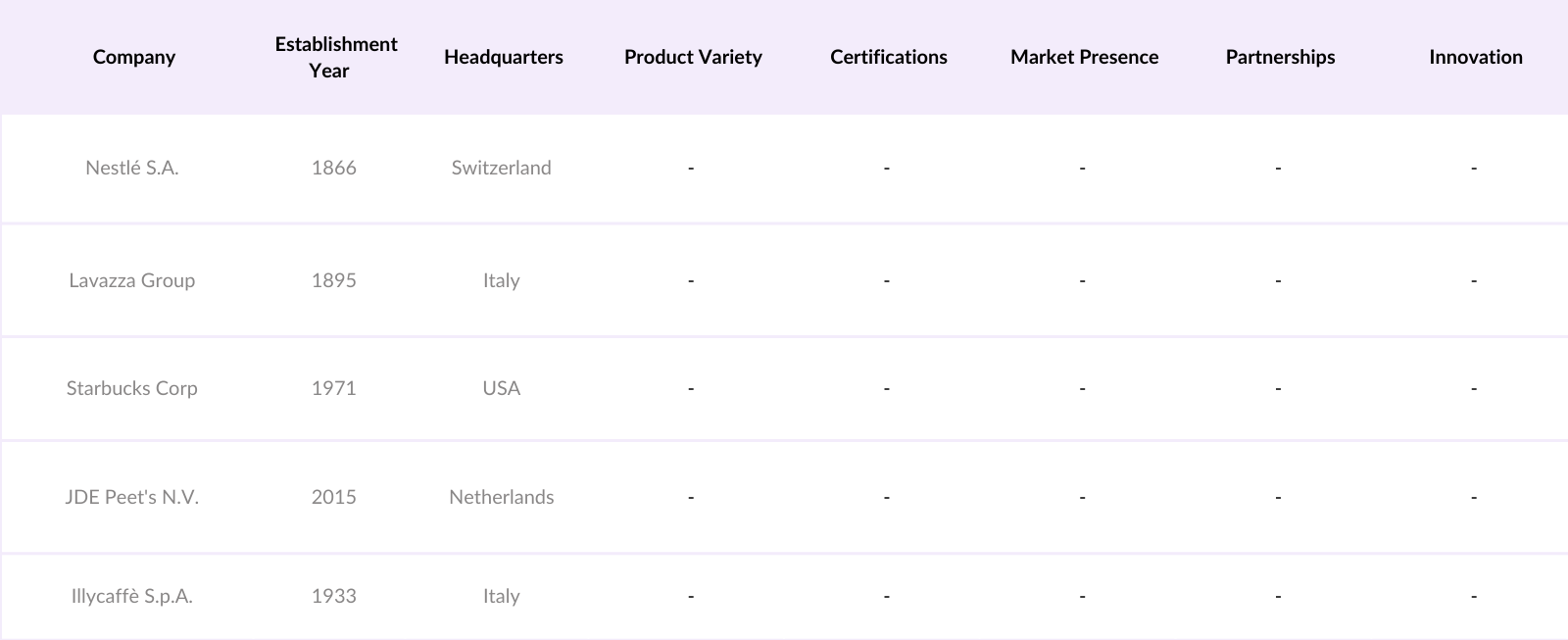

Europe Coffee Market Competitive Landscape

The Europe Coffee Market is dominated by key players who leverage brand recognition, diversified offerings, and extensive distribution networks to maintain their positions. Companies like Nestl S.A., Lavazza Group, and Starbucks Corporation drive the market through sustained investments in premium and specialty coffee lines, innovative flavors, and strategic collaborations.

Europe Coffee Industry Analysis

Growth Drivers

- Growing Specialty Coffee Culture: The rise in specialty coffee consumption across Europe is evidenced by the growth of artisanal coffee shops and consumer preferences for unique flavors. In 2023, over 17,000 specialty coffee shops were operational across Europe, with Germany and France leading, each accounting for around 3,000 locations, as reported by national trade agencies. The preference for high-quality, ethically sourced beans, often single-origin, reflects a cultural shift toward premium coffee experiences. Data from the European Coffee Federation shows that specialty coffee imports grew by 12 million kilograms between 2022 and 2023, underlining the expanding niche.

- Rise of Caf Chains: The caf chain segment in Europe has seen robust growth due to urbanization and a shift toward social coffee experiences. In 2024, the United Kingdom alone registered over 9,500 branded coffee shops, with France and Germany showing similar upward trends, according to EU urbanization data. The increase in city dwellers, estimated at 450 million in 2024 across EU countries, has contributed to this growth, as urban residents tend to frequent coffee shops more often than their rural counterparts.

- Shift towards Premiumization: European coffee consumers are increasingly investing in premium coffee products, with a marked preference for high-grade beans and crafted coffee experiences. In 2024, Eurostat noted that household spending on premium food and beverages increased by 4.3 billion, with coffee as a prominent contributor. This trend correlates with rising disposable incomes, particularly in Western Europe, and reflects a consumer base willing to pay more for premium quality and sustainable products.

Market Challenges

- Price Volatility: The European coffee market faces challenges due to price fluctuations driven by global supply inconsistencies. In 2023, coffee futures spiked by 300 per tonne due to decreased supply from key regions like Colombia. Such volatility can pressure European importers and retailers, impacting profitability and passing costs to consumers. Eurostat noted that these fluctuations contribute to a 3% increase in average coffee product prices in the EU.

- Limited Consumer Awareness in Emerging Markets: In emerging European markets, consumer awareness of specialty and sustainable coffee remains limited. Surveys by the European Consumer Organization show that in Eastern Europe, less than 30% of consumers could differentiate between specialty and regular coffee in 2023, indicating educational and marketing gaps. This lack of awareness hinders potential market expansion for specialty coffee brands.

Europe Coffee Market Future Outlook

Over the next five years, the Europe Coffee Market is anticipated to experience steady growth, driven by the increasing demand for specialty coffee, the expansion of sustainable and ethically sourced coffee products, and continued innovation in brewing technologies. This growth will likely be further supported by rising health-conscious trends, with consumers increasingly opting for high-quality, organic, and environmentally friendly options.

Market Opportunities

- Expanding Cold Brew and Ready-to-Drink Segments: The cold brew and ready-to-drink coffee segments are gaining traction in Europe. In 2023, these segments saw a 2.8-million-liter sales increase across the EU, according to the EU Beverage Association. Younger demographics, particularly those aged 18-35, have shown high adoption rates, presenting an opportunity for brands to expand product offerings in these categories.

- Growth in E-commerce and Direct-to-Consumer Sales: E-commerce for coffee products is experiencing growth across Europe, bolstered by the COVID-19 shift to online shopping. In 2024, online coffee sales in the EU reached 18% of total coffee sales, according to Eurostat, with direct-to-consumer platforms benefiting small and specialty coffee brands. This expansion reflects broader e-commerce trends, with the EUs online retail market growing by 70 billion over the past three years.

Scope of the Report

| By Product Type |

Whole Beans Ground Coffee Instant Coffee Coffee Pods & Capsules |

| By Coffee Type |

Arabica Robusta Liberica Specialty Blends |

| By Distribution Channel |

Supermarkets & Hypermarkets Specialty Stores Online Platforms Convenience Stores Coffee Shops |

| By End User |

Household Commercial (Hotels, Restaurants, Cafés, Offices) |

| By Packaging Type |

Jars Sachets Bottles Pods Bags |

| By Region |

Germany United Kingdom France Italy Spain Netherlands Rest of Europe |

Products

Key Target Audience

Coffee Manufacturers and Roasters

Retailers and Wholesalers

Specialty Coffee Shops and Caf Chains

Importers and Exporters

Investments and Venture Capital Firms

Government and Regulatory Bodies (European Food Safety Authority, EU Trade Commission)

Distributors and Logistics Providers

Coffee Equipment Manufacturers

Companies

Players Mentioned in the Report:

Nestl S.A.

Lavazza Group

Starbucks Corporation

JDE Peet's N.V.

Illycaff S.p.A.

Tchibo GmbH

Melitta Group

The Coca-Cola Company (Costa Coffee)

Dunkin' Brands

Strauss Coffee B.V.

Table of Contents

1. Europe Coffee Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Europe Coffee Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Europe Coffee Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Coffee Consumption

3.1.2. Expansion of Specialty Coffee Shops

3.1.3. Rising Demand for Premium Coffee Products

3.1.4. Technological Advancements in Coffee Machines

3.2. Market Challenges

3.2.1. Fluctuating Coffee Bean Prices

3.2.2. Stringent Environmental Regulations

3.2.3. Competition from Alternative Beverages

3.2.4. Supply Chain Disruptions

3.3. Opportunities

3.3.1. Growth in Ready-to-Drink Coffee Segment

3.3.2. Expansion into Emerging European Markets

3.3.3. Development of Sustainable Coffee Products

3.3.4. Collaboration with E-commerce Platforms

3.4. Trends

3.4.1. Increasing Popularity of Organic and Fair-Trade Coffee

3.4.2. Rise in Home Brewing Practices

3.4.3. Adoption of Subscription-Based Coffee Services

3.4.4. Integration of Smart Technology in Coffee Machines

3.5. Regulatory Landscape

3.5.1. EU Food Safety Regulations

3.5.2. Import Tariffs and Trade Policies

3.5.3. Environmental Compliance Standards

3.5.4. Labeling and Packaging Requirements

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porter’s Five Forces Analysis

3.9. Competition Ecosystem

4. Europe Coffee Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Whole Beans

4.1.2. Ground Coffee

4.1.3. Instant Coffee

4.1.4. Coffee Pods & Capsules

4.2. By Coffee Type (In Value %)

4.2.1. Arabica

4.2.2. Robusta

4.2.3. Liberica

4.2.4. Specialty Blends

4.3. By Distribution Channel (In Value %)

4.3.1. Supermarkets & Hypermarkets

4.3.2. Specialty Stores

4.3.3. Online Platforms

4.3.4. Convenience Stores

4.3.5. Coffee Shops

4.4. By End User (In Value %)

4.4.1. Household

4.4.2. Commercial (Hotels, Restaurants, Cafés, Offices)

4.5. By Region (In Value %)

4.5.1. Germany

4.5.2. United Kingdom

4.5.3. France

4.5.4. Italy

4.5.5. Spain

4.5.6. Netherlands

4.5.7. Rest of Europe

5. Europe Coffee Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Nestlé S.A.

5.1.2. JAB Holding Company

5.1.3. Starbucks Corporation

5.1.4. Luigi Lavazza S.p.A.

5.1.5. Tchibo GmbH

5.1.6. Strauss Group Ltd.

5.1.7. The Kraft Heinz Company

5.1.8. Dunkin’ Brands Group, Inc.

5.1.9. Keurig Dr Pepper Inc.

5.1.10. Melitta Group

5.1.11. UCC Ueshima Coffee Co. Ltd.

5.1.12. Massimo Zanetti Beverage Group

5.1.13. Illycaffè S.p.A.

5.1.14. Peet’s Coffee

5.1.15. Caribou Coffee Company

5.2. Cross Comparison Parameters

5.2.1. Revenue (USD Million)

5.2.2. Market Share (%)

5.2.3. Product Portfolio Diversity

5.2.4. Distribution Network Reach

5.2.5. R&D Investment (% of Revenue)

5.2.6. Sustainability Initiatives

5.2.7. Brand Equity and Recognition

5.2.8. Digital Presence and E-commerce Integration

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.6.1. Venture Capital Funding

5.6.2. Government Grants

5.6.3. Private Equity Investments

6. Europe Coffee Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Europe Coffee Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Europe Coffee Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Coffee Type (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By End User (In Value %)

8.5. By Region (In Value%)

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the Europe Coffee Market ecosystem, focusing on major stakeholders including manufacturers, distributors, and end-consumers. Data is collected from secondary databases, government reports, and credible industry publications to determine influential variables in the coffee market.

Step 2: Market Analysis and Construction

In this phase, historical data on coffee consumption, retail sales, and production volumes are compiled. This includes analyzing the share of premium and specialty coffee segments, pricing trends, and shifts in consumer preferences across different regions within Europe.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through interviews with industry experts, including coffee roasters, caf owners, and industry analysts. This consultation phase provides insights into market trends, operational challenges, and growth opportunities, complementing the quantitative data.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing qualitative and quantitative data from all sources, producing an accurate and comprehensive overview of the Europe Coffee Market. Detailed insights into product segments, pricing strategies, and growth factors are compiled, with the final report validated by industry experts.

Frequently Asked Questions

1. How big is the Europe Coffee Market?

The Europe Coffee Market is valued at USD 46.15 billion, supported by a strong consumer preference for premium coffee and the expanding caf culture across the continent.

2. What are the challenges in the Europe Coffee Market?

Challenges in the Europe Coffee Market include price volatility due to supply chain disruptions and climate impact on coffee crop yields, as well as competition from alternative beverages gaining popularity.

3. Who are the major players in the Europe Coffee Market?

Key players in the Europe Coffee Market include Nestl S.A., Lavazza Group, Starbucks Corporation, JDE Peet's N.V., and Illycaff S.p.A., all of which have strong brand presence and extensive distribution networks across Europe.

4. What are the growth drivers of the Europe Coffee Market?

The Europe Coffee Market is driven by a preference for specialty and high-quality coffee, the rise of sustainable coffee products, and increasing consumer awareness about ethically sourced options.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.