Europe Consumer Packaged Goods (CPG) Market Outlook to 2030

Region:Europe

Author(s):Shreya

Product Code:KROD1866

October 2024

86

About the Report

Europe Consumer Packaged Goods (CPG) Market Overview

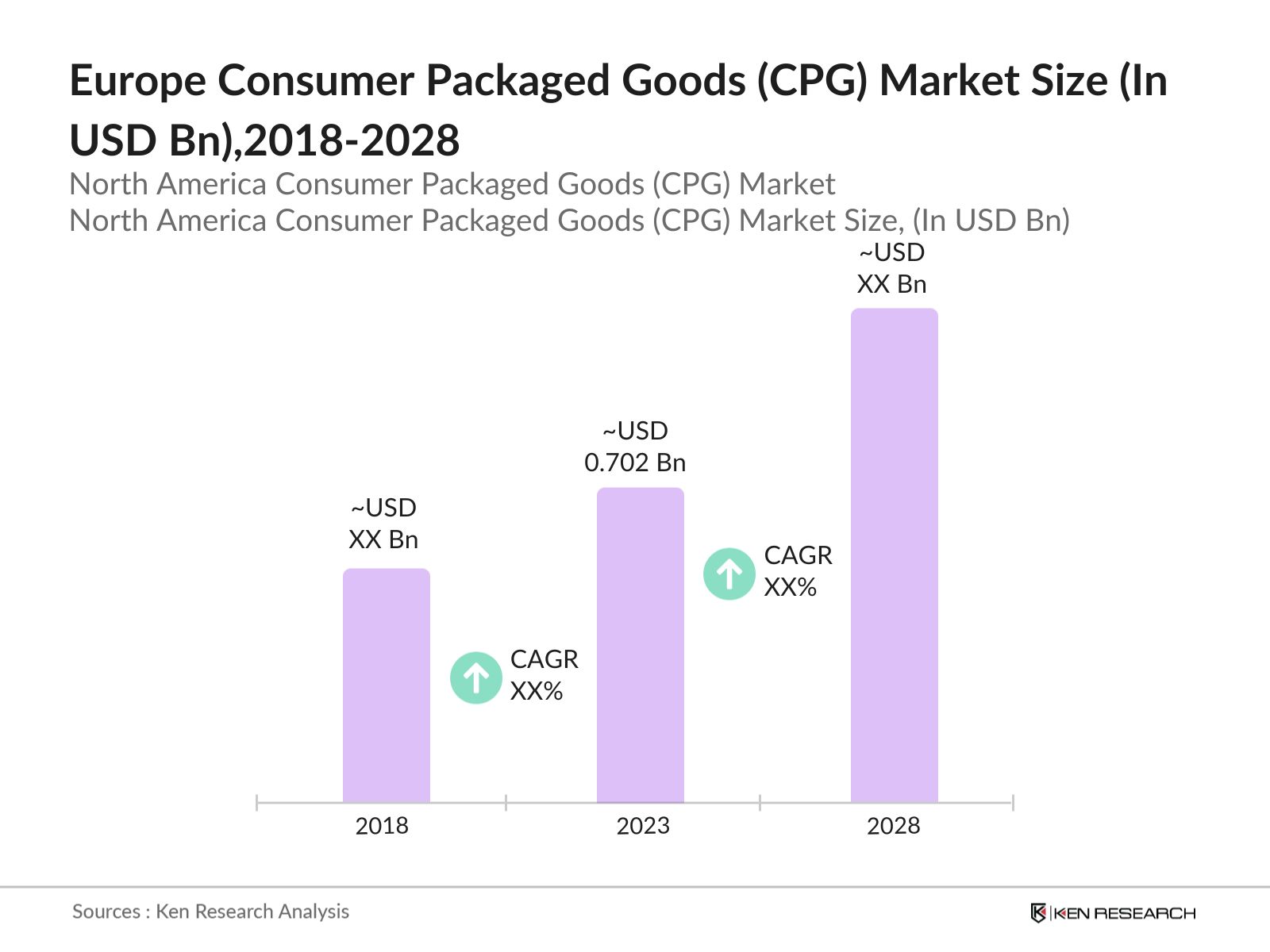

- The Europe Consumer Packaged Goods (CPG) market was valued at USD 702 million. This growth is driven by a combination of factors, including increased consumer spending, technological advancements in packaging, and a growing preference for convenience products. Consumers increasing demand for high-quality, diverse, and convenient products is fueling the market expansion.

- The European CPG market is dominated by several key players, including Nestl, Unilever, Procter & Gamble, L'Oral, and Reckitt Benckiser. These companies have established themselves as market leaders through extensive product portfolios, robust distribution networks, and strong brand recognition.

- The development in the market was the announcement by Unilever in 2023 of its ambitious plan to achieve net-zero carbon emissions by 2030. This commitment aligns with the increasing consumer demand for sustainable and eco-friendly products, reflecting a broader trend within the industry towards sustainability and environmental responsibility.

- Germany and France, dominates the market. In 2023, they accounted for major part of the total market share, driven by a high level of consumer spending, a strong economy, and a well-established retail infrastructure. Germany, for instance, saw a 5% increase in CPG sales in 2023, reflecting its robust market position.

Europe Consumer Packaged Goods (CPG) Market Segmentation

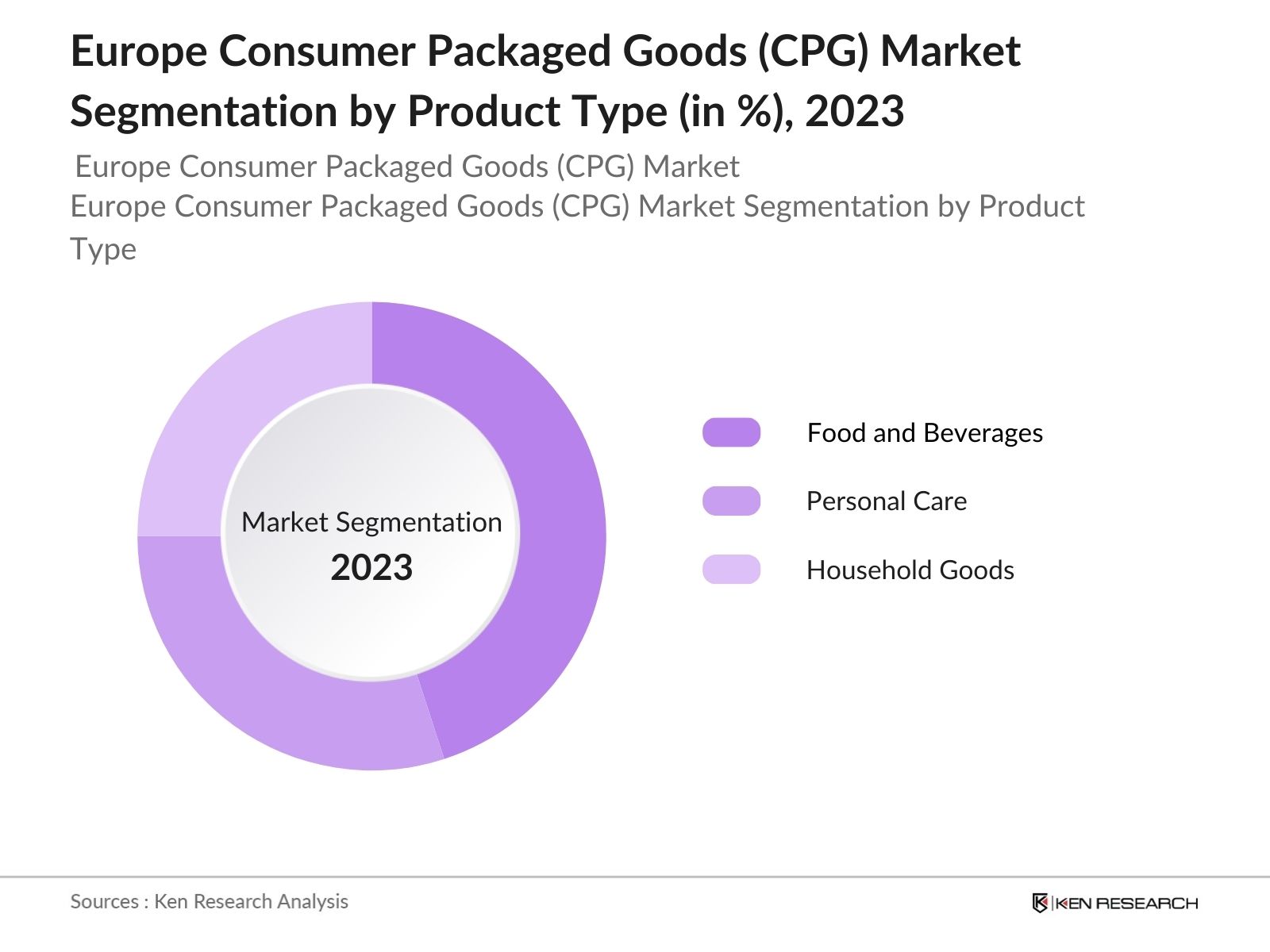

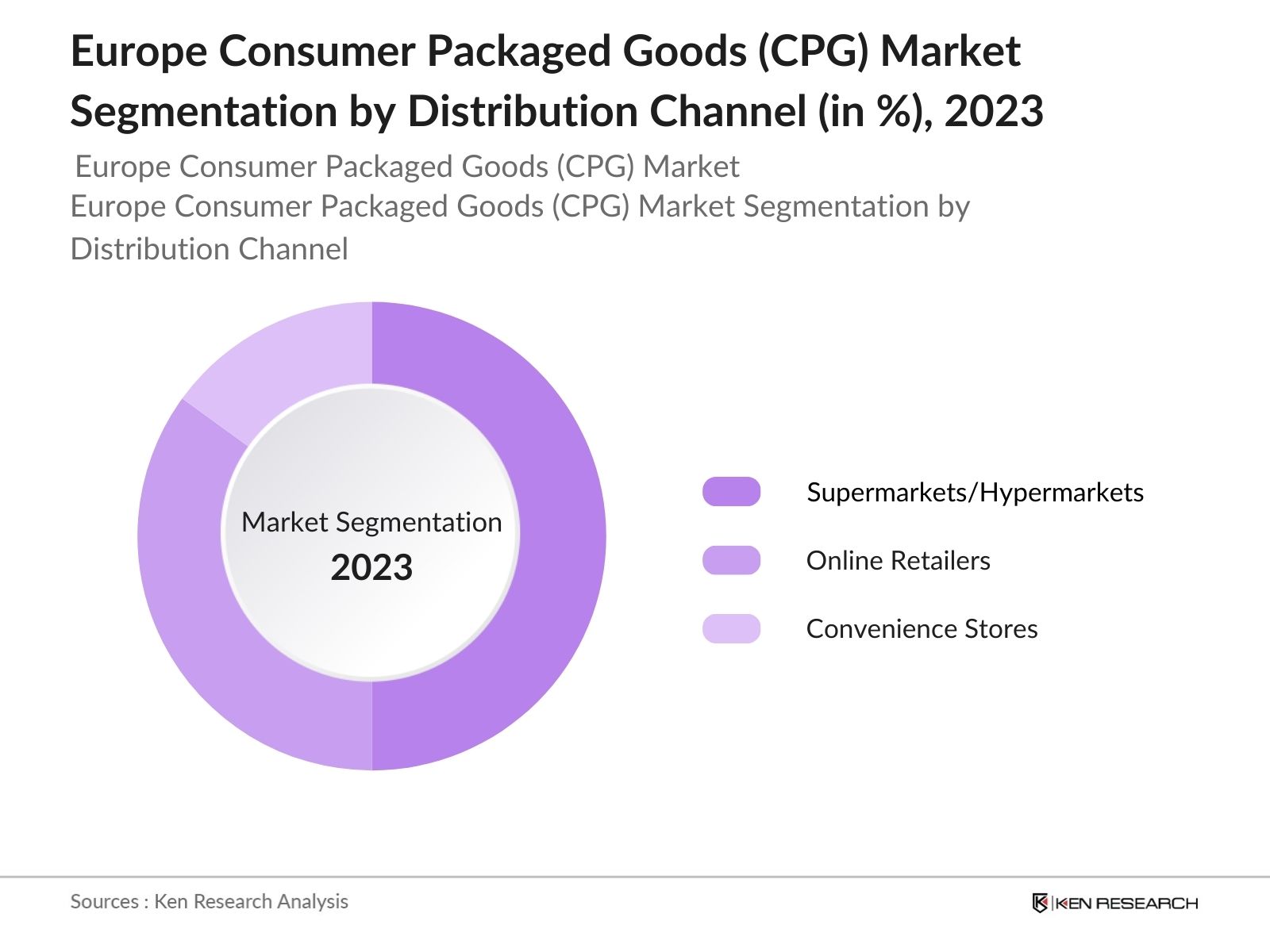

The Europe CPG market is segmented into various segments such as product type, distribution channel and region.

1. By Product Type: The market is segmented by product type into Food & Beverages, Personal Care, and Household Products. In 2023, the Food & Beverages segment held the largest market share. This dominance is attributed to the increasing consumer demand for convenience foods and beverages, driven by busy lifestyles and the growing preference for ready-to-eat meals.

2. By Distribution Channel: The market is segmented by distribution channel into Supermarkets/Hypermarkets, Online Retailers, and Convenience Stores. In 2023, Supermarkets/Hypermarkets dominated the distribution channel. This dominance is due to their extensive reach, wide product assortment, and convenience offered to consumers. The availability of a vast range of products under one roof makes them a preferred shopping destination.

3. By Region: The market is segmented by region into Germany, France, UK, Sweden, Italy and Rest of Europe. Germany is the dominant region in this market in 2023. This dominance is driven by high consumer spending, a strong economy, and a robust retail infrastructure, which supports extensive distribution networks and a wide variety of CPG products.

|

Region |

Market Share (2023) |

|---|---|

|

Germany |

25% |

|

France |

20% |

|

United Kingdom |

18% |

|

Sweden |

10% |

|

Italy |

15% |

|

Rest of Europe |

8% |

Europe Consumer Packaged Goods (CPG) Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|---|---|---|

|

Nestl |

1866 |

Vevey, Switzerland |

|

Unilever |

1930 |

London, UK and Rotterdam, Netherlands |

|

Procter & Gamble |

1837 |

Cincinnati, USA |

|

L'Oral |

1909 |

Clichy, France |

|

Reckitt Benckiser |

1999 |

Slough, UK |

1. Nestl's Investment in Plant-Based Products: In 2024, Nestl announced an investment of 1.5 billion euros in its plant-based product portfolio to meet the growing demand for plant-based alternatives. This investment includes the expansion of Nestl's production facilities in Europe and the development of new plant-based products, including meat and dairy alternatives. This investment reflects Nestl's commitment to innovation and sustainability, positioning the company as a leader in the growing plant-based segment of the CPG market.

2. Procter & Gamble's Digital Transformation Initiative: In 2024, Procter & Gamble (P&G) announced a major digital transformation initiative aimed at enhancing its online presence and e-commerce capabilities. The company has invested 900 million euros in digital marketing, data analytics, and e-commerce platforms to better understand consumer preferences and improve customer engagement.

Europe Consumer Packaged Goods (CPG) Industry Analysis

Growth Drivers

1. Increase in E-commerce Sales: In 2024, the European Consumer Packaged Goods (CPG) market has seen a boost from the growth of e-commerce. E-commerce platforms have expanded their reach across Europe, leading to an increase in online sales of consumer goods. This growth is supported by investments in logistics and distribution networks by major e-commerce players, allowing for faster and more efficient delivery of CPG products. With over 500 new distribution centers established in 2024 alone, the e-commerce channel is expected to continue driving growth in the CPG market, particularly as more consumers prefer the convenience of online shopping.

2. Rising Demand for Health and Wellness Products: In 2024, the demand for health and wellness products in Europe has surged, majorly impacting the CPG market. Consumers are increasingly seeking products that promote health, well-being, and sustainability. Sales of organic and natural CPG products reached 95 million units in 2023 which has heightened awareness of health and hygiene.

3. Expansion of Private Label Brands: Private label brands have continued to expand their presence in the European CPG market in 2024, driving growth. Retailers across Europe have been increasing their investment in private label products. This growth is influenced by consumer demand for affordable alternatives to national brands, as well as retailers' efforts to improve the quality and variety of their private label offerings.

Challenges

1. Rising Raw Material Prices: The cost of raw materials, including key ingredients and packaging materials, increased due to supply chain constraints, impacting the profitability of CPG companies. The shortage of transportation and labor further exacerbates these challenges, causing delays and increasing operational costs. This increase in raw material costs has put pressure on profit margins, forcing CPG companies to either absorb the additional costs or pass them on to consumers in the form of higher prices.

2. Intense Competition from Private Labels: The market faces intense competition from private label brands in 2024, which has put pressure on national brands. Private label products have gained traction among consumers due to their affordability and perceived value for money. In 2024, private label products accounted for close to one third of all CPG sales in Europe, representing a major share of the market.

Government Initiatives

1. Single-Use Plastics Directive: The European Union's Single-Use Plastics Directive, implemented in 2021, continues to impact the CPG market in 2024. The single-use plastic items restricted from being placed on the market from 3 July 2021 include cotton bud sticks, cutlery, plates, straws, beverage stirrers, balloon sticks, and expanded polystyrene food and beverage containers. The transposition of the extended producer responsibility (EPR) provisions must be operational by 31 December 2024 in most EU countries.

2. Farm to Fork Strategy: The European Union's Farm to Fork Strategy, part of the Green Deal, aims to create a sustainable food system by promoting organic farming, reducing food waste, and encouraging healthy diets. In 2024, the strategy led to an increase in organic farming in Europe, contributing to the growth of the organic CPG market. The strategy also emphasizes reducing food waste, with the European Union setting a target to halve food waste by 2030.

Europe Consumer Packaged Goods (CPG) Market Future Outlook

The European CPG market is expected to continue its growth. Factors such as technological advancements in packaging, increasing health consciousness among consumers, and the expansion of digital retail channels are anticipated to drive this growth. Furthermore, sustainability will play a crucial role in shaping the future of the market, with consumers increasingly seeking environmentally friendly products.

Future Trends

1. Expansion of Digital and Omnichannel Retail: The digital transformation of the market is expected to accelerate over the next five years, with a focus on expanding digital and omnichannel retail capabilities, driven by advancements in digital marketing, data analytics, and logistics. Companies will invest in enhancing their online presence, developing personalized marketing campaigns, and optimizing their supply chains to meet the growing demand for online shopping.

2. Adoption of Smart Packaging Technologies: The adoption of smart packaging technologies is expected to grow over the next five years, transforming the market. Smart packaging solutions, such as QR codes, RFID tags, and interactive labels, will enhance the consumer experience by providing information on product origin, ingredients, and sustainability.

Scope of the Report

|

By Product Type |

Food & Beverages Personal Care Household Products |

|

By Distribution Channel |

Supermarkets/Hypermarkets Online Retailers Convenience Stores |

|

By Region |

Germany France UK Sweden Italy Rest of Europe |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Convenience Stores

Manufacturers

Packaging Companies

Logistics and Supply Chain Providers

E-commerce Platforms

Government and Regulatory Bodies (European Union, National Governments)

Banking and Financial Institutions

Investors and VC Firms

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Nestl

Unilever

Procter & Gamble

L'Oral

Reckitt Benckiser

Danone

PepsiCo

Coca-Cola

Mondelez International

Johnson & Johnson

Henkel

Beiersdorf

Mars, Incorporated

Colgate-Palmolive

Kimberly-Clark

Diageo

Heineken

Carlsberg Group

AB InBev

Kellogg's

Table of Contents

1.Europe Consumer Packaged Goods Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2.Europe Consumer Packaged Goods Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3.Europe Consumer Packaged Goods Market Analysis

3.1. Growth Drivers

3.1.1. Increase in E-commerce Sales

3.1.2. Rising Demand for Health and Wellness Products

3.1.3. Expansion of Private Label Brands

3.1.4. Sustainability Initiatives and Eco-friendly Packaging

3.2. Restraints

3.2.1. Supply Chain Disruptions

3.2.2. Regulatory Compliance Costs

3.2.3. Rising Raw Material Prices

3.2.4. Intense Competition from Private Labels

3.3. Opportunities

3.3.1. Expansion into Emerging Markets

3.3.2. Innovation in Product Development

3.3.3. Growth in Digital Marketing and Sales Channels

3.3.4. Development of Sustainable Products

3.4. Trends

3.4.1. Adoption of Smart Packaging Technologies

3.4.2. Increased Focus on Health and Wellness

3.4.3. Growth of Direct-to-Consumer Sales

3.4.4. Rise of Omnichannel Retailing

3.5. Government Regulations

3.5.1. Circular Economy Action Plan

3.5.2. Single-Use Plastics Directive

3.5.3. Farm to Fork Strategy

3.5.4. Green Deal and Climate Goals

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

4.Europe Consumer Packaged Goods Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. Food & Beverages

4.1.2. Personal Care

4.1.3. Household Products

4.2. By Distribution Channel (in Value %)

4.2.1. Supermarkets/Hypermarkets

4.2.2. Online Retailers

4.2.3. Convenience Stores

4.3. By Region (in Value %)

4.3.1. Germany

4.3.2. France

4.3.3. United Kingdom

4.3.4. Sweden

4.3.5. Italy

4.3.6. Rest of Europe

4.3.7. Rest of APAC

5.Europe Consumer Packaged Goods Market Cross Comparison

5.1 Detailed Profiles of Major Companies

5.1.1. Nestl

5.1.2. Unilever

5.1.3. Procter & Gamble

5.1.4. L'Oral

5.1.5. Reckitt Benckiser

5.1.6. Danone

5.1.7. PepsiCo

5.1.8. Coca-Cola

5.1.9. Mondelez International

5.1.10. Johnson & Johnson

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6.Europe Consumer Packaged Goods Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7.Europe Consumer Packaged Goods Market Regulatory Framewor

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8.Europe Consumer Packaged Goods Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9.Europe Consumer Packaged Goods Future Market Segmentation, 2028

9.1. By Product Type (in Value %)

9.2. By Distribution Channel (in Value %)

9.3. By Region (in Value %)

10.Europe Consumer Packaged Goods Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

11.Disclaimer

12.Contact Us

Research Methodology

Step:1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step:2 Market Building:

Collating statistics on this industry over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Europe Consumer packaged goods industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step:3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different Consumer packaged goods Market to validate statistics and seek operational and financial information from company representatives.

Step:4 Research output:

Our team will approach multiple construction companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from such consumer-packaged goods companies.

Frequently Asked Questions

1.How big is the Europe Consumer Packaged Goods Market?

The Europe Consumer Packaged Goods (CPG) market was valued at USD 702 million in 2023, driven by increased consumer spending, the expansion of e-commerce, and the growing demand for health and wellness products.

2.What are the challenges in the Europe Consumer Packaged Goods Market?

Challenges in the Europe CPG market include supply chain disruptions, regulatory compliance costs, rising raw material prices, and intense competition from private labels. These factors contribute to increased operational costs and impact market profitability.

3.Who are the major players in the Europe Consumer Packaged Goods Market?

Major players in the Europe CPG market include Nestl, Unilever, Procter & Gamble, L'Oral, and Reckitt Benckiser. These companies are market leaders due to their extensive product portfolios, strong brand recognition, and robust distribution networks.

4.What are the growth drivers of the Europe Consumer Packaged Goods Market?

The Europe CPG market is driven by the growth of e-commerce sales, rising demand for health and wellness products, the expansion of private label brands, and sustainability initiatives focused on eco-friendly packaging. These factors are significantly shaping market dynamics.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.