Europe Contract Research Organization (CRO) Market Outlook to 2030

Region:Europe

Author(s):Shambhavi

Product Code:KROD5596

November 2024

87

About the Report

Europe Contract Research Organization (CRO) Market Overview

- The Europe Contract Research Organization (CRO) market valued at USD 20 billion is driven by the increasing trend of pharmaceutical and biotechnology companies outsourcing clinical trials to reduce costs and accelerate time-to-market. In 2022, the European Medicines Agency (EMA) approved 89 new medicines, indicating a robust pipeline that fuels the demand for CRO services. The complex regulatory environment in Europe necessitates expertise in navigating clinical trial approvals, further boosting the reliance on CROs.

- Western Europe, particularly Germany, France, and the United Kingdom, dominates the European CRO market due to well-established healthcare systems and significant R&D activities. Germany invested approximately 6.3 billion in pharmaceutical R&D in 2022. The UK's Medicines and Healthcare products Regulatory Agency (MHRA) approved over 1,000 clinical trials in 2022, reflecting the country's scientific expertise and supportive regulatory framework. France's government allocated 7.5 billion for health innovation under the France 2030 investment plan, further enhancing the region's clinical research infrastructure.

- The European Union has implemented the Clinical Trials Regulation (EU) No 536/2014, which became applicable in January 2022, streamlining the approval process for clinical trials across member states. This regulation introduces the Clinical Trials Information System (CTIS), facilitating a centralized application process and promoting transparency. The European Commission allocated 5.5 million in 2022 to support the implementation of CTIS, enhancing the efficiency of clinical research and benefiting CROs operating within Europe.

Europe Contract Research Organization (CRO) Segmentation

- By Service Type: The market is segmented into early phase development services, clinical research services, laboratory services, and consulting services. Clinical research services lead the market due to the increasing complexity of trials and the need for specialized expertise. In 2022, there were over 4,000 active clinical trials in Europe, with oncology trials accounting for a significant portion.

- By Therapeutic Area: Oncology is the dominant therapeutic area in the European CRO market. Europe recorded over 3.9 million new cancer cases in 2022, driving the focus on cancer research and the development of targeted therapies. CROs facilitate large-scale oncology trials, contributing to advancements in immunotherapies and personalized medicine.

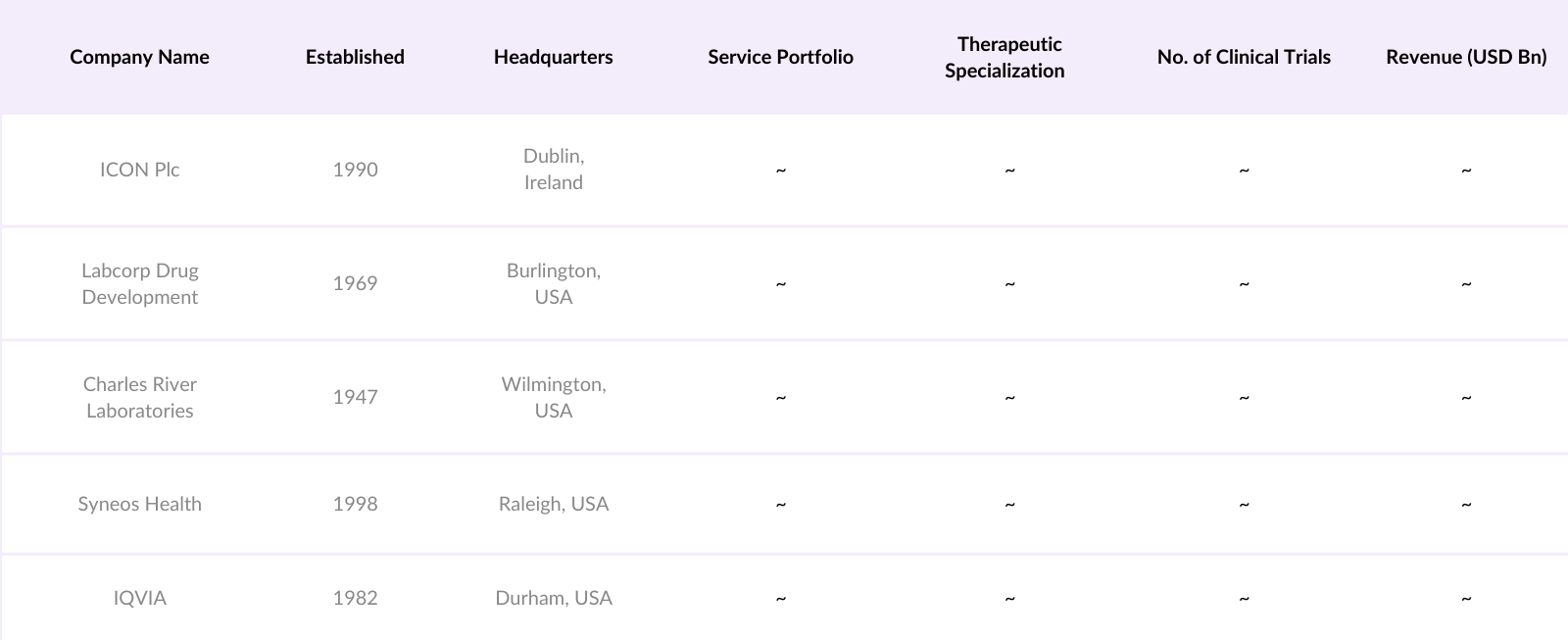

Europe Contract Research Organization (CRO) Competitive Landscape

The Europe CRO market is competitive, with key players like ICON Plc, Labcorp Drug Development, Charles River Laboratories, Syneos Health, and IQVIA leading the industry. ICON Plc, headquartered in Dublin, reported revenues of $7.5 billion in 2022, attributed to its collaboration with Pfizer on COVID-19 vaccine trials. IQVIA, with a workforce exceeding 82,000 employees in Europe, generated revenues of $13 billion in 2022, reflecting its extensive service portfolio and strategic alliances.

These companies have established dominance through strategic mergers and collaborations. For instance, Syneos Health partnered with AstraZeneca in 2022 to manage clinical trials across multiple therapeutic areas, enhancing its service offerings.

Europe Contract Research Organization (CRO) Market Analysis

Growth Drivers

- Increase in Pharmaceutical R&D Expenditure: The European pharmaceutical industry invested 39.7 billion in R&D in 2022, reflecting a commitment to innovation and new drug development. This substantial investment drives the demand for CRO services to conduct clinical trials efficiently. The high cost of in-house R&D, averaging 2.5 billion to bring a new drug to market, encourages companies to outsource to CROs to optimize resources and reduce timeframes.

- Focus on Rare Diseases and Personalized Medicine: Europe has over 30 million people affected by rare diseases. The EU's Horizon Europe program allocated 2 billion in 2022 for research into rare diseases and personalized medicine. This focus increases the complexity of clinical trials, necessitating specialized CRO services with expertise in niche therapeutic areas and advanced technologies.

- Technological Advancements in Clinical Trials: The adoption of technologies like artificial intelligence (AI) and big data analytics is transforming clinical trials. In 2022, the European Medicines Agency (EMA) approved guidelines for the use of AI in clinical research. CROs investing in these technologies improve trial efficiency and data management, attracting more clients seeking innovative solutions.

Market Challenges

- Stringent Regulatory Environment: Europe's complex regulatory framework poses challenges for clinical trials. The General Data Protection Regulation (GDPR) imposes strict data privacy requirements, affecting how CROs handle patient data. Non-compliance can result in significant fines, necessitating substantial investments in compliance and data security measures by CROs.

- Patient Recruitment and Retention Difficulties: Approximately 80% of clinical trials in Europe face delays due to patient recruitment issues. The declining participation rates, influenced by factors like lack of awareness and logistical challenges, increase operational costs and timelines for CROs managing these trials.

Europe Contract Research Organization (CRO) Future Outlook

Over the next few years, the Europe CRO market is expected to witness robust growth, driven by ongoing R&D investments and the increasing complexity of clinical trials. The European Union's commitment to health research, with a budget of 5.1 billion allocated under the Horizon Europe program for 2021-2027, supports this trajectory. Technological advancements such as AI integration and decentralized trials are anticipated to streamline operations. The emphasis on personalized medicine and biologics will further expand the role of CROs in drug development initiatives.

Market Opportunities

- Expansion of Biologics and Biosimilars Research: The European Medicines Agency approved 20 new biologics in 2022, highlighting the growth in this segment. The biologics market requires specialized clinical trials due to their complex nature. CROs with expertise in biologics have the opportunity to capture this growing market segment. The European biosimilars market is also expanding, with sales reaching 3.8 billion in 2022.

- Adoption of Decentralized Clinical Trials: The COVID-19 pandemic accelerated the adoption of decentralized clinical trials (DCTs). In 2022, over 1,200 DCTs were conducted in Europe, a 50% increase from the previous year. CROs offering DCT capabilities can tap into the demand for flexible and patient-centric trial models, reducing geographical barriers and improving patient recruitment.

Scope of the Report

|

Service Type |

Early Phase Development Clinical Research Laboratory Services Consulting Services |

|

Therapeutic Area |

Oncology Cardiovascular Neurology Infectious Diseases Others |

|

End-user |

Pharmaceutical Companies Biotechnology Firms Medical Device Manufacturers |

|

Region |

Western Europe Central & Eastern Europe Nordic Countries Southern Europe |

Products

Key Target Audience

Pharmaceutical Companies

Biotechnology Firms

Medical Device Manufacturers

Government and Regulatory Bodies (European Medicines Agency, MHRA, National Health Authorities)

Venture Capital Firms

Clinical Trial Service Providers

Drug Development Companies

Private Equity Investors

Companies

Players Mentioned in the Report

ICON Plc

Labcorp Drug Development

Charles River Laboratories

Syneos Health

IQVIA

PAREXEL International Corporation

Covance

Medpace

PRA Health Sciences

PPD

Eurofins Scientific

SGS

KCR

Synteract

Ergomed

Table of Contents

1. Europe CRO Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Europe CRO Market Size

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Europe CRO Market Analysis

3.1 Growth Drivers

3.1.1 Increase in Pharmaceutical R&D Expenditure

3.1.2 Focus on Rare Diseases and Personalized Medicine

3.1.3 Technological Advancements in Clinical Trials

3.2 Market Challenges

3.2.1 Stringent Regulatory Environment

3.2.2 Patient Recruitment and Retention Difficulties

3.3 Government Regulations

3.3.1 Implementation of Clinical Trials Regulation (EU) No 536/2014

3.3.2 General Data Protection Regulation (GDPR) Compliance

3.3.3 EMA Guidelines on AI in Clinical Research

3.4 Opportunities

3.4.1 Expansion of Biologics and Biosimilars Research

3.4.2 Adoption of Decentralized Clinical Trials

3.5 Trends

3.5.1 Integration of Artificial Intelligence and Machine Learning

3.5.2 Increase in Virtual and Remote Trials

3.5.3 Collaboration Between CROs and Technology Firms

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

4. Europe CRO Market Segmentation

4.1 By Service Type

4.1.1 Early Phase Development

4.1.2 Clinical Research

4.1.3 Laboratory Services

4.1.4 Consulting Services

4.2 By Therapeutic Area

4.2.1 Oncology

4.2.2 Cardiovascular

4.2.3 Neurology

4.2.4 Infectious Diseases

4.2.5 Others

4.3 By End-user

4.3.1 Pharmaceutical Companies

4.3.2 Biotechnology Firms

4.3.3 Medical Device Manufacturer

4.4 By Region

4.4.1 Western Europe

4.4.2 Central & Eastern Europe

4.4.3 Nordic Countries

4.4.4 Southern Europe

5. Europe CRO Competitive Landscape

5.1 Detailed Profiles of Major Companies

5.2 Cross Comparison Parameters (Revenue, Clinical Trials Conducted, Strategic Partnerships, Regional Presence, Employee Strength)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital and Private Equity Funding

5.8 Government Support and Grants

6. Europe CRO Market Regulatory Framework

6.1 Industry Standards and Certifications

6.2 Data Protection and Privacy Regulations

6.3 Compliance with EMA Guidelines

6.4 Ethical Considerations in Clinical Trials

7. Europe CRO Future Market Outlook

7.1 Future Market Projections

7.2 Key Factors Driving Future Growth

8. Europe CRO Future Market Segmentation

8.1 By Service Type

8.2 By Therapeutic Area

8.3 By End-user

8.4 By Region

9. Europe CRO Market Analysts Recommendations

9.1 Total Addressable Market (TAM) Analysis

9.2 Innovation and Service Development Strategies

9.3 Market Entry and Expansion Strategies

9.4 Targeted Marketing and Client Acquisition Strategies

9.5 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first phase involves mapping the Europe Contract Research Organization (CRO) Market ecosystem, identifying all major stakeholders, including pharmaceutical companies, biotech firms, and regulatory bodies. This step is conducted through extensive desk research, leveraging secondary sources and proprietary databases to gather market intelligence. Key variables such as outsourcing trends, regulatory frameworks, technological innovations, and therapeutic area focus are identified to establish the foundational market dynamics.

Step 2: Market Analysis and Construction

This phase focuses on compiling and analyzing historical data to assess market penetration, service adoption rates, and revenue distribution across different CRO service segments, including clinical trials, preclinical studies, and regulatory consulting. A deep dive into contractual agreements, R&D spending patterns, and operational efficiencies of CROs will be undertaken. Additionally, an evaluation of regional differences, investment trends, and emerging therapeutic areas will ensure the accuracy and robustness of market estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed based on initial data analysis and subsequently validated through expert consultations with industry professionals, including CRO executives, pharmaceutical R&D managers, and regulatory consultants. These expert insights will refine our understanding of market drivers, operational challenges, and future growth potential, adding depth and validation to the research findings.

Step 4: Research Synthesis and Final Output

The final phase involves engaging directly with leading CRO firms and pharmaceutical companies to gather detailed insights into pipeline projects, strategic partnerships, and emerging business models. This process ensures the accuracy of market estimations and provides a well-rounded, validated analysis of the Europe CRO Market, forming the basis for strategic recommendations and industry forecasts.

Frequently Asked Questions

01 How big is the Europe Contract Research Organization Market?

The Europe Contract Research Organization (CRO) market is valued at USD 20 billion, driven by increasing outsourcing of clinical trials to reduce costs and accelerate drug development.

02 What are the challenges in the Europe Contract Research Organization Market?

The Europe Contract Research Organization (CRO) market faces challanges such as stringent regulations, including GDPR and EU Clinical Trials Regulation, increasing compliance costs.

03 Who are the major players in the Europe Contract Research Organization Market?

Key players in the Europe Contract Research Organization (CRO) market include ICON Plc, IQVIA, Labcorp Drug Development, Charles River Laboratories, and Syneos Health, all of which dominate the market through strategic collaborations and advanced clinical research capabilities.

04 What are the growth drivers of the Europe Contract Research Organization Market?

Europe Contract Research Organization (CRO) market Growth is fueled by increased pharmaceutical R&D spending, the rise of personalized medicine and rare disease research, technological advancements like AI and decentralized trials, and the expansion of biologics and biosimilars research.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.