Europe Cross Laminated Timber (CLT) Market Outlook to 2030

Region:Europe

Author(s):Meenakshi Bisht

Product Code:KROD6098

December 2024

82

About the Report

Europe Cross Laminated Timber(CLT) Market Overview

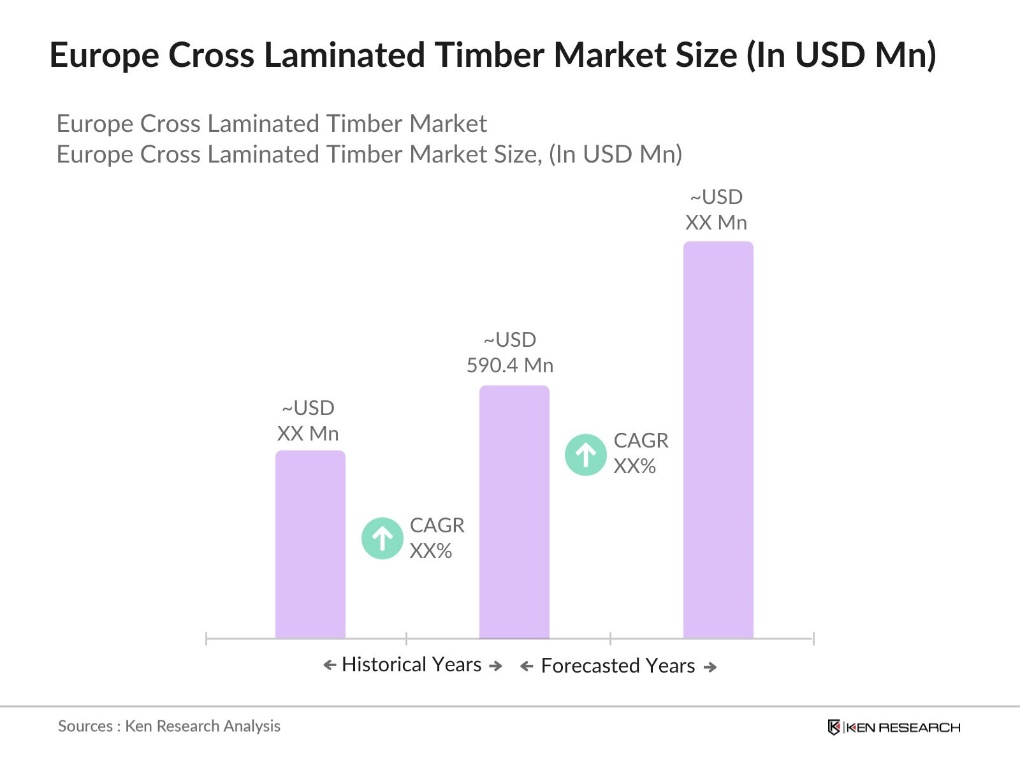

- The Europe Cross Laminated Timber (CLT) Market is valued at USD 590.4 million, reflecting the growing demand for sustainable construction materials. This market growth is driven by the increasing focus on reducing carbon emissions in the construction industry and strong government support for green building initiatives.

- Germany, Austria, and Sweden are the leading countries in the Europe CLT market. Germany's dominance stems from its advanced wood technology sector and stringent environmental regulations that promote sustainable construction practices. Austria's leadership in manufacturing innovation and a strong wood industry also places it at the forefront of the market.

- The European Union's Deforestation-free Regulation (EUDR) was introduced in 2023 to combat deforestation linked to commodity production, including timber. It requires companies to exercise due diligence to ensure products entering or leaving the EU are deforestation-free. The regulation builds on the EU Timber Regulation (EUTR), enforcing strict guidelines on timber products like Cross Laminated Timber (CLT), ensuring that materials are legally sourced and do not contribute to forest degradation. This initiative supports sustainable forestry across Europe.

Europe Cross Laminated Timber(CLT) Market Segmentation

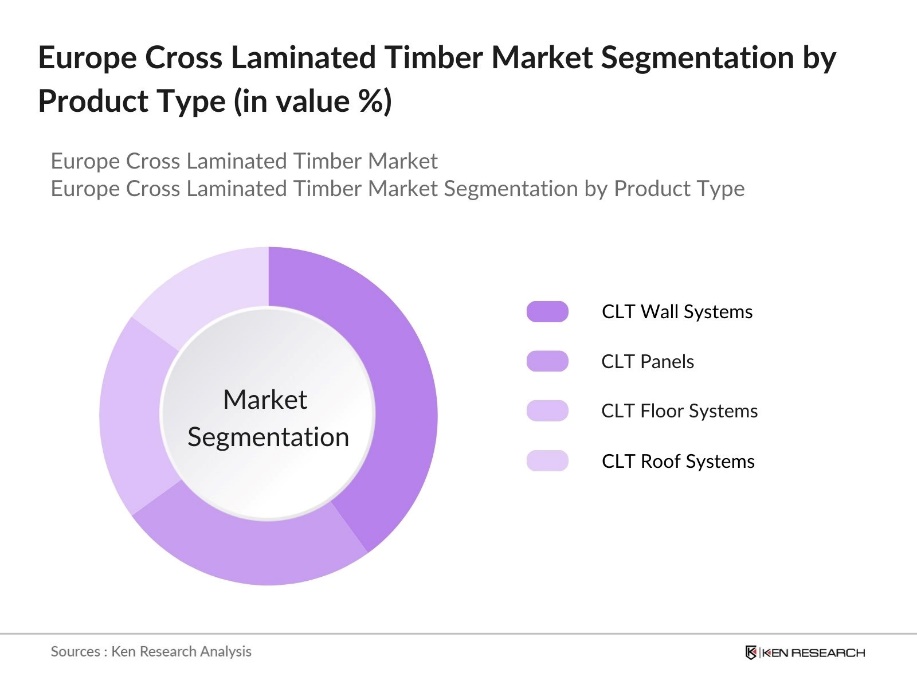

By Product Type: The Europe Cross Laminated Timber market is segmented by product type into CLT Panels, CLT Wall Systems, CLT Floor Systems, and CLT Roof Systems. CLT Wall Systems hold a dominant market share due to their widespread use in residential and commercial construction. The structural strength of CLT wall systems, combined with their ability to act as a sustainable alternative to concrete and steel, has resulted in significant demand. They are also preferred due to their energy efficiency, ease of installation, and superior load-bearing capacity, making them a popular choice for multi-story buildings.

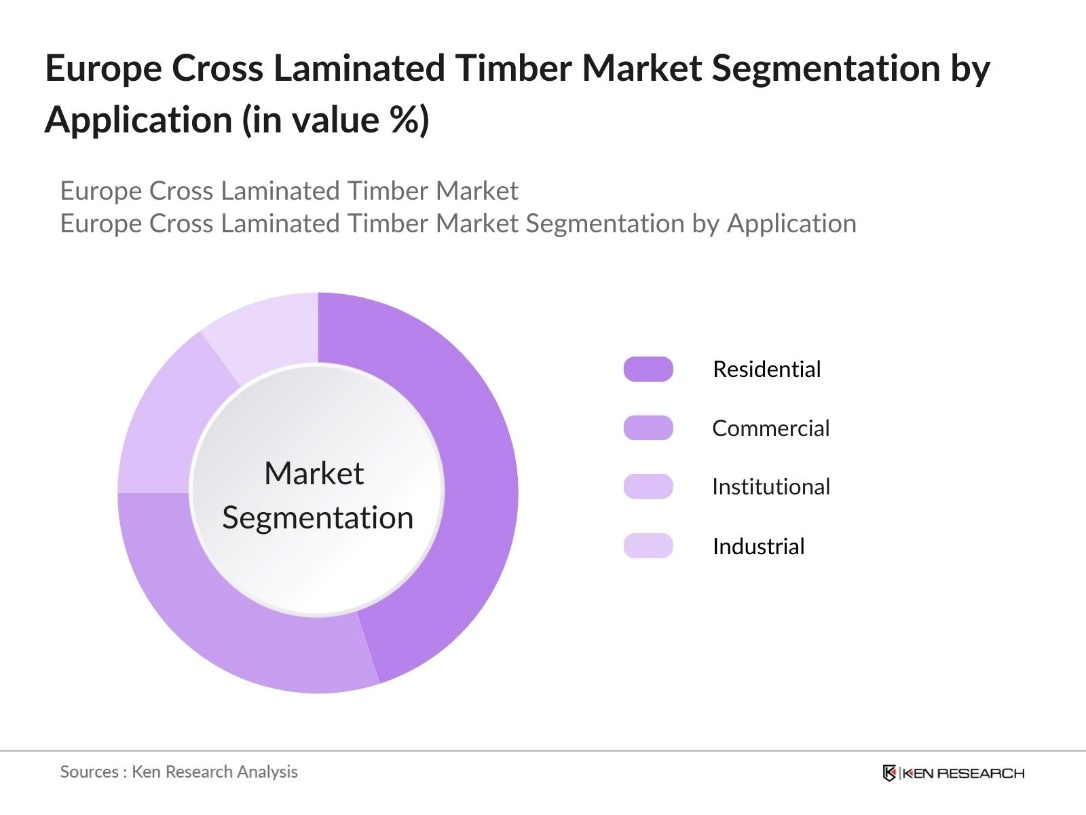

By Application: The Europe CLT market is also segmented by application into Residential, Commercial, Institutional, and Industrial. Residential applications dominate the market share due to the growing trend of using eco-friendly materials in housing projects. With increasing urbanization and the need for affordable, sustainable housing, CLT is being widely adopted in the construction of multi-story residential complexes. The materials natural aesthetic appeal, fire resistance, and structural versatility contribute to its popularity in this segment.

Europe Cross Laminated Timber(CLT) Market Competitive Landscape

The market is dominated by a few key players that have established a strong presence through innovation, partnerships, and strategic initiatives. The market has seen significant consolidation, with companies expanding their production capacities and exploring new geographic markets.

|

Company Name |

Year of Establishment |

Headquarters |

CLT Production Capacity |

Certifications |

Number of Employees |

Revenue (USD) |

Major Markets |

Technology Focus |

Sustainable Practices |

|

Stora Enso |

1998 |

Helsinki, Finland |

|||||||

|

KLH Massivholz GmbH |

1997 |

Teufenbach, Austria |

|||||||

|

Binderholz GmbH |

1950 |

Fgen, Austria |

|||||||

|

Mayr-Melnhof Holz |

1850 |

Leoben, Austria |

|||||||

|

Mets Wood |

1947 |

Espoo, Finland |

Europe Cross Laminated Timber(CLT) Industry Analysis

Growth Drivers

- Sustainability and Environmental Regulations: The European Union (EU) has implemented stringent environmental policies to reduce carbon emissions, pushing the construction sector toward sustainable materials like Cross Laminated Timber (CLT). In 2023, the European Green Deal aims to make Europe climate-neutral by 2050, and timber construction can play a significant role in achieving this. This push for sustainability has led to increasing use of CLT in urban construction, as governments aim to reduce emissions from the building sector.

- Rising Demand for Green Buildings: In 2022, the European construction industry saw a surge in demand for green buildings, driven by regulatory frameworks like the EUs Energy Performance of Buildings Directive (EPBD). Over 40% of Europes total energy consumption comes from buildings, making green construction an essential strategy to reduce this. CLT, as a renewable and energy-efficient material, has gained traction in both residential and commercial sectors, especially in countries like Germany and Austria, where timber buildings have seen substantial growth.

- Prefabrication and Modular Construction Demand: The demand for prefabrication in Europe is rising, particularly with Cross Laminated Timber (CLT), due to its time and cost efficiency. CLTs structural strength makes it ideal for modular construction, where components are manufactured off-site and assembled quickly. This method reduces construction time significantly and aligns with the push for sustainable, eco-friendly building practices, making it a preferred choice in many European projects.

Market Challenges

- High Initial Investment Costs: Although Cross Laminated Timber (CLT) offers long-term environmental and cost advantages, the initial investment is higher than traditional materials like concrete or steel. This is largely due to the specialized machinery and production methods required for CLT panels, as well as the need for sustainably certified timber. These factors can create financial challenges for smaller construction firms, making CLT adoption more difficult for certain projects.

- Technical Limitations in High-Rise Structures: Despite its versatility, CLT faces challenges in high-rise construction. The materials load-bearing capacity is lower than that of steel or concrete, especially in buildings over 10 stories. Additional reinforcement, such as steel support, is often necessary, complicating construction and raising costs. This limits the widespread use of CLT in high-rise structures, especially when compared to traditional building materials.

Europe Cross Laminated Timber(CLT) Market Future Outlook

Over the next five years, the Europe Cross Laminated Timber market is expected to experience significant growth driven by continuous advancements in wood technology, rising environmental awareness, and supportive government regulations. Increasing urbanization and the need for sustainable, energy-efficient buildings will further bolster the market. Technological advancements such as digital prefabrication and automation in CLT manufacturing will also enhance production efficiency, creating new opportunities for growth.

Market Opportunities

- Innovation in Wood Technology and Production Methods: Technological advancements in Cross Laminated Timber (CLT) manufacturing are driving growth in the European market. Innovations have improved CLTs structural integrity, making it more suitable for a wider range of construction projects. Automated production methods have also streamlined the manufacturing process, increasing efficiency. Additionally, new wood preservation techniques have expanded the use of CLT in challenging environments, further enhancing its appeal for infrastructure and large-scale projects.

- Increasing Applications in Non-residential Sectors: CLT is gaining traction in non-residential construction, particularly in schools, offices, and commercial buildings. Many European countries are prioritizing timber for public infrastructure due to its sustainability and energy efficiency. The adoption of CLT in these sectors is growing, supported by policies encouraging the use of eco-friendly materials in public and commercial spaces across Europe. This trend is expected to continue as cities push for more sustainable construction practices.

Scope of the Report

|

By Product Type |

CLT Panels CLT Wall Systems CLT Roof Systems |

|

By Application |

Residential Non-residential Infrastructure |

|

By Raw Material Type |

Spruce Pine Larch Others |

|

By Bonding Method |

Mechanical Bonding Adhesive Bonding |

|

By Region |

Western Central & Eastern Nordic Countries |

Products

Key Target Audience

Timber Manufacturing Companies

Construction Firms

Architecture and Engineering Firms

Green Building Certification Agencies

Government and Regulatory Bodies (European Union Timber Regulation, National Building Code Authorities)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Stora Enso

KLH Massivholz GmbH

Binderholz GmbH

Mayr-Melnhof Holz

Mets Wood

Rubner Holzbau

Hasslacher Norica Timber

SmartLam North America

Structurlam Mass Timber Corporation

HESS Timber

Table of Contents

1. Europe Cross Laminated Timber Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics (Supply Chain, Raw Material Availability, Distribution Channels)

1.4. Market Segmentation Overview

2. Europe Cross Laminated Timber Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Key Market Developments and Milestones (Building Codes, Major Projects)

2.3. Year-On-Year Growth Analysis

2.4. CLT Adoption in Construction (Residential, Commercial, Institutional)

3. Europe Cross Laminated Timber Market Analysis

3.1. Growth Drivers

3.1.1. Sustainability and Environmental Regulations

3.1.2. Rising Demand for Green Buildings

3.1.3. Prefabrication and Modular Construction Demand

3.1.4. Increasing Urbanization and Housing Needs

3.2. Market Challenges

3.2.1. High Initial Investment Costs

3.2.2. Technical Limitations in High-Rise Structures

3.2.3. Lack of Skilled Labor in CLT Manufacturing

3.3. Opportunities

3.3.1. Innovation in Wood Technology and Production Methods

3.3.2. Government Initiatives Promoting Timber Construction

3.3.3. Increasing Applications in Non-residential Sectors

3.4. Trends

3.4.1. Growing Use of CLT in Commercial High-Rise Buildings

3.4.2. Technological Integration in Timber Production (Automation, Digital Prefabrication)

3.4.3. Adoption of CLT in Seismic and Fire-Safe Construction

3.5. Government Regulations

3.5.1. EU Timber Regulation (EUTR) Compliance

3.5.2. National Building Standards Supporting CLT

3.5.3. Certifications for Sustainable Wood Usage

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem

4. Europe Cross Laminated Timber Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. CLT Panels (Custom Sizes, Pre-designed Panels)

4.1.2. CLT Wall, Floor, and Roof Systems

4.2. By Application (In Value %)

4.2.1. Residential (Multi-story Buildings, Low-rise Housing)

4.2.2. Non-residential (Commercial, Institutional, Industrial)

4.2.3. Infrastructure (Bridges, Public Buildings)

4.3. By Raw Material Type (In Value %)

4.3.1. Spruce

4.3.2. Pine

4.3.3. Larch

4.3.4. Others (Douglas Fir, Cedar)

4.4. By Bonding Method (In Value %)

4.4.1. Mechanical Bonding

4.4.2. Adhesive Bonding

4.5. By Region (In Value %)

4.5.1. Western Europe

4.5.2. Central and Eastern Europe

4.5.3. Nordic Countries

5. Europe Cross Laminated Timber Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Stora Enso

5.1.2. KLH Massivholz GmbH

5.1.3. Binderholz GmbH

5.1.4. Mayr-Melnhof Holz

5.1.5. Hasslacher Norica Timber

5.1.6. Mets Wood

5.1.7. Pfeifer Group

5.1.8. Ed. Zblin AG

5.1.9. Rubner Holzbau

5.1.10. Structurlam Mass Timber Corporation

5.1.11. SmartLam North America

5.1.12. CrossLam

5.1.13. HESS Timber

5.1.14. Martinsons

5.1.15. Sdra Wood

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Revenue, CLT Production Capacity)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Partnerships, New Product Launches, Expansions)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Support and Grants for CLT Manufacturing

5.8. Private Equity Investments

6. Europe Cross Laminated Timber Market Regulatory Framework

6.1. Certification Requirements (PEFC, FSC)

6.2. Compliance with National and European Building Codes

6.3. Environmental Standards and Sustainable Wood Sourcing

7. Europe Cross Laminated Timber Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Growth

8. Europe Cross Laminated Timber Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Raw Material Type (In Value %)

8.4. By Bonding Method (In Value %)

8.5. By Region (In Value %)

9. Europe Cross Laminated Timber Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Strategic Focus Areas for Manufacturers

9.3. Market Entry Strategies for New Entrants

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping all significant stakeholders in the Europe CLT market. Desk research using secondary databases identifies crucial market variables, such as timber availability, production capacity, and regulatory requirements, that influence the market's growth.

Step 2: Market Analysis and Construction

This step involves analyzing historical data to assess the market's performance. Key metrics like market penetration rates, usage in different construction types, and revenue generation are evaluated to construct a comprehensive market picture.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through expert interviews, providing operational and financial insights from key industry participants. These insights help refine and confirm the market data.

Step 4: Research Synthesis and Final Output

The final phase involves engaging with major CLT manufacturers to acquire detailed insights into production processes, sales strategies, and customer preferences. This ensures that the market data is accurate and validated through a bottom-up approach.

Frequently Asked Questions

01 How big is the Europe Cross Laminated Timber Market?

The Europe Cross Laminated Timber Market is valued at USD 590.4 million. This market growth is supported by the increasing demand for sustainable construction solutions across various sectors.

02 What are the challenges in the Europe CLT Market?

Challenges in Europe CLT Market include high initial investment costs, technical limitations in high-rise buildings, and a lack of skilled labor in the CLT manufacturing process. Overcoming these barriers is key to further expanding the market.

03 Who are the major players in the Europe CLT Market?

Major players in Europe CLT Market include Stora Enso, KLH Massivholz GmbH, Binderholz GmbH, Mayr-Melnhof Holz, and Mets Wood. These companies dominate due to their innovation in mass timber technology, extensive production capacities, and sustainable practices.

04 What are the growth drivers of the Europe CLT Market?

Key growth drivers in Europe CLT Market include rising demand for eco-friendly building materials, increasing government regulations promoting green construction, and technological advancements in prefabrication and modular construction methods.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.