Europe Cruiser Motorcycle Market Outlook to 2030

Region:Europe

Author(s):Shreya Garg

Product Code:KROD7338

November 2024

88

About the Report

Europe Cruiser Motorcycle Market Overview

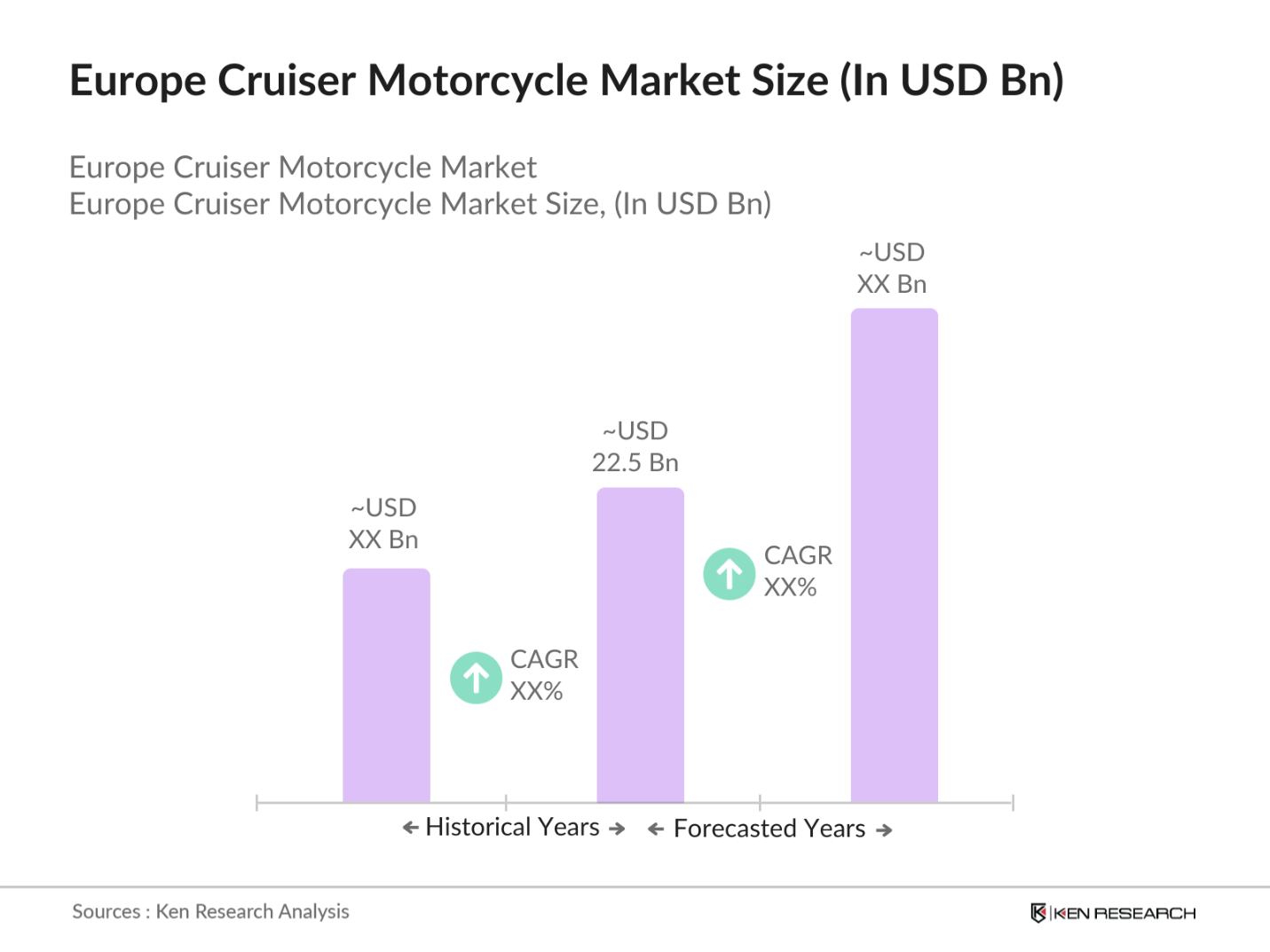

The Europe Cruiser Motorcycle market is valued at USD 22.2 bn, driven by the increasing demand for premium, high-performance motorcycles that cater to the regions growing interest in leisure and long-distance touring. This demand is supported by the expanding disposable income among middle and upper-class consumers and the rising appeal of recreational motorcycling culture, which emphasizes the lifestyle and community aspects of cruiser riding.

Dominant markets within Europe include Germany, Italy, and France due to their established motorcycle culture, advanced manufacturing capabilities, and high consumer demand for premium and technologically advanced models. These countries host major motorcycle brands and events that reinforce their position as leading markets in the region.

Euro 5 emission standards enforce stringent limits on pollutants, mandating technological improvements in new motorcycle models. The European Environment Agencys 2024 emission compliance report indicated that these regulations contributed to a 5% drop in nitrogen oxide emissions from the automotive sector compared to 2022

Europe Cruiser Motorcycle Market Segmentation

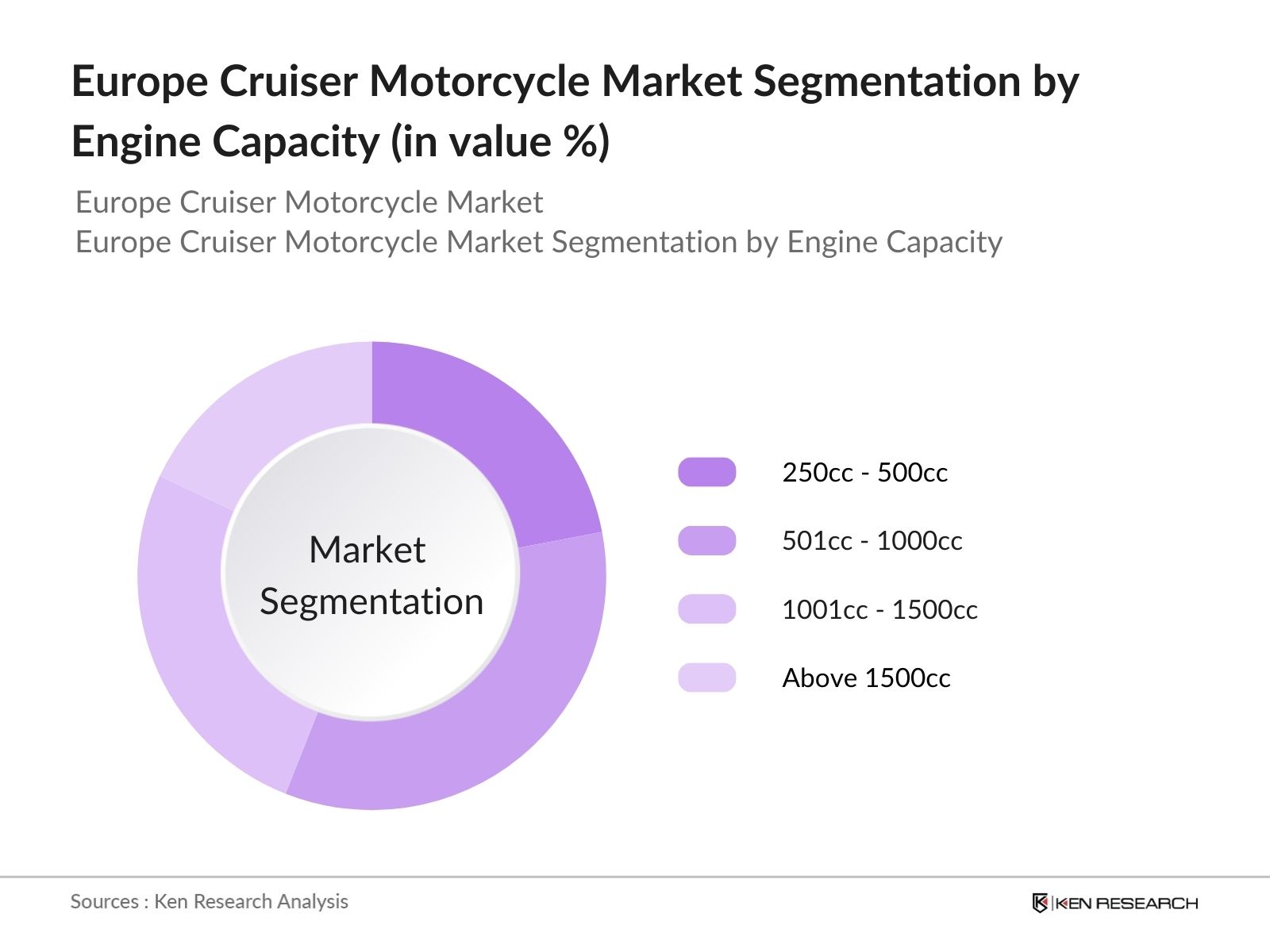

By Engine Capacity: The market is segmented by engine capacity into 250cc - 500cc, 501cc - 1000cc, 1001cc - 1500cc, and above 1500cc. Recently, the 501cc - 1000cc segment has shown a dominant market share due to its balance between power and affordability, appealing to a wide range of consumers who seek both performance and economic value. These models are popular for their versatility and comfort, making them ideal for long-distance touring.

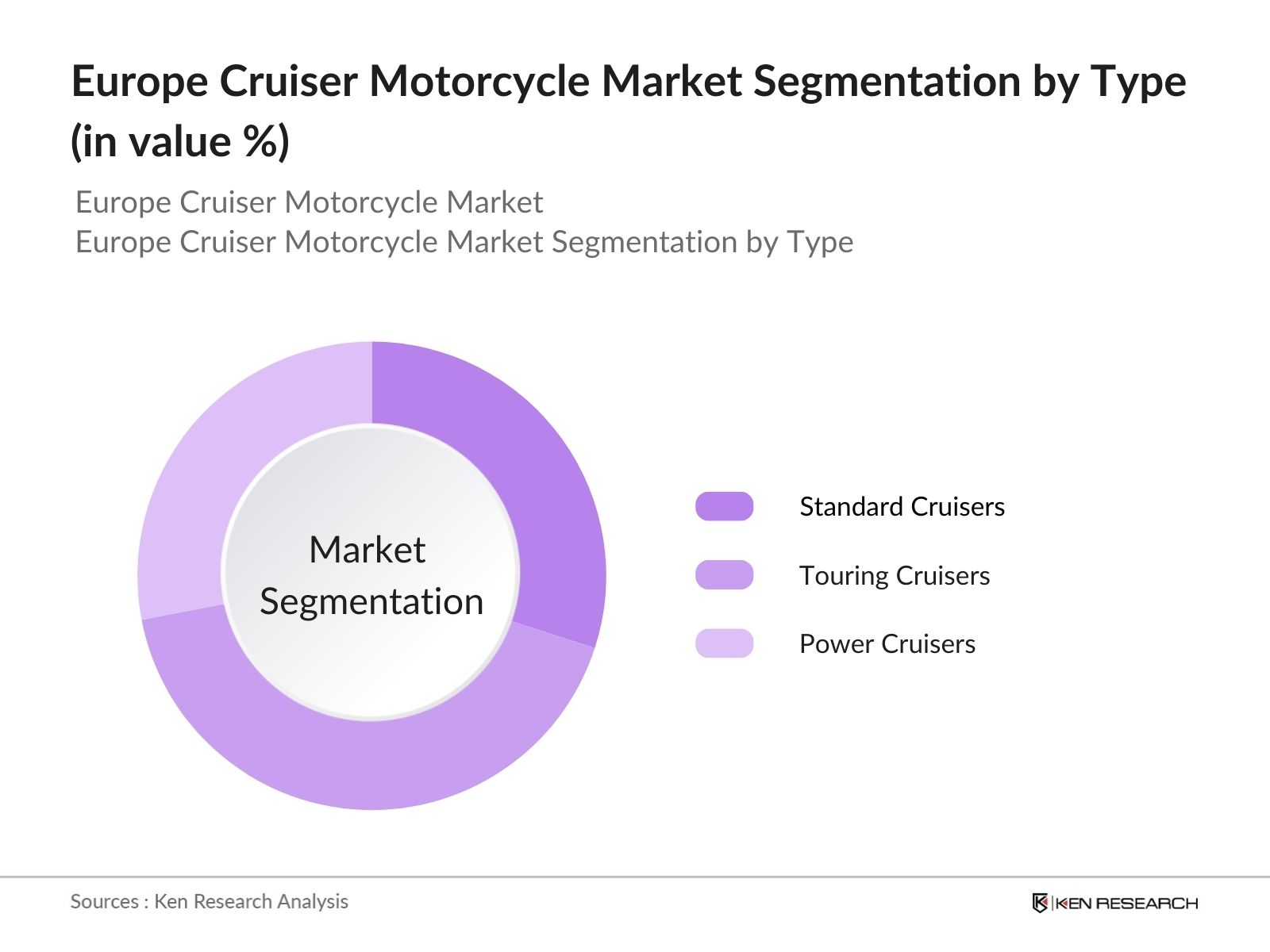

By Type: The market is segmented by type into standard cruisers, touring cruisers, and power cruisers. Touring cruisers hold the dominant market share, driven by the growing trend of adventure and long-distance travel. Consumers prefer touring cruisers for their comfort-oriented features, extended range, and luggage capacity, which make them ideal for multi-day trips across Europes scenic routes.

Europe Cruiser Motorcycle Market Competitive Landscape

The Europe Cruiser Motorcycle market is dominated by a few key players that leverage their brand heritage and innovative technologies to maintain competitive advantages. Leading manufacturers include both European and international brands known for their premium offerings and strong distribution networks.

Europe Cruiser Motorcycle Industry Analysis

Growth Drivers

- Increasing Consumer Interest in Premium Motorcycles: The European market has seen a notable rise in consumer interest for premium motorcycles, driven by an increase in disposable income across key EU nations. For instance, in 2024, Germany's per capita income reached USD 54,000, showing a stable economic environment that supports the purchase of high-end products, including. Additionally, countries like France and Italy have experienced similar income growth, contributing to heightened interest in luxury items such as cruisers that offer superior design, power, and comfort.

- Expanding Middle-Class Income: The middle class in Europe continues to expand, with significant growth observed in countries like Spain and Poland. In Spain, the median income has risen to USD 32,000 as of 2024, indicating greater purchasing power among consumers. This economic uplift facilitates the affordability of mid-to-high range motorcycles. The middle-class segments enthusiasm for premium leisure activities, including motorcycle touring, supports this shift.

- Rising Popularity of Leisure and Adventure Travel: Adventure travel has become an integral part of European lifestyles, with 24 million individuals in the EU undertaking leisure road trips annually, as per 2024 data from the European Travel Commission (Source: ETC, https://www.etc-corporate.org/reports). The inclination towards longer road journeys boosts demand for cruisers known for comfort and long-distance capabilities. This trend aligns with the rise in motorcycle registrations, particularly in Southern Europe, where tourism contributes significantly to the economy.

Market Challenges

- High Cost of Ownership The cost of owning a premium motorcycle remains a significant barrier in Europe, as ongoing economic assessments indicate. The European Consumer Price Index for automotive goods rose by 3% in 2024, impacting affordability. Additionally, insurance rates for high-performance cruisers remain steep, with average annual premiums in countries like the UK hitting USD 1,500.

- Stringent Emission Norms and Regulations Europes stringent emission standards, particularly the Euro 5 regulations implemented across the EU, present challenges for manufacturers of internal combustion motorcycles. The compliance requires significant investments in cleaner technology, as highlighted by the European Environment Agencys 2024 report on vehicle emissions. This regulation impacts production and pricing strategies, potentially slowing down sales.

Europe Cruiser Motorcycle Market Future Outlook

Over the next five years, the Europe Cruiser Motorcycle market is expected to experience significant growth due to the integration of electric and hybrid models, advancements in rider safety technologies, and increasing consumer demand for custom and personalized riding experiences. The adoption of sustainable and eco-friendly practices by manufacturers, coupled with expanding partnerships and collaborations in the industry, is set to create new opportunities for growth.

Future Market Opportunities

- Growth in Customization Trends Customization has gained traction in Europes motorcycle market, with data from 2024 showing that nearly 18% of new motorcycle buyers opted for personalization options, according to reports. This trend aligns with consumer demand for unique, tailored riding experiences, driving potential sales for manufacturers offering extensive customization packages.

- Expanding Electric Cruiser Motorcycle Market: The market for electric cruisers is gaining momentum as EU policies push for a reduction in carbon emissions. The number of electric motorcycle registrations increased by 8,000 units from 2023 to 2024, as noted by the European Alternative Fuels Observatory. With advancements in battery technology and increased charging infrastructure investments, European manufacturers are expanding their electric lineup, positioning themselves for future market shifts.

Scope of the Report

|

Engine Capacity |

250cc - 500cc 501cc - 1000cc 1001cc - 1500cc Above 1500cc |

|

Type |

Standard Cruisers Touring Cruisers Power Cruisers |

|

Fuel Type |

Petrol Electric Hybrid |

|

Sales Channel |

Offline Dealerships Online Retail Direct Sales |

|

Region |

West East North South |

Products

Key Target Audience

Motorcycle Manufacturers

Component and Accessory Suppliers

Dealerships and Retailers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (European Transport Safety Council)

Motorcycle Enthusiast Clubs

Technology Solution Providers

Logistics and Supply Chain Management Companies

Companies

Players mentioned in the Report

Harley-Davidson Inc.

BMW Motorrad

Honda Motor Co., Ltd.

Yamaha Motor Company

Kawasaki Heavy Industries Ltd.

Ducati Motor Holding S.p.A

Triumph Motorcycles Ltd.

Indian Motorcycle Company

Moto Guzzi

Royal Enfield

Suzuki Motor Corporation

Victory Motorcycles

Benelli Q.J.

Husqvarna Motorcycles

CF Moto

Table of Contents

1. Europe Cruiser Motorcycle Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Europe Cruiser Motorcycle Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Europe Cruiser Motorcycle Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Consumer Interest in Premium Motorcycles

3.1.2. Expanding Middle-Class Income

3.1.3. Rising Popularity of Leisure and Adventure Travel

3.1.4. Technological Advancements in Motorcycle Features

3.2. Market Challenges

3.2.1. High Cost of Ownership

3.2.2. Stringent Emission Norms and Regulations

3.2.3. Limited Dealership Network in Emerging Markets

3.2.4. Competition from Other Motorcycle Segments

3.3. Opportunities

3.3.1. Growth in Customization Trends

3.3.2. Expanding Electric Cruiser Motorcycle Market

3.3.3. Increasing Manufacturer Focus on Lightweight Materials

3.3.4. Collaborations with Influencers and Brand Ambassadors

3.4. Trends

3.4.1. Integration of Advanced Safety Features (ABS, Traction Control)

3.4.2. Shift Towards Electric and Hybrid Models

3.4.3. Enhanced Rider Comfort and Ergonomics

3.4.4. Personalized Motorcycle Experiences

3.5. Government Regulation

3.5.1. Euro 5 Emission Standards

3.5.2. Road Safety Regulations

3.5.3. Vehicle Certification Requirements

3.5.4. Import and Export Tariff Structures

3.6. SWOT Analysis

3.7. Stake Ecosystem (OEMs, Distributors, Component Suppliers, End-Users)

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Europe Cruiser Motorcycle Market Segmentation

4.1. By Engine Capacity (In Value %)

4.1.1. 250cc - 500cc

4.1.2. 501cc - 1000cc

4.1.3. 1001cc - 1500cc

4.1.4. Above 1500cc

4.2. By Type (In Value %)

4.2.1. Standard Cruisers

4.2.2. Touring Cruisers

4.2.3. Power Cruisers

4.3. By Fuel Type (In Value %)

4.3.1. Petrol

4.3.2. Electric

4.3.3. Hybrid

4.4. By Sales Channel (In Value %)

4.4.1. Offline Dealerships

4.4.2. Online Retail

4.4.3. Direct Sales

4.5. By Region (In Value %)

4.5.1. West

4.5.2. East

4.5.3. North

4.5.4. South

5. Europe Cruiser Motorcycle Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Harley-Davidson Inc.

5.1.2. BMW Motorrad

5.1.3. Honda Motor Co., Ltd.

5.1.4. Yamaha Motor Company

5.1.5. Kawasaki Heavy Industries Ltd.

5.1.6. Ducati Motor Holding S.p.A.

5.1.7. Triumph Motorcycles Ltd.

5.1.8. Indian Motorcycle Company

5.1.9. Moto Guzzi

5.1.10. Royal Enfield

5.1.11. Suzuki Motor Corporation

5.1.12. Victory Motorcycles

5.1.13. Benelli Q.J.

5.1.14. Husqvarna Motorcycles

5.1.15. CF Moto

5.2. Cross Comparison Parameters (Engine Variants, Market Presence, Production Capabilities, Revenue, Product Portfolio, Distribution Network, Technological Integration, Warranty and Service Options)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. New Product Launches

5.8. Strategic Partnerships

5.9. Technological Collaborations

6. Europe Cruiser Motorcycle Market Regulatory Framework

6.1. Emission Regulations

6.2. Safety Compliance Standards

6.3. Licensing and Registration Guidelines

6.4. Noise Control Policies

7. Europe Cruiser Motorcycle Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Europe Cruiser Motorcycle Future Market Segmentation

8.1. By Engine Capacity (In Value %)

8.2. By Type (In Value %)

8.3. By Fuel Type (In Value %)

8.4. By Sales Channel (In Value %)

8.5. By Region (In Value %)

9. Europe Cruiser Motorcycle Market Analysts Recommendations

9.1. Total Addressable Market (TAM)/Serviceable Available Market (SAM)/Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research process begins by identifying critical variables affecting the Europe Cruiser Motorcycle market. This involves mapping stakeholders and analyzing the ecosystem, including OEMs, suppliers, and end-users, using proprietary databases and secondary research.

Step 2: Market Analysis and Construction

Historical data is collected and analyzed to assess market size, distribution channels, and revenue streams. This phase ensures that market trends and performance metrics are accurately mapped and quantified to understand competitive advantages.

Step 3: Hypothesis Validation and Expert Consultation

Interviews and surveys are conducted with industry experts and major players to validate key market insights. These consultations provide direct feedback on operational strategies and consumer behavior trends.

Step 4: Research Synthesis and Final Output

Findings from secondary and primary research are synthesized to create a robust market analysis. Final reports include a detailed review of market segments, competitive analysis, and future growth projections for the Europe Cruiser Motorcycle market.

Frequently Asked Questions

01 How big is the Europe Cruiser Motorcycle market?

The Europe Cruiser Motorcycle market is valued at USD 22.2 bn, driven by strong consumer interest in premium motorcycles and leisure touring.

02 What are the major challenges in the Europe Cruiser Motorcycle market?

The Europe Cruiser Motorcycle market faces challenges such as high costs of ownership, stringent emission regulations, and competition from other motorcycle types like adventure bikes.

03 Who are the major players in the Europe Cruiser Motorcycle market?

Key players in the Europe Cruiser Motorcycle market Europe Cruiser Motorcycle market include Harley-Davidson, BMW Motorrad, Honda, Ducati, and Triumph, known for their strong market presence and technological innovations.

04 Why is Germany dominant in the Europe Cruiser Motorcycle market?

Germany leads the Europe Cruiser Motorcycle market due to its strong manufacturing base, well-established motorcycle culture, and the presence of premium brands like BMW Motorrad.

05 What is driving the future growth of the Europe Cruiser Motorcycle market?

Growth in the Europe Cruiser Motorcycle market is driven by the adoption of electric models, technological advancements, and increasing consumer demand for personalized and sustainable riding experiences.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.