Europe Digital Camera Market Outlook to 2030

Region:Europe

Author(s):Shreya

Product Code:KROD8094

December 2024

81

About the Report

Europe Digital Camera Market Overview

- The Europe digital camera market is valued at USD 2.3 billion, showing steady growth supported by advancements in camera technology, particularly in sensor development and enhanced resolution capabilities. Driven by consumer demand for high-quality imagery, especially among content creators and professional photographers, the market has thrived on the increased popularity of mirrorless cameras, which offer superior features in a compact format. With the rising trend of social media influence and vlogging, the demand for advanced digital cameras continues to rise.

- The market is dominated by key countries like Germany, France, and the UK due to their high concentration of tech-savvy consumers, established photography communities, and the presence of major distribution hubs. Germany, in particular, benefits from a strong manufacturing base for optical instruments, fostering local adoption of high-end camera technology. The UK and France are likewise influential due to their growing content creation markets, driven by popular social media trends and professional photography needs.

- Environmental standards for camera manufacturing in Europe are becoming more stringent as part of the European Green Deal's objectives to reduce electronic waste. In 2023, the European Union enacted policies mandating eco-design requirements for electronic devices, including cameras, to ensure energy efficiency and material recyclability. These regulations encourage manufacturers to adopt greener practices, such as reducing hazardous materials and using recycled components. Compliance with these standards is essential for brands looking to maintain market access in Europe. The shift toward sustainability in the regulatory landscape influences product design and production processes across the digital camera industry.

Europe Digital Camera Market Segmentation

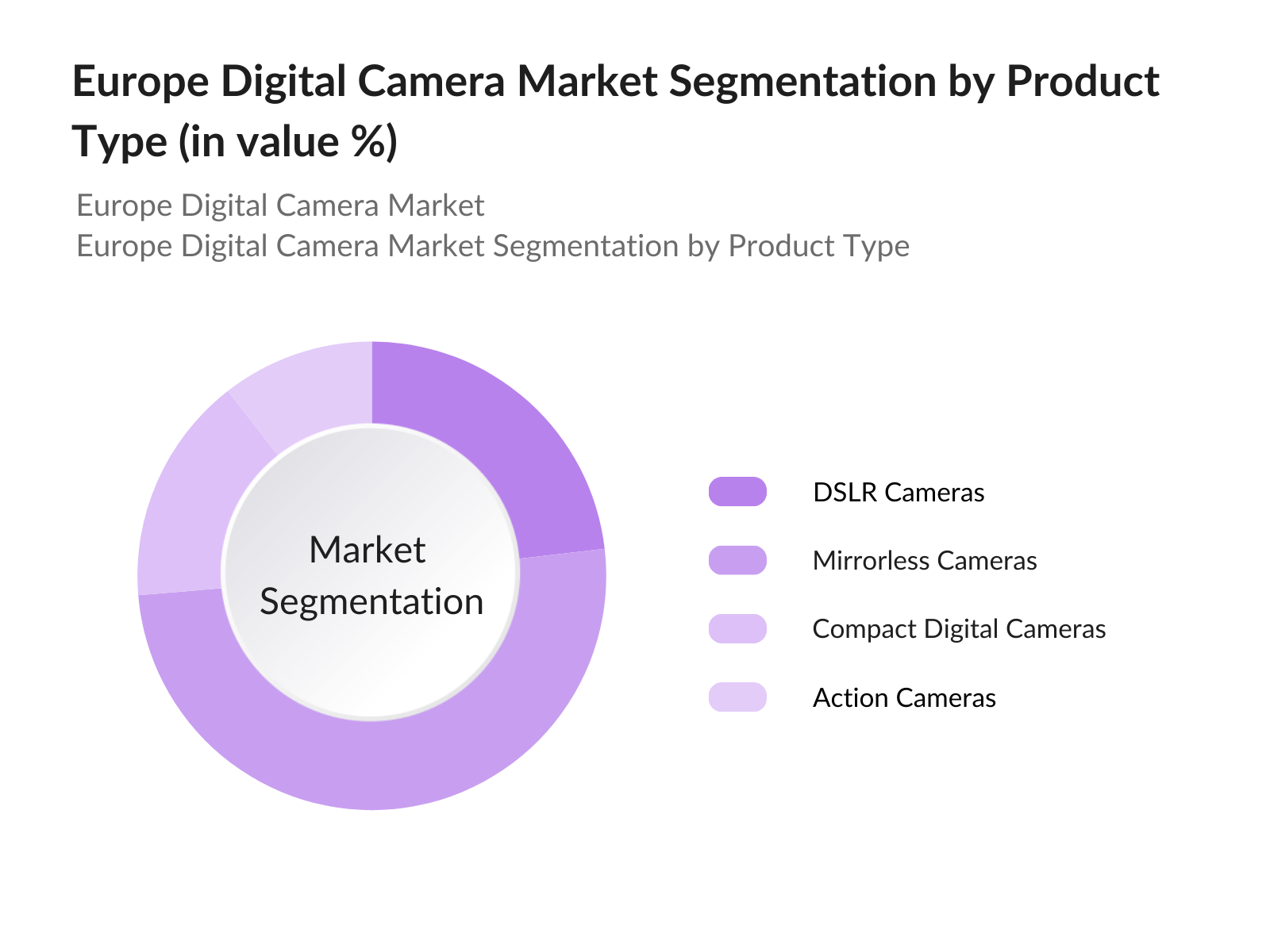

By Product Type: The market is segmented by product type into DSLR cameras, mirrorless cameras, compact digital cameras, and action cameras. Mirrorless cameras currently hold a dominant market share in Europe, attributed to their superior image quality, fast autofocus, and reduced weight compared to traditional DSLRs. The compact design appeals to both professionals and hobbyists, making it a preferred choice in the market. Brands like Sony and Fujifilm lead the segment, capturing the growing audience looking for professional-grade yet portable options.  By Application: The market is segmented by application into consumer photography, professional photography, media & entertainment, and industrial applications. Professional photography dominates the market, largely due to the need for high-quality, durable, and versatile cameras by media professionals, freelance photographers, and content creators. Professional-grade cameras with features like weather sealing, enhanced durability, and interchangeable lenses appeal to this segment, securing its lead. Canon and Nikon are prominent in this area, providing reliable products with robust customer support.

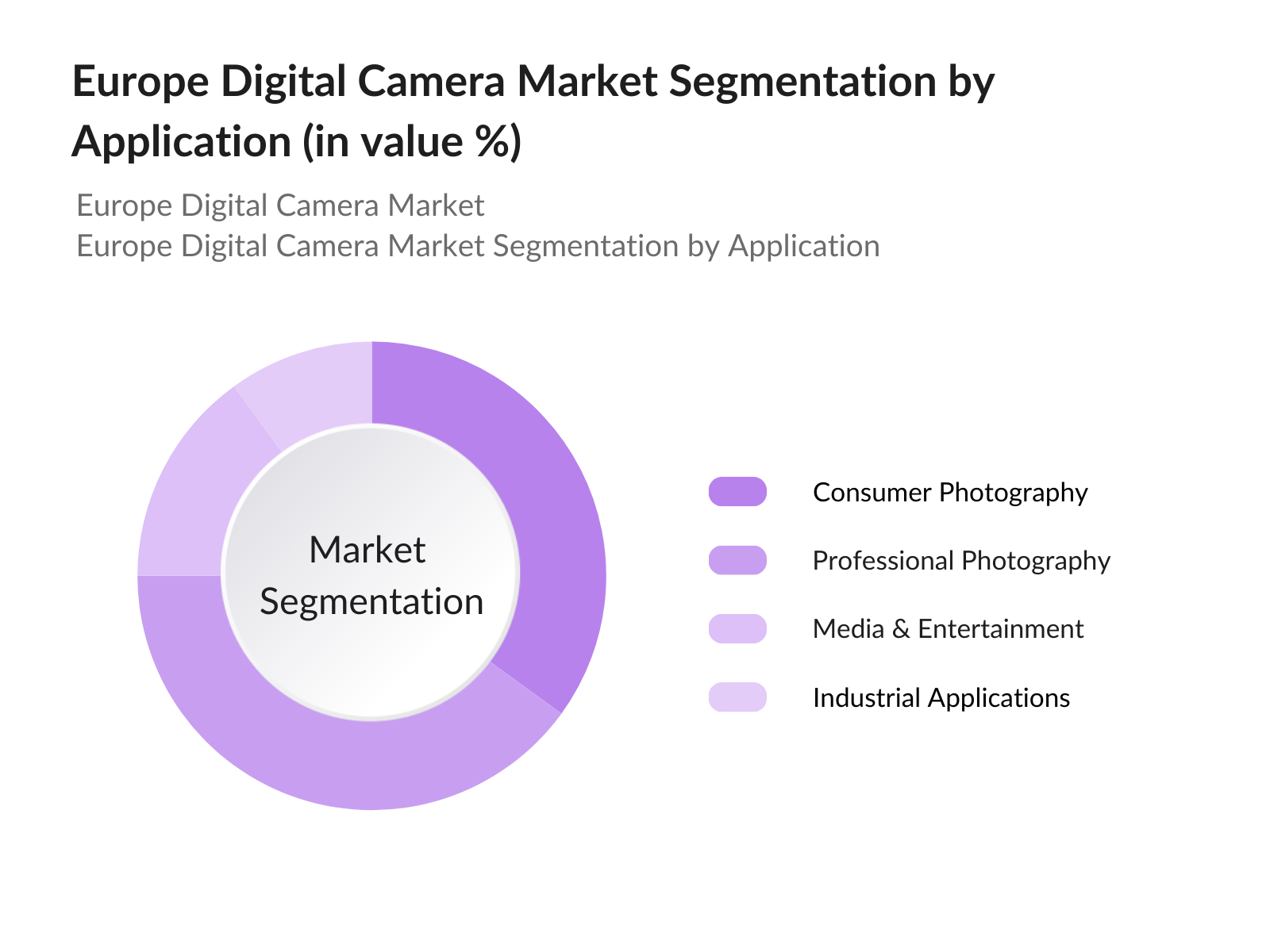

By Application: The market is segmented by application into consumer photography, professional photography, media & entertainment, and industrial applications. Professional photography dominates the market, largely due to the need for high-quality, durable, and versatile cameras by media professionals, freelance photographers, and content creators. Professional-grade cameras with features like weather sealing, enhanced durability, and interchangeable lenses appeal to this segment, securing its lead. Canon and Nikon are prominent in this area, providing reliable products with robust customer support.

Europe Digital Camera Market Competitive Landscape

The Europe digital camera market is characterized by the presence of both long-standing brands and innovative new entrants. Major players dominate the landscape, with companies like Sony, Canon, and Nikon taking the lead through continual technological innovation and strong distribution networks. This consolidation highlights the influence of these established brands, often preferred by professionals for their reliable performance and support services.

Europe Digital Camera Market Analysis

Growth Drivers

Rise in Content Creation: The surge in content creation across Europe has significantly influenced the digital camera market. As of 2023, Europe had approximately 500 million internet users, with a substantial portion engaging in content creation for platforms like YouTube and Instagram. YouTube reported over 35 million active channels in Europe, contributing to a vast array of user-generated content. This proliferation of content creators has driven demand for high-quality digital cameras to produce professional-grade videos and photos. The European Union's Digital Economy and Society Index (DESI) 2023 highlighted that 80% of individuals aged 16-74 used the internet daily, indicating a broad base of potential content creators.

Technological Advancements in Camera Sensors: Technological advancements in camera sensors have propelled the digital camera market in Europe. The introduction of back-illuminated CMOS sensors has enhanced low-light performance, catering to the needs of professional photographers and enthusiasts. In 2023, leading manufacturers like Sony and Canon released cameras featuring sensors with resolutions exceeding 50 megapixels, enabling ultra-high-definition imaging. The European Patent Office reported a 5% increase in patent applications related to imaging technologies in 2023, reflecting ongoing innovation in this sector.

Increasing Adoption of Mirrorless Cameras: The European market has witnessed a significant shift towards mirrorless cameras. In 2023, mirrorless cameras accounted for 60% of interchangeable lens camera sales in Europe, surpassing traditional DSLRs. This transition is attributed to the compact design, faster autofocus, and superior video capabilities of mirrorless systems. The Camera & Imaging Products Association (CIPA) reported that global shipments of mirrorless cameras reached 3 million units in the first half of 2023, with Europe being a major contributor.

Market Challenges

Impact of Smartphone Cameras: The proliferation of smartphones with advanced camera capabilities poses a significant challenge to the digital camera market in Europe. In 2023, smartphone penetration in Europe reached 85%, with many devices featuring multi-lens systems and AI-enhanced photography. The European Commission's Digital Economy and Society Index (DESI) 2023 reported that 70% of individuals used their smartphones for photography, reducing the need for standalone digital cameras. This trend has led to a decline in entry-level camera sales, compelling manufacturers to focus on high-end models and niche markets to maintain profitability.

High Initial Cost of Advanced Cameras: The high initial cost of advanced digital cameras remains a barrier for many consumers in Europe. Professional-grade cameras often exceed 2,000, making them less accessible to amateur photographers and hobbyists. The European Consumer Centre reported that 40% of consumers consider price as the primary factor when purchasing electronic devices. This price sensitivity affects the adoption rate of high-end cameras, especially in markets with lower disposable incomes. Manufacturers are exploring financing options and entry-level models to mitigate this challenge and broaden their customer base.

Europe Digital Camera Market Future Outlook

Over the next five years, the Europe digital camera market is expected to experience steady growth driven by continuous advancements in sensor technology, enhanced connectivity features, and increased consumer interest in high-quality content creation. The rise of mirrorless cameras with AI-based functionalities, combined with a surge in content-driven platforms, will likely support this growth trajectory. Additionally, industrial applications of digital cameras in sectors like healthcare and surveillance are anticipated to contribute to the markets expansion.

Future Market Opportunities

Expansion in Emerging Photography Markets: Emerging photography markets in Eastern Europe present significant growth opportunities. Countries like Poland and Romania have seen a rise in photography enthusiasts and professionals. The Polish Photographers Association reported a 20% increase in membership in 2023, indicating growing interest in photography. Additionally, the European Union's Cohesion Policy has invested in digital skills training in these regions, fostering a new generation of photographers.

Potential in Surveillance and Security Applications: The integration of digital cameras into surveillance and security systems offers a promising avenue for market growth. The European Commission's 2023 report on internal security highlighted a 15% increase in public and private sector investment in surveillance technologies. Digital cameras with advanced features like high-resolution imaging and low-light performance are essential components of modern security systems. The European Security and Defence Union noted that the demand for surveillance equipment in urban areas has risen due to increased security concerns.

Scope of the Report

|

By ProductType |

DSLR Cameras |

|

By Resolution |

Less than 12 MP |

|

By PriceRange |

Entry-Level |

|

By Application |

Consumer Photography |

|

By Region |

West |

Products

Key Target Audience

Camera Manufacturers

Distribution and Retail Companies

Photography Equipment Suppliers

Professional Photography Studios

E-commerce Platforms

Content Creation Agencies

Investment and Venture Capitalist Firms

Government and Regulatory Bodies (European Commission, National Broadcasting Authorities)

Companies

Players Mentioned in the Report

Sony Corporation

Canon Inc.

Nikon Corporation

Fujifilm Holdings Corp.

Leica Camera AG

Panasonic Corporation

Ricoh Imaging Company

Olympus Corporation

Samsung Electronics

GoPro, Inc.

Sigma Corporation

Zeiss

Polaroid Corporation

Casio Computer Co., Ltd.

Kodak Alaris

Table of Contents

1. Europe Digital Camera Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Europe Digital Camera Market Size (In USD Billion)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Europe Digital Camera Market Analysis

3.1 Growth Drivers

3.1.1 Rise in Content Creation (Vlogging, Social Media)

3.1.2 Technological Advancements in Camera Sensors

3.1.3 Increasing Adoption of Mirrorless Cameras

3.1.4 Demand for High-Resolution Image Quality

3.2 Market Challenges

3.2.1 Impact of Smartphone Cameras

3.2.2 High Initial Cost of Advanced Cameras

3.2.3 Slow Replacement Cycles

3.3 Opportunities

3.3.1 Expansion in Emerging Photography Markets

3.3.2 Potential in Surveillance and Security Applications

3.3.3 Integration with Artificial Intelligence (AI) and IoT

3.4 Trends

3.4.1 Compact Cameras with Improved Portability

3.4.2 Rise of 360-Degree and Action Cameras

3.4.3 Increased Investment in Professional DSLR and Mirrorless Models

3.4.4 Growth in Sustainable and Eco-Friendly Camera Components

3.5 Regulatory Landscape

3.5.1 Environmental Standards for Camera Manufacturing

3.5.2 Data Protection for Smart Cameras

3.5.3 Import and Export Regulations within Europe

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. Europe Digital Camera Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 DSLR Cameras

4.1.2 Mirrorless Cameras

4.1.3 Compact Digital Cameras

4.1.4 Action Cameras

4.2 By Resolution (In Value %)

4.2.1 Less than 12 MP

4.2.2 12 MP to 24 MP

4.2.3 24 MP to 36 MP

4.2.4 Above 36 MP

4.3 By Price Range (In Value %)

4.3.1 Entry-Level

4.3.2 Mid-Range

4.3.3 High-End

4.4 By Application (In Value %)

4.4.1 Consumer Photography

4.4.2 Professional Photography

4.4.4 Media & Entertainment

4.4.5 Industrial Applications

4.5 By Region (In Value %)

4.5.1 West

4.5.2 East

4.5.3 North

4.5.4 South

5. Europe Digital Camera Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Canon Inc.

5.1.2 Nikon Corporation

5.1.3 Sony Corporation

5.1.4 Panasonic Corporation

5.1.5 Olympus Corporation

5.1.6 Fujifilm Holdings Corporation

5.1.7 GoPro, Inc.

5.1.8 Ricoh Imaging Company

5.1.9 Samsung Electronics

5.1.10 Leica Camera AG

5.1.11 Hasselblad

5.1.12 Sigma Corporation

5.1.13 Zeiss

5.1.14 Polaroid Corporation

5.1.15 Casio Computer Co., Ltd.

5.2 Cross Comparison Parameters (Resolution, Sensor Type, Frame Rate, Image Stabilization, Optical Zoom, Connectivity, Weight, Market Share)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Europe Digital Camera Market Regulatory Framework

6.1 Environmental Compliance Requirements

6.2 EU Standards for Safety and Quality

6.3 Data Privacy and Security Regulations for Smart Cameras

6.4 Import and Export Compliance

6.5 Certifications and Quality Standards

7. Europe Digital Camera Market Future Size (In USD Billion)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Europe Digital Camera Market Future Segmentation

8.1 By Product Type (In Value %)

8.2 By Resolution (In Value %)

8.3 By Price Range (In Value %)

8.4 By Application (In Value %)

8.5 By Region (In Value %)

9. Europe Digital Camera Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This initial stage focuses on constructing a detailed map of the Europe digital camera ecosystem, encompassing camera manufacturers, distributors, and key user segments. Through comprehensive desk research and data aggregation, core market variables such as consumer demand, technological advancements, and regional adoption rates are identified.

Step 2: Market Analysis and Construction

Using historical data, we assess the markets size, growth trajectory, and product preference patterns. The analysis includes an evaluation of the camera type distribution, product demand per country, and market penetration rates to provide a holistic understanding of market performance.

Step 3: Hypothesis Validation and Expert Consultation

Through interviews with industry experts, we validate market hypotheses related to demand drivers, product preferences, and consumer behavior. These insights offer nuanced perspectives on market trends and provide real-world validation for our analysis.

Step 4: Research Synthesis and Final Output

The final stage synthesizes all data points into a comprehensive report. By engaging with leading camera brands and distributors, we ensure accurate representation of the market landscape and validate revenue estimates through triangulation.

Frequently Asked Questions

01. How big is the Europe Digital Camera Market?

The Europe digital camera market is valued at USD 2.3 billion, driven by consumer demand for high-quality imaging solutions and advancements in camera technology.

02. What are the challenges in the Europe Digital Camera Market?

Challenges in the Europe digital camera market include strong competition from smartphone cameras, high initial costs for advanced cameras, and slow replacement cycles due to product longevity.

03. Who are the major players in the Europe Digital Camera Market?

Key players in the Europe digital camera market include Sony Corporation, Canon Inc., Nikon Corporation, Fujifilm Holdings, and Leica Camera AG, renowned for their strong brand loyalty and advanced technology.

04. What are the growth drivers of the Europe Digital Camera Market?

The Europe digital camera market is propelled by the rise of content creation, advancements in sensor technology, and consumer demand for professional-grade camera quality.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.