Europe Distributed Control System Market Outlook to 2030

Region:Europe

Author(s):Shreya Garg

Product Code:KROD9988

November 2024

92

About the Report

Europe Distributed Control System Market Overview

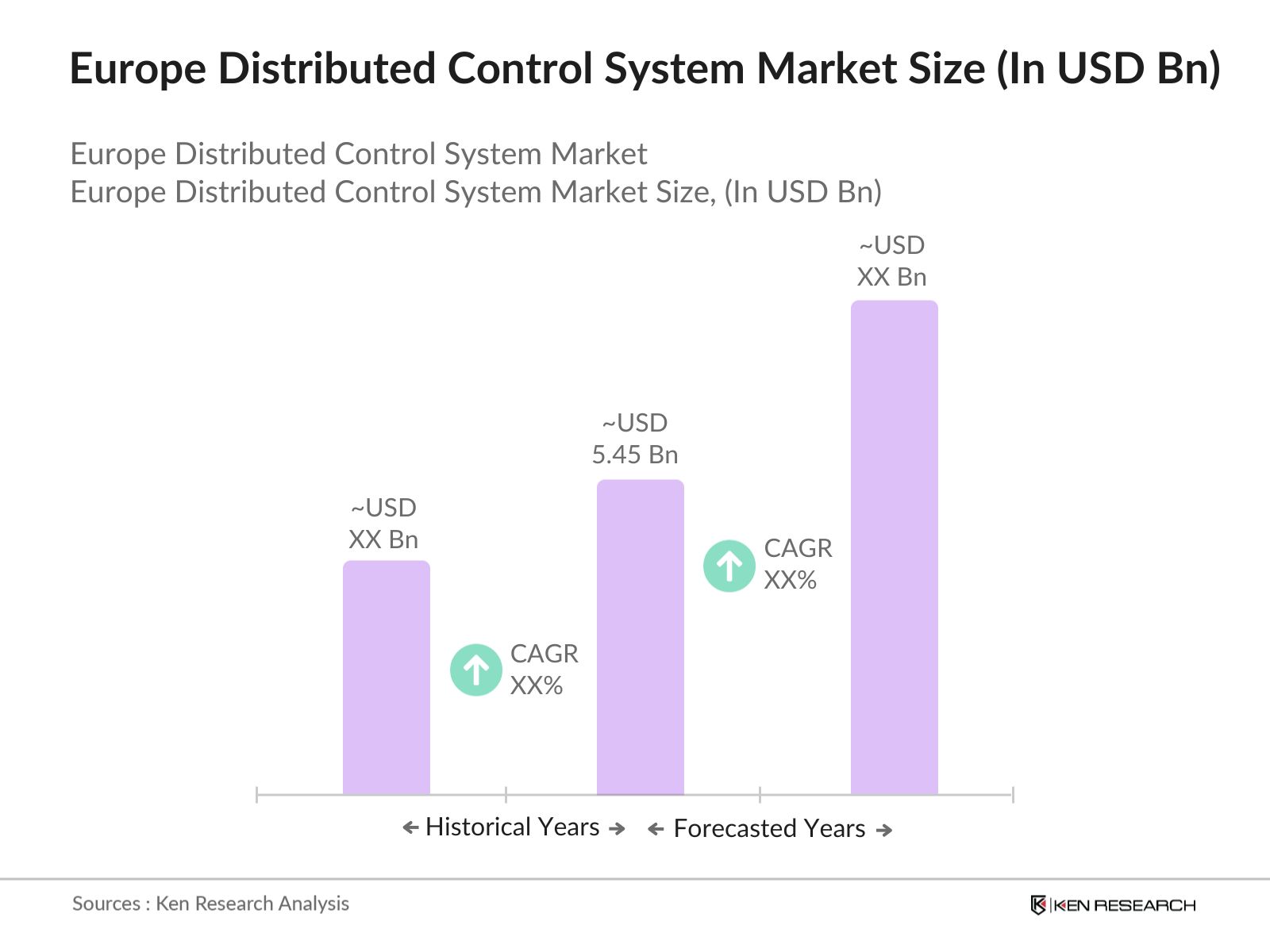

- The Europe Distributed Control System (DCS) market is valued at USD 5.45 billion, driven by increased adoption of automation technologies across process industries like oil & gas, chemicals, and power generation. The growing focus on energy efficiency and sustainability has fueled demand for DCS solutions, which offer superior control over distributed systems, leading to optimal energy usage and cost savings. Furthermore, government initiatives pushing for industry digitalization and regulatory frameworks focused on emissions reduction are key growth drivers for the DCS market in Europe.

- Countries such as Germany, the United Kingdom, and France dominate the Europe Distributed Control System market. Germany leads due to its robust industrial base and commitment to adopting Industry 4.0 technologies. The UKs dominance stems from its well-established oil & gas industry, while France has been a strong player due to its advanced power generation sector, especially in nuclear energy. The presence of world-leading automation providers also strengthens their market positioning in these regions.

- Cybersecurity standards in Europe are becoming more stringent, especially for critical infrastructure industries. The EUs NIS2 Directive, enforced in 2023, mandates that industries like energy, transportation, and chemicals adopt enhanced cybersecurity measures, including secure DCS implementations. The European Union Agency for Cybersecurity (ENISA) has allocated 450 million to ensure that critical industries comply with these standards, further driving demand for secure DCS

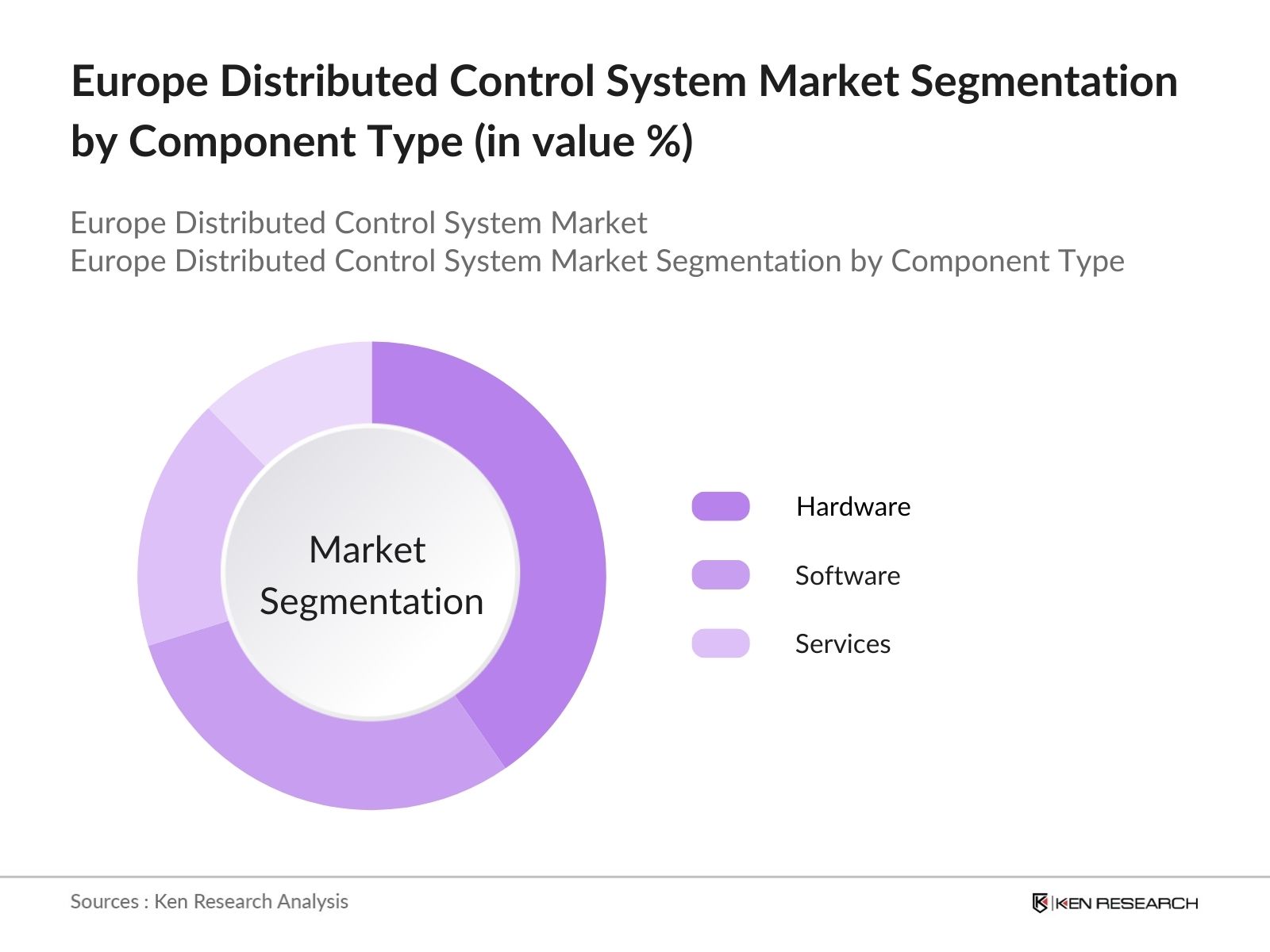

Europe Distributed Control System Market Segmentation

By Component Type: The market is segmented by component type into hardware, software, and services. Recently, the hardware segment has maintained a dominant market share due to the essential nature of control devices, sensors, and input/output modules required for managing complex industrial processes. These components ensure reliable, real-time control, driving significant investments from large-scale industries like power generation and chemicals.

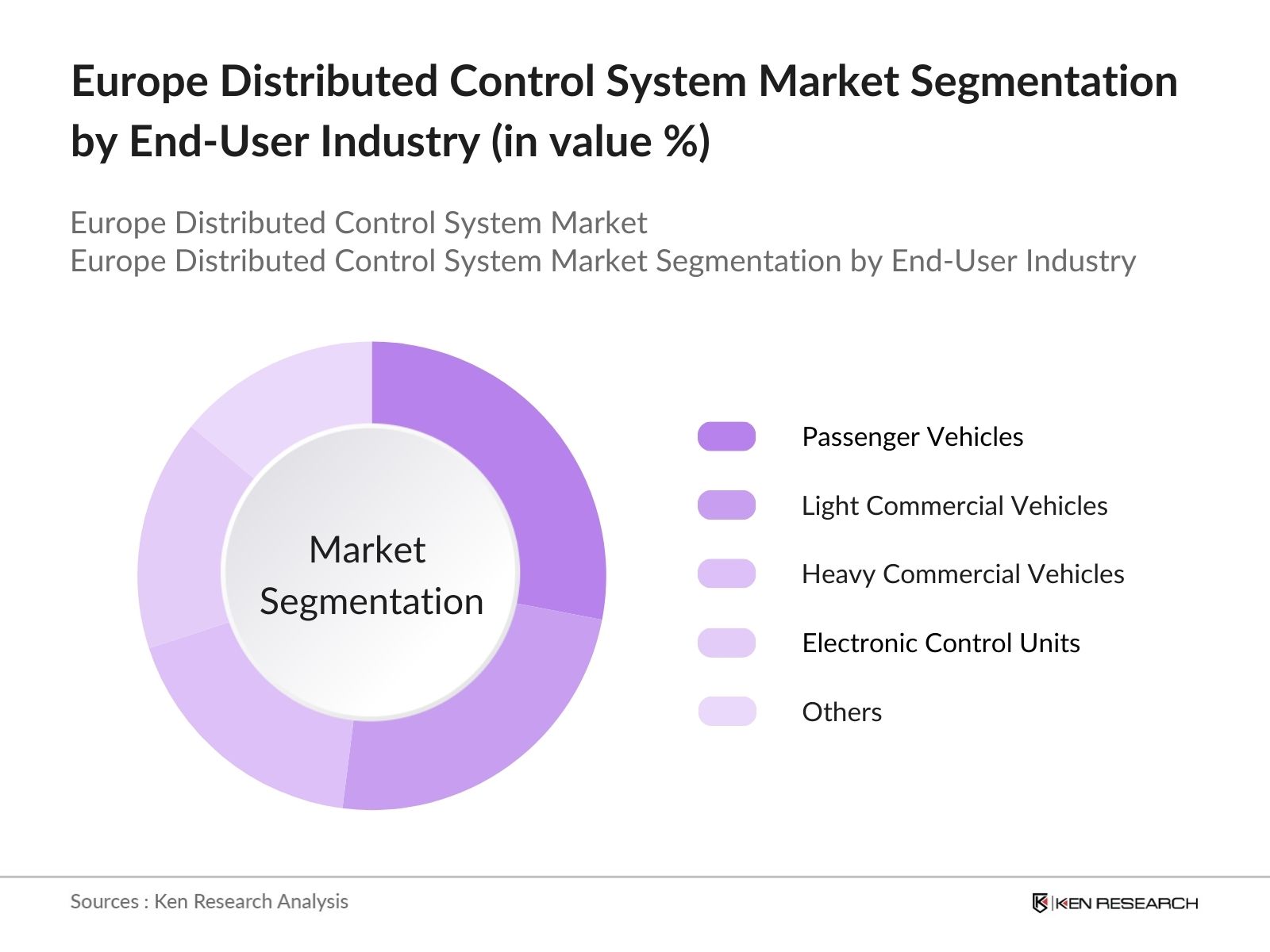

By End-User Industry: The market is further segmented by end-user industry into oil & gas, chemicals, power generation, pharmaceuticals, and food & beverage. Among these, the power generation sector leads the market due to the need for advanced control systems to manage distributed energy resources and enhance grid stability. The transition towards decentralized energy systems and renewables also demands more sophisticated DCS solutions, positioning power generation as the largest sub-segment.

Europe Distributed Control System Market Competitive Landscape

The Europe Distributed Control System market is dominated by several key players that leverage extensive R&D capabilities and technological advancements to maintain their leadership. These companies focus on providing integrated solutions for industrial automation, thereby improving operational efficiency for end-users.

improving user interfaces.

|

Company |

Establishment Year |

Headquarters |

R&D Investment |

Number of Employees |

Product Portfolio |

Geographic Presence |

Technological Innovations |

|

Siemens AG |

1847 |

Munich, Germany |

|||||

|

ABB Ltd. |

1988 |

Zurich, Switzerland |

|||||

|

Schneider Electric SE |

1836 |

Rueil-Malmaison, France |

|||||

|

Emerson Electric Co. |

1890 |

St. Louis, USA |

|||||

|

Honeywell International Inc. |

1906 |

Charlotte, USA |

Europe Distributed Control System Industry Analysis

Growth Drivers

- Industrial Automation Adoption: The adoption of industrial automation in Europe is accelerating, driven by an increasing demand for operational efficiency and productivity in industries such as manufacturing, oil & gas, and chemicals. As of 2024, approximately 40% of manufacturing plants in the EU have incorporated industrial automation, according to the European Commission. Automation is expected to reduce operational downtime significantly, with automated factories reporting a 15% increase in uptime in 2023 alone. Additionally, the EU invested 13.5 billion in automation technologies to enhance its manufacturing sector. This trend is critical for driving demand for Distributed Control Systems (DCS) across industries in the region.

- Energy Efficiency Initiatives: Europes Distributed Control System market benefits from energy efficiency initiatives like the EU Green Deal, which aims to reduce greenhouse gas emissions by 55% by 2030. In 2024, the EU allocated 1.8 billion for the adoption of energy-efficient technologies in industrial operations. The introduction of digital twin technology in energy management systems is also driving demand for DCS, enabling real-time monitoring and optimization of energy consumption in industrial plants. As a result, industries utilizing DCS are achieving energy savings of up to 10%, reducing their carbon footprint.

- Expansion of Process Industries: The expansion of Europes process industries, particularly in oil & gas and chemicals, has been a significant driver for the Distributed Control System market. In 2024, Europes chemical production reached 180 million tons, a 6% rise from 2022, while oil & gas investments in the North Sea were projected at $20 billion. These sectors rely heavily on advanced control systems for process optimization and operational efficiency. The increased output from these industries has boosted demand for DCS solutions to manage complex processes and improve production reliability.

Market Challenges

- High Initial Investment: The initial capital expenditure for implementing Distributed Control Systems is a significant challenge, particularly for small and medium-sized enterprises (SMEs). According to the European Investment Bank (EIB), the average cost for DCS implementation in a mid-sized industrial facility in Europe is 1.2 million as of 2024. This high upfront cost has slowed the adoption of DCS, especially among cost-sensitive industries like food & beverage and textiles, limiting market growth.

- Complex Integration Requirements: Integrating Distributed Control Systems with legacy equipment and other operational technology (OT) systems poses technical challenges. A 2023 study by the European Association of Automation indicated that 45% of European manufacturers experience difficulties in integrating DCS with existing infrastructure, leading to delays and increased costs. This complexity can extend project timelines by up to 18 months, as reported by the industry, slowing down market penetration in some sectors.

Europe Distributed Control System Market Future Outlook

Over the next few years, the Europe Distributed Control System market is expected to experience steady growth, driven by the increasing adoption of Industry 4.0 technologies and government incentives for industrial automation. The ongoing shift towards renewable energy and decentralized energy systems will further necessitate advanced DCS solutions to manage grid stability and optimize energy consumption. Additionally, emerging trends such as the integration of AI and machine learning in control systems will continue to enhance operational efficiency in industrial sectors, particularly in power generation and oil & gas.

Future Market Opportunities

- Digitalization of Industrial Processes: The digitalization of industrial processes across Europe is creating significant opportunities for Distributed Control Systems. As of 2024, 56% of European manufacturing companies have digitalized at least one core process, with a heavy reliance on DCS for process automation and control. Governments in Western Europe are promoting digital transformation by offering tax incentives, with countries like France allocating 2 billion in digital infrastructure development in the industrial sector. This presents a strong market opportunity for DCS providers to offer integrated, digitalized solutions.

- Integration of IoT in Distributed Control Systems: The integration of the Internet of Things (IoT) with Distributed Control Systems is transforming industrial automation in Europe. By 2024, over 1.4 billion IoT devices are connected across European industries, driving the need for DCS that can manage real-time data from these devices. Industries such as automotive and pharmaceuticals are utilizing IoT-enabled DCS to monitor and optimize production lines remotely. IoT integration has led to a 20% increase in operational efficiency in these industries, making it a key growth area for DCS providers.

Scope of the Report

|

By Component Type |

Hardware Software Services |

|

By End-User Industry |

Oil & Gas Chemicals Power Generation Pharmaceuticals Food & Beverage |

|

By Technology |

Centralized Control Systems Hybrid Control Systems Distributed Control Systems |

|

By Deployment Mode |

On-Premise Cloud-Based |

|

By Geography |

Western Europe Eastern Europe Northern Europe Southern Europe |

Products

Key Target Audience

Distributed Control System Manufacturers

Automation Software Providers

Industrial Process Automation Companies

Power Generation Companies

Oil & Gas Companies

Chemicals and Petrochemicals Companies

Government and Regulatory Bodies (European Commission, National Environmental Agencies)

Investor and Venture Capitalist Firms

Companies

Major Players

Siemens AG

ABB Ltd.

Schneider Electric SE

Emerson Electric Co.

Honeywell International Inc.

Yokogawa Electric Corporation

Rockwell Automation

Mitsubishi Electric Corporation

General Electric

Hitachi Ltd.

Azbil Corporation

Toshiba Corporation

Omron Corporation

Metso Automation

Invensys (Schneider Electric)

Table of Contents

Europe Distributed Control System Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Market-specific: Industrial automation growth, digital transformation initiatives)

1.4. Market Segmentation Overview

Europe Distributed Control System Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis (Market-specific: Impact of Industry 4.0 adoption, energy transition focus)

2.3. Key Market Developments and Milestones

Europe Distributed Control System Market Analysis

3.1. Growth Drivers

3.1.1. Industrial Automation Adoption

3.1.2. Energy Efficiency Initiatives (EU Green Deal, Digital Twin Technology)

3.1.3. Expansion of Process Industries (Oil & Gas, Chemicals)

3.1.4. Increasing Demand for Smart Factories (Smart Manufacturing Trends)

3.2. Market Challenges

3.2.1. High Initial Investment

3.2.2. Complex Integration Requirements

3.2.3. Cybersecurity Concerns in Automation

3.2.4. Skills Gap in Workforce

3.3. Opportunities

3.3.1. Digitalization of Industrial Processes

3.3.2. Integration of IoT in Distributed Control Systems

3.3.3. Transition to Decentralized Energy Systems

3.3.4. Expansion of Emerging Markets in Eastern Europe

3.4. Trends

3.4.1. Adoption of Cloud-based Control Systems

3.4.2. Growth in Renewable Energy Applications

3.4.3. Increasing Usage of AI and Machine Learning in DCS

3.4.4. Collaboration between IT and OT in Process Automation

3.5. Government Regulations

3.5.1. EU Regulations on Energy Efficiency

3.5.2. Cybersecurity Standards for Critical Infrastructure

3.5.3. Environmental Compliance (Reduction of Emissions in Industrial Plants)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Market-specific: Role of OEMs, System Integrators, End Users)

3.8. Porters Five Forces

3.9. Competitive Landscape

Europe Distributed Control System Market Segmentation

4.1. By Component Type (In Value %)

4.1.1. Hardware

4.1.2. Software

4.1.3. Services

4.2. By End-User Industry (In Value %)

4.2.1. Oil & Gas

4.2.2. Chemicals

4.2.3. Power Generation

4.2.4. Pharmaceuticals

4.2.5. Food & Beverage

4.3. By Technology (In Value %)

4.3.1. Centralized Control Systems

4.3.2. Hybrid Control Systems

4.3.3. Distributed Control Systems (Traditional)

4.4. By Deployment Mode (In Value %)

4.4.1. On-Premise

4.4.2. Cloud-Based

4.5. By Geography (In Value %)

4.5.1. Western Europe

4.5.2. Eastern Europe

4.5.3. Northern Europe

4.5.4. Southern Europe

Europe Distributed Control System Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Siemens AG

5.1.2. ABB Ltd.

5.1.3. Schneider Electric SE

5.1.4. Emerson Electric Co.

5.1.5. Honeywell International Inc.

5.1.6. Yokogawa Electric Corporation

5.1.7. Rockwell Automation

5.1.8. Mitsubishi Electric Corporation

5.1.9. General Electric

5.1.10. Hitachi Ltd.

5.1.11. Azbil Corporation

5.1.12. Toshiba Corporation

5.1.13. Omron Corporation

5.1.14. Metso Automation

5.1.15. Invensys (Schneider Electric)

5.2. Cross Comparison Parameters (No. of Employees, Market Share, Revenue, R&D Expenditure, Geographical Presence, Technological Capabilities, Product Portfolio, Recent Contracts)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Private Equity Investments

Europe Distributed Control System Market Regulatory Framework

6.1. Industrial Standards (IEC 62443, ISA/IEC-95)

6.2. Compliance Requirements for Process Industries

6.3. Certification Processes

Europe Distributed Control System Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

Europe Distributed Control System Future Market Segmentation

8.1. By Component Type (In Value %)

8.2. By End-User Industry (In Value %)

8.3. By Technology (In Value %)

8.4. By Deployment Mode (In Value %)

8.5. By Geography (In Value %)

Europe Distributed Control System Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

This step involves mapping out key stakeholders within the Europe Distributed Control System Market. Extensive desk research is conducted using proprietary databases to define critical variables such as market drivers, competitive landscape, and technological trends influencing market dynamics.

Step 2: Market Analysis and Construction

Historical data is compiled and analyzed to assess market trends, revenue streams, and technological advancements within the Europe DCS market. This includes evaluating the adoption of Industry 4.0 and its impact on automation processes.

Step 3: Hypothesis Validation and Expert Consultation

Key market hypotheses are validated through consultations with industry experts, using computer-assisted telephone interviews (CATIs). These interviews provide insights into market growth, technological advancements, and operational challenges in the DCS market.

Step 4: Research Synthesis and Final Output

The final phase involves direct interactions with DCS manufacturers and end-users to validate findings and refine market forecasts. This bottom-up approach ensures a comprehensive analysis of market trends, challenges, and opportunities within the Europe Distributed Control System Market.

Frequently Asked Questions

01 How big is the Europe Distributed Control System Market?

The Europe Distributed Control System Market is valued at USD 5.45 billion, primarily driven by increased industrial automation, energy efficiency regulations, and the shift towards decentralized energy systems.

02 What are the key growth drivers in the Europe Distributed Control System Market?

Key drivers in the Europe Distributed Control System Market include the growing demand for automation across process industries, advancements in energy management technologies, and the integration of IoT and AI within distributed control systems.

03 Who are the major players in the Europe Distributed Control System Market?

The major players in the Europe Distributed Control System Market include Siemens AG, ABB Ltd., Schneider Electric SE, Emerson Electric Co., and Honeywell International Inc., all of which have a strong presence in industrial automation and control systems.

04 What are the main challenges in the Europe Distributed Control System Market?

Challenges in the Europe Distributed Control System Market include high initial investments in distributed control systems, the complexity of system integration across legacy infrastructures, and increasing cybersecurity concerns due to digital transformation.

05 Which industries dominate the Europe Distributed Control System Market?

The power generation and oil & gas sectors are the leading industries in the Europe Distributed Control System Market, driven by the need for real-time control systems to manage complex operations and ensure energy efficiency.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.