Europe Drones Market Outlook to 2030

Region:Europe

Author(s):Shreya Garg

Product Code:KROD7912

December 2024

86

About the Report

Europe Drones Market Overview

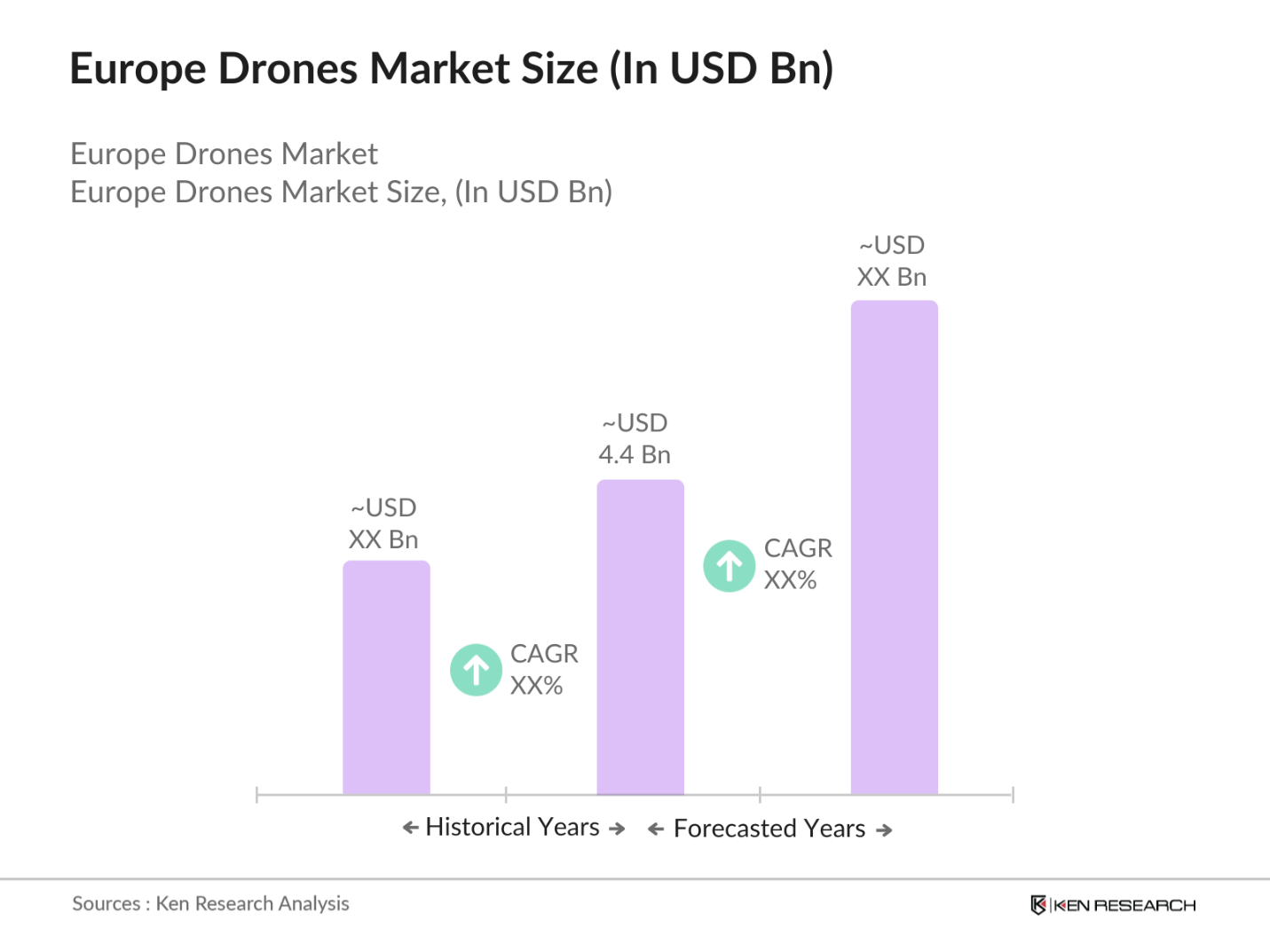

- The Europe drones market, based on a five-year historical analysis, is valued at USD 4.4 billion. Growth is driven by innovations in UAV technology, including longer endurance, payload capacity, and improved imaging systems such as LiDAR and thermal cameras, essential for industries like agriculture, construction, and law enforcement. Moreover, regulatory support from the European Union Aviation Safety Agency (EASA) for Beyond Visual Line of Sight (BVLOS) operations has eased the deployment of drones in various sectors, further strengthening market growth.

- Key players in the Europe drones market include the United Kingdom, Germany, and France, where high adoption is driven by applications in emergency services, agricultural monitoring, and infrastructure maintenance. The United Kingdom, with support from the Civil Aviation Authority (CAA), has pioneered BVLOS operations, benefitting local firms in drone-based construction and law enforcement. Germany has seen substantial uptake due to regulatory clarity and robust support for industrial applications, including pipeline monitoring and environmental assessments.

- Regulatory framework for drones, established in 2022, mandates compliance with operational and safety standards, including detailed operator certifications for BVLOS and autonomous flights. These certifications are essential for drones used in industrial applications across Europe, ensuring safety while encouraging technological innovation in commercial drone use

Europe Drones Market Segmentation

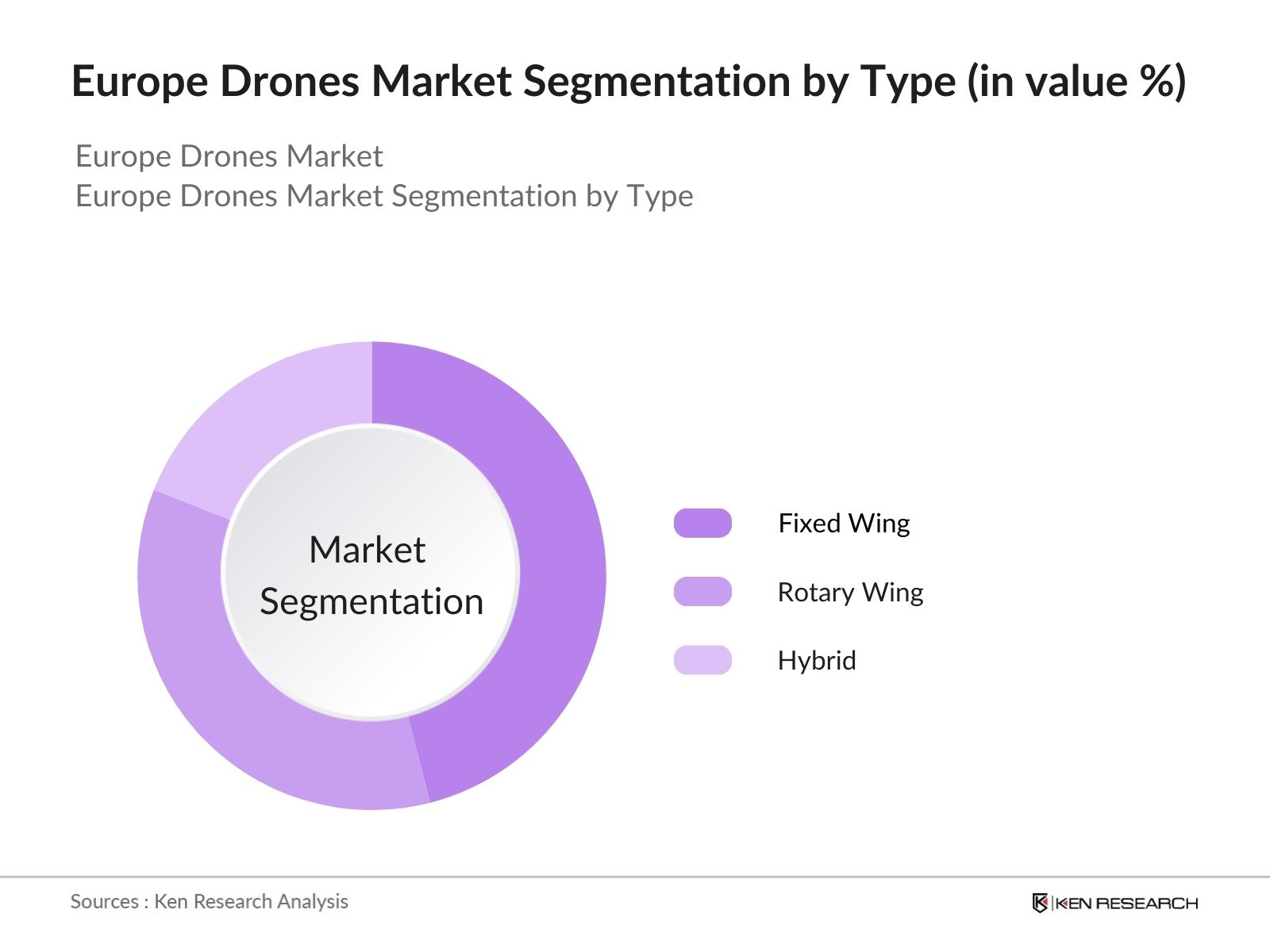

By Type: The market is segmented by type into Fixed Wing Drones, Rotary Wing Drones, and Hybrid Drones. Recently, Fixed Wing Drones have a dominant market share, primarily due to their efficiency in long-range applications like defense surveillance and environmental monitoring. Their aerodynamic structure supports stable flight at higher altitudes, allowing for effective use in large-scale surveys and industrial inspections, critical for sectors such as military and agriculture.

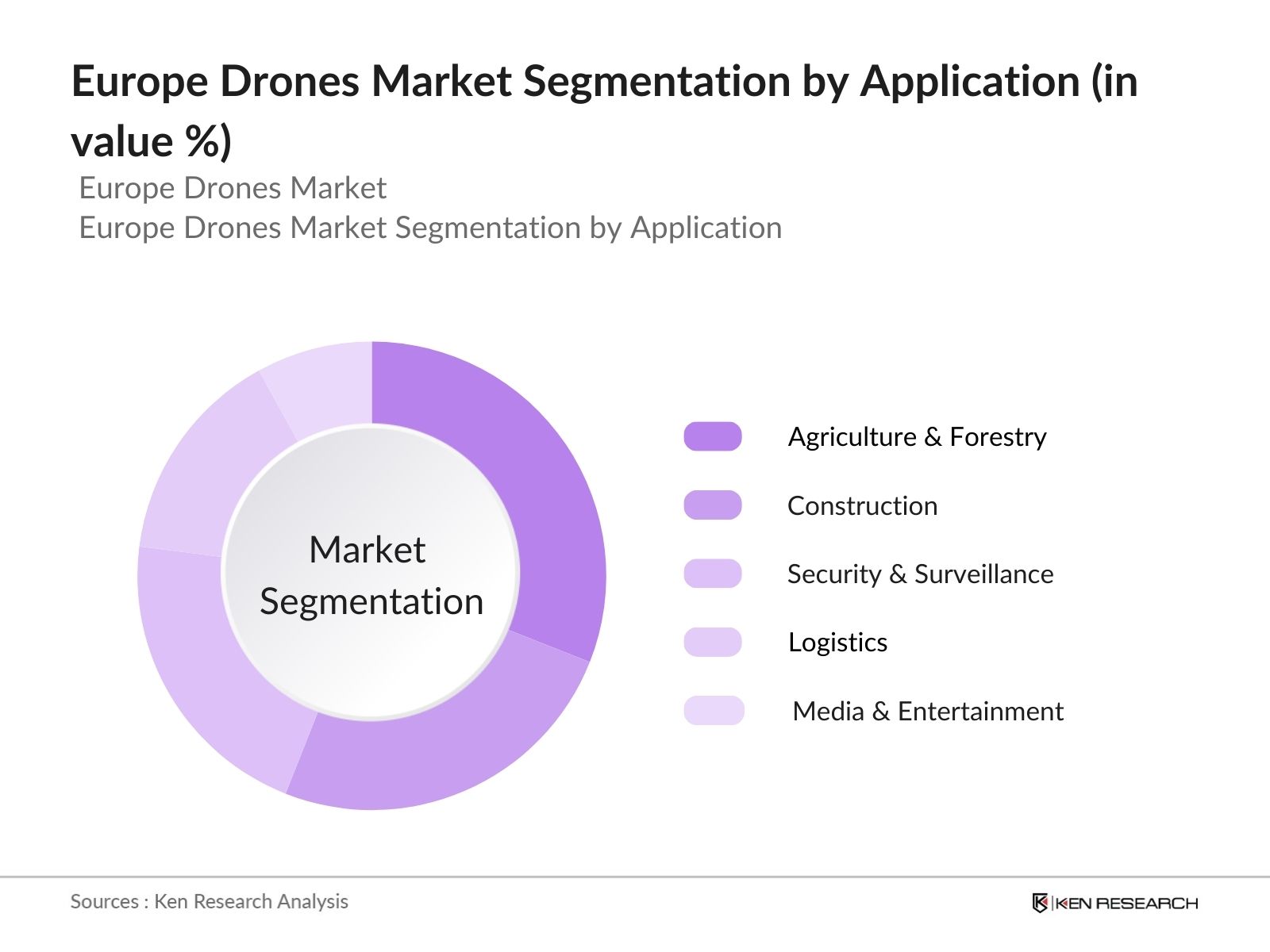

By Application: The market is segmented by application into Agriculture & Forestry, Construction & Infrastructure, Security & Surveillance, Logistics & Parcel Delivery, and Media & Entertainment. Agriculture & Forestry currently holds a significant share due to drones' capacity for precision agriculture, real-time weather monitoring, and data collection for crop health analysis. With the European Unions increased focus on sustainable farming practices, drones are extensively used for irrigation planning, pesticide management, and yield estimation.

Europe Drones Market Competitive Landscape

The Europe drones market is characterized by a mix of established players and innovative startups. Major players dominate by leveraging advanced technologies like AI integration and forging strategic partnerships with governmental agencies and private sectors.

|

Company |

Established |

Headquarters |

Product Range |

Technology Focus |

Partnerships |

Key Sector |

R&D Investment |

|

Parrot Drones |

1994 |

France |

|||||

|

Terra Drone Corporation |

2016 |

Japan/Europe |

|||||

|

Azure Drones |

2011 |

France |

|||||

|

DJI Innovations |

2006 |

China/Germany |

|||||

|

DelAir |

2011 |

France |

Europe Drones Industry Analysis

Growth Drivers

- Advancements in Drone Technology: Drone technology in Europe has advanced significantly, especially in payload capacities and Beyond Visual Line of Sight (BVLOS) capabilities, which have extended the operational reach of drones. In 2024, drones like the DJI Matrice 30 can operate up to 15 kilometers from operators, making them suitable for large-scale industrial tasks, such as infrastructure inspection and environmental monitoring. The Skydio X2, with autonomous flight capabilities and advanced obstacle avoidance, further exemplifies the push toward long-range and complex applications, enhancing efficiency and safety for European industries.

- Regulatory Easing by EASA: The European Union Aviation Safety Agency (EASA) has progressively relaxed regulations for drone use, with a focus on BVLOS operations. In 2022, EASA introduced specific guidelines and predefined risk assessments for BVLOS flights to allow safer, more controlled operations in densely populated areas. These regulations are anticipated to boost industries like agriculture, construction, and energy by reducing logistical constraints and operational costs associated with traditional methods.

- Increasing Application in Critical Sectors: Drones are increasingly integrated into critical European sectors due to their efficiency in handling complex tasks. For instance, in agriculture, drones equipped with advanced sensors now monitor crop health over large areas, while construction companies utilize drones to map and inspect sites efficiently, often reducing survey times by up to 50%. The surveillance sector has also benefited as drones provide real-time security monitoring across urban spaces, leveraging high-resolution imaging technologies.

Market Challenges

- High Compliance Costs: EASAs stringent compliance standards, including operator certifications and specific operational guidelines, often result in high compliance costs for European drone operators. Data privacy regulations, which mandate secure data handling, particularly in urban applications, also add to operational costs. These compliance demands affect smaller enterprises, increasing the need for investment in data management and privacy protocols.

- Limited Skilled Workforce (UAV Pilot Training Gaps) The rapid adoption of drones in Europe has highlighted a shortage of trained UAV pilots. The European job market is struggling to keep pace with the demand for pilots certified in BVLOS operations, which require additional skills and licensing. Specialized training programs are still limited, impacting the scalability of drone services in agriculture, construction, and logistics, where consistent pilot availability is crucial for operational continuity.

Europe Drones Market Future Outlook

Over the coming years, the Europe drones market is anticipated to see significant growth as technological advancements continue to emerge in UAV payloads, range, and endurance. Driven by robust demand across agriculture, logistics, and security sectors, and backed by favorable regulations, the market will also benefit from emerging applications in urban mobility and environmental monitoring, paving the way for further market expansion and innovation.

Future Market Opportunities

- Rising Demand for Autonomous Drones (AI Integration) There is a growing demand in Europe for autonomous drones capable of AI-driven operations. Drones equipped with AI can execute complex, repetitive tasks autonomously, such as monitoring traffic or assessing construction sites. By 2024, AI integration in drones is anticipated to support European industries automation efforts, particularly in agriculture and logistics, by reducing labor reliance and enhancing operational precision.

- Collaboration with Startups for Niche Applications (Precision Agriculture, Smart Cities) Collaboration between established firms and drone startups is increasing, particularly for niche applications like precision agriculture and urban air mobility. Startups in Europe are developing specialized drones for data-driven farming, which enhances crop yield and minimizes resource use. Similarly, smart city projects are leveraging drones to monitor urban environments, a growing opportunity given Europes focus on smart, sustainable urbanization.

Scope of the Report

|

Type |

Fixed Wing Rotary Wing Hybrid |

|

Payload |

<25 Kg 25170 Kg >170 Kg |

|

Application |

Agriculture Construction Security Logistics Media |

|

End-use |

Government Commercial Consumer Law Enforcement |

|

Operating Range |

VLOS EVLOS BVLOS |

Products

Key Target Audience

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (European Union Aviation Safety Agency, EASA)

Security and Defense Agencies

Agricultural Cooperatives and Sustainability Programs

Logistics and Parcel Delivery Firms

Infrastructure and Construction Companies

Banks and Financial Institutes

Environmental Monitoring Organizations

Commercial Drone Operators and Resellers

Companies

Major Players

Parrot Drones

Terra Drone Corporation

Azure Drones

DJI Innovations

DelAir

AltiGator Unmanned Solutions

Flyability SA

Onyx Scan Advanced LiDAR Systems

senseFly (AgEagle Aerial Systems Inc.)

PrecisionHawk Europe

Bauer Umwelt

AscTec (Intel)

BAE Systems

Sees.ai

Sentient Blue

Table of Contents

1. Europe Drones Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Europe Drones Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Europe Drones Market Analysis

3.1. Growth Drivers

- 3.1.1. Technological Innovation (Autonomous Control, AI)

- 3.1.2. Increasing Demand in Industrial Applications (Agriculture, Energy)

- 3.1.3. Government Support and Funding

- 3.1.4. Evolving Consumer Adoption in Entertainment and Photography

3.2. Market Challenges - 3.2.1. Regulatory Restrictions on Drone Usage

- 3.2.2. High Cost of Advanced Drones

- 3.2.3. Privacy and Security Concerns

3.3. Opportunities - 3.3.1. Expansion in Infrastructure Monitoring

- 3.3.2. Emerging Markets in Eastern Europe

- 3.3.3. Partnerships with Smart City Initiatives

3.4. Trends - 3.4.1. Drone Swarm Technology

- 3.4.2. Integration of IoT for Enhanced Monitoring

- 3.4.3. Miniaturization and Lightweight Design

3.5. Government Regulations - 3.5.1. EU Drone Regulation Package

- 3.5.2. Data Protection Requirements (GDPR)

- 3.5.3. Compliance with Aviation Safety Standards

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. Europe Drones Market Segmentation

4.1 By Type (In Value %)

- 4.1.1 Fixed Wing

- 4.1.2 Rotary Wing

- 4.1.3 Hybrid

4.2 By Payload (In Value %)

- 4.2.1 <25 Kg

- 4.2.2 25170 Kg

- 4.2.3 >170 Kg

4.3 By Application (In Value %)

- 4.3.1 Agriculture

- 4.3.2 Construction

- 4.3.3 Security

- 4.3.4 Logistics

- 4.3.5 Media

4.4 By End-Use (In Value %)

- 4.4.1 Government

- 4.4.2 Commercial

- 4.4.3 Consumer

- 4.4.4 Law Enforcement

4.5 By Operating Range (In Value %)

- 4.5.1 VLOS (Visual Line of Sight)

- 4.5.2 EVLOS (Extended Visual Line of Sight)

- 4.5.3 BVLOS (Beyond Visual Line of Sight)

5. Europe Drones Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

- 5.1.1. DJI Technology Co., Ltd.

- 5.1.2. Parrot Drones

- 5.1.3. Yuneec International

- 5.1.4. Ehang Holdings Limited

- 5.1.5. Delair

- 5.1.6. AeroVironment, Inc.

- 5.1.7. FLIR Systems

- 5.1.8. Teledyne Technologies

- 5.1.9. Intel Corporation

- 5.1.10. senseFly

- 5.1.11. Schiebel Corporation

- 5.1.12. Microdrones GmbH

- 5.1.13. Kespry

- 5.1.14. Insitu Inc.

- 5.1.15. PrecisionHawk

5.2. Cross-Comparison Parameters (No. of Employees, Revenue, Innovation Capacity, Drone Portfolio Breadth, Regional Presence, Strategic Partnerships, R&D Investments, Manufacturing Capabilities)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Europe Drones Market Regulatory Framework

6.1. Airspace Access and Traffic Control Standards

6.2. Privacy and Data Protection Laws

6.3. Certifications and Compliance Requirements

6.4. Export Control Policies

7. Europe Drones Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Influencing Future Growth

8. Europe Drones Future Market Segmentation

8.1. By Type (In Value %)

8.2. By Application (In Value %)

8.3. By End-User (In Value %)

8.4. By Payload Capacity (In Value %)

8.5. By Region (In Value %)

9. Europe Drones Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Key Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involved defining the ecosystem of stakeholders within the Europe drones market, supported by desk research across secondary sources to map out industry trends, technology adoption, and regulatory influences.

Step 2: Market Analysis and Construction

Historical market data and competitive landscape insights were compiled, covering parameters like market penetration and revenue generation. Service and product quality statistics were assessed to ensure reliable projections.

Step 3: Hypothesis Validation and Expert Consultation

Industry hypotheses were refined through consultations with drone operators, suppliers, and regulatory experts, offering detailed insights into operational and financial metrics crucial for market validation.

Step 4: Research Synthesis and Final Output

Direct interaction with UAV manufacturers provided insights into segmental performance and consumer preferences, complementing data from the bottom-up approach for a comprehensive, validated market report.

Frequently Asked Questions

1. How big is the Europe Drones Market?

The Europe drones market, valued at USD 4.4 billion, has experienced growth driven by UAV technology advancements and regulatory support across commercial and industrial applications.

2. What are the challenges in the Europe Drones Market?

Challenges in the Europe drones market include high regulatory compliance costs, limited skilled UAV operators, and concerns over privacy and security, especially for BVLOS operations.

3. Who are the major players in the Europe Drones Market?

Key players in the Europe drones market include Parrot Drones, Terra Drone, DJI Innovations, DelAir, and Azure Drones, each leveraging cutting-edge technology to serve sectors like agriculture and defense.

4. What are the growth drivers of the Europe Drones Market?

The Europe drones market is propelled by factors such as regulatory support from EASA, increased adoption in agriculture, and demand for precision monitoring in construction and infrastructure sectors.

5. Which applications dominate the Europe Drones Market?

Agriculture and infrastructure applications dominate the Europe drones market due to drones efficiency in data gathering, real-time monitoring, and reduced operational costs in sectors like farming and asset management.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.