Europe Electric Automobile Market Outlook to 2030

Region:Europe

Author(s):Shreya Garg

Product Code:KROD2231

November 2024

84

About the Report

Europe Electric Automobile Market Overview

- The Europe Electric Automobile Market is valued at USD 200 billion, based on a five-year historical analysis. The market is driven by increasing government incentives and policies to reduce carbon emissions, as well as a rise in consumer awareness of environmental sustainability. The growing focus on energy-efficient transportation options, coupled with advancements in battery technology, is accelerating the demand for electric vehicles (EVs) across Europe. This rapid growth is further fueled by declining prices of lithium-ion batteries and the establishment of public charging infrastructure.

- In terms of dominance, Germany, France, and the Netherlands lead the market due to their advanced automotive industries, supportive government policies, and robust charging infrastructure. Germany, in particular, benefits from being home to several leading car manufacturers like Volkswagen, BMW, and Mercedes-Benz, which have heavily invested in EV technology. The Netherlands' widespread adoption of EVs is driven by high fuel taxes and a dense network of public charging stations, making it a favorable market for electric vehicles.

- Public-private partnerships (PPPs) are instrumental in expanding Europes EV charging infrastructure. As of 2024, several major PPPs have been established to boost investment in charging networks, including a 1 billion partnership between the European Commission and major utility providers to develop charging stations across highways and urban areas. These collaborations aim to address the growing demand for accessible and reliable charging solutions, particularly in regions with underdeveloped infrastructure.

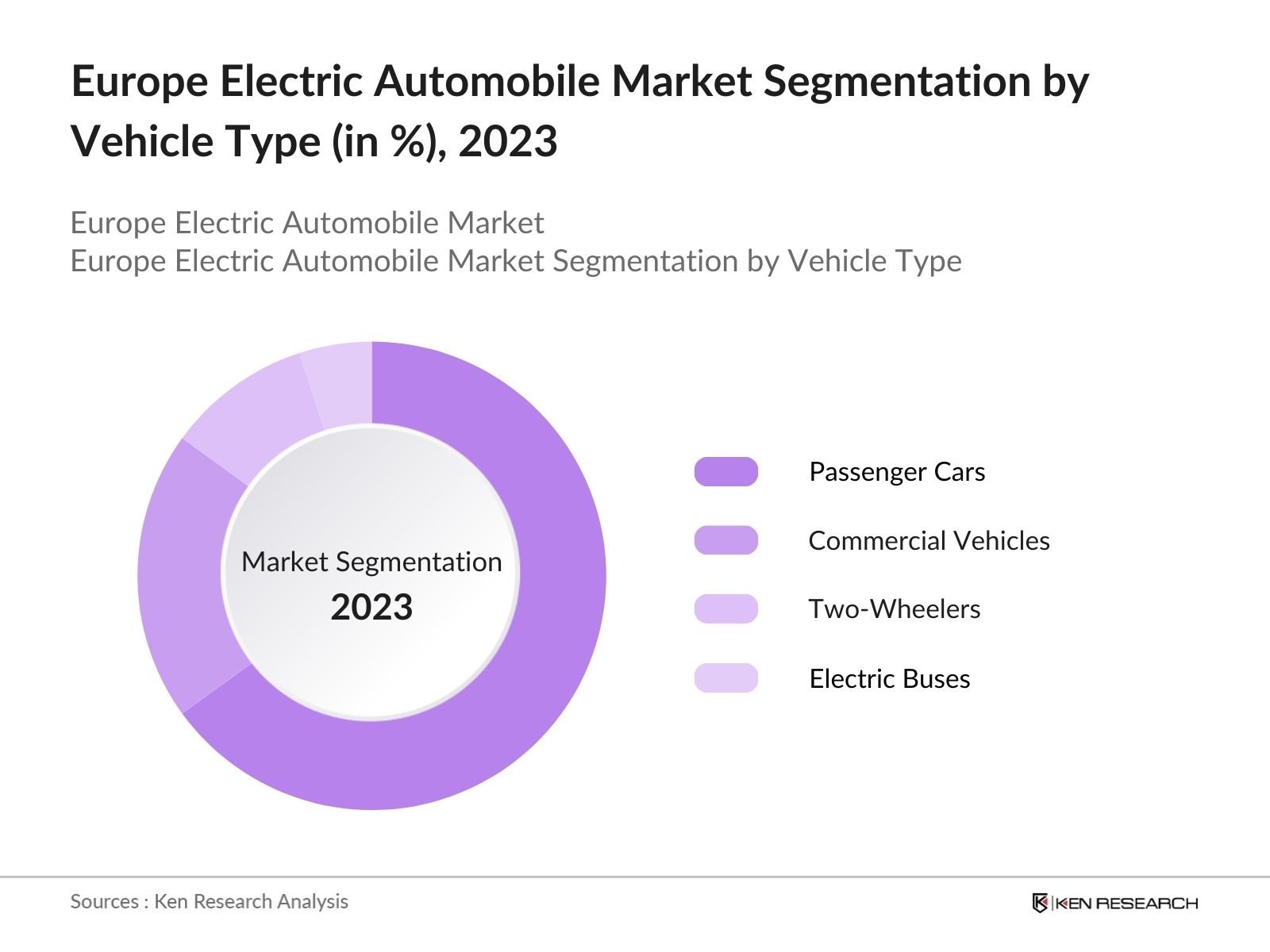

Europe Electric Automobile Market Segmentation

By Vehicle Type: The market is segmented by vehicle type into passenger cars, commercial vehicles, two-wheelers, and electric buses. Recently, passenger cars have a dominant market share under the vehicle type segmentation. This is due to increasing consumer demand for environmentally friendly transportation, with governments offering subsidies and tax benefits on the purchase of electric cars. Additionally, major automobile manufacturers are launching new models in the electric passenger car segment, further driving growth.

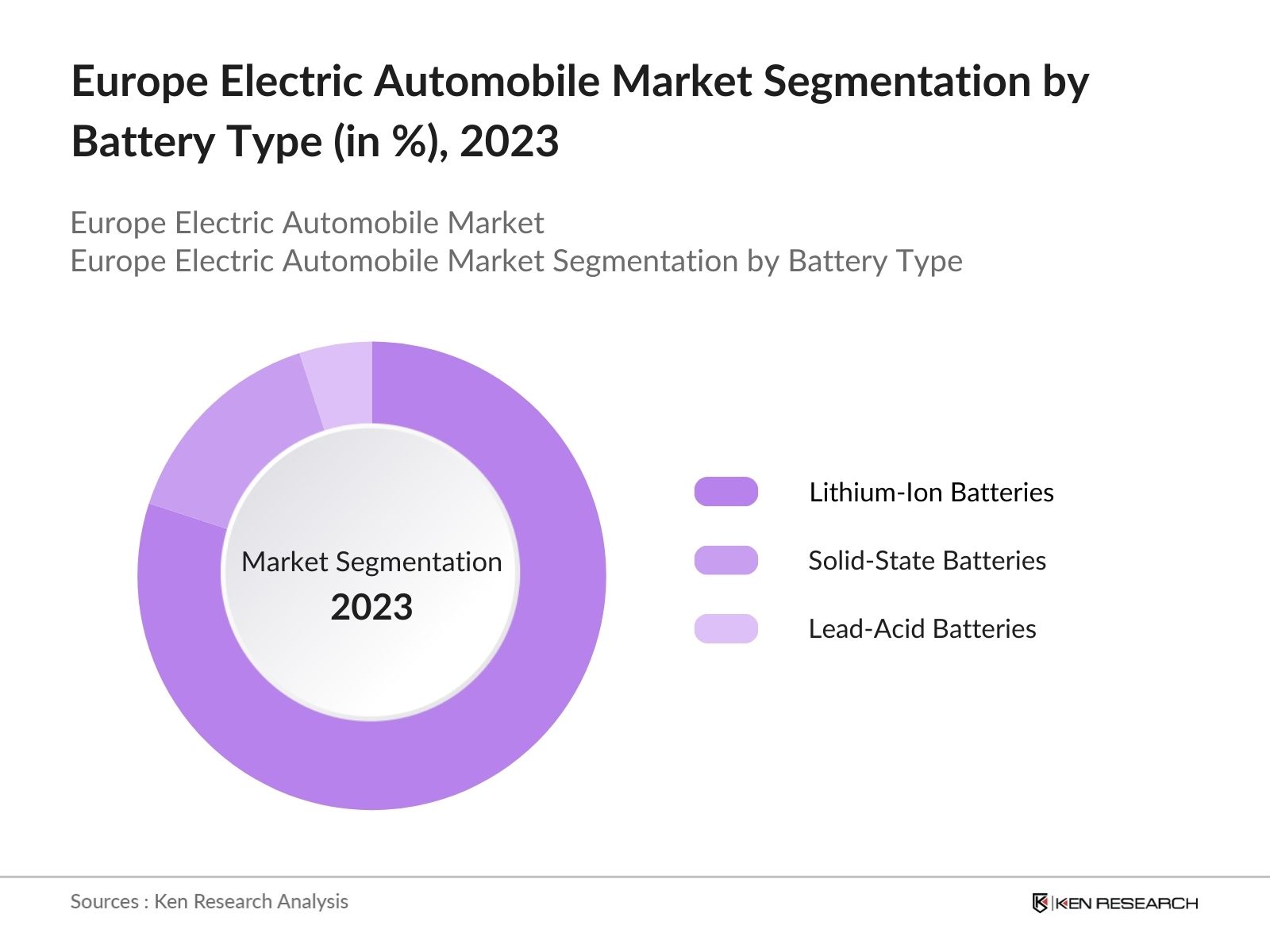

By Battery Type: The market is segmented by battery type into lithium-ion batteries, solid-state batteries, and lead-acid batteries. Lithium-ion batteries dominate this segment due to their higher energy density, longer lifespan, and faster charging times compared to other battery types. These batteries have become the standard for electric vehicles, allowing manufacturers to offer longer driving ranges. Moreover, declining lithium-ion battery prices and continuous technological advancements are making them more accessible, solidifying their leading position in the market.

Europe Electric Automobile Market Competitive Landscape

The Europe Electric Automobile Market is dominated by a few major players, including global automotive brands and local electric vehicle manufacturers. Companies like Tesla, Volkswagen Group, and BMW have established a significant market presence by investing heavily in electric vehicle technology and infrastructure. The competitive landscape is characterized by technological innovation, strategic partnerships, and expansion in charging infrastructure.

|

Company Name |

Establishment Year |

Headquarters |

No. of EV Models |

R&D Investment (USD Mn) |

Charging Network |

Partnerships |

Manufacturing Plants |

Market Revenue (USD Bn) |

Carbon Neutral Targets |

|---|---|---|---|---|---|---|---|---|---|

|

Tesla Inc. |

2003 |

Austin, USA |

|||||||

|

Volkswagen Group |

1937 |

Wolfsburg, Germany |

|||||||

|

BMW AG |

1916 |

Munich, Germany |

|||||||

|

Renault S.A. |

1899 |

Boulogne, France |

|||||||

|

Nissan Motor Co. |

1933 |

Yokohama, Japan |

Europe Electric Automobile Industry Analysis

Growth Drivers

- Expansion of Charging Infrastructure: The expansion of EV charging infrastructure has significantly accelerated across Europe, with over 500,000 public charging points available as of mid-2024, a substantial increase from 330,000 in 2022. The European Commission has committed 1.8 billion to establish additional charging stations by 2025, aiming to cover every 60 km on major European highways. Netherlands is leading with around 117,000 charging points as of early 2024, while France follows closely with approximately 74,000 and Germany with about 64,000 to support growing EV usage.

- Technological Advancements in Battery Efficiency: Europe's automotive sector is witnessing rapid advancements in battery technology, focusing on increasing energy density and reducing charging times. In 2024, solid-state batteries, being developed by companies like Northvolt, promise higher efficiency and faster charging. Current lithium-ion batteries power vehicles for over 600 km on a single charge, a significant leap from the 300 km range in 2020. The European Battery Alliance has invested 6 billion in R&D, accelerating innovation to meet demand and comply with sustainability goals.

- Increasing Consumer Awareness about Environmental Impact: Consumer awareness regarding the environmental benefits of electric vehicles has surged in recent years, contributing to higher adoption rates. In 2023, a survey conducted by the European Environment Agency revealed that 68 million Europeans are now more inclined to purchase EVs, compared to 45 million in 2020. This shift is backed by stringent emission targets and rising environmental consciousness across the region, with policies like the European Green Deal influencing public behavior towards sustainable transportation.

Market Challenges

- High Initial Purchase Costs: The high upfront cost of electric vehicles remains a significant barrier to widespread adoption in Europe. In 2024, the average price of a new EV in Germany stood at 41,000, compared to 28,000 for traditional gasoline vehicles. Despite government incentives, the cost gap between EVs and internal combustion engine (ICE) vehicles is narrowing slowly, leading to challenges for middle-income consumers. Addressing this issue requires further reductions in battery costs, which currently account for 30% of an EVs price.

- Insufficient Charging Stations in Rural Areas: Rural areas in Europe still face a shortage of charging infrastructure, with only 25% of total charging stations located outside urban centers. This disparity impacts EV adoption rates in countries like Poland and Romania, where the lack of charging facilities has been cited as a major reason for consumers' reluctance to transition to electric mobility. In 2024, the EU initiated a 500 million fund to expand rural charging infrastructure, aiming to add 100,000 new stations in underserved regions.

Europe Electric Automobile Market Future Outlook

Over the next five years, the Europe Electric Automobile Market is expected to experience significant growth driven by strong government support, advancements in battery technology, and increasing consumer demand for environmentally friendly transportation. The expansion of EV charging infrastructure and the rise of electric commercial vehicles will be key drivers of this growth. As technology advances, electric vehicles will become more affordable, and innovations such as ultra-fast charging and autonomous driving systems will further accelerate market expansion.

Future Market Opportunities

- Expansion into Eastern European Markets: Eastern European countries present untapped growth potential for electric automobiles, as nations like Poland, Hungary, and Romania are experiencing rising interest in electric vehicles. In 2023, Poland reported an increase of 150,000 EV registrations, a notable jump from 90,000 in 2020. The EU's 1 billion cohesion fund, launched in 2024, aims to further promote green transport initiatives in these regions, offering subsidies to local manufacturers and encouraging public and private investment

- Development of High-Speed Charging Technologies: The development of high-speed charging technologies presents a significant growth opportunity for Europes EV market. In 2024, ultra-fast chargers capable of delivering up to 350 kW power are being rolled out across major highways, reducing charging time to just 10-15 minutes for a full charge. Countries like Norway and Germany are leading this initiative, with over 2,000 high-speed stations operational as of 2024. The European Union is supporting this expansion with a 750 million fund to develop high-speed charging infrastructure across the continents.

Scope of the Report

|

Vehicle Type |

Passenger Cars Commercial Vehicles Two-Wheelers Electric Buses |

|

Battery Type |

Lithium-Ion Batteries Solid-State Batteries Lead-Acid Batteries |

|

Charging Infrastructure |

Public Charging Stations Home Charging Solutions Ultra-Fast Charging Networks |

|

Component |

Battery Packs Electric Motors On-Board Chargers |

|

Region |

West North South East |

Products

Key Target Audience

Electric Vehicle Manufacturers

Automotive Component Suppliers

EV Charging Infrastructure Developers

Battery Manufacturers

Automotive Dealers and Distributors

Venture Capital Firms and Investors

Government and regulatory bodies (European Commission, National Road Traffic Authorities)

Regulatory Bodies (European Environment Agency, National Automotive Regulators)

Companies

Major Players

Tesla Inc.

Volkswagen Group

BMW AG

Renault S.A.

Nissan Motor Co., Ltd.

Hyundai Motor Company

Mercedes-Benz AG

Audi AG

Kia Motors Corporation

Rivian Automotive

Polestar

BYD Company Limited

Stellantis N.V.

General Motors

Lucid Motors

Table of Contents

Europe Electric Automobile Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

Europe Electric Automobile Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

Europe Electric Automobile Market Analysis

3.1 Growth Drivers

3.1.1 Government Incentives for EV Adoption

3.1.2 Expansion of Charging Infrastructure

3.1.3 Technological Advancements in Battery Efficiency

3.1.4 Increasing Consumer Awareness about Environmental Impact

3.2 Market Challenges

3.2.1 High Initial Purchase Costs

3.2.2 Limited Range of Electric Vehicles (Range Anxiety)

3.2.3 Insufficient Charging Stations in Rural Areas

3.3 Opportunities

3.3.1 Expansion into Eastern European Markets

3.3.2 Development of High-Speed Charging Technologies

3.3.3 Growth in Electric Commercial Vehicles Segment

3.4 Trends

3.4.1 Integration of AI in Autonomous Driving Systems

3.4.2 Shift Toward Electric SUVs and Crossovers

3.4.3 Use of Renewable Energy in EV Charging Stations

3.5 Government Regulations

3.5.1 European Green Deal and Emission Targets

3.5.2 Subsidies and Tax Benefits for EV Purchases

3.5.3 Public-Private Partnerships in Charging Infrastructure Expansion

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

Europe Electric Automobile Market Segmentation

4.1 By Vehicle Type (In Value %)

4.1.1 Passenger Cars

4.1.2 Commercial Vehicles

4.1.3 Two-Wheelers

4.1.4 Electric Buses

4.2 By Battery Type (In Value %)

4.2.1 Lithium-Ion Batteries

4.2.2 Solid-State Batteries

4.2.3 Lead-Acid Batteries

4.3 By Charging Infrastructure (In Value %)

4.3.1 Public Charging Stations

4.3.2 Home Charging Solutions

4.3.3 Ultra-Fast Charging Networks

4.4 By Component (In Value %)

4.4.1 Battery Packs

4.4.2 Electric Motors

4.4.3 On-Board Chargers

4.5 By Region (In Value %)

4.5.1 West

4.5.2 North

4.5.3 South

4.5.4 East

Europe Electric Automobile Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Tesla Inc.

5.1.2 Volkswagen Group

5.1.3 Renault S.A.

5.1.4 BMW AG

5.1.5 Mercedes-Benz AG

5.1.6 Nissan Motor Co., Ltd.

5.1.7 Hyundai Motor Company

5.1.8 General Motors (GM)

5.1.9 Stellantis N.V.

5.1.10 Rivian Automotive

5.1.11 Polestar

5.1.12 BYD Company Limited

5.1.13 Audi AG

5.1.14 Kia Motors Corporation

5.1.15 Lucid Motors

5.2 Cross Comparison Parameters (Revenue, Market Share, R&D Expenditure, No. of EV Models, Geographical Presence, Charging Infrastructure, Partnerships, Manufacturing Capacity)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants and Incentives

5.9 Private Equity Investments

Europe Electric Automobile Market Regulatory Framework

6.1 EU Emission Standards and Carbon Credit Systems

6.2 Compliance with Safety Regulations

6.3 Charging Infrastructure Regulations

6.4 EV Battery Recycling Regulations

Europe Electric Automobile Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

Europe Electric Automobile Future Market Segmentation

8.1 By Vehicle Type (In Value %)

8.2 By Battery Type (In Value %)

8.3 By Charging Infrastructure (In Value %)

8.4 By Component (In Value %)

8.5 By Region (In Value %)

Europe Electric Automobile Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Market Entry Strategy for New Entrants

9.3 Growth Strategy for Incumbents

9.4 White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping out the ecosystem for the Europe Electric Automobile Market. This includes a deep dive into automotive manufacturers, EV component suppliers, and charging infrastructure developers. The aim is to identify the key market variables and drivers.

Step 2: Market Analysis and Construction

We gather and analyze historical data pertaining to vehicle sales, charging infrastructure growth, and regulatory policies. This helps in establishing trends and estimating the market's potential.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses about market growth are validated through consultations with industry experts, including automobile manufacturers, battery suppliers, and policymakers. These interviews provide operational insights into market dynamics.

Step 4: Research Synthesis and Final Output

Finally, we engage directly with electric vehicle manufacturers and government bodies to ensure the accuracy of data. This step confirms the alignment of market trends with consumer behavior, charging infrastructure availability, and technological advancements.

Frequently Asked Questions

01. How big is the Europe Electric Automobile Market?

The Europe Electric Automobile Market is valued at USD 200 billion, driven by strong government support for electric vehicles and growing consumer demand for sustainable transportation options.

02. What are the challenges in the Europe Electric Automobile Market?

Challenges in the Europe Electric Automobile Market include high initial costs for electric vehicles, range anxiety due to insufficient charging infrastructure in rural areas, and the cost of battery technology.

03. Who are the major players in the Europe Electric Automobile Market?

Key players in the Europe Electric Automobile Market include Tesla Inc., Volkswagen Group, BMW AG, Renault S.A., and Nissan Motor Co., Ltd., who dominate the market through technological advancements and investments in charging networks.

04. What are the growth drivers of the Europe Electric Automobile Market?

The Europe Electric Automobile Market is propelled by government policies incentivizing electric vehicle purchases, advancements in battery technology, and the increasing availability of public and home-based charging infrastructure.

05. What are the emerging trends in the Europe Electric Automobile Market?

Emerging trends in the Europe Electric Automobile Market include the development of autonomous electric vehicles, the rise of electric commercial vehicles, and the integration of renewable energy into EV charging stations.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.