Europe Engineering Plastics Market Outlook to 2030

Region:Europe

Author(s):Yogita Sahu

Product Code:KROD7414

December 2024

94

About the Report

Europe Engineering Plastics Market Overview

- The Europe Engineering Plastics market is valued at USD 24 billion, driven by increased demand across various industries such as automotive, electronics, and construction. Growth in automotive applications, where engineering plastics contribute to vehicle weight reduction and fuel efficiency, is a major factor. Additionally, rising demand for sustainable and high-performance materials in electrical and electronics applications is propelling market expansion.

- The market is dominated by Germany, France, and the United Kingdom. Germany leads due to its robust automotive and manufacturing sectors, which are intensive users of engineering plastics. France and the UK follow closely, driven by technological advancements in aerospace, electronics, and packaging. This dominance is further supported by strong R&D activities and high investment in sustainable material solutions across these regions.

- Under the European Green Deal, the EU has allocated 1 trillion for sustainable initiatives, with 50 billion earmarked for the plastics industry by 2030. This funding includes grants for research on eco-friendly engineering plastics and incentives for companies that reduce their carbon footprint. These investments are fostering a shift in the engineering plastics industry towards more sustainable practices and innovations.

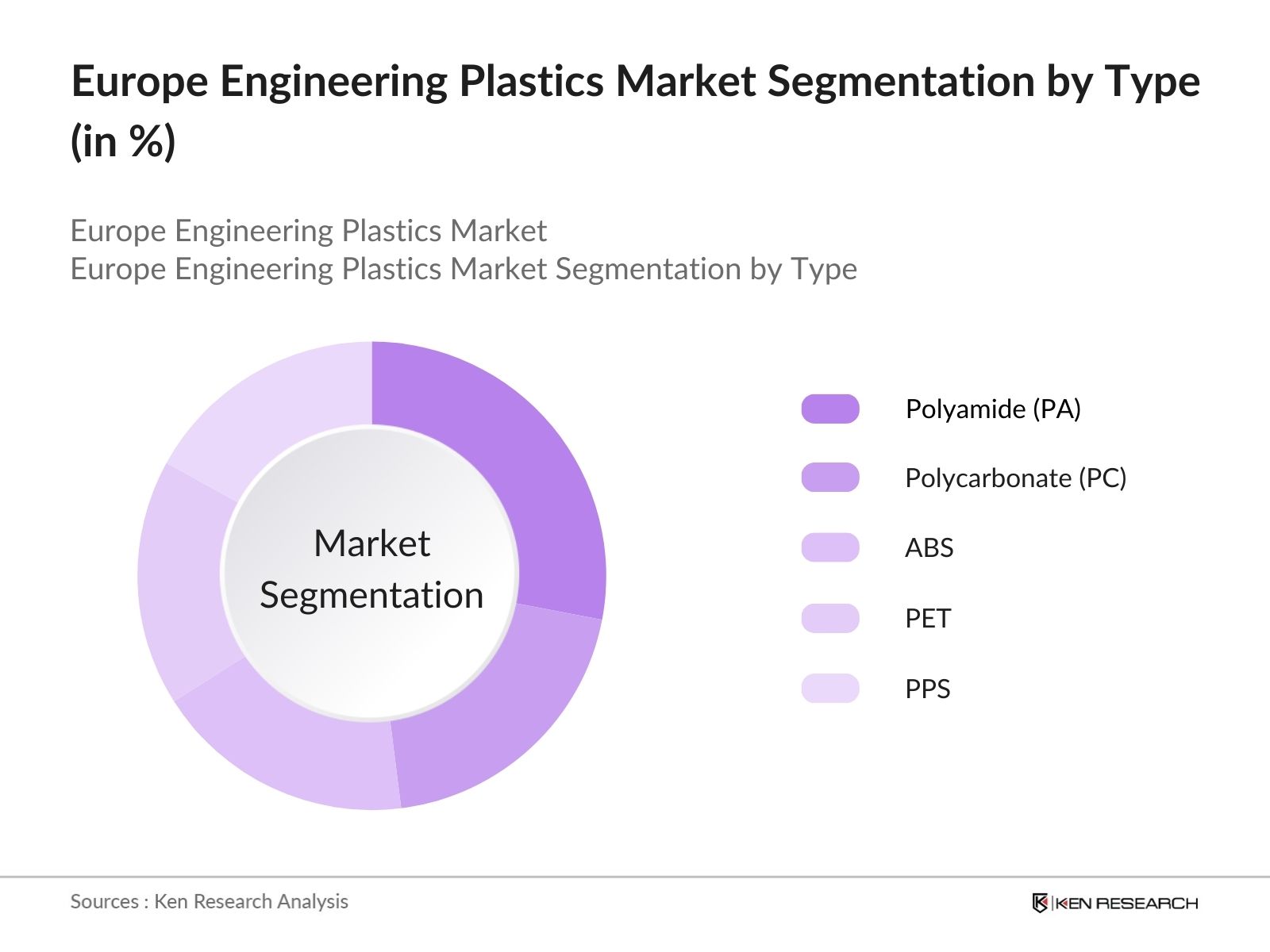

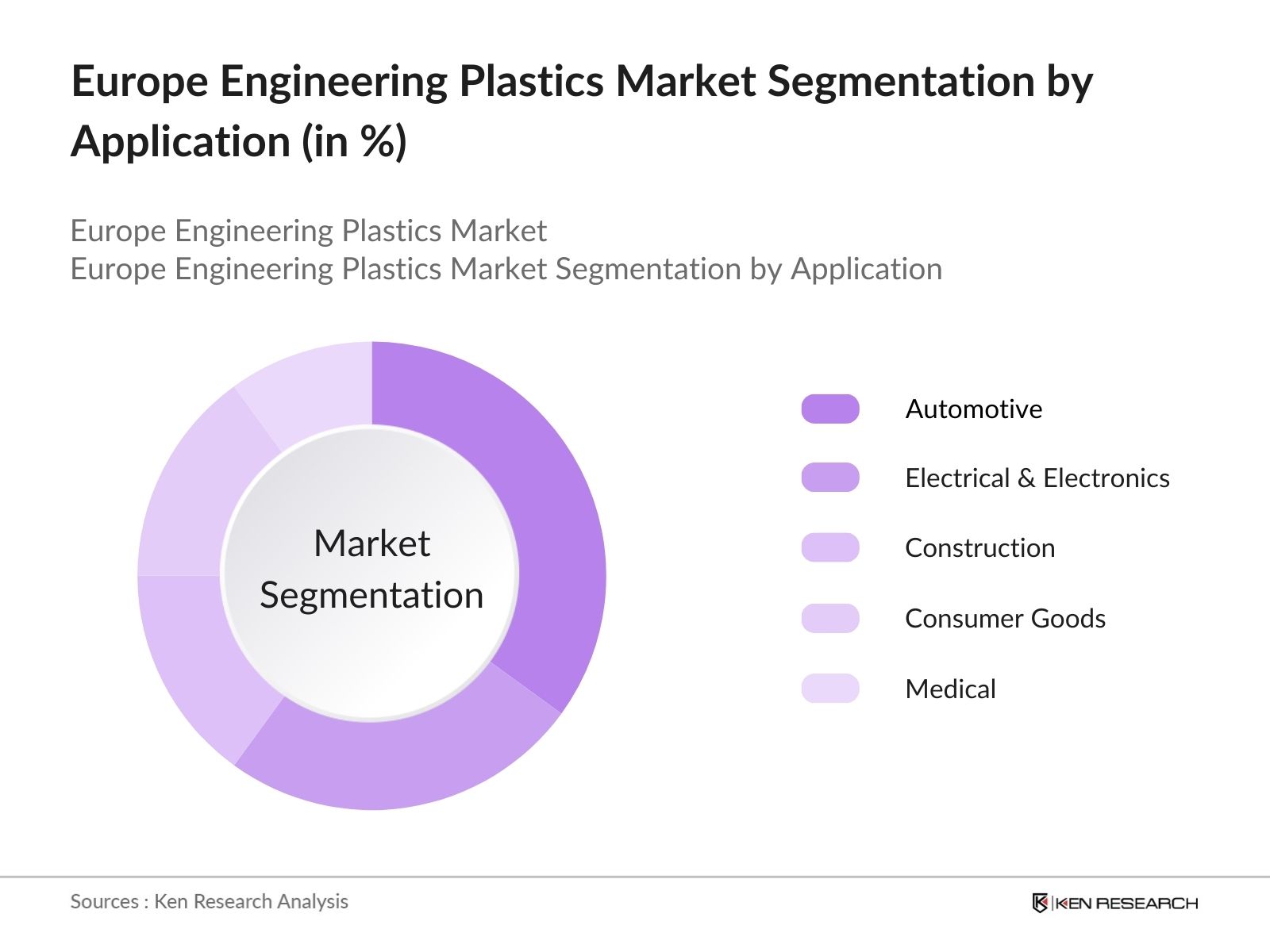

Europe Engineering Plastics Market Segmentation

By Type: The market is segmented by type into Polyamide (PA), Polycarbonate (PC), Acrylonitrile Butadiene Styrene (ABS), Polyethylene Terephthalate (PET), and Polyphenylene Sulfide (PPS). Among these, Polyamide holds a dominant market share, primarily due to its high mechanical strength, thermal stability, and wide application range in automotive and electrical industries. Polyamide is widely used in automotive under-the-hood applications and electrical connectors, contributing significantly to its market dominance.

By Application: By application, the market is divided into Automotive, Electrical & Electronics, Construction, Consumer Goods, and Medical sectors. The Automotive segment is the leading application due to engineering plastics' essential role in enhancing fuel efficiency, weight reduction, and durability in automotive manufacturing. With a strong focus on emission reduction, automakers in Europe are increasingly integrating engineering plastics, which provides a steady demand for this segment.

Europe Engineering Plastics Market Competitive Landscape

The market is dominated by a select group of key players, including international giants and European-based companies with a significant market presence. Their extensive portfolios and strong regional distribution networks allow them to maintain competitive edges in product innovation, sustainability initiatives, and market share.

Europe Engineering Plastics Market Analysis

Market Growth Drivers

- Increasing Demand for Lightweight Automotive Components: In 2024, the automotive industry in Europe is projected to require 6.5 million metric tons of engineering plastics for manufacturing lightweight, fuel-efficient vehicles. Countries like Germany and France are spearheading this growth due to robust automotive production, which accounted for over 3 million vehicles combined in 2023.

- Boom in Electric Vehicle (EV) Production: Europes electric vehicle market is anticipated to see exponential growth, with over 7 million EVs expected to be on the road by 2025, supported by the European Green Deals target of carbon neutrality by 2050. This growth in EVs, which rely heavily on engineering plastics for components like battery casings and electric circuitry, is increasing the consumption of these materials across production hubs in Norway, Germany, and the Netherlands.

- Expansion of the Construction Sector: Engineering plastics are integral in the construction industry, especially in the European Union where construction output has surged, reaching 1.4 trillion in 2024. Major projects, such as infrastructure development in Spain and Eastern Europe, have seen increased adoption of plastics like polycarbonate and ABS for durable, impact-resistant building materials.

Market Challenges

- Volatility in Raw Material Prices: Engineering plastics production relies on petrochemical raw materials, with the cost of materials like crude oil reaching around $93 per barrel in 2024. This volatility directly affects the cost structure of engineering plastics manufacturers, pressuring profit margins and creating supply chain challenges.

- Stringent EU Environmental Regulations: The European Unions regulatory framework, including the REACH regulation, imposes strict environmental and safety compliance standards on plastics manufacturing. In 2024, compliance costs for major engineering plastics companies in Europe exceeded 500 million, significantly impacting production costs.

Europe Engineering Plastics Market Future Outlook

Over the next five years, the Europe Engineering Plastics industry is anticipated to experience steady growth driven by heightened demand for sustainable materials, advancements in polymer technologies, and the rising adoption of engineering plastics in automotive and electrical applications.

Future Market Opportunities

- Increased Adoption of Bio-Based Engineering Plastics: Over the next five years, bio-based engineering plastics are projected to gain traction, supported by government initiatives and consumer demand for sustainable alternatives. By 2028, bio-based plastics are estimated to constitute 15 million metric tons of Europes plastics market, reducing dependency on petrochemical-derived plastics.

- Advancements in Plastic Recycling Technologies: Recycling capabilities for engineering plastics are expected to double by 2028, driven by 5 billion in investments from the European Union. With improvements in recycling infrastructure, Europe aims to recycle 10 million metric tons of engineering plastics annually, addressing environmental concerns and aligning with circular economy goals.

Scope of the Report

|

Type |

Polyamide (PA) Polycarbonate (PC) ABS PET PPS |

|

Application |

Automotive Electrical & Electronics Construction Consumer Goods Medical |

|

Processing Method |

Injection Molding Extrusion Blow Molding Thermoforming Rotational Molding |

|

End-User Industry |

Automotive OEMs Electronics Manufacturers Construction Companies Medical Equipment Suppliers Consumer Goods Brands |

|

Region |

Western Europe Eastern Europe Northern Europe Southern Europe Central Europe |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Automotive Manufacturers

Electronics & Electrical Component Manufacturers

Construction Firms

Medical Equipment Manufacturers

Consumer Goods Brands

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (European Commission, REACH Regulators)

Companies

Players Mentioned in the Report:

BASF SE

Covestro AG

DuPont de Nemours, Inc.

Solvay S.A.

SABIC

LG Chem

Arkema S.A.

Lanxess AG

Celanese Corporation

DSM Engineering Plastics

Table of Contents

1. Europe Engineering Plastics Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Europe Engineering Plastics Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Europe Engineering Plastics Market Analysis

3.1. Growth Drivers

3.1.1. Industrial Demand in Automotive (Material Demand, Durability, Weight Reduction)

3.1.2. Expansion in Electrical & Electronics Sector (Thermal Resistance, Electrical Insulation)

3.1.3. Demand for Sustainable Materials (Recyclability, Carbon Emission Reduction)

3.2. Market Challenges

3.2.1. High Raw Material Prices (Cost Analysis, Sourcing Challenges)

3.2.2. Competition with Alternative Materials (Metal Substitution, Composite Materials)

3.2.3. Regulatory Compliance (REACH Standards, Environmental Impact)

3.3. Opportunities

3.3.1. Advanced Material Technologies (Bio-based Engineering Plastics, Nanocomposites)

3.3.2. Growth in Construction and Infrastructure (Heat Resistance, Durability)

3.3.3. Medical Application Potential (Biocompatibility, Sterilization Resistance)

3.4. Trends

3.4.1. Shift Towards Sustainable Engineering Plastics (Circular Economy, Green Certifications)

3.4.2. Increased R&D Investment in Material Innovation (Strength-to-Weight Ratio, Process Optimization)

3.4.3. Adoption of Digital Manufacturing (3D Printing, Industry 4.0 Integration)

3.5. Regulatory Framework

3.5.1. EU Plastic Waste Directives

3.5.2. Circular Economy Action Plan Compliance

3.5.3. Import/Export Regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Producers, Distributors, End-Users)

3.8. Porters Five Forces

3.9. Competition Landscape

4. Europe Engineering Plastics Market Segmentation

4.1. By Type (In Value %)

4.1.1. Polyamide (PA)

4.1.2. Polycarbonate (PC)

4.1.3. Acrylonitrile Butadiene Styrene (ABS)

4.1.4. Polyethylene Terephthalate (PET)

4.1.5. Polyphenylene Sulfide (PPS)

4.2. By Application (In Value %)

4.2.1. Automotive

4.2.2. Electrical & Electronics

4.2.3. Construction

4.2.4. Consumer Goods

4.2.5. Medical

4.3. By Processing Method (In Value %)

4.3.1. Injection Molding

4.3.2. Extrusion

4.3.3. Blow Molding

4.3.4. Thermoforming

4.3.5. Rotational Molding

4.4. By End-User Industry (In Value %)

4.4.1. Automotive OEMs

4.4.2. Electronics Manufacturers

4.4.3. Construction Companies

4.4.4. Medical Equipment Suppliers

4.4.5. Consumer Goods Brands

4.5. By Region (In Value %)

4.5.1. Western Europe

4.5.2. Eastern Europe

4.5.3. Northern Europe

4.5.4. Southern Europe

4.5.5. Central Europe

5. Europe Engineering Plastics Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. BASF SE

5.1.2. Covestro AG

5.1.3. DuPont de Nemours, Inc.

5.1.4. Solvay S.A.

5.1.5. SABIC

5.1.6. LG Chem

5.1.7. Arkema S.A.

5.1.8. Lanxess AG

5.1.9. Celanese Corporation

5.1.10. DSM Engineering Plastics

5.1.11. Evonik Industries AG

5.1.12. Mitsubishi Chemical Corporation

5.1.13. Toray Industries, Inc.

5.1.14. RadiciGroup

5.1.15. Teijin Limited

5.2. Cross Comparison Parameters (Product Portfolio, Market Presence, Regional Distribution, Manufacturing Facilities, R&D Expenditure, Employee Strength, Customer Base, Revenue Generation)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Europe Engineering Plastics Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Europe Engineering Plastics Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Europe Engineering Plastics Future Market Segmentation

8.1. By Type (In Value %)

8.2. By Application (In Value %)

8.3. By Processing Method (In Value %)

8.4. By End-User Industry (In Value %)

8.5. By Region (In Value %)

9. Europe Engineering Plastics Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the entire stakeholder ecosystem within the Europe Engineering Plastics market. Secondary and proprietary databases are utilized to compile comprehensive data, identifying variables like market size, industry demand, and emerging technologies.

Step 2: Market Analysis and Construction

Historical data and trends in engineering plastics are analyzed to assess demand across automotive, electronics, and consumer goods industries. The market penetration ratio, quality parameters, and revenue generation factors are evaluated for precise segmentation.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are verified through interviews with industry experts. These consultations yield operational and financial insights that help refine data accuracy and provide a robust foundation for revenue estimates and projections.

Step 4: Research Synthesis and Final Output

Conversations with engineering plastics manufacturers provide detailed product insights, consumer preferences, and market trends. This interaction supports the synthesis of final, validated findings, ensuring a comprehensive and accurate market analysis.

Frequently Asked Questions

01. How big is the Europe Engineering Plastics Market?

The Europe Engineering Plastics market is valued at USD 24 billion, driven by extensive applications in the automotive, electronics, and construction industries.

02. What are the challenges in the Europe Engineering Plastics Market?

Challenges in the Europe Engineering Plastics market include high raw material prices, stringent regulatory requirements, and competition from alternative materials, which impact production costs and market expansion.

03. Who are the major players in the Europe Engineering Plastics Market?

Key players in the Europe Engineering Plastics market include BASF SE, Covestro AG, DuPont de Nemours, Inc., Solvay S.A., and SABIC. These companies dominate due to strong regional presence, extensive R&D investments, and diverse product portfolios.

04. What are the growth drivers of the Europe Engineering Plastics Market?

Growth in the Europe Engineering Plastics market is driven by the demand for sustainable materials, advancements in high-performance polymers, and engineering plastics' critical role in automotive and electronics manufacturing.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.