Europe Fast Food Market Outlook to 2030

Region:Europe

Author(s):Shreya Garg

Product Code:KROD8080

December 2024

98

About the Report

Europe Fast Food Market Overview

- The Europe fast food market is valued at USD 149 billion, with substantial growth attributed to increasing urbanization, evolving lifestyles, and the growing preference for convenience among consumers. A historical analysis highlights the robust expansion of fast-food chains due to demand for quick and accessible meals. Key factors such as technology-driven delivery platforms and consumer inclination toward diverse and accessible dining options have significantly contributed to this market growth, fueling innovation within the industry.

- The United Kingdom, Germany, and France lead the fast-food market in Europe, largely due to high urbanization rates and a strong consumer base with disposable income supporting the fast-food culture. The UK, known for its trendsetting consumption patterns, has a widespread presence of global fast-food chains, while Germanys robust infrastructure for drive-through and delivery options solidifies its standing. In France, the blend of local fast-food innovations and international brands meets a unique market demand, making it a leading region.

- Food safety regulations are stringent in Europe, with regular checks and standards set by the European Food Safety Authority (EFSA). In 2024, new regulations mandate that fast-food chains conduct routine food safety assessments every three months to prevent contamination. Compliance with these safety standards is essential, as any non-compliance could lead to fines and affect brand reputation. This regulatory framework safeguards consumers and ensures a high quality of service, thereby increasing operational responsibilities for fast-food establishments

Europe Fast Food Market Segmentation

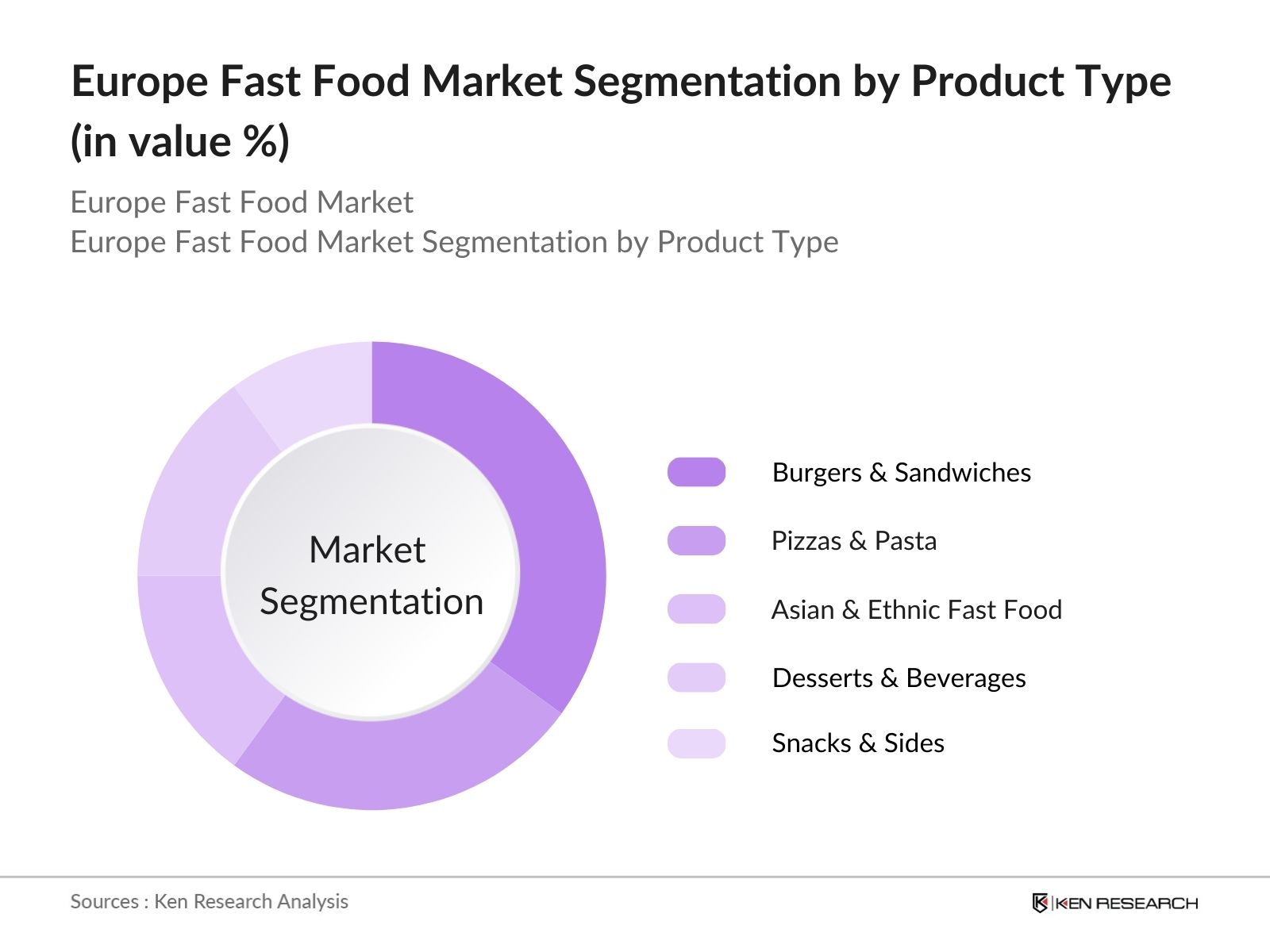

By Product Type: The market is segmented by product type into burgers & sandwiches, pizzas & pasta, Asian & ethnic fast food, desserts & beverages, and snacks & sides. Currently, burgers & sandwiches maintain a dominant share within this category, attributed to their embedded place in European fast-food culture. Popularity among consumers is sustained by brand loyalty, strong promotional activities, and customization options. Major brands such as McDonalds and Burger King have built a consistent market presence through standardized quality and widespread availability.

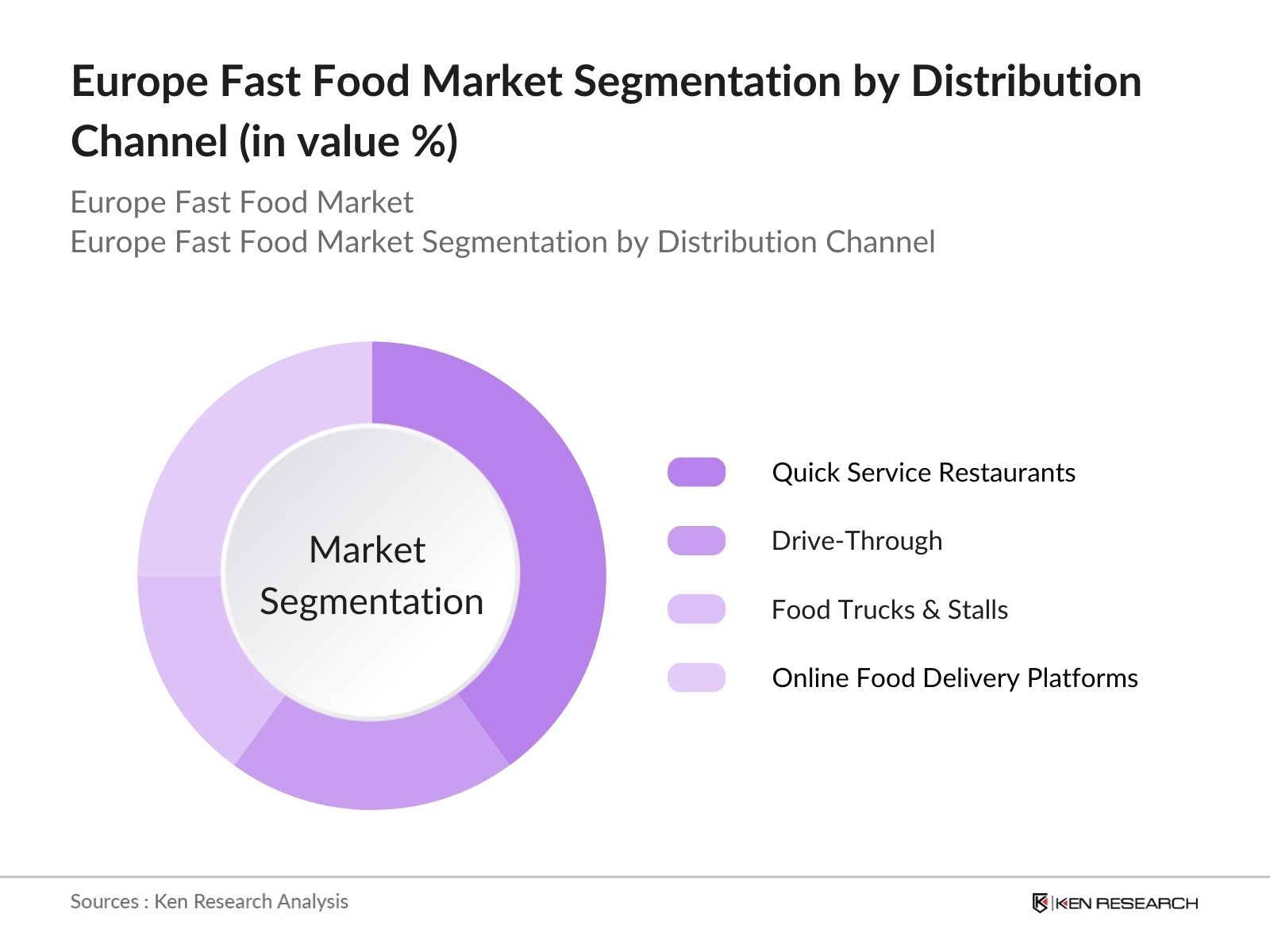

By Distribution Channel: The market is also segmented by distribution channel into quick-service restaurants (QSRs), drive-through, food trucks & stalls, and online food delivery platforms. QSRs lead in this segment due to their convenience, quick service, and frequent adoption of consumer-oriented digital solutions. Chains within QSRs have embraced the digital transformation, offering streamlined mobile ordering and contactless payment options, which have enhanced customer convenience and expanded their reach across urban and suburban markets.

Europe Fast Food Market Competitive Landscape

The Europe fast food market is characterized by intense competition among key global and regional players, each capitalizing on specific market niches and consumer preferences. The market is led by well-established companies that continuously evolve their menu options and enhance service quality to retain and grow their customer base.

|

Company Name |

Establishment Year |

Headquarters |

Market Focus |

Digital Strategy |

Sustainability Initiatives |

Revenue (USD Bn) |

Number of Outlets |

Regional Presence |

|

McDonalds Corporation |

1940 |

USA |

||||||

|

Burger King |

1954 |

USA |

||||||

|

Dominos Pizza |

1960 |

USA |

||||||

|

Starbucks |

1971 |

USA |

||||||

|

KFC |

1930 |

USA |

Europe Fast Food Industry Analysis

Growth Drivers

- Urbanization and Changing Lifestyles: The fast-food market in Europe is significantly influenced by rapid urbanization and changing consumer lifestyles. In 2024, over 75% of the European population lives in urban areas, increasing demand for quick-service restaurants that fit into fast-paced urban schedules. Eurostat highlights a steady rise in single-person households and dual-income families in countries like Germany and France, who seek accessible dining options due to limited time for meal preparation. Urban areas across the region report higher engagement with fast food, with urbanites consuming nearly 40% more fast food than those in rural regions.

- Increase in Disposable Income: Disposable income across European Union countries has risen, supporting consumer spending on dining out, including fast food. The World Bank reports that disposable income per capita rose by 3,200 USD in Western Europe from 2022 to 2024, facilitating higher spending on convenient food options. Countries like Germany, France, and the United Kingdom show increased expenditure on fast food, with Germanys spending on dining out reaching 120 billion USD in 2024. This income growth is vital for the fast-food industry as consumers are willing to allocate more resources to convenience dining options.

- Consumer Preference for Convenience Foods: Consumer preferences in Europe have increasingly leaned toward convenience foods, driven by work demands and busy lifestyles. Eurostat notes a 35% rise in fast-food purchases in metropolitan areas across Europe between 2022 and 2024. This shift is particularly prominent in younger demographics, where over 60% report choosing fast food for its time-saving benefits. Convenience-focused dining has become integral in fast-paced settings, reinforcing the growth of the fast-food market across major European cities.

Market Challenges

- Rising Health Concerns and Regulations on Ingredients: Health concerns and stringent regulations on ingredients present challenges to the fast-food sector. In 2024, the European Union imposed further restrictions on trans fats, with limits now mandating that trans fats cannot exceed 2 grams per 100 grams of fat in food products. With 72% of consumers prioritizing health-focused food choices, fast-food chains face pressure to reformulate products, impacting operational costs and product availability. This regulatory environment directly influences menu offerings and aligns with the broader European emphasis on public health initiatives.

- Environmental Sustainability: Environmental regulations on waste management and carbon emissions challenge the European fast-food market as it faces compliance requirements in waste reduction. In 2024, the EU rolled out the European Green Deal Waste Reduction Policy, affecting packaging and waste handling in food services, including fast food. Additionally, fast-food chains are encouraged to minimize carbon footprints as the European Environment Agency reports that food-related emissions constitute 25% of the EUs total CO emissions. Compliance with these policies imposes additional operational and cost burdens on fast-food providers, especially those relying heavily on disposable packaging.

Europe Fast Food Market Future Outlook

The Europe fast food market is expected to continue evolving with a focus on health-conscious options, innovative delivery models, and sustainability initiatives. This growth trajectory is influenced by both technological advancements and shifting consumer preferences towards sustainable and convenient food choices. Additionally, the rise in plant-based and alternative protein products is anticipated to reshape traditional menu offerings, expanding the markets consumer base.

Future Market Opportunities

- Health-Conscious Menu Innovations: As health consciousness rises among European consumers, fast-food chains have begun innovating their menus to cater to this demand. The European Consumer Health Report 2024 reveals that 65% of consumers are willing to pay a premium for healthier food options, indicating strong support for health-focused fast food. Chains have introduced items like baked options, gluten-free, and low-sugar choices to capture this market segment. The shift to healthier menus provides an avenue for growth as the market evolves to meet consumer dietary preferences without compromising on convenience.

- Technological Integration: Technology adoption in fast food, such as self-service kiosks and mobile ordering, has transformed the customer experience. According to Eurostat, 78% of fast-food outlets in major European cities now use digital ordering systems. This technological integration reduces wait times and streamlines ordering, especially during peak hours. Additionally, app-based loyalty programs attract repeat customers, further driving sales. As European consumers embrace tech-based dining experiences, fast-food chains leverage these tools to enhance efficiency and customer engagement in high-traffic areas.

Scope of the Report

|

Product Type |

Burgers & Sandwiches |

|

Distribution Channel |

Quick Service Restaurants (QSRs) |

|

Age Group |

Kids & Teenagers |

|

Dining Mode |

Dine-In |

|

Country |

United Kingdom |

Products

Key Target Audience

Quick Service Restaurant (QSR) Chains

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., European Food Safety Authority, UK Food Standards Agency)

Digital Payment Solution Providers

Sustainability and Environmental Agencies (e.g., European Environment Agency)

Local and Regional Food Delivery Services

Technology and Software Providers for Ordering Systems

Plant-Based and Alternative Protein Suppliers

Companies

Major Players

McDonalds Corporation

Burger King

Dominos Pizza

Starbucks

KFC

Subway

Pizza Hut

Tim Hortons

Five Guys

Dunkin Donuts

Taco Bell

Nandos

Vapiano

Nordsee

Pret A Manger

Table of Contents

Europe Fast Food Market Overview

Definition and Scope

Market Taxonomy

Competitive Landscape Overview

Distribution Channels Overview

Market Maturity Analysis

Europe Fast Food Market Size (In USD Bn)

Historical Market Size

Year-On-Year Growth Analysis

Key Market Developments and Milestones

Market Impact of Regulatory Changes

Consumer Demand Shifts

Europe Fast Food Market Analysis

Growth Drivers

Urbanization and Changing Lifestyles

Increase in Disposable Income

Consumer Preference for Convenience Foods

Expansion of Delivery Services (On-demand, Contactless)

Market Challenges

Rising Health Concerns and Regulations on Ingredients

Environmental Sustainability (Waste Management, Carbon Footprint)

High Competition from Local & International Chains

Opportunities

Health-Conscious Menu Innovations

Technological Integration (Kiosk, Mobile Ordering)

Expansion in Tier 2 and Tier 3 Cities

Trends

Rise in Plant-Based & Organic Options

Digital Transformation in Ordering and Payment Systems

Partnerships with Delivery Aggregators

Government Regulations

Food Safety Standards

Advertising Restrictions (Nutritional and Health Claims)

Sustainable Packaging and Waste Management Policies

Europe Fast Food Market Segmentation

By Product Type (In Value %)

Burgers & Sandwiches

Pizzas & Pasta

Asian & Ethnic Fast Food

Desserts & Beverages

Snacks & Sides

By Distribution Channel (In Value %)

Quick Service Restaurants (QSRs)

Drive-Through

Food Trucks & Stalls

Online Food Delivery Platforms

By Age Group (In Value %)

Kids & Teenagers

Young Adults

Working Professionals

Family Groups

By Dining Mode (In Value %)

Dine-In

Takeaway

Delivery (Home & Office)

By Country (In Value %)

United Kingdom

Germany

France

Spain

Italy

Europe Fast Food Market Competitive Analysis

Detailed Profiles of Major Companies

McDonalds Corporation

Burger King

Subway

KFC

Dominos Pizza

Starbucks

Pizza Hut

Tim Hortons

Five Guys

Dunkin Donuts

Taco Bell

Nandos

Vapiano

Nordsee

Pret A Manger

Cross Comparison Parameters (Revenue, Headquarters, Employee Count, Outlet Count, Regional Presence, Product Innovation, Delivery Service Collaboration, Sustainability Initiatives)

Market Share Analysis

Strategic Initiatives (Franchise Expansion, Partnerships)

Mergers and Acquisitions

Investment Analysis

Private Equity Involvement

Technological Adoption Levels

Europe Fast Food Market Regulatory Framework

Food Safety Regulations

Nutritional Labeling Requirements

Health & Hygiene Compliance Standards

Advertising and Marketing Regulations

Environmental Compliance (Sustainable Practices)

Europe Fast Food Future Market Size (In USD Bn)

Projected Growth and Market Expansion

Anticipated Changes in Consumer Preferences

Technology-Driven Operational Efficiency

Strategic Partnerships and Collaborations

Europe Fast Food Future Market Segmentation

By Product Type (In Value %)

By Distribution Channel (In Value %)

By Age Group (In Value %)

By Dining Mode (In Value %)

By Country (In Value %)

Europe Fast Food Market Analysts Recommendations

TAM/SAM/SOM Analysis

Consumer Behavior Analysis

Strategic Positioning for New Entrants

Marketing & Branding Strategy

White Space Analysis for Unexplored Segments

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first phase involves identifying primary variables shaping the Europe fast food market. This includes extensive desk research to map out stakeholder ecosystems, consumer behavior, and technological trends across the industry.

Step 2: Market Analysis and Data Compilation

In this phase, we analyze historical data to understand market dynamics, including sales performance, consumer demographics, and geographic segmentation. This stage helps in establishing accurate market size estimates for different segments.

Step 3: Hypothesis Validation and Expert Consultation

Consultations with industry experts using computer-assisted telephone interviews (CATIs) are conducted to validate initial findings. These insights help to fine-tune our understanding of revenue projections and competitive strategies.

Step 4: Research Synthesis and Final Output

The final phase integrates findings from bottom-up and top-down approaches, along with direct input from fast food operators. This synthesis ensures comprehensive coverage of the market, including emerging trends and strategic opportunities.

Frequently Asked Questions

01. How big is the Europe Fast Food Market?

The Europe fast food market is valued at USD 149 billion, driven by urbanization and evolving consumer preferences for convenience-based dining options, supported by extensive digital integration across major chains.

02. What are the challenges in the Europe Fast Food Market?

The Europe fast food market faces challenges such as rising health consciousness, regulatory scrutiny over nutritional content, and the environmental impact of waste management, all of which necessitate sustainable adaptations by industry players.

03. Who are the major players in the Europe Fast Food Market?

Major players in the Europe fast food market include McDonalds, Burger King, Dominos, Starbucks, and KFC, dominating due to strong brand presence, robust supply chains, and consistent service quality across regions.

04. What are the growth drivers of the Europe Fast Food Market?

Key drivers in the Europe fast food market include increased consumer demand for quick and accessible meal options, technological innovations in ordering and delivery, and evolving dietary preferences, particularly toward alternative protein and plant-based options.

05. Which regions dominate the Europe Fast Food Market and why?

The UK, Germany, and France are prominent in the Europe fast food market due to high urban populations, established food delivery networks, and consumer trends favoring international fast food brands, enhancing accessibility and demand for diverse food options.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.