Europe Fertilizers Market Outlook to 2030

Region:Europe

Author(s):Yogita Sahu

Product Code:KROD10677

December 2024

81

About the Report

Europe Fertilizers Market Overview

- The Europe Fertilizers Market is valued at USD 52.9 billion, driven by consistent demand from the agricultural sector for yield optimization and soil health improvement. The market's growth is influenced by advancements in precision agriculture, government initiatives promoting sustainable farming, and increasing adoption of bio-based fertilizers to meet environmental regulations. Key driving factors include nutrient management practices and the rising need for high-quality crop yields to support Europes food security.

- Key markets dominating the Europe Fertilizers sector include Germany, France, and Spain. Germany leads due to its advanced agricultural practices, robust governmental support for sustainable farming, and significant investment in research and development for eco-friendly fertilizers. France benefits from a strong agricultural base and high demand for diverse fertilizer types, while Spains dominance is supported by its vast agricultural exports and focus on crop quality improvement.

- The European Union has allocated over 500 million in subsidies to promote the use of efficient fertilizers in agriculture. This funding is expected to reach 800,000 farmers by 2025, helping them transition to fertilizers with optimized nutrient release properties, enhancing yield and reducing environmental impact.

Europe Fertilizers Market Segmentation

By Product Type: The market is segmented by product type into nitrogenous, phosphatic, potash, compound, and bio-based fertilizers. Nitrogenous fertilizers currently hold the dominant market share due to their essential role in enhancing crop growth and yield. This dominance is sustained by widespread usage in staple crop production across Europe and supported by technological advancements that have improved the efficacy of nitrogen-based products in various soil types.

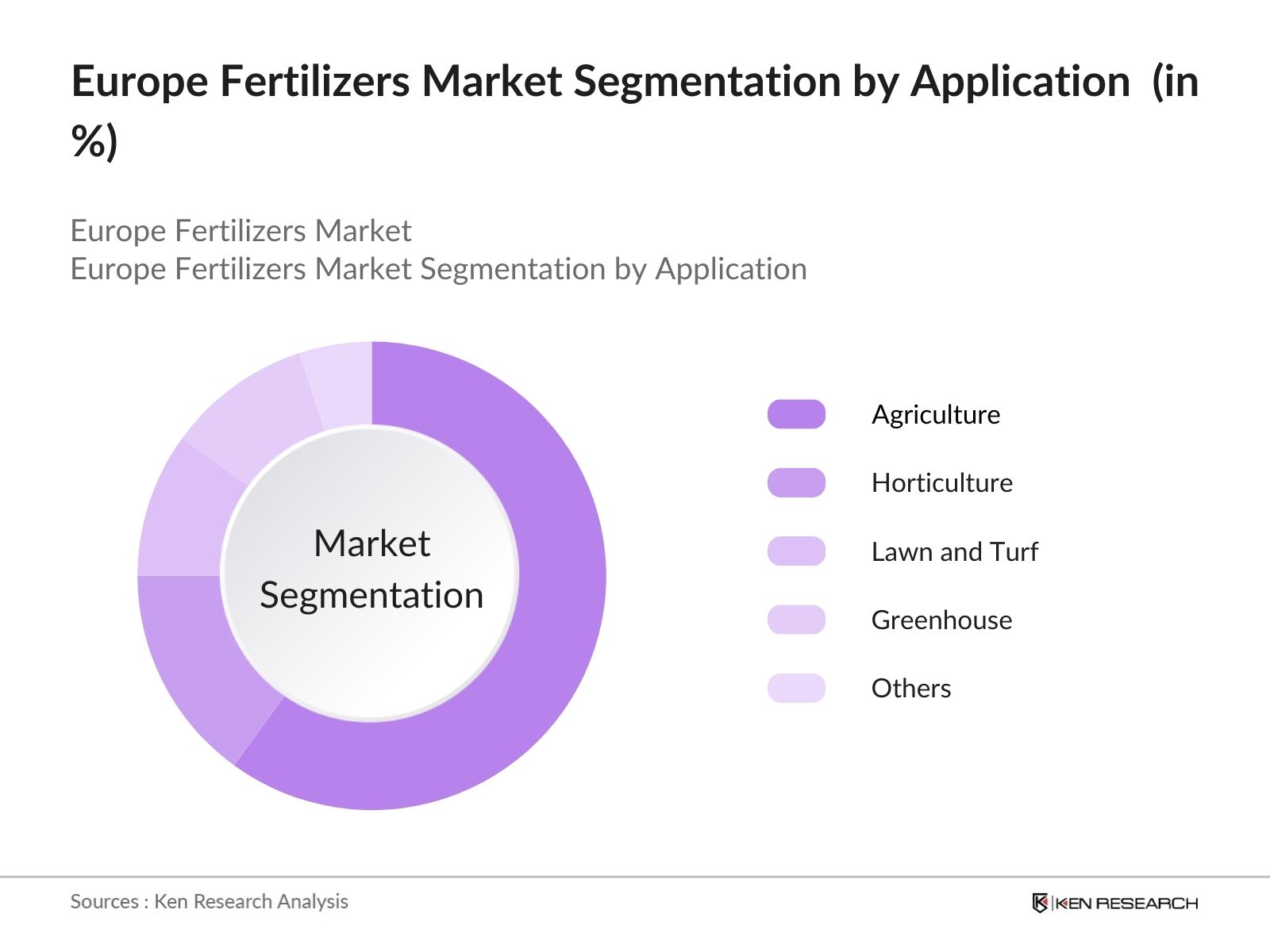

By Application: The market is further segmented by application into agriculture, horticulture, lawn and turf, greenhouse, and others (such as aquaculture). Agriculture dominates this segment due to its vast demand for fertilizers to increase food production and improve crop quality. The demand in this application is primarily driven by staple crops such as wheat and maize, making it the largest consumer of fertilizers in the region.

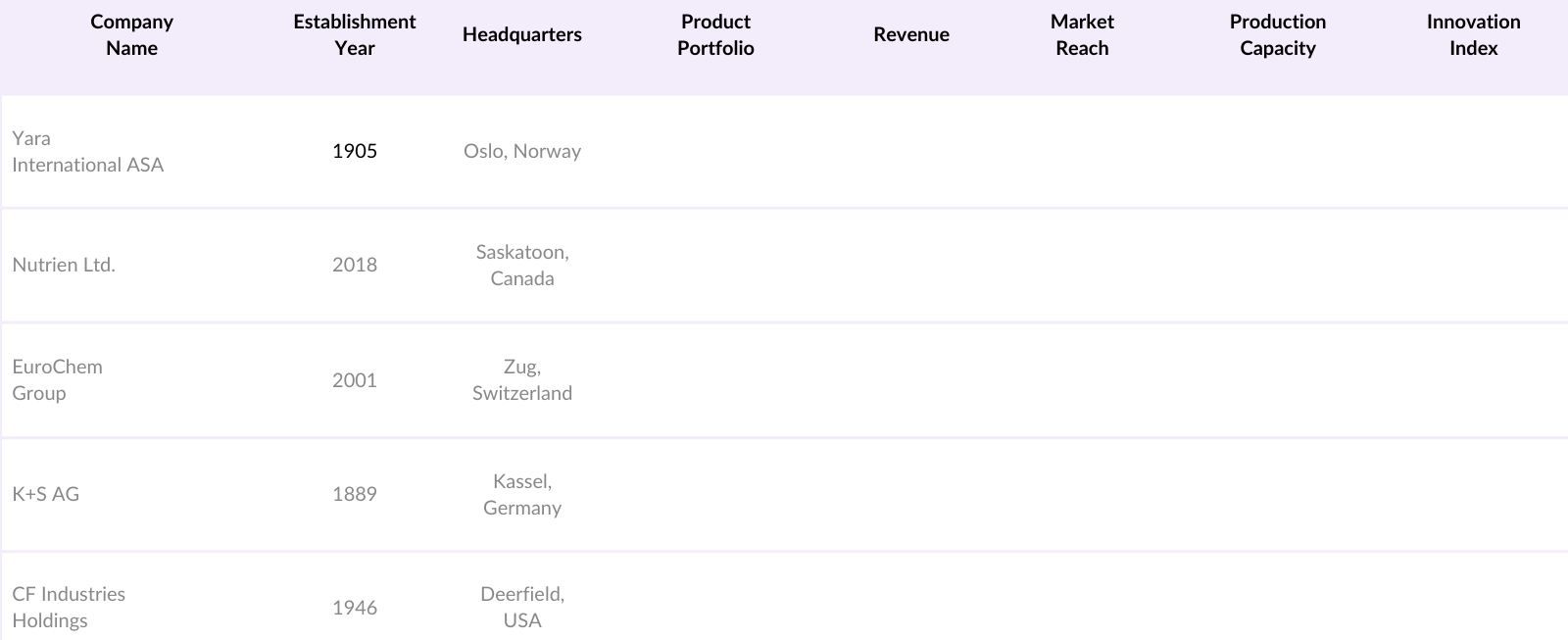

Europe Fertilizers Market Competitive Landscape

The market is dominated by key players who focus on sustainable fertilizer solutions and innovations to meet stringent environmental regulations. Companies like Yara International and Nutrien Ltd. leverage their technological expertise and extensive distribution networks to maintain a competitive edge in the market.

Europe Fertilizers Market Analysis

Market Growth Drivers

- Increased Demand for Food Security: Europes fertilizer industry is experiencing growth driven by the need to enhance food security. The European Union reports that over 340 million people across the continent depend on local food production for sustainable consumption, making fertilizers essential for achieving higher agricultural yields. By 2024, the European food supply chain's demand for nitrogen and phosphorous fertilizers is expected to reach 12 million metric tons, addressing regional food security concerns.

- Expansion of Organic Farming Initiatives: With the EUs Farm to Fork strategy aiming to achieve a 25% share of organic farmland by 2030, organic fertilizer use has seen considerable support and funding. According to the European Commission, over 200 million has been allocated to support organic fertilizers. As of 2024, organic fertilizers account for around 2 million metric tons in the EU, reflecting their growing role in agriculture.

- Soil Health and Restoration Programs: The EU has initiated extensive programs for soil health, which includes the application of fertilizers that restore soil nutrients. Reports indicate that around 45 million hectares of agricultural land in Europe require nutrient recovery and quality improvements, with projects funded up to 100 million in 2024 for soil restoration and fertilizer application, ensuring long-term soil productivity.

Market Challenges

- Strict Environmental Regulations: The European Green Deal has imposed rigorous regulations limiting fertilizer emissions, which could cost the industry around 1 billion annually to comply with new standards. Fertilizer producers are now required to reduce nitrogen oxide emissions to meet targets, creating high compliance costs impacting profit margins and operational efficiency.

- Rising Production Costs: Production costs in the market are influenced by energy prices, which have been rising steadily. For example, natural gas prices have led to an increase of around 150 per ton in production costs for ammonia-based fertilizers, making it challenging for companies to maintain profitability and remain competitive in a cost-sensitive market.

Europe Fertilizers Market Future Outlook

Over the coming years, the Europe Fertilizers industry is expected to see steady growth driven by a shift toward sustainable agricultural practices, increased government support for eco-friendly fertilizers, and advancements in bio-based fertilizers.

Future Market Opportunities

- Increased Demand for Bio-Fertilizers to Meet Organic Farming Needs: Over the next five years, bio-fertilizer use will likely increase to support the EU's organic farming goals. Bio-fertilizers are projected to occupy a larger share of the fertilizer market, with estimated use rising to 4 million metric tons by 2029 as organic agriculture gains traction across the region.

- Adoption of Precision Agriculture and IoT-Driven Fertilization: By 2029, nearly 40 million hectares in Europe will adopt IoT-driven fertilization technologies, optimizing nutrient application and minimizing environmental impacts. This trend will drive efficiency in fertilizer usage, cutting down on over-application and aligning with the EUs Green Deal objectives.

Scope of Report:

|

Product Type |

Nitrogenous Fertilizers |

|

Application |

Agriculture |

|

Nutrient Type |

Nitrogen (N) |

|

Crop Type |

Cereals and Grains |

|

Region |

Western Europe |

Scope of the Report

|

Product Type |

Nitrogenous Fertilizers |

|

Application |

Agriculture |

|

Nutrient Type |

Nitrogen (N) |

|

Crop Type |

Cereals and Grains |

|

Region |

Western Europe |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Banks and Financial Institution

Crop Management Companies

Government and Regulatory Bodies (e.g., European Environment Agency, EU Commission on Agriculture)

Large Scale Farms and Agribusinesses

Fertilizer Manufacturers

Investor and Venture Capitalist Firms

Greenhouse and Horticultural Corporations

Companies

Players Mentioned in the Report:

Yara International ASA

Nutrien Ltd.

EuroChem Group

K+S AG

CF Industries Holdings

Borealis AG

OCI N.V.

PhosAgro

ICL Group

Haifa Group

Table of Contents

1. Europe Fertilizers Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Dynamics Overview

1.4 Market Segmentation Overview

2. Europe Fertilizers Market Size (USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Milestones

3. Europe Fertilizers Market Analysis

3.1 Growth Drivers

3.1.1 Agricultural Demand (Yield Optimization, Crop Variety)

3.1.2 Environmental Concerns (Nutrient Management, Soil Health)

3.1.3 Technological Advancements (Precision Agriculture, Controlled-Release Fertilizers)

3.1.4 Government Initiatives (Sustainability Programs, Subsidies)

3.2 Market Challenges

3.2.1 Stringent Regulatory Policies (Environmental Standards, Nutrient Content Regulations)

3.2.2 Volatility in Raw Material Prices (Phosphate, Nitrogen, Potassium)

3.2.3 Climate Impacts (Drought, Changing Growing Seasons)

3.3 Opportunities

3.3.1 Organic Fertilizer Growth (Market Penetration, Product Development)

3.3.2 Increasing Investments in Biostimulants

3.3.3 Demand for Eco-Friendly Fertilizers (Biodegradable Solutions, Carbon-Neutral Products)

3.4 Trends

3.4.1 Adoption of Sustainable Fertilizers (Bio-Based Fertilizers, Green Ammonia)

3.4.2 Microbial and Biofertilizers Advancements

3.4.3 Smart Fertilizers with Sensor-Based Applications

3.5 Government Regulations

3.5.1 European Common Agricultural Policy (CAP)

3.5.2 Environmental Permits and Certifications

3.5.3 Emission Reduction Targets

3.6 Competitive Ecosystem

3.6.1 Key Competitors Overview

3.6.2 Investment and Mergers

4. Europe Fertilizers Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Nitrogenous Fertilizers

4.1.2 Phosphatic Fertilizers

4.1.3 Potash Fertilizers

4.1.4 Compound Fertilizers

4.1.5 Bio-Based Fertilizers

4.2 By Application (In Value %)

4.2.1 Agriculture

4.2.2 Horticulture

4.2.3 Lawn and Turf

4.2.4 Greenhouse

4.2.5 Others (Aquaculture, Golf Courses)

4.3 By Nutrient Type (In Value %)

4.3.1 Nitrogen (N)

4.3.2 Phosphorus (P)

4.3.3 Potassium (K)

4.3.4 Micronutrients (Zn, Fe, Mn)

4.4 By Crop Type (In Value %)

4.4.1 Cereals and Grains

4.4.2 Oilseeds

4.4.3 Fruits and Vegetables

4.4.4 Others (Pulses, Forage Crops)

4.5 By Region (In Value %)

4.5.1 Western Europe

4.5.2 Eastern Europe

4.5.3 Northern Europe

4.5.4 Southern Europe

4.5.5 Central Europe

5. Europe Fertilizers Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Yara International ASA

5.1.2 Nutrien Ltd.

5.1.3 EuroChem Group

5.1.4 K+S AG

5.1.5 CF Industries Holdings, Inc.

5.1.6 Borealis AG

5.1.7 OCI N.V.

5.1.8 PhosAgro

5.1.9 ICL Group

5.1.10 Haifa Group

5.1.11 Timac Agro International

5.1.12 Acron Group

5.1.13 SABIC (Saudi Basic Industries Corporation)

5.1.14 The Mosaic Company

5.1.15 Compo Expert GmbH

5.2 Cross Comparison Parameters (Product Portfolio, Innovation Index, Production Capacity, Revenue, Market Reach, Sustainability Initiatives, Regional Coverage, Strategic Partnerships)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers & Acquisitions

5.6 Investment Analysis

5.7 Government Grants and Subsidies

6. Europe Fertilizers Market Regulatory Framework

6.1 Fertilizer Regulation (EU) 2019/1009

6.2 Environmental Safety Regulations

6.3 Compliance Certifications

6.4 Soil Health Monitoring Standards

7. Europe Fertilizers Future Market Size (USD Bn)

7.1 Future Market Projections

7.2 Key Growth Drivers for Future Market

8. Europe Fertilizers Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Application (In Value %)

8.3 By Nutrient Type (In Value %)

8.4 By Crop Type (In Value %)

8.5 By Region (In Value %)

9. Europe Fertilizers Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 White Space Analysis

9.3 Key Marketing Initiatives

9.4 Strategic Investment Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This initial step involves creating a comprehensive ecosystem map to identify all major stakeholders within the Europe Fertilizers Market. Extensive desk research is conducted to gather insights from secondary and proprietary databases, focusing on the critical variables influencing the market, such as product type, application, and technological innovations.

Step 2: Market Analysis and Construction

In this phase, historical data on the Europe Fertilizers Market is analyzed to determine market growth trends, key demand regions, and sectoral contributions. The analysis assesses market penetration, the ratio of manufacturers to distributors, and historical revenue data for reliability and accuracy.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts are consulted to validate the market hypotheses using computer-assisted interviews. These insights provide operational and financial data directly from sector specialists, helping to refine and confirm the market findings.

Step 4: Research Synthesis and Final Output

This final step consolidates data gathered from various segments, including product types, application, and end-users. Direct engagement with fertilizer manufacturers and distributors verifies the statistical analysis, ensuring comprehensive, validated insights for the Europe Fertilizers Market.

Frequently Asked Questions

01. How big is the Europe Fertilizers Market?

The Europe Fertilizers Market is valued at USD 52.9 billion, with demand driven by the agricultural sector's focus on yield improvement and sustainable farming practices.

02. What are the challenges in the Europe Fertilizers Market?

Major challenges in the Europe Fertilizers Market include stringent regulatory standards, fluctuating raw material prices, and the need to balance environmental sustainability with high crop yields.

03. Who are the major players in the Europe Fertilizers Market?

Key players in the Europe Fertilizers Market include Yara International ASA, Nutrien Ltd., EuroChem Group, and K+S AG. These companies dominate due to extensive product portfolios and established distribution networks.

04. What are the growth drivers of the Europe Fertilizers Market?

Growth in the Europe Fertilizers Market is fueled by advancements in sustainable farming, increasing investment in bio-based fertilizers, and a rising demand for high-quality crop yields across Europe.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.