Europe Fiberglass Pipes Market Outlook to 2030

Region:Europe

Author(s):Paribhasha Tiwari

Product Code:KROD10489

December 2024

82

About the Report

Europe Fiberglass Pipes Market Overview

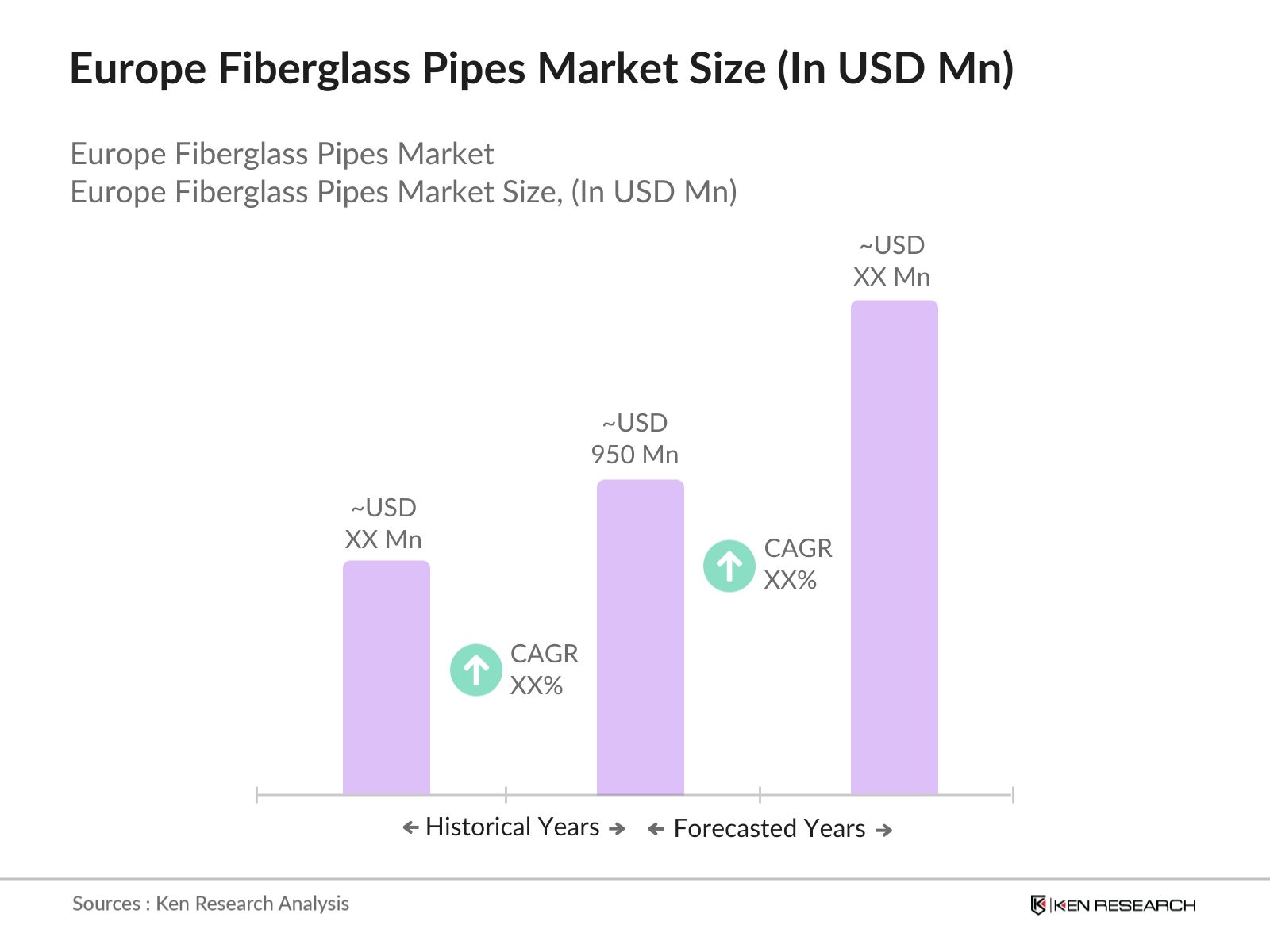

- The Europe Fiberglass Pipes Market is valued at USD 950 million, based on a five-year historical analysis. This growth is primarily driven by the rising demand for durable and corrosion-resistant piping solutions in sectors such as oil and gas, chemical processing, and water treatment. Fiberglass pipes offer a lightweight alternative to traditional steel and PVC options, making them a preferred choice for industries prioritizing long-term sustainability and reduced maintenance costs.

- The Europe Fiberglass Pipes Market sees significant traction in countries like Germany, France, and the United Kingdom. Germany leads due to its advanced infrastructure projects, robust manufacturing sector, and high adoption rates of technologically advanced, corrosion-resistant materials. France and the UK follow, largely driven by their robust industrial bases and substantial investments in sustainable infrastructure for energy and wastewater management.

- In October 2022, Spain and France signed an agreement to construct an underwater gas pipeline connecting Barcelona to Marseille. This project aims to facilitate the transport of additional liquefied natural gas (LNG) supplies from Spain and Portugal to France and other European countries, enhancing energy security and integration within the region.

Europe Fiberglass Pipes Market Segmentation

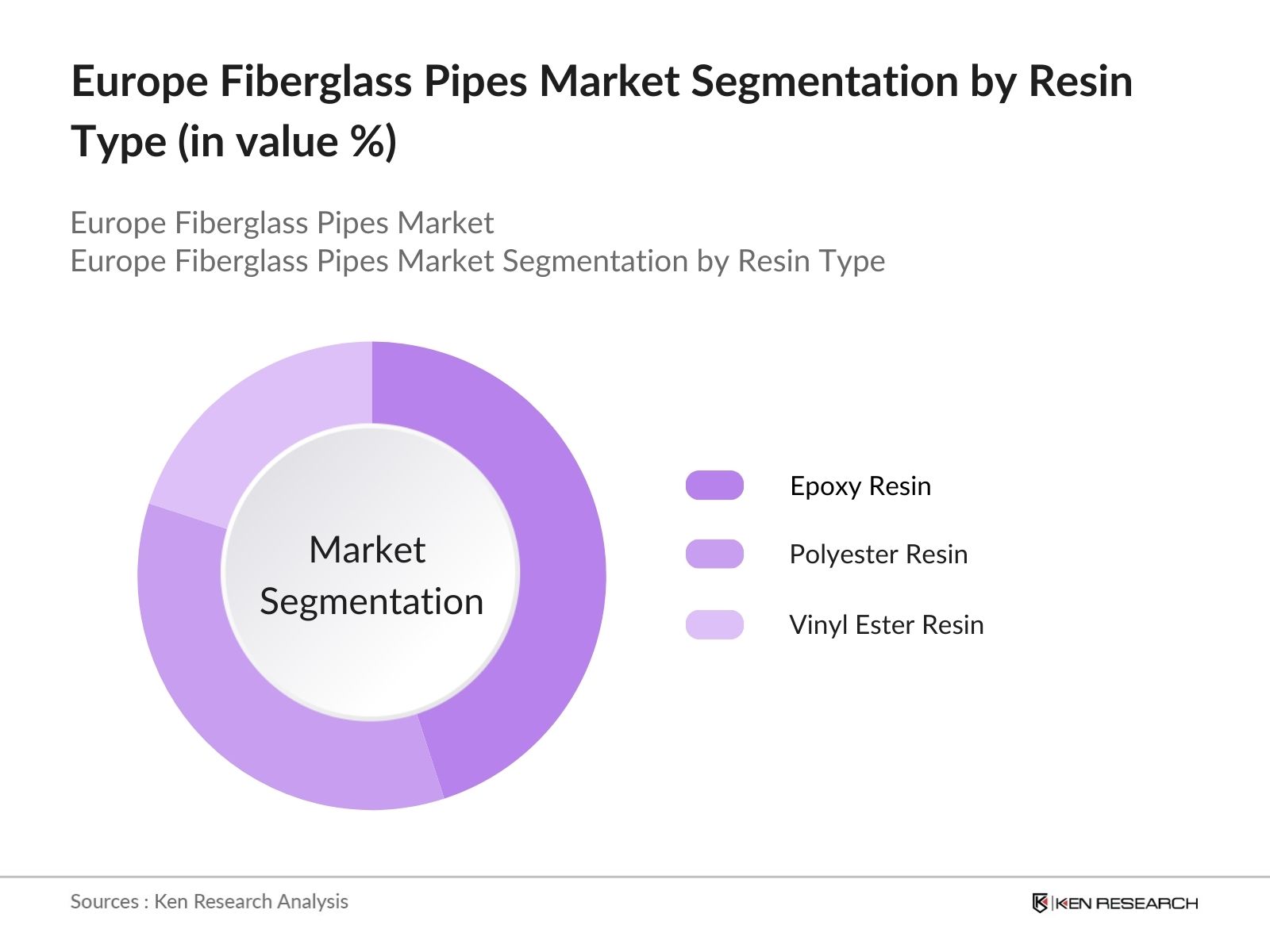

By Resin Type: Europe's fiberglass pipes market is segmented by resin type into Epoxy Resin, Polyester Resin, and Vinyl Ester Resin. Epoxy Resin has a dominant market share under this segmentation. The material's high strength-to-weight ratio and superior resistance to chemicals make it suitable for heavy-duty applications in the oil and gas industry, where pipes are often subjected to corrosive environments. This durability and resilience contribute to epoxy resins stronghold within the resin-type segment.

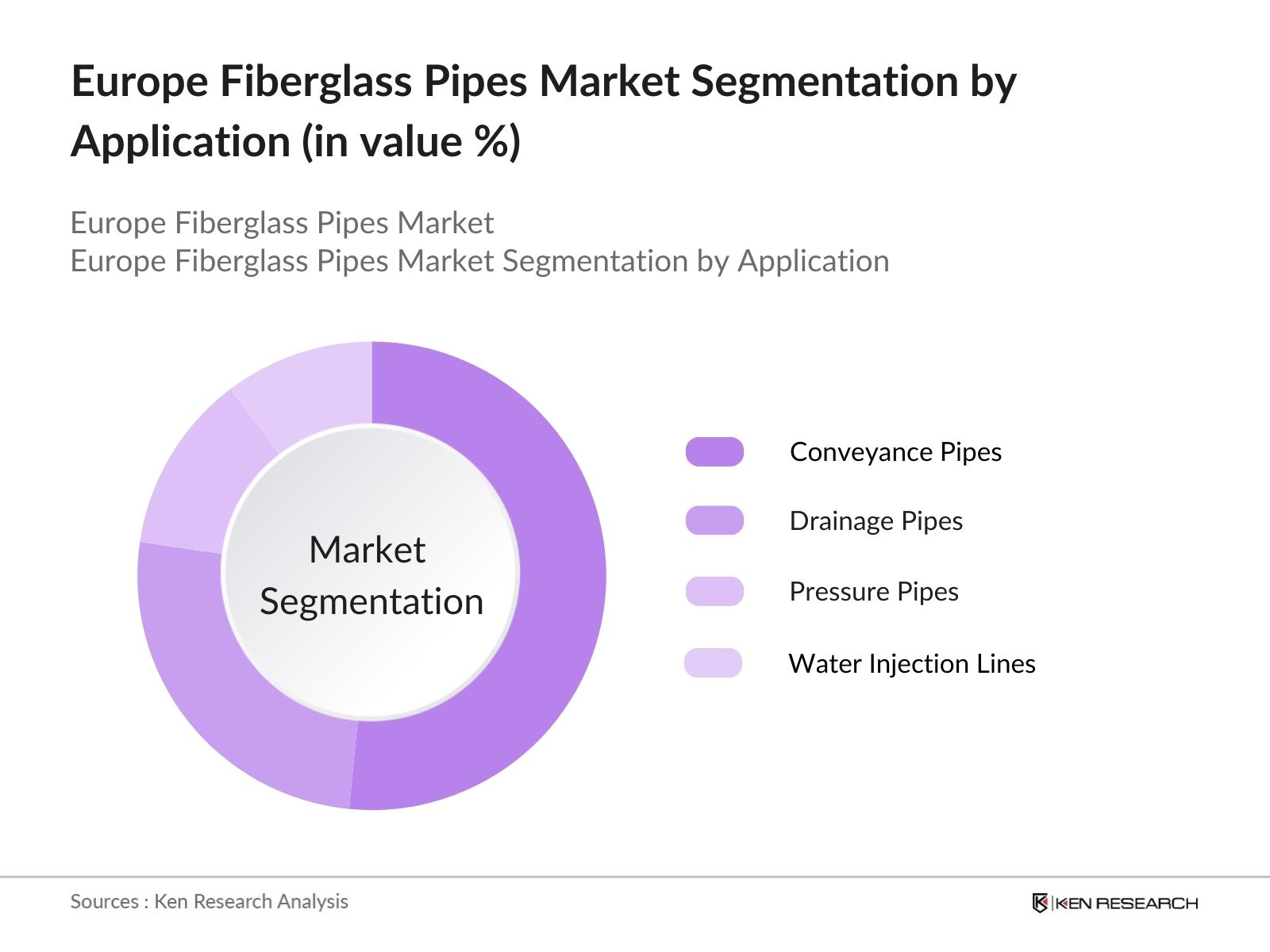

By Application: The market is segmented by application into Conveyance Pipes, Drainage Pipes, Pressure Pipes, and Water Injection Lines. Conveyance Pipes hold the largest market share due to their extensive use in transporting water and wastewater over long distances in municipalities and industrial plants. Their lightweight construction, combined with low maintenance needs, makes them highly cost-effective, aligning with the growing demand for sustainable and efficient water transportation solutions across Europe.

Europe Fiberglass Pipes Market Competitive Landscape

The Europe Fiberglass Pipes Market is primarily dominated by a few key players, including National Oilwell Varco, Future Pipe Industries, and Amiblu Holding. These companies have established a strong presence in the European market due to their technological expertise, extensive manufacturing capabilities, and investment in R&D.

Europe Fiberglass Pipes Market Analysis

Growth Drivers

- Infrastructure Development (Water & Sewage Applications): The European Union invested over 85 billion euros in 2024 for water infrastructure projects, with an estimated 35,000 kilometers of pipelines dedicated to municipal water and sewage systems. Fiberglass pipes, known for their corrosion resistance and lightweight features, have become essential in these projects, supporting governments' focus on long-term infrastructure resilience.

- Industrial Pipeline Expansion (Oil & Gas, Chemicals): Industrial pipeline expansion across Europe has seen a surge, with over 10,000 new kilometers of pipelines planned or under construction as of 2024 in the oil and gas sector. The demand for durable materials like fiberglass pipes has increased, especially as industries seek to avoid corrosion-related issues, which cost the sector approximately 15 billion euros annually.

- Environmental Regulations (Emissions and Waste Management): The European Commission allocated over 120 billion euros in 2024 toward reducing emissions and managing industrial waste, focusing on replacing metal pipes with fiberglass ones to prevent leakage and environmental hazards. Fiberglass pipes align with eco-friendly compliance and help reduce carbon footprints by over 20% compared to traditional materials.

Market Challenges

- Competition from Alternative Materials (Steel, PVC): The steel and PVC industries in Europe produce approximately 50 million tons annually, posing a challenge for fiberglass pipes. Both materials remain dominant in sectors where they offer cost advantages or meet specific regulatory standards, impacting the market share of fiberglass alternatives in key applications.

- Cost of Installation and Maintenance: With fiberglass pipes requiring specialized installation techniques, the initial setup costs can range from 20,000 to 50,000 euros per kilometer, depending on pipe diameter and application. These expenses, especially for large-scale industrial projects, continue to be a deterrent despite the long-term durability benefits of fiberglass.

Europe Fiberglass Pipes Market Future Outlook

Over the next five years, the Europe Fiberglass Pipes Market is expected to experience substantial growth, driven by investments in sustainable infrastructure, particularly in water management and industrial applications. Technological advancements, combined with an increasing focus on reducing carbon footprints, will further stimulate demand for fiberglass pipes as companies shift towards durable, eco-friendly solutions. As major economies in Europe continue to emphasize regulatory standards for sustainable construction materials, fiberglass pipes are positioned to see increased adoption across various industries.

Market Opportunities

- Adoption in Emerging Markets: Several European manufacturers are expanding into Eastern European markets, where pipeline projects are estimated to total 12,000 kilometers through 2025. These regions are prioritizing fiberglass pipes for water management and industrial projects, creating substantial growth potential for companies expanding beyond the EU.

- Growing Demand for Lightweight Materials: Demand for lightweight, durable materials is increasing, with Europes construction and water sectors investing approximately 40 billion euros in 2024. Fiberglass pipes, due to their 75% weight reduction compared to steel, fulfill industry needs for ease of transportation and installation, particularly in remote or challenging terrain.

Products

Key Target Audience

Construction and Engineering Companies

Oil and Gas Corporations

Water Treatment Facilities

Municipal Water and Sewage Authorities

Chemical Processing Companies

Manufacturers and Distributors of Industrial Equipment

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., European Environment Agency, Germanys Federal Waterways Engineering and Research Institute)

Companies

Players Mentioned in the Report:

National Oilwell Varco, Inc.

Future Pipe Industries

Amiblu Holding GmbH

Fibrex Corporation

Saudi Arabian Amiantit Co.

Hobas Pipe USA

Hengrun Group Co., Ltd.

Graphite India Limited

Enduro Composites

Composite Pipes Industry LLC

Table of Contents

1. Europe Fiberglass Pipes Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Dynamics Overview

1.4 Market Segmentation Overview

2. Europe Fiberglass Pipes Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Technological Milestones

3. Europe Fiberglass Pipes Market Analysis

3.1 Growth Drivers

3.1.1 Infrastructure Development (Water & Sewage Applications)

3.1.2 Industrial Pipeline Expansion (Oil & Gas, Chemicals)

3.1.3 Environmental Regulations (Emissions and Waste Management)

3.1.4 Advancements in Manufacturing Techniques

3.2 Market Challenges

3.2.1 Competition from Alternative Materials (Steel, PVC)

3.2.2 Cost of Installation and Maintenance

3.2.3 Industry-Specific Regulatory Constraints

3.3 Opportunities

3.3.1 Adoption in Emerging Markets

3.3.2 Growing Demand for Lightweight Materials

3.3.3 Expansion into New Industrial Applications

3.4 Trends

3.4.1 Increase in Offshore Applications

3.4.2 Enhanced Durability Solutions

3.4.3 Increased Use in Chemical Processing

3.5 Regulatory Landscape

3.5.1 EU Environmental Standards

3.5.2 Water Resource Management Policies

3.5.3 Cross-Border Pipeline Regulatory Requirements

3.6 SWOT Analysis

3.7 Ecosystem Analysis

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. Europe Fiberglass Pipes Market Segmentation

4.1 By Resin Type (In Value %)

4.1.1 Epoxy Resin

4.1.2 Polyester Resin

4.1.3 Vinyl Ester Resin

4.2 By Diameter (In Value %)

4.2.1 Small Diameter (Under 10 inches)

4.2.2 Medium Diameter (10-24 inches)

4.2.3 Large Diameter (Above 24 inches)

4.3 By End-User Industry (In Value %)

4.3.1 Oil & Gas

4.3.2 Chemicals & Petrochemicals

4.3.3 Water Treatment

4.3.4 Power Generation

4.3.5 Sewage & Sanitation

4.4 By Application (In Value %)

4.4.1 Conveyance Pipes

4.4.2 Drainage Pipes

4.4.3 Pressure Pipes

4.4.4 Water Injection Lines

4.5 By Country (In Value %)

4.5.1 Germany

4.5.2 France

4.5.3 Italy

4.5.4 United Kingdom

4.5.5 Spain

4.5.6 Rest of Europe

5. Europe Fiberglass Pipes Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 National Oilwell Varco, Inc.

5.1.2 Future Pipe Industries

5.1.3 Amiblu Holding GmbH

5.1.4 Fibrex Corporation

5.1.5 Saudi Arabian Amiantit Co.

5.1.6 Hobas Pipe USA

5.1.7 Hengrun Group Co., Ltd.

5.1.8 Graphite India Limited

5.1.9 Enduro Composites

5.1.10 Composite Pipes Industry LLC

5.1.11 Ershigs, Inc.

5.1.12 Lianyungang Zhongfu Lianzhong Composites Group Co.

5.1.13 Ashland Global Holdings Inc.

5.1.14 Shawcor Ltd.

5.1.15 FiberTech Composite Pvt. Ltd.

5.2 Cross Comparison Parameters (Revenue, Market Share, Regional Reach, Product Portfolio, Technological Capabilities, Manufacturing Footprint, Key Clients, R&D Investments)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers And Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants and Subsidies

5.9 Private Equity Investments

6. Europe Fiberglass Pipes Market Regulatory Framework

6.1 Industry Standards (EN, ISO, ASTM)

6.2 Compliance Requirements

6.3 Certification Processes

7. Europe Fiberglass Pipes Future Market Size (In USD Bn)

7.1 Market Size Projections

7.2 Key Factors Driving Future Growth

8. Europe Fiberglass Pipes Future Market Segmentation

8.1 By Resin Type (In Value %)

8.2 By Diameter (In Value %)

8.3 By End-User Industry (In Value %)

8.4 By Application (In Value %)

8.5 By Country (In Value %)

9. Europe Fiberglass Pipes Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Segment Analysis

9.3 Marketing Strategies

9.4 White Space Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research process begins with mapping the ecosystem of stakeholders within the Europe Fiberglass Pipes Market. Through desk research and secondary databases, we gather comprehensive data on industry-level trends and market drivers. This step ensures the accurate identification of variables impacting market growth.

Step 2: Market Analysis and Construction

In this stage, historical data on market size, technological adoption, and industry expansion are analyzed. Factors such as production capacity, adoption rates across industries, and revenue generation are assessed to refine the segmentation of the market.

Step 3: Hypothesis Validation and Expert Consultation

To validate the market data, structured interviews with industry experts are conducted. These insights from stakeholders and specialists help ensure the accuracy and relevance of the data collected, providing a solid foundation for market estimations.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing data from manufacturers and suppliers across the fiberglass pipe supply chain. This ensures a comprehensive perspective, verified by bottom-up and top-down approaches, to provide an accurate assessment of the market dynamics.

Frequently Asked Questions

01. How big is the Europe Fiberglass Pipes Market?

The Europe Fiberglass Pipes Market is valued at USD 950 million, driven by high demand from industries like oil and gas, water treatment, and chemical processing, which require durable and corrosion-resistant piping solutions.

02. What are the main challenges in the Europe Fiberglass Pipes Market?

Challenges in the Europe Fiberglass Pipes Market include competition from alternative materials like steel and PVC, high installation costs, and strict compliance requirements across different European regions, impacting overall market adoption.

03. Which companies lead the Europe Fiberglass Pipes Market?

Leading players in the Europe Fiberglass Pipes Market include National Oilwell Varco, Future Pipe Industries, and Amiblu Holding, all known for their technological expertise and established manufacturing networks across Europe.

04. What are the key growth drivers of the Europe Fiberglass Pipes Market?

Growth in this Europe Fiberglass Pipes Market is primarily driven by infrastructure development, increasing industrial adoption of corrosion-resistant materials, and regulatory emphasis on sustainable water and wastewater management.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.