Europe Flexible Electronics Market Outlook to 2030

Region:Europe

Author(s):Paribhasha Tiwari

Product Code:KROD2380

October 2024

93

About the Report

Europe Flexible Electronics Market Overview

- In 2023, the European flexible electronics market was valued at USD 9.05 billion. This market expansion is primarily driven by the rising adoption of wearable devices, smart automotive solutions, and flexible healthcare electronics. The increasing integration of flexible displays, sensors, and batteries into consumer electronics and automotive industries are fueling this growth

- The market is dominated by key players such as Samsung Electronics, LG Electronics, 3M, AU Optronics, and Blue Spark Technologies. These companies have significantly invested in research and development to introduce innovative solutions in flexible displays, batteries, and sensors for diverse industries including healthcare and automotive

- In 2023, LG Electronics expanded its flexible display technology for the automotive sector, partnering with European automakers to integrate flexible OLED displays into next-generation electric vehicles. This development, aimed at enhancing infotainment and in-car communication systems, is expected to drive significant demand in 2024. The expansion of the flexible electronics market in automotive applications is seen as a critical driver for the upcoming years

- Germany, the United Kingdom, and France dominate the market, with Germany leading due to its well-established automotive industry. The UK is a major contributor thanks to its advanced aerospace and defense sectors, while France shows significant growth in healthcare applications. These regions are hubs for R&D activities and have a strong industrial base, further supported by government funding and private sector investments.

Europe Flexible Electronics Market Segmentation

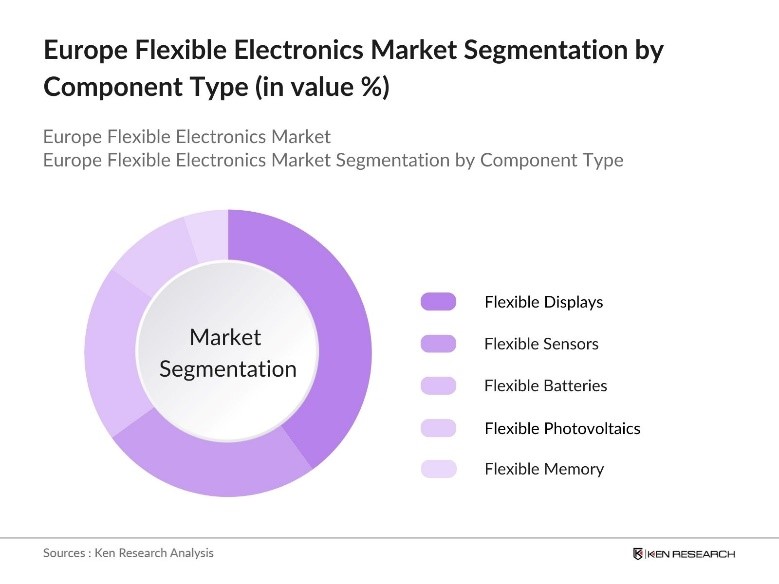

By Component: The Europe flexible electronics market is segmented by component into flexible displays, flexible sensors, flexible batteries, flexible memory, and flexible photovoltaics. In 2023, flexible displays held the dominant market share, driven by their adoption in consumer electronics, such as smartphones, and automotive infotainment systems. Companies like Samsung and LG lead in flexible OLED displays, which are preferred for their durability and energy efficiency.

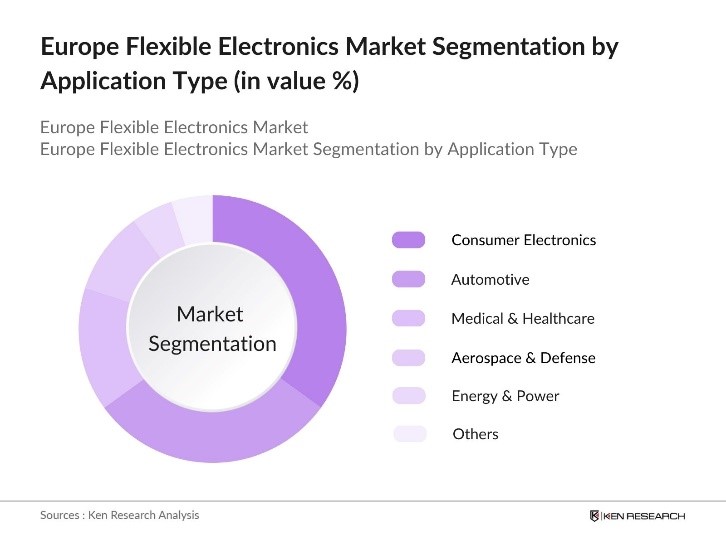

By Application: Flexible electronics in Europe are segmented into consumer electronics, medical & healthcare, automotive, aerospace & defense, energy & power, and others. Consumer electronics lead the market due to the high demand for smartphones and wearable devices. The automotive sector is also expanding rapidly, with flexible components becoming integral to the design of electric vehicles.

By Region: The market is segmented by region into Germany, United Kingdom, France, Italy and rest of Europe. Germany dominates the market, primarily due to its robust automotive sector. The country is heavily investing in flexible sensors, displays, and battery technologies, which are integral to electric and autonomous vehicles, positioning Germany as the leader in this segment.

Europe Flexible Electronics Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|---|---|---|

|

Samsung Electronics |

1969 |

Suwon, South Korea |

|

LG Electronics |

1958 |

Seoul, South Korea |

|

3M |

1902 |

Saint Paul, USA |

|

Blue Spark Technologies |

2003 |

Ohio, USA |

|

AU Optronics |

1996 |

Hsinchu, Taiwan |

- Samsung Electronics continues to expand its flexible display business in Europe, partnering with leading automotive manufacturers to develop OLED dashboards for next-generation electric vehicles in 2023. This partnership is expected to enhance user interface technology within the automotive industry.

- 3M made significant investments in the European healthcare sector in 2023, expanding its flexible medical device offerings. Their innovations focus on disposable flexible sensors for continuous health monitoring, a rapidly growing segment. The company announced an investment of $146 million aimed at enhancing its manufacturing facilities in Europe, which includes the addition of 60 full-time positions.

Europe Flexible Electronics Market Analysis

Growth Drivers

- Rising Demand for Wearable Devices and Smart Electronics: The demand for wearable devices, such as fitness trackers, smartwatches, and healthcare sensors, has significantly increased in Europe. In 2024, the wearable device sector is expected to contribute $12 billion to the consumer electronics market in Europe. This demand is primarily fueled by health-conscious consumers and advancements in miniaturized electronics. The integration of flexible displays and sensors in wearables has become a key driver of growth in the flexible electronics market.

- Automotive Industry Adoption of Flexible Electronics: Europe's automotive industry is pushing the adoption of flexible electronics for in-vehicle applications, such as OLED dashboards, flexible sensors for real-time monitoring, and battery management systems. In 2024, over 50% of European automakers will incorporate flexible electronics into electric and autonomous vehicles. Germany and France are leading the charge, with the German automotive market alone expected to spend $8 billion on electronic components by 2025.

- Increased Government Investments in Green Technologies: The European Union has ramped up investments in green technologies as part of the European Green Deal. In 2024, 1.8 billion is allocated for research and development in renewable energy technologies, including flexible photovoltaics. This push toward sustainable electronics is driving demand for flexible photovoltaics, which are being integrated into smart city projects and energy-efficient buildings.

Challenges

- High Production Costs for Flexible Components: Despite technological advancements, the production of flexible electronics remains expensive, particularly for components like flexible displays and batteries. Manufacturing costs are expected to remain high in 2024 due to the complex materials and fabrication processes involved. European manufacturers face competitive pressure from Asia, where production costs are significantly lower, challenging the cost-efficiency of flexible electronics.

- Limited Standardization and Interoperability: A key challenge in the flexible electronics market is the lack of standardized protocols across industries. In 2024, the lack of interoperability between flexible electronic components and existing systems in sectors like automotive and healthcare creates barriers to adoption. This challenge is compounded by fragmented regulations across European countries, leading to slow market penetration

Government Initiatives

- Germany's National Strategy for Microelectronics: The German government announced a 1.2 billion investment in its National Strategy for Microelectronics in 2023. This strategy prioritizes the development of flexible electronics, especially in the automotive and healthcare sectors. By 2025, Germany aims to lead Europe in the production of flexible displays and sensors, with a focus on sustainability and energy efficiency.

- United Kingdoms Aerospace Technology Institute (ATI) Program: The UK governments Aerospace Technology Institute (ATI) program, which continues into 2024, is investing 685 million in flexible electronics for aerospace applications. This initiative supports the development of flexible displays and sensors for cockpit controls, as well as lightweight, flexible communication systems for unmanned aerial vehicles (UAVs). The ATI aims to enhance the competitiveness of the UKs aerospace industry through these innovations.

Europe Flexible Electronics Market Future Outlook

The Europe Flexible Electronics Market is projected to grow exponentially in the future. This growth will be driven by rising demand for wearable devices and smart electronics, automotive industry adoption of flexible electronics and increased government investments in green technologies.

Future Trends

- Flexible Electronics to Revolutionize Electric Vehicles: By 2028, flexible electronics are expected to be an integral part of electric vehicles in Europe, driven by the automotive industrys shift towards lightweight, energy-efficient components. Flexible displays, sensors, and energy storage solutions will be extensively integrated into vehicle interiors and exteriors, enhancing real-time monitoring, connectivity, and driver experience.

- Growth in Flexible Medical Devices for Remote Healthcare: The healthcare industry will witness rapid growth in flexible electronics applications by 2028, particularly in remote patient monitoring and telemedicine. Flexible biosensors and wearable devices will dominate the European market, enabling real-time diagnostics and remote healthcare services. In the near future, European healthcare facilities are expected to adopt these devices, significantly improving patient care in rural and underserved areas.

Scope of the Report

|

By Component |

Flexible Displays Flexible Sensors Flexible Batteries Flexible Memory Flexible Photovoltaics |

|

By Application |

Consumer Electronics Medical & Healthcare Automotive Aerospace & Defense Energy & Power Others |

|

By Region |

Germany United Kingdom France Italy Rest Of Europe. |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Automotive Manufacturers

Consumer Electronics Companies

Healthcare Device Manufacturers

Renewable Energy Providers

Defense and Aerospace Companies

Smart Wearable Companies

Government and Regulatory Bodies (e.g., European Commission)

Investors and Venture Capitalist Firms

Companies

Players mentioned in the report:

Samsung Electronics

LG Electronics

AU Optronics

Fujikura Ltd

Flex Ltd

Sony Corporation

Panasonic

Enfucell Oy

Flexpoint Sensor Systems Inc

Table of Contents

1. Europe Flexible Electronics Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy (Technology, Applications, End-Use Industries)

1.3 Market Growth Rate and Analysis

1.4 Overview of Key Segments (Applications, Technology, Geography)

2. Europe Flexible Electronics Market Size and Financial Analysis

2.1 Historical Market Size (Revenue)

2.2 Year-on-Year Market Growth Analysis

2.3 Key Financial Metrics (Profit Margins, Revenue Growth, Investments)

2.4 Key Milestones and Developments (Acquisitions, Mergers, Product Launches)

3. Europe Flexible Electronics Market-Key Market Dynamics

3.1 Growth Drivers

3.1.1 Increasing Demand for Wearables (Healthcare, Fitness Devices)

3.1.2 Adoption in Electric and Autonomous Vehicles (Flexible Sensors, Displays)

3.1.3 Government Investments in Renewable Energy (Flexible Photovoltaics)

3.2 Market Restraints

3.2.1 High Production Costs of Flexible Electronics

3.2.2 Technological Integration Challenges (Complexities in Manufacturing)

3.2.3 Limited Standardization Across Regions

3.3 Market Opportunities

3.3.1 Growing Applications in Medical Devices (Non-Invasive Biosensors)

3.3.2 Expansion in Smart Packaging (Food and Pharmaceutical)

3.3.3 Integration in Smart Cities (Energy-Efficient Infrastructure)

3.4 Market Trends

3.4.1 Flexible Electronics in Aerospace and Defense (Lightweight Communication Devices)

3.4.2 Advancements in Flexible Batteries (Extended Device Lifespan)

3.4.3 Increased Use in IoT Devices and Smart Homes

4. Government Initiatives and Regulatory Framework

4.1 EU Green Deal Initiatives Supporting Flexible Electronics

4.2 Horizon Europe Program Funding for Flexible Electronics

4.3 Country-Specific Initiatives (Germany, UK, France)

4.4 Compliance and Standards for Flexible Electronics Manufacturing

5. Europe Flexible Electronics Market SWOT Analysis

5.1 Strengths (Technological Innovation, Government Support)

5.2 Weaknesses (High Costs, Limited Manufacturing Scale)

5.3 Opportunities (Green Energy Solutions, Wearables)

5.4 Threats (Supply Chain Issues, Material Shortages)

6. Europe Flexible Electronics Market Competitive Landscape

6.1 Major Market Players and Company Profiles

6.1.1 Samsung Electronics (Flexible Display Innovation)

6.1.2 LG Electronics (Flexible OLED Development)

6.1.3 AU Optronics (Automotive Flexible Electronics)

6.1.4 Blue Spark Technologies (Healthcare Applications)

6.1.5 3M (Flexible Medical Sensors)

6.2 Market Share Analysis (Revenue, Operational Metrics)

6.3 Strategic Initiatives (Product Launches, Mergers, Partnerships)

6.4 Investment and Funding Landscape (Venture Capital, Government Grants)

6.5 Market Penetration Strategies (Distribution Channels, Pricing Models)

7. Europe Flexible Electronics Market Segmentation

7.1 By Component (Value %)

1. Flexible Displays

2. Flexible Batteries

3. Flexible Sensors

4. Flexible Photovoltaics

5. Flexible Memory

7.2 By Application (Value %)

1. Consumer Electronics

2. Automotive

3. Aerospace and Defense

4. Medical and Healthcare

5. Energy and Power

7.3 By Region (Value %)

1. Germany

2. United Kingdom

3. France

4. Italy

5. Rest of Europe

8. Cross-Comparative Analysis of Key Players

8.1 Comparative Financials

8.2 Operational Efficiency

8.3 Technological Innovation

8.4 Strategic Expansion

9. Europe Flexible Electronics Market Projections and Future Trends

9.1 Market Size Projections: Revenue

9.2 Key Future Trends

10. Investment Analysis and Capital Landscape

10.1 Venture Capital Investments in Flexible Electronics

10.2 Government Grants and Funding Opportunities: EU Green Deal

10.3 Private Equity Investments: Key Sectors and Players

11. Analysts' Recommendations

11.1 TAM/SAM/SOM Analysis

11.2 Product Differentiation and Positioning Strategies

11.3 Market Entry Strategies for New Players

11.4 Key Strategic Partnerships and Collaborations for Growth

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping out the ecosystem of the Europe flexible electronics market by identifying key stakeholders such as OEMs, technology providers, and logistics operators. Extensive desk research, supported by secondary databases, is used to pinpoint critical factors influencing the market.

Step 2: Market Analysis and Construction

This step entails a thorough analysis of historical data and current market penetration. Special attention is given to the relationship between electronics and industrial growth, particularly in high-demand sectors like e-commerce and consumer products.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through consultations with industry experts from key electronic companies. These interviews provide practical insights and operational details that help refine our market models and projections.

Step 4: Research Synthesis and Final Output

The final stage synthesizes all gathered data into a comprehensive market report. Further interactions with electronic manufacturers ensure the accuracy of sales and product segment data, solidifying our final output.

Frequently Asked Questions

1. How big is the Europe Flexible Electronics Market?

The Europe flexible electronics market was valued at approximately USD 9.05 billion in 2023. The market's growth is driven by increasing demand for wearable devices, automotive applications, and advancements in flexible displays, sensors, and energy-efficient components.

2. What are the challenges in the Europe Flexible Electronics Market?

Challenges in the Europe flexible electronics market include high production costs, supply chain disruptions, and material shortages, particularly of indium tin oxide and conductive polymers. Additionally, the lack of standardization across European countries hinders seamless integration of flexible electronics technologies.

3. Who are the major players in the Europe Flexible Electronics Market?

Key players in the Europe flexible electronics market include Samsung Electronics, LG Electronics, Blue Spark Technologies, 3M, and AU Optronics. These companies dominate the market through innovation in flexible displays, sensors, and medical applications.

4. What are the growth drivers of the Europe Flexible Electronics Market?

The market is propelled by rising demand for flexible electronics in wearables, the automotive sectors shift toward electric and autonomous vehicles, and government investments in green technologies such as flexible photovoltaics for renewable energy applications.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.