Europe Food Market Outlook to 2030

Region:Europe

Author(s):Sanjna

Product Code:KROD3033

December 2024

90

About the Report

Europe Food Market Overview

- The Europe food market is valued at USD 1995 billion, driven by rising consumer demand for healthier, sustainable food options. This growth is bolstered by government initiatives supporting local food production and stringent food safety regulations, making Europe one of the most regulated food markets globally. The demand for organic, plant-based, and minimally processed food is a key driver, as consumers shift towards healthier eating habits.

- Countries such as France, Germany, and Italy dominate the Europe food market due to their robust agricultural industries, well-established food production systems, and high consumer demand for diverse food products. These countries are known for their innovative approaches in food technology, making them leaders in food export and processing. Their dominance is also attributed to strong government support in food safety and sustainability initiatives.

- The European Union has some of the strictest food safety standards in the world, governed by the European Food Safety Authority (EFSA). In 2023, new regulations were introduced to ensure better food traceability, requiring all food businesses to provide detailed information on the origin and safety of their products. These regulations have led to increased adoption of blockchain technology in the food supply chain, allowing for real-time tracking of food products from farm to table. Compliance with these standards is mandatory for any company wishing to sell food products within the EU.

Europe Food Market Segmentation

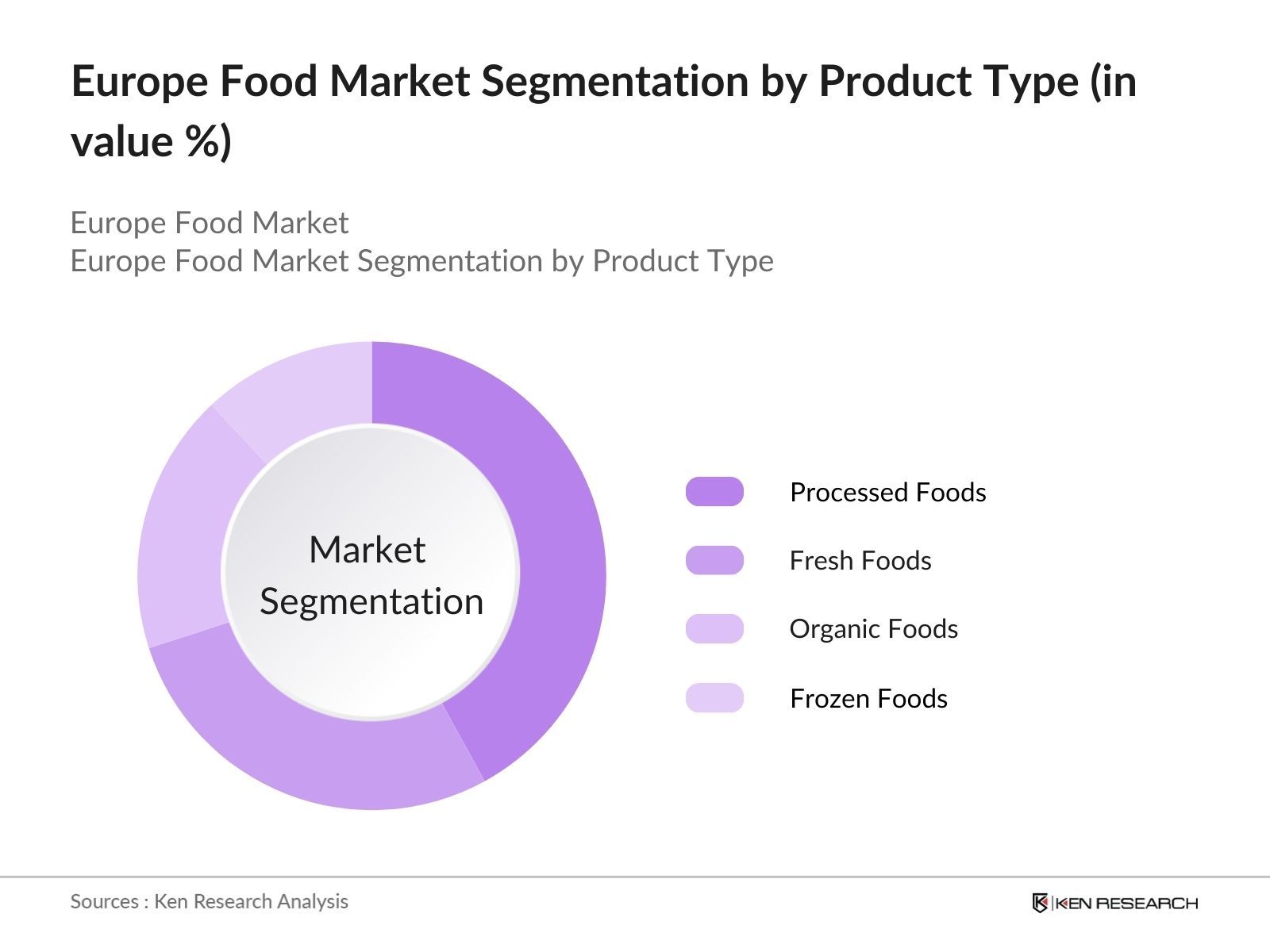

- By Product Type: The Europe food market is segmented by product type into processed foods, fresh foods, organic foods, and frozen foods. Processed foods, particularly ready-to-eat meals, are dominating the market due to their convenience and long shelf life. With the fast-paced lifestyle in urban regions, consumers increasingly prefer processed foods, contributing to their widespread adoption. Major players in this segment are continuously innovating with healthier versions to meet consumer demand for nutritious yet convenient options.

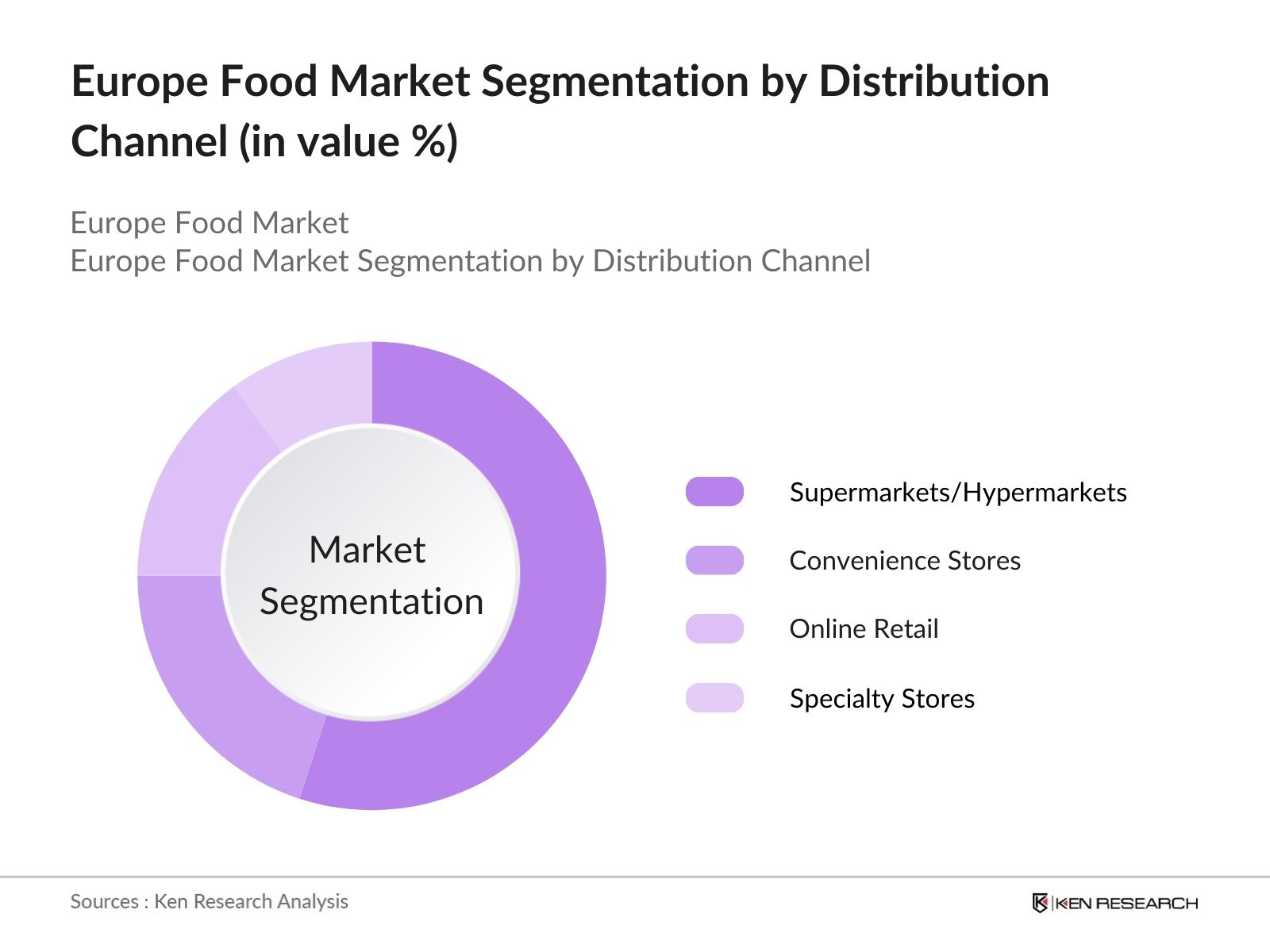

- By Distribution Channel: Europes food market is segmented by distribution channel into supermarkets/hypermarkets, convenience stores, online retail, and specialty stores. Supermarkets/hypermarkets dominate due to their extensive presence, wide product variety, and competitive pricing. In countries like the United Kingdom and Germany, supermarkets like Tesco and Aldi hold a major share, offering consumers both local and international food products. The integration of technology in these stores, such as self-checkouts and mobile payments, further strengthens their dominance.

Europe Food Market Competitive Landscape

The Europe food market is characterized by the presence of global giants and established local players. Leading companies focus on expanding their product portfolio to cater to changing consumer preferences and sustainable practices. The market is highly competitive, with companies competing on innovation, sustainability, and marketing strategies.

|

Company |

Established |

Headquarters |

No. of Employees |

Revenue (USD bn) |

Product Portfolio |

R&D Investment |

Sustainability Initiatives |

Market Share |

Key Regions |

|

Nestl S.A. |

1867 |

Switzerland |

- |

- |

- |

- |

- |

- |

- |

|

Unilever PLC |

1929 |

United Kingdom |

- |

- |

- |

- |

- |

- |

- |

|

Danone S.A. |

1919 |

France |

- |

- |

- |

- |

- |

- |

- |

|

Mondelez International |

1923 |

USA |

- |

- |

- |

- |

- |

- |

- |

|

Arla Foods Amba |

2000 |

Denmark |

- |

- |

- |

- |

- |

- |

- |

Europe Food Market Analysis

Growth Drivers

- Consumer Preferences: European consumers are increasingly focusing on healthy, organic, and locally sourced products. As of 2023, approximately 67% of consumers in Europe are choosing organic products over conventional ones due to health concerns and environmental sustainability. The rise in vegetarianism and veganism is also contributing to a shift in dietary preferences, leading to a surge in demand for plant-based alternatives.

- Sustainable Sourcing: Sustainable sourcing has become a key driver for the European food market as environmental concerns increase. In 2022, the EU implemented stricter guidelines on sustainable farming practices, resulting in 25% of all agricultural land in Europe being utilized for organic farming, a significant increase from the previous decade. The push for sustainability is supported by the EUs Common Agricultural Policy (CAP), which allocated over USD 431.6 billion between 2021 and 2027 to promote environmental sustainability in agriculture. This allocation has accelerated the adoption of sustainable sourcing practices across Europe.

- Technological Advancements: The European food market is benefiting from rapid technological advancements, particularly in precision farming and food processing. In 2023, the European Commissions Horizon Europe program invested USD 105.3 billion in research and innovation, a portion of which was directed towards the agri-food sector. Technologies such as blockchain, AI, and IoT are being implemented to improve traceability and food safety. Additionally, precision farming technologies have led to an increase in crop yields by as much as 15% in some EU countries, boosting productivity while maintaining sustainable farming practices.

Challenges

- Supply Chain Disruptions: Supply chain disruptions continue to challenge the European food market. Ukraine is a major grain producer, accounting for significant shares of global wheat, corn, and barley markets. Before the war, it exported over 60 million tons of grain annually, representing about10% of global wheat exportsand15% of corn exports. This disruption has caused significant price fluctuations in raw materials and impacted food production, particularly in Eastern European countries.

- High Operational Costs: High operational costs are a significant barrier to growth in the European food market. Rising energy costs, which surged by 28% across the EU in 2022, have impacted food production and logistics. In 2023, the minimum wage in several EU countries, including Germany and France, increased by 5%, adding to operational costs. These combined factors are pushing up the overall cost structure for food producers, limiting profit margins and increasing consumer prices.

Europe Food Market Future Outlook

Europe food market is expected to experience steady growth driven by a combination of factors such as growing consumer awareness of sustainability, rising demand for organic and plant-based products, and increased investment in food technology. Additionally, government regulations on food safety and sustainability will play a significant role in shaping the future market landscape, encouraging food producers to adopt innovative and eco-friendly practices.

Market Opportunities

- Plant-Based Foods: The plant-based food sector is experiencing robust growth in Europe, driven by shifting consumer preferences towards healthier, more sustainable options. In 2023, plant-based food sales across the EU reached USD 6.4 billion, reflecting a growing demand for meat and dairy alternatives. The European Union has been promoting plant-based diets as part of its Farm to Fork Strategy, which aims to reduce greenhouse gas emissions from agriculture. Additionally, advancements in food technology, such as cultured meat and precision fermentation, are opening new avenues for the expansion of plant-based products.

- Health & Wellness Trends: The health and wellness trend continues to present significant opportunities for the European food market. As of 2022, more than 60% of European consumers were actively seeking healthier food options, according to Eurostat. The demand for functional foods, which offer additional health benefits such as probiotics or fortified nutrients, has been increasing. In response, food manufacturers are innovating with products that support immunity, digestive health, and mental well-being.

Scope of the Report

|

Segments |

Sub-Segments |

|

By Product Type |

Processed Foods Fresh Foods Organic Foods Frozen Foods Ready-to-Eat Meals |

|

By Distribution Channel |

Supermarkets/Hypermarkets Convenience Stores Online Retail Specialty Stores Direct to Consumer (DTC) |

|

By Consumer Group |

Retail Consumers Foodservice Industry Institutional Buyers |

|

By Processing Technology |

Traditional Processing High-Pressure Processing Cold Chain Logistics Modified Atmosphere Packaging |

|

By Region |

United Kingdom Germany France Italy Spain |

Products

Key Target Audience

Food Manufacturers

E-commerce Platforms (Amazon, Ocado)

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (EU Food Safety Authority)

Organic and Sustainable Food Brands

Packaging and Supply Chain Companies

Technology Providers (for food production and packaging innovation)

Companies

Players Mentioned in the Report

Nestl S.A.

Unilever PLC

Danone S.A.

Mondelez International

Arla Foods Amba

Glanbia PLC

Heineken N.V.

Lactalis International

General Mills Inc.

The Kraft Heinz Company

Table of Contents

1. Europe Food Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Europe Food Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Europe Food Market Analysis

3.1. Growth Drivers

3.1.1. Consumer Preferences

3.1.2. Sustainable Sourcing

3.1.3. Technological Advancements

3.1.4. E-commerce Growth

3.1.5. Regulatory Shifts

3.2. Market Challenges

3.2.1. Supply Chain Disruptions

3.2.2. High Operational Costs

3.2.3. Regulatory Compliance

3.2.4. Environmental Impact

3.3. Opportunities

3.3.1. Plant-Based Foods

3.3.2. Health & Wellness Trends

3.3.3. Private Label Expansion

3.3.4. Digital Transformation

3.4. Trends

3.4.1. Clean Label Movement

3.4.2. Local Sourcing

3.4.3. Organic Food Demand

3.4.4. Packaging Innovation

3.5. Government Regulation

3.5.1. EU Food Safety Standards

3.5.2. Import Tariffs

3.5.3. Labeling Requirements

3.5.4. Food Waste Management Regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Europe Food Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Processed Foods

4.1.2. Fresh Foods

4.1.3. Organic Foods

4.1.4. Frozen Foods

4.1.5. Ready-to-Eat Meals

4.2. By Distribution Channel (In Value %)

4.2.1. Supermarkets/Hypermarkets

4.2.2. Convenience Stores

4.2.3. Online Retail

4.2.4. Specialty Stores

4.2.5. Direct to Consumer (DTC)

4.3. By Consumer Group (In Value %)

4.3.1. Retail Consumers

4.3.2. Foodservice Industry

4.3.3. Institutional Buyers

4.4. By Processing Technology (In Value %)

4.4.1. Traditional Processing

4.4.2. High-Pressure Processing

4.4.3. Cold Chain Logistics

4.4.4. Modified Atmosphere Packaging

4.5. By Region (In Value %)

4.5.1. United Kingdom

4.5.2. Germany

4.5.3. France

4.5.4. Italy

4.5.5. Spain

5. Europe Food Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Nestl S.A.

5.1.2. Unilever PLC

5.1.3. Danone S.A.

5.1.4. Mondelez International, Inc.

5.1.5. The Kraft Heinz Company

5.1.6. Arla Foods Amba

5.1.7. Glanbia PLC

5.1.8. Heineken N.V.

5.1.9. Lactalis International

5.1.10. General Mills Inc.

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Market Share, Sustainability Initiatives, Regional Presence)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Europe Food Market Regulatory Framework

6.1. EU Food Safety Regulations

6.2. Compliance with EU Food Information Regulations

6.3. Certification and Labeling Requirements

6.4. Food Safety Modernization Initiatives

6.5. Packaging and Waste Management Regulations

7. Europe Food Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Europe Food Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Consumer Group (In Value %)

8.4. By Processing Technology (In Value %)

8.5. By Region (In Value %)

9. Europe Food Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research process begins by mapping the entire ecosystem of the Europe food market. Secondary sources such as industry reports, government data, and company financials are analyzed to identify key variables like market demand, regulatory frameworks, and consumer preferences that influence the market dynamics.

Step 2: Market Analysis and Construction

Historical data is collected to evaluate market penetration, assess product performance across segments, and identify shifts in consumer behavior. Proprietary databases are used to gather insights into market shares, distribution channels, and revenue generation.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on market trends and drivers are formed and validated through interviews with industry experts and representatives from leading food manufacturers. Their input provides practical insights, ensuring accuracy in market estimates and forecasts.

Step 4: Research Synthesis and Final Output

Finally, the data is synthesized into a comprehensive report, integrating inputs from all stakeholders. This phase includes validating data on product innovations, sustainability trends, and government regulations, ensuring the report reflects the most current market situation.

Frequently Asked Questions

01. How big is the Europe food market?

The Europe food market is valued at USD 1995 billion, driven by strong consumer demand for organic, plant-based, and minimally processed food options.

02. What are the challenges in the Europe food market?

Challenges in Europe food market include stringent food safety regulations, high operational costs, and disruptions in the supply chain due to geopolitical factors.

03. Who are the major players in the Europe food market?

Major players in Europe food market include Nestl, Unilever, Danone, Mondelez, and Arla Foods. These companies dominate through extensive product portfolios and strong distribution networks.

04. What are the growth drivers of the Europe food market?

Europe food market is driven by increasing demand for sustainable, organic, and plant-based foods, along with innovations in food processing and packaging technology.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.