Europe Food Service Market Outlook to 2030

Region:Europe

Author(s):Shreya Garg

Product Code:KROD9158

December 2024

84

About the Report

Europe Food Service Market Overview

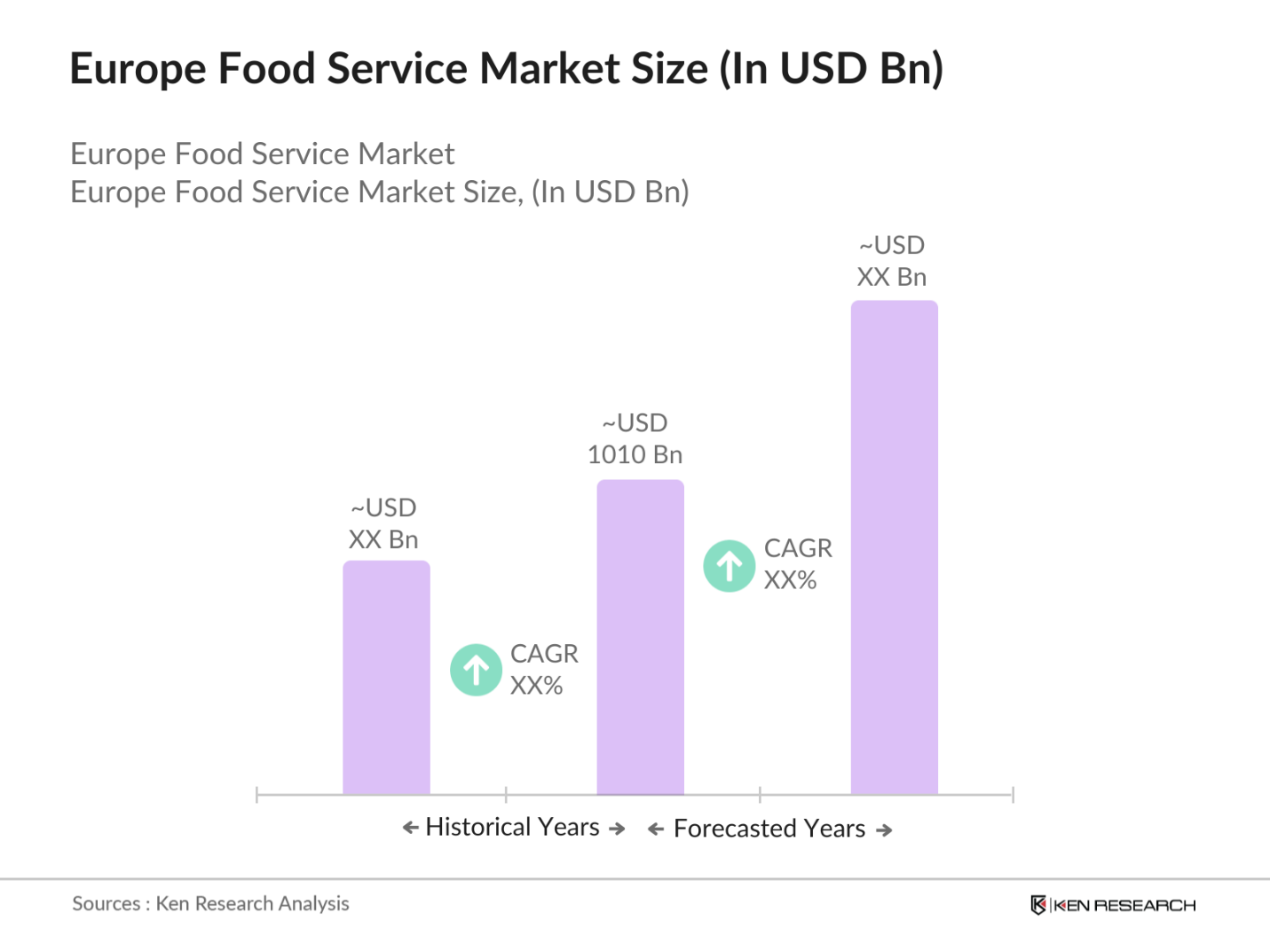

- The Europe food service market is valued at USD 1010 billion based on a five-year historical analysis. The market is driven primarily by the rise in consumer spending on dining out, growing demand for takeaway and delivery services, and technological innovations such as online food ordering and point-of-sale systems. Additionally, the rising popularity of healthier food options and eco-friendly practices within the sector has significantly contributed to market growth.

- Western Europe, led by countries such as France, Germany, and the UK, dominates the European food service market. These countries have well-established food service infrastructures, a high level of consumer dining-out culture, and significant international tourism, all of which contribute to their dominance. Their leadership in innovations, including sustainable food service practices and advanced food technology, also strengthens their position in the market.

- Food hygiene regulations in Europe are among the strictest in the world, with the European Food Safety Authority (EFSA) enforcing comprehensive standards for restaurant operations. In 2023, over 25,000 food service establishments were inspected for compliance, with significant penalties imposed for non-adherence. These regulations are designed to ensure the safety and quality of food served across the EU.

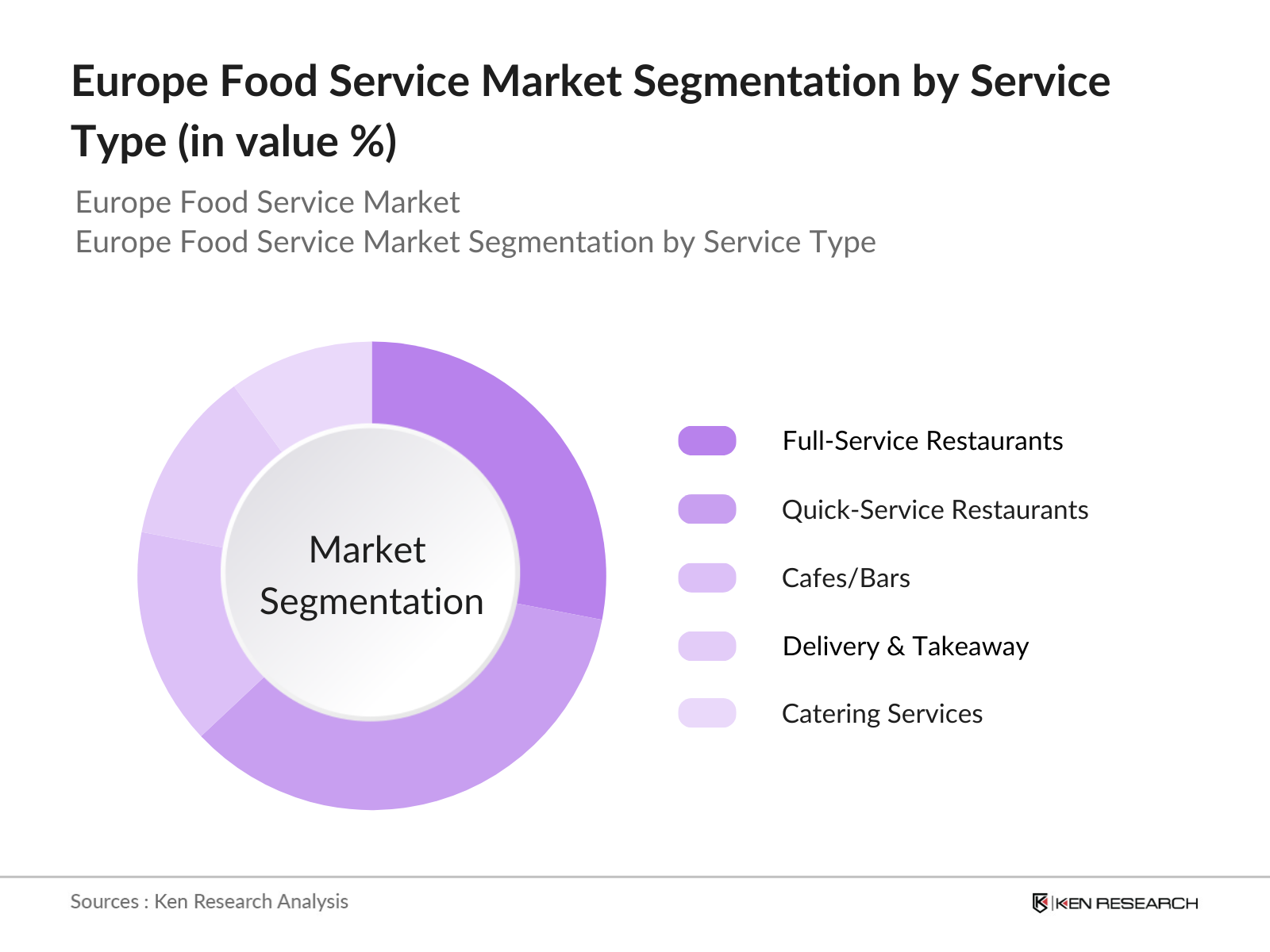

Europe Food Service Market Segmentation

By Service Type: The market is segmented by service type into Full-Service Restaurants (FSR), Quick-Service Restaurants (QSR), Cafes/Bars, Delivery & Takeaway, and Catering Services. Among these, Quick-Service Restaurants (QSR) hold the dominant market share in 2023 due to their rapid expansion and affordability, which aligns with the increasing consumer demand for fast and convenient dining options. Leading QSR brands such as McDonald's and Burger King have established extensive networks across Europe, contributing to their prominence. Furthermore, the rise of food delivery platforms has strengthened QSR's position by offering quick, digitally enabled services.

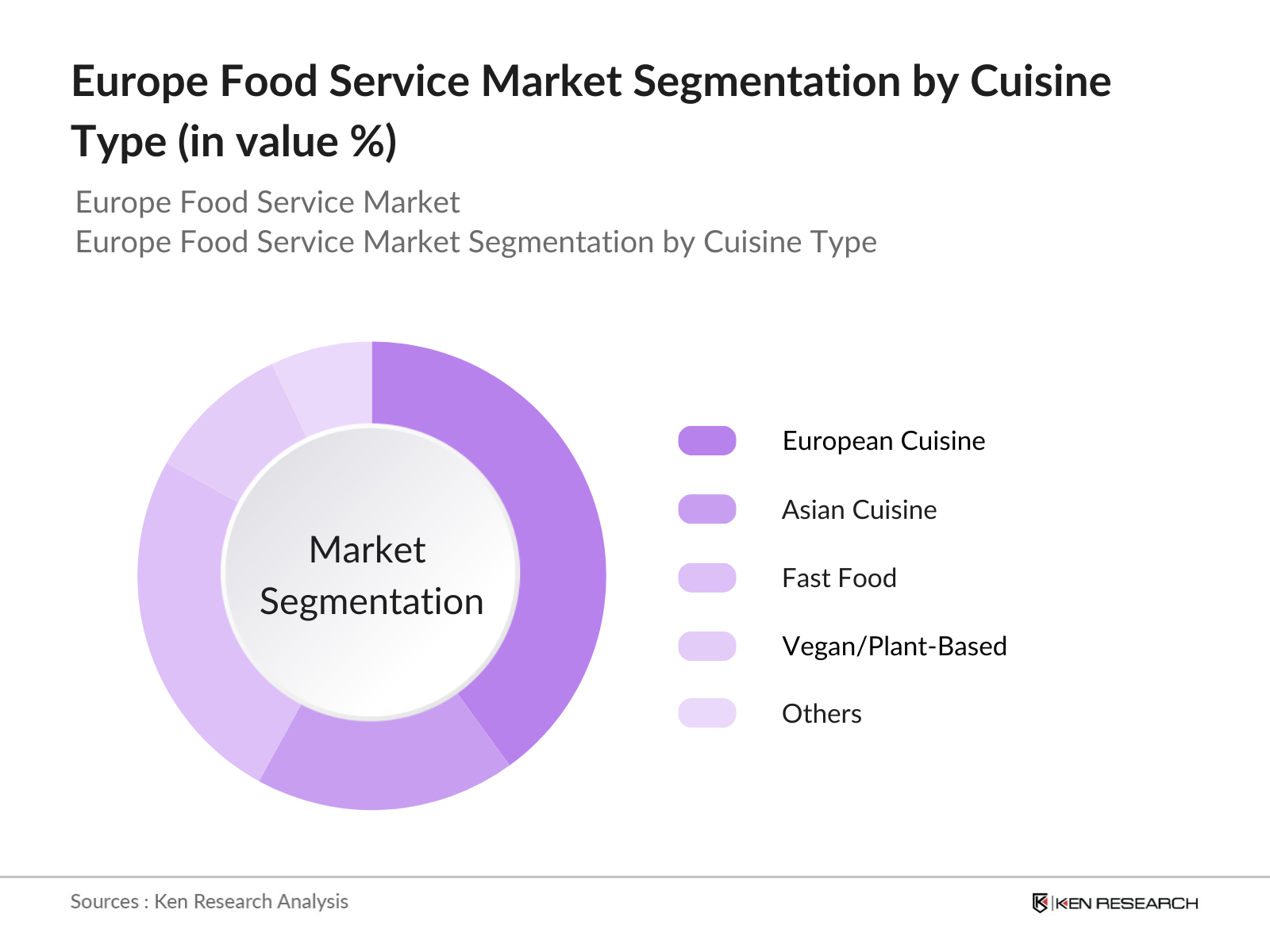

By Cuisine Type: The market is segmented by cuisine type into European Cuisine, Asian Cuisine, Fast Food, Vegan/Plant-Based, and Others. European cuisine dominates the market share due to its deep cultural integration and the growing demand for authentic, locally sourced dishes. Traditional European dining experiences, combined with the influence of Michelin-starred restaurants in cities like Paris, Rome, and Barcelona, bolster the popularity of this segment. Additionally, local sourcing and farm-to-table initiatives have increased the appeal of European cuisine, reinforcing its dominance in the market.

Europe Food Service Market Competitive Landscape

The Europe food service market is dominated by a mix of global and regional players, ranging from large multinational chains to local eateries. This competitive landscape highlights the key role of companies with strong brand identities and innovative business models. Major players dominate through large-scale franchising, digital transformation, and a strong focus on sustainability practices such as waste reduction and eco-friendly packaging.

|

Company |

Establishment Year |

Headquarters |

Revenue (USD Bn) |

No. of Employees |

Outlets |

Franchise Model |

Sustainability Initiatives |

Digital Presence |

Customer Loyalty Programs |

|

McDonald's Corporation |

1940 |

USA |

|||||||

|

Compass Group PLC |

1941 |

UK |

|||||||

|

Sodexo Group |

1966 |

France |

|||||||

|

Yum! Brands, Inc. |

1997 |

USA |

|||||||

|

Starbucks Corporation |

1971 |

USA |

Europe Food Service Industry Analysis

Growth Drivers

- Rising Demand for Takeaway and Delivery Services: The growing demand for takeaways and delivery services continues to drive the food service market in Europe. As of 2023, food delivery services generated 25 billion across key markets like the UK, France, and Germany, reflecting a 20% increase from 2022. This rise is linked to changing lifestyles, with more consumers preferring convenience, especially in urban centers where delivery apps have become the norm. The ease of digital ordering platforms and the shift to cashless payments further supports this trend.

- Increasing Consumer Preferences for Dining Out: The increase in dining out across Europe has been a significant growth factor. In 2023, household expenditure on restaurants and cafes in the EU was approximately 450 billion. Popularity surged due to rising disposable incomes and a growing trend of social dining among younger consumers. Countries such as Spain, Italy, and France lead the continent with their robust restaurant cultures, accounting for nearly 50% of the sectors revenue.

- Growth of Tourism and International Travel: The revival of tourism in Europe post-pandemic has given a significant boost to the food service market. According to the World Tourism Organization, Europe hosted 585 million international tourist arrivals in 2023, with countries like France, Spain, and Italy seeing substantial increases in tourist-driven restaurant revenue. This influx of visitors has contributed to heightened restaurant sales, with popular tourist destinations witnessing a direct correlation between visitor numbers and dining expenditures.

Market Challenges

- Stringent Food Safety and Hygiene Regulations: European food service providers face strict food safety and hygiene standards, as outlined by the European Food Safety Authority. In 2023, 35,000 inspections across the region revealed numerous compliance issues, pushing businesses to invest more in hygiene certifications and staff training. The high costs associated with meeting these regulatory requirements pose a significant challenge for small and medium-sized enterprises (SMEs) in the industry.

- Workforce Shortages and High Turnover Rates: The food service industry in Europe continues to struggle with workforce shortages, exacerbated by high turnover rates. In 2023, the sector reported a vacancy rate of 4.7% across the EU, with many businesses struggling to fill positions. This shortage is particularly pronounced in hospitality-heavy regions like Italy and Spain, where restaurant operators have had to offer higher wages and benefits to attract talent, further increasing operational costs.

Europe Food Service Market Future Outlook

The Europe food service market is set for continued growth, driven by several key factors. The growing demand for online food delivery, along with the expansion of cloud kitchens, is expected to play a major role in shaping the market. Additionally, sustainability will remain a central focus as consumer demand for eco-friendly food services increases, and food service providers continue to adopt greener practices. Technological innovations, such as AI-driven customer service and digital ordering systems, are likely to further enhance the market's growth trajectory.

Future Market Opportunities

- Growth of Plant-Based and Sustainable Menu Options: The demand for plant-based and sustainable food options has opened new avenues for the food service market in Europe. In 2023, the sales of plant-based meals in restaurants across the EU totaled 2.3 billion, as consumers become more environmentally conscious. This shift presents a significant opportunity for restaurants to tap into this growing demographic by offering plant-based menu options, which are gaining traction across all segments of the industry.

- Leveraging Cloud Kitchens and Dark Kitchens: Cloud kitchens and dark kitchens are emerging as lucrative opportunities for the food service industry, especially in urban areas. In 2023, cloud kitchens generated 4.16 billion across major European cities, as they enable restaurants to operate with lower overhead costs and cater specifically to the growing delivery market. These virtual kitchens are proving to be particularly popular in high-density areas, where demand for delivery is highest.

Scope of the Report

|

By Service Type |

Full-Service Restaurants (FSR) Quick-Service Restaurants (QSR) Cafes/Bars Delivery & Takeaway Catering Services |

|

By Cuisine Type |

European Cuisine Asian Cuisine Fast Food Vegan/Plant-Based Others |

|

By Distribution Channel |

Dine-In Online Delivery Takeaway Drive-Thru |

|

By End-User |

Individual Consumers Corporate Clients Event Organizers Healthcare & Institutional Food Services Travel & Leisure |

|

By Region |

West East North South |

Products

Key Target Audience

Foodservice Operators

Food and Beverage Manufacturers

Restaurant Chains and Franchises

Banks and Financial Institutes

Cloud Kitchens and Dark Kitchens

Food Delivery Aggregators

Investors and Venture Capital Firms

Government and Regulatory Bodies (European Food Safety Authority, National Hospitality Associations)

Logistics and Supply Chain Providers

Companies

Major Players

McDonald's Corporation

Compass Group PLC

Sodexo Group

Yum! Brands, Inc.

Starbucks Corporation

Restaurant Brands International (RBI)

Darden Restaurants, Inc.

Elior Group

SSP Group PLC

Whitbread PLC

Jollibee Foods Corporation

Domino's Pizza Inc.

Aramark Corporation

Brinker International

Nando's Group Holdings

Table of Contents

1. Europe Food Service Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (CAGR, YoY Growth)

1.4. Market Segmentation Overview

2. Europe Food Service Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis (Revenue, Consumer Base, Industry Value)

2.3. Key Market Developments and Milestones

3. Europe Food Service Market Analysis

3.1. Growth Drivers

3.1.1. Rising Demand for Takeaway and Delivery Services

3.1.2. Increasing Consumer Preferences for Dining Out

3.1.3. Growth of Tourism and International Travel

3.1.4. Technological Integration in Food Services (POS, Online Ordering)

3.2. Market Challenges

3.2.1. Stringent Food Safety and Hygiene Regulations

3.2.2. High Operational Costs

3.2.3. Workforce Shortages and High Turnover Rates

3.2.4. Shifting Consumer Preferences Towards Healthier Options

3.3. Opportunities

3.3.1. Expansion into Quick-Service Restaurants (QSR)

3.3.2. Growth of Plant-Based and Sustainable Menu Options

3.3.3. Leveraging Cloud Kitchens and Dark Kitchens

3.3.4. Franchising Opportunities in Untapped Markets

3.4. Trends

3.4.1. Digitalization and Automation in Food Ordering and Delivery

3.4.2. Growing Popularity of Healthy, Organic, and Local Foods

3.4.3. Increased Focus on Sustainability and Reducing Food Waste

3.4.4. Rise of Food Delivery Platforms and Aggregators

3.5. Government Regulation

3.5.1. EU Food Hygiene Regulations

3.5.2. Nutritional Labeling and Transparency Requirements

3.5.3. Environmental Impact Regulations for Food Packaging

3.5.4. Labor Laws and Wage Requirements in the Hospitality Sector

3.6. SWOT Analysis

3.7. Stake Ecosystem (Suppliers, Distributors, Technology Providers)

3.8. Porters Five Forces (Competitive Rivalry, Threat of New Entrants, Buyer Power, etc.)

3.9. Competition Ecosystem

4. Europe Food Service Market Segmentation

4.1. By Service Type (In Value %)

4.1.1. Full-Service Restaurants (FSR)

4.1.2. Quick-Service Restaurants (QSR)

4.1.3. Cafes/Bars

4.1.4. Delivery & Takeaway

4.1.5. Catering Services

4.2. By Cuisine Type (In Value %)

4.2.1. European Cuisine

4.2.2. Asian Cuisine

4.2.3. Fast Food

4.2.4. Vegan/Plant-Based

4.2.5. Others

4.3. By Distribution Channel (In Value %)

4.3.1. Dine-In

4.3.2. Online Delivery

4.3.3. Takeaway

4.3.4. Drive-Thru

4.4. By End-User (In Value %)

4.4.1. Individual Consumers

4.4.2. Corporate Clients

4.4.3. Event Organizers

4.4.4. Healthcare & Institutional Food Services

4.4.5. Travel & Leisure

4.5. By Region (In Value %)

4.5.1. West

4.5.2. East

4.5.3. North

4.5.4. South

5. Europe Food Service Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Compass Group PLC

5.1.2. Sodexo Group

5.1.3. Elior Group

5.1.4. Aramark Corporation

5.1.5. Dominos Pizza Inc.

5.1.6. McDonalds Corporation

5.1.7. Yum! Brands, Inc.

5.1.8. Restaurant Brands International (RBI)

5.1.9. Starbucks Corporation

5.1.10. Jollibee Foods Corporation

5.1.11. Darden Restaurants, Inc.

5.1.12. SSP Group PLC

5.1.13. Whitbread PLC

5.1.14. Nandos Group Holdings

5.1.15. Brinker International

5.2. Cross Comparison Parameters (Revenue, Number of Employees, Operational Countries, No. of Outlets, Average Check Size, Digital Presence, Sustainability Initiatives, Customer Ratings)

5.3. Market Share Analysis (Top 10 Players, Fragmented Market Characteristics)

5.4. Strategic Initiatives (Product Innovations, Geographic Expansions)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants and Subsidies

5.9. Private Equity Investments

6. Europe Food Service Market Regulatory Framework

6.1. Food Safety and Hygiene Regulations (EU Regulation No. 852/2004)

6.2. Nutritional Labeling Standards

6.3. Waste Management and Environmental Policies

6.4. Employment and Labor Laws

7. Europe Food Service Future Market Size (In USD Bn)

7.1. Market Size Projections

7.2. Key Factors Driving Future Market Growth (Online Ordering, Consumer Behavior Shifts, Economic Growth, Digital Transformation)

8. Europe Food Service Future Market Segmentation

8.1. By Service Type (In Value %)

8.2. By Cuisine Type (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. Europe Food Service Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis (Millennials, Gen Z, Affluent Consumers)

9.3. Marketing Initiatives (Digital Campaigns, Loyalty Programs)

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research process began with mapping the key stakeholders in the Europe food service market, which included food service operators, supply chain partners, and regulators. Extensive desk research was conducted using proprietary databases and secondary data sources to identify critical variables driving market trends.

Step 2: Market Analysis and Construction

Historical data from leading market sources was analyzed to determine market penetration and growth in sub-segments. A detailed analysis of consumer behavior, demand trends, and service quality was undertaken to provide accurate revenue projections.

Step 3: Hypothesis Validation and Expert Consultation

Industry hypotheses were developed and validated through direct consultations with food service industry experts via structured interviews. These discussions helped fine-tune data and provided insights into emerging trends and operational challenges within the market.

Step 4: Research Synthesis and Final Output

Data collected from multiple sources was synthesized to ensure a holistic understanding of the market. This phase included engaging with key food service players to verify the findings, ensuring a robust and accurate report.

Frequently Asked Questions

01 How big is the Europe food service market?

The Europe food service market is valued at USD 1010 billion. This market is driven by increased consumer spending on dining out and the growing popularity of takeaway and delivery services.

02 What are the major challenges in the Europe food service market?

Key challenges in the Europe food service market include high operational costs, labor shortages, and stringent food safety regulations. The market also faces rising consumer demands for healthier and sustainable food options.

03 Who are the major players in the Europe food service market?

Prominent players in the Europe food service market include McDonald's Corporation, Compass Group PLC, Sodexo Group, Yum! Brands, and Starbucks Corporation. These companies lead due to their expansive networks, brand strength, and digital innovations.

04 What are the growth drivers for the Europe food service market?

The Europe food service market is primarily driven by the increasing demand for fast, convenient food options, digital ordering platforms, and sustainability initiatives. The rise of cloud kitchens and food delivery apps also fuels market growth.

05 What are the major trends in the Europe food service market?

Major trends in the Europe food service market include the adoption of digital technologies such as online ordering, the rise of eco-friendly practices, and a growing consumer preference for plant-based and sustainable food options.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.