Europe Frozen Dessert Market Outlook to 2030

Region:Europe

Author(s):Paribhasha Tiwari

Product Code:KROD9777

November 2024

87

About the Report

Europe Frozen Dessert Market Overview

- The Europe Frozen Dessert market is valued at USD 31.5 billion based on a five-year historical analysis. This market is driven by the increasing consumer preference for healthier and plant-based dessert options. Growing demand for dairy-free and low-sugar frozen desserts has reshaped the market, with manufacturers focusing on innovations like organic and vegan products to meet the health-conscious consumer base. This trend is particularly fueled by advancements in freezing technologies, making it easier to produce and distribute these products efficiently.

- Dominant countries in the Europe frozen dessert market include France, Italy, and Germany. These countries dominate the market due to their well-established food processing industries, diverse consumer preferences, and strong distribution networks. Additionally, the growing tourism industry in these countries contributes significantly to the rising demand for artisanal frozen desserts, making them key players in the European market.

- In 2024, several leading frozen dessert brands, including key players like Unilever and Nestl, launched new organic and vegan frozen dessert lines across Europe. These product lines include innovative plant-based formulations made from almond, soy, and coconut milk, contributing to a combined sales increase of 600,000 units in the first half of the year alone. The expansion into the organic and vegan segments is aimed at catering to the growing health-conscious consumer base.

Europe Frozen Dessert Market Segmentation

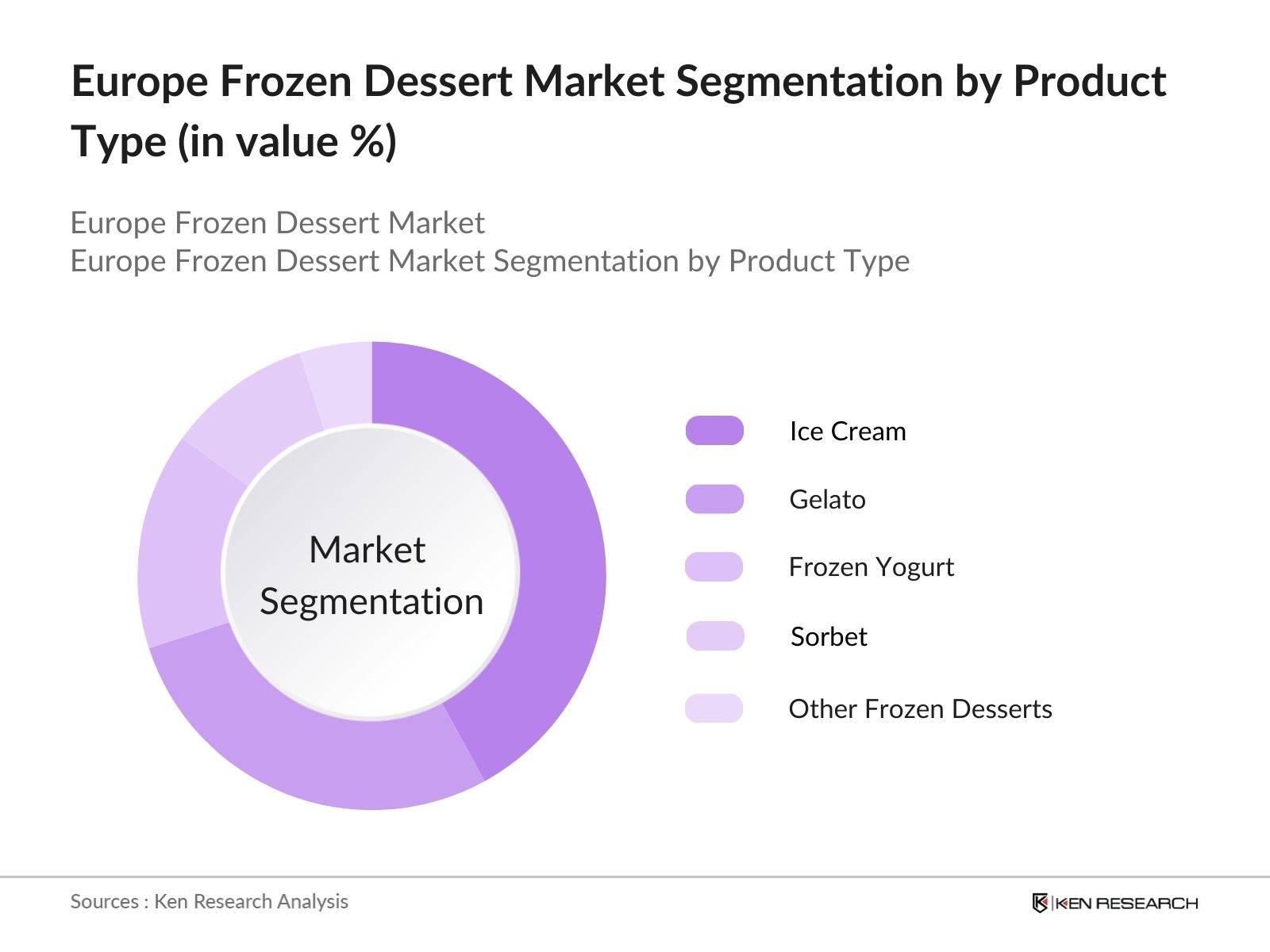

By Product Type: The Europe Frozen Dessert market is segmented by product type into ice cream, gelato, frozen yogurt, sorbet, and other frozen desserts. Among these, ice cream holds the dominant market share due to its established popularity and wide range of flavors. Ice cream's engrained presence in European culture and the increasing availability of premium varieties have ensured its sustained dominance. Innovations such as dairy-free ice cream and the introduction of exotic flavors have also contributed to maintaining this segments top position.

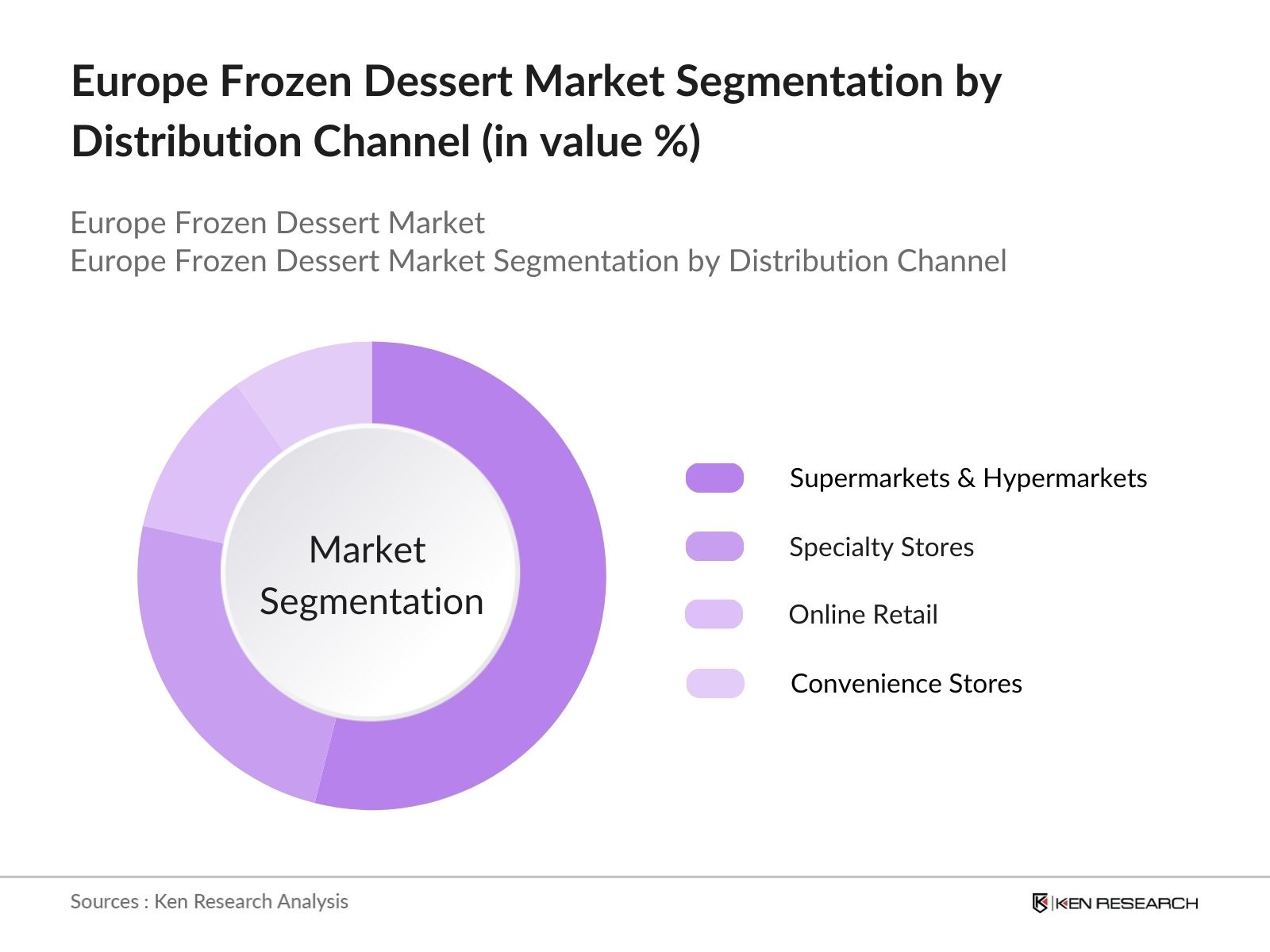

By Distribution Channel: Europes frozen dessert market is also segmented by distribution channels, including supermarkets & hypermarkets, specialty stores, online retail, and convenience stores. Supermarkets & hypermarkets dominate this segment due to their vast network, large product offerings, and discounts. Consumers often prefer these stores because they offer a wide range of frozen desserts, including both premium and budget-friendly options, all under one roof, which makes them a preferred choice for frozen dessert purchases.

Europe Frozen Dessert Market Competitive Landscape

The Europe Frozen Dessert market is dominated by several key players, including both global giants and regional specialists. The landscape is characterized by strong competition, innovation, and constant product diversification. Companies are expanding their portfolios to include healthier options, with a focus on plant-based and organic ingredients. This competition is fueled by changing consumer preferences, leading to a constant push for new flavors and sustainable packaging.

Europe Frozen Dessert Market Analysis

Growth Drivers

- Rising Consumer Demand for Healthier Dessert Options (Increased Consumer Preference for Plant-Based Ingredients): The European frozen dessert market is experiencing significant growth as consumers increasingly demand healthier dessert alternatives. According to macroeconomic data from 2024, there is a surge in the consumption of plant-based frozen desserts, with over 2 million consumers in key markets such as Germany, France, and Italy opting for dairy-free and plant-based options. This shift is supported by increased health consciousness, particularly regarding lactose intolerance and dietary preferences. In 2024, the plant-based frozen dessert category grew by 120,000 new product variants to cater to this expanding consumer base.

- Technological Advancements in Freezing Techniques (Impact on Production Efficiency): The adoption of advanced freezing techniques, such as cryogenic freezing, has greatly improved production efficiency across the European frozen dessert industry. In 2024, over 500 production plants in Europe integrated these advanced technologies, reducing spoilage rates by 15,000 tons per year and boosting production speed by 30%. This efficiency supports the industry's capacity to meet rising demand for premium frozen desserts, particularly in urban centers across France, Spain, and the UK, where energy-efficient production plants have become key to profitability.

- Expansion of Retail Chains and E-Commerce Platforms (Broader Market Access): Retail chains and e-commerce platforms are rapidly expanding their frozen dessert offerings, providing greater market access for manufacturers. In 2024, more than 150,000 stores across Europe expanded their frozen dessert sections, with an additional 30,000 online grocery platforms increasing their inventory by over 20% for frozen dessert categories. This development is particularly pronounced in Italy, where e-commerce dessert sales hit 450,000 units monthly, helping brands reach a broader, tech-savvy consumer base.

Market Challenges

- Seasonal Dependency (High Summer Demand, Low Winter Sales): The demand for frozen desserts is heavily seasonal, with peak sales occurring during the summer months. According to 2024 data, sales during the summer were three times higher than in winter, with over 100 million units sold across key markets like Spain and Greece between May and August, while winter sales dropped by 50 million units. This seasonal fluctuation creates challenges for manufacturers in maintaining steady year-round production and profitability.

- High Energy Consumption in Cold Storage (Rising Energy Costs Impacting Profitability): Cold storage for frozen desserts is highly energy-intensive, and rising energy costs in Europe have significantly impacted profitability. In 2024, energy prices for industrial users increased by 0.25 per kWh in major markets such as Germany and the UK, leading to an annual increase of 150 million in operational costs for the frozen dessert sector. The energy-intensive nature of cold storage remains a substantial financial burden for manufacturers, limiting profitability margins.

Europe Frozen Dessert Market Future Outlook

Over the next five years, the Europe Frozen Dessert market is expected to exhibit significant growth, driven by the increasing consumer demand for healthier, low-sugar, and dairy-free alternatives. The rise of plant-based diets and the premiumization of frozen dessert products are also anticipated to drive this growth. Companies are likely to invest in research and development to offer innovative flavors and sustainable packaging solutions, further enhancing the consumer appeal of frozen desserts.

Market Opportunities

- Increasing Demand for Organic and Vegan Products (Expanding the Product Portfolio): The rising consumer demand for organic and vegan frozen desserts presents significant opportunities for manufacturers in Europe. In 2024, the organic frozen dessert segment grew by 600,000 new units, driven by increased demand in countries like Germany and France. Brands that introduced vegan variants, such as coconut milk-based ice creams, saw substantial sales growth, with an additional 2 million consumers transitioning to vegan frozen desserts.

- New Flavors and Ingredient Innovation (Customization and Flavor Experiments): Innovation in flavors and ingredients has become a major opportunity for growth in the European frozen dessert market. In 2024, over 90,000 new flavor combinations were introduced, including exotic ingredients like matcha, black sesame, and Mediterranean fruits, which gained popularity among younger consumers. The Italian market alone saw a 300,000-unit increase in sales for innovative flavors, highlighting the potential for flavor customization to drive market growth.

Scope of the Report

|

By Product Type |

Ice Cream Gelato Sorbet Frozen Yogurt Other Frozen Desserts |

|

By Distribution Channel |

Supermarkets & Hypermarkets Specialty Stores Online Retail Convenience Stores |

|

By End Consumer |

Retail Consumers Foodservice & Hospitality |

|

By Ingredient Type |

Dairy-Based Plant-Based (Vegan) Low-Fat & Low-Sugar |

|

By Region |

West East South North |

Products

Key Target Audience

Frozen Dessert Manufacturers

Retailers and Distributors

Supermarkets & Hypermarkets Chains

Specialty Stores Owners

Frozen Yogurt & Gelato Parlors

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (European Food Safety Authority, EU Environmental Regulations)

Packaging Manufacturers

Companies

Players Mentioned in the Report:

Unilever

Nestl S.A.

Froneri International Ltd

General Mills Inc.

Mars, Incorporated

Valsoia S.p.A

Lotus Bakeries

Yeo Valley

Ledo Plus

Gelatelli (ALDI)

Table of Contents

1. Europe Frozen Dessert Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Key Market Growth Rate (in Value %)

1.4. Market Segmentation Overview

2. Europe Frozen Dessert Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Europe Frozen Dessert Market Analysis

3.1. Growth Drivers

3.1.1. Rising Consumer Demand for Healthier Dessert Options (Increased consumer preference for plant-based ingredients)

3.1.2. Technological Advancements in Freezing Techniques (Impact on production efficiency)

3.1.3. Expansion of Retail Chains and E-Commerce Platforms (Broader market access)

3.1.4. Shift Towards Premium Products (Higher spending on luxury frozen desserts)

3.2. Market Challenges

3.2.1. Seasonal Dependency (High summer demand, low winter sales)

3.2.2. High Energy Consumption in Cold Storage (Rising energy costs impacting profitability)

3.2.3. Supply Chain Disruptions (Impact of temperature-sensitive logistics)

3.2.4. Regulatory Standards on Food Additives (Adapting to changing regulations)

3.3. Opportunities

3.3.1. Increasing Demand for Organic and Vegan Products (Expanding the product portfolio)

3.3.2. New Flavors and Ingredient Innovation (Customization and flavor experiments)

3.3.3. Partnerships with Grocery Retail Chains (Strategic distribution alliances)

3.3.4. Growth in Private Label Brands (Retailers expanding frozen dessert offerings)

3.4. Trends

3.4.1. Rising Popularity of Artisanal Frozen Desserts (Niche market growth)

3.4.2. Demand for Dairy-Free and Low-Sugar Variants (Targeting health-conscious consumers)

3.4.3. Adoption of Sustainable Packaging Solutions (Focus on eco-friendly packaging)

3.4.4. Increasing Penetration of Plant-Based Frozen Desserts (Vegan products)

3.5. Government Regulations

3.5.1. EU Food Safety Standards (Compliance with EU regulations)

3.5.2. Packaging Waste Regulations (Reduction of plastic usage)

3.5.3. Nutrition Labeling Requirements (Impact on product labeling)

3.5.4. Tax on Sugary Products (Implications of health-focused taxation)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Retailers, manufacturers, distributors)

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Europe Frozen Dessert Market Segmentation (In Value %)

4.1. By Product Type (In Value %)

4.1.1. Ice Cream

4.1.2. Gelato

4.1.3. Sorbet

4.1.4. Frozen Yogurt

4.1.5. Other Frozen Desserts

4.2. By Distribution Channel (In Value %)

4.2.1. Supermarkets & Hypermarkets

4.2.2. Specialty Stores

4.2.3. Online Retail

4.2.4. Convenience Stores

4.3. By End Consumer (In Value %)

4.3.1. Retail Consumers

4.3.2. Foodservice & Hospitality

4.4. By Ingredient Type (In Value %)

4.4.1. Dairy-Based

4.4.2. Plant-Based (Vegan)

4.4.3. Low-Fat & Low-Sugar

4.5. By Region (In Value %)

4.5.1. Western Europe

4.5.2. Eastern Europe

4.5.3. Southern Europe

4.5.4. Northern Europe

5. Europe Frozen Dessert Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Unilever

5.1.2. Nestl S.A.

5.1.3. Froneri International Ltd

5.1.4. General Mills Inc.

5.1.5. Mars, Incorporated

5.1.6. Valsoia S.p.A

5.1.7. Ledo Plus

5.1.8. Lotus Bakeries

5.1.9. Amorino Gelato

5.1.10. Emmi Group

5.1.11. Gelatelli (ALDI)

5.1.12. Yeo Valley

5.1.13. R&R Ice Cream

5.1.14. Danone

5.1.15. Frusco Gelato

5.2. Cross Comparison Parameters (Revenue, Product Portfolio, Distribution Network, Sustainability Initiatives, Regional Presence, Innovation Capabilities, Number of Employees, Market Share)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Mergers & Acquisitions, Partnerships, New Product Launches)

5.5. Investment and Funding Overview

5.6. Venture Capital Funding

5.7. Government Grants

5.8. Private Equity Investments

6. Europe Frozen Dessert Market Regulatory Framework

6.1. EU Food Safety and Hygiene Standards

6.2. Sugar Reduction Policies

6.3. Compliance Requirements for Plant-Based and Dairy-Free Labels

6.4. Packaging Regulations and Sustainability Goals

7. Europe Frozen Dessert Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Europe Frozen Dessert Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By End Consumer (In Value %)

8.4. By Ingredient Type (In Value %)

8.5. By Region (In Value %)

9. Europe Frozen Dessert Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Behavior Insights (Vegan and Health-Conscious Segment)

9.3. Branding and Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase of research includes mapping the ecosystem of the Europe Frozen Dessert Market. Primary research sources include desk reviews, government databases, and proprietary resources. Critical variables such as consumer behavior, distribution channels, and market dynamics are identified for further analysis.

Step 2: Market Analysis and Construction

In this phase, historical market data is analyzed to construct a detailed picture of market dynamics. Factors such as penetration rate, product distribution, and revenue from various distribution channels are considered to ensure accurate analysis.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated using expert interviews with key industry players, including manufacturers, distributors, and food industry experts. Insights gathered from these consultations offer deeper operational understanding, helping refine market forecasts and trend analysis.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing the collected data with insights from direct consultations. This ensures that the output is accurate and reflective of the real-world scenario of the Europe Frozen Dessert Market. The analysis will also include cross-verification with market performance data to ensure comprehensive and validated results.

Frequently Asked Questions

01. How big is the Europe Frozen Dessert Market?

The Europe Frozen Dessert Market was valued at USD 31.5 billion, driven by consumer demand for healthier dessert options and the rise of vegan and low-sugar alternatives.

02. What are the challenges in the Europe Frozen Dessert Market?

Challenges in the Europe Frozen Dessert Market include high energy consumption in cold storage, fluctuating raw material prices, and the need for compliance with stringent EU food safety and packaging regulations.

03. Who are the major players in the Europe Frozen Dessert Market?

Key players include Unilever, Nestl S.A., Froneri International Ltd, General Mills Inc., and Mars, Incorporated. These companies lead due to their diverse product offerings and strong brand presence.

04. What are the growth drivers of the Europe Frozen Dessert Market?

Growth of Europe Frozen Dessert Market is driven by rising consumer demand for dairy-free, organic, and low-sugar frozen desserts. The increasing adoption of plant-based diets and innovative product offerings also fuel market expansion.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.