Europe Gluten Free Foods and Beverages Market Outlook to 2030

Region:Europe

Author(s):Naman Rohilla

Product Code:KROD10263

December 2024

97

About the Report

Europe Gluten Free Foods and Beverages Market Overview

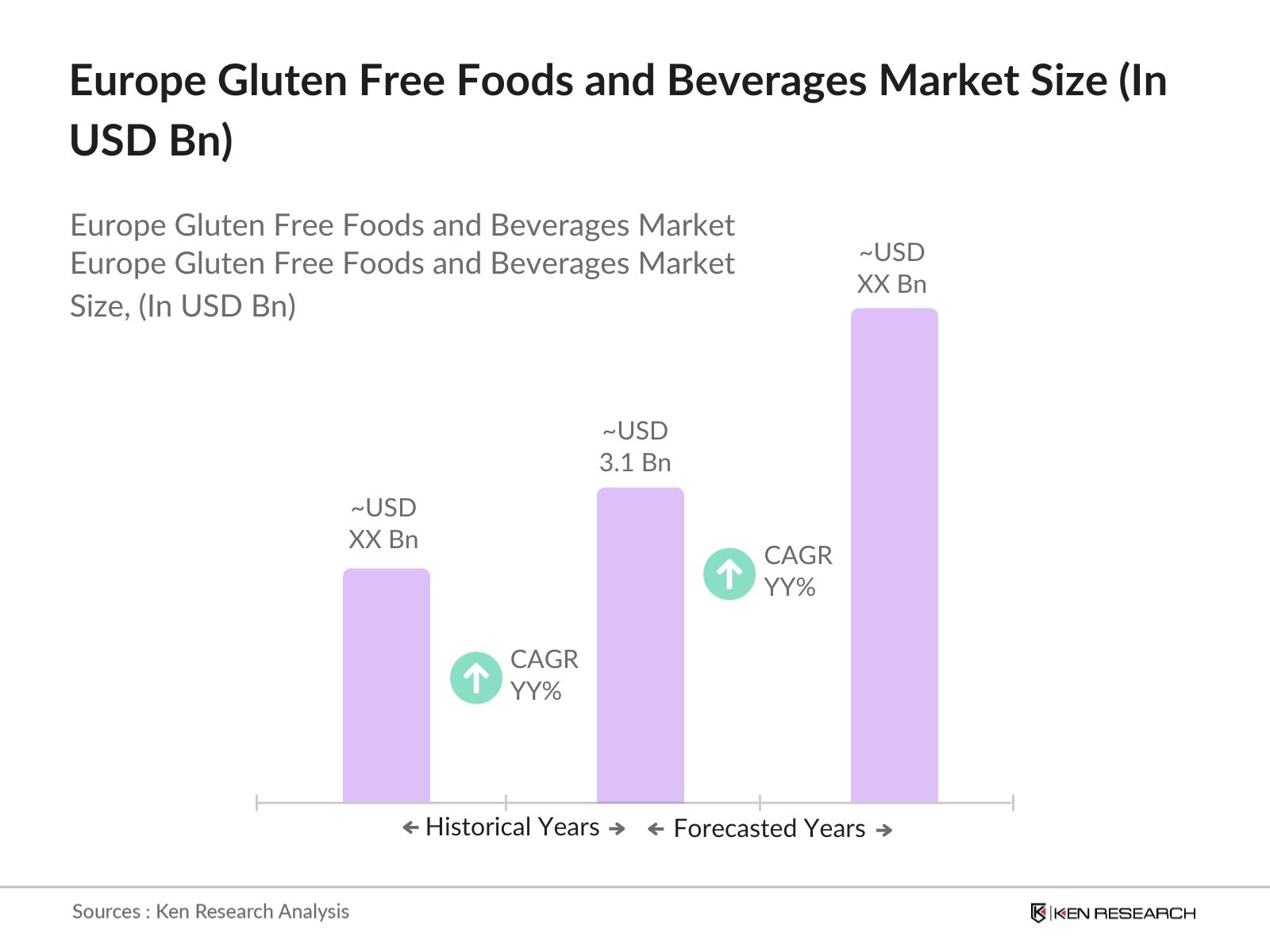

- The Europe gluten-free foods and beverages market is valued at USD 3.1 billion, based on a five-year historical analysis. This growth is primarily driven by increasing consumer awareness of gluten-related health issues, such as celiac disease and gluten intolerance, leading to a higher demand for gluten-free alternatives. Additionally, a broader shift toward health and wellness, where individuals choose gluten-free diets as part of a healthier lifestyle, is further fueling the market.

- Germany, the United Kingdom, and Italy are the dominant countries in the European gluten-free market. Germany leads the market with a surge in product launches, followed by the United Kingdom and Italy. The market is characterized by a growing interest in alternative meat products and plant-based diets, as consumers become more health-conscious and seek to avoid gluten-related health issues.

- The EU's Food Information for Consumers Regulation (EU) No 1169/2011 mandates clear labeling of allergens, including gluten, on food products. This regulation ensures that consumers are well-informed about the presence of gluten, aiding those with celiac disease in making safe food choices.

Europe Gluten Free Foods and Beverages Market Segmentation

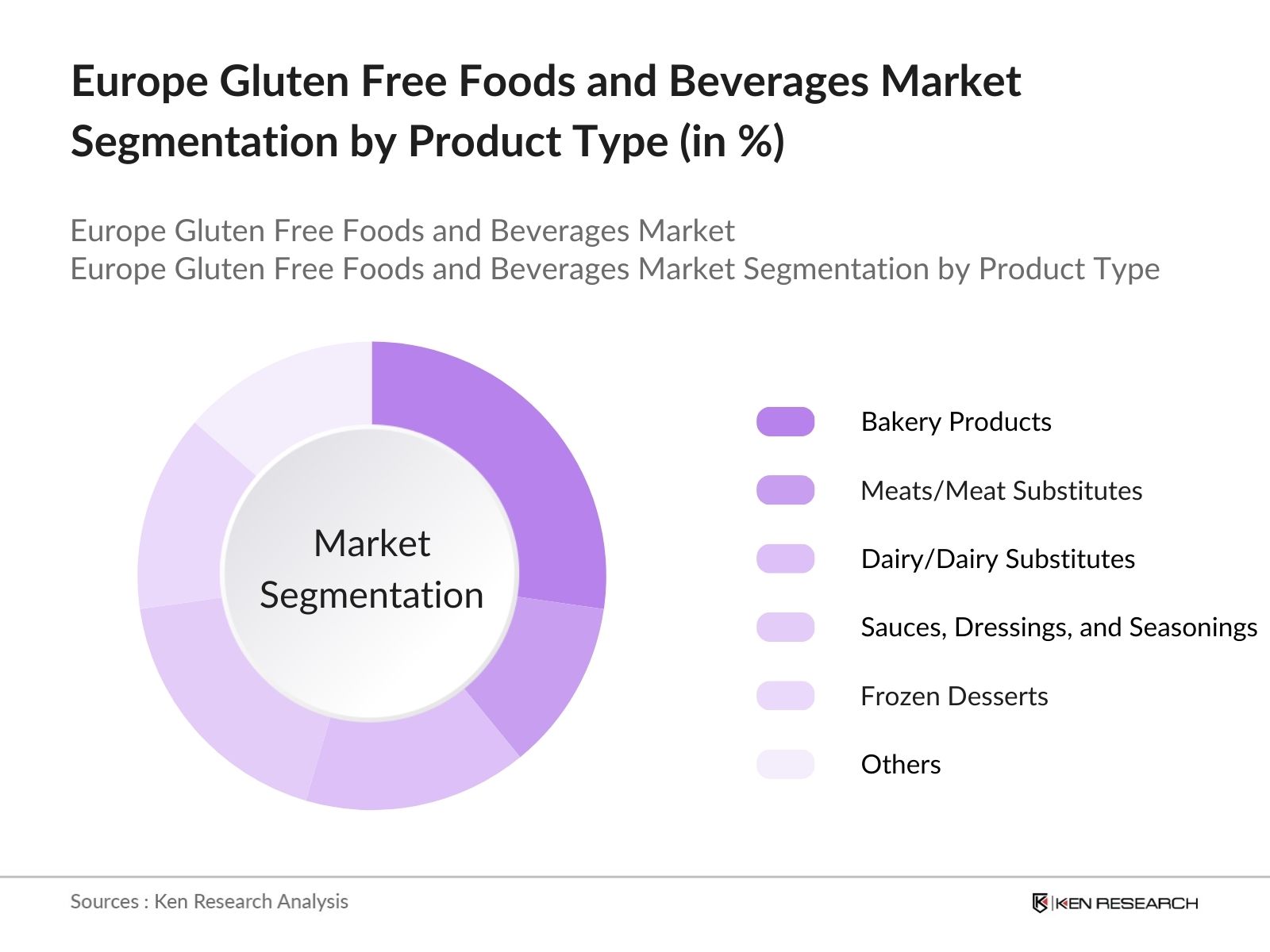

By Product Type: The market is segmented by product type into bakery products, meats/meat substitutes, dairy/dairy substitutes, sauces, dressings, and seasonings, frozen desserts, beverages, and other product types. Recently, bakery products have a dominant market share in Europe under the segmentation product type, due to the increasing demand for various gluten-free bakery products. The surge in demand for gluten-free bread, cakes, cookies, and pastries is driven by innovations that enhance taste and texture, positively influencing the market.

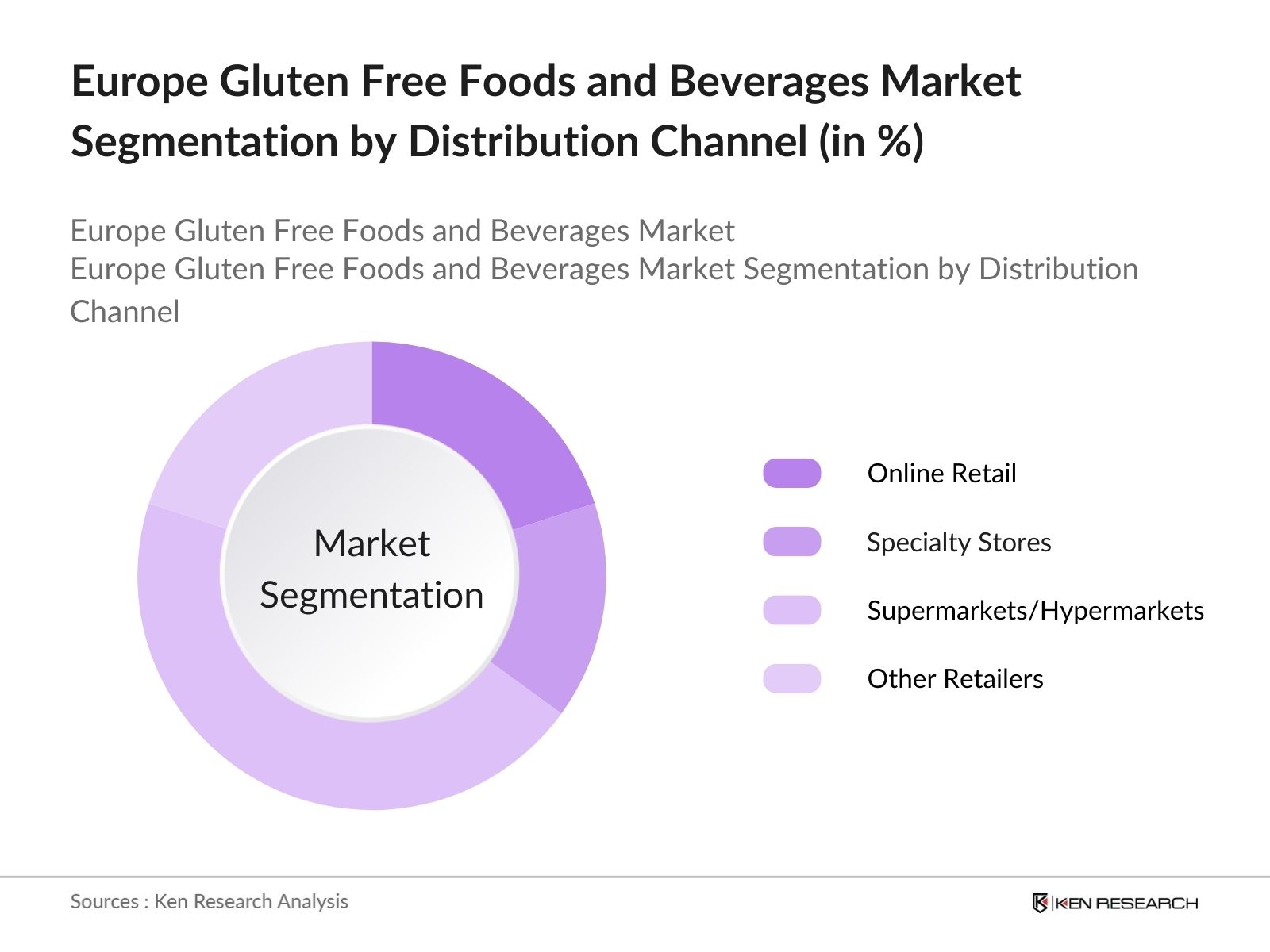

By Distribution Channel: The market is also segmented by distribution channel into online retail, specialty stores, supermarkets/hypermarkets, and other retailers. Supermarkets/hypermarkets hold a significant market share in Europe under this segmentation. This is attributed to the widespread availability and accessibility of gluten-free products in these retail outlets, catering to the growing consumer demand for gluten-free options. The expansion of distribution channels has made gluten-free foods more widely available, reaching a broader audience of consumers.

Europe Gluten Free Foods and Beverages Market Competitive Landscape

The European gluten-free foods and beverages market is highly competitive, with the presence of several global and local players due to the high demand for gluten-free foods among the local population. Key players include General Mills Inc., Conagra Brands Inc., Dr. Schr AG/SPA, Bobs Red Mill Natural Foods, and Amy's Kitchen Inc. These companies dominate due to their extensive distribution networks, strong brand presence, and diverse product portfolios.

|

Company Name |

Establishment Year |

Headquarters |

Product Portfolio |

Market Share |

Revenue (USD Billion) |

Number of Employees |

Geographic Presence |

|

General Mills Inc. |

1928 |

Minneapolis, USA |

|||||

|

Conagra Brands Inc. |

1919 |

Chicago, USA |

|||||

|

Dr. Schr AG/SPA |

1922 |

Burgstall, Italy |

|||||

|

Bobs Red Mill Natural Foods |

1978 |

Oregon, USA |

|||||

|

Amy's Kitchen Inc. |

1987 |

California, USA |

Europe Gluten Free Foods and Beverages Market Analysis

Market Growth Drivers

- Rising Prevalence of Celiac Disease: Celiac disease, an autoimmune disorder triggered by gluten ingestion, affects 1% of the European population, equating to over 7 million individuals. In the United Kingdom alone, around 500,000 people are diagnosed with celiac disease. This significant prevalence has heightened demand for gluten-free foods and beverages, as those affected must adhere to strict gluten-free diets to manage their condition. The European Society for the Study of Coeliac Disease (ESsCD) reports that early diagnosis and dietary management are crucial for preventing complications associated with celiac disease.

- Increasing Health Consciousness: A growing emphasis on health and wellness among European consumers has led to a surge in demand for gluten-free products. A survey by the European Food Information Council (EUFIC) indicates that 70% of Europeans are actively seeking healthier food options, with 30% specifically reducing gluten intake for perceived health benefits. This trend is not limited to individuals with gluten-related disorders but extends to health-conscious consumers aiming to improve overall well-being.

- Expansion of Distribution Channels: The availability of gluten-free products has expanded significantly across Europe. Major supermarket chains, such as Tesco and Carrefour, have increased their gluten-free offerings, dedicating entire sections to these products. Additionally, the rise of online retail platforms has made gluten-free products more accessible, with e-commerce sales in the European food and beverage sector reaching 54 billion in 2023, according to Eurostat. This expansion has facilitated consumer access to a wider variety of gluten-free options.

Market Challenges

- Higher Production Costs: Producing gluten-free products often incurs higher costs due to the need for specialized ingredients and stringent manufacturing processes to prevent cross-contamination. The European Commission's report on food prices indicates that gluten-free products are, on average, 159% more expensive than their gluten-containing counterparts. This price disparity can deter price-sensitive consumers and limit market growth.

- Limited Consumer Awareness in Emerging Markets: While awareness of gluten-related disorders is high in Western Europe, it remains limited in emerging European markets. A study by the World Gastroenterology Organisation found that only 20% of individuals in Eastern Europe are aware of celiac disease and its dietary requirements. This lack of awareness hinders demand for gluten-free products in these regions.

Europe Gluten Free Foods and Beverages Market Future Outlook

Over the next five years, the European gluten-free foods and beverages market is expected to show growth driven by continuous product innovation, expansion of distribution channels, and increasing consumer demand for healthier dietary options. The market is projected to reach USD 5.92 billion, growing at a CAGR of 10.33% during the forecast period.

Market Opportunities

- Technological Advancements in Product Development: Advancements in food processing technologies, such as the use of alternative flours and enzymes, are enhancing the quality of gluten-free products. The European Food Research and Technology journal reports that incorporating sourdough fermentation in gluten-free bread production improves texture and shelf life, presenting opportunities for manufacturers to develop superior products.

- Growing Demand for Organic and Clean Label Products: European consumers are increasingly seeking organic and clean label gluten-free products. The Organic Trade Association notes that organic food sales in Europe reached 45 billion in 2023, with a significant portion attributed to gluten-free items. This trend offers manufacturers the chance to cater to health-conscious consumers by offering products free from artificial additives and pesticides.

Scope of the Report

|

Segment |

Sub-Segments |

|

Product Type |

Bakery Products |

|

Distribution Channel |

Online Retail |

|

Country |

United Kingdom |

Products

Key Target Audience

Gluten-Free Product Manufacturers

Food and Beverage Distributors

Retail Chains and Supermarkets

Online Retailers

Health and Wellness Centers

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., European Food Safety Authority)

Consumer Advocacy Groups

Companies

Players Mentioned in the Report

General Mills Inc.

Conagra Brands Inc.

Dr. Schr AG/SPA

Bobs Red Mill Natural Foods

Amy's Kitchen Inc.

Kraft Heinz Company

Genius Foods

Hain Celestial Group

Enjoy Life Foods

Nestl S.A.

Table of Contents

1. Europe Gluten Free Foods and Beverages Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Europe Gluten Free Foods and Beverages Market Size (In USD Billion)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Europe Gluten Free Foods and Beverages Market Analysis

3.1 Growth Drivers

3.1.1 Rising Prevalence of Celiac Disease

3.1.2 Increasing Health Consciousness

3.1.3 Expansion of Distribution Channels

3.1.4 Product Innovation and Diversification

3.2 Market Challenges

3.2.1 Higher Production Costs

3.2.2 Limited Consumer Awareness in Emerging Markets

3.2.3 Taste and Texture Limitations

3.3 Opportunities

3.3.1 Technological Advancements in Product Development

3.3.2 Growing Demand for Organic and Clean Label Products

3.3.3 Expansion into Untapped Markets

3.4 Trends

3.4.1 Adoption of Plant-Based Gluten-Free Products

3.4.2 Integration of E-commerce Platforms

3.4.3 Increased Focus on Sustainable Packaging

3.5 Government Regulations

3.5.1 EU Food Information for Consumers Regulation

3.5.2 National Standards and Certifications

3.5.3 Labeling and Allergen Disclosure Requirements

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape

4. Europe Gluten Free Foods and Beverages Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Bakery Products

4.1.2 Meats/Meat Substitutes

4.1.3 Dairy/Dairy Substitutes

4.1.4 Sauces, Dressings, and Seasonings

4.1.5 Frozen Desserts

4.1.6 Beverages

4.1.7 Other Product Types

4.2 By Distribution Channel (In Value %)

4.2.1 Online Retail

4.2.2 Specialty Stores

4.2.3 Supermarkets/Hypermarkets

4.2.4 Other Retailers

4.3 By Country (In Value %)

4.3.1 United Kingdom

4.3.2 Germany

4.3.3 France

4.3.4 Italy

4.3.5 Spain

4.3.6 Russia

4.3.7 Rest of Europe

4. Europe Gluten Free Foods and Beverages Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 General Mills Inc.

5.1.2 Conagra Brands Inc.

5.1.3 Dr. Schr AG/SPA

5.1.4 Bobs Red Mill Natural Foods

5.1.5 Amy's Kitchen Inc.

5.1.6 Kraft Heinz Company

5.1.7 Genius Foods

5.1.8 Hain Celestial Group

5.1.9 Enjoy Life Foods

5.1.10 Nestl S.A.

5.1.11 Kellogg Company

5.1.12 Glutino

5.1.13 Warburtons

5.1.14 Schar

5.1.15 Barilla G. e R. Fratelli S.p.A.

5.2 Cross Comparison Parameters (Revenue, Market Share, Product Portfolio, Geographic Presence, R&D Investment, Strategic Initiatives, Number of Employees, Year of Establishment)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.6.1 Venture Capital Funding

5.6.2 Government Grants

5.6.3 Private Equity Investments

6. Regulatory Framework

6.1 European Food Safety Authority (EFSA) Guidelines

6.2 National Food Safety Standards

6.3 Certification Processes

6.3.1 Gluten-Free Certification Organization (GFCO)

6.3.2 Association of European Coeliac Societies (AOECS) Standard

7. Future Market Size (In USD Billion)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Distribution Channel (In Value %)

8.3 By Country (In Value %)

9. Analysts Recommendations

9.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the European Gluten-Free Foods & Beverages Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the European Gluten-Free Foods & Beverages Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple manufacturers and distributors within the European gluten-free foods and beverages market. This will include acquiring detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the market dynamics and trends.

Frequently Asked Questions

01. How big is the Europe Gluten-Free Foods & Beverages Market?

The Europe gluten-free foods and beverages market is valued at USD 3.1 billion, driven by increasing consumer awareness of gluten-related health issues and a growing preference for healthy diets.

02. What are the challenges in the Europe Gluten-Free Foods & Beverages Market?

Challenges include the high cost of gluten-free ingredients, limited consumer knowledge in emerging markets, and the perception that gluten-free products are less tasty compared to traditional options.

03. Who are the major players in the Europe Gluten-Free Foods & Beverages Market?

Key players include General Mills, Conagra Brands, Dr. Schr, Bobs Red Mill, and Amy's Kitchen. Their extensive product offerings and strong brand loyalty contribute to their market dominance.

04. What are the growth drivers of the Europe Gluten-Free Foods & Beverages Market?

The market is propelled by rising health consciousness, an increase in the prevalence of celiac disease, and a growing trend towards organic and natural food products, attracting more consumers to gluten-free options.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.