Europe Hearing Aids Market Outlook to 2030

Region:Europe

Author(s):Paribhasha Tiwari

Product Code:KROD7351

December 2024

82

About the Report

Europe Hearing Aids Market Overview

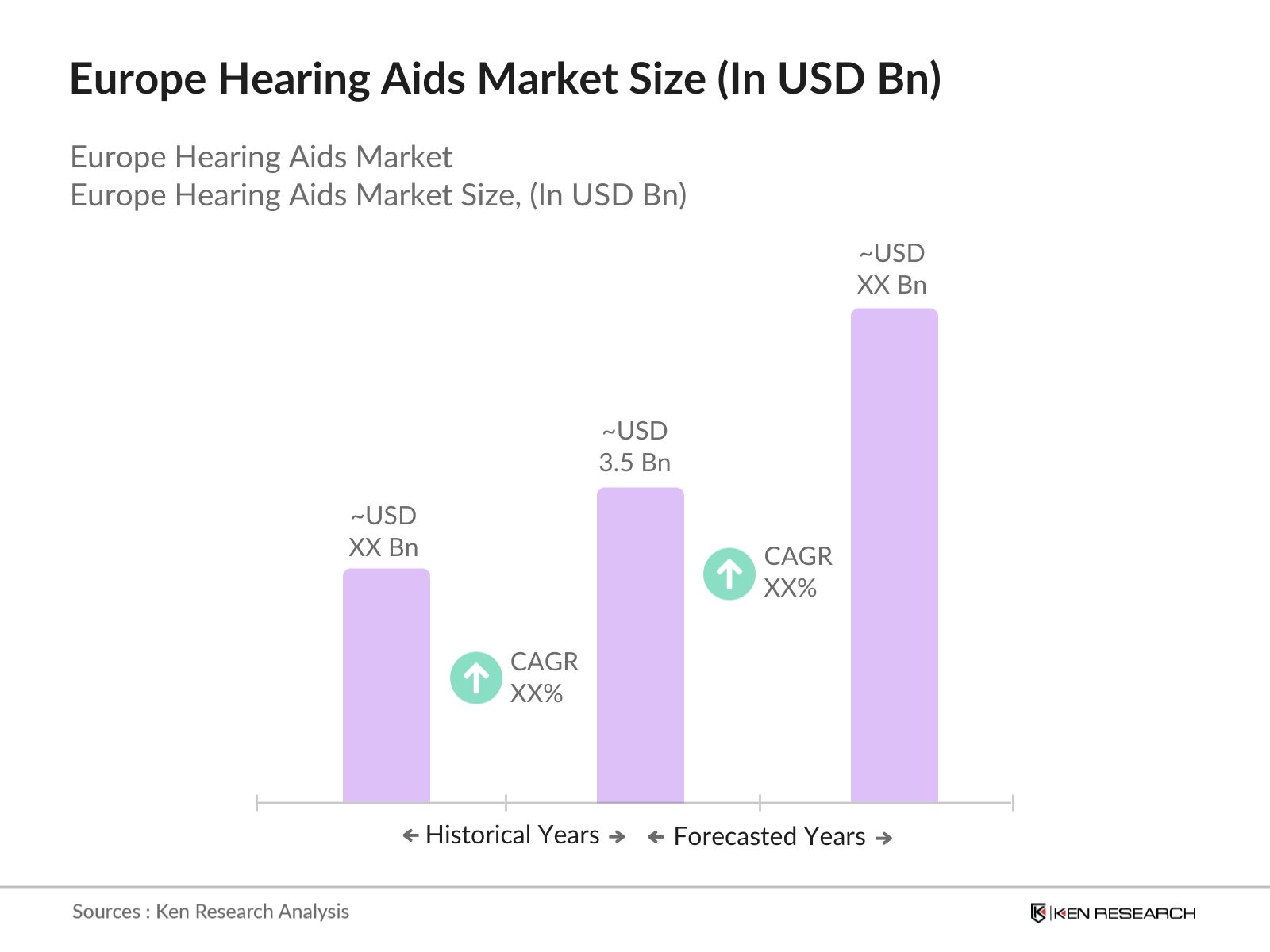

- The Europe Hearing Aids Market is valued at USD 3.5 billion, reflecting robust growth driven by a rising geriatric population and increasing incidences of hearing impairments. The market is strongly supported by advancements in digital technology, with devices becoming increasingly accessible and effective. Government initiatives in European countries, such as reimbursement policies for hearing aids, have further bolstered market demand.

- Countries like Germany, France, and the United Kingdom lead the market due to their extensive healthcare infrastructure and high healthcare spending. Germanys dominance stems from its advanced healthcare systems and significant investments in R&D, while the United Kingdom benefits from widespread public awareness and accessible healthcare provisions. Additionally, Frances focus on integrating digital hearing solutions and rising consumer awareness contributes significantly to its market share.

- Governments across Europe are offering financial support for low-income individuals to access hearing aids. The UK allocated 100 million in 2024 to improve device affordability, targeting 500,000 users over the next five years.

Europe Hearing Aids Market Segmentation

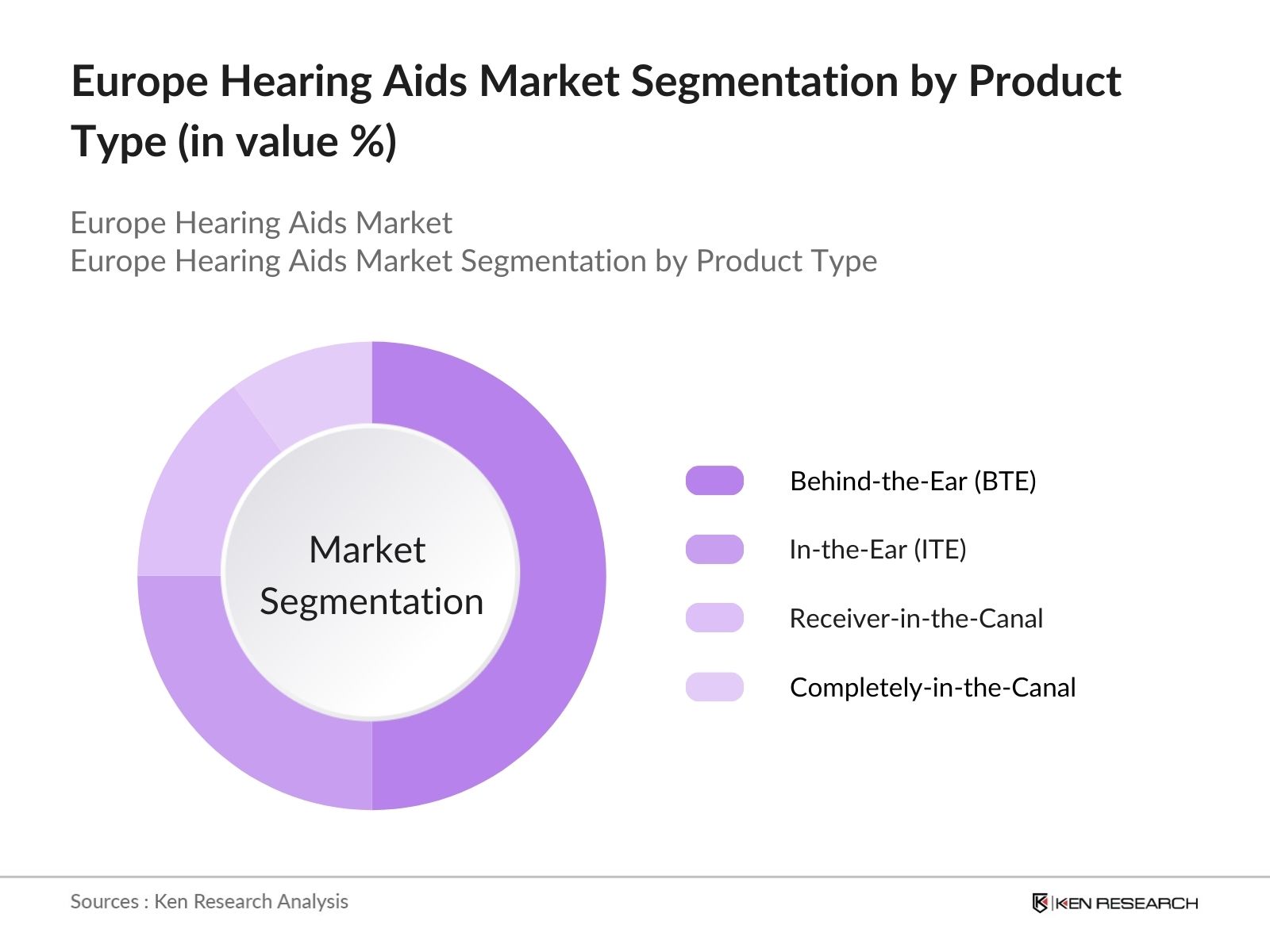

By Product Type: The Europe Hearing Aids Market is segmented by product type into Behind-the-Ear (BTE), In-the-Ear (ITE), Receiver-in-the-Canal (RIC), and Completely-in-the-Canal (CIC) hearing aids. Recently, BTE hearing aids dominate the product type segment due to their durability, high power levels, and ease of use, particularly among older adults. These devices are widely favored in hospitals and clinics, contributing to their strong market presence. BTE models also support advanced connectivity features, appealing to a tech-savvy demographic seeking improved auditory assistance.

By Technology: The market is segmented by technology into Analog and Digital hearing aids. Digital hearing aids are dominant in this segment due to their superior sound quality, noise reduction capabilities, and connectivity to other smart devices, enhancing user experience. Digital technology allows for customized hearing solutions tailored to user needs, contributing to their preference among audiologists and consumers alike. The integration of AI and IoT with digital devices also attracts younger consumers and those looking for advanced hearing solutions.

Europe Hearing Aids Market Competitive Landscape

The Europe Hearing Aids Market is dominated by a select few established players, including multinational companies with expansive R&D investments, advanced technology, and widespread distribution networks. These major players leverage their innovation capacities to meet evolving consumer needs, maintaining strong market shares across Europe.

Europe Hearing Aids Market Analysis

Growth Drivers

- Aging Population: The increasing population aged 65 and above in Europe reached 95 million in 2024, driving demand for hearing aids due to natural hearing degeneration. This demographic is expected to expand further by 2029, creating sustained demand for hearing solutions in the market. Eurostat's 2024 estimates indicate that this age group will grow by nearly 10 million over the next five years, enhancing demand for hearing aids.

- Increasing Prevalence of Hearing Loss: Over 60 million individuals in Europe are affected by moderate to severe hearing loss, especially in countries like Germany, the UK, and France. Health organizations project this number to rise to 75 million by 2030 due to environmental and health factors, reinforcing demand for effective hearing aid solutions.

- Technological Advancements in Hearing Aids: The market has seen an influx of innovative features like Bluetooth compatibility, rechargeable batteries, and AI-powered noise cancellation, resulting in an 18% increase in device adoption over traditional models in 2024. Leading manufacturers are prioritizing R&D, with $500 million invested collectively across major players to enhance technological integration within hearing aids.

Market Challenges

- High Device Costs: Premium hearing aids in Europe range from 1,000 to 4,000 per unit, limiting accessibility for low-income individuals. Despite insurance, out-of-pocket expenses can exceed 1,000 per device in markets like Germany, making it a significant barrier to widespread adoption.

- Limited Accessibility in Rural Areas: Rural regions in Eastern and Southern Europe face challenges in accessing hearing aids due to insufficient distribution channels. In 2024, over 20 million residents in these areas were found to have limited access to qualified audiologists or hearing aid providers, restricting market penetration.

Europe Hearing Aids Market Future Outlook

Over the next five years, the Europe Hearing Aids Market is poised to experience significant growth due to ongoing innovations in hearing aid technology, an increase in digital health integration, and supportive government policies across Europe. The surge in demand for user-friendly, technologically advanced, and highly customizable hearing aids is expected to further expand the market, particularly in developed European economies with high healthcare spending.

Market Opportunities

- Emerging Digital Health Technologies: Digital health technologies are bridging gaps in healthcare accessibility, with teleaudiology expanding hearing aid access in rural areas. By 2024, teleaudiology solutions reached 1.5 million users across Europe, and future expansion into remote areas promises further growth.

- Expansion in Emerging Markets within Europe: Eastern European markets like Poland and Romania are experiencing increased demand for hearing aids, with their markets collectively projected to add over 2 million new users by 2029. Rising healthcare investments in these regions aim to improve hearing care services and device accessibility.

Scope of the Report

|

By Product Type |

Behind-the-Ear (BTE) In-the-Ear (ITE) Receiver-in-the-Canal (RIC) Completely-in-the-Canal (CIC) |

|

By Technology |

Analog Digital |

|

By Patient Age Group |

Pediatric Adult Geriatric |

|

By Distribution Channel |

Hospital Clinics Retail Pharmacies Online Sales |

|

By Region |

West East North South |

Products

Key Target Audience

Hearing Clinics and Audiology Centers

Healthcare Providers and Practitioners

Manufacturers of Hearing Aids and Related Equipment

Suppliers and Distributors

E-commerce Platforms Specialized in Healthcare

Retail Pharmacies

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., European Medicines Agency, National Institute for Health and Care Excellence)

Companies

Players Mentioned in the Report:

Sonova Holding AG

Demant A/S

GN Store Nord A/S

Cochlear Limited

Amplifon

Starkey Hearing Technologies

MED-EL

WS Audiology

Oticon Medical

Sivantos Pte. Ltd.

Table of Contents

1. Europe Hearing Aids Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Europe Hearing Aids Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Europe Hearing Aids Market Analysis

3.1 Growth Drivers

3.1.1 Aging Population

3.1.2 Increasing Prevalence of Hearing Loss

3.1.3 Technological Advancements in Hearing Aids

3.1.4 Government Initiatives (Subsidies, Insurance Policies)

3.2 Market Challenges

3.2.1 High Device Costs

3.2.2 Limited Accessibility in Rural Areas

3.2.3 Competition from Alternative Solutions (e.g., PSAPs)

3.3 Opportunities

3.3.1 Emerging Digital Health Technologies

3.3.2 Expansion in Emerging Markets within Europe

3.3.3 Increasing Penetration of E-commerce for Distribution

3.4 Trends

3.4.1 Growth in Tele-Audiology Services

3.4.2 Demand for Invisible Hearing Aids

3.4.3 Integration with Smartphone Applications

3.5 Government Regulations

3.5.1 EU Medical Device Regulation (MDR) Compliance

3.5.2 Reimbursement Policies in Key Markets

3.5.3 Data Privacy and Digital Health Regulations

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape Ecosystem

4. Europe Hearing Aids Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Behind-the-Ear (BTE)

4.1.2 In-the-Ear (ITE)

4.1.3 Receiver-in-the-Canal (RIC)

4.1.4 Completely-in-the-Canal (CIC)

4.2 By Technology (In Value %)

4.2.1 Analog Hearing Aids

4.2.2 Digital Hearing Aids

4.3 By Patient Age Group (In Value %)

4.3.1 Pediatric

4.3.2 Adult

4.3.3 Geriatric

4.4 By Distribution Channel (In Value %)

4.4.1 Hospital Clinics

4.4.2 Retail Pharmacies

4.4.3 Online Sales

4.5 By Region (In Value %)

4.5.1 Western Europe

4.5.2 Eastern Europe

4.5.3 Northern Europe

4.5.4 Southern Europe

5. Europe Hearing Aids Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Sonova Holding AG

5.1.2 Demant A/S

5.1.3 GN Store Nord A/S

5.1.4 WS Audiology

5.1.5 Cochlear Limited

5.1.6 Starkey Hearing Technologies

5.1.7 MED-EL

5.1.8 Amplifon

5.1.9 Zounds Hearing, Inc.

5.1.10 RION Co., Ltd.

5.1.11 IntriCon Corporation

5.1.12 Eargo, Inc.

5.1.13 Sivantos Pte. Ltd.

5.1.14 Hearing Life

5.1.15 Oticon Medical

5.2 Cross Comparison Parameters (Revenue, R&D Expenditure, Number of Patents, Market Presence, Partnerships, Target Market, Product Portfolio Range, Geographic Reach)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Europe Hearing Aids Market Regulatory Framework

6.1 Medical Device Regulations (EU MDR)

6.2 Compliance Requirements

6.3 Certification Processes

6.4 Data Protection Regulations (GDPR for Digital Health Data)

7. Europe Hearing Aids Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Europe Hearing Aids Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Technology (In Value %)

8.3 By Patient Age Group (In Value %)

8.4 By Distribution Channel (In Value %)

8.5 By Region (In Value %)

9. Europe Hearing Aids Market Analysts Recommendations

9.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Suggested Marketing Initiatives

9.4 Identification of White Space Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first phase involves developing a comprehensive ecosystem map to identify major stakeholders within the Europe Hearing Aids Market. Through rigorous desk research, leveraging secondary and proprietary sources, the goal is to recognize critical factors driving market dynamics.

Step 2: Market Analysis and Construction

This step involves gathering historical data on the Europe Hearing Aids Market, evaluating trends in consumer adoption, regional distribution, and sales channels to construct accurate market estimates. A rigorous examination of service quality metrics further validates these revenue projections.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are formulated and validated through consultations with industry experts and stakeholders across Europe, offering essential insights into operational and strategic aspects. This phase ensures the reliability of market data through qualitative insights from seasoned professionals.

Step 4: Research Synthesis and Final Output

In the final stage, interactions with leading hearing aid manufacturers provide data on product-specific sales, consumer preferences, and regional demand. This approach ensures a comprehensive, data-backed analysis of the Europe Hearing Aids Market.

Frequently Asked Questions

1. How big is the Europe Hearing Aids Market?

The Europe Hearing Aids Market is valued at USD 3.5 billion, reflecting a strong demand driven by the aging population and the adoption of digital hearing solutions.

2. What challenges does the Europe Hearing Aids Market face?

The Europe Hearing Aids Market faces challenges such as high device costs, limited access in rural areas, and competition from alternative solutions like personal sound amplification products (PSAPs).

3. Who are the major players in the Europe Hearing Aids Market?

Key players in the Europe Hearing Aids Market include Sonova Holding AG, Demant A/S, GN Store Nord A/S, Amplifon, and Cochlear Limited, dominating due to their extensive product portfolios and technological advancements.

4. What are the growth drivers of the Europe Hearing Aids Market?

The Europe Hearing Aids Market is propelled by rising incidences of hearing loss, government healthcare initiatives, and the adoption of advanced digital hearing aids with connectivity features.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.