Europe Heating Radiator Market Outlook to 2030

Region:Europe

Author(s):Meenakshi Bisht

Product Code:KROD5679

November 2024

83

About the Report

Europe Heating Radiator Market Overview

- The Europe Heating Radiator market, based on five years of historical data, is valued at USD 2 billion. The markets growth is largely fueled by the regions adoption of stringent energy efficiency regulations, efforts toward carbon neutrality, and increasing demand for residential heating solutions. Rising urbanization and renovations of aging infrastructure in Western Europe also play a key role in this markets expansion.

- The market is dominated by countries like Germany, the United Kingdom, and France. Germanys leadership is attributed to its robust manufacturing capabilities, continuous innovation in heating technology, and strong environmental policies that support energy-efficient infrastructure. The UK and France are also key players, driven by high demand for residential heating in densely populated urban areas and government subsidies aimed at promoting energy-efficient home improvements.

- The European Union's revised Energy Efficiency Directive (EU) 2023/1791, which entered into force on October 10, 2023, establishes a legally binding target to reduce the EU's final energy consumption by 11.7% by 2030, compared to the 2020 reference scenario. This directive emphasizes the 'energy efficiency first' principle, mandating that energy efficiency considerations be integrated into all relevant policy and investment decisions across sectors.

Europe Heating Radiator Market Segmentation

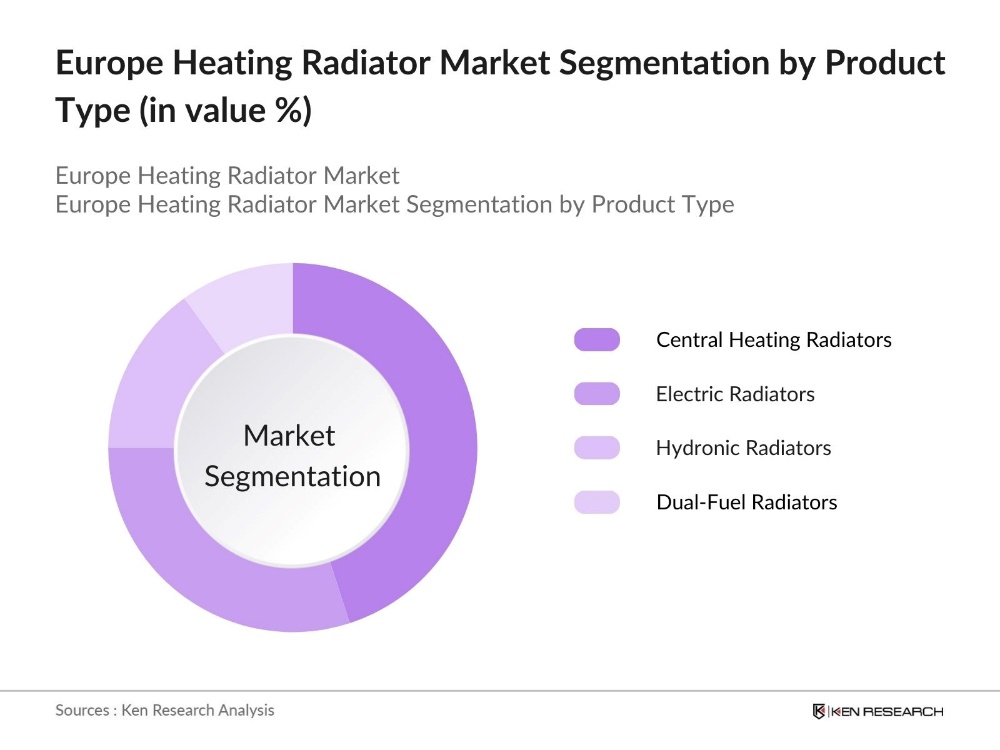

By Product Type: The market is segmented by product type into central heating radiators, electric radiators, hydronic radiators, and dual-fuel radiators. Central heating radiators currently dominate this segment due to their widespread adoption in residential buildings and the infrastructure in place to support central heating systems in Europe. Their energy efficiency and compatibility with various fuel types, including renewable energy sources, make them the preferred choice in residential and commercial spaces. Additionally, retrofitting central heating systems with modern radiators aligns with the EUs energy-saving directives.

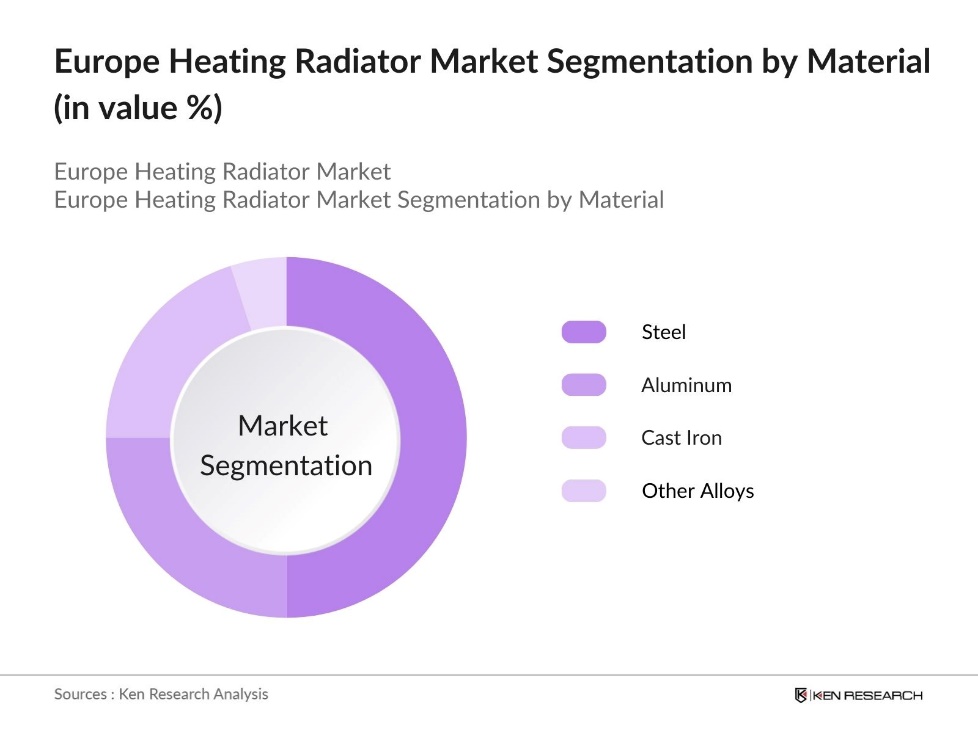

By Material: The market is segmented by material, including steel, aluminum, cast iron, and other alloys. Steel radiators dominate the segment due to their durability, affordability, and compatibility with modern heating systems. Steels excellent thermal conductivity and fast heating capability make it ideal for central heating systems, which are common across European households. Manufacturers continue to innovate with high-quality steel radiators that meet European efficiency standards, making steel the most popular material in this market.

Europe Heating Radiator Market Competitive Landscape

The Europe Heating Radiator market is characterized by the presence of key domestic and international players, each contributing to product innovation, market expansion, and adherence to European regulatory standards. Major players such as Stelrad Radiators, Zehnder Group AG, and Rointe dominate the market with a strong focus on energy efficiency and sustainability. This consolidation showcases the influence of established players in driving innovation within the heating radiator sector.

Europe Heating Radiator Industry Analysis

Growth Drivers

- Climate Adaptation Initiatives: Europe's commitment to climate adaptation is evident through substantial investments in sustainable infrastructure. In 2023, the European Union allocated €17.5 billion to the Just Transition Fund (JTF), which is designed to support regions transitioning to a low-carbon economy.. This fund facilitates the adoption of energy-efficient technologies, including modern heating radiators, to mitigate climate change impacts. Such financial commitments underscore the region's dedication to integrating eco-friendly heating solutions.

- Increasing Urbanization: Europe's urban population has been steadily rising, with urban areas housing approximately 75% of the total population in 2022. This urban expansion drives the demand for residential and commercial buildings equipped with efficient heating systems. The construction of new urban housing units necessitates the installation of modern heating radiators, aligning with the continent's energy efficiency goals.

- Rise in Energy-Efficient Building Standards: The European Union's Energy Performance of Buildings Directive mandates that all new buildings must be nearly zero-energy by 2021. This directive has led to a surge in the adoption of energy-efficient heating solutions, including advanced radiators. For instance, the Energy Performance of Buildings Directive (EPBD) and the Green Homes Directive are pivotal in setting ambitious targets for new constructions to achieve zero emissions by 2030.

Market Challenges

- High Production Costs: The production of advanced heating radiators requires premium materials and intricate manufacturing processes, leading to higher production expenses. The complexity of production contributes to elevated prices, impacting affordability and possibly limiting consumer reach. Supply chain disruptions and rising costs of essential materials further amplify the financial strain on manufacturers. Consequently, these factors contribute to higher end prices, which can potentially slow down market growth and accessibility.

- Installation Complexities: The installation of modern heating radiators often demands specific technical skills and can be labor-intensive. A shortage of skilled professionals has made it difficult for many companies to find qualified installers, resulting in project delays and increased installation expenses. These complexities pose a significant barrier to market growth, as both delays and higher installation costs may deter potential consumers from adopting advanced heating radiator systems.

Europe Heating Radiator Market Future Outlook

Over the next five years, the Europe Heating Radiator market is expected to show notable growth driven by continuous advancements in energy-efficient heating technologies, rising adoption of smart home systems, and governmental support for low-emission solutions. This growth trajectory is likely to be bolstered by Europe’s commitment to carbon neutrality, leading to increased demand for radiators that align with eco-friendly initiatives. Manufacturers are anticipated to focus on hybrid and smart radiator systems that enhance heating efficiency while reducing overall energy consumption.

Market Opportunities

- Renewable Energy Integration: The European Union's policies strongly encourage the shift toward renewable energy, fostering opportunities for integrating green energy solutions within heating systems. This regulatory focus on sustainability incentivizes radiator manufacturers to develop products compatible with renewable energy sources, which aligns with the region’s broader environmental goals. By embracing renewable energy compatibility, manufacturers can support the transition to more eco-friendly heating solutions, appealing to a market increasingly driven by sustainability priorities.

- Expansion in Smart Home Systems: The rapid growth of the smart home market in Europe presents a valuable opportunity for heating radiator manufacturers to innovate. As more homes adopt connected devices, there is increasing demand for smart heating solutions that integrate seamlessly with home automation systems. Smart radiators offer users enhanced control, such as remote access and programmable settings, which can contribute to both energy efficiency and improved user experience. This trend underscores a shift toward convenience and intelligent energy management in modern households.

Scope of the Report

|

By Product Type |

Central Heating Radiators Electric Radiators Hydronic Radiators Dual Fuel Radiators |

|

By Material |

Steel Aluminum Cast Iron Others (e.g., Copper Alloys) |

|

By Application |

Residential Commercial Industrial Healthcare |

|

By Technology |

Conventional Radiators Smart Radiators Low-Temperature Radiators |

|

By Region |

Western Eastern Northern Southern |

Products

Key Target Audience

Heating Equipment Manufacturers

Residential Construction Companies

Commercial Property Manufacturers

Energy Service Companies (ESCOs)

Renewable Energy Industry

Government and Regulatory Bodies (e.g., European Environment Agency, EU Directorate-General for Energy)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Stelrad Radiators

Zehnder Group AG

Rointe

Vasco Group

Rettig ICC

Purmo Group

Kermi GmbH

Fondital S.p.A.

IRSAP S.p.A.

Therma Group

Table of Contents

1. Europe Heating Radiator Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Europe Heating Radiator Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Europe Heating Radiator Market Analysis

3.1. Growth Drivers

3.1.1. Climate Adaptation Initiatives

3.1.2. Increasing Urbanization

3.1.3. Rise in Energy-Efficient Building Standards

3.1.4. Enhanced Aesthetic Demand for Interiors

3.2. Market Challenges

3.2.1. High Production Costs

3.2.2. Installation Complexities

3.2.3. Environmental Concerns Regarding Emissions

3.3. Opportunities

3.3.1. Renewable Energy Integration

3.3.2. Expansion in Smart Home Systems

3.3.3. Development of Hybrid Heating Solutions

3.4. Trends

3.4.1. Rising Demand for Smart Radiators

3.4.2. Innovations in Radiator Design and Materials

3.4.3. Adoption of Low-Temperature Radiators

3.5. Government Regulations

3.5.1. European Energy Efficiency Directives

3.5.2. Standards for Low Emission Heating Systems

3.5.3. Renewable Heat Incentives

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. Europe Heating Radiator Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Central Heating Radiators

4.1.2. Electric Radiators

4.1.3. Hydronic Radiators

4.1.4. Dual Fuel Radiators

4.2. By Material (In Value %)

4.2.1. Steel

4.2.2. Aluminum

4.2.3. Cast Iron

4.2.4. Others (e.g., Copper Alloys)

4.3. By Application (In Value %)

4.3.1. Residential

4.3.2. Commercial

4.3.3. Industrial

4.3.4. Healthcare

4.4. By Technology (In Value %)

4.4.1. Conventional Radiators

4.4.2. Smart Radiators

4.4.3. Low-Temperature Radiators

4.5. By Region (In Value %)

4.5.1. Western Europe

4.5.2. Eastern Europe

4.5.3. Northern Europe

4.5.4. Southern Europe

5. Europe Heating Radiator Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Stelrad Radiators

5.1.2. Zehnder Group AG

5.1.3. Rointe

5.1.4. Vasco Group

5.1.5. Rettig ICC

5.1.6. Purmo Group

5.1.7. Kermi GmbH

5.1.8. Fondital S.p.A.

5.1.9. IRSAP S.p.A.

5.1.10. Therma Group

5.1.11. Brugman Radiatorenfabriek B.V.

5.1.12. Myson Heating

5.1.13. Radson

5.1.14. Baxi Heating

5.1.15. Ferroli S.p.A.

5.2. Cross Comparison Parameters (Revenue, Production Capacity, Regional Reach, Product Portfolio, Innovation Score, Brand Strength, Customer Reach, Market Share)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Private Equity and Venture Capital Funding

6. Europe Heating Radiator Market Regulatory Framework

6.1. Energy Efficiency Standards

6.2. Low-Carbon Heating Incentives

6.3. Certification Processes

7. Europe Heating Radiator Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Europe Heating Radiator Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Material (In Value %)

8.3. By Application (In Value %)

8.4. By Technology (In Value %)

8.5. By Region (In Value %)

9. Europe Heating Radiator Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involved mapping out the key stakeholders within the Europe Heating Radiator market. Extensive desk research and database analysis were employed to define critical variables influencing the market, such as regulatory requirements, technology trends, and end-user preferences.

Step 2: Market Analysis and Construction

In this phase, historical data for heating radiator adoption was analyzed alongside infrastructure statistics, energy-efficiency standards, and consumer purchasing trends. This comprehensive analysis facilitated an accurate estimate of market size and growth projections.

Step 3: Hypothesis Validation and Expert Consultation

Industry hypotheses were validated through interviews with heating radiator manufacturers, energy consultants, and construction industry experts. These insights were instrumental in aligning the studys findings with real-world operational insights.

Step 4: Research Synthesis and Final Output

The final stage involved synthesizing data from both bottom-up and top-down approaches. Detailed feedback from market practitioners was integrated to verify data accuracy, ensuring a comprehensive and credible market analysis.

Frequently Asked Questions

01. How big is the Europe Heating Radiator market?

The Europe Heating Radiator market, valued at USD 2 billion, is driven by increasing urbanization and stringent energy-efficiency regulations that have propelled the adoption of modern heating solutions.

02. What are the challenges in the Europe Heating Radiator market?

Challenges in Europe Heating Radiator market include high production costs, compliance with strict environmental standards, and the technical complexities of integrating renewable energy into traditional heating systems.

03. Who are the major players in the Europe Heating Radiator market?

Key players in Europe Heating Radiator market include Stelrad Radiators, Zehnder Group AG, and Rointe. These companies are influential due to their extensive product portfolios, production capacity, and adherence to energy-efficient innovations.

04. What are the growth drivers of the Europe Heating Radiator market?

The Europe Heating Radiator market is driven by factors such as government incentives for low-emission solutions, consumer demand for energy-efficient products, and the modernization of heating infrastructure across urban areas.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.