Europe Heavy Construction Equipment Market Outlook to 2030

Region:Europe

Author(s):Paribhasha Tiwari

Product Code:KROD10295

November 2024

84

About the Report

Europe Heavy Construction Equipment Market Overview

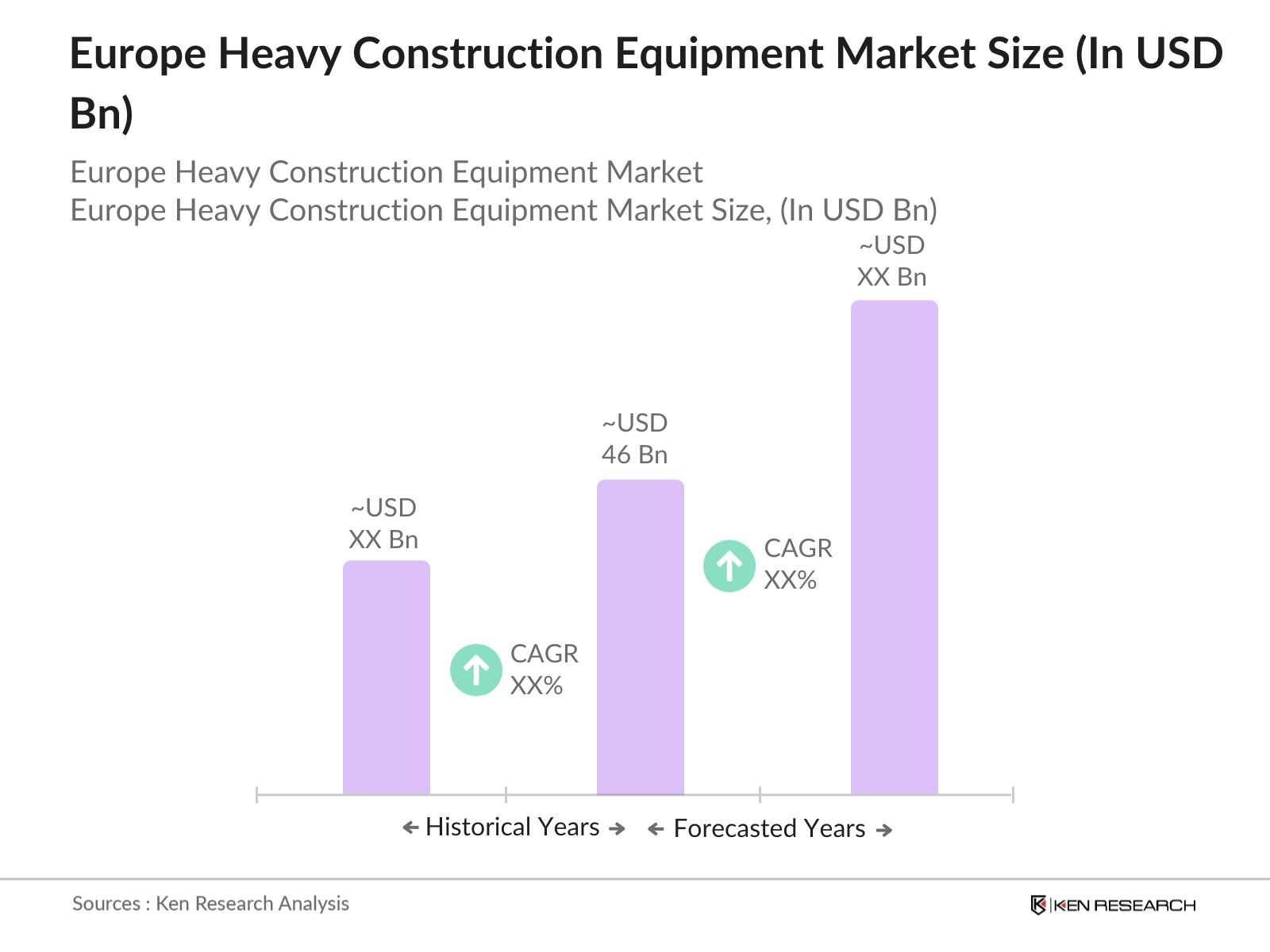

- The Europe Heavy Construction Equipment market is valued at USD 46 billion, driven by large-scale infrastructure development projects and rising demand for advanced construction machinery. Significant investments from both public and private sectors are propelling growth, especially in key areas such as roads, bridges, and renewable energy projects. Additionally, technological innovations, including automation and electric-powered equipment, are reshaping the market dynamics by enhancing operational efficiency and reducing emissions, thereby fueling demand for newer equipment.

- Germany and France dominate the Europe Heavy Construction Equipment market due to their robust infrastructure development plans and government-backed initiatives aimed at modernizing construction practices. These countries also lead in adopting sustainable construction equipment, driven by stringent environmental regulations that push for low-emission machinery. Furthermore, their strong construction sectors, coupled with substantial investments in transportation, renewable energy projects, and housing, solidify their dominance in the market.

- The European Green Deal, with over 1 trillion in funding, continues to impact the construction sector by promoting sustainable and eco-friendly practices. This initiative drives demand for energy-efficient heavy construction equipment, with an emphasis on reducing carbon emissions across the EU.

Europe Heavy Construction Equipment Market Segmentation

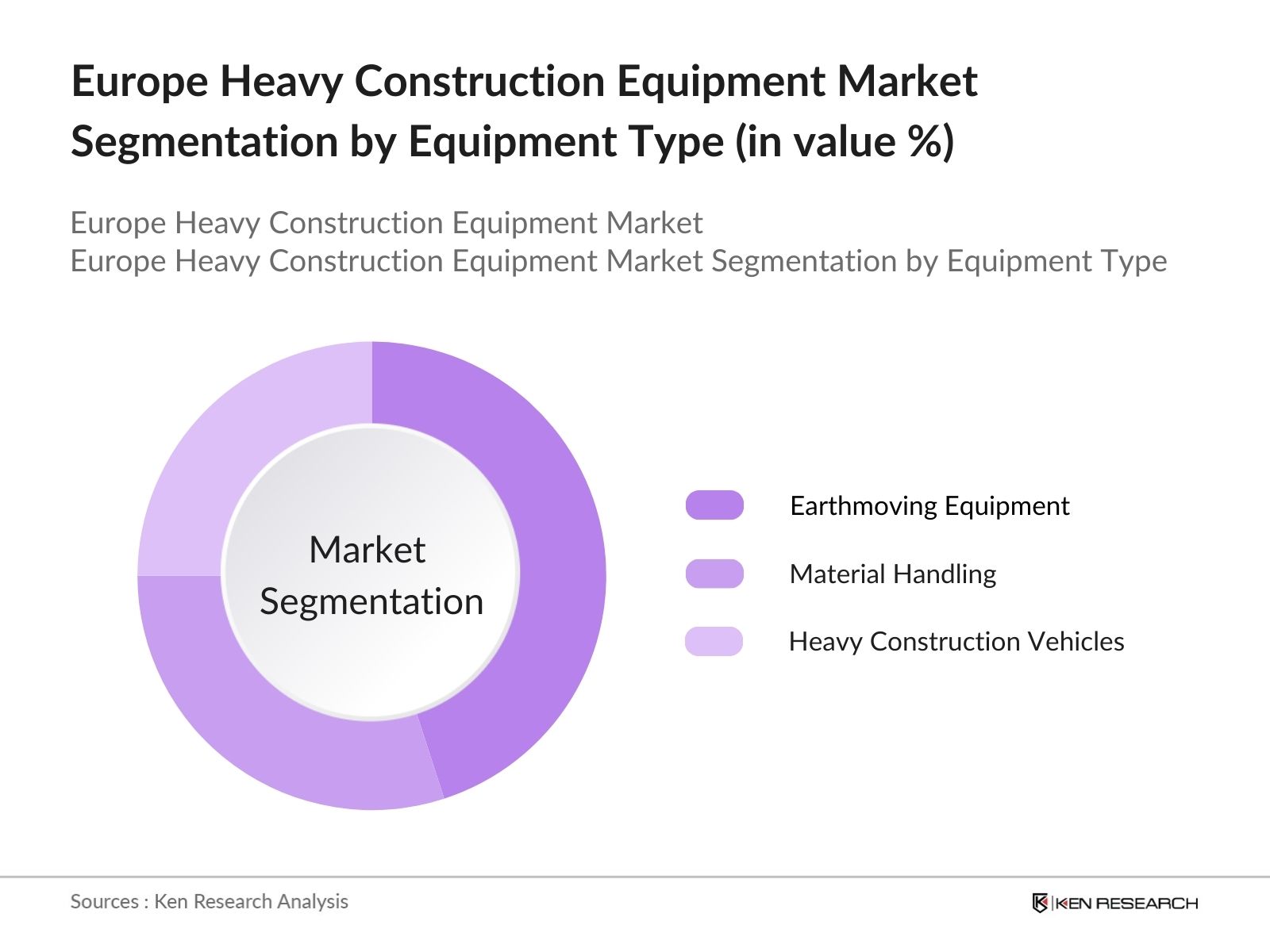

By Equipment Type: The Europe Heavy Construction Equipment market is segmented by equipment type into earthmoving equipment, material handling equipment, and heavy construction vehicles. Recently, earthmoving equipment has dominated the market due to its widespread application in large infrastructure projects, such as road and highway construction, as well as in mining activities. This segment includes excavators, loaders, and bulldozers, which are essential for digging and moving earth, making them crucial for almost every type of construction project. Technological advancements such as autonomous machinery are also propelling this segment.

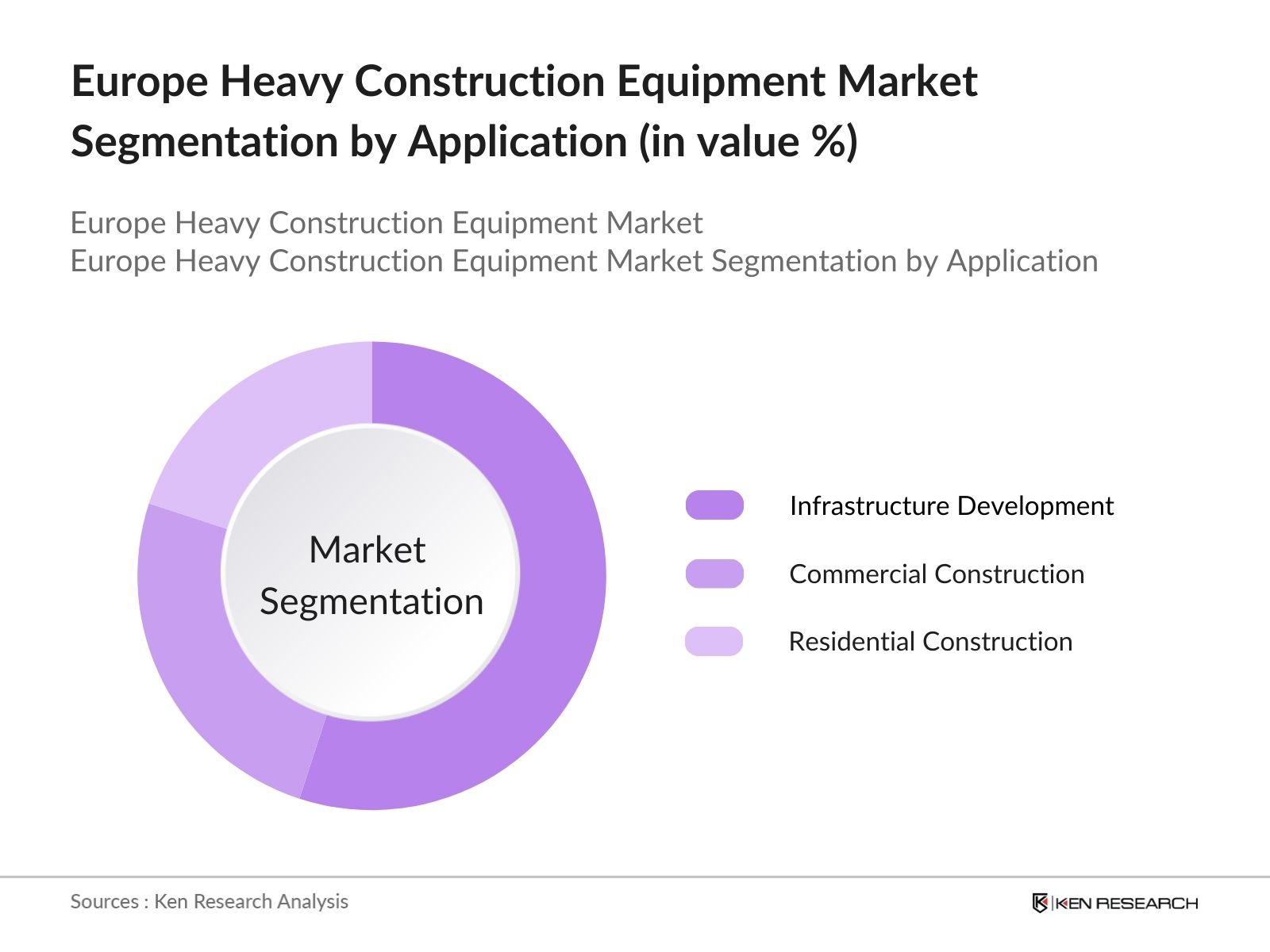

By Application: The market is further segmented by application into commercial construction, residential construction, and infrastructure development. Infrastructure development holds the dominant market share due to the surge in government-led infrastructure projects across Europe. The ongoing investments in roads, railways, and bridges, particularly in Western Europe, contribute significantly to the demand for heavy construction equipment. With a focus on upgrading transportation networks and renewable energy projects, infrastructure development is expected to remain the largest application segment in the near future.

Europe Heavy Construction Equipment Market Competitive Landscape

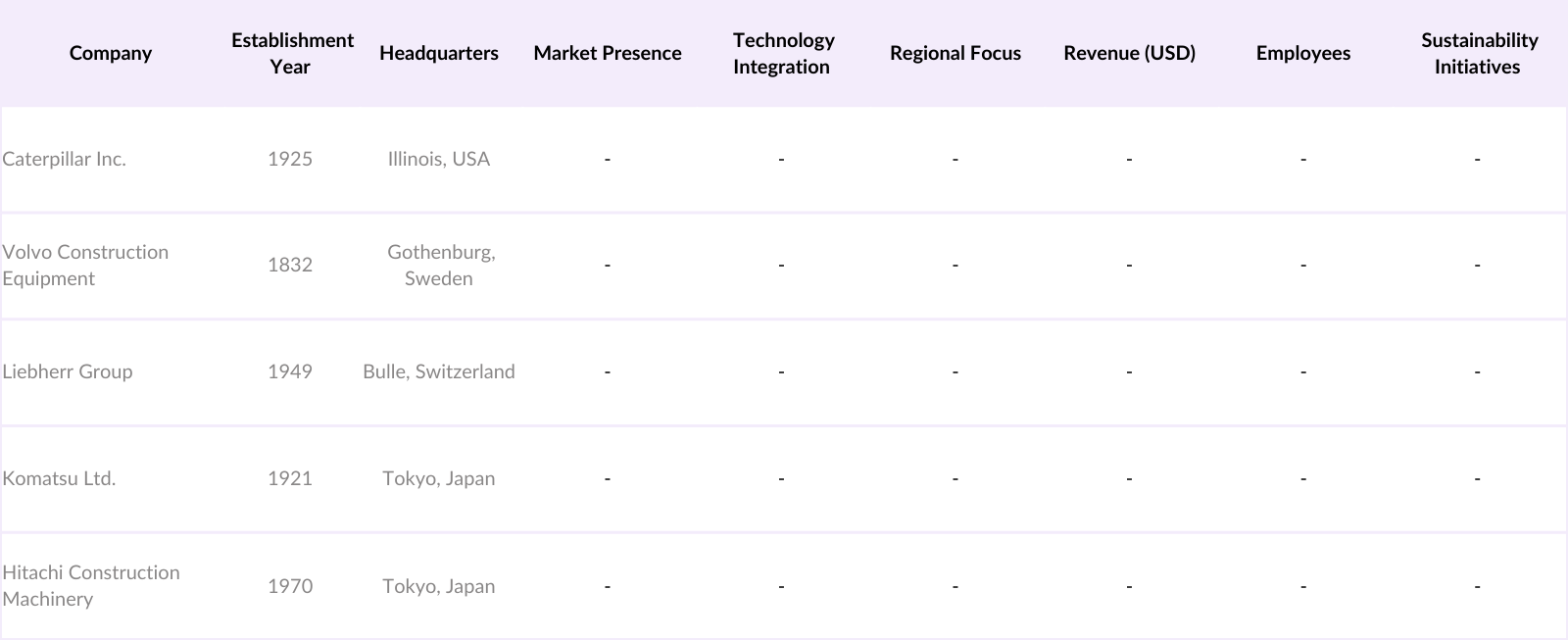

The Europe Heavy Construction Equipment market is highly consolidated, with a few key players holding significant market share. These companies are characterized by their strong presence across multiple regions, advanced technological integration, and robust financial capabilities. For example, Caterpillar Inc. and Volvo Construction Equipment lead the market with innovations in automated machinery and sustainability initiatives aimed at reducing the carbon footprint of their equipment.

Europe Heavy Construction Equipment Market Analysis

Growth Drivers

- Government Infrastructure Projects: In 2024, European governments continue to channel significant investments into public infrastructure. For example, the European Investment Bank has allocated 25 billion towards projects such as railways, roads, and renewable energy installations, driving demand for heavy construction equipment. Public sector-led initiatives, including the European Green Deal, have enhanced demand for sustainable construction machinery, spurring industry growth.

- Private Investment in Mega Projects: The private sector plays a key role in funding large-scale projects across Europe, such as the 16 billion Thames Tideway Tunnel project in the UK and the Grand Paris Express project, valued at over 35 billion. This influx of private capital into high-profile infrastructure and residential developments boosts demand for cranes, excavators, and other heavy equipment.

- Increasing Automation in Construction: In 2024, Europe sees increased integration of automated and AI-driven machinery on construction sites. Major construction firms in Germany and France have adopted autonomous excavators, reducing labor dependency and speeding up project timelines. The number of such machines is projected to reach around 20,000 units by 2025, enhancing efficiency in the sector.

Market Challenges

- High Cost of Heavy Equipment: The average cost of new heavy construction equipment ranges from 100,000 to 500,000 in Europe, making it a significant capital expenditure for many companies. Smaller contractors, in particular, face difficulties in financing such machinery, limiting the overall market adoption.

- Stringent Emission Norms: In 2024, the EU's strict emission regulations under the European Green Deal continue to impact the industry. Heavy equipment manufacturers must comply with low-emission standards, such as Stage V engine regulations, which require a significant investment in research and development. This regulatory pressure drives up costs for manufacturers and delays new product launches.

Europe Heavy Construction Equipment Market Future Outlook

Over the next five years, the Europe Heavy Construction Equipment market is expected to experience robust growth driven by the increasing adoption of automated and electric-powered equipment. Continuous government support for large-scale infrastructure development, coupled with rising environmental concerns, will push the demand for low-emission, technologically advanced construction equipment. Furthermore, growing investments in renewable energy projects and smart city initiatives across Europe will also contribute to this growth trajectory.

Market Opportunities

- Adoption of Electric and Hybrid Equipment: The demand for electric and hybrid construction machinery is growing rapidly due to Europe's green initiatives. By 2025, over 10,000 electric excavators and loaders are expected to be in operation across Europe, driven by the need for zero-emission equipment in urban projects. Major manufacturers like Volvo and Caterpillar are ramping up their electric equipment offerings, capitalizing on this trend.

- Rising Demand for Rental Equipment: The rental equipment market is growing as companies aim to reduce their capital expenditures. The European Equipment Rental Association reported that the rental market surpassed 27 billion in 2023, and this number is expected to rise steadily as businesses opt to rent rather than purchase expensive machinery. This shift benefits rental companies while increasing equipment accessibility for smaller contractors.

Scope of the Report

|

By Equipment Type |

Earthmoving Equipment Material Handling Equipment Heavy Construction Vehicles Road Construction Equipment Concrete Equipment |

|

By Application |

Commercial Construction Residential Construction Infrastructure Mining and Excavation, Oil and Gas Industry |

|

By Power Output |

Below 200 HP 200500 HP Above 500 HP |

|

By Drive Type |

Hydraulic Drive Electric Drive Hybrid Drive |

|

By Region |

Germany France United Kingdom Italy Spain |

Products

Key Target Audience

Construction Equipment Manufacturers

Infrastructure Developers

Construction Contractors

Investors and Venture Capitalist Firms

Renewable Energy Project Developers

Heavy Equipment Rental Services

Green Construction Companies

Government and Regulatory Bodies (e.g., European Environment Agency, European Commission)

Companies

Players Mentioned in the Report:

Caterpillar Inc.

Volvo Construction Equipment

Liebherr Group

Komatsu Ltd.

Hitachi Construction Machinery

JCB Ltd.

CNH Industrial N.V.

Doosan Infracore

Sany Heavy Industry Co., Ltd.

Hyundai Heavy Industries

Table of Contents

1. Europe Heavy Construction Equipment Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics Overview

1.4. Market Segmentation Overview

2. Europe Heavy Construction Equipment Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Europe Heavy Construction Equipment Market Analysis

3.1. Growth Drivers (Factors such as Infrastructure Investments, Government Stimulus, Technological Advancements)

3.1.1. Government Infrastructure Projects

3.1.2. Private Investment in Mega Projects

3.1.3. Increasing Automation in Construction

3.1.4. Green Construction Demand

3.2. Market Challenges (Challenges like High Initial Costs, Environmental Regulations, and Market Fragmentation)

3.2.1. High Cost of Heavy Equipment

3.2.2. Stringent Emission Norms

3.2.3. Labor Skill Gaps and Workforce Challenges

3.2.4. Competition from Low-cost Imports

3.3. Opportunities (Opportunities arising from Technological Integration, Rental Services Growth, Sustainability Initiatives)

3.3.1. Adoption of Electric and Hybrid Equipment

3.3.2. Rising Demand for Rental Equipment

3.3.3. Focus on Sustainable Construction Practices

3.3.4. Development of Smart Cities Initiatives

3.4. Trends (Latest Trends like Autonomous Construction Equipment, Data Analytics Integration)

3.4.1. Autonomous Construction Machinery

3.4.2. Predictive Maintenance with IoT

3.4.3. Usage of Advanced Construction Materials

3.4.4. Integration of 3D Printing in Construction Projects

3.5. Government Regulations (Government initiatives related to Safety Standards, Emission Controls, and Equipment Certification)

3.5.1. European Emission Standards

3.5.2. National Construction Safety Guidelines

3.5.3. Certification for Heavy Equipment Usage

3.5.4. Green Building Regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Europe Heavy Construction Equipment Market Segmentation

4.1. By Equipment Type (In Value %)

4.1.1. Earthmoving Equipment

4.1.2. Material Handling Equipment

4.1.3. Heavy Construction Vehicles

4.1.4. Road Construction Equipment

4.1.5. Concrete Equipment

4.2. By Application (In Value %)

4.2.1. Commercial Construction

4.2.2. Residential Construction

4.2.3. Infrastructure

4.2.4. Mining and Excavation

4.2.5. Oil and Gas Industry

4.3. By Power Output (In Value %)

4.3.1. Below 200 HP

4.3.2. 200500 HP

4.3.3. Above 500 HP

4.4. By Drive Type (In Value %)

4.4.1. Hydraulic Drive

4.4.2. Electric Drive

4.4.3. Hybrid Drive

4.5. By Region (In Value %)

4.5.1. Germany

4.5.2. France

4.5.3. United Kingdom

4.5.4. Italy

4.5.5. Spain

5. Europe Heavy Construction Equipment Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Caterpillar Inc.

5.1.2. Volvo Construction Equipment

5.1.3. Liebherr Group

5.1.4. Komatsu Ltd.

5.1.5. CNH Industrial N.V.

5.1.6. Hitachi Construction Machinery

5.1.7. Doosan Infracore

5.1.8. JCB Ltd.

5.1.9. Hyundai Heavy Industries

5.1.10. Terex Corporation

5.1.11. Sany Heavy Industry Co., Ltd.

5.1.12. Kubota Corporation

5.1.13. Manitou Group

5.1.14. Wacker Neuson SE

5.1.15. XCMG Group

5.2. Cross Comparison Parameters (No. of Employees, Revenue, Global Reach, Power Output, Annual Production, Inception Year, Market Share, Manufacturing Locations)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Joint Ventures and Partnerships

5.8. New Product Launches

5.9. Innovation in Automation and Digitalization

6. Europe Heavy Construction Equipment Market Regulatory Framework

6.1. Environmental Regulations

6.2. Compliance with European Machinery Directives

6.3. Certification and Standardization Requirements

6.4. Worker Safety and Training Guidelines

7. Europe Heavy Construction Equipment Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Europe Heavy Construction Equipment Future Market Segmentation

8.1. By Equipment Type (In Value %)

8.2. By Application (In Value %)

8.3. By Power Output (In Value %)

8.4. By Drive Type (In Value %)

8.5. By Region (In Value %)

9. Europe Heavy Construction Equipment Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Key Investment Opportunities

9.3. Go-to-Market Strategy

9.4. Value Chain Optimization

Research Methodology

Step 1: Identification of Key Variables

The first step involves identifying key variables such as demand trends, technological advancements, and regulatory factors affecting the Europe Heavy Construction Equipment market. This is conducted through comprehensive desk research and stakeholder analysis, covering both primary and secondary data sources.

Step 2: Market Analysis and Construction

In this phase, historical data on market size, equipment usage trends, and revenue generation is analyzed. Particular focus is placed on infrastructure development projects and their influence on heavy equipment demand. Key metrics such as the penetration of automated machinery are also examined to understand market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses developed from the initial data analysis are validated through expert interviews and consultations with industry professionals. This process ensures that market estimates and trends are grounded in practical insights from leading market players and industry experts.

Step 4: Research Synthesis and Final Output

The final step integrates all data sources to create a holistic market overview. This includes consolidating insights from heavy equipment manufacturers and validating trends in sustainability, technological integration, and market demand. The final report presents an accurate, data-backed analysis of the Europe Heavy Construction Equipment market.

Frequently Asked Questions

1. How big is the Europe Heavy Construction Equipment Market?

The Europe Heavy Construction Equipment market is valued at USD 46 billion, driven by significant infrastructure investments across the region, particularly in sectors such as renewable energy and transportation.

2. What are the challenges in the Europe Heavy Construction Equipment Market?

Challenges in the Europe Heavy Construction Equipment market include high initial costs of equipment, stringent environmental regulations, and a shortage of skilled labor, which may impede operational efficiency in certain areas.

3. Who are the major players in the Europe Heavy Construction Equipment Market?

Major players in the Europe Heavy Construction Equipment market include Caterpillar Inc., Volvo Construction Equipment, Liebherr Group, Komatsu Ltd., and Hitachi Construction Machinery, dominating due to their technological advancements and strong regional presence.

4. What are the growth drivers of the Europe Heavy Construction Equipment Market?

Key growth drivers in the Europe Heavy Construction Equipment market include increasing government infrastructure spending, a rise in smart city projects, and the adoption of automated and electric-powered construction equipment.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.