Europe Industrial Gases Market Outlook to 2030

Region:Europe

Author(s):Sanjeev

Product Code:KROD5712

November 2024

95

About the Report

Europe Industrial Gases Market Overview

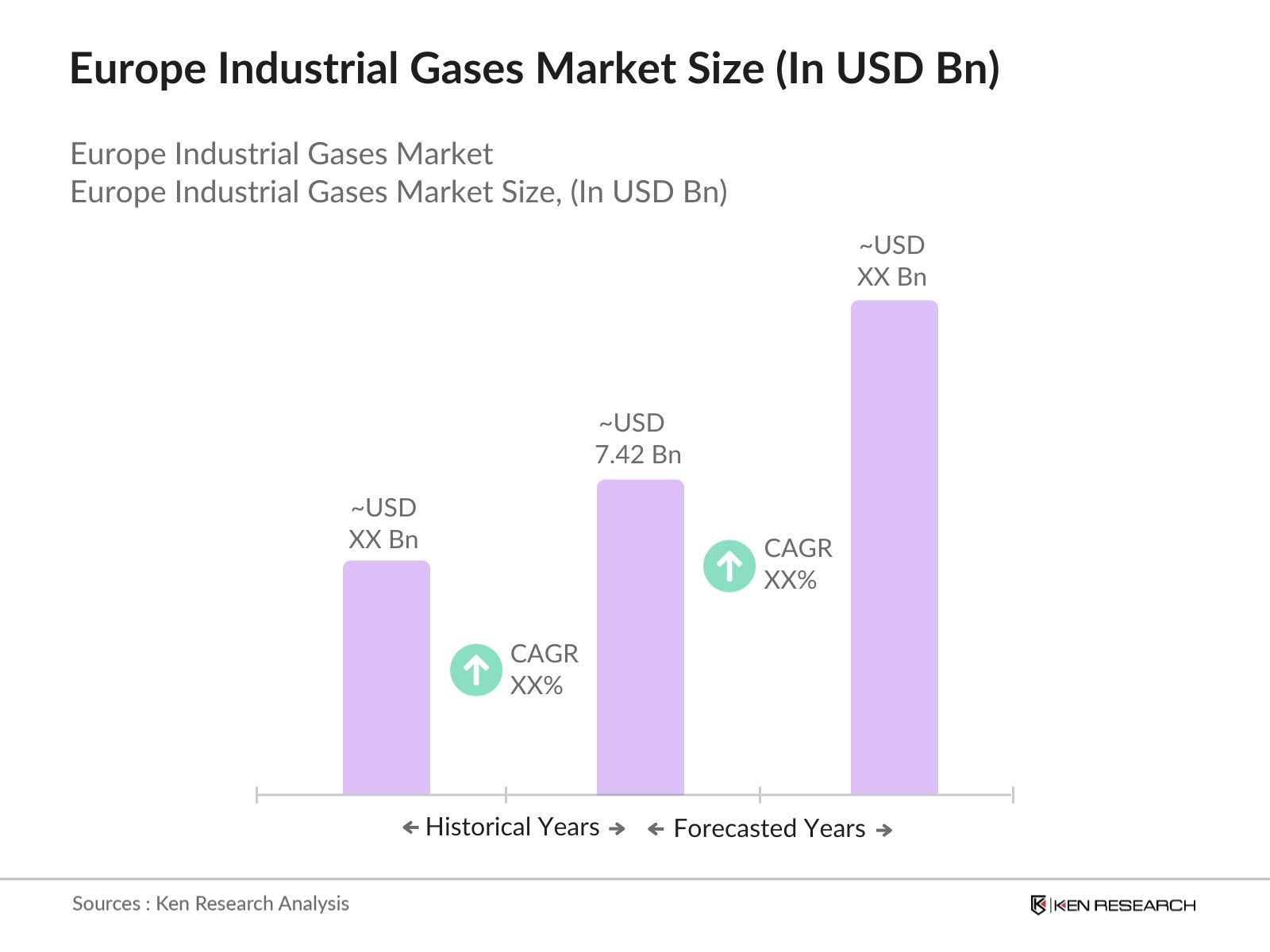

- The Europe industrial gases market is valued at approximately USD 7.42 billion, driven by significant demand from manufacturing and healthcare sectors. With advancements in gas production technologies, the demand for gases like nitrogen, oxygen, and hydrogen has increased. Industrial gases are essential across sectors such as chemicals, food processing, and metallurgy, where they contribute to high production efficiency and quality. The robust infrastructure in these industries has further supported the consistent growth of the industrial gases market in the region, bolstering its valuation.

- Western European countries, particularly Germany and France, dominate the industrial gases market due to their advanced manufacturing base and strong presence of healthcare and automotive sectors. Germany's leadership in automotive manufacturing and high research investment in hydrogen fuel technology amplify its demand for industrial gases. Additionally, Frances progressive policies supporting hydrogen energy have strengthened its position in the market, making these two countries key drivers in the European region.

- The European Union has implemented strict emission control standards, requiring industrial gas producers to comply with CO2 emission reduction mandates. In 2024, the EUs Emission Trading System (ETS) covered approximately 10,000 installations, targeting sectors responsible for 40% of greenhouse gas emissions. Compliance with these standards significantly impacts the industrial gases market as producers invest in low-emission technologies to meet regulatory requirements.

Europe Industrial Gases Market Segmentation

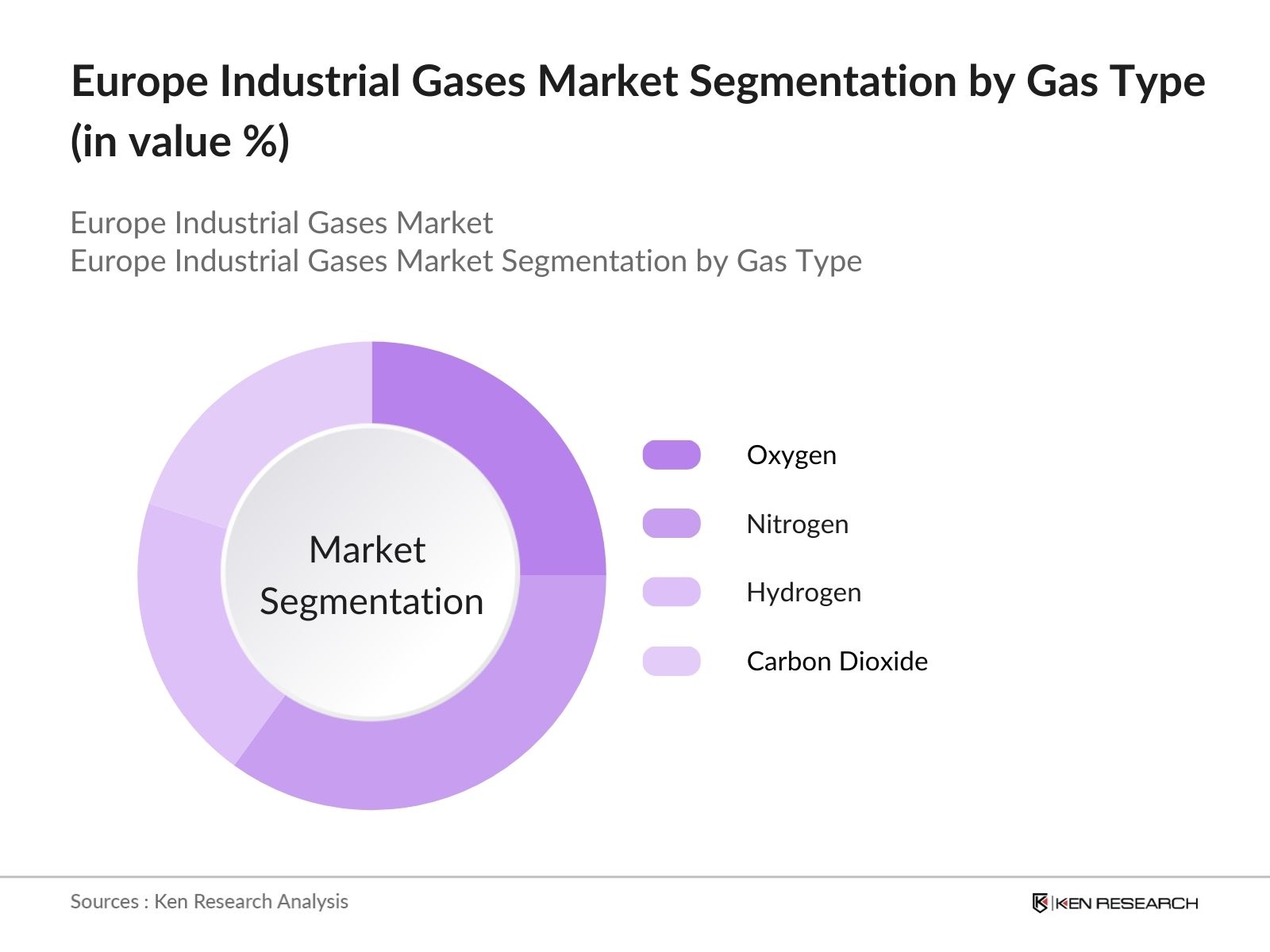

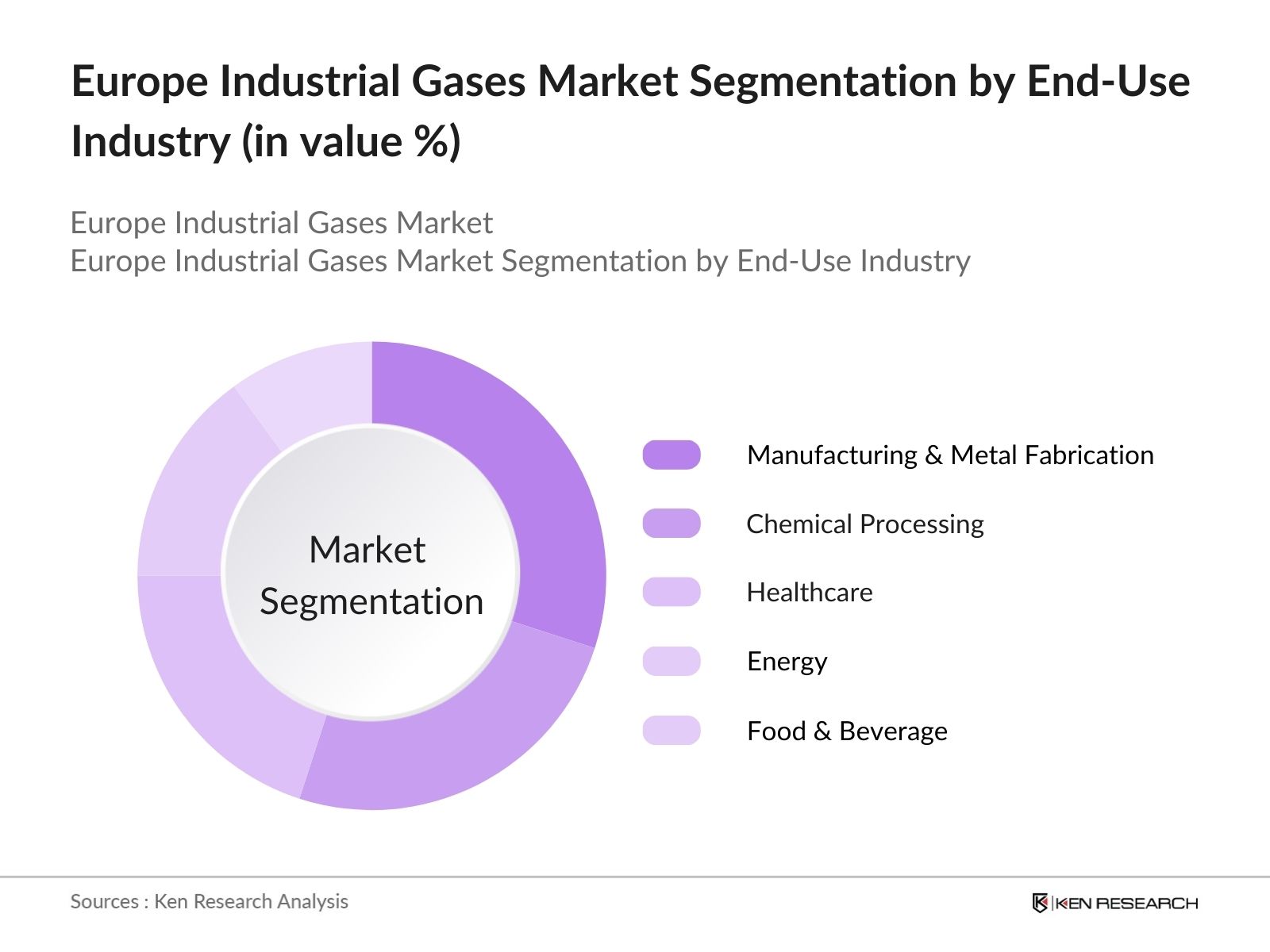

Europe's industrial gases market is segmented by gas type and by end-use industry.

- By Gas Type: Europe's industrial gases market is segmented by gas type into oxygen, nitrogen, hydrogen, and carbon dioxide. Currently, nitrogen has a dominant share under this segment, primarily due to its extensive applications in industries like food processing, electronics, and metal fabrication. Nitrogens inert properties make it valuable in preserving food, manufacturing semiconductors, and preventing oxidation in metal processes, which has driven its widespread usage.

- By End-Use Industry: The market is segmented by end-use industry, which includes manufacturing and metal fabrication, chemical processing, healthcare, energy, and food & beverage. The manufacturing and metal fabrication segment currently holds the highest share, due to the essential role of gases like oxygen and nitrogen in welding, cutting, and refining metals. Additionally, Europes large automotive and aerospace sectors further fuel demand in this segment, making it a significant contributor to market share.

Europe Industrial Gases Market Competitive Landscape

The Europe industrial gases market is dominated by a few key players, with companies such as Linde plc, Air Liquide, and Messer Group leading in terms of innovation and strategic expansions. This consolidation underscores the influence of these companies and their established distribution networks across the region.

Europe Industrial Gases Industry Analysis

Growth Drivers

- Expanding Manufacturing Sector: The industrial gases market in Europe is seeing significant demand growth, primarily driven by the manufacturing sectors expansion. Industrial production in Europe rose by approximately 1.8% in 2023, with manufacturing sectors such as automotive, chemicals, and steel reporting high demand for gases like oxygen and nitrogen for welding, cutting, and chemical reactions. The German manufacturing sector, the largest in Europe, contributed heavily, with an output of EUR 2.2 trillion in 2023, fueling industrial gas demand. Government incentives aimed at boosting European manufacturing resilience further support this trend.

- Rise in Clean Energy Initiatives: The rise in clean energy initiatives across Europe is pushing the demand for hydrogen, particularly for green hydrogen production. The European Union allocated EUR 20 billion in 2024 towards green hydrogen projects, aiming to reduce carbon emissions across various sectors. The renewable energy sectors growth12% annually in wind and solar installationsrequires industrial gases for operations and manufacturing components. These investments also align with the EUs Green Deal objectives, enhancing the industrial gases markets demand within Europes green energy transition.

- Growth in the Food & Beverage Industry: Industrial gases are integral to the food and beverage sector for freezing, packaging, and carbonation processes. The European food and beverage sector, valued at EUR 1.4 trillion in 2023, has seen an increase in nitrogen and carbon dioxide use, specifically for preservation and quality control. Countries like France and Italy lead in this industry, supporting growth in the industrial gases market. The European Food and Drink Industry Confederation highlights a steady increase in gas applications, driven by consumer demand for packaged goods.

Market Challenges

- High Storage and Transportation Costs: The storage and transportation of industrial gases in Europe remain high-cost processes due to stringent safety standards and infrastructure demands. In 2024, the European transport sector faced fuel price increases of up to 10%, impacting logistics expenses for compressed and liquid gas shipments. Transportation of hazardous gases requires specialized vehicles and infrastructure, raising operational costs, particularly in regions with stringent cross-border regulations like the EU.

- Stringent Regulatory Policies: Industrial gases in Europe are subject to strict environmental and safety regulations. The European Chemicals Agencys REACH regulation mandates rigorous safety testing, creating operational compliance challenges for manufacturers and distributors. In 2023, compliance costs associated with emissions and safety standards reached approximately EUR 200 million for the sector, adding financial strain. These regulations ensure environmental and occupational safety but limit smaller firms' competitive ability, thereby impacting market growth.

Europe Industrial Gases Market Future Outlook

Over the coming years, the Europe industrial gases market is expected to experience significant growth due to the rise of green energy projects, increased adoption of hydrogen as an alternative fuel, and expanding applications in healthcare and environmental sectors. As industries prioritize sustainability, the demand for clean gases is likely to rise, making this sector integral to Europes green transition and circular economy initiatives.

Market Opportunities

- Emerging Applications in Electronics and Automotive Sectors: The electronics and automotive sectors increasingly utilize industrial gases for semiconductor manufacturing, laser cutting, and material processing. Germany, a leader in automotive production, reported over 5 million vehicles produced in 2023, with significant industrial gas requirements in welding and assembly processes. The rise of electric vehicle production in Europe further necessitates gases like nitrogen and carbon dioxide, creating opportunities within the expanding automotive and electronics supply chain.

- Government Support for Hydrogen Fuel Initiatives: Hydrogen fuel initiatives receive strong government support across Europe, aligning with the EUs clean energy goals. France and Germany invested a combined EUR 7 billion in hydrogen projects in 2024, with a focus on sustainable fuel alternatives and green hydrogen production. These projects anticipate reducing carbon emissions across industries, providing growth opportunities for industrial gas providers. The EUs Hydrogen Strategy targets an additional 40 gigawatts of hydrogen electrolysers by 2030, pushing near-term demand for industrial gases in green energy projects.

Scope of the Report

|

Oxygen Nitrogen Argon Hydrogen Carbon Dioxide |

|

|

By End-Use Industry |

Manufacturing and Metal Fabrication Chemical Processing Food & Beverage Healthcare, Energy Sector |

|

By Production Technology |

Cryogenic Air Separation Non-Cryogenic Air Separation Hydrogen Production |

|

By Supply Mode |

Packaged Bulk On-Site Generation |

|

By Region |

North East West South |

Products

Key Target Audience

Industrial Gas Manufacturers

Energy Sector Companies

Automotive Manufacturers

Healthcare Providers

Food & Beverage Manufacturers

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., European Commission on Environment, European Chemicals Agency)

Research and Development Firms

Companies

Players Mention in the Report:

Linde plc

Air Liquide

Messer Group GmbH

Praxair Technology, Inc.

Air Products and Chemicals, Inc.

Nippon Gases Europe

SOL Group

SIAD Group

Iwatani Corporation

BASF SE (Industrial Gases Division)

The Linde Group (Industrial Gases Division)

Taiyo Nippon Sanso Corporation

Air Water Inc.

Gulf Cryo

Atlas Copco AB

Table of Contents

1. Europe Industrial Gases Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Key Market Dynamics

1.4 Market Segmentation Overview

2. Europe Industrial Gases Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Europe Industrial Gases Market Analysis

3.1 Growth Drivers

3.1.1 Expanding Manufacturing Sector

3.1.2 Rise in Clean Energy Initiatives

3.1.3 Growth in the Food & Beverage Industry

3.1.4 Increased Demand in the Healthcare Sector

3.2 Market Challenges

3.2.1 High Storage and Transportation Costs

3.2.2 Stringent Regulatory Policies

3.2.3 Infrastructure Limitations

3.3 Opportunities

3.3.1 Emerging Applications in Electronics and Automotive Sectors

3.3.2 Government Support for Hydrogen Fuel Initiatives

3.3.3 Expansion of Carbon Capture and Utilization (CCU)

3.4 Trends

3.4.1 Increasing Adoption of On-Site Gas Generation Systems

3.4.2 Technological Advancements in Gas Purification

3.4.3 Shift towards Renewable Energy Sources for Gas Production

3.5 Regulatory Landscape

3.5.1 Emission Control Standards

3.5.2 European Union Regulations on Industrial Gases

3.5.3 Health and Safety Standards

3.5.4 Permits and Licensing Requirements

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape Mapping

4. Europe Industrial Gases Market Segmentation

4.1 By Gas Type (In Value %)

4.1.1 Oxygen

4.1.2 Nitrogen

4.1.3 Argon

4.1.4 Hydrogen

4.1.5 Carbon Dioxide

4.2 By End-Use Industry (In Value %)

4.2.1 Manufacturing and Metal Fabrication

4.2.2 Chemical Processing

4.2.3 Food & Beverage

4.2.4 Healthcare

4.2.5 Energy Sector

4.3 By Production Technology (In Value %)

4.3.1 Cryogenic Air Separation

4.3.2 Non-Cryogenic Air Separation

4.3.3 Hydrogen Production

4.4 By Supply Mode (In Value %)

4.4.1 Packaged

4.4.2 Bulk

4.4.3 On-Site Generation

4.5 By Region (In Value %)

4.5.1 Western Europe

4.5.2 Eastern Europe

4.5.3 Northern Europe

4.5.4 Southern Europe

4.5.5 Central Europe

5. Europe Industrial Gases Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Linde plc

5.1.2 Air Liquide

5.1.3 Messer Group GmbH

5.1.4 Praxair Technology, Inc.

5.1.5 Air Products and Chemicals, Inc.

5.1.6 Nippon Gases Europe

5.1.7 SOL Group

5.1.8 SIAD Group

5.1.9 Iwatani Corporation

5.1.10 BASF SE (Industrial Gases Division)

5.1.11 The Linde Group (Industrial Gases Division)

5.1.12 Taiyo Nippon Sanso Corporation

5.1.13 Air Water Inc.

5.1.14 Gulf Cryo

5.1.15 Atlas Copco AB

5.2 Cross-Comparison Parameters (Annual Revenue, Market Share %, No. of Production Facilities, Distribution Network Size, Innovations in Gas Technologies, Strategic Partnerships, Environmental Sustainability Initiatives, Market Penetration by Region)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment and Expansion Plans

5.7 Government and Private Sector Investments

5.8 R&D Spending Analysis

6. Europe Industrial Gases Market Regulatory Framework

6.1 Emission Reduction Mandates

6.2 Compliance Standards for Production and Safety

6.3 Industry Certifications

6.4 Regional Environmental Policies and Initiatives

7. Europe Industrial Gases Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Drivers Shaping Future Market Growth

8. Europe Industrial Gases Future Market Segmentation

8.1 By Gas Type (In Value %)

8.2 By End-Use Industry (In Value %)

8.3 By Production Technology (In Value %)

8.4 By Supply Mode (In Value %)

8.5 By Region (In Value %)

9. Europe Industrial Gases Market Analysts Recommendations

9.1 Total Addressable Market (TAM) and Serviceable Market (SAM) Analysis

9.2 Key Customer Segment Insights

9.3 Innovation and Product Development Strategies

9.4 Unexplored Market Opportunities Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping out all critical stakeholders in the Europe Industrial Gases Market, supported by in-depth desk research. This stage also involves categorizing variables impacting market dynamics using a combination of proprietary and secondary databases to ensure a comprehensive market understanding.

Step 2: Market Analysis and Data Compilation

Historical data related to market penetration, distribution trends, and end-use applications is compiled. This phase also examines industry growth patterns in alignment with economic indicators, ensuring accuracy in estimating historical and future growth rates.

Step 3: Hypothesis Validation and Expert Consultation

Developed market hypotheses are validated through consultations with industry professionals via computer-assisted telephone interviews (CATI). Insights from these discussions refine our understanding of operational practices, financial stability, and market dynamics.

Step 4: Final Data Synthesis and Validation

The final phase includes verification of segmented data through engagement with key industry players. This helps confirm data accuracy, particularly regarding market-specific parameters, ensuring a robust analysis of the Europe Industrial Gases Market.

Frequently Asked Questions

01. How big is the Europe Industrial Gases Market?

The Europe industrial gases market is valued at approximately USD 7.42 billion, driven by high demand across industries such as manufacturing and healthcare.

02. What are the key challenges in the Europe Industrial Gases Market?

Challenges in Europe industrial gases market include stringent regulatory compliance, high transportation costs, and the need for significant storage infrastructure, which can impact the operational efficiency of market players.

03. Who are the major players in the Europe Industrial Gases Market?

Key companies in Europe industrial gases market include Linde plc, Air Liquide, Messer Group GmbH, Praxair Technology, and Air Products and Chemicals, Inc., with significant influence due to their established production and distribution networks.

04. What drives the growth of the Europe Industrial Gases Market?

The Europe industrial gases market growth is propelled by increased demand from manufacturing, food processing, and healthcare sectors, as well as the rising adoption of hydrogen as a clean energy source.

05. Which segment dominates the Europe Industrial Gases Market?

The nitrogen segment holds a dominant share due to its extensive use across industries, particularly in food preservation, electronics, and metal fabrication.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.