Europe IoT Market Outlook to 2030

Region:Europe

Author(s):Paribhasha Tiwari

Product Code:KROD3401

November 2024

81

About the Report

Europe IoT Market Overview

- The Europe Internet of Things (IoT) market is currently billion, driven by strong advancements in smart technologies and infrastructure, as well as increased investments in IoT across various industries. Significant drivers include the adoption of IoT in sectors such as manufacturing, transportation, and healthcare. These industries utilize IoT to optimize operations, reduce costs, and enhance efficiency. Government initiatives supporting digital transformation further boost the adoption of IoT technologies across the region.

- Major countries driving the Europe IoT market include Germany, the UK, and France. These countries benefit from their well-developed technology ecosystems, strong R&D investment, and established industrial bases. Germany, in particular, is a leader due to its focus on Industry 4.0 and advanced manufacturing systems, while the UK and France are pushing smart city and IoT-enabled infrastructure projects. Their commitment to innovation, technology infrastructure, and favorable government policies create an environment conducive to IoT expansion.

- The manufacturing, healthcare, and agriculture sectors are leading the charge in IoT adoption. In particular, the healthcare hold a considerable market share as it increasingly integrates connected devices with large databases to improve medical outcomes. Additionally, smart city initiatives are gaining traction, with applications ranging from smart utility meters to transportation solutions.

Europe IoT Market Segmentation

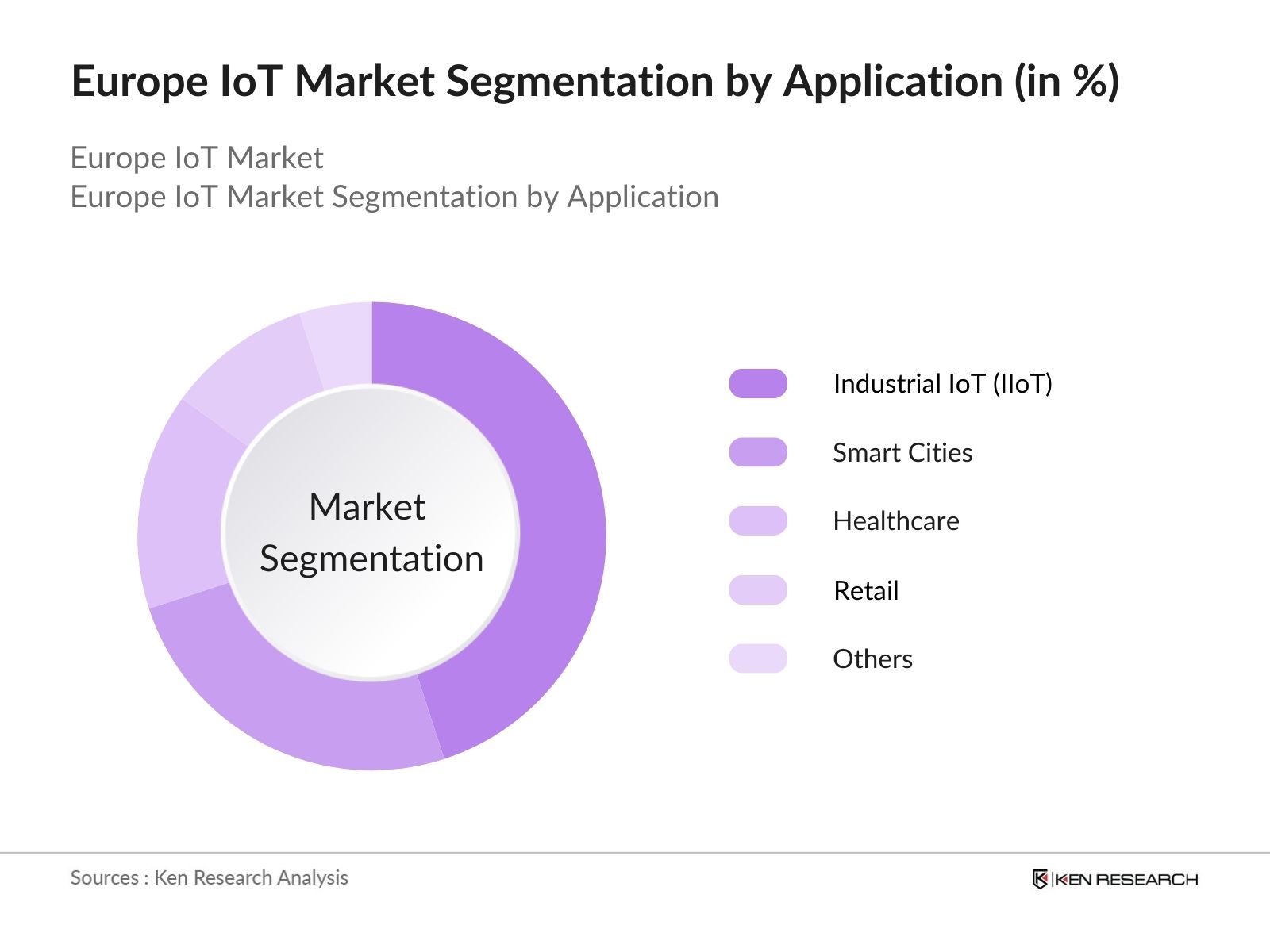

By Application: The Europe IoT market is segmented by application into industrial IoT (IIoT), smart cities, healthcare, and retail. Among these, industrial IoT (IIoT) holds the dominant market share due to the increasing demand for automation and data-driven decision-making in manufacturing. IIoT solutions improve operational efficiency, predictive maintenance, and quality control, all of which are crucial for Europe’s advanced manufacturing industries. Countries like Germany and Italy are leading in this sector due to their robust industrial bases and early adoption of Industry 4.0 initiatives.

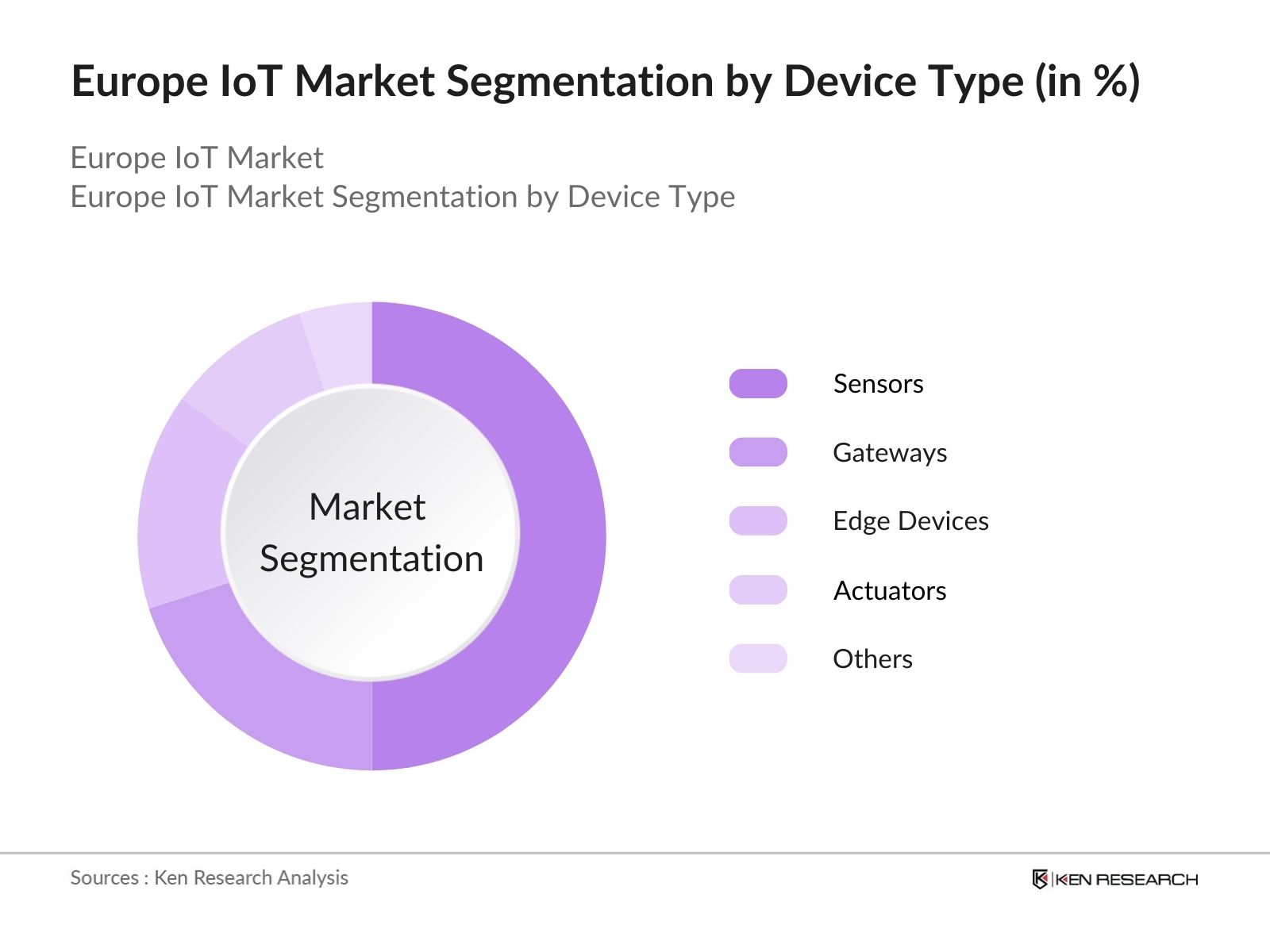

By Device Type: The Europe IoT market is also segmented by device type into sensors, gateways, edge devices, and actuators. Sensors dominate this segment as they are fundamental to all IoT systems, enabling data collection from the physical environment. The demand for sensors is particularly high in industrial IoT applications where they play a crucial role in tracking machine health, product quality, and environmental conditions. Additionally, the proliferation of connected devices in sectors like healthcare and smart cities has further fueled the demand for sensors.

By Device Type: The Europe IoT market is also segmented by device type into sensors, gateways, edge devices, and actuators. Sensors dominate this segment as they are fundamental to all IoT systems, enabling data collection from the physical environment. The demand for sensors is particularly high in industrial IoT applications where they play a crucial role in tracking machine health, product quality, and environmental conditions. Additionally, the proliferation of connected devices in sectors like healthcare and smart cities has further fueled the demand for sensors.

Europe IoT Market Competetive Landscape

Europe IoT Market Competetive Landscape

The Europe IoT market is dominated by several global and regional players that have built a strong presence through technological innovations, strategic partnerships, and deep industry knowledge. Companies like Siemens AG and Bosch Software Innovations lead the market due to their significant investments in industrial IoT and smart infrastructure. Other notable players include Vodafone Group for its IoT connectivity services, Nokia Networks, and SAP SE. These companies have created an ecosystem that supports the scalability of IoT solutions across different verticals.

|

Company |

Establishment Year |

Headquarters |

Market Cap |

IoT Patents |

R&D Investments |

Strategic Partnerships |

Vertical Expertise |

Global Reach |

|

Siemens AG |

1847 |

Germany |

- |

- |

- |

- |

- |

- |

|

Bosch Software Innovations |

1886 |

Germany |

- |

- |

- |

- |

- |

- |

|

Vodafone Group PLC |

1984 |

UK |

- |

- |

- |

- |

- |

- |

|

Nokia Networks |

1865 |

Finland |

- |

- |

- |

- |

- |

- |

|

SAP SE |

1972 |

Germany |

- |

- |

- |

- |

- |

- |

Europe IoT Market Analysis

Growth Drivers

- Expansion of Smart City Projects: The expansion of smart city projects across Europe is driving IoT adoption, with over 300 cities implementing smart technology frameworks. In 2024, the European Commission allocated more than $1.1 billion for urban digitalization, and smart traffic systems. These investments are enhancing the demand for IoT solutions across sectors like mobility, security, and urban planning, fostering innovation and development in smart city projects.

- Rising Demand for Industrial IoT (IIoT): Industrial IoT (IIoT) is revolutionizing industries such as manufacturing and energy, where connected devices enhance productivity. In 2024, Germany alone had over facilities using IoT solutions for automation. The EU is expected to spend $250 billion on IIoT technologies by 2025, driven by industrial digitalization and sustainability initiatives like the European Green Deal.

- Government Investments and Initiatives: are heavily investing in IoT through national programs and EU initiatives. In 2024, the EU committed $2 billion towards IoT technology development under its Digital Europe Programme. Countries like the UK and France have dedicated $150 million to IoT innovation hubs, supporting public infrastructure and industrial modernization.

Market Challenges

- Security and Privacy Concerns: IoT devices are prone to data breaches and cybersecurity risks. In 2024, more than 70% of IoT manufacturers reported vulnerabilities. Europe experienced over 290,000 cybersecurity incidents related to IoT devices in 2023, prompting the European Union to tighten cybersecurity regulations through measures like the Cybersecurity Act to mitigate these risks.

- Lack of IoT Standardization: Interoperability challenges hinder IoT deployment due to varying standards across platforms. In 2024, 80% of IoT solutions in Europe operated on different platforms, making integration difficult. Efforts by the European Telecommunications Standards Institute (ETSI) to standardize protocols are ongoing, but the lack of uniformity still hampers large-scale IoT projects.

Europe IoT Market Future Outlook

Over the next five years, the Europe IoT market is expected to experience substantial growth driven by advancements in AI, 5G, and edge computing technologies. The expansion of smart cities and the continued digitization of industries will also contribute to this growth. Governments across Europe are promoting initiatives to integrate IoT into various sectors such as healthcare, manufacturing, and energy. Additionally, IoT security and data management solutions will play a pivotal role in the future as concerns regarding data privacy and cybersecurity continue to rise.

Market Opportunities

- Growth in IoT Platforms and Solutions: The demand for IoT platforms is expanding, with over 250 platforms active in Europe by 2024. These platforms simplify IoT deployment by offering integrated solutions for industries like healthcare, energy, and logistics. Countries such as Germany and France have invested $500 million in developing IoT platforms, accelerating IoT adoption across multiple sectors.

- Emerging Applications in Healthcare, Agriculture, and Retail: IoT is driving new applications in healthcare, agriculture, and retail. In 2024, 60% of European healthcare facilities implemented IoT-enabled patient monitoring systems, while 2 million connected devices were used in precision farming. In retail, over 500,000 IoT devices enhanced supply chain management, presenting significant growth opportunities in these sectors.

Scope of the Report

|

By Device Type |

IoT Sensors IoT Gateways IoT Edge Devices IoT Actuators |

|

By Application |

Smart Home Automation Industrial IoT (IIoT) Healthcare and Wearables Smart Agriculture Connected Retail |

|

By Connectivity Technology |

5G Connectivity LPWAN (Low Power Wide Area Network) Bluetooth Low Energy (BLE) NFC (Near Field Communication) |

|

By Component |

Hardware (Sensors, Gateways, Chips) Software (Platforms, IoT Solutions) Services (IoT Integration, Maintenance) |

|

By Region |

West East North South |

Products

Key Target Audience

IoT Solution Providers

Network and Connectivity Providers

Industrial Automation Companies

Smart City Infrastructure Developers

IoT Device Manufacturers

Automotive and Transportation Enterprises

Government and Regulatory Bodies (EU Commission, National Telecom Regulators)

Investments and Venture Capitalist Firms

Companies

Players Mentioned in the Report:

Siemens AG

Bosch Software Innovations

Vodafone Group PLC

Nokia Networks

SAP SE

Huawei Technologies Co. Ltd.

Thales Group

Arm Holdings

Ericsson AB

Intel Corporation

Orange S.A.

Schneider Electric

Atos SE

Cisco Systems Inc.

Telit Communications PLC

Table of Contents

1. Europe IoT Market

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

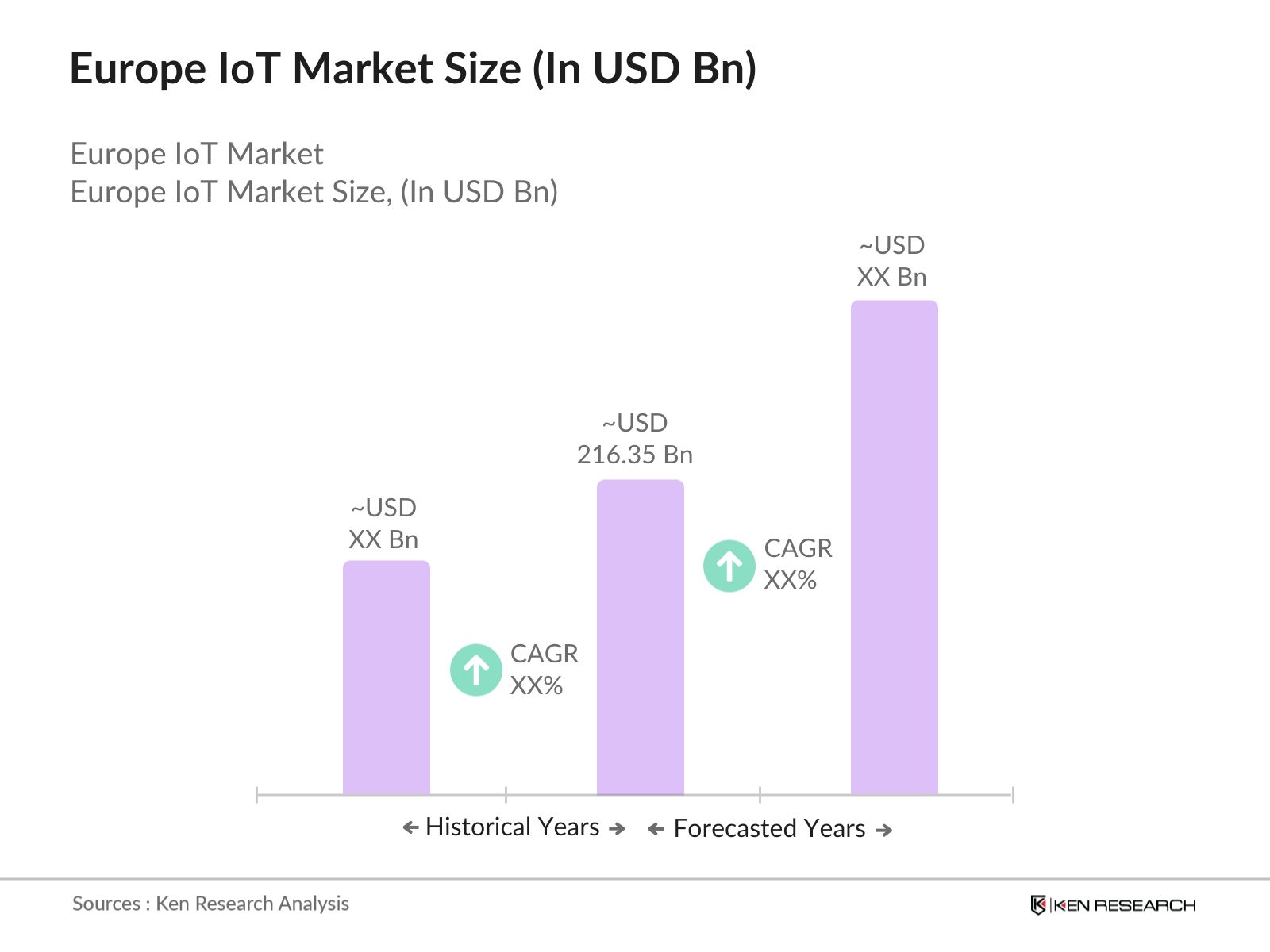

2. Europe IoT Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Europe IoT Market Analysis

3.1. Growth Drivers

3.1.1. Expansion of Smart City Projects

3.1.2. Rising Demand for Industrial IoT (IIoT)

3.1.3. Government Investments and Initiatives

3.1.4. Increased Connectivity and 5G Penetration

3.1.5. Adoption of Edge Computing (IoT Edge Devices)

3.2. Market Challenges

3.2.1. Security and Privacy Concerns

3.2.2. Lack of IoT Standardization

3.2.3. High Initial Investment Costs

3.2.4. Data Management and Integration Complexity

3.3. Opportunities

3.3.1. Growth in IoT Platforms and Solutions

3.3.2. Emerging Applications in Healthcare, Agriculture, and Retail

3.3.3. Collaboration with AI and Blockchain Technologies

3.3.4. IoT Integration in Renewable Energy and Smart Grids

3.4. Trends

3.4.1. Increasing Adoption of Wearable IoT Devices

3.4.2. Growth in IoT-enabled Predictive Maintenance

3.4.3. Connected Autonomous Vehicles

3.4.4. AI-powered IoT Analytics for Business Intelligence

3.5. Government Regulations

3.5.1. GDPR Compliance (Data Privacy for IoT Devices)

3.5.2. IoT Certification Programs and Protocols

3.5.3. Smart Infrastructure Regulations

3.6. Stake Ecosystem (Service Providers, IoT Hardware Vendors, Application Developers, and Systems Integrators)

3.7. Porters Five Forces Analysis

3.8. Competitive Landscape (IoT Market Players, IoT Device Manufacturers, Connectivity Providers)

4. Europe IoT Market Segmentation

4.1. By Device Type (In Value %)

4.1.1. IoT Sensors

4.1.2. IoT Gateways

4.1.3. IoT Edge Devices

4.1.4. IoT Actuators

4.2. By Application (In Value %)

4.2.1. Smart Home Automation

4.2.2. Industrial IoT (IIoT)

4.2.3. Healthcare and Wearables

4.2.4. Smart Agriculture

4.2.5. Connected Retail

4.3. By Connectivity Technology (In Value %)

4.3.1. 5G Connectivity

4.3.2. LPWAN (Low Power Wide Area Network)

4.3.3. Bluetooth Low Energy (BLE)

4.3.4. NFC (Near Field Communication)

4.4. By Component (In Value %)

4.4.1. Hardware (Sensors, Gateways, Chips)

4.4.2. Software (Platforms, IoT Solutions)

4.4.3. Services (IoT Integration, Maintenance)

4.5. By Region (In Value %)

4.5.1. Western Europe

4.5.2. Eastern Europe

4.5.3. Northern Europe

4.5.4. Southern Europe

5. Europe IoT Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Siemens AG

5.1.2. Vodafone Group PLC

5.1.3. Bosch Software Innovations

5.1.4. Cisco Systems Inc.

5.1.5. SAP SE

5.1.6. Huawei Technologies Co.

5.1.7. Atos SE

5.1.8. Schneider Electric

5.1.9. Nokia Networks

5.1.10. Ericsson AB

5.1.11. Intel Corporation

5.1.12. Thales Group

5.1.13. Telit Communications

5.1.14. Orange S.A.

5.1.15. Arm Holdings

5.2 Cross Comparison Parameters (Market Cap, R&D Investments, Global Reach, Vertical Expertise, Customer Base, IoT Patents, Strategic Partnerships, IoT Use Cases)

5.3 Market Share Analysis

5.4 Strategic Initiatives (Joint Ventures, New Product Launches, Strategic Alliances)

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants and Subsidies

5.9 Private Equity Investments

6. Europe IoT Market Regulatory Framework

6.1 Environmental and Data Protection Regulations

6.2 IoT Device Standards and Certifications

6.3 Compliance with IoT Cybersecurity Laws

7. Europe IoT Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Europe IoT Future Market Segmentation

8.1. By Device Type (In Value %)

8.2. By Application (In Value %)

8.3. By Connectivity Technology (In Value %)

8.4. By Component (In Value %)

8.5. By Region (In Value %)

9. Europe IoT Market Analysts' Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Segmentation Analysis

9.3 IoT Monetization Strategies

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

This phase involves mapping the IoT ecosystem in Europe, including key stakeholders such as device manufacturers, IoT solution providers, and network operators. This step is based on comprehensive secondary research utilizing proprietary databases, reports, and market analysis tools to capture relevant data for the market.

Step 2: Market Analysis and Construction

The next step involves the analysis of historical data related to the adoption of IoT across various verticals such as industrial, healthcare, and smart cities. This analysis includes assessing revenue generation, market penetration rates, and identifying the driving factors for each segment.

Step 3: Hypothesis Validation and Expert Consultation

A detailed hypothesis regarding the market size and growth trajectory is developed and validated through interviews with industry experts. This includes consultations with IoT solution providers, manufacturers, and telecom operators to gain firsthand insights into industry trends, challenges, and opportunities.

Step 4: Research Synthesis and Final Output

The final phase includes synthesizing the gathered data to develop a comprehensive market report. The report will include IoT adoption trends, key drivers, growth opportunities, and future projections. It also undergoes expert validation to ensure the accuracy and relevance of the information provided.

Frequently Asked Questions

01. How big is the Europe IoT Market?

The Europe IoT market is valued at USD 216.35 billion, driven by the rapid expansion of smart cities, industrial IoT, and the adoption of edge computing solutions. The rise in connected devices and IoT platforms contributes to its growth.

02. What are the challenges in the Europe IoT Market?

Challenges include data privacy concerns, lack of standardization across IoT devices, and the high cost of infrastructure setup. Furthermore, the fragmented IoT landscape with numerous vendors creates integration complexities.

03. Who are the major players in the Europe IoT Market?

Key players include Siemens AG, Bosch Software Innovations, Vodafone Group, Nokia Networks, and SAP SE. These companies dominate due to their strong industry presence, advanced IoT solutions, and strategic partnerships.

04. What are the growth drivers of the Europe IoT Market?

Growth drivers include the widespread adoption of 5G, the increasing focus on Industry 4.0, and government initiatives to promote digital transformation. The rise of smart cities and connected devices across sectors like healthcare and manufacturing also fuels growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.