Europe Jewelry Market Outlook to 2030

Region:Europe

Author(s):Paribhasha Tiwari

Product Code:KROD6988

December 2024

82

About the Report

Europe Jewelry Market Overview

- The Europe Jewelry Market is valued at USD 36 billion, driven by a strong consumer preference for luxury goods and increasing disposable income. Rising awareness and demand for sustainable and ethically sourced jewelry also play a significant role in propelling market growth. Additionally, digital innovation and increased e-commerce penetration are encouraging online jewelry sales, making it easier for consumers to access a wider range of products.

- France, Italy, and the United Kingdom dominate the European jewelry market. This dominance is largely due to Frances global fashion influence, Italys historical craftsmanship, and the UKs robust luxury goods market. Cities like Paris, Milan, and London are key hubs for luxury jewelry brands, providing a combination of skilled artisans, affluent consumers, and an established retail infrastructure that supports market prominence.

- European jewelry brands are increasingly adopting blockchain technology to enhance supply chain transparency. In 2024, approximately 150 brands incorporated blockchain solutions, allowing consumers to trace the origin of gemstones and metals, verifying authenticity and ethical sourcing. This integration reflects the markets commitment to transparency and sustainability, aligning with consumer preferences and regulatory standards.

Europe Jewelry Market Segmentation

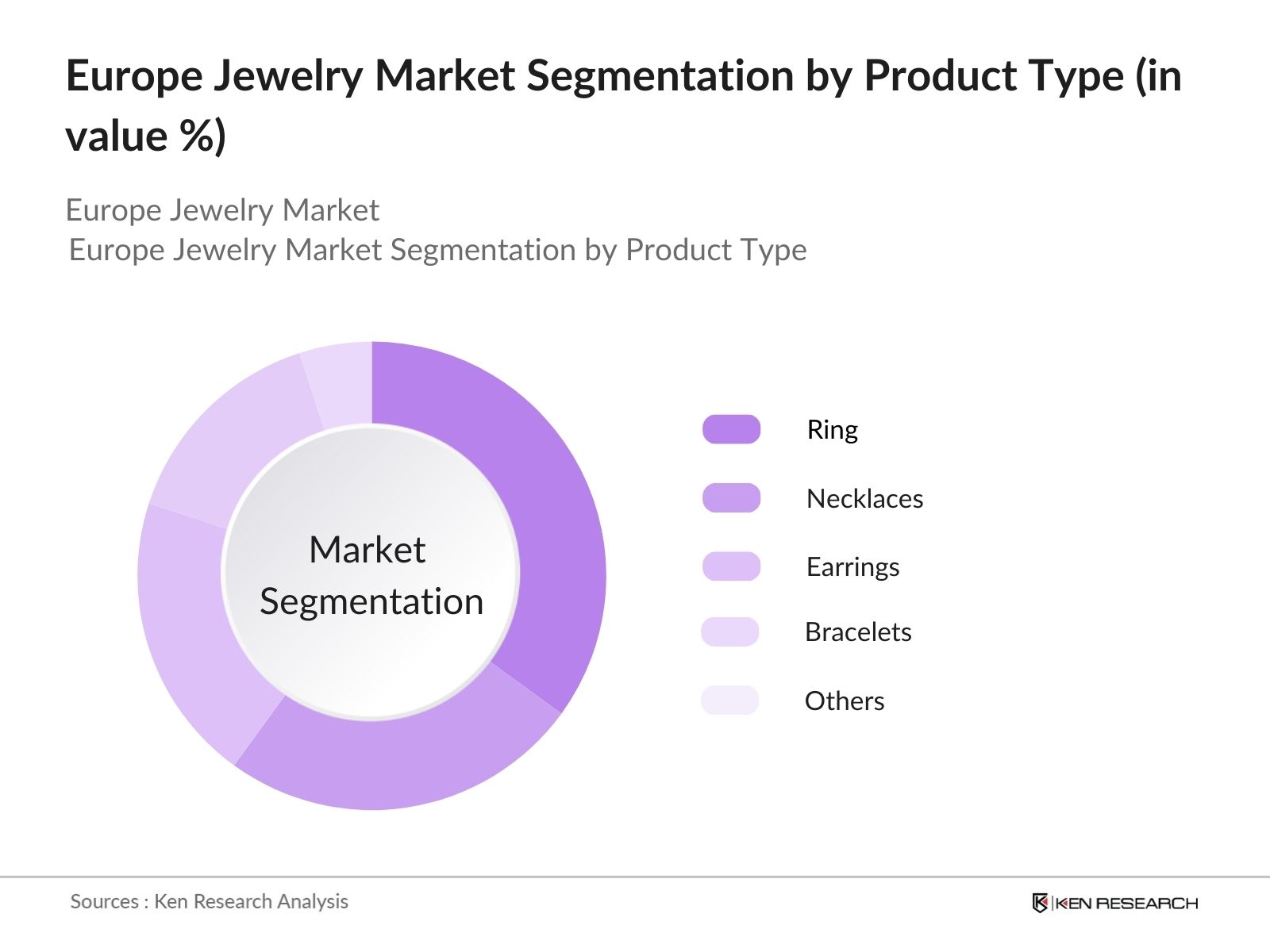

By Product Type: The Europe Jewelry Market is segmented by product type into necklaces, rings, earrings, bracelets, and others. Rings hold a dominant market share due to their popularity for engagement and wedding occasions, contributing significantly to the jewelry sector's revenue. Established brands have built a reputation around classic and contemporary ring designs, which cater to a wide consumer base, reinforcing rings as a top choice in the European market.

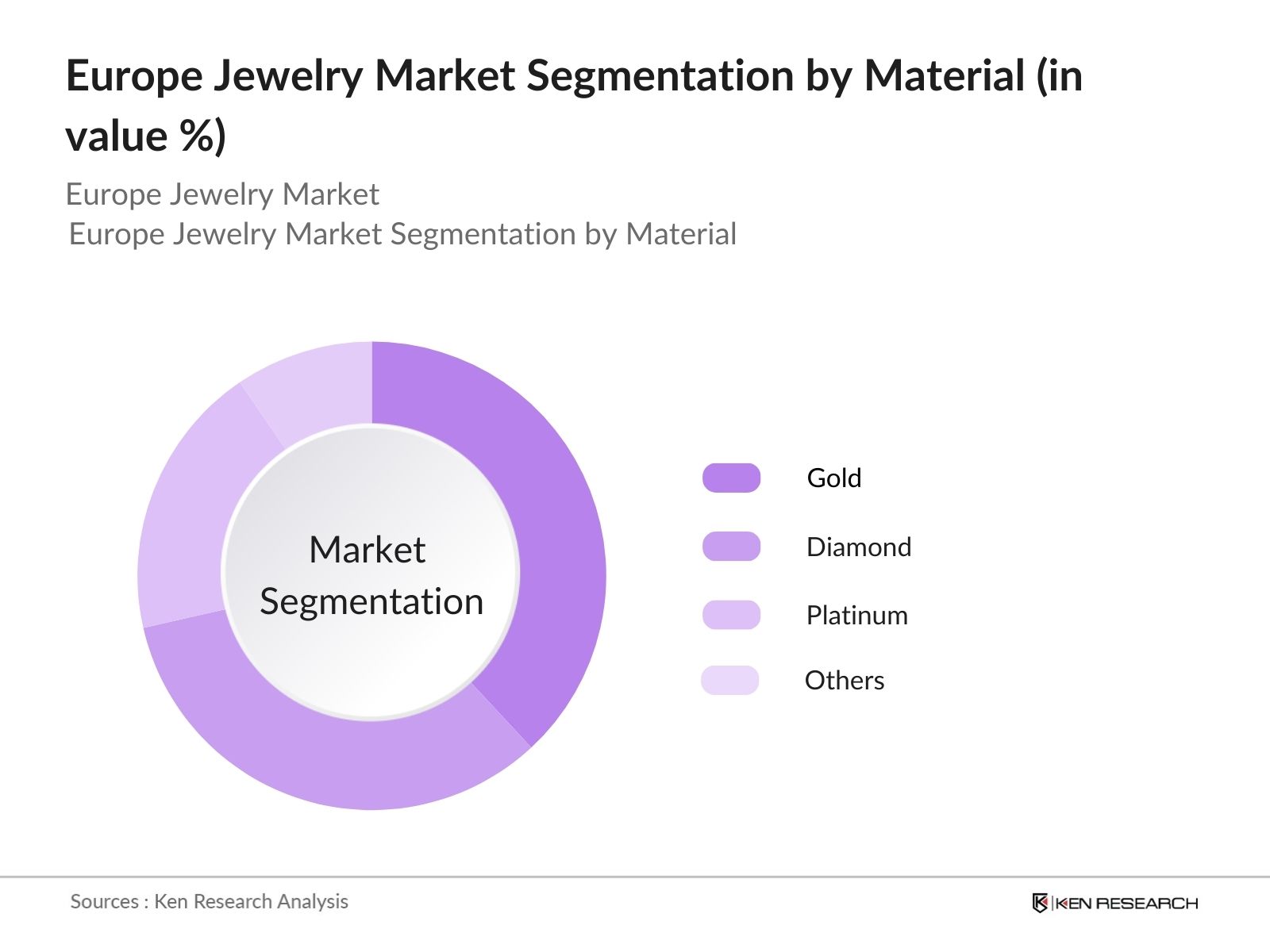

By Material: The material-based segmentation of the European jewelry market includes gold, platinum, diamond, and others. Gold jewelry leads due to its timeless appeal and cultural significance, particularly in markets like Italy and France. Its versatility and value make gold a preferred choice among consumers for various occasions, thus consolidating its dominance in the European market.

Europe Jewelry Market Competitive Landscape

The Europe jewelry market is characterized by the presence of both global luxury brands and specialized local players, creating a competitive environment focused on craftsmanship, innovation, and brand heritage.

Europe Jewelry Market Analysis

Growth Drivers

- Cultural Significance of Jewelry: In Europe, jewelry is deeply rooted in cultural traditions and continues to hold high sentimental and symbolic value. Countries like Italy and France see jewelry as an integral part of cultural heritage, with consumers prioritizing jewelry for events such as weddings, anniversaries, and cultural festivals. This cultural affinity significantly impacts purchasing behavior, contributing to steady demand in regions like the UK and Germany. The Italian jewelry sector, for example, has seen an increase in consumer spending of nearly 1.2 billion in traditional fine jewelry products, driven by cultural traditions and gifting occasions in 2024.

- Expansion of Online Sales Channels: The growth of e-commerce has made luxury jewelry more accessible, with leading brands establishing robust online sales platforms to meet demand across Europe. In 2024, online jewelry sales surged, contributing over 4 billion to total jewelry sales in Western Europe. This growth is supported by advancements in virtual try-on features, personalization, and digital marketing strategies, allowing consumers to explore, customize, and purchase jewelry with ease. The accessibility and convenience of online platforms have broadened the market reach, attracting a younger demographic and driving cross-border sales.

- Demand for Sustainable and Ethically Sourced Jewelry: European consumers are increasingly focused on sustainability, with a marked rise in demand for jewelry crafted from ethically sourced materials. In 2024, Europe saw nearly 6 million consumers prioritize sustainable jewelry purchases, favoring brands that source conflict-free diamonds and use recycled metals. Regulations such as the EU Conflict Minerals Regulation have further reinforced this trend, mandating transparency in sourcing practices. Jewelers across France, Germany, and the UK are expanding sustainable product lines to meet these ethical preferences, enhancing their appeal to environmentally conscious buyers.

Market Challenges

- High Competition from Counterfeit Products: The European jewelry market faces significant challenges from counterfeit products, which impact brand reputation and revenue. Counterfeit jewelry imports were valued at 2 billion in 2024, largely affecting high-end brands across major markets like Italy and France. This influx of fake goods not only erodes consumer trust but also results in revenue loss for authentic brands, leading industry players to increase investments in anti-counterfeiting measures.

- Fluctuating Raw Material Prices: Jewelry production costs are directly impacted by the volatility in the prices of raw materials like gold, platinum, and diamonds. In 2024, the price of gold reached $1,950 per ounce, leading to higher production costs for jewelry manufacturers. This fluctuation affects profit margins and creates pricing challenges for brands aiming to maintain affordability for consumers while managing costs, especially in countries like Germany and Spain, where consumer sensitivity to price changes is high.

Europe Jewelry Market Future Outlook

Over the next five years, the Europe jewelry market is poised for robust growth, driven by consumer demand for personalization, ethical sourcing, and advancements in digital retail. The market's expansion is also fueled by the increasing inclination toward high-value investments, with affluent consumers viewing fine jewelry as a stable asset.

Market Opportunities

- Technological Advancements in Jewelry Design: Innovations in jewelry design technology, including 3D printing and Computer-Aided Design (CAD), have revolutionized production. In 2024, over 2,000 European jewelry designers integrated 3D printing to streamline production, enabling faster prototyping and reducing waste. These advancements allow brands to create intricate designs, catering to the high demand for unique jewelry pieces in markets like France and the UK, while also optimizing production efficiency and sustainability.

- Growth in Male Jewelry Segment: Traditionally, jewelry has been marketed primarily to women, but there has been a notable increase in demand among male consumers in Europe. In 2024, approximately 1.7 million men in Europe purchased jewelry, favoring items like bracelets, rings, and necklaces. This growing interest is driving brands to develop male-oriented product lines, with brands in the UK and Germany reporting a 12% increase in sales from male customers, supported by targeted marketing campaigns and dedicated product ranges.

Scope of the Report

|

By Product Type |

Necklaces Rings Earrings Bracelets Others |

|

By Material |

Gold Platinum Diamond Others |

|

By End-User |

Men Women Children |

|

By Distribution Channel |

Specialty Stores Department Stores Online Retailers Others |

|

By Country |

Germany France United Kingdom Italy Spain Others |

Products

Key Target Audience

Luxury Retail Chains

Jewelry Manufacturers

E-commerce Retailers

Raw Material Suppliers (Precious Metals and Gemstones)

Independent Jewelry Designers

Industry Associations (e.g., European Federation of Jewelry)

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., European Commission)

Companies

Players mentioned in the Report:

Cartier

Bulgari

Chopard

Pandora A/S

Tiffany & Co.

Van Cleef & Arpels

Graff

Piaget

Boucheron

De Beers

Table of Contents

1. Europe Jewelry Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Europe Jewelry Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Europe Jewelry Market Analysis

3.1. Growth Drivers

3.1.1. Rising Disposable Income

3.1.2. Cultural Significance of Jewelry

3.1.3. Expansion of Online Sales Channels

3.1.4. Demand for Sustainable and Ethically Sourced Jewelry

3.2. Market Challenges

3.2.1. High Competition from Counterfeit Products

3.2.2. Fluctuating Raw Material Prices

3.2.3. Changing Consumer Preferences

3.3. Opportunities

3.3.1. Technological Advancements in Jewelry Design

3.3.2. Growth in Male Jewelry Segment

3.3.3. Emerging Markets in Eastern Europe

3.4. Trends

3.4.1. Adoption of Lab-Grown Diamonds

3.4.2. Popularity of Minimalist and Personalized Designs

3.4.3. Integration of Smart Technology in Jewelry

3.5. Government Regulations

3.5.1. Import and Export Tariffs

3.5.2. Hallmarking Standards

3.5.3. Environmental and Ethical Sourcing Regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. Europe Jewelry Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Necklaces

4.1.2. Rings

4.1.3. Earrings

4.1.4. Bracelets

4.1.5. Others

4.2. By Material (In Value %)

4.2.1. Gold

4.2.2. Platinum

4.2.3. Diamond

4.2.4. Others

4.3. By End-User (In Value %)

4.3.1. Men

4.3.2. Women

4.3.3. Children

4.4. By Distribution Channel (In Value %)

4.4.1. Specialty Stores

4.4.2. Department Stores

4.4.3. Online Retailers

4.4.4. Others

4.5. By Country (In Value %)

4.5.1. Germany

4.5.2. France

4.5.3. United Kingdom

4.5.4. Italy

4.5.5. Spain

4.5.6. Others

5. Europe Jewelry Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Cartier

5.1.2. Bulgari

5.1.3. Chopard

5.1.4. Pandora A/S

5.1.5. Swarovski

5.1.6. Van Cleef & Arpels

5.1.7. Tiffany & Co.

5.1.8. Graff

5.1.9. Piaget

5.1.10. Boucheron

5.1.11. Buccellati

5.1.12. Damiani

5.1.13. Georg Jensen

5.1.14. Pomellato

5.1.15. De Beers

5.2. Cross Comparison Parameters (Revenue, Market Share, Product Portfolio, Geographic Presence, Number of Retail Outlets, Online Presence, Brand Value, Sustainability Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.6.1. Venture Capital Funding

5.6.2. Government Grants

5.6.3. Private Equity Investments

6. Europe Jewelry Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Europe Jewelry Market Future Size (In USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Europe Jewelry Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Material (In Value %)

8.3. By End-User (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Country (In Value %)

9. Europe Jewelry Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This stage involves mapping out the jewelry market ecosystem in Europe, identifying stakeholders from luxury brands to independent artisans. Extensive desk research is conducted using primary and secondary databases to establish key market drivers and challenges.

Step 2: Market Analysis and Construction

Here, we analyze historical data on market performance, consumer preferences, and retail trends to develop a comprehensive understanding of current market dynamics and forecast growth patterns.

Step 3: Hypothesis Validation and Expert Consultation

Our team validates market insights through consultations with industry experts, including retailers, artisans, and technology integrators. These insights refine our analysis, ensuring accuracy and reliability.

Step 4: Research Synthesis and Final Output

The concluding phase synthesizes data from across the market value chain, including insights from leading brands and small-scale jewelers, culminating in a validated, robust analysis of the European jewelry market.

Frequently Asked Questions

1. How big is the Europe Jewelry Market?

The Europe Jewelry Market is valued at USD 36 billion, supported by a robust luxury goods market and consumer interest in sustainable, high-quality jewelry.

2. What are the challenges in the Europe Jewelry Market?

Key challenges in the Europe Jewelry Market include competition from counterfeit products, fluctuations in raw material prices, and evolving consumer preferences toward ethical sourcing.

3. Who are the major players in the Europe Jewelry Market?

Dominant players in the Europe Jewelry Market include Cartier, Bulgari, Chopard, Tiffany & Co., and Pandora, who lead due to their brand heritage, extensive distribution, and high consumer loyalty.

4. What are the growth drivers of the Europe Jewelry Market?

The Europe Jewelry Market is driven by increasing disposable income, demand for personalized and sustainable jewelry, and a significant shift towards online retail.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.