Europe Lactic Acid Market Outlook to 2030

Region:Global

Author(s):Sanjna

Product Code:KROD10412

November 2024

90

About the Report

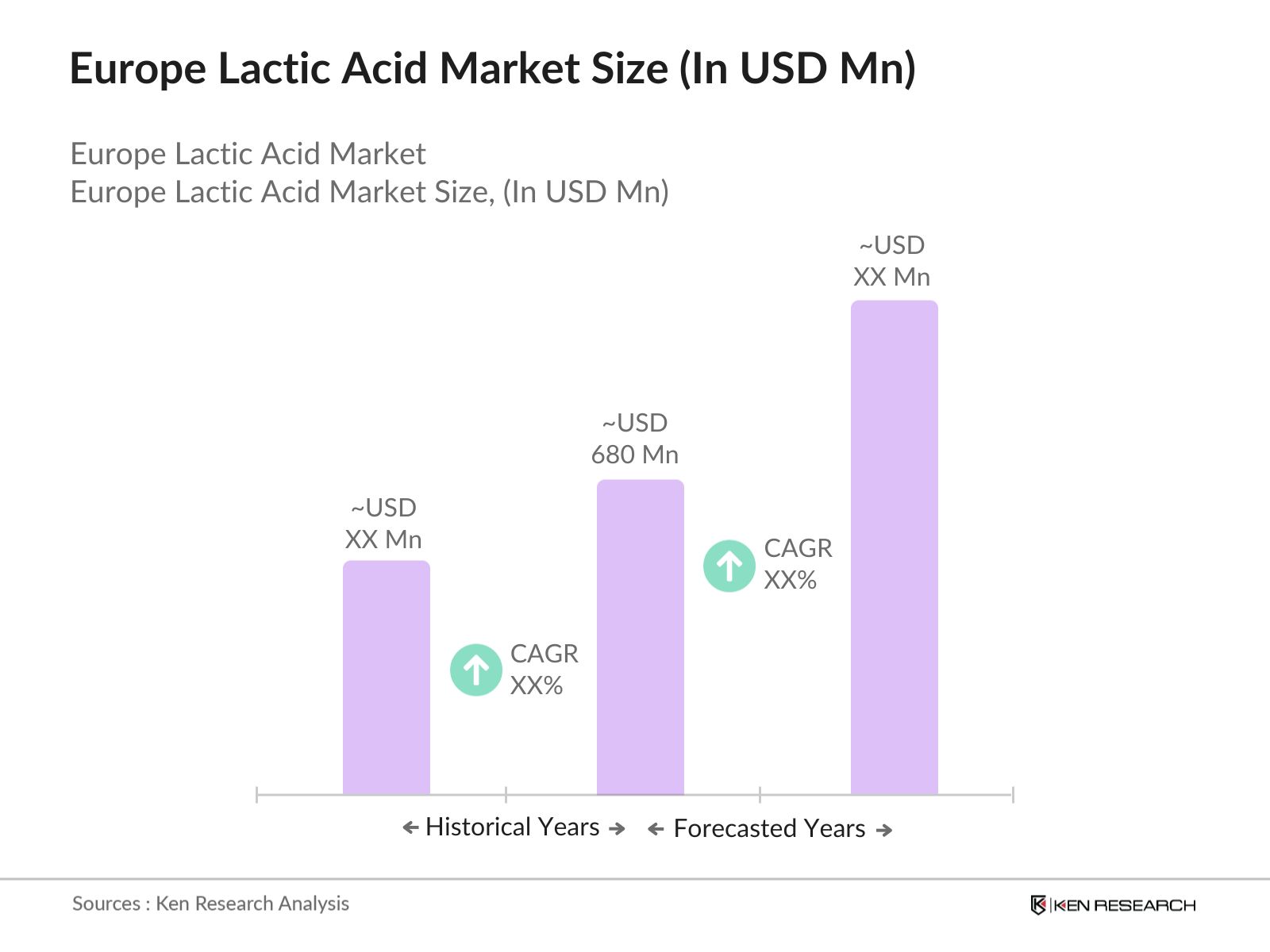

Europe Lactic Acid Market Overview

- The Europe lactic acid market is valued at USD 680 million, driven by increasing demand for biodegradable plastics and rising applications across various industries, including food and beverages, personal care, and pharmaceuticals. The growing shift toward sustainable and bio-based products, particularly in sectors that are adopting greener practices, has propelled the lactic acid market in recent years. As the manufacturing processes become more cost-effective and efficient, industries such as bioplastics continue to drive the market forward, capitalizing on lactic acids eco-friendly properties.

- Germany, France, and the United Kingdom are the dominant countries in the European lactic acid market, largely due to their strong industrial base, robust regulatory frameworks favoring bio-based chemicals, and significant investments in research and development. The concentration of major biopolymer manufacturing facilities in these countries has established them as key players. Moreover, the demand for sustainable packaging in these regions aligns with global trends, positioning them as critical hubs for lactic acid production and consumption.

- The European Union's Directive 2019/904 on the reduction of the impact of certain plastic products on the environment has been a major regulatory driver for biodegradable plastics, including those made from lactic acid. The directive, implemented in 2021, bans certain single-use plastics and promotes the use of biodegradable alternatives, creating a favorable regulatory environment for lactic acid-based products. In 2022, the European Commission allocated over 500 million for the development of bio-based alternatives under its Horizon Europe program .

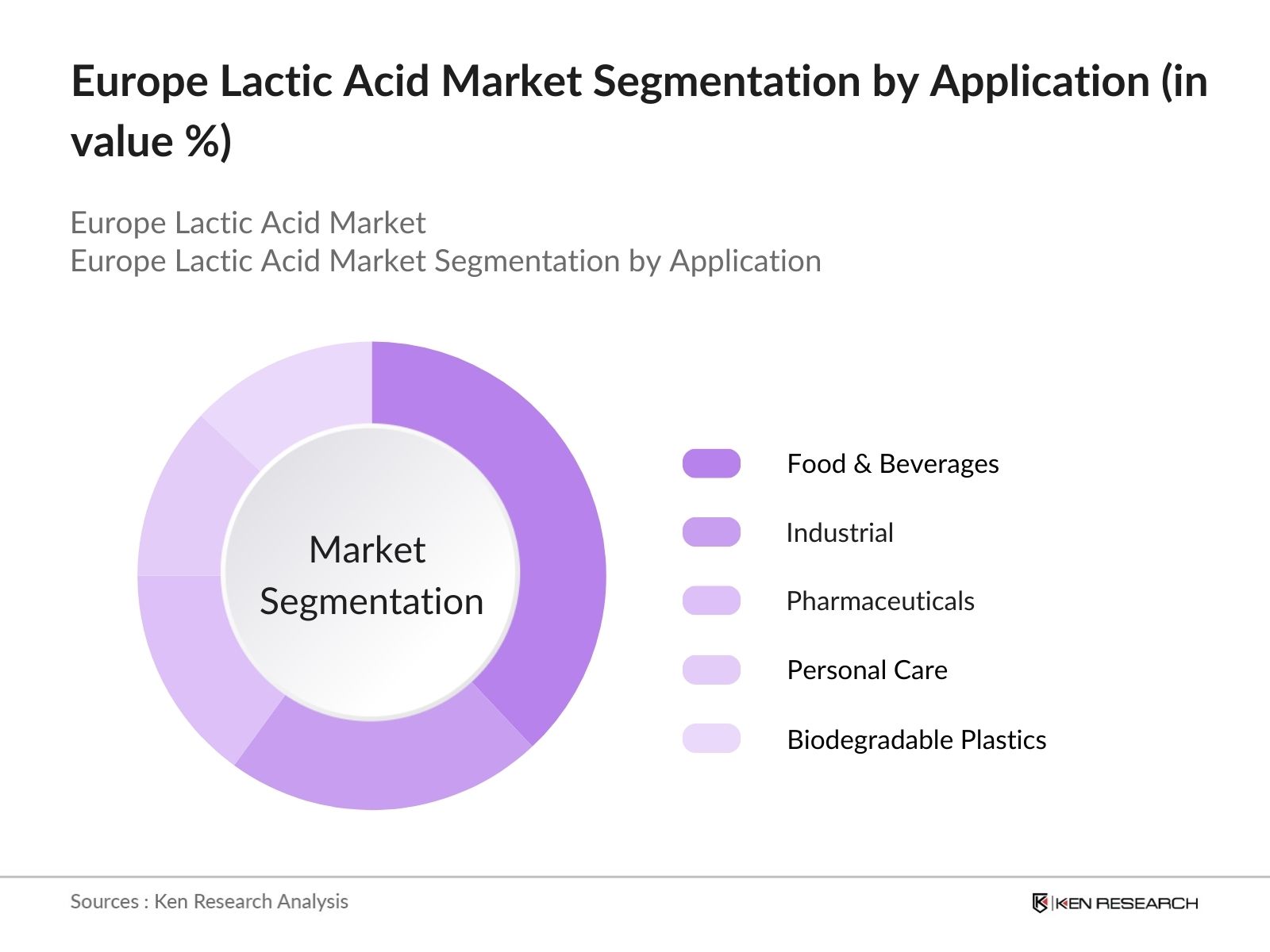

Europe Lactic Acid Market Segmentation

By Application: The Europe lactic acid market is segmented by application into food & beverages, industrial, pharmaceuticals, personal care, and biodegradable plastics.

Food & beverages hold a dominant share in the Europe lactic acid market due to the increasing demand for natural preservatives and flavor enhancers. As consumers move toward cleaner labels and organic products, lactic acids role as a natural preservative and acidulant becomes more significant in processed foods, dairy products, and beverages. Furthermore, its non-toxic and biodegradable properties make it ideal for use in both food preservation and enhancement.

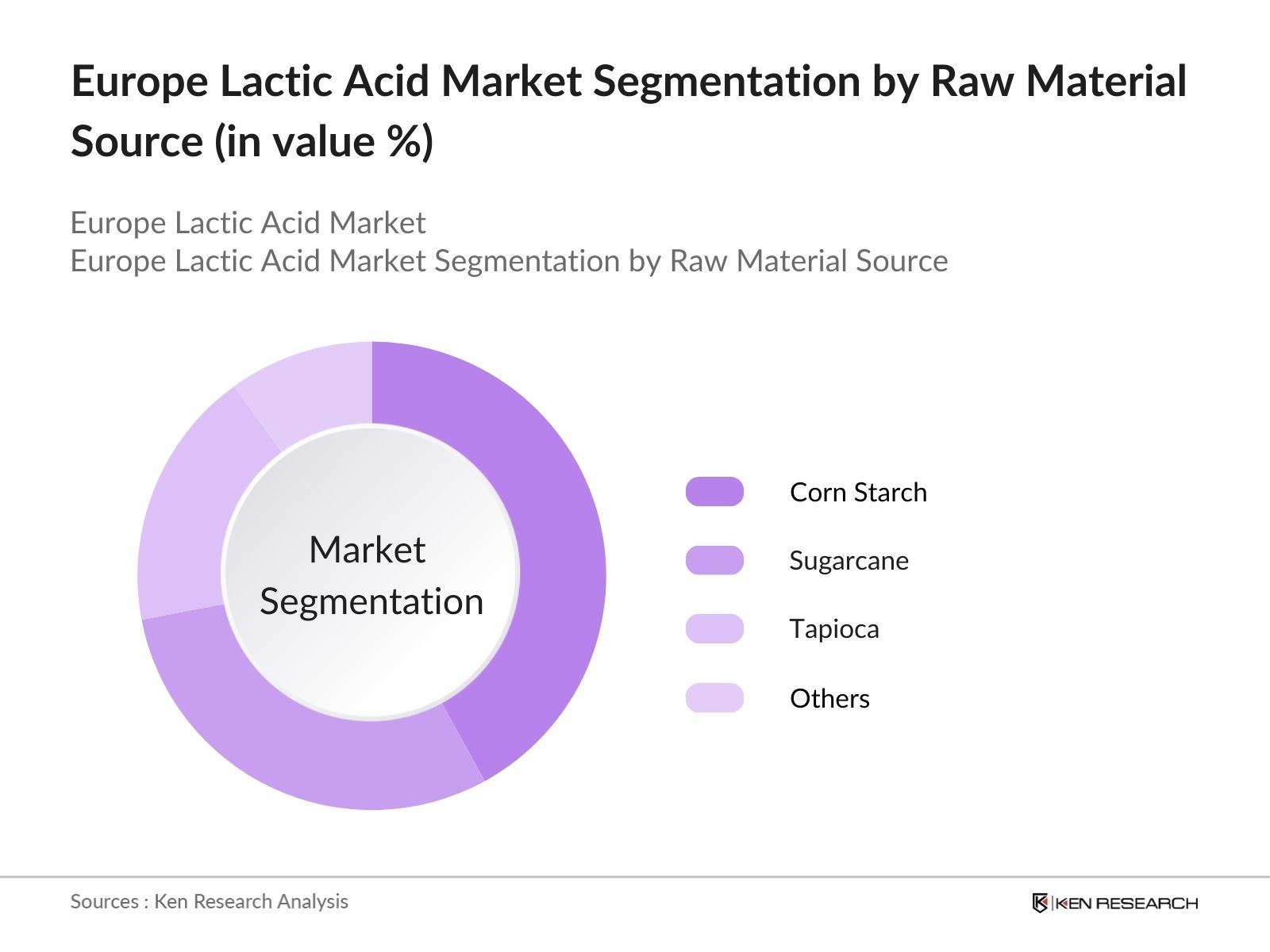

By Raw Material Source: The Europe lactic acid market is further segmented by raw material source into corn starch, sugarcane, tapioca, and others. Corn starch dominates the raw material source segment, accounting for the largest share. This is due to its widespread availability and cost-effectiveness in lactic acid production. Corn starch is a preferred feedstock in Europe for producing lactic acid because of its high yield and suitability for various industrial and food applications. The use of corn starch is particularly prominent in bio-based polymer production, further strengthening its position in the lactic acid market.

Europe Lactic Acid Market Competitive Landscape

The Europe lactic acid market is dominated by several global and regional players, with significant contributions from companies specializing in bio-based chemicals, sustainable solutions, and food additives. These players leverage technological advancements and strategic partnerships to maintain their competitive edge. The market remains highly competitive, with companies investing heavily in R&D for sustainable practices and expanding their lactic acid production capabilities to meet growing demand in various industries.

Europe Lactic Acid Market Analysis

Growth Drivers

- Rising Demand for Biodegradable Plastics: The demand for biodegradable plastics is increasing significantly in Europe due to regulatory pressures to reduce plastic waste. The European Unions Directive 2019/904 mandates the reduction of single-use plastics, leading to heightened demand for biodegradable alternatives. Lactic acid is a key component in the production of polylactic acid (PLA), a biodegradable polymer used extensively in packaging and other applications.

- Increasing Application in Food & Beverage Industry: Lactic acid is widely used in the food and beverage industry for its preservative properties and as a pH regulator. The European food processing industry, valued at over $1 trillion in 2023, is increasingly adopting lactic acid due to its natural and non-toxic properties, particularly in the production of dairy products and beverages. This is aligned with the growing consumer demand for clean-label and natural ingredients. The European Commission's food safety standards also support the increasing application of lactic acid in various food products.

- Advancements in Lactic Acid Production Technologies: Technological advancements in the fermentation process and the use of renewable resources for lactic acid production have significantly reduced energy consumption and improved yields. As of 2023, Europe is investing heavily in bio-based technologies, with over $535 million directed towards research and development in sustainable chemical processes. This has enabled higher production efficiency, leading to more cost-effective and eco-friendly lactic acid production methods. Such innovations are supported by the European Green Deal, which encourages industries to adopt green chemistry solutions.

Challenges

- High Raw Material Costs: The cost of raw materials for lactic acid production, particularly renewable feedstocks such as corn and sugarcane, remains high. In 2023, the price of sugarcane, a key input for lactic acid production, reached $34 per metric ton, driven by global supply chain disruptions and adverse weather conditions affecting crop yields. The elevated cost of raw materials poses a challenge for manufacturers trying to maintain competitive pricing for lactic acid.

- Competition from Petrochemical-based Alternatives: Petrochemical-based plastics continue to dominate the market due to their low cost and wide availability. In 2023, over 300 million tons of plastic were produced globally, with a significant portion in Europe still relying on petrochemical derivatives. This presents stiff competition for biodegradable alternatives like lactic acid, particularly in cost-sensitive applications such as packaging. The lower price point of petrochemical-based plastics remains a considerable challenge for lactic acid producers.

Europe Lactic Acid Market Future Outlook

Europe lactic acid market is poised to experience substantial growth, driven by increasing consumer preference for eco-friendly products, stricter environmental regulations, and innovations in bioplastic applications. As governments push for greener policies, industries are expected to expand their use of lactic acid in biodegradable products and packaging, enhancing the market's growth trajectory. With advancements in fermentation technology, the production process for lactic acid will become more efficient, opening up new applications in sectors such as personal care, pharmaceuticals, and food preservation.

Market Opportunities

- Growth in Bio-based Polymers Market: The bio-based polymers market is expanding rapidly, with lactic acid playing a crucial role as a raw material in producing biopolymers like PLA, with Europe accounting for a significant share due to its strong environmental regulations and consumer demand for sustainable products. This growing demand for biopolymers represents a lucrative opportunity for lactic acid producers to expand their presence in this high-growth sector.

- Strategic Collaborations and Partnerships: Collaborations between lactic acid manufacturers and large-scale chemical companies offer significant opportunities for growth. In 2023, several strategic partnerships were formed between European lactic acid producers and multinational corporations aiming to develop sustainable solutions in plastics, pharmaceuticals, and personal care products. These partnerships are critical in scaling production, improving supply chains, and accessing new markets.

Scope of the Report

|

Segment |

Sub-segments |

|

Application |

Food & Beverages Industrial Pharmaceuticals Personal Care Biodegradable Plastics |

|

Raw Material Source |

Corn Starch Sugarcane Tapioca Others |

|

Form |

Liquid Solid |

|

End User |

Food & Beverage Manufacturers Biopolymer Manufacturers Cosmetic Product Manufacturers Pharmaceutical Companies |

|

Region |

Germany France Italy United Kingdom Spain |

Products

Key Target Audience

Biopolymer Manufacturers

Food & Beverage Manufacturers

Pharmaceutical Companies

Cosmetic Product Manufacturers

Personal Care Product Manufacturers

Sustainable Packaging Companies

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (EU Commission, REACH Compliance Authorities)

Companies

Players Mentioned in the Report

Corbion N.V.

Cargill Inc.

BASF SE

Galactic S.A.

NatureWorks LLC

Henan Jindan Lactic Acid Technology Co., Ltd.

Musashino Chemical Laboratory Ltd.

Archer Daniels Midland Company

Futerro

Danimer Scientific

Table of Contents

1. Europe Lactic Acid Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Europe Lactic Acid Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Europe Lactic Acid Market Analysis

3.1 Growth Drivers

3.1.1 Rising Demand for Biodegradable Plastics

3.1.2 Increasing Application in Food & Beverage Industry

3.1.3 Advancements in Lactic Acid Production Technologies

3.1.4 Regulatory Support for Sustainable Products

3.2 Market Challenges

3.2.1 High Raw Material Costs

3.2.2 Competition from Petrochemical-based Alternatives

3.2.3 Supply Chain Disruptions

3.3 Opportunities

3.3.1 Growth in Bio-based Polymers Market

3.3.2 Increased Adoption in Personal Care Products

3.3.3 Expansion of Pharmaceutical Applications

3.3.4 Strategic Collaborations and Partnerships

3.4 Trends

3.4.1 Shift towards Green Chemistry Solutions

3.4.2 Rise in Demand for Natural Ingredients in Cosmetics

3.4.3 Focus on Circular Economy Practices

3.5 Government Regulations

3.5.1 EU Directives on Biodegradable Plastics

3.5.2 REACH Regulations Impacting Lactic Acid Production

3.5.3 National Policies Supporting Green Manufacturing

3.6 SWOT Analysis

3.7 Stake Ecosystem

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. Europe Lactic Acid Market Segmentation

4.1 By Application (In Value %)

4.1.1 Food & Beverages

4.1.2 Industrial

4.1.3 Pharmaceuticals

4.1.4 Personal Care

4.1.5 Biodegradable Plastics

4.2 By Raw Material Source (In Value %)

4.2.1 Corn Starch

4.2.2 Sugarcane

4.2.3 Tapioca

4.2.4 Others

4.3 By Form (In Value %)

4.3.1 Liquid

4.3.2 Solid

4.4 By End User (In Value %)

4.4.1 Food & Beverage Manufacturers

4.4.2 Biopolymer Manufacturers

4.4.3 Cosmetic Product Manufacturers

4.4.4 Pharmaceutical Companies

4.5 By Region (In Value %)

4.5.1 Germany

4.5.2 France

4.5.3 Italy

4.5.4 United Kingdom

4.5.5 Spain

5. Europe Lactic Acid Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Corbion N.V.

5.1.2 Cargill Inc.

5.1.3 BASF SE

5.1.4 Galactic S.A.

5.1.5 NatureWorks LLC

5.1.6 Henan Jindan Lactic Acid Technology Co., Ltd.

5.1.7 Musashino Chemical Laboratory Ltd.

5.1.8 Archer Daniels Midland Company

5.1.9 Futerro

5.1.10 Danimer Scientific

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Product Offering, R&D Spending, Market Presence, Production Capacity)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Europe Lactic Acid Market Regulatory Framework

6.1 EU Lactic Acid Production Standards

6.2 Compliance Requirements for Bioplastics

6.3 Certification Processes for Food-Grade Lactic Acid

7. Europe Lactic Acid Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Europe Lactic Acid Future Market Segmentation

8.1 By Application (In Value %)

8.2 By Raw Material Source (In Value %)

8.3 By Form (In Value %)

8.4 By End User (In Value %)

8.5 By Region (In Value %)

9. Europe Lactic Acid Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research process begins with identifying key variables impacting the Europe lactic acid market. This step involves thorough desk research using secondary and proprietary databases to identify the critical factors driving market dynamics. Key variables include industry trends, technological advancements, and regulatory influences that shape the market.

Step 2: Market Analysis and Construction

This phase involves analyzing historical data on lactic acid production, usage, and demand across various industries. The analysis considers key performance indicators such as production volumes, application segments, and end-user demand trends to construct an accurate market model.

Step 3: Hypothesis Validation and Expert Consultation

In this phase, hypotheses are developed regarding market growth patterns and trends. These are validated through interviews with industry experts, including manufacturers and stakeholders, to gather first-hand insights into the market's performance and outlook.

Step 4: Research Synthesis and Final Output

The final stage consolidates data gathered from multiple sources and methodologies to present a comprehensive analysis of the Europe lactic acid market. The research synthesis ensures that data is accurate, validated, and reflective of current industry trends, providing actionable insights for stakeholders.

Frequently Asked Questions

1. How big is the Europe Lactic Acid Market?

The Europe lactic acid market is valued at USD 680 million, driven by the increasing demand for biodegradable plastics, particularly in food packaging and consumer goods.

2. What are the challenges in the Europe Lactic Acid Market?

Major challenges in Europe lactic acid market include high raw material costs and competition from petrochemical-based products. Additionally, supply chain disruptions and a limited skilled workforce impact production efficiency.

3. Who are the major players in the Europe Lactic Acid Market?

Key players in Europe lactic acid market include Corbion N.V., Cargill Inc., BASF SE, and Galactic S.A. These companies have a significant market presence due to their extensive production capacities and advanced technology integration.

4. What are the growth drivers of the Europe Lactic Acid Market?

Growth drivers in Europe lactic acid market include increasing consumer demand for sustainable and eco-friendly products, government regulations supporting green chemistry, and technological advancements in lactic acid production processes.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.