Europe Learning Management System (LMS) Market Outlook to 2030

Region:Europe

Author(s):Sanjna

Product Code:KROD11216

November 2024

88

About the Report

Europe Learning Management System (LMS) Market Overview

- The Europe Learning Management System (LMS) market is valued at USD 6.5 billion, based on a five-year historical analysis. This growth is driven by the increasing adoption of e-learning platforms across educational institutions and corporate sectors, aiming to enhance training efficiency and accessibility. The integration of advanced technologies, such as artificial intelligence and cloud computing, has further propelled the demand for LMS solutions.

- Countries like the United Kingdom, Germany, and France dominate the Europe LMS market. This dominance is attributed to their robust educational infrastructures, high digital literacy rates, and proactive government initiatives promoting digital learning. Additionally, the presence of major LMS providers and a strong emphasis on corporate training programs contribute to their leading positions in the market.

- The European Committee for Standardization (CEN) has developed standards to ensure the quality and interoperability of e-learning content. The CEN Workshop Agreement (CWA) 16624, published in 2023, provides guidelines for developing and implementing e-learning materials. These standards facilitate the creation of high-quality educational content and ensure compatibility across different LMS platforms, promoting a cohesive digital education ecosystem in Europe.

Europe Learning Management System (LMS) Market Segmentation

By Deployment Mode: The Europe LMS market is segmented by deployment mode into On-Premise and Cloud-based solutions. Cloud-based LMS solutions hold a dominant market share due to their scalability, cost-effectiveness, and ease of access. Organizations prefer cloud-based systems as they eliminate the need for extensive IT infrastructure and offer flexibility in terms of updates and maintenance.

By End-User: The market is further segmented by end-user into Academic and Corporate sectors. The Corporate sector leads the market share, driven by the increasing need for employee training, compliance management, and skill development programs. Companies are investing in LMS platforms to streamline training processes and ensure consistent knowledge dissemination across their workforce.

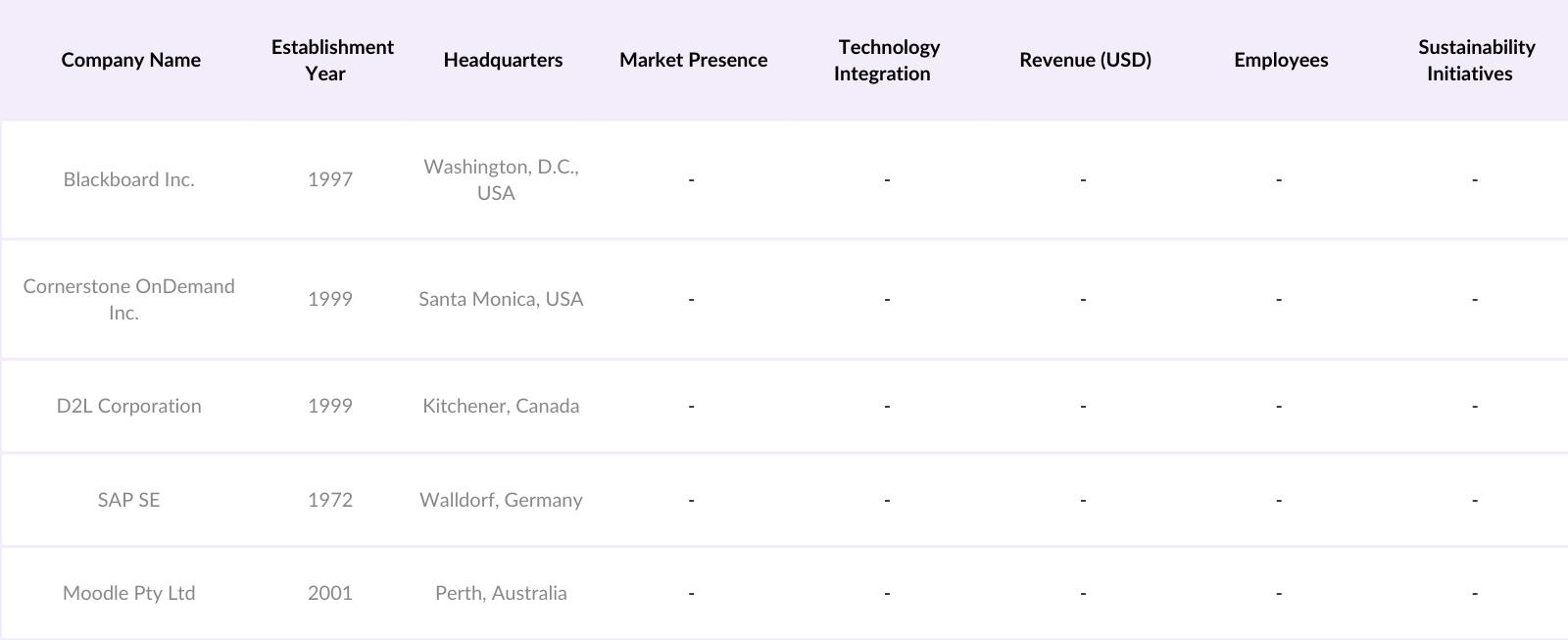

Europe Learning Management System (LMS) Market Competitive Landscape

The Europe LMS market is characterized by the presence of several key players who contribute significantly to its growth. These companies offer a range of solutions tailored to various organizational needs, ensuring a competitive and dynamic market environment.

Europe Learning Management System (LMS) Market Analysis

Growth Drivers

- Increasing Adoption of E-Learning in Corporate Training: The European corporate sector is increasingly integrating e-learning into training programs to enhance workforce skills and adaptability. In 2023, 30% of EU internet users aged 16 to 74 reported participating in online courses or utilizing online learning materials within the preceding three months, up from 28% in 2022. This trend reflects a growing recognition of e-learning's efficiency in delivering consistent training across diverse locations, crucial for multinational corporations.

- Technological Advancements in LMS Platforms: Technological innovations are transforming LMS platforms, enhancing user experience and functionality. The integration of artificial intelligence (AI) and machine learning (ML) enables personalized learning paths, while advancements in cloud computing facilitate scalable and flexible LMS solutions. The European Union's Horizon Europe program allocated USD 16.48 billion for digital transformation projects between 2021 and 2027, promoting the development of advanced educational technologies.

- Government Initiatives Promoting Digital Education: European governments are actively promoting digital education to enhance learning outcomes and bridge skill gaps. The European Commission's Digital Education Action Plan 2021-2027 outlines initiatives to support the development of a high-performing digital education ecosystem, including the promotion of digital literacy and investment in digital infrastructure. Furthermore, the Recovery and Resilience Facility, part of the NextGenerationEU initiative, allocated USD 789 billion to support reforms and investments by Member States, with a significant portion dedicated to digital education and training.

Challenges

- High Implementation and Maintenance Costs: Implementing and maintaining LMS platforms can be costly, posing a challenge for organizations, especially small and medium-sized enterprises (SMEs). The European Investment Bank's 2023 report indicates that 30% of EU SMEs identified the cost of digital infrastructure as a significant barrier to digitalization. Additionally, the European Commission's DESI 2023 highlights that only 17% of EU SMEs have a high level of digital intensity, partly due to financial constraints. These financial challenges can hinder the widespread adoption of LMS platforms across Europe.

- Data Security and Privacy Concerns: Data security and privacy are critical concerns in the adoption of LMS platforms. The European Union's General Data Protection Regulation (GDPR) imposes strict requirements on data handling, and non-compliance can result in significant fines. In 2023, the European Data Protection Board reported that over 1,000 fines were issued for GDPR violations, totaling more than USD 2.3 billion. These stringent regulations necessitate robust data protection measures in LMS platforms, which can be complex and costly to implement.

Europe Learning Management System (LMS) Market Future Outlook

Over the next five years, the Europe LMS market is expected to exhibit significant growth, driven by continuous technological advancements, increasing demand for remote learning solutions, and the integration of artificial intelligence and machine learning to enhance personalized learning experiences. Additionally, the emphasis on upskilling and reskilling in the corporate sector will further propel market expansion.

Market Opportunities

- Integration of Artificial Intelligence and Machine Learning: Integrating AI and ML into LMS platforms offers opportunities for personalized learning experiences. The European Commission's Coordinated Plan on Artificial Intelligence 2021 Review emphasizes the importance of AI in education and allocates funding for AI research and innovation. Additionally, the European AI Alliance, comprising over 4,000 stakeholders, is actively exploring AI applications in education, indicating a supportive environment for AI integration in LMS platforms.

- Expansion into Small and Medium Enterprises (SMEs): SMEs represent a significant opportunity for LMS providers in Europe. According to the European Commission, SMEs account for 99% of all businesses in the EU, employing around 100 million people. However, the DESI 2023 reports that only 17% of EU SMEs have a high level of digital intensity, indicating substantial potential for digital learning solutions. Tailoring LMS platforms to meet the specific needs and budgets of SMEs can drive market growth.

Scope of the Report

|

Segment |

Sub-Segments |

|

Component |

- Solutions |

|

Deployment Mode |

- On-Premise |

|

Delivery Mode |

- Distance Learning |

|

End-User |

- Academic |

|

Country |

- United Kingdom |

Products

Key Target Audience

Corporate Training Departments

Educational Institutions (Universities and Schools)

E-Learning Content Developers

Human Resource Managers

Information Technology Departments

Non-Governmental Organizations (NGOs) focusing on education

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., European Commission)

Companies

Players Mentioned in the Report

Blackboard Inc.

Cornerstone OnDemand Inc.

D2L Corporation

SAP SE

Moodle Pty Ltd

Instructure Inc.

Adobe Inc.

TalentLMS

Absorb LMS

Docebo

Table of Contents

1. Europe Learning Management System Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Europe Learning Management System Market Size (In USD Million)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Europe Learning Management System Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Adoption of E-Learning in Corporate Training

3.1.2 Technological Advancements in LMS Platforms

3.1.3 Government Initiatives Promoting Digital Education

3.1.4 Rising Demand for Continuous Skill Development

3.2 Market Challenges

3.2.1 High Implementation and Maintenance Costs

3.2.2 Data Security and Privacy Concerns

3.2.3 Resistance to Change from Traditional Learning Methods

3.3 Opportunities

3.3.1 Integration of Artificial Intelligence and Machine Learning

3.3.2 Expansion into Small and Medium Enterprises (SMEs)

3.3.3 Growth in Mobile Learning and BYOD Trends

3.4 Trends

3.4.1 Shift Towards Cloud-Based LMS Solutions

3.4.2 Personalization and Adaptive Learning Paths

3.4.3 Gamification and Interactive Content

3.5 Government Regulations

3.5.1 Data Protection and GDPR Compliance

3.5.2 Funding Programs for Digital Education

3.5.3 Standards for E-Learning Content

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porter’s Five Forces Analysis

3.9 Competitive Landscape

4. Europe Learning Management System Market Segmentation

4.1 By Component (In Value %)

4.1.1 Solutions

4.1.2 Services

4.2 By Deployment Mode (In Value %)

4.2.1 On-Premise

4.2.2 Cloud

4.3 By Delivery Mode (In Value %)

4.3.1 Distance Learning

4.3.2 Instructor-Led Training

4.3.3 Blended Learning

4.4 By End-User (In Value %)

4.4.1 Academic

4.4.1.1 K-12

4.4.1.2 Higher Education

4.4.2 Corporate

4.5 By Country (In Value %)

4.5.1 United Kingdom

4.5.2 Germany

4.5.3 France

4.5.4 Italy

4.5.5 Spain

4.5.6 Netherlands

4.5.7 Belgium

4.5.8 Austria

4.5.9 Poland

4.5.10 Rest of Europe

5. Europe Learning Management System Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Blackboard Inc.

5.1.2 Cornerstone OnDemand Inc.

5.1.3 D2L Corporation

5.1.4 Docebo

5.1.5 SAP SE

5.1.6 Moodle Pty Ltd

5.1.7 Instructure Inc.

5.1.8 Adobe Inc.

5.1.9 TalentLMS

5.1.10 Absorb LMS

5.2 Cross Comparison Parameters

(Number of Employees, Headquarters, Inception Year, Revenue, Market Share, Product Portfolio, Regional Presence, Strategic Initiatives)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.6.1 Venture Capital Funding

5.6.2 Government Grants

5.6.3 Private Equity Investments

6. Europe Learning Management System Market Regulatory Framework

6.1 Data Protection and Privacy Laws

6.2 Compliance Requirements

6.3 Certification Processes

7. Europe Learning Management System Future Market Size (In USD Million)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Europe Learning Management System Future Market Segmentation

8.1 By Component (In Value %)

8.2 By Deployment Mode (In Value %)

8.3 By Delivery Mode (In Value %)

8.4 By End-User (In Value %)

8.5 By Country (In Value %)

9. Europe Learning Management System Market Analysts’ Recommendations

9.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Europe Learning Management System Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Europe Learning Management System Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple LMS providers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Europe Learning Management System market.

Frequently Asked Questions

01. How big is the Europe Learning Management System (LMS) Market?

The Europe Learning Management System (LMS) market is valued at USD 6.5 billion, based on a five-year historical analysis. This growth is driven by the increasing adoption of e-learning platforms across educational institutions and corporate sectors, aiming to enhance training efficiency and accessibility.

02. What are the challenges in the Europe LMS Market?

Challenges in Europe Learning Management System (LMS) market include high implementation and maintenance costs, data security and privacy concerns, and resistance to change from traditional learning methods.

03. Who are the major players in the Europe LMS Market?

Key players in Europe Learning Management System (LMS) market include Blackboard Inc., Cornerstone OnDemand Inc., D2L Corporation, SAP SE, Moodle Pty Ltd, Instructure Inc., and Adobe Inc. These companies lead due to their established market presence, advanced technology offerings, and extensive client base across Europe.

04. What are the growth drivers of the Europe LMS Market?

Europe Learning Management System (LMS) market is propelled by factors such as the increasing adoption of cloud-based LMS solutions, government support for digital learning initiatives, and the growing need for continuous skill development across both academic and corporate sectors.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.