Europe Linux in OS Market Outlook to 2030

Region:Europe

Author(s):Sanjna Verma

Product Code:KROD7229

December 2024

87

About the Report

Europe Linux in OS Market Overview

- The Europe Linux in OS market is valued at USD 6 billion, based on a five-year historical analysis. This market is driven primarily by the rising adoption of open-source solutions by enterprises seeking to reduce costs, improve flexibility, and avoid vendor lock-in. Linux, being open-source and highly customizable, provides businesses with the ability to modify their operating systems to fit their specific needs. Additionally, the strong demand from industries like IT & telecommunications, government, and healthcare has further propelled market growth.

- Germany, France, and the United Kingdom dominate the European Linux market due to their well-established IT sectors and strong government support for open-source software adoption. Germany's influence is particularly notable, driven by government-backed initiatives promoting open-source software to enhance digital sovereignty. Meanwhile, the UK's focus on cloud services and France's emphasis on cybersecurity have further solidified their dominance in the Linux OS market.

- Linux adoption is bolstered by the European Unions Digital Strategy, which promotes the use of open-source technologies to drive digital transformation. The strategy outlines specific regulations that encourage member states to adopt Linux in public sector IT infrastructure. In 2023, the European Commission allocated over $1.096 billion to support digital transformation initiatives, with a significant portion aimed at encouraging open-source software like Linux. This regulatory push has made Linux a preferred option for compliance with European digital standards.

Europe Linux in OS Market Segmentation

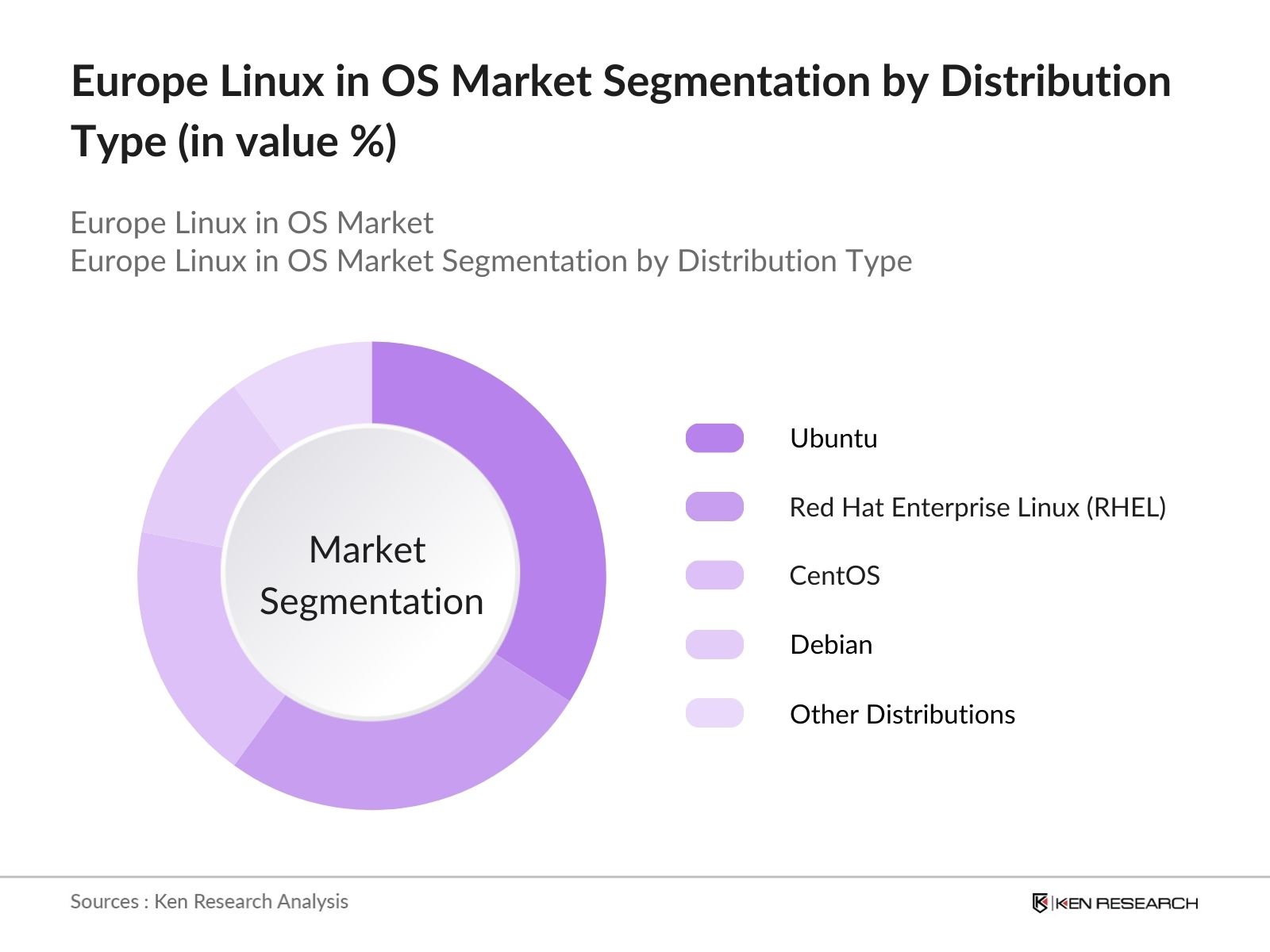

By Distribution Type: The Europe Linux in OS market is segmented by distribution type into Ubuntu, Red Hat Enterprise Linux (RHEL), CentOS, Debian, and other distributions. Ubuntu holds the largest market share under this segmentation due to its widespread use among developers and enterprises. Its user-friendly nature and large community support have made it a preferred choice for IT firms. Additionally, Ubuntu's integration with cloud services and container orchestration tools like Kubernetes has further enhanced its appeal, particularly in cloud and DevOps environments.

By Deployment: The market is also segmented by deployment type into on-premise and cloud-based. Cloud-based Linux deployments are leading in this segment due to the increasing shift of enterprises towards cloud infrastructure. The scalability and flexibility offered by cloud-based systems allow companies to reduce costs associated with hardware infrastructure while ensuring seamless operations. Moreover, cloud-based deployments provide greater integration with advanced technologies such as AI, IoT, and big data, making them a dominant choice for organizations across Europe.

By Deployment: The market is also segmented by deployment type into on-premise and cloud-based. Cloud-based Linux deployments are leading in this segment due to the increasing shift of enterprises towards cloud infrastructure. The scalability and flexibility offered by cloud-based systems allow companies to reduce costs associated with hardware infrastructure while ensuring seamless operations. Moreover, cloud-based deployments provide greater integration with advanced technologies such as AI, IoT, and big data, making them a dominant choice for organizations across Europe.

Europe Linux in OS Market Competitive Landscape

The Europe Linux in OS market is characterized by the presence of a few dominant players, including Red Hat, Canonical, and SUSE. These companies have carved a niche by offering enterprise-grade support, ensuring stability, and facilitating seamless integration with cloud services. Additionally, strategic partnerships and mergers have bolstered the market presence of key players. The market landscape is highly competitive, with companies competing on product customization, security features, and enterprise support services.

|

Company Name |

Year of Establishment |

Headquarters |

Key Products |

Cloud Integration |

Security Features |

Enterprise Support |

Client Base |

Strategic Partnerships |

Annual Revenue |

|

Red Hat Inc. |

1993 |

Raleigh, USA |

- |

- |

- |

- |

- |

- |

- |

|

Canonical Ltd. |

2004 |

London, UK |

- |

- |

- |

- |

- |

- |

- |

|

SUSE Linux GmbH |

1992 |

Nuremberg, Germany |

- |

- |

- |

- |

- |

- |

- |

|

Oracle Corporation |

1977 |

Austin, USA |

- |

- |

- |

- |

- |

- |

- |

|

IBM Corporation |

1911 |

Armonk, USA |

- |

- |

- |

- |

- |

- |

- |

Europe Linux in OS Market Analysis

Growth Drivers

- Increased Adoption of Open-Source Software: The European Commission has set a clear preference for open-source software, with several governmental organizations opting for Linux-based systems to reduce dependency on proprietary software. In 2024, open-source adoption is expected to reach a significant point, driven by key sectors like public services and education. A report by the European Union indicates that over 35% of public administrations across Europe have adopted open-source platforms. This shift is bolstered by EU regulations encouraging the use of open technology.

- Enterprise-Wide Deployments in Key Sectors: European enterprises are increasingly turning to Linux for enterprise-wide deployments, especially in industries like finance, healthcare, and automotive. In 2024, around 60% of data center deployments in Europe are expected to run on Linux systems, particularly in financial services, where security and customization are key requirements. The European Central Bank, for instance, has migrated several of its core systems to Linux for better scalability and lower operational costs.

- Cost Efficiency and Customizability: Linux offers cost-efficiency, which makes it an attractive alternative to proprietary software in Europe. The European Commission has actively promoted an Open Source Software Strategy from 2020 to 2023, aiming to enhance the use of open-source solutions across its institutions, which aligns with efforts to reduce IT costs and increase digital sovereignty. Moreover, the ability to customize the OS to specific enterprise needs enhances efficiency across multiple sectors, further reducing the reliance on paid licenses and expensive support contracts.

Challenges

- Security Concerns and Threat Vulnerability: While Linux is known for its robustness, security concerns still pose challenges in its widespread enterprise adoption. According to the European Union Agency for Cybersecurity (ENISA), Linux systems experienced over 6,000 reported security vulnerabilities in 2023, particularly related to its open-source nature, where malicious actors can exploit publicly available source code. Despite advancements in security patches, the challenge remains for enterprises in highly regulated sectors like healthcare and banking, where compliance with stringent security standards is paramount.

- Compatibility with Legacy Systems: The European Union is actively working towards enhancing its digital infrastructure, with initiatives aimed at improving connectivity and reducing reliance on outdated systems. The EU's Digital Decade targets aim to ensure comprehensive high-speed internet access across member states by 2030/ For industries such as manufacturing and retail, this creates a barrier to fully integrating Linux OS into their operations without costly overhauls of existing hardware and software.

Europe Linux in OS Market Future Outlook

Europe Linux in OS market is expected to witness significant growth driven by the increasing adoption of cloud-based services, advancements in open-source technology, and growing demand from sectors like government, healthcare, and telecommunications. The rapid digitization efforts in European countries will continue to fuel the demand for Linux, which is seen as a cost-effective and secure operating system solution. Enterprises are also likely to increase their reliance on Linux for cloud integration, IoT, and containerization, providing a robust outlook for the market.

Market Opportunities

- Integration with Cloud-Based Services: The increasing shift toward cloud computing in Europe provides a significant growth opportunity for Linux-based operating systems. In 2024, nearly 70% of European cloud infrastructure is expected to be powered by Linux due to its scalability and open-source nature, which makes it ideal for cloud environments. Key cloud providers, including AWS and Google Cloud, heavily rely on Linux to deliver their services in Europe, further encouraging its integration across industries like retail, manufacturing, and healthcare. This growing cloud adoption presents ongoing opportunities for Linux in the OS market.

- Growing Use of Automation and DevOps Tools: Automation technologies, particularly in DevOps, are driving increased Linux adoption across Europe. Linux forms the backbone of several automation tools such as Jenkins, Docker, and Ansible, which are widely used by European companies to streamline operations. In 2023, over 55% of automation tool deployments across industries in Europe were based on Linux. As more businesses look to automate their IT processes, particularly in sectors like finance and manufacturing, the adoption of Linux-based DevOps tools is expected to grow significantly.

Scope of the Report

|

By Segments |

Sub-Segments |

|

By Distribution Type |

Ubuntu Red Hat Enterprise Linux CentOS, Debian Other Distributions |

|

By Deployment |

On-Premise Cloud-Based |

|

By Application |

IT & Telecommunication Healthcare Retail Government Education |

|

By Enterprise Size |

Large Enterprises Small and Medium Enterprises (SMEs) |

|

By Country |

Germany France United Kingdom Italy Spain Netherlands Sweden Poland |

Products

Key Target Audience

IT & Telecommunications Companies

Cloud Service Providers

Open-Source Software Developers

Data Centers and Hosting Companies

Healthcare IT Solutions Providers

Defense and Security Organizations

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (European Commission, National Cybersecurity Agencies)

Companies

Players Mentioned in the Report

Red Hat Inc.

Canonical Ltd.

SUSE Linux GmbH

Oracle Corporation

IBM Corporation

Debian Project

ClearCenter

Amazon Web Services (AWS)

Google Cloud

Microsoft Azure

Table of Contents

1. Europe Linux in OS Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Europe Linux in OS Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Europe Linux in OS Market Analysis

3.1. Growth Drivers

3.1.1. Increased adoption of Open-Source Software

3.1.2. Enterprise-wide Deployments in Key Sectors

3.1.3. Cost Efficiency and Customizability

3.1.4. Government Promotion of Open-Source Technologies

3.2. Market Challenges

3.2.1. Security Concerns and Threat Vulnerability

3.2.2. Compatibility with Legacy Systems

3.2.3. Limited Vendor Support

3.2.4. High Training Costs for IT Staff

3.3. Opportunities

3.3.1. Integration with Cloud-Based Services

3.3.2. Growing Use of Automation and DevOps Tools

3.3.3. Adoption by Small and Medium Enterprises (SMEs)

3.3.4. Strategic Partnerships with Key IT Providers

3.4. Trends

3.4.1. Rising Adoption of Kubernetes for Container Orchestration

3.4.2. Increased Virtualization in Data Centers

3.4.3. Hybrid Environments Between On-Premise and Cloud

3.4.4. Role of Linux in IoT Deployments

3.5. Government Regulation

3.5.1. Compliance with European Digital Strategy

3.5.2. National Digital Sovereignty Initiatives

3.5.3. Data Privacy Regulations under GDPR

4. Europe Linux in OS Market Segmentation

4.1. By Distribution Type (In Value %)

4.1.1. Ubuntu

4.1.2. Red Hat Enterprise Linux (RHEL)

4.1.3. CentOS

4.1.4. Debian

4.1.5. Other Distributions

4.2. By Deployment (In Value %)

4.2.1. On-Premise

4.2.2. Cloud-Based

4.3. By Application (In Value %)

4.3.1. IT & Telecommunication

4.3.2. Healthcare

4.3.3. Retail

4.3.4. Government

4.3.5. Education

4.4. By Enterprise Size (In Value %)

4.4.1. Large Enterprises

4.4.2. Small and Medium Enterprises (SMEs)

4.5. By Country (In Value %)

4.5.1. Germany

4.5.2. France

4.5.3. United Kingdom

4.5.4. Italy

4.5.5. Spain

4.5.6. Netherlands

4.5.7. Sweden

4.5.8. Poland

5. Europe Linux in OS Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Red Hat Inc.

5.1.2. Canonical Ltd.

5.1.3. SUSE Linux GmbH

5.1.4. Oracle Corporation

5.1.5. IBM Corporation

5.1.6. Debian Project

5.1.7. ClearCenter

5.1.8. Amazon Web Services (AWS)

5.1.9. Google Cloud

5.1.10. Microsoft Azure

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Enterprise Client Base, OS Support, Cloud Integration, Security Features)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Europe Linux in OS Market Regulatory Framework

6.1. Open-Source Software Regulations

6.2. National and EU Digital Strategies

6.3. Data Protection and Compliance Requirements

6.4. Certification Processes for Enterprise Linux

7. Europe Linux in OS Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Europe Linux in OS Future Market Segmentation

8.1. By Distribution Type (In Value %)

8.2. By Deployment (In Value %)

8.3. By Application (In Value %)

8.4. By Enterprise Size (In Value %)

8.5. By Country (In Value %)

9. Europe Linux in OS Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying critical market drivers, distribution channels, and key stakeholders within the Europe Linux in OS market. Secondary research from proprietary databases, government publications, and industry reports is used to map the market's ecosystem.

Step 2: Market Analysis and Construction

In this phase, historical data on market penetration, revenue, and service providers is analyzed. We assess the relationship between various Linux distributions, customer preferences, and industry adoption rates.

Step 3: Hypothesis Validation and Expert Consultation

Experts from IT and cloud service sectors are consulted through computer-assisted interviews to validate market assumptions and refine our revenue projections. These insights ensure the accuracy of the market analysis.

Step 4: Research Synthesis and Final Output

The final step includes synthesizing the collected data into a comprehensive report. We consult multiple Linux distribution providers to ensure the data accurately reflects the market reality, focusing on revenue generation and enterprise adoption rates.

Frequently Asked Questions

01. How big is the Europe Linux in OS Market?

The Europe Linux in OS market is valued at USD 6 billion, driven by increasing adoption across industries such as IT & telecommunications, government, and healthcare. Its open-source nature and cost-efficiency make it a preferred choice for enterprises.

02. What are the challenges in the Europe Linux in OS Market?

Challenges in Europe Linux in OS market include security vulnerabilities, especially due to its open-source architecture, and compatibility issues with legacy systems. The limited availability of enterprise-grade support is another significant challenge for large corporations.

03. Who are the major players in the Europe Linux in OS Market?

Key players in Europe Linux in OS market include Red Hat Inc., Canonical Ltd., SUSE Linux GmbH, Oracle Corporation, and IBM Corporation. These companies dominate the market due to their extensive enterprise support services and strategic partnerships.

04. What are the growth drivers of the Europe Linux in OS Market?

Growth drivers in Europe Linux in OS market include the increasing adoption of open-source software, the shift towards cloud-based services, and government initiatives promoting open-source technologies to achieve digital sovereignty.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.