Europe Liquor Market Outlook to 2030

Region:Europe

Author(s):Sanjna

Product Code:KROD9782

November 2024

99

About the Report

Europe Liquor Market Overview

- The Europe liquor market is a significant segment of the global alcoholic beverages industry, with a valuation of USD 227 billion. This substantial market size is driven by factors such as increasing consumer demand for premium and craft spirits, the expansion of e-commerce platforms facilitating wider product accessibility, and evolving consumer preferences towards innovative flavors and experiences. These elements collectively contribute to the robust growth and diversification of the liquor market across Europe.

- Dominant countries in the European liquor market include Germany, the United Kingdom, and France. Germany's dominance is attributed to its rich brewing heritage and high per capita beer consumption. The United Kingdom leads in the consumption of spirits, particularly gin, driven by a burgeoning craft distillery scene. France's prominence is due to its historical association with wine production and consumption, making it a central hub for the wine segment within the European market.

- The European Union enforces comprehensive alcohol policies to regulate production, distribution, and consumption. In 2023, the EU maintained strict advertising restrictions, particularly targeting youth exposure, and upheld minimum pricing laws to discourage excessive consumption. The EU also continued to support member states in implementing national alcohol strategies aligned with the WHO's Global Strategy to Reduce the Harmful Use of Alcohol.

Europe Liquor Market Segmentation

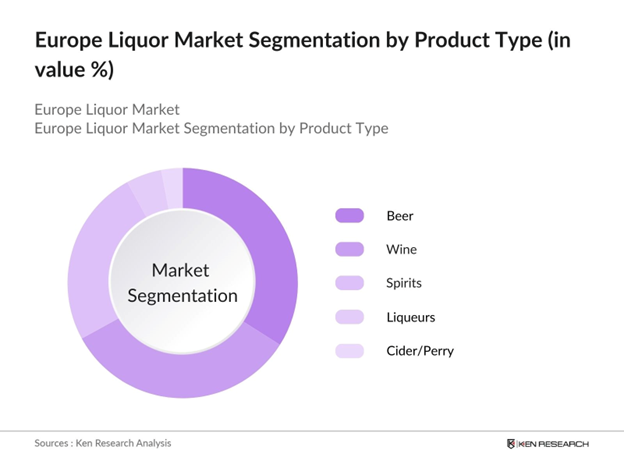

By Product Type: The Europe liquor market is segmented by product type into beer, wine, spirits, liqueurs, and cider/perry. Among these, beer holds a dominant market share, primarily due to its deep-rooted cultural significance and widespread consumption across various European countries. The longstanding tradition of beer brewing, coupled with a diverse range of beer styles and flavors, has solidified its position as a staple beverage in the region.

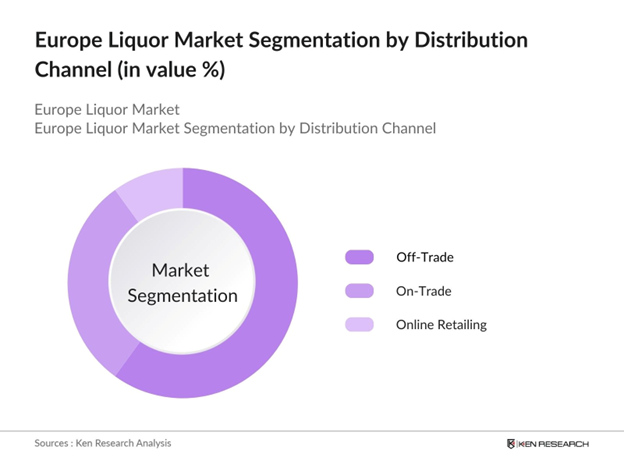

By Distribution Channel: Distribution channels in the Europe liquor market are categorized into on-trade (bars, restaurants, hotels), off-trade (supermarkets, hypermarkets, specialty stores), and online retailing. The off-trade segment commands a significant market share, largely because consumers frequently purchase alcoholic beverages for home consumption from retail outlets. The convenience, variety, and competitive pricing offered by supermarkets and specialty stores contribute to the dominance of this distribution channel.

Europe Liquor Market Competitive Landscape

The Europe liquor market is characterized by the presence of several key players who have established strong market positions through extensive product portfolios, strategic acquisitions, and robust distribution networks. These companies play a pivotal role in shaping market trends and consumer preferences across the region.

Europe Liquor Market Analysis

Growth Drivers

- Increasing Disposable Income: In 2023, the European Union's gross domestic product (GDP) reached $18.35 trillion, reflecting economic growth that has bolstered disposable incomes across member states. For instance, Germany's GDP per capita was approximately $50,000. This rise in disposable income has led to increased consumer spending on non-essential goods, including alcoholic beverages. The European Central Bank reported a 2% increase in household consumption expenditure in 2023, indicating a growing capacity for discretionary spending.

- Rising Demand for Premium and Craft Spirits: The European spirits market has seen a notable shift toward premium and craft products. In 2023, the European Spirits Organisation reported that premium spirits accounted for 20% of total spirits sales, up from 15% in 2020. This trend is driven by consumers' willingness to pay higher prices for quality and unique flavors. The United Kingdom, for example, saw a 5% increase in craft gin distilleries, reaching a total of 820 in 2023. This surge in demand for premium and craft spirits is reshaping the market landscape, encouraging producers to innovate and cater to sophisticated consumer preferences.

- Expansion of E-commerce Platforms: The European e-commerce sector has experienced significant growth, with online retail sales reaching $784.6 billion in 2023, up from $687.2 billion in 2020. This expansion has extended to the alcoholic beverages market, where online alcohol sales increased by 12% in 2023. The convenience and accessibility of e-commerce platforms have made it easier for consumers to explore and purchase a wide range of liquor products, contributing to market growth.

Challenges

- Stringent Government Regulations and Taxation Policies: The European liquor market faces challenges due to stringent regulations and high taxation. In 2023, the average excise duty on spirits in the EU was $6.03 per liter of pure alcohol, with countries like Sweden imposing rates as high as $7.07. Additionally, advertising restrictions have tightened; for example, France's Loi vin prohibits alcohol advertising on television and in cinemas. These regulations can limit market expansion and increase operational costs for producers and distributors.

- Health Concerns and Growing Trend of Sobriety: Health concerns related to alcohol consumption are influencing consumer behavior in Europe. The World Health Organization reported that in 2023, alcohol was responsible for 1 in 11 deaths in the European Region. This has led to a growing trend of sobriety and moderation, with 30% of Europeans aged 18-24 reporting reduced alcohol intake in 2023. Campaigns promoting alcohol-free lifestyles and the rise of "sober curious" movements are impacting traditional liquor consumption patterns.

Europe Liquor Market Future Outlook

Over the next five years, the Europe liquor market is expected to experience steady growth, driven by continuous consumer interest in premium and craft beverages, the expansion of online retail channels, and the introduction of innovative product offerings. Additionally, the increasing focus on sustainability and health-conscious consumption patterns is anticipated to influence market dynamics, leading to the development of low and non-alcoholic beverage options. These trends are likely to shape the future landscape of the liquor market in Europe.

Market Opportunities

- Emergence of Low and Non-Alcoholic Beverages: The market for low and non-alcoholic beverages is expanding in Europe. In 2023, sales of non-alcoholic beer reached 1 billion liters, a 10% increase from the previous year. The United Kingdom saw a 15% rise in non-alcoholic spirit sales, totaling 5 million liters. This growth is driven by health-conscious consumers seeking alternatives to traditional alcoholic drinks, presenting an opportunity for producers to diversify their product lines.

- Growth in Emerging Markets within Europe: Emerging markets in Eastern Europe are showing potential for growth in the liquor industry. In 2023, Poland's spirits market grew by 7%, with vodka sales reaching 150 million liters. Romania experienced a 5% increase in beer consumption, totaling 20 million hectoliters. Rising disposable incomes and changing consumer preferences in these regions offer opportunities for market expansion.

Scope of the Report

|

Segment |

Sub-Segments |

|

By Product Type |

Beer |

|

By Distribution Channel |

On-Trade (Bars, Restaurants, Hotels) |

|

By Packaging Type |

Bottles |

|

By Alcohol Content |

Low Alcohol (Up to 5% ABV) |

|

By Country |

Germany |

Products

Key Target Audience

Liquor Manufacturers

Alcoholic Beverage Distributors

Retail Chains and Supermarkets

Hospitality Industry Stakeholders

E-commerce Platforms Specializing in Alcohol Sales

Packaging and Bottling Companies

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., European Commission, National Health Agencies)

Companies

Players Mentioned in the Report

Diageo Plc

Pernod Ricard SA

Bacardi Limited

Anheuser-Busch InBev SA/NV

Heineken Holding NV

Carlsberg Breweries A/S

Molson Coors Brewing Company

LVMH Mot Hennessy Louis Vuitton

E & J Gallo Winery

Brown-Forman Corporation

Table of Contents

1. Europe Liquor Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Europe Liquor Market Size (In USD Million)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Europe Liquor Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Disposable Income

3.1.2 Rising Demand for Premium and Craft Spirits

3.1.3 Expansion of E-commerce Platforms

3.1.4 Changing Consumer Preferences Towards Innovative Flavors

3.2 Market Challenges

3.2.1 Stringent Government Regulations and Taxation Policies

3.2.2 Health Concerns and Growing Trend of Sobriety

3.2.3 Supply Chain Disruptions

3.3 Opportunities

3.3.1 Emergence of Low and Non-Alcoholic Beverages

3.3.2 Growth in Emerging Markets within Europe

3.3.3 Technological Advancements in Production Processes

3.4 Trends

3.4.1 Increasing Popularity of Ready-to-Drink (RTD) Cocktails

3.4.2 Sustainable and Eco-Friendly Packaging Solutions

3.4.3 Collaboration Between Alcohol Brands and Hospitality Sector

3.5 Government Regulations

3.5.1 European Union Alcohol Policies

3.5.2 Country-Specific Taxation and Import Laws

3.5.3 Advertising and Marketing Restrictions

3.5.4 Health Warning Label Requirements

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape

4. Europe Liquor Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Beer

4.1.2 Wine

4.1.3 Spirits

4.1.4 Liqueurs

4.1.5 Cider/Perry

4.2 By Distribution Channel (In Value %)

4.2.1 On-Trade (Bars, Restaurants, Hotels)

4.2.2 Off-Trade (Supermarkets, Hypermarkets, Specialty Stores)

4.2.3 Online Retailing

4.3 By Packaging Type (In Value %)

4.3.1 Bottles

4.3.2 Cans

4.3.3 Tetra Packs

4.3.4 Kegs

4.4 By Alcohol Content (In Value %)

4.4.1 Low Alcohol (Up to 5% ABV)

4.4.2 Medium Alcohol (5% - 20% ABV)

4.4.3 High Alcohol (Above 20% ABV)

4.5 By Country (In Value %)

4.5.1 Germany

4.5.2 United Kingdom

4.5.3 France

4.5.4 Italy

4.5.5 Spain

4.5.6 Russia

4.5.7 Rest of Europe

5. Europe Liquor Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Diageo Plc

5.1.2 Pernod Ricard SA

5.1.3 Bacardi Limited

5.1.4 Anheuser-Busch InBev SA/NV

5.1.5 Heineken Holding NV

5.1.6 Carlsberg Breweries A/S

5.1.7 Molson Coors Brewing Company

5.1.8 LVMH Mot Hennessy Louis Vuitton

5.1.9 E & J Gallo Winery

5.1.10 Brown-Forman Corporation

5.2 Cross Comparison Parameters (Revenue, Market Share, Product Portfolio, Geographic Presence, Strategic Initiatives, R&D Investment, Number of Employees, Year of Establishment)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.6.1 Venture Capital Funding

5.6.2 Government Grants

5.6.3 Private Equity Investments

6. Europe Liquor Market Regulatory Framework

6.1 European Union Directives on Alcohol Production and Sales

6.2 Country-Specific Regulations and Compliance Requirements

6.3 Certification Processes and Quality Standards

7. Europe Liquor Market Future Size (In USD Million)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Europe Liquor Market Future Segmentation

8.1 By Product Type (In Value %)

8.2 By Distribution Channel (In Value %)

8.3 By Packaging Type (In Value %)

8.4 By Alcohol Content (In Value %)

8.5 By Country (In Value %)

9. Europe Liquor Market Analysts Recommendations

9.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

10. Disclaimer

11. Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Europe liquor market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Europe liquor market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple liquor manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Europe liquor market.

Frequently Asked Questions

01. How big is the Europe Liquor Market?

The Europe liquor market is valued at USD 227 billion, driven by strong consumer demand for premium and craft beverages, along with evolving distribution channels that facilitate wider accessibility across the region.

02. What are the key growth drivers in the Europe Liquor Market?

Growth in the Europe liquor market is primarily driven by rising consumer demand for premium and craft beverages, the expansion of e-commerce platforms, and the development of innovative product offerings that cater to diverse consumer preferences.

03. What challenges does the Europe Liquor Market face?

Europe liquor market faces challenges such as stringent government regulations, health concerns around alcohol consumption, and an increasing trend toward sobriety, which may impact future growth in certain alcoholic beverage categories.

04. Who are the major players in the Europe Liquor Market?

Key players in the Europe liquor market include Diageo Plc, Pernod Ricard SA, Bacardi Limited, Anheuser-Busch InBev SA/NV, and Heineken Holding NV, who dominate through established brands, extensive distribution, and strong market presence.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.