Europe Luxury Car Market Outlook to 2030

Region:Europe

Author(s):Shreya

Product Code:KROD4088

December 2024

80

About the Report

Europe Luxury Car Market Overview

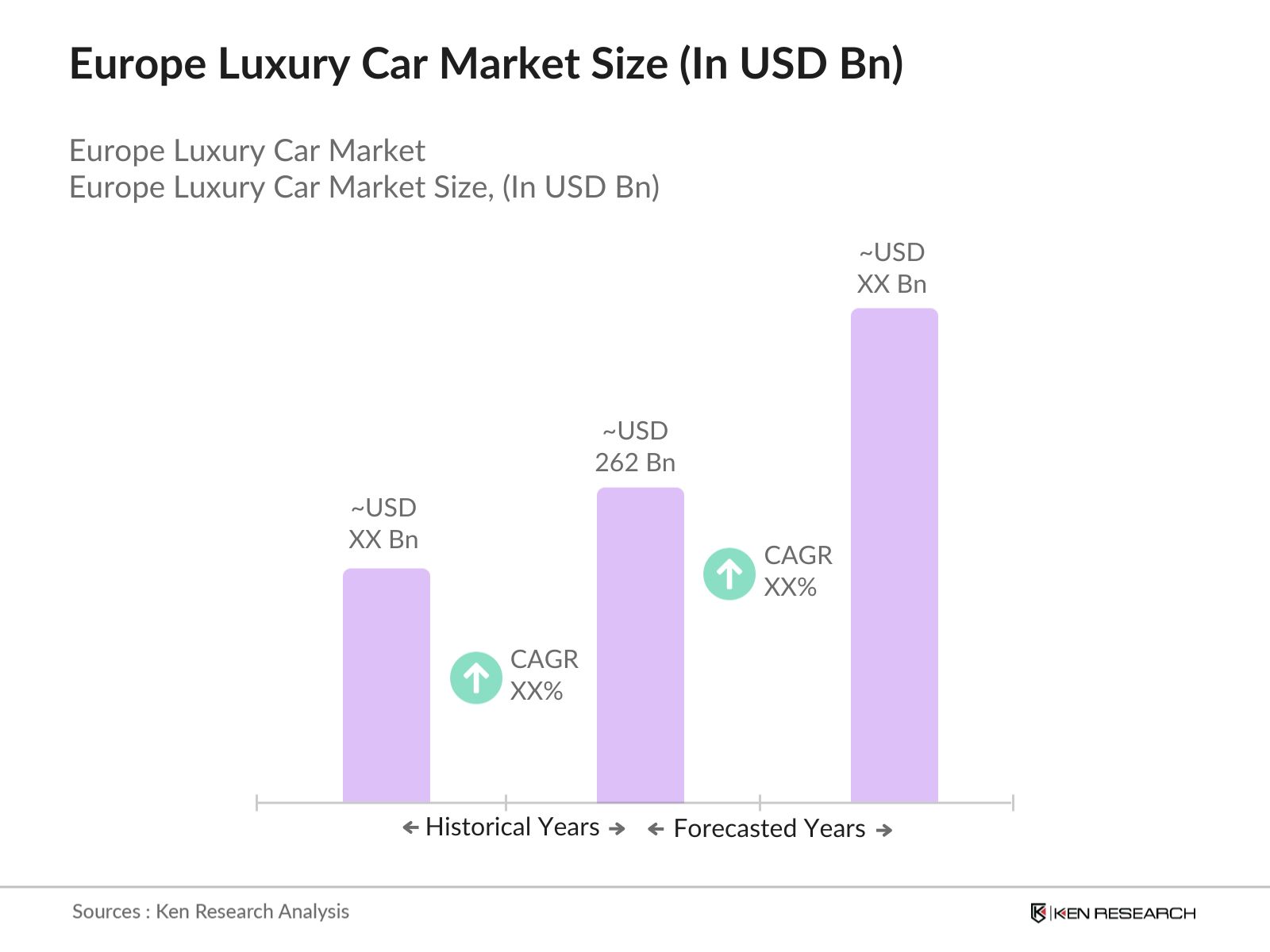

- The Europe luxury car market is currently valued at USD 262 billion, driven by the rising consumer demand for high-performance, technologically advanced vehicles that offer both status and superior comfort. This growth has been supported by a surge in high-net-worth individuals and an increased focus on vehicle customization and advanced in-car technology features, such as semi-autonomous driving and enhanced infotainment systems.

- The leading markets within Europe for luxury cars include Germany, the United Kingdom, and France. Germanys dominance is largely due to its robust automotive industry and the presence of renowned brands like BMW, Mercedes-Benz, and Porsche, which benefit from deep-rooted expertise in car manufacturing and innovation. The UKs strong demand arises from affluent consumer demographics and a high interest in luxury SUVs, while Frances market is bolstered by a preference for high-end electric vehicles and eco-friendly luxury options.

- The European Union's Euro 7 standards set stricter limits on pollutant emissions, affecting luxury car manufacturers who must adapt their models to meet these regulations. According to the European Commission, compliance costs for Euro 7 are expected to increase manufacturing expenses for luxury brands, impacting pricing and model availability. Compliance with these regulations is essential for automakers aiming to continue operations in the European market.

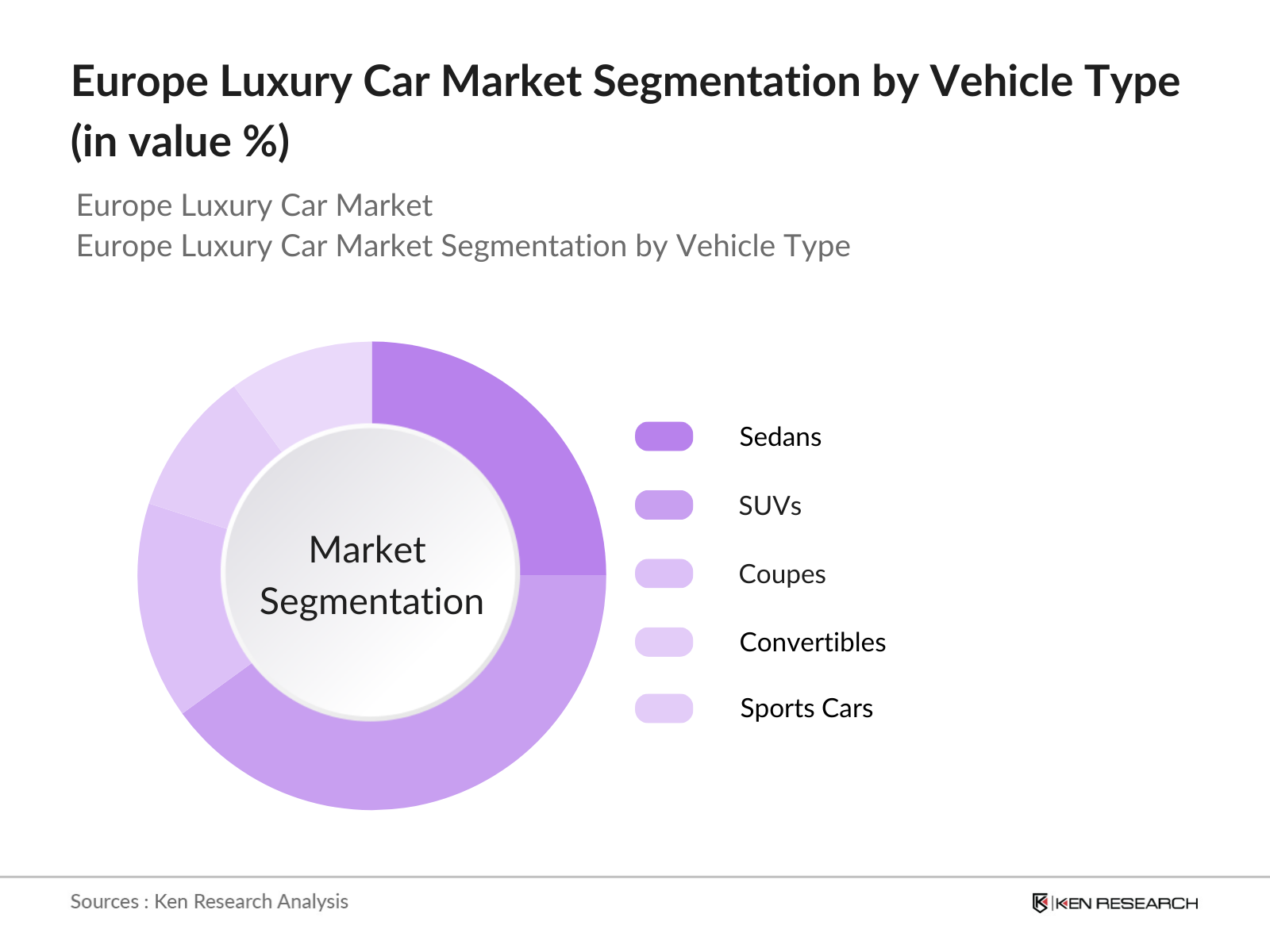

Europe Luxury Car Market Segmentation

By Vehicle Type: The market is segmented by vehicle type into sedans, SUVs, coupes, convertibles, and sports cars. SUVs hold a dominant market share under the segmentation of vehicle type due to the growing consumer preference for spacious and versatile vehicles. The SUV segments popularity is driven by factors such as increased family use, all-terrain capability, and luxury SUV models enhanced comfort and safety features. Brands like Porsche and BMW lead in this segment by offering premium SUV options tailored to European consumers' tastes.

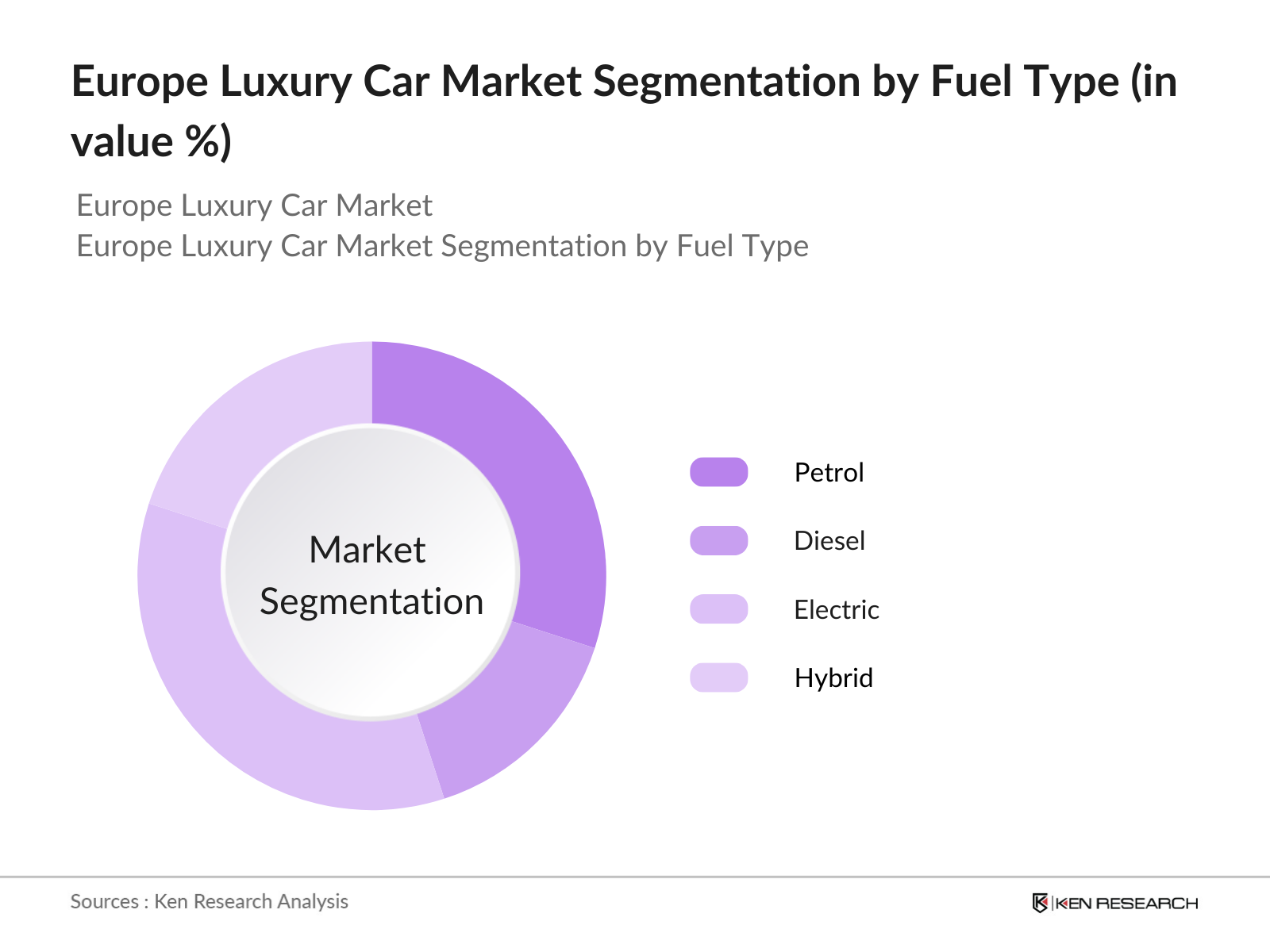

By Fuel Type: The market is also segmented by fuel type into petrol, diesel, electric, and hybrid vehicles. Electric luxury vehicles dominate the market share within this segment, driven by the European Union's stringent emissions regulations and consumers' growing environmental awareness. Brands like Tesla and Mercedes-Benz have led in this category, with a strong emphasis on producing high-performance electric vehicles that align with Europes green mobility goals.

Europe Luxury Car Market Competitive Landscape

The Europe luxury car market is dominated by several key players, including both established European brands and emerging international competitors. This consolidation highlights the substantial influence and market control these companies have in terms of innovation, pricing, and product differentiation.

Europe Luxury Car Industry Analysis

Growth Drivers

- Increasing Disposable Income: With Europes median income per capita rising to $34,000 USD in 2024, supported by IMF reports, consumers have increased purchasing power to invest in high-value items, including luxury vehicles. According to Eurostat, economic stability in key European markets like Germany and France has significantly boosted disposable income, allowing for luxury purchases that were previously inaccessible. This trend aligns with the rise in per capita gross national income in Western Europe, now reported at $48,000 USD, indicating a robust economic backdrop for luxury vehicle purchases in 2024.

- Rise in Urbanization: By 2024, nearly 75% of Europes population resides in urban areas, with cities like Paris, Berlin, and Madrid experiencing higher concentrations of high-net-worth individuals (HNWI), as per United Nations data. This urbanization has driven demand for luxury vehicles that offer advanced technologies and enhanced performance, suited to the fast-paced urban environment. Urban residents now constitute the primary demographic for luxury vehicle purchases, with increasing migration to cities bolstering this trend.

- Demand for Personalized Vehicles: Europes luxury car market is witnessing an increased demand for personalized vehicles as discerning customers seek custom designs, unique color options, and bespoke interiors. Data from the European Automobile Manufacturers Association indicates a 15% rise in demand for customizations in luxury vehicles in 2023. Many manufacturers have introduced advanced customization programs catering specifically to European clients who now expect a tailored experience reflective of their personal brand and lifestyle.

Market Challenges

- High Initial and Maintenance Costs: Luxury cars have high upfront costs and are accompanied by considerable maintenance expenses due to sophisticated features and premium components. Data from the European Automobile Manufacturers Association reveals that luxury car maintenance expenses averaged around $1,200 USD annually, significantly higher than standard vehicles, deterring potential buyers in some segments. These high costs can limit accessibility to broader consumer bases, especially in middle-income brackets.

- Stringent Emission Regulations: The European Unions stringent emission norms, particularly Euro 6 standards, require luxury car manufacturers to invest heavily in cleaner technologies, thereby increasing production costs. As of 2024, the average CO2 emission from new luxury cars must meet stringent limits, with fines imposed for every gram over the prescribed levels, influencing market dynamics by adding pressure on traditional internal combustion engines. This has posed challenges for manufacturers, pushing many to accelerate investments in electric models.

Europe Luxury Car Market Future Outlook

Over the next five years, the Europe luxury car market is expected to witness substantial growth fueled by advancements in electric vehicle technology, rising disposable incomes, and increasing demand for sustainable mobility solutions. With continued investment in eco-friendly car production and the introduction of more electric and hybrid luxury vehicles, the market will likely expand significantly, aligning with European green policies and regulations.

Future Market Opportunities

- Electric and Hybrid Luxury Cars: With Europes increasing emphasis on sustainability, electric and hybrid luxury vehicles have gained traction, representing 25% of total luxury car sales in 2023. Government incentives for electric vehicle purchases, including tax reductions and grants in countries like Norway and Germany, have boosted sales of hybrid and fully electric luxury models. The trend towards eco-friendly vehicles aligns with EU climate goals, creating a promising growth avenue for luxury automakers.

- Emerging Markets in Eastern Europe: Eastern European markets, including Poland, the Czech Republic, and Hungary, have seen economic growth rates averaging 4% annually, according to IMF. Rising disposable incomes in these regions have driven demand for luxury cars, with registrations in Poland and the Czech Republic rising by over 8% in 2023. These emerging markets offer untapped potential for luxury brands seeking to expand beyond Western Europes saturated markets.

Scope of the Report

|

Vehicle Type |

Sedans |

|

Fuel Type |

Petrol |

|

End-User |

Individual Buyers |

|

Sales Channel |

Offline Dealerships |

|

Region |

East West North South |

Products

Key Target Audience

Luxury Vehicle Manufacturers

Component and Technology Providers

Dealership Networks

Aftermarket Service Providers

Government and Regulatory Bodies (European Commission, National Automotive Authorities)

Financial Institutions and Investors

Investments and Venture Capitalist Firms

Research and Development Organizations

Companies

Major Players

Mercedes-Benz Group AG

BMW AG

Audi AG

Porsche AG

Ferrari N.V.

Aston Martin Lagonda Global Holdings PLC

Bentley Motors Limited

Rolls-Royce Motor Cars

Maserati S.p.A.

Jaguar Land Rover Automotive PLC

Lamborghini (Volkswagen Group)

McLaren Automotive

Bugatti Automobiles S.A.S.

Tesla, Inc. (Luxury Segment)

Lexus (Toyota Motor Corporation)

Table of Contents

Europe Luxury Car Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

Europe Luxury Car Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

Europe Luxury Car Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Disposable Income

3.1.2. Rise in Urbanization

3.1.3. Demand for Personalized Vehicles

3.1.4. Integration of Advanced Technology (ADAS, IoT)

3.2. Market Challenges

3.2.1. High Initial and Maintenance Costs

3.2.2. Stringent Emission Regulations

3.2.3. Competition from Premium Car Segment

3.3. Opportunities

3.3.1. Electric and Hybrid Luxury Cars

3.3.2. Emerging Markets in Eastern Europe

3.3.3. Growth in Luxury Car Subscription Services

3.4. Trends

3.4.1. Focus on Sustainability

3.4.2. Autonomous Driving Capabilities

3.4.3. Luxury Electric Vehicle Market Expansion

3.5. Regulatory Impact

3.5.1. Emission Standards Compliance

3.5.2. Fuel Efficiency Regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

Europe Luxury Car Market Segmentation

4.1. By Vehicle Type (In Value %)

4.1.1. Sedans

4.1.2. SUVs

4.1.3. Coupes

4.1.4. Convertibles

4.1.5. Sports Cars

4.2. By Fuel Type (In Value %)

4.2.1. Petrol

4.2.2. Diesel

4.2.3. Electric

4.2.4. Hybrid

4.3. By End-User (In Value %)

4.3.1. Individual Buyers

4.3.2. Fleet Operators

4.4. By Sales Channel (In Value %)

4.4.1. Offline Dealerships

4.4.2. Online Sales

4.5. By Region (In Value %)

4.5.1. West

4.5.2. North

4.5.3. East

4.5.4. South

Europe Luxury Car Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Mercedes-Benz Group AG

5.1.2. BMW AG

5.1.3. Audi AG

5.1.4. Porsche AG

5.1.5. Ferrari N.V.

5.1.6. Aston Martin Lagonda Global Holdings PLC

5.1.7. Bentley Motors Limited

5.1.8. Rolls-Royce Motor Cars

5.1.9. Maserati S.p.A.

5.1.10. Jaguar Land Rover Automotive PLC

5.1.11. Lamborghini (Volkswagen Group)

5.1.12. McLaren Automotive

5.1.13. Bugatti Automobiles S.A.S.

5.1.14. Tesla, Inc. (Luxury Segment)

5.1.15. Lexus (Toyota Motor Corporation)

5.2. Cross Comparison Parameters (Market Share, Revenue, R&D Spending, Product Portfolio, Customer Satisfaction Index, Brand Perception, After-Sales Service, Dealer Network)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Subsidies

5.9. Private Equity Investments

Europe Luxury Car Market Regulatory Framework

6.1. Emission Standards

6.2. Safety Regulations

6.3. Certification Processes

Europe Luxury Car Future Market Size (In USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

Europe Luxury Car Future Market Segmentation

8.1. By Vehicle Type (In Value %)

8.2. By Fuel Type (In Value %)

8.3. By End-User (In Value %)

8.4. By Sales Channel (In Value %)

8.5. By Region (In Value %)

Europe Luxury Car Market Analysts Recommendations

9.1. Total Addressable Market Analysis

9.2. Customer Demographics and Preferences

9.3. Marketing Strategies

9.4. White Space Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This step involves mapping the key stakeholders across the Europe luxury car market, supported by comprehensive desk research using secondary sources and proprietary databases. The aim is to establish the main market variables impacting dynamics, including consumer preferences and market regulations.

Step 2: Market Analysis and Data Compilation

In this phase, we analyze historical data for the Europe luxury car market, including sales volumes, market growth trends, and regulatory impacts. A careful evaluation of performance metrics and price trends provides a foundation for accurate revenue estimations.

Step 3: Hypothesis Validation and Expert Consultation

To validate market hypotheses, we engage in interviews with industry experts via computer-assisted telephone interviews (CATIs). These discussions offer critical insights from various market stakeholders, which helps refine and corroborate the data.

Step 4: Synthesis and Final Output

The final step integrates insights from luxury car manufacturers to verify data collected through a bottom-up approach. This step ensures a detailed and validated analysis of the European luxury car market.

Frequently Asked Questions

01. How big is the Europe Luxury Car Market?

The Europe luxury car market, valued at USD 262 billion, is driven by the regions affluent consumers and a high demand for technologically advanced vehicles.

02. What are the key challenges in the Europe Luxury Car Market?

Challenges in the Europe luxury car market include stringent emissions regulations, high production costs for luxury electric vehicles, and increasing competition from premium car manufacturers.

03. Who are the major players in the Europe Luxury Car Market?

Key players in the Europe luxury car market include Mercedes-Benz, BMW, Audi, Porsche, and Tesla. Their dominance is due to strong brand recognition, extensive R&D, and a wide array of luxury vehicle options.

04. What drives growth in the Europe Luxury Car Market?

Growth drivers in the Europe luxury car market include rising consumer wealth, technological advancements in electric vehicles, and the markets adaptation to eco-friendly mobility solutions aligned with EU emissions targets.

05. What trends are shaping the Europe Luxury Car Market?

Trends in the Europe luxury car market include the shift toward electric and hybrid luxury vehicles, the integration of advanced autonomous driving features, and increased demand for personalized vehicle options.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.