Europe Metal Shredder Market Outlook to 2030

Region:Europe

Author(s):Shreya Garg

Product Code:KROD9030

December 2024

82

About the Report

Europe Metal Shredder Market Overview

- The Europe Metal Shredder Market is valued at USD 390 million, driven by rising demand for sustainable metal recycling solutions. Metal shredding has become crucial due to stringent environmental regulations aimed at reducing waste and maximizing resource recovery. Industries such as automotive, construction, and electronics are significant contributors to this demand, as they seek efficient shredding systems to handle large volumes of scrap metal.

- Germany and the United Kingdom dominate the metal shredder market in Europe. Germanys extensive automotive and industrial base, combined with advanced recycling infrastructure, makes it a primary driver of demand for metal shredders. Meanwhile, the United Kingdoms focus on sustainable waste management practices, backed by regulatory incentives, enhances its role in metal recycling and contributes to its market dominance.

- EU regulations on emissions and noise significantly impact the metal shreddi. Shredding facilities must adhere to strict noise limits of 70-80 decibels and emissions control, requiring investments in advanced technology to meet these standards. These regulations, enforced under the EU Noise Directive, ensure that shredding operations minimize environmental impact, pushing shredding companies to adopt quieter, low-emission machines that align with EU environmental goals.

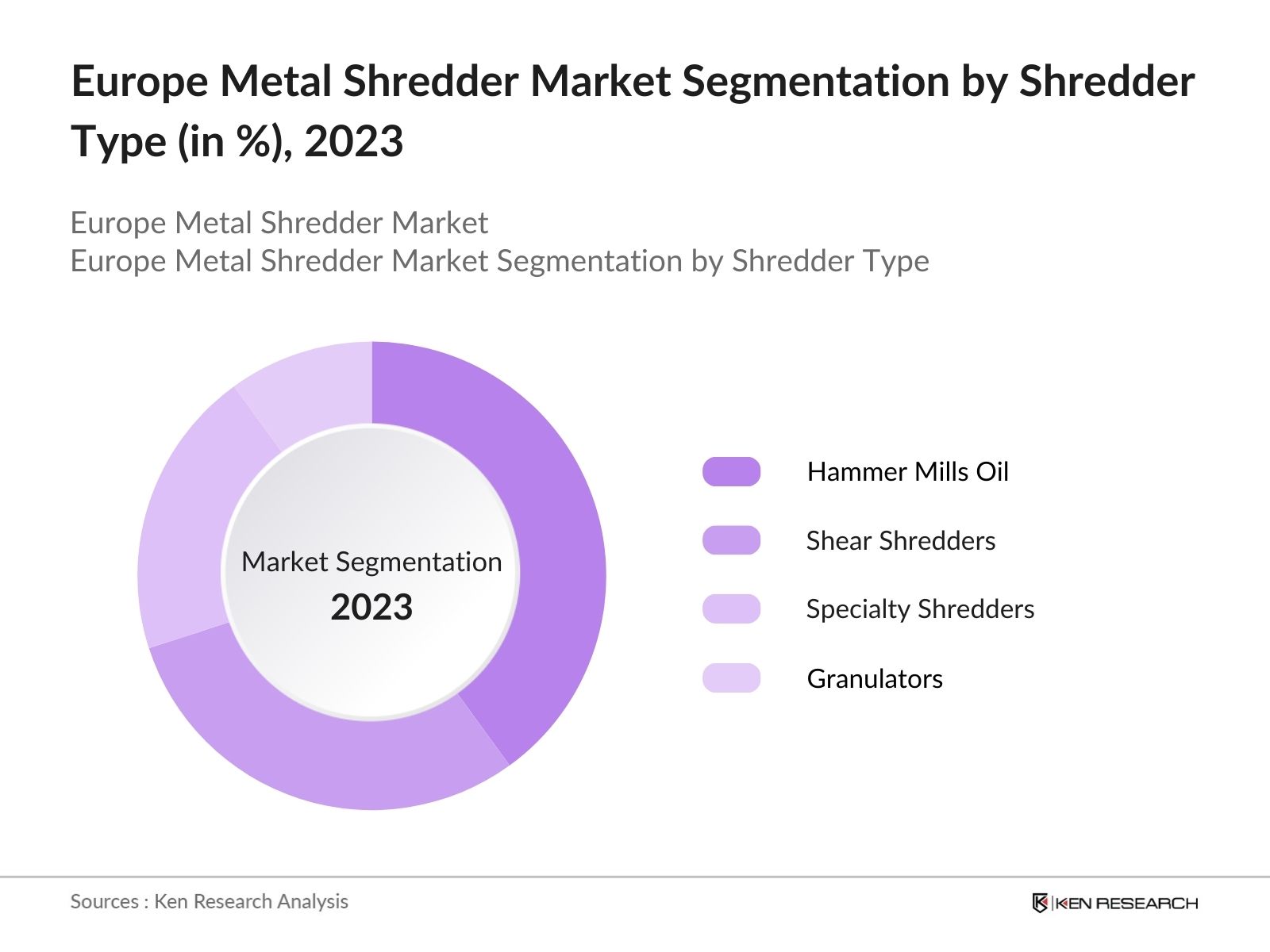

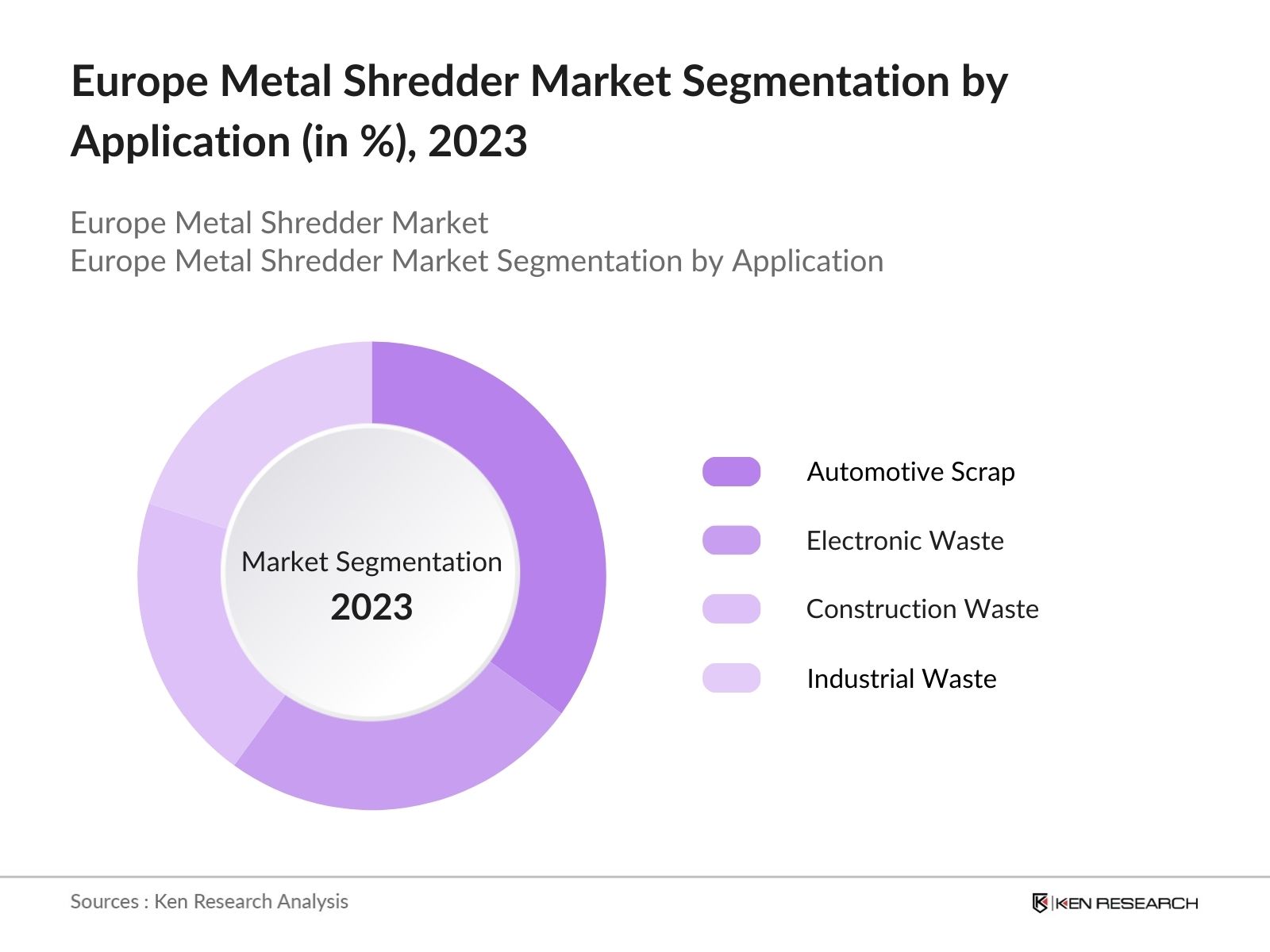

Europe Metal Shredder Market Segmentation

By Shredder Type: The Market is segmented by shredder type into hammer mills, shear shredders, specialty shredders, and granulators. Recently, hammer mills hold a dominant share under the shredder type segment. Their capability to efficiently process large volumes of ferrous and non-ferrous metals has made them the preferred choice among recycling firms. Hammer mills also benefit from durability and ease of maintenance, allowing companies to sustain high operational performance with reduced downtime.

By Application: The market is segmented by application into automotive scrap, electronic waste, construction and demolition waste, and industrial waste. Automotive scrap holds a dominant share within the application segment, driven by the high turnover rate of vehicles in Europe. With a robust automotive recycling infrastructure, metal shredders have become integral to dismantling and processing vehicles efficiently, allowing for maximum metal recovery and ensuring compliance with environmental standards.

Europe Metal Shredder Market Competitive Landscape

The Europe Metal Shredder Market is dominated by a few major players, including prominent names such as Metso Corporation, SSI Shredding Systems, and Untha Shredding Technology. This competitive landscape reflects a high degree of specialization in shredding technologies, with each player leveraging unique product innovations to capture market share. Established firms maintain strong positions through extensive R&D investments, comprehensive service networks, and strong customer relationships across industries.

|

Company |

Establishment Year |

Headquarters |

Product Offering |

R&D Investment |

Manufacturing Facilities |

Employee Strength |

Key Markets |

|

Metso Corporation |

1999 |

Helsinki, Finland |

|||||

|

SSI Shredding Systems, Inc. |

1980 |

Wilsonville, USA |

|||||

|

Untha Shredding Technology |

1970 |

Kuchl, Austria |

|||||

|

BCA Industries |

1998 |

Milwaukee, USA |

|||||

|

Granutech-Saturn Systems |

1968 |

Grand Prairie, USA |

Europe Metal Shredder Industry Analysis

Growth Drivers

- Automotive and Electronics Industry Growth: The automotive and electronics sectors in Europe rely on shredded metals for sustainable material sourcing, driven by strong growth in electric vehicle (EV) and electronic waste (e-waste) recycling. In 2023, Europe produced 4.8 million metric tons of e-waste, making metal shredders essential to recycling efforts. EV production has also surged, reaching 2.7 million units across the EU, further increasing demand for shredded aluminum and steel. Metal shredders play a vital role in breaking down these components, fostering a sustainable supply chain.

- Increased Demand for Recycled Metals: Demand for recycled metals has risen with Europes focus on circular economy goals, requiring higher metal recovery and recycling rates. In 2022, Europe processed over 100 million metric tons of metal waste, with steel and aluminum as primary recovered materials. With this heightened demand, shredders are instrumental in processing and refining metals, contributing to EU goals for resource efficiency and material reuse. Recycled metals now contribute to over 60% of raw material inputs for various industries, significantly impacting market demand for advanced shredding technologies.

- Advancements in Shredding Technologies: Technological advancements in shredders, such as high-torque, low-speed shredders and multi-stage shredding, are optimizing metal recovery and energy efficiency. In 2023, nearly 35% of metal shredders in Europe incorporated smart automation for efficient processing, reducing operational costs by 20%. Additionally, innovations in shredder design have led to a reduction in energy consumption, essential for Europes energy transition. These advances align with industry goals for improved resource efficiency and lower emissions.

Market Challenges

- High Initial Capital Investment: Metal shredders require substantial capital for installation and operational setup. A typical large-capacity shredder installation can cost up to EUR 5 million, which poses a barrier for small-scale recycling facilities. In 2023, EU funding for recycling infrastructure primarily favored larger entities, limiting small businesses' ability to enter the market. These high initial costs have restrained market expansion in Europe, where large-scale plants dominate recycling capabilities.

- Environmental Compliance Costs: Strict environmental regulations on emissions and noise significantly increase compliance costs for metal shredders in Europe. In 2022, the EU introduced stricter limits on noise emissions for industrial equipment, affecting around 45% of metal shredders in operation. Additionally, meeting air pollution standards has cost recycling companies an estimated EUR 1.2 billion in equipment upgrades and installations of advanced filtration systems. These compliance costs create financial strain on smaller market players, limiting their competitive potential.

Europe Metal Shredder Market Future Outlook

The Europe Metal Shredder Market is anticipated to undergo further expansion, driven by continued environmental pressures and advancements in recycling technology. As Europe seeks to implement more circular economy practices, the demand for advanced shredding solutions will likely rise, supported by government initiatives to reduce industrial waste and encourage metal recycling. The market outlook suggests that companies focusing on R&D and sustainable technology solutions will be well-positioned for future growth.

Future Market Opportunities

- Emerging Shredding Technology Innovations: Europe is at the forefront of innovation in shredding technologies, with advancements in modular and energy-efficient shredders in 2023. Technologies like intelligent shredders with integrated AI for material sorting have increased processing efficiency by 30%. This technological progress allows European shredding companies to improve recovery rates, meeting high recycling targets and reducing waste. With government funding for R&D in green technologies, companies are encouraged to invest in advanced shredders.

- Expansion of Recycling Facilities: In 2023, the EU allocated EUR 4.3 billion toward expanding recycling facilities, aiming to achieve a 90% recycling rate by 2025. This expansion, particularly in countries like Germany and France, drives demand for high-capacity shredders. New recycling plants across Europe are projected to increase shredded metal production by up to 12 million metric tons annually, providing significant opportunities for shredder manufacturers.

Scope of the Report

|

Shredder Type |

Hammer Mills |

|

Application |

Automotive Scrap |

|

Capacity |

Low Capacity (Less than 10 TPH) |

|

Power Source |

Electric Shredders |

|

Country |

Germany |

Products

Key Target Audience

Metal Recycling Companies

Industrial Waste Management Firms

Automotive Dismantlers

E-waste Recycling Facilities

Manufacturers in Construction and Demolition

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (European Environment Agency, Ministry of Environment)

Banks and Financial Institutes

Environmental Compliance Consultants

Companies

Major Players

Metso Corporation

SSI Shredding Systems, Inc.

Untha Shredding Technology

BCA Industries

Granutech-Saturn Systems

Vecoplan LLC

Lindner Recyclingtech GmbH

Stokkermill Recycling Machinery

Wendt Corporation

Forrec Srl Recycling Systems

Shred-Tech Corp.

CM Shredders

ARJES GmbH

BMH Technology Oy

Erdwich Zerkleinerungs-Systeme GmbH

Table of Contents

1. Europe Metal Shredder Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics Overview

1.4. Market Segmentation Overview

2. Europe Metal Shredder Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Europe Metal Shredder Market Analysis

3.1. Growth Drivers

3.1.1. Recycling Regulations and Policies

3.1.2. Automotive and Electronics Industry Growth

3.1.3. Increased Demand for Recycled Metals

3.1.4. Advancements in Shredding Technologies

3.2. Market Challenges

3.2.1. High Initial Capital Investment

3.2.2. Fluctuating Raw Material Prices

3.2.3. Environmental Compliance Costs

3.3. Opportunities

3.3.1. Rising Scrap Metal Exports

3.3.2. Emerging Shredding Technology Innovations

3.3.3. Expansion of Recycling Facilities

3.4. Trends

3.4.1. Integration with Smart Recycling Systems

3.4.2. Development of Compact Shredding Solutions

3.4.3. Increased Adoption of Mobile Shredders

3.5. Regulatory Framework

3.5.1. EU Waste Framework Directive

3.5.2. Circular Economy Package

3.5.3. Emission and Noise Control Regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Landscape

4. Europe Metal Shredder Market Segmentation

4.1. By Shredder Type (In Value %)

4.1.1. Hammer Mills

4.1.2. Shear Shredders

4.1.3. Specialty Shredders

4.1.4. Granulators

4.2. By Application (In Value %)

4.2.1. Automotive Scrap

4.2.2. Electronic Waste

4.2.3. Construction & Demolition Waste

4.2.4. Industrial Waste

4.3. By Capacity (In Value %)

4.3.1. Low Capacity (Less than 10 TPH)

4.3.2. Medium Capacity (10-20 TPH)

4.3.3. High Capacity (Above 20 TPH)

4.4. By Power Source (In Value %)

4.4.1. Electric Shredders

4.4.2. Hydraulic Shredders

4.5. By Country (In Value %)

4.5.1. Germany

4.5.2. France

4.5.3. United Kingdom

4.5.4. Italy

4.5.5. Spain

5. Europe Metal Shredder Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Metso Corporation

5.1.2. SSI Shredding Systems, Inc.

5.1.3. Untha Shredding Technology

5.1.4. BCA Industries

5.1.5. Granutech-Saturn Systems

5.1.6. Vecoplan LLC

5.1.7. Erdwich Zerkleinerungs-Systeme GmbH

5.1.8. CM Shredders

5.1.9. Stokkermill Recycling Machinery

5.1.10. Forrec Srl Recycling Systems

5.1.11. Lindner Recyclingtech GmbH

5.1.12. Shred-Tech Corp.

5.1.13. Wendt Corporation

5.1.14. BMH Technology Oy

5.1.15. ARJES GmbH

5.2 Cross-Comparison Parameters (Market Share, Annual Revenue, Headquarters Location, Core Product Offering, R&D Investments, Manufacturing Facilities, Regional Presence, Certifications)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Private Equity and Venture Capital Funding

5.8 Government and EU Funding Initiatives

6. Europe Metal Shredder Market Regulatory Framework

6.1. Environmental Protection Standards

6.2. Compliance and Certification Processes

6.3. Shredder Safety Standards and Guidelines

7. Europe Metal Shredder Future Market Size (In USD Mn)

7.1. Market Size Projections

7.2. Key Factors Influencing Future Market Size

8. Europe Metal Shredder Future Market Segmentation

8.1. By Shredder Type (In Value %)

8.2. By Application (In Value %)

8.3. By Capacity (In Value %)

8.4. By Power Source (In Value %)

8.5. By Country (In Value %)

9. Europe Metal Shredder Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing and Product Positioning

9.4. Regional Expansion Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

In this initial phase, an ecosystem map of stakeholders within the Europe Metal Shredder Market was created, backed by secondary research from proprietary databases and market reports. This step identifies essential variables shaping the industry.

Step 2: Market Analysis and Data Compilation

Historical data on market penetration, industrial applications, and recycling rates were compiled and analyzed. A structured approach to data collection was applied, including industry-level insights from trusted governmental sources.

Step 3: Hypothesis Validation and Industry Expert Consultation

Key market hypotheses were tested through direct consultation with industry experts from major metal shredding firms and recycling bodies, providing operational and financial insights to validate collected data.

Step 4: Data Synthesis and Final Output

The synthesis stage involved cross-verifying data with recycling and manufacturing stakeholders, ensuring accurate, robust insights into market dynamics and performance metrics for the Europe Metal Shredder Market.

Frequently Asked Questions

01. How big is the Europe Metal Shredder Market?

The Europe Metal Shredder Market is valued at USD 390 million, driven by growing demands for sustainable metal recycling in automotive, construction, and electronics sectors.

02. What are the main challenges in the Europe Metal Shredder Market?

Challenges in the Europe Metal Shredder Market include high capital investment costs, fluctuating raw material prices, and stringent environmental compliance requirements, which impact operational efficiency and profitability.

03. Which regions are dominant in the Europe Metal Shredder Market?

Germany and the United Kingdom are dominant in the Europe Metal Shredder Market, owing to their well-developed recycling infrastructure and strong emphasis on waste management regulations.

04. Who are the leading players in the Europe Metal Shredder Market?

Key players in the Europe Metal Shredder Market include Metso Corporation, SSI Shredding Systems, Untha Shredding Technology, Vecoplan LLC, and Lindner Recyclingtech GmbH, known for their advanced shredding technologies and extensive regional presence.

05. What drives growth in the Europe Metal Shredder Market?

Growth in the Europe Metal Shredder Market is propelled by the push for a circular economy, increased recycling of scrap metals, and the introduction of advanced shredding solutions that maximize resource recovery and minimize waste.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.