Europe Motorcycle Helmet Market Outlook to 2030

Region:Europe

Author(s):Paribhasha Tiwari

Product Code:KROD7030

December 2024

91

About the Report

Europe Motorcycle Helmet Market Overview

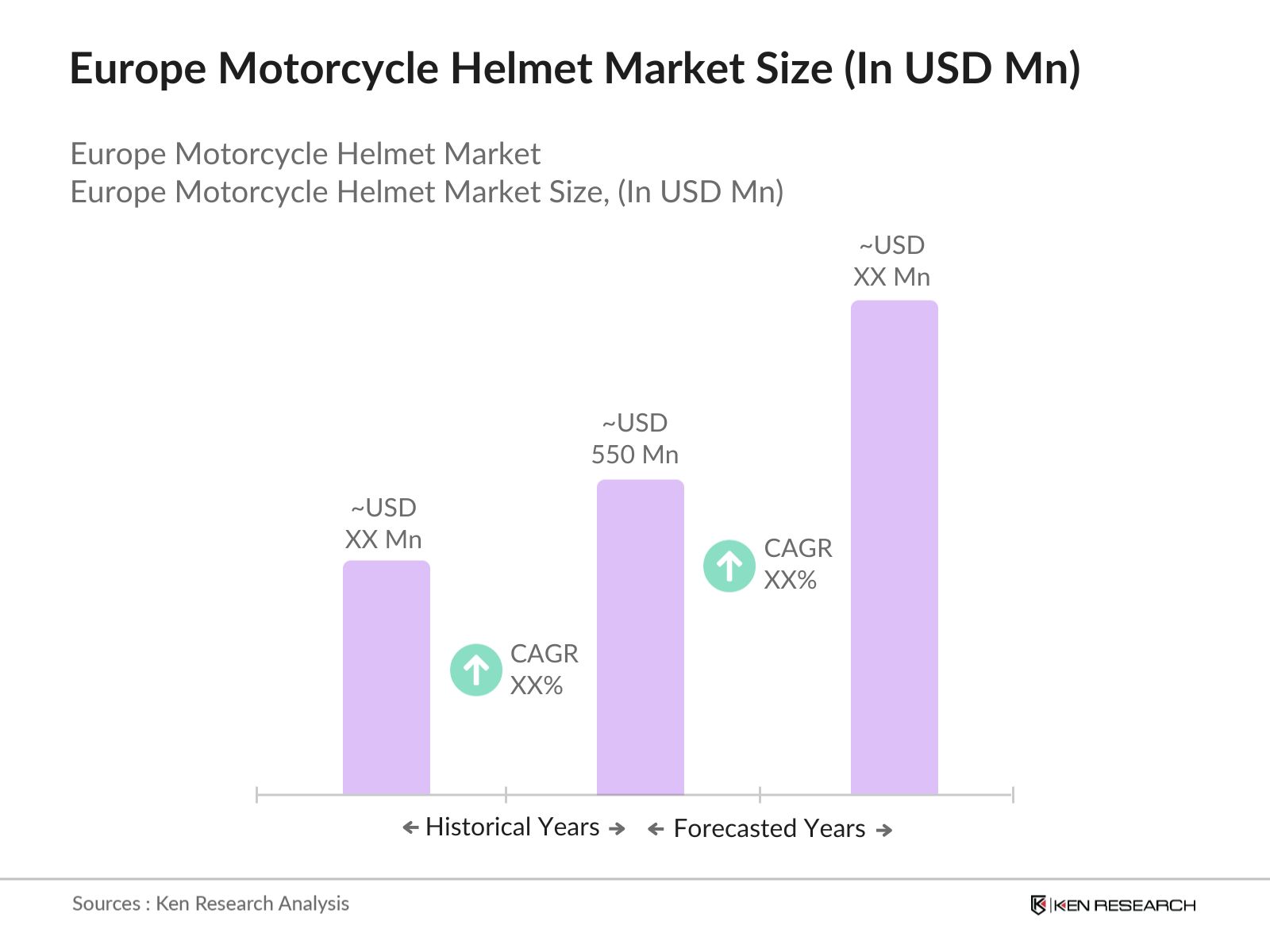

- The Europe motorcycle helmet market, valued at USD 550 million, is driven by increasing safety awareness among motorcyclists and stringent government regulations mandating helmet use. The rise in motorcycle tourism and the popularity of motorcycling as a leisure activity further contribute to market growth.

- Germany and Italy dominate the European motorcycle helmet market due to their strong motorcycling cultures and well-established manufacturing industries. Germany's emphasis on road safety and Italy's renowned motorcycle brands bolster helmet demand in these countries.

- Customization options are increasingly available, allowing consumers to personalize helmet aesthetics and fit. In 2024, helmet companies saw an increase in personalized helmet orders, with approximately 1.2 million customized helmets sold across major markets.

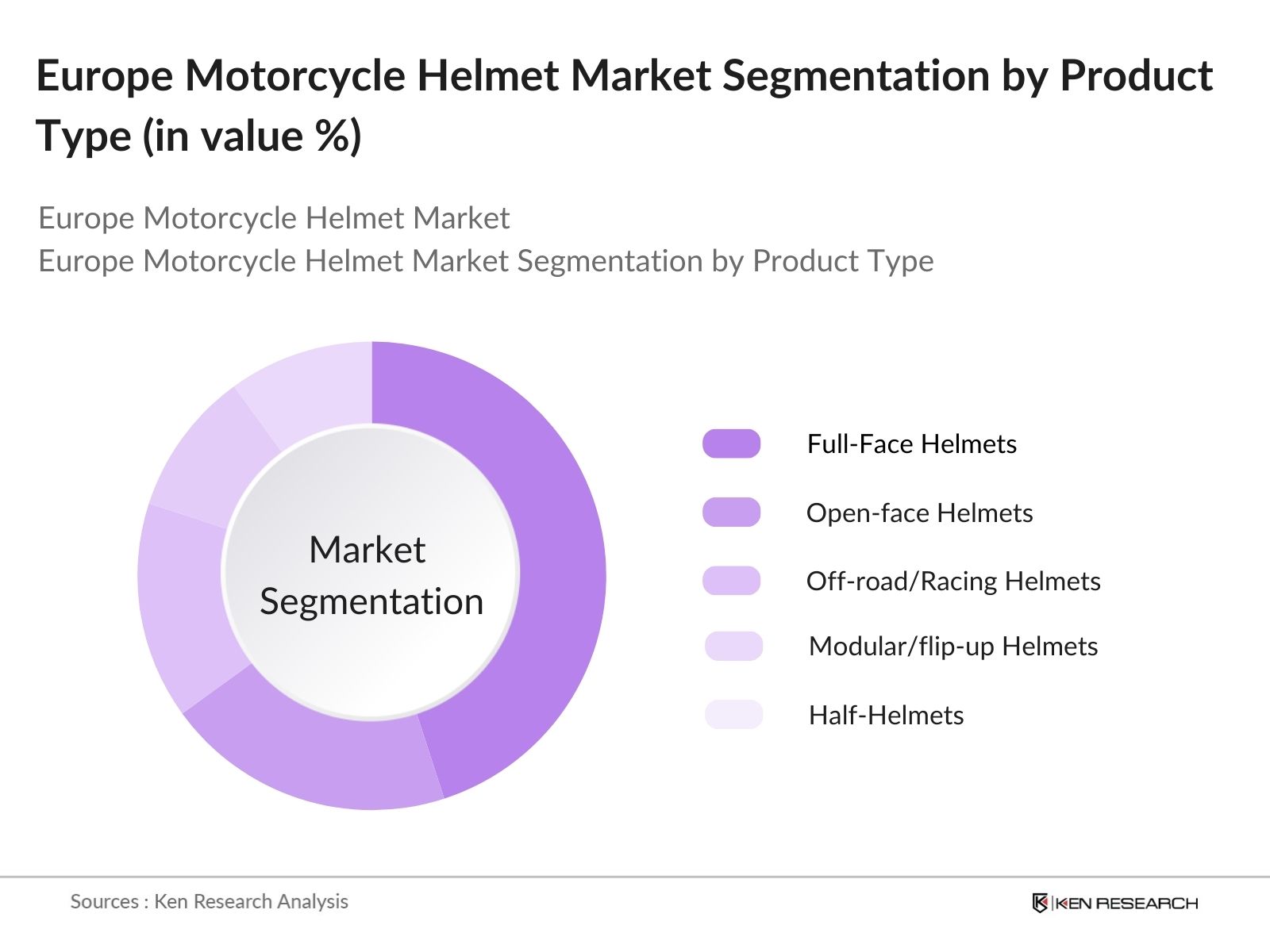

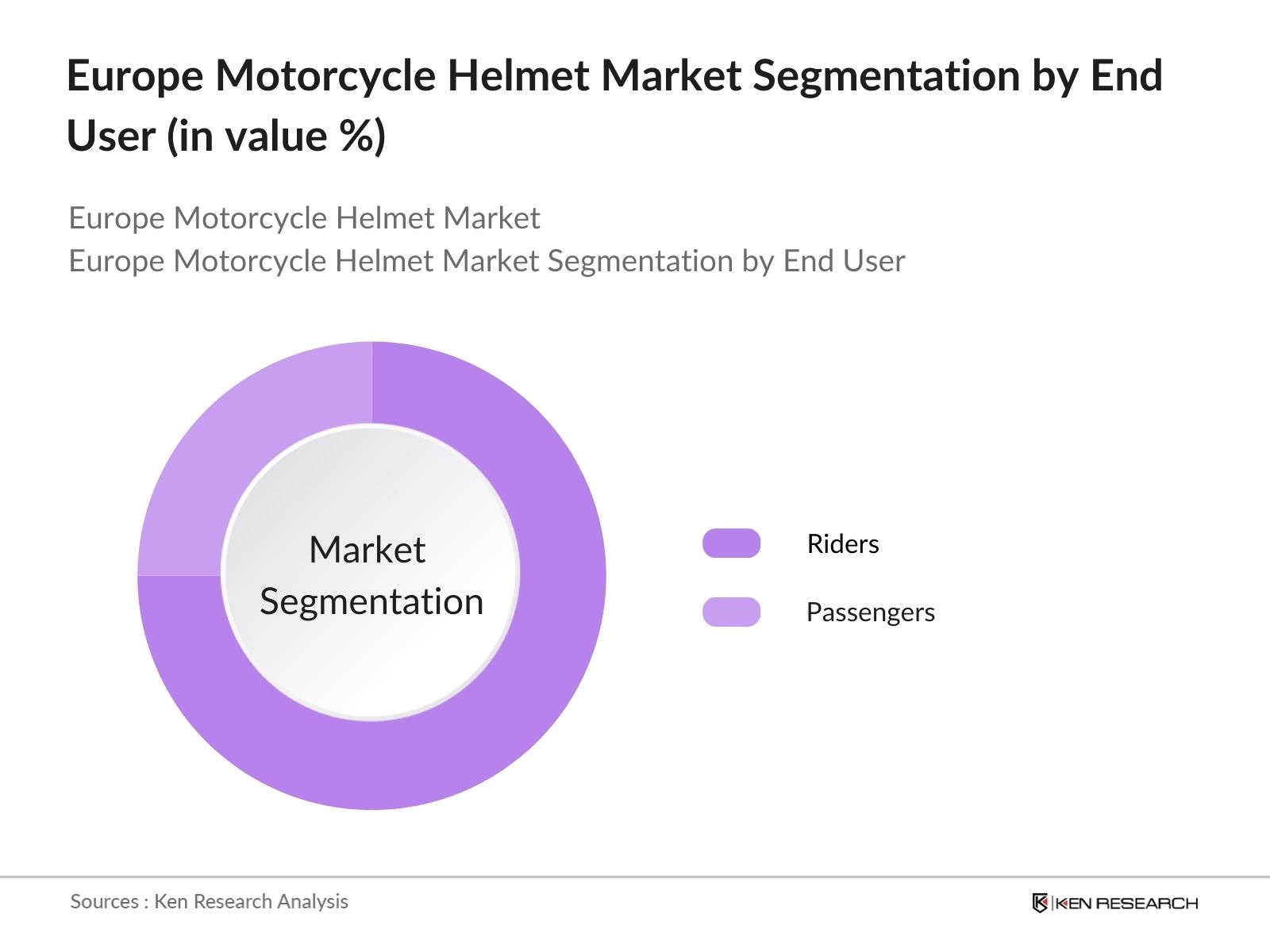

Europe Motorcycle Helmet Market Segmentation

By Product Type: The Europe motorcycle helmet market is segmented by product type into full-face helmets, open-face helmets, off-road/racing helmets, modular/flip-up helmets, and half helmets. Full-face helmets hold a dominant market share due to their comprehensive protection, covering the entire head and face, which appeals to safety-conscious riders.

By End User: The market is also segmented by end user into riders and passengers. The rider segment dominates the market, as riders are more exposed to potential hazards and are more likely to invest in high-quality helmets for enhanced safety.

Europe Motorcycle Helmet Market Competitive Landscape

The Europe motorcycle helmet market features several key players:

Europe Motorcycle Helmet Market Analysis

Growth Drivers

- Rising Motorcycle Ownership: The number of registered motorcycles worldwide has reached an all-time high, with over 100 million new units sold globally in 2024. This significant growth in motorcycle ownership is driven by increased urban congestion, especially in densely populated regions such as Southeast Asia and Latin America, where motorcycles serve as a practical and affordable commuting option. The motorcycle market is forecasted to continue this trend, with ownership numbers expected to rise steadily in emerging economies, creating a corresponding demand for quality helmets that align with safety and legal standards.

- Stringent Safety Regulations: Governments worldwide are enacting stricter helmet regulations, with nearly 85 countries implementing compulsory helmet laws for motorcyclists in 2024. These regulations are also becoming more rigorous regarding helmet quality, requiring manufacturers to adhere to advanced safety specifications. As a result, helmet producers are compelled to meet these evolving standards to ensure compliance, stimulating demand for high-quality and certified helmets in both domestic and international markets.

- Technological Advancements in Helmet Design: Innovations in helmet manufacturing, such as advanced impact-absorption materials and improved aerodynamics, are increasingly incorporated into modern helmet designs. Manufacturers have introduced features such as multi-density EPS liners, enhanced ventilation systems, and anti-fog visors, which have enhanced both the comfort and safety of helmets. These advancements, attracting motorcycle owners and safety-conscious consumers, have contributed to an increased demand for helmets that offer both style and state-of-the-art safety features.

Market Challenges

- High Cost of Advanced Helmets: Advanced helmets with safety features like Bluetooth connectivity, voice command systems, and integrated cameras are considerably more expensive, with average prices often exceeding $200 per unit. This high cost is a barrier for many consumers, especially in price-sensitive markets across Asia and Africa, where the majority of motorcyclists seek budget-friendly safety solutions. This cost disparity is a challenge for manufacturers looking to expand the market for premium, feature-rich helmets in these regions.

- Presence of Counterfeit Products: The rise in counterfeit helmet production poses a significant challenge, with over 10 million fake helmets reportedly entering the market in 2024 alone. These products, often lacking essential safety certifications, undermine consumer trust in legitimate brands and pose severe risks to users. The influx of counterfeit helmets particularly affects developing regions where enforcement of product standards is lax, impeding market growth for genuine, certified helmets.

Europe Motorcycle Helmet Market Future Outlook

Over the next five years, the Europe motorcycle helmet market is expected to experience significant growth, driven by continuous government support, advancements in helmet technology, and increasing consumer demand for enhanced safety features. The integration of smart technologies and the development of lightweight, durable materials are anticipated to further propel market expansion.

Market Opportunities

- Growth in Motorcycle Tourism: Motorcycle tourism has surged, with approximately 20 million enthusiasts globally in 2024, driving demand for helmets specifically designed for long-distance travel. This includes helmets with enhanced comfort, modular designs, and features like sun visors and intercom systems that cater to touring needs. Countries like the U.S., Germany, and Japan are experiencing increased popularity in motorcycle road trips, creating opportunities for manufacturers to market helmets tailored for travel enthusiasts.

- Expansion of E-commerce Channels: E-commerce platforms have enabled consumers to access a wider variety of helmet brands and models, with an estimated 30 million helmets sold online globally in 2024. The expansion of online sales channels offers companies an opportunity to reach consumers directly, bypassing traditional retail limitations. Major e-commerce markets like China and India have shown substantial growth, where digital retail provides consumers with easier access to certified helmet brands, further accelerating market demand.

Scope of the Report

|

By Product Type |

Full Face Helmets |

|

By End User |

Riders |

|

By Distribution Channel |

Offline |

|

By Country |

Germany |

Products

Key Target Audience

Motorcycle Manufacturers

Helmet Manufacturers

Safety Equipment Distributors

E-commerce Platforms

Government and Regulatory Bodies (e.g., European Commission)

Insurance Companies

Motorcycle Clubs and Associations

Investors and Venture Capitalist Firms

Companies

Players Mentioned in the Report:

Dainese S.p.A

HJC Helmets

SHOEI Co., Ltd.

Schuberth GmbH

Nolan Helmets S.p.A.

AGV Helmets

Arai Helmet Ltd.

LS2 Helmets

Caberg S.p.a.

Shark Helmets

Table of Contents

1. Europe Motorcycle Helmet Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Europe Motorcycle Helmet Market Size (in USD Billion)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Europe Motorcycle Helmet Market Analysis

3.1 Growth Drivers

3.1.1 Rising Motorcycle Ownership

3.1.2 Stringent Safety Regulations

3.1.3 Technological Advancements in Helmet Design

3.1.4 Increasing Awareness of Road Safety

3.2 Market Challenges

3.2.1 High Cost of Advanced Helmets

3.2.2 Presence of Counterfeit Products

3.2.3 Variability in Safety Standards Across Countries

3.3 Opportunities

3.3.1 Growth in Motorcycle Tourism

3.3.2 Expansion of E-commerce Channels

3.3.3 Demand for Smart Helmets

3.4 Trends

3.4.1 Customization and Personalization of Helmets

3.4.2 Integration of Communication Systems

3.4.3 Adoption of Lightweight Materials

3.5 Government Regulations

3.5.1 Mandatory Helmet Laws

3.5.2 Safety Certification Standards

3.5.3 Subsidies and Incentives for Safety Gear

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porter's Five Forces Analysis

3.9 Competitive Landscape

4. Europe Motorcycle Helmet Market Segmentation

4.1 By Product Type (in Value %)

4.1.1 Full Face Helmets

4.1.2 Open Face Helmets

4.1.3 Off-road/Racing Helmets

4.1.4 Modular/Flip-up Helmets

4.1.5 Half Helmets

4.2 By End User (in Value %)

4.2.1 Riders

4.2.2 Passengers

4.3 By Distribution Channel (in Value %)

4.3.1 Offline

4.3.2 Online

4.4 By Country (in Value %)

4.4.1 Germany

4.4.2 United Kingdom

4.4.3 France

4.4.4 Italy

4.4.5 Spain

4.4.6 Russia

4.4.7 Rest of Europe

5. Europe Motorcycle Helmet Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Dainese S.p.A

5.1.2 HJC Helmets

5.1.3 SHOEI Co., Ltd.

5.1.4 Alpinestars

5.1.5 Schuberth GmbH

5.1.6 STUDDS Accessories Limited

5.1.7 Caberg S.p.a.

5.1.8 Fox Racing, Inc. (Vista Outdoor, Inc.)

5.1.9 Manufacturas Tomas helmets (MT Helmets)

5.1.10 Shark SAS

5.1.11 Nolan Helmets S.p.A.

5.1.12 AGV Helmets

5.1.13 Bell Helmets

5.1.14 Arai Helmet Ltd.

5.1.15 LS2 Helmets

5.2 Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Market Presence, R&D Investment, Strategic Initiatives)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.6.1 Venture Capital Funding

5.6.2 Government Grants

5.6.3 Private Equity Investments

6. Europe Motorcycle Helmet Regulatory Framework

6.1 Safety Standards and Certifications

6.2 Compliance Requirements

6.3 Certification Processes

7. Europe Motorcycle Helmet Future Market Size (in USD Billion)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Europe Motorcycle Helmet Future Market Segmentation

8.1 By Product Type (in Value %)

8.2 By End User (in Value %)

8.3 By Distribution Channel (in Value %)

8.4 By Country (in Value %)

9. Europe Motorcycle Helmet Analysts Recommendations

9.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

Disclaimer

Contact Us

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Europe Motorcycle Helmet Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Europe Motorcycle Helmet Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple helmet manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Europe Motorcycle Helmet market.

Frequently Asked Questions

01. How big is the Europe Motorcycle Helmet Market?

The Europe motorcycle helmet market is valued at USD 550 million, driven by increasing safety awareness and stringent government regulations.

02. What are the challenges in the Europe Motorcycle Helmet Market?

Challenges in the Europe motorcycle helmet market include the high cost of advanced helmets, the presence of counterfeit products, and variability in safety standards across countries.

03. Who are the major players in the Europe Motorcycle Helmet Market?

Key players in the Europe motorcycle helmet market include Dainese S.p.A, HJC Helmets, SHOEI Co., Ltd., Schuberth GmbH, and Nolan Helmets S.p.A.

04. What are the growth drivers of the Europe Motorcycle Helmet Market?

The Europe motorcycle helmet market is propelled by factors such as rising motorcycle ownership, stringent safety regulations, technological advancements in helmet design, and increasing awareness of road safety.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.