Europe MVNO Ranking Market Outlook to 2030

Region:Europe

Author(s):Paribhasha Tiwari

Product Code:KROD9330

December 2024

82

About the Report

Europe MNVO Ranking Market Overview

- The Europe MVNO market is valued at USD 34.4 billion, supported by robust infrastructure and increasing demand for cost-effective mobile services. A five-year historical analysis highlights how innovative business models such as niche targeting and value-added services have contributed to the growth. The introduction of full MVNO capabilities by several providers and the popularity of prepaid mobile services further bolster the market's expansion.

- Germany and the United Kingdom lead the Europe MVNO market due to their advanced telecom infrastructure and regulatory frameworks favoring competition. Germany dominates with its strong retail-based MVNO presence, while the UK's leadership is attributed to consumer-friendly policies and diverse market offerings catering to various segments like migrants and IoT services.

- The European Union's "Roam Like at Home" initiative has eliminated roaming charges across member states. This policy has increased cross-border mobile usage by 25%, benefiting MVNOs by expanding their service appeal to frequent travelers.

Europe MNVO Ranking Market Segmentation

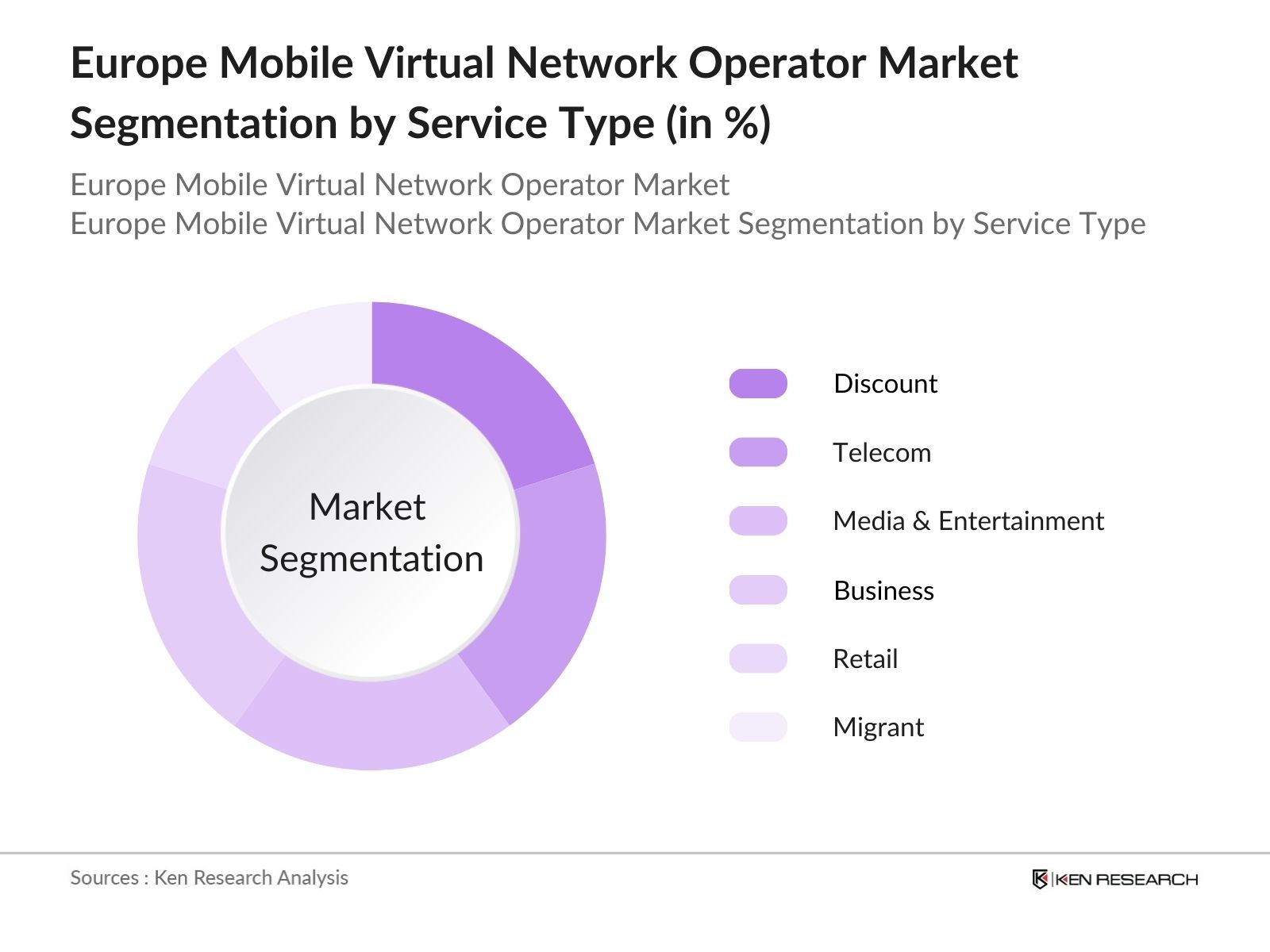

By Service Type The Europe MVNO market is segmented by service type into discount, telecom, media & entertainment, business, retail, and migrant services. Discount services hold a significant market share as they cater to cost-sensitive consumers. This segment thrives on offering affordable plans with competitive benefits, especially in regions like Eastern Europe, where price sensitivity is higher. Their popularity is also boosted by simple billing structures and transparent pricing.

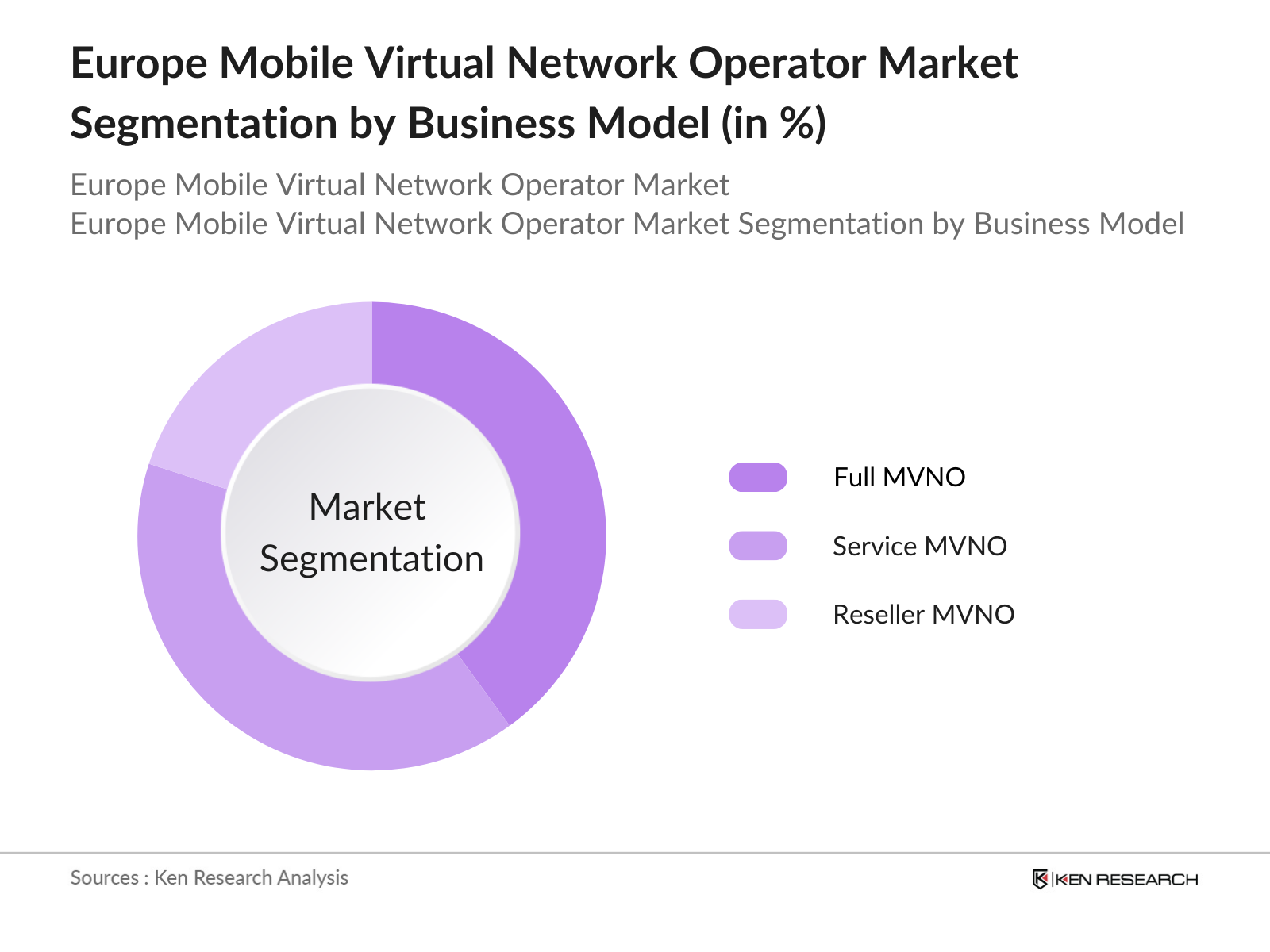

By Business Model The market is further categorized into full MVNO, service MVNO, and reseller MVNO. Full MVNOs dominate due to their control over core network elements, allowing them to innovate and customize offerings. This model supports scalability, efficient resource utilization, and unique value propositions, especially in competitive markets like France and Spain.

Europe MNVO Ranking Market Competitive Landscape

The Europe MVNO market is dominated by several key players that influence pricing strategies and technological advancements. Companies leverage strong partnerships with Mobile Network Operators (MNOs) to expand coverage and enhance service offerings.

Europe MNVO Ranking Market Analysis

Growth Drivers

- Segment-Targeted Pricing Strategies: European MVNOs are increasingly adopting pricing models tailored to specific customer segments, such as migrant workers and tourists. This approach has led to a significant increase in subscriber numbers, with some MVNOs reporting additions of over 500,000 users in a single quarter. This strategy enhances customer acquisition and retention by addressing unique needs and preferences.

- Innovative Distribution Channels: The deployment of digital platforms and partnerships with non-traditional retailers has expanded MVNO reach. For instance, collaborations with major supermarket chains have resulted in a 20% increase in SIM card sales over six months, demonstrating the effectiveness of these channels in broadening customer bases.

- Rapid Deployment of Cloud-Based Solutions: The integration of cloud technologies has streamlined MVNO operations, reducing operational costs by approximately $2 million annually for some operators. This efficiency enables MVNOs to offer competitive pricing and invest in customer service enhancements, thereby improving overall market competitiveness.

Market Challenges

- High Wholesale Traffic Fees: MVNOs often face substantial costs when purchasing network access from MNOs, with fees reaching up to $0.05 per minute of voice traffic. These expenses can erode profit margins, making it challenging for MVNOs to offer competitive pricing while maintaining profitability.

- Decreasing Average Revenue Per User (ARPU): The European MVNO market has experienced a decline in ARPU, with figures dropping from $15 to $12 over the past two years. This trend pressures MVNOs to find new revenue streams or risk financial instability.

Europe MNVO Ranking Market Future Outlook

The Europe MVNO market is poised for substantial growth driven by increased smartphone penetration, the rise of IoT applications, and government regulations promoting competition. Expanding into niche markets and leveraging 5G technology will be critical for sustaining growth. The transition toward full MVNO models and integration with AI-based customer management systems further enhances market opportunities.

Market Opportunities

- Adoption of Self-Service Portals: Implementing user-friendly self-service platforms has led to a 30% reduction in customer service calls for some MVNOs. This not only cuts operational costs but also enhances customer satisfaction by providing greater control over account management.

- Expansion into Niche Markets: Targeting underserved segments, such as senior citizens and expatriates, has enabled MVNOs to tap into new revenue streams. For instance, specialized plans for seniors have attracted over 200,000 new subscribers within a year, highlighting the potential of niche market strategies.

Scope of the Report

|

By Service Type |

Discount, Telecom Media & Entertainment Business, Retail Migrant IoT Roaming |

|

By Business Model |

Full MVNO Service MVNO Reseller MVNO |

|

By Subscriber Type |

Consumer Enterprise Small and Medium Enterprises (SMEs) Large Enterprises |

|

By Application |

Individual Consumers M2M Communications IoT Solutions Prepaid Services Postpaid Services |

|

By Geography |

Germany United Kingdom France Italy Spain Rest of Europe |

Products

Key Target Audience

Telecom Service Providers

Internet of Things (IoT) Solution Providers

Consumer Electronics Manufacturers

Mobile Application Developers

Retail Chains and Distribution Partners

Technology Integrators and Cloud Service Providers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ofcom, BNetzA)

Companies

Players Mentioned in the Report:

Virgin Mobile

Tesco Mobile

Lycamobile

Giffgaff

Freenet AG

Drillisch Telecom

Lebara Group

ASDA Mobile

Truphone

BT Mobile

Table of Contents

1. Europe MVNO Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Europe MVNO Market Size (In USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Europe MVNO Market Analysis

3.1. Growth Drivers

3.1.1. Segment-Targeted Pricing Strategies

3.1.2. Innovative Distribution Channels

3.1.3. Rapid Deployment of Cloud-Based Solutions

3.1.4. Surge in Mobile Device Penetration

3.2. Market Challenges

3.2.1. High Wholesale Traffic Fees

3.2.2. Decreasing Average Revenue Per User (ARPU)

3.2.3. Dependence on Host Mobile Network Operators (MNOs)

3.3. Opportunities

3.3.1. Adoption of Self-Service Portals

3.3.2. Expansion into Niche Markets

3.3.3. Integration with IoT and M2M Services

3.4. Trends

3.4.1. Emergence of Full MVNO Models

3.4.2. Focus on Customer Experience Enhancement

3.4.3. Growth of Prepaid MVNO Services

3.5. Regulatory Landscape

3.5.1. National Telecommunications Regulations

3.5.2. EU Roaming Policies

3.5.3. Spectrum Allocation Policies

3.5.4. Data Privacy and Security Regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porter's Five Forces Analysis

3.9. Competitive Landscape

4. Europe MVNO Market Segmentation

4.1. By Service Type (In Value %)

4.1.1. Discount

4.1.2. Telecom

4.1.3. Media & Entertainment

4.1.4. Business

4.1.5. Retail

4.1.6. Migrant

4.1.7. Cellular Machine-to-Machine (M2M)

4.1.8. Roaming

4.2. By Category (In Value %)

4.2.1. Postpaid

4.2.2. Prepaid

4.3. By Business Model (In Value %)

4.3.1. Full MVNO

4.3.2. Service MVNO

4.3.3. Reseller MVNO

4.4. By Subscriber (In Value %)

4.4.1. Consumer

4.4.2. Enterprise

4.5. By Country (In Value %)

4.5.1. Germany

4.5.2. United Kingdom

4.5.3. France

4.5.4. Italy

4.5.5. Spain

4.5.6. Rest of Europe

5. Europe MVNO Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Virgin Mobile

5.1.2. Tesco Mobile

5.1.3. Lebara Group

5.1.4. PosteMobile S.p.A.

5.1.5. ASDA Mobile

5.1.6. Lycamobile

5.1.7. Giffgaff

5.1.8. TalkTalk Mobile

5.1.9. Truphone

5.1.10. Drillisch Telecom

5.1.11. Freenet AG

5.1.12. BT Mobile

5.1.13. Sky Mobile

5.1.14. Vectone Mobile

5.1.15. Blyk

5.2. Cross Comparison Parameters (Number of Subscribers, Market Share, Service Offerings, Revenue, ARPU, Network Partnerships, Geographic Coverage, Customer Satisfaction Ratings)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Europe MVNO Market Regulatory Framework

6.1. Licensing Requirements

6.2. Compliance Standards

6.3. Certification Processes

7. Europe MVNO Future Market Size (In USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Europe MVNO Future Market Segmentation

8.1. By Service Type (In Value %)

8.2. By Category (In Value %)

8.3. By Business Model (In Value %)

8.4. By Subscriber (In Value %)

8.5. By Country (In Value %)

9. Europe MVNO Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research begins with mapping the ecosystem, identifying stakeholders, and evaluating key variables influencing the Europe MVNO market. Primary data from telecom authorities and secondary databases form the foundation for this analysis.

Step 2: Market Analysis and Construction

This phase involves collating historical market data, analyzing penetration trends, and assessing service diversification. A bottom-up approach is utilized to calculate market shares and segment performance.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses derived from quantitative and qualitative analysis are validated through interviews with industry experts, including MVNO operators and MNO partners, to ensure comprehensive insights.

Step 4: Research Synthesis and Final Output

The final step consolidates findings from primary and secondary research, ensuring a reliable and actionable report. This phase includes recommendations for market entry and expansion strategies.

Frequently Asked Questions

01. How big is the Europe MVNO Market?

The Europe MVNO market is valued at USD 34.4 billion, driven by competitive pricing strategies and innovative service offerings that cater to diverse consumer needs.

02. What are the challenges in the Europe MVNO Market?

Challenges in the Europe MVNO market include high wholesale network costs, dependence on MNOs, and declining ARPU. Balancing cost efficiency with quality remains a persistent concern.

03. Who are the major players in the Europe MVNO Market?

Key players in the Europe MVNO market include Virgin Mobile, Tesco Mobile, Lycamobile, Giffgaff, and Freenet AG, known for their wide range of offerings and innovative service models.

04. What are the growth drivers of the Europe MVNO Market?

Growth of Europe MVNO market is fueled by increasing demand for affordable mobile services, the adoption of niche business models, and the rise in IoT and M2M applications.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.