Europe Nutraceuticals Market Outlook to 2030

Region:Europe

Author(s):Shreya

Product Code:KROD2932

November 2024

81

About the Report

Europe Nutraceuticals Market Overview

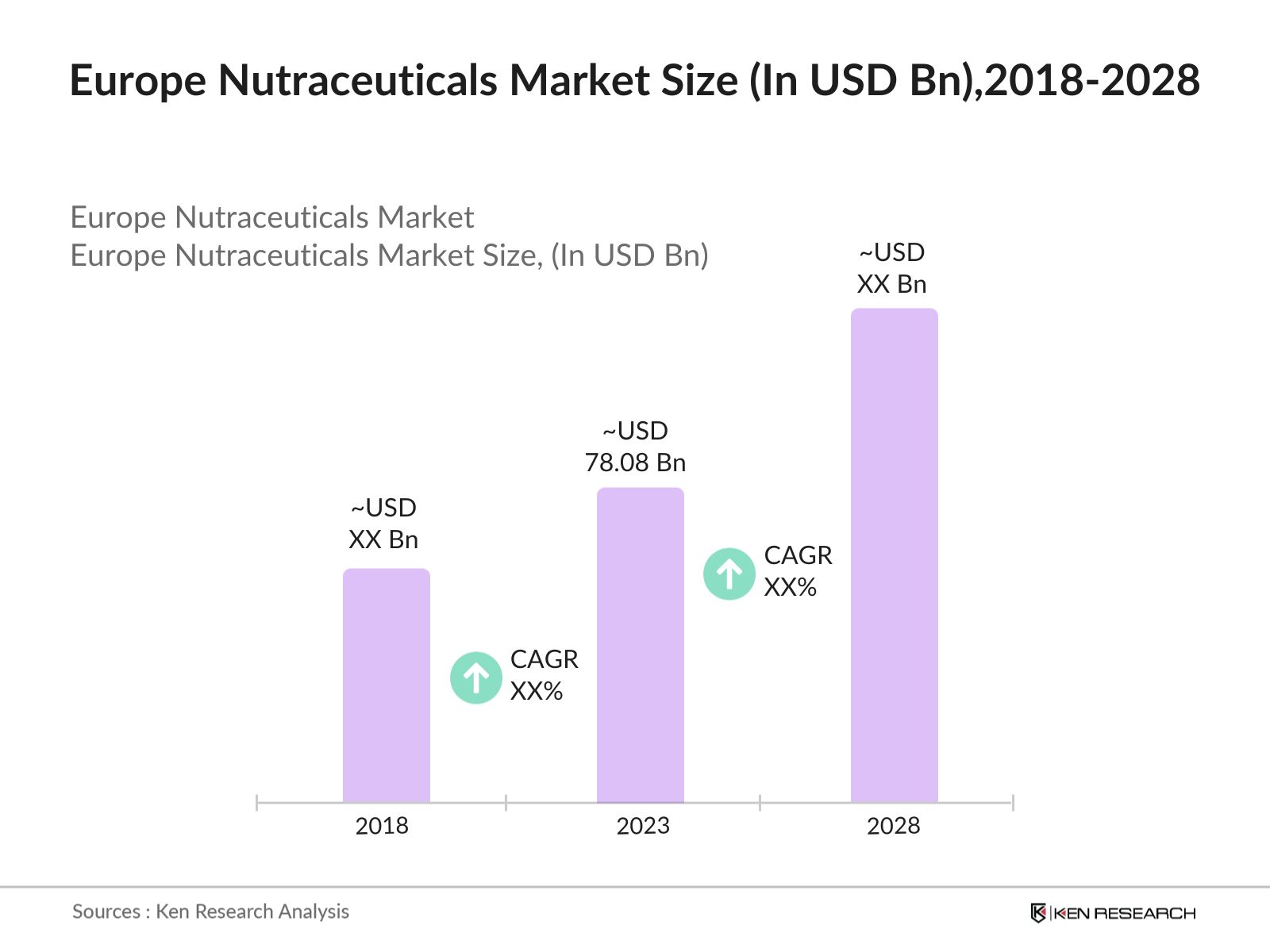

The Europe Nutraceuticals market was valued at USD 78.08 billion in 2023. This growth is primarily driven by the increasing consumer awareness of health and wellness, a rising trend towards preventive healthcare, and the growing aging population across Europe. The demand for functional foods and dietary supplements has surged, with consumers increasingly seeking products that provide health benefits beyond basic nutrition.

The key players dominating the Europe nutraceuticals market include BASF SE, Nestl, Danone S.A., Glanbia PLC, and Koninklijke DSM N.V. These companies are at the forefront of research and development, focusing on product innovations, strategic mergers and acquisitions, and expanding their product portfolios to cater to the growing consumer demand for nutraceuticals. Their strong presence across Europe, coupled with extensive distribution networks, has enabled them to maintain a significant share of the market.

Nestl Health Science is focusing on personalized nutrition, particularly through its acquisition of Persona, a personalized vitamin business, in 2019. This acquisition allowed Nestl to leverage Persona's technology to create customized supplement packs tailored to individual health needs, which aligns with the growing consumer demand for personalized health products.

In 2023, Germany emerged as the leading market for nutraceuticals in Europe. This dominance is attributed to Germanys large health-conscious population, high disposable income, and strong healthcare infrastructure. The countrys emphasis on preventive healthcare and a well-established pharmaceutical industry also contribute to the high demand for nutraceuticals.

Europe Nutraceuticals Market Segmentation

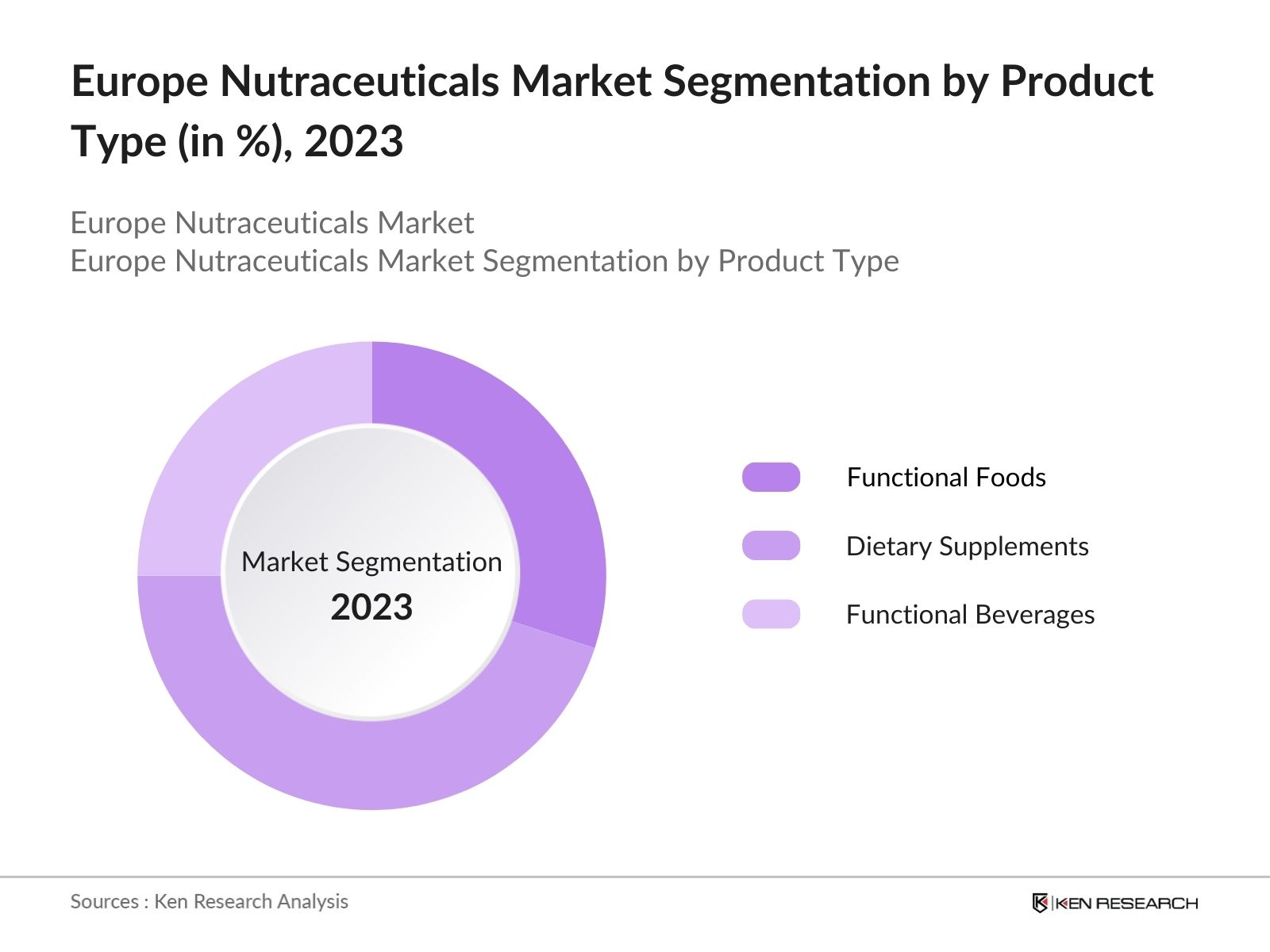

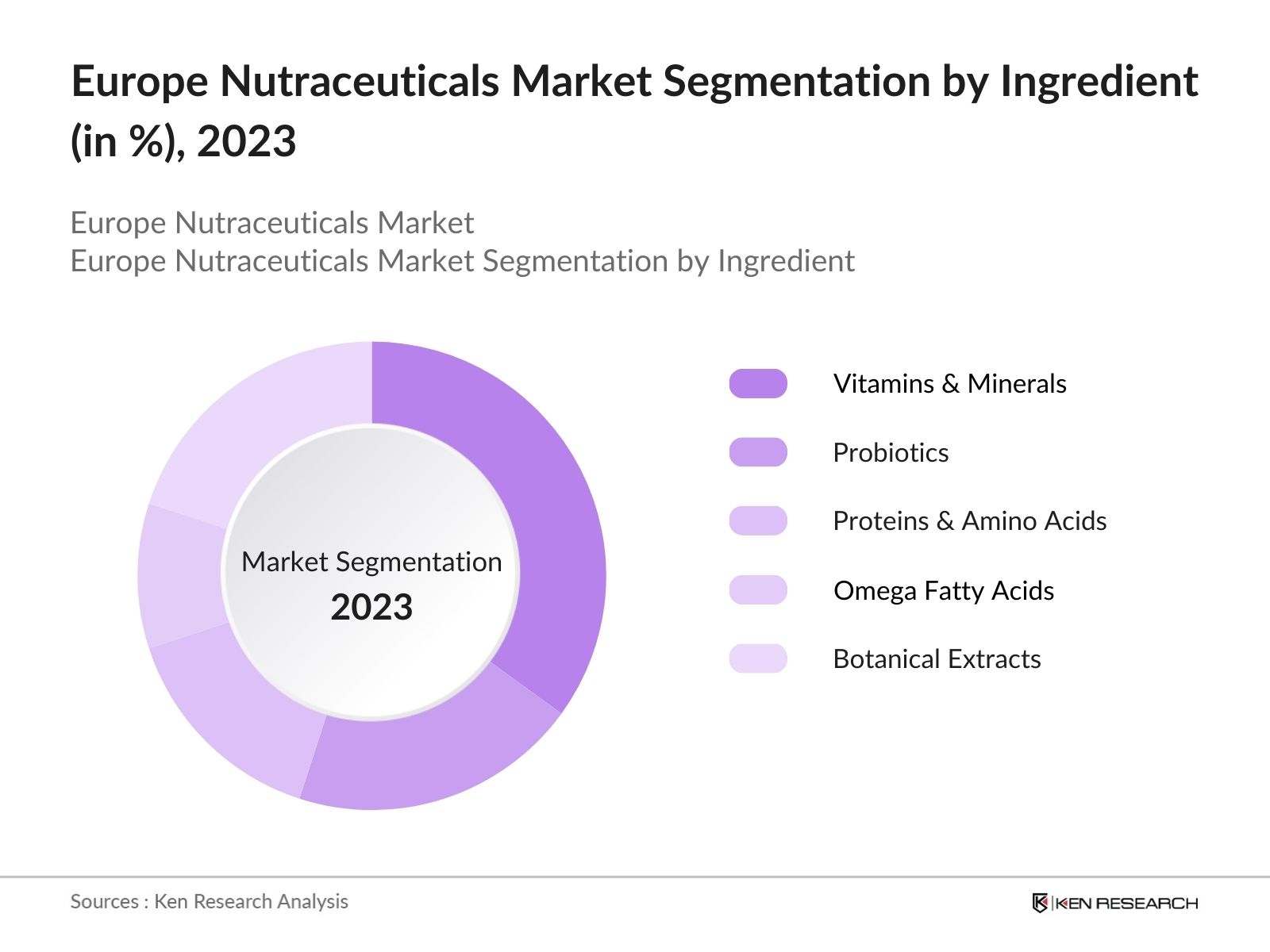

The Europe nutraceuticals market is segmented into various factors such as product type, ingredient and region etc.

1. By Product Type: The market is segmented by product type into Functional Foods, Dietary Supplements, and Functional Beverages. In 2023, Dietary Supplements held the dominant market share. Dietary Supplements have gained popularity due to their convenience and perceived effectiveness in addressing specific health concerns.

2. By Ingredient: The market is also segmented by ingredient into Vitamins & Minerals, Probiotics, Proteins & Amino Acids, Omega Fatty Acids, and Botanical Extracts. In 2023, Vitamins & Minerals dominated the market share. Vitamins & Minerals are integral to numerous bodily functions, and their supplementation is often recommended to individuals who may not obtain sufficient quantities from their diet alone.

3. By Region: The market is segmented by region into Germany, France, United Kingdom, Sweden, Italy and Rest of Europe. In 2023, Germany dominates the Europe nutraceuticals market share, driven by its large health-conscious population, advanced healthcare infrastructure, and a strong emphasis on preventive healthcare. The presence of leading nutraceutical companies and extensive R&D activities further bolster Germany's leadership in the regional market.

Europe Nutraceuticals Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

BASF SE |

1865 |

Ludwigshafen, Germany |

|

Nestl S.A. |

1867 |

Vevey, Switzerland |

|

Danone S.A. |

1919 |

Paris, France |

|

Glanbia PLC |

1997 |

Kilkenny, Ireland |

|

Koninklijke DSM N.V. |

1902 |

Heerlen, Netherlands |

- Danones Strategic Investment: Danone has invested 70 million in its Steenvoorde facility in France to enhance its specialized nutrition category. This investment aims to optimize production capacity for oral nutrition supplements, targeting a production of 20 million liters by 2026. The facility will focus on producing various recipes under Danone's specialized nutrition range, Nutricia, which is crucial for patients with severe health conditions.

- BASF SE Introduces Plant-Based Omega-3 Supplements: In 2023, BASF SE introduced a new line of plant-based omega-3 supplements in the European market. These supplements, derived from marine algae, offer a sustainable alternative to traditional fish oil-based omega-3 products. The launch aligns with the growing consumer preference for plant-based and environmentally friendly products and will contribute to the company's growth in the nutraceuticals market.

Europe Nutraceuticals Industry Analysis

Growth Drivers

- Rising Prevalence of Chronic Diseases: More than 49 million individuals living with cardiovascular diseases (CVD)in the European Union (EU). This growing burden has led consumers to seek preventive measures, including nutraceuticals, to manage or reduce their risk factors. The demand for products like omega-3 fatty acids, which are known to support heart health, has seen a substantial rise, further propelling market growth.

- Aging Population: Europe is home to one of the worlds oldest populations, with over 95.5 million individuals aged 60 and above as of 2024, as older adults increasingly turn to dietary supplements to support their health and manage age-related conditions. Products aimed at improving bone health, cognitive function, and immune support are in high demand, contributing to the market's expansion.

- Growing Consumer Awareness of Preventive Healthcare: With more and more individuals actively seeking ways to improve their health and prevent illnesses through diet and supplements. This shift towards preventive measures is fueling the demand for nutraceuticals, as consumers are more inclined to invest in products that offer long-term health benefits. The trend is particularly strong in urban areas, where access to information and higher education levels are prevalent.

Challenges

- High Costs of Product Development Developing new nutraceutical products is a costly endeavor, particularly in Europe, where stringent regulations and the need for extensive clinical trials drive up expenses. These high development costs can be prohibitive, especially for small and medium-sized enterprises (SMEs), limiting their ability to compete with larger, well-established companies.

- Lack of Consumer Trust in Certain Products Despite the overall growth in the nutraceuticals market, consumer trust remains a challenge, particularly for certain product categories like weight management supplements. This lack of trust is often fueled by misleading marketing claims and the presence of low-quality products in the market. Building consumer confidence through transparency and education is essential for the sustained growth of the market.

Government Initiatives

- "Healthier Together" Initiative: In 2023, the European Commission launched the "Healthier Together" initiative, aimed at reducing the burden of non-communicable diseases (NCDs) by promoting preventive healthcare practices, including the use of nutraceuticals. The initiative is backed by a budget of 11 million for health determinants which encourages member states to integrate nutraceuticals into their public health strategies.

- Subsidies for Nutraceutical Research and Development: Several European governments have introduced subsidies and grants to support research and development in the nutraceuticals sector, The German government has earmarked38 millionin its 2024 budget, specifically for the promotion of alternative proteins and a transition to plant-based agriculture. These subsidies are designed to encourage innovation and help European companies remain competitive in the global market.

Europe Nutraceuticals Market Future Outlook

The Europe nutraceuticals market is expected to continue to grow exponentially by 2028. The market will be shaped by ongoing trends in health and wellness, increased demand for organic and natural products, and the integration of advanced technologies in product development. Additionally, regulatory support and growing consumer trust in nutraceuticals as a preventive health measure will further drive market growth.

Future Trends

- Increased Focus on Personalized Nutrition: Over the next five years, the European nutraceuticals sector is expected to witness a shift towards personalized nutrition, driven by the demand for more targeted and effective health solutions. This trend is expected to redefine the nutraceuticals market, with a growing emphasis on customized products that cater to specific needs such as weight management, cognitive health, and immunity.

- Expansion of Online Retail Channels: The expansion of online retail channels is expected to continue driving the growth of the nutraceuticals market in Europe over the next five years, which will offer consumers a convenient way to access a wide range of nutraceutical products. The rise of digital health platforms that provide personalized recommendations based on consumer health data will also contribute to the growth of online sales.

Scope of the Report

|

By Product Type |

Functional Foods Dietary Supplements Functional Beverages |

|

By Ingredient |

Vitamins & Minerals Probiotics Proteins & Amino Acids Omega Fatty Acids Botanical Extracts |

|

By Region |

Germany France United Kingdom Sweden Italy Rest of Europe |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Nutraceutical Manufacturers

Dietary Supplement Suppliers

Functional Food Producers

Pharmaceutical Companies

Organic Product Stores

Geriatric Care Providers

Health-Conscious Consumers

Investors and VC Firms

Banks and Financial Institutions

European Medicines Agency (EMA)

National Institutes of Public Health across Europe

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

BASF SE

Nestl S.A.

Danone S.A.

Glanbia PLC

Koninklijke DSM N.V.

Abbott Laboratories

Bayer AG

Amway

Herbalife Nutrition Ltd.

The Nature's Bounty Co.

PepsiCo Inc.

Kellogg's

Kerry Group

Unilever

Yakult Honsha Co. Ltd.

Table of Contents

Europe Nutraceuticals Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

Europe Nutraceuticals Market Size (in EUR Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

Europe Nutraceuticals Market Analysis

3.1. Growth Drivers

3.1.1. Rising Prevalence of Chronic Diseases

3.1.2. Aging Population

3.1.3. Growing Consumer Awareness of Preventive Healthcare

3.1.4. Expansion of E-commerce Platforms

3.2. Restraints

3.2.1. Stringent Regulatory Environment

3.2.2. High Costs of Product Development

3.2.3. Lack of Consumer Trust in Certain Products

3.2.4. Supply Chain Disruptions

3.3. Opportunities

3.3.1. Technological Advancements in Personalized Nutrition

3.3.2. Increasing Demand for Plant-Based Nutraceuticals

3.3.3. Expansion in Emerging Markets

3.3.4. Strategic Collaborations and Partnerships

3.4. Trends

3.4.1. Growth of Online Retail Channels

3.4.2. Emphasis on Sustainable and Ethical Products

3.4.3. Integration of AI and Data Analytics in Product Development

3.4.4. Focus on Probiotics and Gut Health Products

3.5. Government Initiatives

3.5.1. "Healthier Together" Initiative

3.5.2. EU Action Plan on Childhood Obesity

3.5.3. Subsidies for Nutraceutical Research and Development

3.5.4. Regulation on Food Supplements and Nutraceuticals

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competitive Ecosystem

Europe Nutraceuticals Market Segmentation, 2023

4.1. By Product Type (in Value EUR)

4.1.1. Functional Foods

4.1.2. Dietary Supplements

4.1.3. Functional Beverages

4.2. By Ingredient (in Value EUR)

4.2.1. Vitamins & Minerals

4.2.2. Probiotics

4.2.3. Proteins & Amino Acids

4.2.4. Omega Fatty Acids

4.2.5. Botanical Extracts

4.3. By Region (in Value EUR)

4.3.1. North Europe

4.3.2. South Europe

4.3.3. East Europe

4.3.4. West Europe

Europe Nutraceuticals Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. BASF SE

5.1.2. Nestl S.A.

5.1.3. Danone S.A.

5.1.4. Glanbia PLC

5.1.5. Koninklijke DSM N.V.

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

Europe Nutraceuticals Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

Europe Nutraceuticals Market Regulatory Framework

7.1. Regulatory Standards

7.2. Compliance Requirements

7.3. Certification Processes

Europe Nutraceuticals Market Future Size (in EUR Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

Europe Nutraceuticals Market Future Segmentation, 2028

9.1. By Product Type (in Value EUR)

9.2. By Ingredient (in Value EUR)

9.3. By Region (in Value EUR)

Europe Nutraceuticals Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step:1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step:2 Market Building:

Collating statistics on this industry over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Europe Nutraceuticals industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step:3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different neutraceutical companies to validate statistics and seek operational and financial information from company representatives.

Step:4 Research output:

Our team will approach multiple alternative milk products companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from such Nutraceutical companies.

Frequently Asked Questions

How big is the Europe Nutraceuticals Market?

The Europe nutraceuticals market was valued at USD 78.08 billion in 2023, driven by the rising prevalence of chronic diseases, an aging population, and increasing consumer awareness of preventive healthcare.

What are the challenges in the Europe Nutraceuticals Market?

Challenges in the Europe nutraceuticals market include a stringent regulatory environment, high costs of product development, supply chain disruptions, and a lack of consumer trust in certain product categories, particularly weight management supplements.

Who are the major players in the Europe Nutraceuticals Market?

Key players in the Europe nutraceuticals market include BASF SE, Nestl S.A., Danone S.A., Glanbia PLC, and Koninklijke DSM N.V. These companies lead the market through extensive R&D, strong distribution networks, and diverse product offerings.

What are the growth drivers of the Europe Nutraceuticals Market?

The Europe nutraceuticals market is propelled by the rising prevalence of chronic diseases, an aging population, growing consumer awareness of preventive healthcare, and the expansion of e-commerce platforms that make nutraceuticals more accessible.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.