Europe Online Gambling Market Outlook to 2030

Region:Europe

Author(s):Meenakshi Bisht

Product Code:KROD10596

November 2024

84

About the Report

Europe Online Gambling Market Overview

- The Europe Online Gambling market, valued at USD 40 billion, has grown significantly over the past few years. This market expansion is driven by the increasing use of mobile devices, the rise of digital payment platforms, and strong consumer demand for interactive and live gaming experiences. Favorable regulatory frameworks in countries such as the UK, Malta, and Sweden, alongside technological advancements like cryptocurrency integration, have further boosted this sector.

- In Europe, countries like the UK, Germany, and Italy dominate the online gambling landscape due to their progressive regulatory environments and high internet penetration rates. The UK, in particular, is home to some of the world's largest online gambling companies, benefiting from a well-established legal framework and consumer familiarity with online gaming.

- The European Union has imposed stricter regulations on the online gambling sector, particularly focused on Anti-Money Laundering (AML) compliance and player protection. The total fines for non-compliance under the General Data Protection Regulation (GDPR) alone reached over 1.64 billion (USD 1.73 billion) in 2022. The EU also strengthened its guidelines on responsible gambling, requiring operators to implement robust player protection measures such as age verification and spending limits to ensure safer gaming environments

Europe Online Gambling Market Segmentation

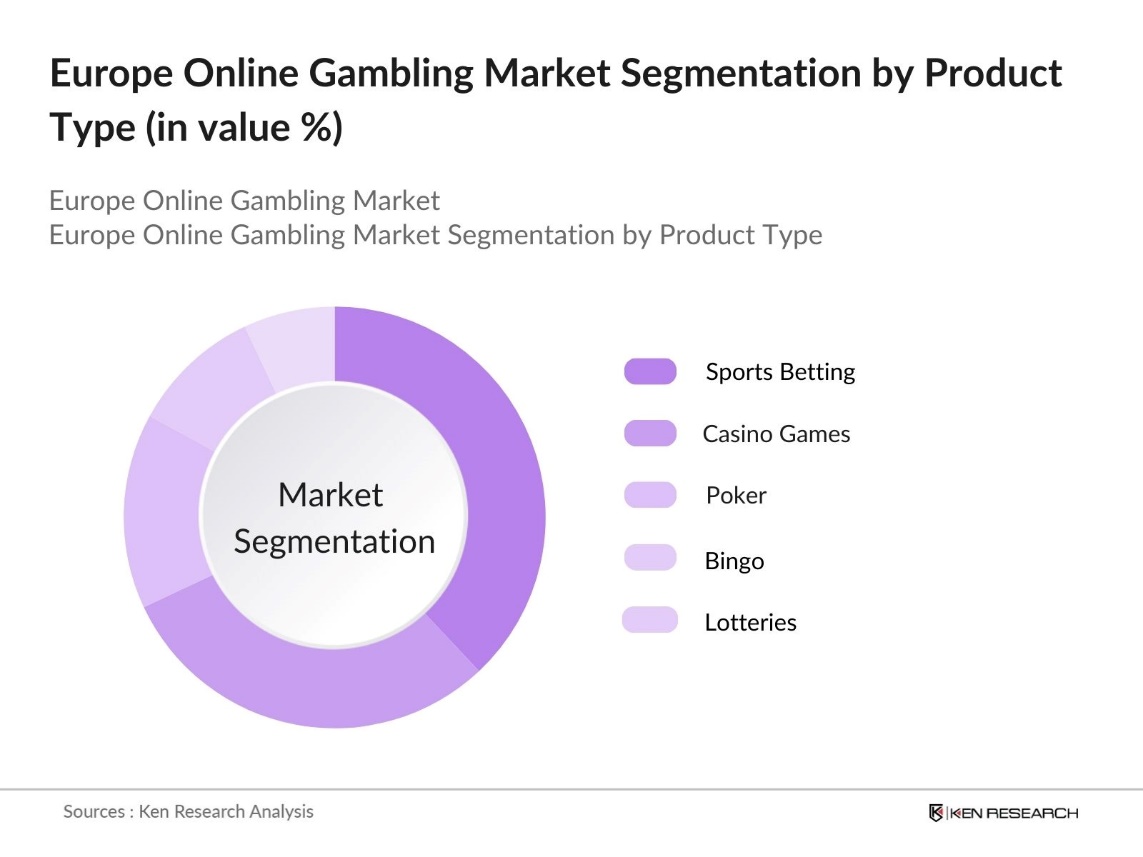

By Product Type: The market is segmented by product type into sports betting, casino games, poker, bingo, and lotteries. Sports betting continues to dominate the market, primarily due to its widespread popularity among consumers and the vast array of sports events that attract global audiences. The increase in live betting options and the integration of real-time data have made sports betting more engaging, driving its continued market leadership. Major events such as the UEFA Champions League and international tennis tournaments create consistent spikes in user engagement, further bolstering this segment.

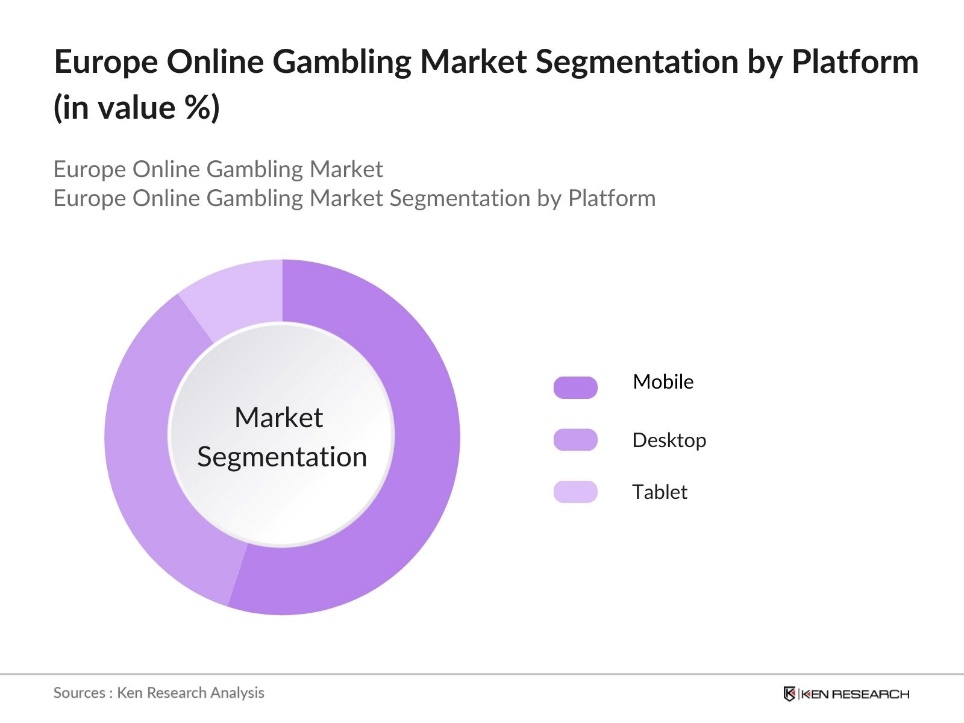

By Platform: The market is segmented by platform into desktop, mobile, and tablet. Mobile gaming is the leading platform due to the proliferation of smartphones and better internet connectivity across Europe. The convenience of mobile access allows consumers to gamble at any time, making it the most accessible platform. Additionally, gambling operators have optimized their mobile apps for seamless experiences, incorporating secure payment gateways and offering features like live betting and in-app gaming. This shift in user behavior continues to drive the mobile segment's growth.

Europe Online Gambling Market Competitive Landscape

The Europe Online Gambling market is highly competitive, with several key players dominating the landscape. These companies have cemented their positions through brand loyalty, superior technological platforms, and regulatory compliance. Leading operators in this market leverage innovation, customer-centric solutions, and strategic partnerships to maintain their market share. The market sees constant consolidation, with mergers and acquisitions being common to increase global reach and technological capabilities.

Europe Online Gambling Industry Analysis

Growth Drivers

- Mobile Device Adoption (Mobile Gaming Revenue, User Growth): The widespread adoption of smartphones in Europe has become a critical driver for online gambling, with mobile gaming accounting for a significant portion of the online gambling industry. As of 2023, 91% of individuals aged 16-74 in the EU reported using the internet, with household internet access rates being notably high. This increased accessibility is boosting user growth on gambling platforms, with mobile gambling contributing a growing share to overall gambling revenues.

- Favorable Regulation (Gambling Laws, Licensing Frameworks): The European Union has made strides in streamlining regulations for online gambling, though many challenges persist. Markets like the UK and Malta are setting examples with well-established licensing frameworks through bodies such as the UK Gambling Commission and Malta Gaming Authority. For instance, the IZI Group reported a GGR of 86.5 million for FY2024, marking a 25% increase from the previous year. These regulations allow for safer gaming environments, encouraging investment and innovation.

- Enhanced Payment Solutions: Online gambling platforms have greatly benefited from the rise of digital wallets and cryptocurrency payments. These advancements enable faster, more secure, and efficient cross-border transactions, enhancing user convenience. The increasing adoption of cryptocurrencies like Bitcoin offers players added privacy and smoother transactions, while digital wallets streamline payment processes. This integration has significantly improved the overall user experience on online gambling platforms, making payments simpler and more accessible.

Market Challenges

- Regulatory Fragmentation (Country-Specific Restrictions, Tax Variations): Regulatory fragmentation across European countries presents significant challenges for online gambling operators. Each nation has its own set of gambling laws and tax structures, complicating cross-border operations. This diversity in regulatory and tax standards limits operators' ability to expand uniformly across Europe, often increasing compliance costs. As a result, operators must navigate different legal landscapes, making it harder to achieve consistent growth and profitability.

- Problem Gambling Awareness (Self-Exclusion Measures, Player Protection Regulations): Growing awareness of problem gambling in Europe is leading to stricter regulations, such as self-exclusion programs and enhanced player protection measures. These initiatives, while designed to safeguard players, reduce the number of active users on gambling platforms, directly affecting revenue for operators. The increasing enforcement of such measures across multiple countries poses additional operational challenges for gambling companies trying to balance user growth with responsible gaming practices.

Europe Online Gambling Market Future Outlook

Over the next several years, the Europe Online Gambling market is expected to experience continued growth, driven by expanding mobile and digital payment technologies, consumer preference for immersive gaming, and the rise of live and in-play betting features. Countries such as Germany and Italy are likely to see increased market participation due to favorable legislation and tax incentives. The development of blockchain technology and cryptocurrency acceptance is set to revolutionize payment methods, offering greater security and anonymity to players.

Market Opportunities

- Legalization in New Markets (Country-Specific Legalizations): Europe continues to present opportunities for online gambling operators as more countries legalize and regulate the industry. New markets, supported by updated regulatory frameworks, offer online gambling operators the chance to enter untapped regions. These legalizations help expand the customer base and create favorable conditions for operators, encouraging further growth in the industry. The introduction of clear legal structures allows operators to confidently invest and operate in newly regulated markets.

- Growth of Virtual Reality (VR Integration in Gambling Platforms): Virtual Reality (VR) is becoming a key innovation in the online gambling sector, offering immersive and interactive gaming experiences. As more platforms integrate VR technology, users can enjoy a more engaging and lifelike gambling environment. This technology opens new avenues for operators to enhance user engagement and increase player activity. VR integration represents a forward-thinking opportunity for operators to offer unique gaming experiences, attracting tech-savvy players and boosting revenue potential.

Scope of the Report

|

Product Type |

Sports Betting Casino Games Poker Bingo Lotteries |

|

Platform |

Desktop Mobile Tablet |

|

Payment Method |

Credit/Debit Cards Digital Wallets Cryptocurrencies Bank Transfers |

|

Age Group |

18-24 25-34 35-44 45+ |

|

Region |

West East South North |

Products

Key Target Audience

Online Gambling Operators

Affiliate Marketing Agencies

Software Providers for Online Gambling Platforms

E-sports Betting Platforms

Government and Regulatory Bodies (e.g., UK Gambling Commission, Malta Gaming Authority)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

888 Holdings

Bet365

Flutter Entertainment

Kindred Group

LeoVegas

Betsson AB

GVC Holdings

William Hill

Entain Plc

Unibet Group

Table of Contents

1. Europe Online Gambling Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Gross Gambling Revenue, Player Demographics, Regional Penetration)

1.4. Market Segmentation Overview

2. Europe Online Gambling Market Size (In USD Mn)

2.1. Historical Market Size (Gross Revenue, Players Spending)

2.2. Year-On-Year Growth Analysis (Regulatory Impacts, Technological Innovations, Player Acquisition Costs)

2.3. Key Market Developments and Milestones (Licensing Trends, Platform Expansion, Notable Transactions)

3. Europe Online Gambling Market Analysis

3.1. Growth Drivers

3.1.1. Mobile Device Adoption (Mobile Gaming Revenue, User Growth)

3.1.2. Favorable Regulation (Gambling Laws, Licensing Frameworks)

3.1.3. Enhanced Payment Solutions (Digital Wallet Penetration, Crypto Acceptance)

3.1.4. E-Sports Betting Popularity (E-Sports Market Growth, Viewer Participation)

3.2. Market Challenges

3.2.1. Regulatory Fragmentation (Country-Specific Restrictions, Tax Variations)

3.2.2. Problem Gambling Awareness (Self-Exclusion Measures, Player Protection Regulations)

3.2.3. Cybersecurity Threats (Fraud Incidents, Data Breaches)

3.2.4. High Competition (Market Saturation, Brand Loyalty Barriers)

3.3. Opportunities

3.3.1. Legalization in New Markets (Country-Specific Legalizations)

3.3.2. Growth of Virtual Reality (VR Integration in Gambling Platforms)

3.3.3. Cross-Platform Integration (Desktop, Mobile, Tablet Synchronization)

3.3.4. Personalized User Experiences (AI-Based Customization, In-Game Ads)

3.4. Trends

3.4.1. Cryptocurrency Adoption (Cryptocurrency Payment Share)

3.4.2. Live Dealer Games (Real-Time Gambling Trends)

3.4.3. Growth of Fantasy Sports (Fantasy Sports Revenue Contribution)

3.4.4. Gamification Elements (User Engagement Metrics)

3.5. Government Regulation

3.5.1. EU-Wide Regulations (AML Regulations, Player Protection Guidelines)

3.5.2. Country-Specific Licensing (UK Gambling Commission, Malta Gaming Authority)

3.5.3. Anti-Money Laundering (AML Compliance, Regulatory Requirements)

3.5.4. Responsible Gambling Initiatives (Advertising Regulations, Age Verification Systems)

3.6. SWOT Analysis

3.6.1. Strengths

3.6.2. Weaknesses

3.6.3. Opportunities

3.6.4. Threats

3.7. Stake Ecosystem (Gambling Operators, Software Providers, Payment Processors)

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem (Number of Players, M&A Trends, Market Share Distribution)

4. Europe Online Gambling Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Sports Betting

4.1.2. Casino Games

4.1.3. Poker

4.1.4. Bingo

4.1.5. Lotteries

4.2. By Platform (In Value %)

4.2.1. Desktop

4.2.2. Mobile

4.2.3. Tablet

4.3. By Payment Method (In Value %)

4.3.1. Credit/Debit Cards

4.3.2. Digital Wallets

4.3.3. Cryptocurrencies

4.3.4. Bank Transfers

4.4. By Age Group (In Value %)

4.4.1. 18-24

4.4.2. 25-34

4.4.3. 35-44

4.4.4. 45+

4.5. By Region (In Value %)

4.5.1. West

4.5.2. East

4.5.3. South

4.5.4. North

5. Europe Online Gambling Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. 888 Holdings

5.1.2. GVC Holdings

5.1.3. Bet365

5.1.4. Kindred Group

5.1.5. Flutter Entertainment

5.1.6. William Hill

5.1.7. Entain

5.1.8. LeoVegas

5.1.9. Evolution Gaming

5.1.10. Betsson AB

5.1.11. Rank Group

5.1.12. Kambi Group

5.1.13. Aspire Global

5.1.14. Unibet Group

5.1.15. Mr Gree

5.2 Cross Comparison Parameters (Revenue, Market Share, Platform Compatibility, Licensing, Customer Base, CSR Initiatives, Regional Penetration, Partnership Deals)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Partnerships, Sponsorships, White Label Deals)

5.5. Mergers And Acquisitions (Recent Deals, Strategic Acquisitions)

5.6. Investment Analysis

5.7 Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Europe Online Gambling Market Regulatory Framework

6.1. EU Regulatory Landscape

6.2. Country-Specific Compliance (Licensing, Advertising Laws, Taxation)

6.3. Certification Processes (eCOGRA, GLI, iTech Labs)

7. Europe Online Gambling Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Europe Online Gambling Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Platform (In Value %)

8.3. By Payment Method (In Value %)

8.4. By Age Group (In Value %)

8.5. By Region (In Value %)

9. Europe Online Gambling Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first step focuses on identifying the critical variables influencing the Europe Online Gambling market, such as consumer behavior, regulatory changes, and technological advancements. This is done through desk research and industry reports, analyzing key drivers and inhibitors affecting the market.

Step 2: Market Analysis and Construction

Historical data and market penetration rates are analyzed to develop a clear view of market growth patterns. Key segments such as product types and platform preferences are examined, with revenue breakdowns evaluated against real-time performance indicators from market operators.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts are consulted through interviews to validate hypotheses concerning market dynamics, revenue models, and future growth trajectories. These consultations help refine the understanding of key trends and challenges within the market.

Step 4: Research Synthesis and Final Output

A comprehensive synthesis of primary and secondary data is conducted to finalize the report. The research is cross-referenced with real-time performance metrics from leading operators in the industry to ensure accuracy and relevance.

Frequently Asked Questions

01. How big is the Europe Online Gambling Market?

The Europe Online Gambling market is valued at USD 40 billion, driven by mobile adoption, regulatory support, and the growing popularity of live sports betting.

02. What are the challenges in the Europe Online Gambling Market?

Challenges in Europe Online Gambling market include varying regulatory landscapes across European countries, cybersecurity threats, and the high competition among major players.

03. Who are the major players in the Europe Online Gambling Market?

Key players in the Europe Online Gambling market include 888 Holdings, Bet365, Flutter Entertainment, Kindred Group, and LeoVegas, all of which hold strong positions due to their established brand presence and technological investments.

04. What are the growth drivers of the Europe Online Gambling Market?

The Europe Online Gambling market is driven by the increasing use of mobile platforms, innovations in live betting technology, and the rise of cryptocurrency as an accepted payment method in gambling.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.