Europe Online Travel Market Outlook to 2030

Region:Europe

Author(s):Rajat Galav

Product Code:KROD1195

May 2025

90

About the Report

Europe Online Travel Market Overview

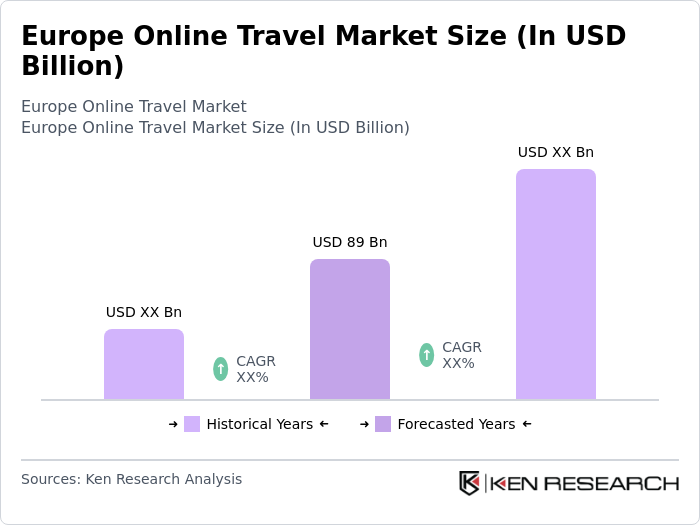

- The Europe Online Travel Market was valued at USD 89 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of digital platforms for travel bookings, enhanced user experiences, and the rise of mobile applications. The convenience of online transactions and the availability of diverse travel options have significantly contributed to the market's expansion.

- Key players in this market include countries like the United Kingdom, Germany, and France, which dominate due to their robust tourism infrastructure, high internet penetration rates, and a strong preference for online booking among consumers. These nations have established themselves as travel hubs, attracting both domestic and international tourists, thereby fueling the online travel market.

- The European Union introduced significant new travel-related systems in 2024, such as the European Travel Information and Authorization System (ETIAS) and the Entry/Exit System (EES), aimed primarily at improving border security and traveler monitoring across 30 European countries

Europe Online Travel Market Segmentation

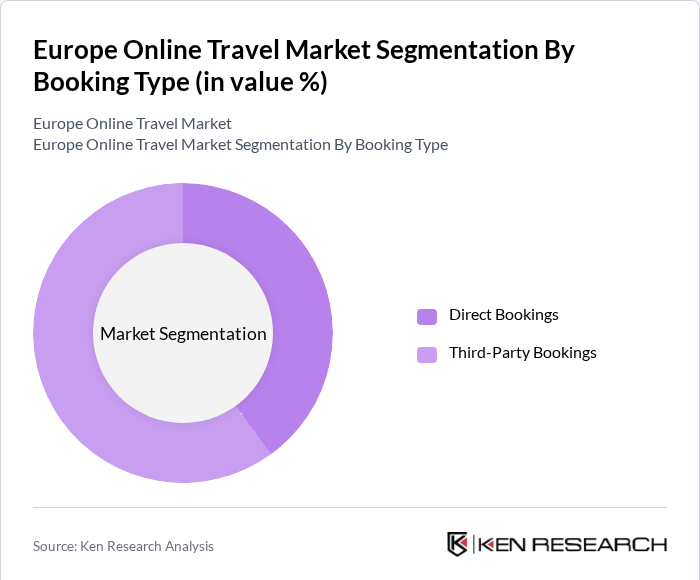

By Booking Type: The online travel market is primarily segmented into two major booking types: direct bookings and third-party bookings. Direct bookings, where consumers book directly through airline or hotel websites, have gained significant traction due to the perceived benefits of better deals and exclusive offers. However, third-party bookings, facilitated by online travel agencies (OTAs), dominate the market as they provide consumers with a one-stop solution for comparing prices and options across various providers. The convenience and comprehensive nature of OTAs cater to the evolving consumer behavior, making them the preferred choice for many travelers.

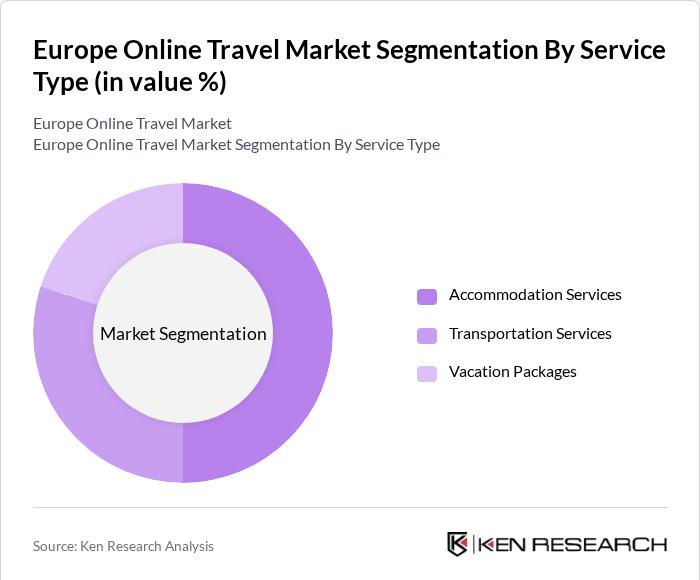

By Service Type: The market is also segmented by service type, which includes accommodation services, transportation services, and vacation packages. Among these, accommodation services hold a dominant position due to the increasing number of travelers seeking diverse lodging options, from hotels to vacation rentals. The rise of platforms like Airbnb has transformed consumer preferences, leading to a significant shift towards alternative accommodations. This trend is further supported by the growing desire for unique travel experiences, making accommodation services a key driver in the online travel market.

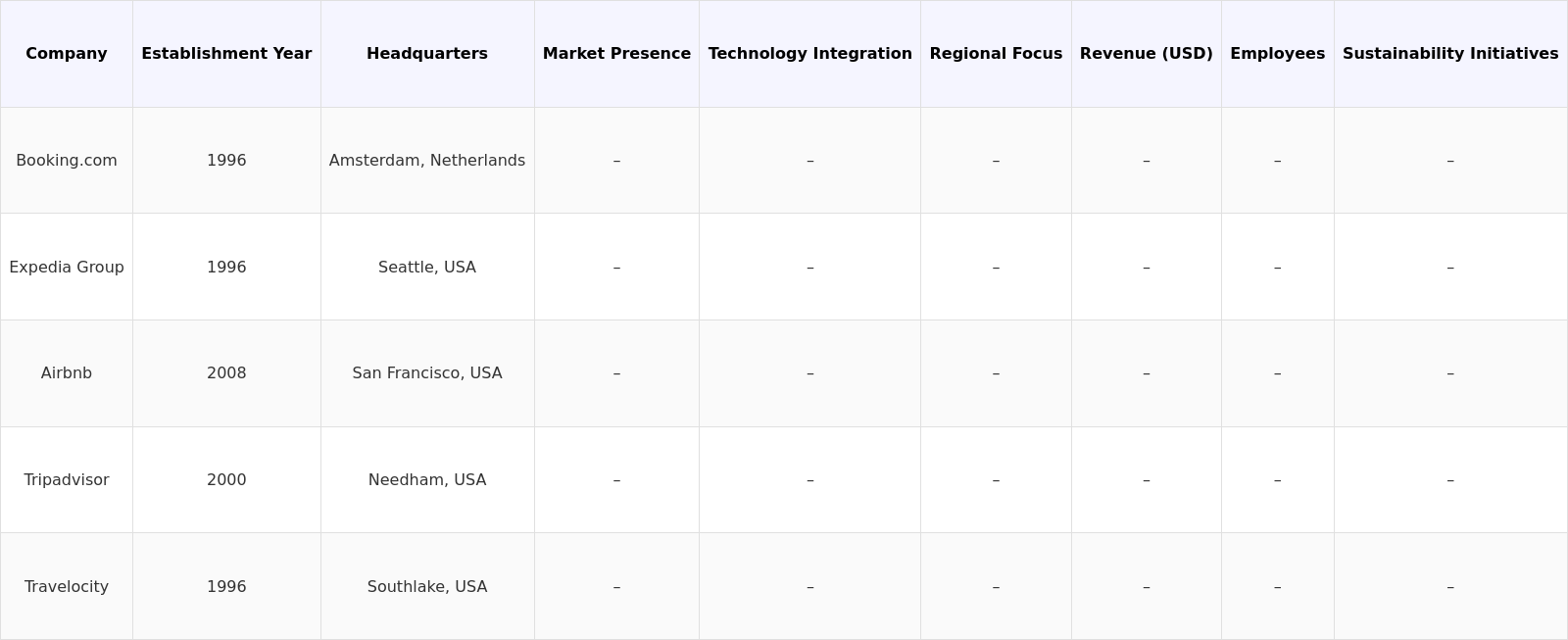

Europe Online Travel Market Competitive Landscape

The Europe Online Travel Market is characterized by a competitive landscape dominated by several key players, including both established companies and emerging startups. This consolidation reflects the significant influence of these major companies in shaping market trends and consumer preferences. Their ability to innovate and adapt to changing consumer demands plays a crucial role in maintaining their market positions.

Europe Online Travel Market Industry Analysis

Growth Drivers

- Increasing Internet Penetration and Smartphone Usage: As of 2024, Europe boasts an internet penetration rate of approximately 92%, with over 85% of the population using smartphones. This widespread access facilitates online travel bookings, enabling consumers to plan and purchase travel services conveniently. The European Commission reports that the digital economy is expected to contribute over USD 1 trillion to the region's GDP, further driving the online travel market as more consumers turn to digital platforms for travel arrangements.

- Rise in Disposable Income and Travel Expenditure: The average disposable income in Europe is projected to reach USD 24,890 per capita in 2025, reflecting a steady increase in consumer spending power. This growth in disposable income is correlated with a rise in travel expenditure, as individuals are more willing to invest in leisure and business travel. The overall travel and tourism sector in Europe is expected to contribute USD 2.5 trillion to the economy, highlighting the increasing financial capacity of consumers to engage in travel.

- Growing Preference for Online Booking Platforms: The shift towards online booking platforms is evident, with over 75% of travelers in Europe preferring to book their travel online. This trend is supported by the rise of user-friendly mobile applications and websites that streamline the booking process. The European Travel Commission indicates that online travel sales are expected to surpass USD 95 billion by 2025, driven by the convenience and accessibility of digital platforms, which cater to the evolving preferences of tech-savvy consumers.

Market Challenges

- Intense Competition Among Online Travel Agencies: The online travel market in Europe is characterized by fierce competition, with numerous players vying for market share. Major OTAs like Booking.com and Expedia dominate the landscape, making it challenging for smaller companies to establish a foothold. The European Commission has noted that this competitive environment can lead to price wars, which may erode profit margins and hinder the growth of new entrants in the market.

- Regulatory Compliance and Data Privacy Concerns: The implementation of stringent data protection regulations, such as the General Data Protection Regulation (GDPR), poses significant challenges for online travel companies. Compliance with these regulations requires substantial investment in data management and security systems. The European Data Protection Board reported that non-compliance can result in fines of up to USD 20 million or 4% of global turnover, creating a financial burden for businesses operating in the online travel sector.

Europe Online Travel Market Future Outlook

The online travel market in Europe is poised for continued growth through 2028, driven by advancements in technology, increasing consumer demand for personalized travel experiences, and the expansion of niche travel segments. As the market adapts to changing consumer preferences and regulatory landscapes, opportunities for innovation and service diversification will emerge, further enhancing the sector's resilience and growth potential.

Market Opportunities

- Expansion of Niche Travel Segments: The growing interest in niche travel experiences, such as eco-tourism and adventure travel, presents significant opportunities for online travel agencies to cater to specialized markets. As consumers increasingly seek unique and personalized travel experiences, companies can develop tailored packages that align with these preferences, tapping into a market projected to exceed USD 100 billion by 2025.

- Integration of AI and Machine Learning in Travel Services: The adoption of AI and machine learning technologies in the travel sector is set to revolutionize customer service and operational efficiency. By leveraging data analytics, companies can offer personalized recommendations and streamline booking processes. The Global AI in travel market is growing rapidly, indicating a substantial opportunity for online travel platforms to enhance user experience and drive customer loyalty.

Scope of the Report

| By Booking Type | Direct Bookings Third-Party Bookings |

| By Service Type | Accommodation Services Transportation Services Vacation Packages |

| By Region | Western Europe Eastern Europe Southern Europe Northern Europe |

| By Customer Segment | Leisure Travelers Business Travelers, Family Travelers Solo Travelers |

| By Distribution Channel | Online Travel Agencies (OTAs) Direct Airline Websites Hotel Websites Mobile Apps |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., European Commission, National Tourism Boards)

Travel Technology Providers

Online Travel Agencies (OTAs)

Airlines and Transportation Companies

Hospitality and Accommodation Providers

Tourism Boards and Destination Marketing Organizations

Payment Processing Companies

Companies

Players Mentioned in the Report

Booking.com

Expedia Group

Airbnb

Tripadvisor

Travelocity

EuroTrip Connect

Wanderlust Ventures

TravelSphere Europe

ExploreEU

JourneyNest

Table of Contents

1. Europe Online Travel Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Europe Online Travel Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Europe Online Travel Market Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Internet Penetration and Smartphone Usage

3.1.2. Rise in Disposable Income and Travel Expenditure

3.1.3. Growing Preference for Online Booking Platforms

3.2. Market Challenges

3.2.1. Intense Competition Among Online Travel Agencies

3.2.2. Regulatory Compliance and Data Privacy Concerns

3.2.3. Economic Uncertainties Affecting Consumer Spending

3.3. Opportunities

3.3.1. Expansion of Niche Travel Segments

3.3.2. Integration of AI and Machine Learning in Travel Services

3.3.3. Growth of Sustainable and Eco-Friendly Travel Options

3.4. Trends

3.4.1. Increasing Use of Mobile Applications for Travel Booking

3.4.2. Personalization of Travel Experiences Through Data Analytics

3.4.3. Emergence of Subscription-Based Travel Services

3.5. Government Regulation

3.5.1. Data Protection Regulations (GDPR Compliance)

3.5.2. Travel Safety and Health Regulations

3.5.3. Environmental Regulations Impacting Travel Services

3.5.4. Consumer Protection Laws in Online Transactions

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. Europe Online Travel Market Segmentation

4.1. By Booking Type

4.1.1. Direct Bookings

4.1.2. Third-Party Bookings

4.2. By Service Type

4.2.1. Accommodation Services

4.2.2. Transportation Services

4.2.3. Vacation Packages

4.3. By Region

4.3.1. Western Europe

4.3.2. Eastern Europe

4.3.3. Southern Europe

4.3.4. Northern Europe

4.4. By Customer Segment

4.4.1. Leisure Travelers

4.4.2. Business Travelers

4.4.3. Family Travelers

4.4.4. Solo Travelers

4.5. By Distribution Channel

4.5.1. Online Travel Agencies (OTAs)

4.5.2. Direct Airline Websites

4.5.3. Hotel Websites

4.5.4. Mobile Apps

5. Europe Online Travel Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Booking.com

5.1.2. Expedia Group

5.1.3. Airbnb

5.1.4. Tripadvisor

5.1.5. Travelocity

5.1.6. EuroTrip Connect

5.1.7. Wanderlust Ventures

5.1.8. TravelSphere Europe

5.1.9. ExploreEU

5.1.10. JourneyNest

5.2. Cross Comparison Parameters

5.2.1. Market Share by Company

5.2.2. Revenue Growth Rate

5.2.3. Customer Satisfaction Ratings

5.2.4. Number of Active Users

5.2.5. Average Booking Value

5.2.6. Service Diversification

5.2.7. Geographic Reach

5.2.8. Technology Adoption Rate

6. Europe Online Travel Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Europe Online Travel Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Europe Online Travel Market Future Market Segmentation

8.1. By Booking Type

8.1.1. Direct Bookings

8.1.2. Third-Party Bookings

8.2. By Service Type

8.2.1. Accommodation Services

8.2.2. Transportation Services

8.2.3. Vacation Packages

8.3. By Region

8.3.1. Western Europe

8.3.2. Eastern Europe

8.3.3. Southern Europe

8.3.4. Northern Europe

8.4. By Customer Segment

8.4.1. Leisure Travelers

8.4.2. Business Travelers

8.4.3. Family Travelers

8.4.4. Solo Travelers

8.5. By Distribution Channel

8.5.1. Online Travel Agencies (OTAs)

8.5.2. Direct Airline Websites

8.5.3. Hotel Websites

8.5.4. Mobile Apps

9. Europe Online Travel Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map that includes all major stakeholders within the Europe Online Travel Market. This step relies on extensive desk research, utilizing a mix of secondary and proprietary databases to gather comprehensive industry-level information. The primary goal is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data related to the Europe Online Travel Market. This includes evaluating market penetration, the ratio of online platforms to service providers, and the resulting revenue generation. Additionally, an assessment of service quality metrics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be formulated and validated through computer-assisted telephone interviews (CATIs) with industry experts from a diverse range of companies. These consultations will yield valuable operational and financial insights directly from industry practitioners, which will be crucial in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves engaging with multiple stakeholders to gather detailed insights into product segments, sales performance, consumer preferences, and other relevant factors. This interaction will help verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the Europe Online Travel Market.

Frequently Asked Questions

01. How big is the Europe Online Travel Market?

The Europe Online Travel Market is valued at USD 89 billion, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the Europe Online Travel Market?

Key challenges in the Europe Online Travel Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the Europe Online Travel Market?

Major players in the Europe Online Travel Market include Booking.com, Expedia Group, Airbnb, Tripadvisor, Travelocity, among others.

04. What are the growth drivers for the Europe Online Travel Market?

The primary growth drivers for the Europe Online Travel Market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.