Europe Petroleum Coke Market Outlook to 2030

Region:Europe

Author(s):Paribhasha Tiwari

Product Code:KROD9095

December 2024

90

About the Report

Europe Petroleum Coke Market Overview

- The Europe Petroleum Coke Market is valued at USD 2.1 billion based on extensive analysis of historical data. The market's growth is driven by the rising demand for petroleum coke in energy-intensive industries, including aluminum smelting and cement manufacturing. This demand is fueled by its cost-effectiveness as a fuel source compared to coal and natural gas. Furthermore, advancements in refinery technology have enhanced the quality of petroleum coke, making it a preferred alternative in industrial applications.

- Germany, France, and the United Kingdom dominate the Europe Petroleum Coke Market due to their robust industrial base, significant investments in refinery upgrades, and high consumption of calcined coke for aluminum production. Germany leads in technological integration within refineries, while France's strategic focus on energy-intensive industries strengthens its position. The UK benefits from a well-established export network for petroleum coke to neighboring regions.

- In October 2023, the U.S. Department of Energy announced a $7 billion investment to establish seven Regional Clean Hydrogen Hubs. These hubs aim to produce over three million metric tons of clean hydrogen annually, significantly contributing to the nation's decarbonization goals.

Europe Petroleum Coke Market Segmentation

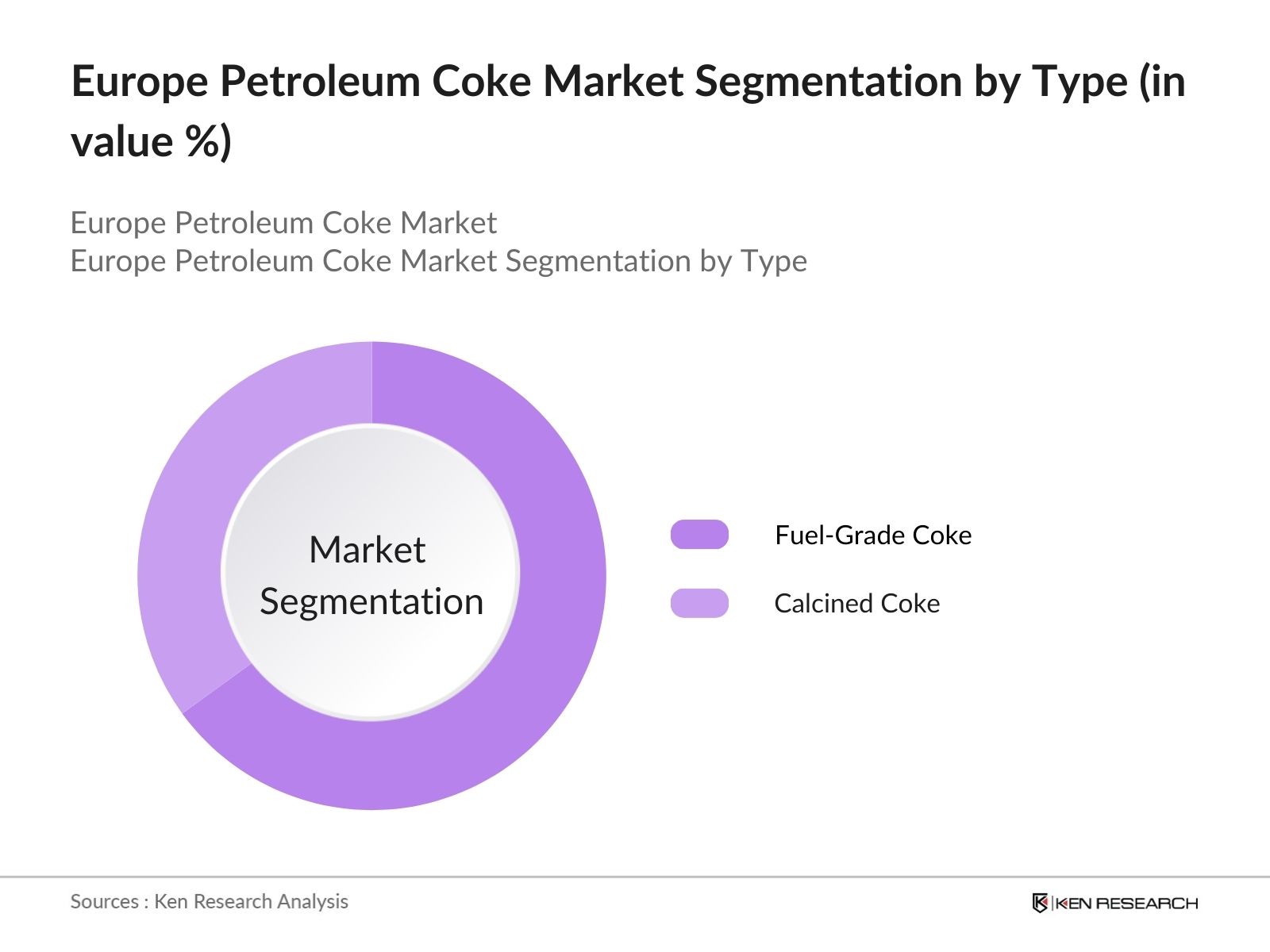

By Type: The Europe Petroleum Coke Market is segmented by type into fuel-grade coke and calcined coke. Fuel-grade coke dominates the market due to its widespread use in power plants and cement kilns as a cost-effective energy source. It is preferred for its high carbon content, which delivers efficient energy output, particularly in countries like Germany and Poland with significant power generation needs.

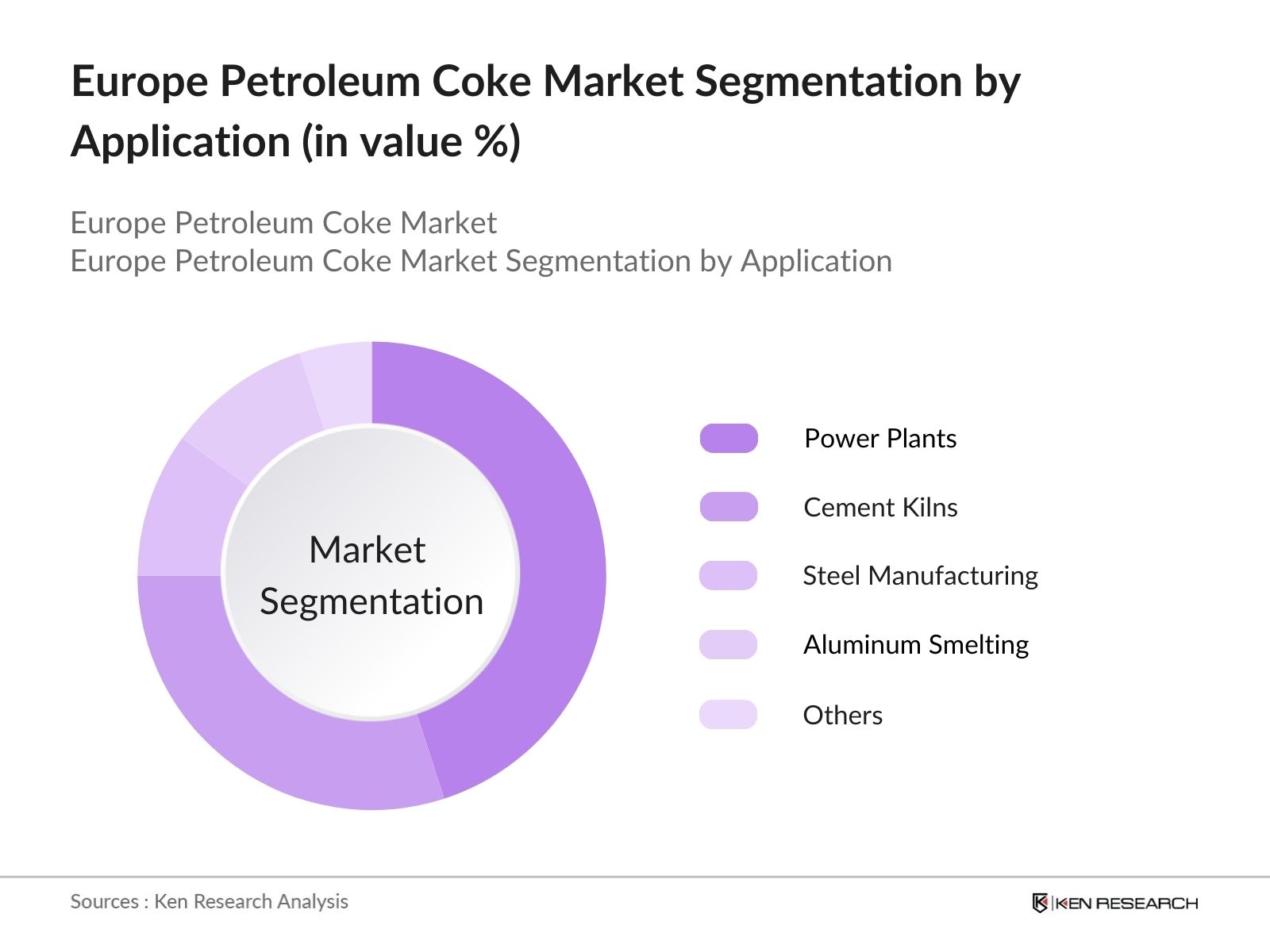

By Application: The Europe Petroleum Coke Market is segmented by application into power plants, cement kilns, steel manufacturing, aluminum smelting, and others. Petroleum coke's application in power plants holds the largest market share due to its ability to provide high energy density at a lower cost than traditional fuels. The growth of this segment is attributed to increasing energy demand in industrial zones across Europe.

Europe Petroleum Coke Market Competitive Landscape

The Europe Petroleum Coke Market is dominated by a few major players, including leading global refinery operators and regional manufacturers. This consolidation underlines the influence of technological advancements, strategic investments, and well-established supply chains.

Europe Petroleum Coke Market Analysis

Growth Drivers

- Industrialization: The rapid pace of industrialization across developing regions in 2024 has led to a surge in the demand for efficient, cost-effective energy sources. For instance, the manufacturing output in North America increased by over $800 billion in 2024 due to expansion in industrial production, driving demand for advanced energy solutions like blue hydrogen, which offers a lower carbon footprint compared to traditional fuels.

- Energy Demand: Global energy consumption in 2024 is expected to exceed 600 quadrillion British thermal units (BTUs), according to macroeconomic reports. With this growing demand, blue hydrogen is emerging as a key player to bridge the gap between fossil fuels and renewable energy, particularly in industrial applications such as ammonia production and steel manufacturing.

- Infrastructure Development: In 2024, governments worldwide have allocated over $150 billion to hydrogen infrastructure projects, including pipelines and storage facilities. This push supports the adoption of blue hydrogen, ensuring its availability and affordability for large-scale applications like power generation.

Market Challenges

- Environmental Regulations: Stringent emission norms in regions like North America require industries to reduce CO emissions below 50 kilograms per megawatt-hour by 2030. These regulations put pressure on the blue hydrogen market, as carbon capture systems must consistently operate at above 90% efficiency to comply.

- Price Volatility: Natural gas prices, a key input for blue hydrogen, have shown fluctuations in 2024, ranging from $3.50 to $6.00 per million BTUs in major markets. Such price volatility impacts the overall cost stability of blue hydrogen production.

Europe Petroleum Coke Market Future Outlook

Over the next five years, the Europe Petroleum Coke Market is poised for steady growth, driven by increasing industrial activities, advancements in refinery capabilities, and a growing focus on low-cost, high-efficiency fuel sources. Additionally, emerging applications in battery manufacturing and enhanced sustainability initiatives by major players will contribute to market expansion.

Market Opportunities

- Technological Advancements: Innovations in membrane technology for hydrogen separation, such as high-temperature proton exchange membranes, have improved blue hydrogen production efficiency by 15% in 2024. This advancement opens new doors for industrial applications.

- Emerging Applications: In 2024, blue hydrogen has found applications in sectors like heavy transportation, with over 2,000 hydrogen-powered trucks deployed globally. Such developments highlight the potential for blue hydrogen to penetrate non-traditional markets.

Scope of the Report

|

By Type |

Fuel Grade Coke Calcined Coke |

|

By Physical Form |

Needle Coke Sponge Coke Shot Coke Honeycomb Coke |

|

By Application |

Power Plants Cement Kilns Steel Industry Aluminum Industry Fertilizer Industry Other Applications |

|

By End-User Industry |

Energy Construction Metallurgy Chemical Manufacturing |

|

By Country |

Germany United Kingdom France Italy Spain Rest of Europe |

Products

Key Target Audience

Industrial Manufacturers

Energy Generation Companies

Aluminum and Steel Manufacturers

Cement Manufacturers

Government and Regulatory Bodies (e.g., European Environmental Agency, European Commission)

Investors and Venture Capitalist Firms

Exporters and Importers of Petroleum Coke

Refinery Operators

Companies

Players Mentioned in the Report:

BP PLC

Saudi Arabian Oil Co.

Phillips 66 Company

Reliance Industries Ltd.

Valero Energy Corporation

ExxonMobil

Indian Oil Corporation Ltd.

Chevron Corporation

Marathon Petroleum Corporation

PJSC Lukoil

Table of Contents

1. Europe Petroleum Coke Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Europe Petroleum Coke Market Size (in USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Europe Petroleum Coke Market Analysis

3.1. Growth Drivers

3.1.1. Industrialization

3.1.2. Energy Demand

3.1.3. Infrastructure Development

3.1.4. Cost-Effectiveness

3.2. Market Challenges

3.2.1. Environmental Regulations

3.2.2. Price Volatility

3.2.3. Supply Chain Disruptions

3.3. Opportunities

3.3.1. Technological Advancements

3.3.2. Emerging Applications

3.3.3. Strategic Partnerships

3.4. Trends

3.4.1. Shift Towards Cleaner Fuels

3.4.2. Integration with Renewable Energy

3.4.3. Increased Use in Battery Manufacturing

3.5. Government Regulations

3.5.1. Emission Standards

3.5.2. Import/Export Policies

3.5.3. Subsidies and Incentives

3.5.4. Trade Agreements

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. Europe Petroleum Coke Market Segmentation

4.1. By Type (in Value %)

4.1.1. Fuel Grade Coke

4.1.2. Calcined Coke

4.2. By Physical Form (in Value %)

4.2.1. Needle Coke

4.2.2. Sponge Coke

4.2.3. Shot Coke

4.2.4. Honeycomb Coke

4.3. By Application (in Value %)

4.3.1. Power Plants

4.3.2. Cement Kilns

4.3.3. Steel Industry

4.3.4. Aluminum Industry

4.3.5. Fertilizer Industry

4.3.6. Other Applications

4.4. By End-User Industry (in Value %)

4.4.1. Energy

4.4.2. Construction

4.4.3. Metallurgy

4.4.4. Chemical

4.4.5. Manufacturing

4.5. By Country (in Value %)

4.5.1. Germany

4.5.2. United Kingdom

4.5.3. France

4.5.4. Italy

4.5.5. Spain

4.5.6. Rest of Europe

5. Europe Petroleum Coke Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. BP PLC

5.1.2. Saudi Arabian Oil Co.

5.1.3. Phillips 66 Company

5.1.4. Reliance Industries Limited

5.1.5. Valero Energy Corporation

5.1.6. Indian Oil Corporation Ltd.

5.1.7. PJSC Lukoil

5.1.8. Chevron Corporation

5.1.9. Marathon Petroleum Corporation

5.1.10. HPCL - Mittal Energy Limited

5.1.11. Bharat Petroleum Corporation Ltd.

5.1.12. GAIL India Ltd.

5.1.13. Hindustan Petroleum Corporation Ltd.

5.1.14. China National Petroleum Corporation

5.1.15. ExxonMobil

5.2. Cross Comparison Parameters (Number of Employees, Headquarters, Inception Year, Revenue, Market Share, Product Portfolio, R&D Investment, Regional Presence)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Europe Petroleum Coke Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Europe Petroleum Coke Future Market Size (in USD Billion)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Europe Petroleum Coke Future Market Segmentation

8.1. By Type (in Value %)

8.2. By Physical Form (in Value %)

8.3. By Application (in Value %)

8.4. By End-User Industry (in Value %)

8.5. By Country (in Value %)

9. Europe Petroleum Coke Market Analysts Recommendations

9.1. Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying key variables such as consumption patterns, refinery outputs, and industrial usage trends. This is achieved through desk research leveraging databases like Eurostat and company-specific reports.

Step 2: Market Analysis and Construction

This phase involves analyzing historical data to construct a comprehensive understanding of the market. It includes assessing production capacities, refinery upgrades, and downstream consumption statistics.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses developed from secondary research are validated through interviews with industry professionals, including executives from major refineries and industrial buyers.

Step 4: Research Synthesis and Final Output

The final phase synthesizes primary and secondary research to deliver a validated analysis of market size, segmentation, and future growth trajectories.

Frequently Asked Questions

01. How big is the Europe Petroleum Coke Market?

The Europe Petroleum Coke Market is valued at USD 2.1 billion, driven by increasing industrial applications, particularly in aluminum smelting and cement manufacturing.

02. What are the challenges in the Europe Petroleum Coke Market?

Challenges in the Europe Petroleum Coke Market include stringent environmental regulations, price volatility, and supply chain disruptions that can hinder the market's growth potential.

03. Who are the major players in the Europe Petroleum Coke Market?

Key players in the Europe Petroleum Coke Market include BP PLC, Saudi Arabian Oil Co., Phillips 66 Company, Reliance Industries Ltd., and Valero Energy Corporation, among others.

04. What drives growth in the Europe Petroleum Coke Market?

The Europe Petroleum Coke Market is driven by the rising demand for low-cost, high-efficiency fuel sources, advancements in refinery technologies, and increasing industrial activities.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.