Europe Plant Growth Regulators Market Outlook to 2030

Region:Europe

Author(s):Yogita Sahu

Product Code:KROD9772

December 2024

82

About the Report

Europe Plant Growth Regulators Market Overview

- The Europe Plant Growth Regulators market is valued at USD 1.45 billion, driven by several factors, including the increasing demand for organic food production and the focus on sustainable farming practices. The market's growth is also influenced by advancements in crop-specific product development and the rising adoption of precision agriculture techniques.

- In terms of regional dominance, countries like Germany, France, and Spain are at the forefront of the plant growth regulators market due to their robust agricultural sectors and established organic farming practices. These countries benefit from favorable government regulations and incentives promoting eco-friendly farming.

- The European Unions Green Deal, launched in 2020, continues to provide financial and policy support for sustainable agricultural practices. By 2024, the European Commission had allocated 100 billion to climate action and agricultural innovation, with a portion focused on reducing chemical pesticide use and promoting PGR adoption.

Europe Plant Growth Regulators Market Segmentation

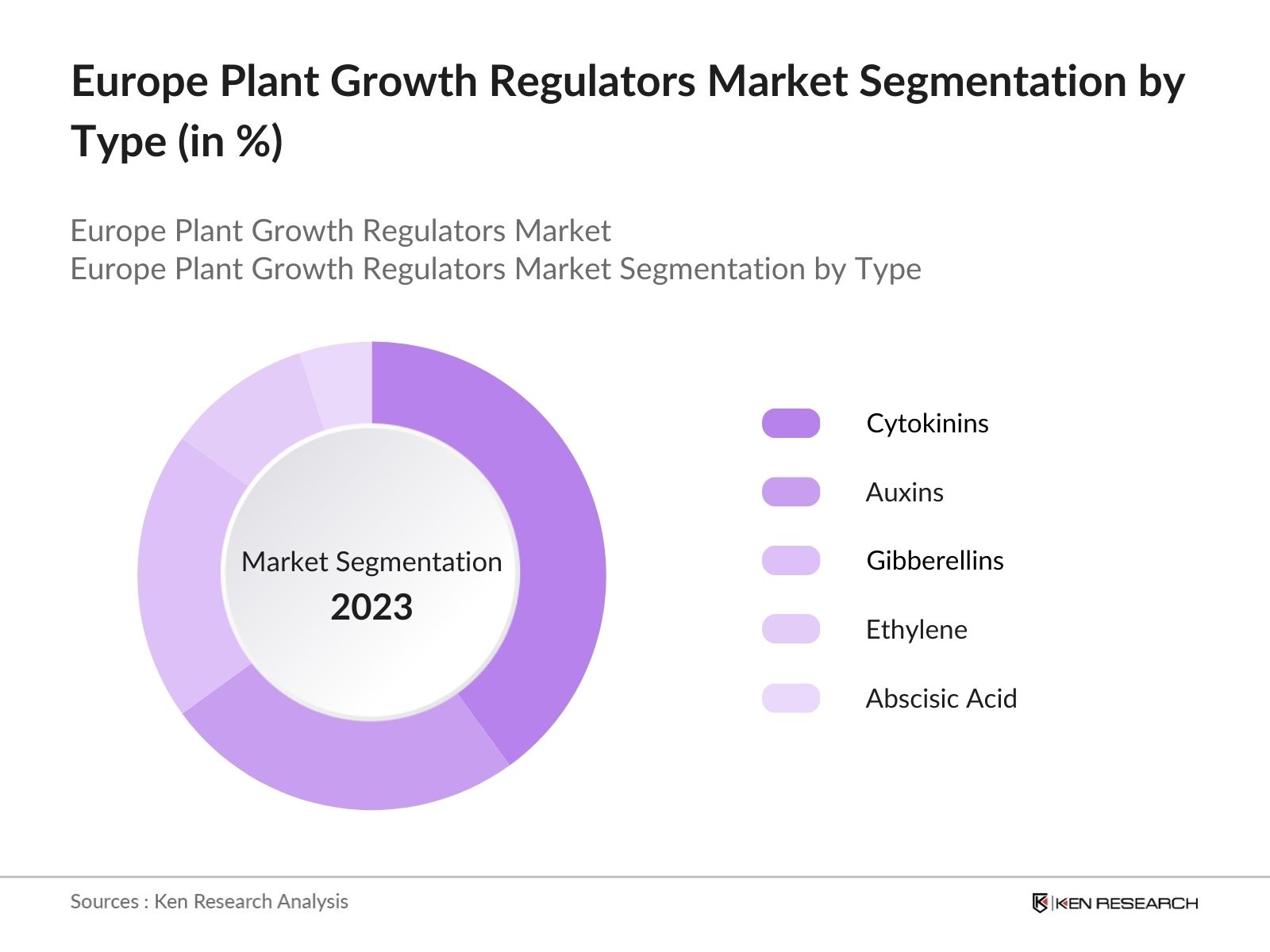

By Type: The market is segmented by type into cytokinins, auxins, gibberellins, ethylene, and abscisic acid. Among these, cytokinins hold a dominant market share due to their widespread use in enhancing plant tolerance to water deficiencies and protecting nitrogen assimilation processes during periods of stress. This demand for cytokinins has been growing as they are increasingly employed in fruit and vegetable farming, as well as in cereals and grains, to improve plant growth and development under harsh environmental conditions.

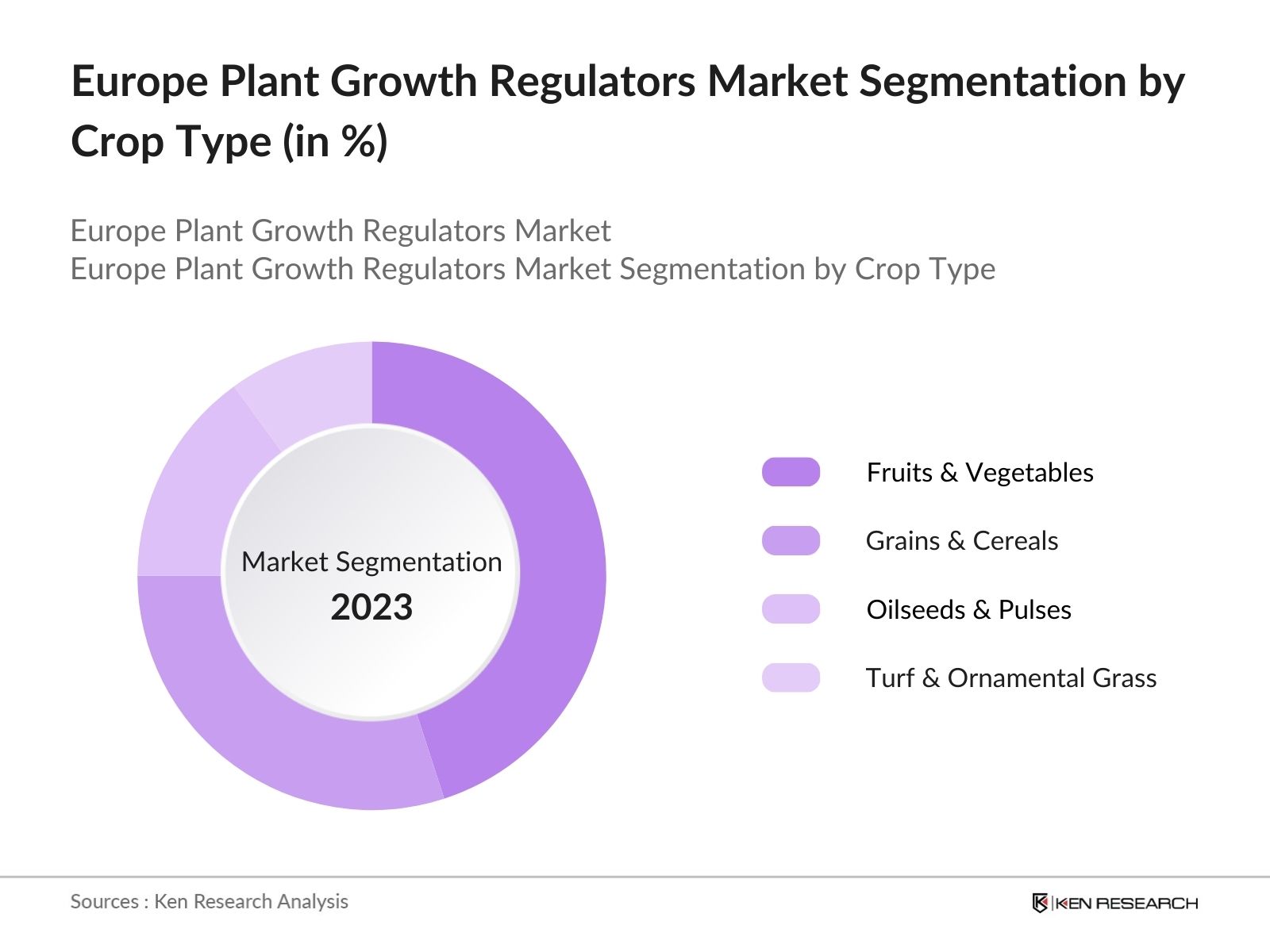

By Crop Type: The market is also segmented by crop type into fruits and vegetables, grains and cereals, oilseeds and pulses, and turf and ornamental grasses. In this segment, fruits and vegetables dominate the market. The extensive use of plant growth regulators in this sub-segment is primarily driven by the need to enhance crop yield and improve post-harvest qualities such as shelf life, color, and ripening. Europes focus on high-quality organic produce, particularly in countries like Spain and Italy, fuels the demand for these products in the fruits and vegetable segment.

Europe Plant Growth Regulators Market Competitive Landscape

The market is highly competitive, with major players investing in research and development to enhance their product portfolios and expand their market presence.

|

Company Name |

Establishment Year |

Headquarters |

R&D Investment |

Sustainability Focus |

Global Presence |

Key Product |

Market Strategy |

|

BASF SE |

1865 |

Ludwigshafen, Germany |

|||||

|

Bayer Crop Science |

1863 |

Leverkusen, Germany |

|||||

|

Corteva Agriscience |

2019 |

Wilmington, U.S. |

|||||

|

FMC Corporation |

1883 |

Philadelphia, U.S. |

|||||

|

Syngenta Group |

2000 |

Basel, Switzerland |

Europe Plant Growth Regulators Market Analysis

Market Growth Drivers

- Rising Demand for Organic Agriculture: The European region has seen a increase in demand for organic farming practices, leading to a greater need for plant growth regulators (PGRs) that are compatible with organic certifications. The European Union reported that in 2024, over 16.6 million hectares of land in Europe were under organic farming.

- Increasing Focus on Food Security: Due to concerns over food security exacerbated by geopolitical tensions and climate change, European governments have increased their focus on enhancing crop yield and resilience. In 2024, the European Commission allocated 1.2 billion toward agricultural innovation, including plant growth regulation research.

- Government Initiatives to Reduce Chemical Pesticides: The European Unions Green Deal, initiated in 2020, aims to reduce chemical pesticide use by 50% by 2030. By 2024, countries like France and Germany had already reduced pesticide use by 25%, shifting demand toward plant growth regulators as safer alternatives.

Market Challenges

- Stringent Regulatory Requirements: The European Union has some of the worlds strictest regulations concerning agrochemical products, including PGRs. The cost of registration and compliance with EU laws has been steadily rising, with estimates showing an increase of 10 million annually for industry-wide compliance costs.

- High Costs of Research and Development: Developing novel PGR products in Europe has become increasingly expensive. In 2024, European companies invested 450 million in PGR research, with each new product requiring an average development time of 8-10 years. The financial burden of R&D is especially high for smaller firms that lack access to significant capital.

Europe Plant Growth Regulators Market Future Outlook

Over the next five years, the Europe Plant Growth Regulators industry is expected to grow steadily, driven by the region's increasing focus on sustainable farming practices and the rising adoption of bio-based solutions.

Future Market Opportunities

- Increased Adoption of Biostimulant PGRs: Over the next 5 years, Europe will see a substantial rise in the adoption of biostimulant PGRs, driven by increasing demand for sustainable agricultural practices. Governments across Europe are expected to provide additional subsidies to farmers switching to bio-based PGRs.

- Development of Climate-Resilient PGRs: Given the increasing challenges posed by climate change, the European PGR market will shift toward products that enhance crop resilience to extreme weather conditions. In the coming years, it is expected that more than 70% of newly developed PGRs will focus on drought and flood resistance, with an additional 3 billion invested in research and product development by 2028.

Scope of the Report

|

By Type |

Cytokinins Auxins Gibberellins Ethylene Abscisic Acid Others |

|

By Crop Type |

Fruits & Vegetables Grains & Cereals Oilseeds & Pulses Turf & Ornamentals Others |

|

By Application |

Seed Treatment Foliar Spray Soil Drenching Others |

|

By Formulation |

Liquid Formulation Solid Formulation |

|

By Region |

North East West South |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Agricultural input manufacturers

Government and regulatory bodies (European Commission, EU Agricultural Ministries)

Private Equity Firms

Banks and Financial Institution

Agricultural cooperatives

Investor and venture capitalist firms

Companies

Players Mentioned in the Report:

BASF SE

Bayer Crop Science

Corteva Agriscience

Syngenta Group

FMC Corporation

Nufarm

Tata Chemicals Ltd.

UPL Ltd.

Sumitomo Chemical

Nippon Soda Co. Ltd.

Table of Contents

1. Europe Plant Growth Regulators Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Influence of EU Agricultural Policies)

1.4. Market Segmentation Overview

2. Europe Plant Growth Regulators Market Size (in USD Bn)

2.1. Historical Market Size (Impact of Organic Farming Growth)

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Europe Plant Growth Regulators Market Dynamics

3.1. Growth Drivers

3.1.1. Increasing Organic Farming Adoption

3.1.2. Regulatory Support for Sustainable Farming (EU's Green Deal)

3.1.3. Rising Demand for High-Quality Crops

3.1.4. Innovations in Crop-Specific PGR Products

3.2. Market Challenges

3.2.1. Complex Regulatory Compliance (Product Registration)

3.2.2. Limited Farmer Awareness of PGR Benefits

3.2.3. High Product Costs for Small-Scale Farmers

3.2.4. Lower Yield Compared to Chemical Fertilizers

3.3. Opportunities

3.3.1. Growth of Bio-Based PGRs

3.3.2. Precision Agriculture Adoption

3.3.3. Increased Focus on Sustainable Crop Practices

3.3.4. Technological Advancements in Nanotechnology

3.4. Trends

3.4.1. Demand for Multi-Component Formulations

3.4.2. Integration with Digital Agriculture Technologies

3.4.3. Rise of Bio-Stimulants and Eco-Friendly Solutions

4. Europe Plant Growth Regulators Market Segmentation

4.1. By Type (in Value %)

4.1.1. Cytokinins

4.1.2. Auxins

4.1.3. Gibberellins

4.1.4. Ethylene

4.1.5. Abscisic Acid

4.1.6. Others

4.2. By Crop Type (in Value %)

4.2.1. Fruits and Vegetables

4.2.2. Grains and Cereals

4.2.3. Oilseeds and Pulses

4.2.4. Turf and Ornamentals

4.3. By Application (in Value %)

4.3.1. Seed Treatment

4.3.2. Foliar Spray

4.3.3. Soil Drenching

4.4. By Formulation (in Value %)

4.4.1. Liquid Formulation

4.4.2. Solid Formulation

4.5. By Region (in Value %)

4.5.1. North

4.5.2. East

4.5.3. West

4.5.4. South

5. Europe Plant Growth Regulators Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. BASF SE

5.1.2. Bayer Crop Science

5.1.3. Corteva Agriscience

5.1.4. Syngenta Group

5.1.5. FMC Corporation

5.1.6. Nufarm

5.1.7. Tata Chemicals Ltd.

5.1.8. UPL

5.1.9. Sumitomo Chemical

5.1.10. Nippon Soda Co. Ltd.

5.1.11. Sipcam Oxon Spa

5.1.12. De Sangosse

5.1.13. DHANUKA AGRITECH LTD

5.1.14. Sichuan Guoguang Agrochemical

5.1.15. Zagro

5.2. Cross Comparison Parameters (Revenue, Product Portfolio, Global Presence, Innovation Focus)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers & Acquisitions

5.6. R&D Investment Analysis

6. Europe Plant Growth Regulators Market Regulatory Framework

6.1. EU Green Deal Agricultural Policies

6.2. Compliance with European Commission Regulations (Authorization, Registration)

6.3. Environmental Safety Standards

7. Europe Plant Growth Regulators Future Market Size (in USD Bn)

7.1. Future Market Size Projections

7.2. Key Drivers of Future Market Growth (Sustainability Practices, Rising Consumer Demand)

8. Europe Plant Growth Regulators Future Market Segmentation

8.1. By Type (in Value %)

8.2. By Crop Type (in Value %)

8.3. By Application (in Value %)

8.4. By Formulation (in Value %)

8.5 By Region (in Value %)

9. Europe Plant Growth Regulators Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Market Entry Strategies

9.4. White Space Opportunities

Research Methodology

Step 1: Identification of Key Variables

The first step involves mapping out key stakeholders in the Europe Plant Growth Regulators Market. This is achieved through desk research, utilizing secondary databases to gather relevant information. The main objective here is to define critical variables influencing the market, including regulatory changes and technological advancements in precision agriculture.

Step 2: Market Analysis and Construction

In this phase, historical data on the use of plant growth regulators is analyzed, with a focus on understanding the adoption rates across different segments such as fruits, vegetables, and cereals. This also includes assessing supply chain dynamics and distribution networks within Europe.

Step 3: Hypothesis Validation and Expert Consultation

The market hypotheses are validated through interviews with industry experts, including large-scale farmers, agrochemical manufacturers, and regulatory bodies. These consultations provide insights into the operational aspects of the market and validate the growth projections.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing data obtained from primary and secondary sources to create a comprehensive analysis of the Europe Plant Growth Regulators market. This includes evaluating product segments, market drivers, and competitive strategies employed by leading players.

Frequently Asked Questions

How big is the Europe Plant Growth Regulators Market?

The Europe Plant Growth Regulators market is valued at USD 1.45 billion, with growth driven by the region's focus on sustainable farming and the adoption of bio-based products.

What are the challenges in the Europe Plant Growth Regulators Market?

Challenges in the Europe Plant Growth Regulators market include stringent regulatory requirements for product registration, lack of awareness among small-scale farmers, and competition from chemical fertilizers.

Who are the major players in the Europe Plant Growth Regulators Market?

Key players in the Europe Plant Growth Regulators market include BASF SE, Bayer Crop Science, Corteva Agriscience, FMC Corporation, and Syngenta Group. These companies dominate due to their strong R&D capabilities and wide distribution networks.

What are the growth drivers for the Europe Plant Growth Regulators Market?

The Europe Plant Growth Regulators market is driven by the increasing demand for organic farming products, advancements in crop-specific PGR formulations, and the adoption of precision agriculture technologies.

What is the future outlook for the Europe Plant Growth Regulators Market?

The Europe Plant Growth Regulators market is expected to grow steadily over the next five years, with increasing government support for sustainable farming and innovations in bio-based PGR products.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.