Europe Polylactic Acid (PLA) Market Outlook to 2030

Region:Global

Author(s):Sanjna

Product Code:KROD8405

November 2024

99

About the Report

Europe Polylactic Acid (PLA) Market Overview

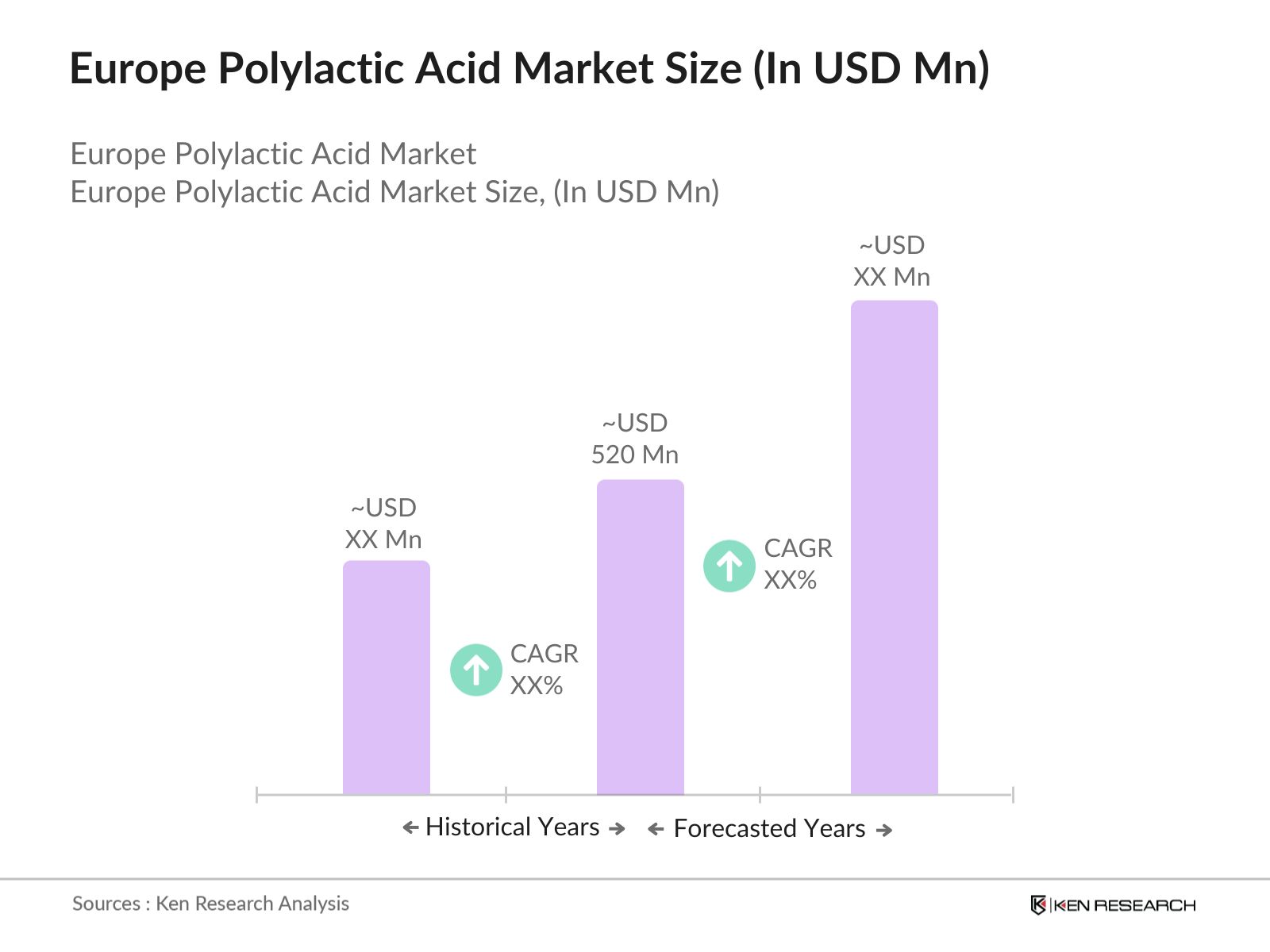

- The Europe Polylactic Acid (PLA) market is valued at USD 520 million based on a five-year historical analysis. The market's growth is primarily driven by the increasing demand for sustainable packaging solutions and the push towards biodegradable plastics across industries. Several governments in Europe have introduced stringent regulations to curb plastic waste, significantly influencing the adoption of PLA, a bio-based alternative.

- Germany, France, and the Netherlands are the dominant players in the Europe PLA market due to their advanced manufacturing infrastructure and strong commitment to sustainability initiatives. These countries have well-established recycling systems and favorable policies that promote the use of biodegradable materials. In particular, Germany's large automotive and packaging industries have been pivotal in driving the demand for PLA, while France's focus on reducing single-use plastics has accelerated its adoption.

- In line with the European Green Deal, the EUs carbon reduction initiatives are further encouraging the use of bioplastics like PLA. In 2023, the EU aimed to cut emissions by 15 million tonnes across the industrial sector, which has resulted in a shift towards sustainable materials that contribute to lower carbon footprints. PLA, as a bio-based polymer, plays a critical role in reducing emissions in packaging, textiles, and automotive industries.

Europe Polylactic Acid Market Segmentation

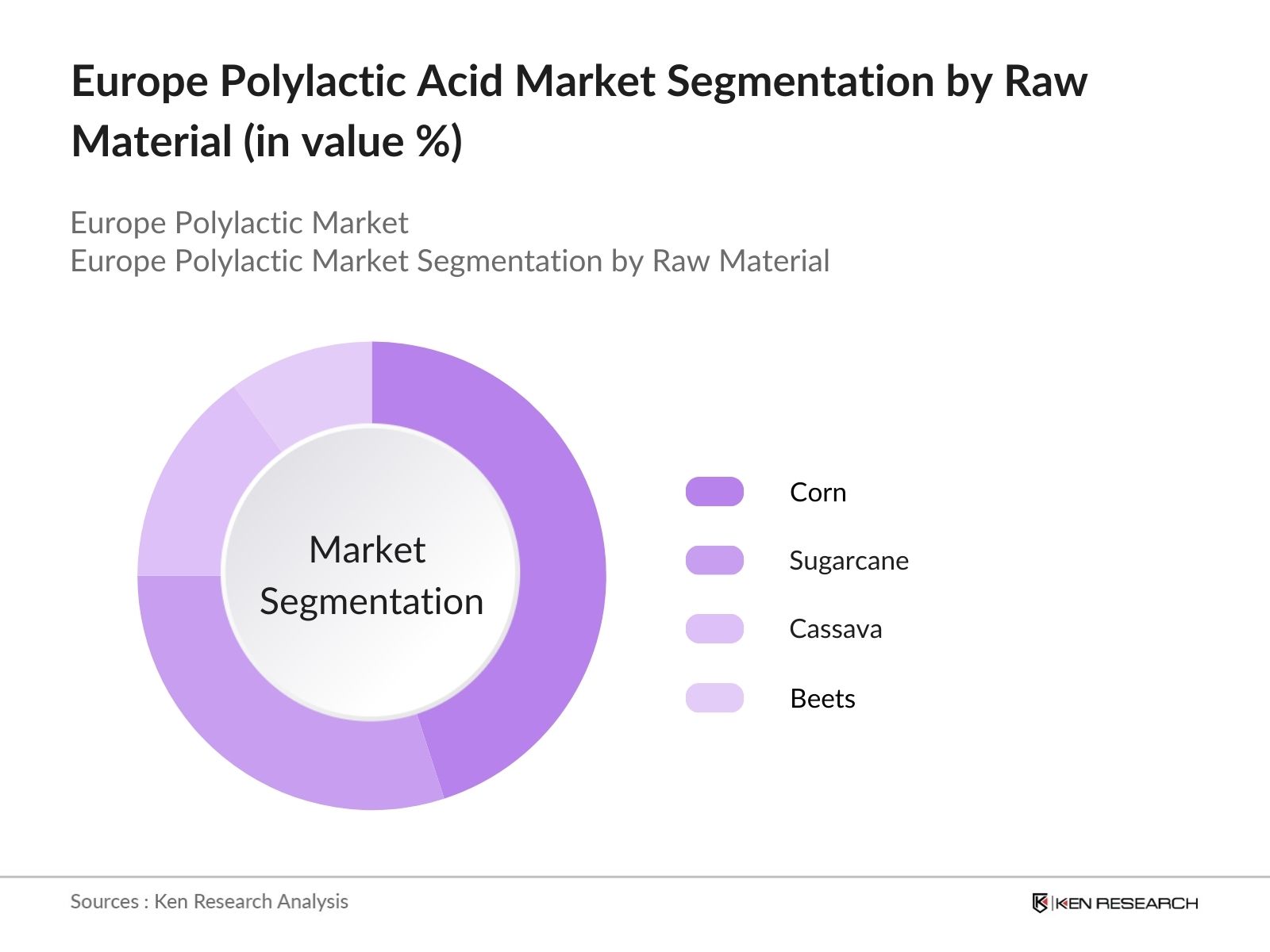

By Raw Material: Europes Polylactic Acid market is segmented by raw material into corn, sugarcane, cassava, and beets. Corn-based PLA has dominated the market in this segment due to its high availability and relatively lower production cost compared to other raw materials. Corn is widely grown across Europe, especially in countries like France and Germany, where there is significant agricultural activity. The abundant supply of corn makes it an affordable feedstock for PLA production, ensuring its continued dominance in this segment.

By End-User Industry: The market is segmented by end-user industries into packaging, agriculture, automotive, consumer goods, and electronics. Packaging dominates the Europe PLA market in this segmentation due to the increasing demand for eco-friendly and sustainable packaging solutions. The packaging industry is witnessing a shift from conventional plastics to biodegradable materials like PLA, especially in food and beverage packaging, where sustainability is a critical factor. The European Union's Single-Use Plastics Directive further drives this transition, ensuring that PLA-based packaging solutions continue to gain prominence.

Europe Polylactic Acid (PLA) Market Competitive Landscape

The Europe PLA market is dominated by several key players who have a significant market presence. These companies have invested heavily in research and development to improve PLA production efficiency and expand its applications across industries. Major players include NatureWorks LLC, Total Corbion PLA, and BASF SE, among others. The market is characterized by strong collaborations between these key players and end-user industries to develop innovative PLA products. The competitive landscape is marked by strong partnerships, technological advancements in bioplastics production, and increasing focus on sustainability initiatives.

Europe Polylactic Acid Market Analysis

Growth Drivers

- Government Regulations: The European Union (EU) has implemented strict regulations like the Single-Use Plastics Directive, banning products such as plastic cutlery and straws. This regulatory push is increasing demand for sustainable materials like Polylactic Acid (PLA), which aligns with EU goals for reducing plastic waste. In 2023, over 16.13 million tonnes of plastic waste were generated in the EU, and regulations like these have prompted industries to shift towards alternatives like PLA. This is directly influencing the adoption of biodegradable plastics across sectors.

- Shift Toward Sustainable Materials: With mounting concerns about plastic pollution, the shift towards sustainable and eco-friendly materials has gained momentum. By 2023, more than 25% of companies in Europe had adopted biodegradable materials, driven largely by growing consumer awareness and pressure from regulations. PLA, as a biodegradable polymer, has gained traction in packaging, textiles, and medical applications. The European Commission's efforts to reduce 32 million tonnes of plastic waste annually is encouraging industries to transition to bioplastics like PLA, increasing demand in packaging and consumer goods.

- Industrial Usage Growth: PLA's applications in industrial sectors, including automotive and agriculture, are expanding. For instance, the automotive sector in Europe adopted approximately 12,000 metric tonnes of PLA in 2023 for producing lighter, more fuel-efficient vehicle components. Industries are also leveraging PLA in medical implants and 3D printing. The growing industrial adoption of biodegradable polymers such as PLA is driven by the need to comply with EUs environmental targets, including reducing greenhouse gas emissions by 55% by 2030.

Challenges

- Feedstock Availability: In 2023, Europe imported around 6 million tonnes of corn for bioplastic production, but climate change and geopolitical issues impacted the supply chain, leading to constraints in sourcing these raw materials. This challenge creates uncertainty in the market and affects the consistency of production for bioplastics. The European Commissions focus on sustainability has also put additional pressure on sourcing renewable feedstocks domestically.

- High Production Costs: One of the major barriers for PLA adoption in Europe is its relatively high production cost compared to conventional plastics. In 2023, it was reported that the cost of producing PLA was approximately 30-40% higher than petroleum-based plastics, mainly due to the cost of raw materials and energy inputs. This cost disparity hinders widespread adoption, particularly in cost-sensitive sectors like packaging and textiles. The European Bioplastics Association also notes that production costs are expected to stabilize as technological advancements reduce reliance on costly feedstocks.

Europe Polylactic Acid Market Future Outlook

Europe Polylactic Acid market is expected to experience robust growth driven by the increasing push for sustainable solutions across multiple industries. As governments continue to implement stricter regulations on plastic usage and waste management, the demand for PLA will rise significantly. In addition, advancements in production technologies, particularly in making PLA more cost-effective and versatile, will open new avenues for its application in diverse sectors such as automotive, electronics, and consumer goods.

Market Opportunities

- Innovation in Production Technology: Technological advancements in PLA production are creating new opportunities for reducing costs and improving material properties. In 2023, several European manufacturers introduced novel fermentation and polymerization techniques that reduced energy consumption by 15%, according to the European Bioplastics Association. These innovations are expected to improve the scalability and cost-effectiveness of PLA production. This technological progress could help close the cost gap between PLA and conventional plastics, making it a more viable option for a wider range of industries.

- Expanding Applications in Automotive and Electronics: PLA is increasingly being adopted in the automotive and electronics sectors, especially in lightweight components. The electronics sector has also started integrating PLA into components like casings and insulation. These expanding applications represent significant growth opportunities, especially as manufacturers look for materials that align with the EUs carbon-neutrality goals.

Scope of the Report

|

Segments |

Sub-segments |

|

Raw Material |

Corn Sugarcane Cassava Beets |

|

End-User Industry |

Packaging Agriculture Automotive Consumer Goods Electronics |

|

Form |

Films and Sheets Coatings, Fibers Injection Molding |

|

Application |

Rigid Packaging Flexible Packaging Textiles Medical Devices 3D Printing |

|

Country |

Germany France United Kingdom Italy Spain Netherlands Belgium Sweden Poland Austria |

Products

Key Target Audience

PLA manufacturers and suppliers

Packaging industry players

Automotive industry stakeholders

Agricultural businesses

Consumer goods companies

Bioplastic technology developers

Investors and venture capitalist firms

Government and regulatory bodies (European Environment Agency, European Commission)

Companies

Players Mentioned in the Report

NatureWorks LLC

BASF SE

Total Corbion PLA

Danimer Scientific

Futerro

Synbra Technology BV

Teijin Limited

Green Dot Bioplastics

Sulzer Chemtech

Toyobo Co., Ltd.

Table of Contents

1. Europe Polylactic Acid Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Europe Polylactic Acid Market Size (In USD Billion)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Europe Polylactic Acid Market Analysis

3.1 Growth Drivers (Government Regulations, Shift Toward Sustainable Materials, Industrial Usage Growth, Consumer Demand for Biodegradable Products)

3.2 Market Challenges (Feedstock Availability, High Production Costs, Technical Limitations, Competition from Conventional Plastics)

3.3 Opportunities (Innovation in Production Technology, Expanding Applications in Automotive and Electronics, Strategic Partnerships, Circular Economy Initiatives)

3.4 Trends (Rise of Bioplastics in Packaging, Technological Innovations, Shift to Local Sourcing of Raw Materials, Increased Regulatory Scrutiny on Plastic Waste)

3.5 Government Regulations (EU Single-Use Plastics Directive, Circular Economy Action Plan, Carbon Reduction Initiatives, Recycling Mandates)

3.6 SWOT Analysis

3.7 Stake Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

4. Europe Polylactic Acid Market Segmentation

4.1 By Raw Material (In Value %)

4.1.1 Corn

4.1.2 Sugarcane

4.1.3 Cassava

4.1.4 Beets

4.2 By End-User Industry (In Value %)

4.2.1 Packaging

4.2.2 Agriculture

4.2.3 Automotive

4.2.4 Consumer Goods

4.2.5 Electronics

4.3 By Form (In Value %)

4.3.1 Films and Sheets

4.3.2 Coatings

4.3.3 Fibers

4.3.4 Injection Molding

4.4 By Application (In Value %)

4.4.1 Rigid Packaging

4.4.2 Flexible Packaging

4.4.3 Textiles

4.4.4 Medical Devices

4.4.5 3D Printing

4.5 By Country (In Value %)

4.5.1 Germany

4.5.2 France

4.5.3 United Kingdom

4.5.4 Italy

4.5.5 Spain

4.5.6 Netherlands

4.5.7 Belgium

4.5.8 Sweden

4.5.9 Poland

4.5.10 Austria

5. Europe Polylactic Acid Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 NatureWorks LLC

5.1.2 BASF SE

5.1.3 Total Corbion PLA

5.1.4 Danimer Scientific

5.1.5 Futerro

5.1.6 Synbra Technology BV

5.1.7 Teijin Limited

5.1.8 Green Dot Bioplastics

5.1.9 Sulzer Chemtech

5.1.10 Toyobo Co., Ltd.

5.2 Cross Comparison Parameters (Revenue, Headquarters, Product Portfolio, Sustainability Initiatives, Production Capacity, R&D Investments, Market Share, Strategic Alliances)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Europe Polylactic Acid Market Regulatory Framework

6.1 Sustainability and Environmental Standards

6.2 Compliance with EU Directives

6.3 Certification Processes (ISO Standards, EN Certifications, Green Certifications)

6.4 Product Labeling Requirements

7. Europe Polylactic Acid Future Market Size (In USD Billion)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Europe Polylactic Acid Future Market Segmentation

8.1 By Raw Material (In Value %)

8.2 By End-User Industry (In Value %)

8.3 By Form (In Value %)

8.4 By Application (In Value %)

8.5 By Country (In Value %)

9. Europe Polylactic Acid Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial stage involved constructing an ecosystem map that included all major stakeholders within the Europe PLA market. Extensive desk research was performed using secondary and proprietary databases to gather comprehensive industry-level data, including production capacities, raw material sourcing, and technology integration. Key variables were identified, focusing on their influence on market dynamics.

Step 2: Market Analysis and Construction

The second phase included compiling and analyzing historical market data, with a focus on production output, raw material costs, and demand fluctuations across key industries such as packaging and automotive. The assessment covered critical metrics such as market penetration and the ratio of bioplastic products in overall production.

Step 3: Hypothesis Validation and Expert Consultation

Industry-specific hypotheses were validated through in-depth interviews with key stakeholders in the PLA production and end-user industries. Consultation with bioplastic manufacturers provided direct insights into the challenges and opportunities within the PLA supply chain, complementing the findings from desk research.

Step 4: Research Synthesis and Final Output

In the final phase, the research was synthesized and reviewed for accuracy and completeness. Feedback from industry professionals was incorporated, and final market projections were created using bottom-up approaches, ensuring a precise analysis of the Europe PLA market.

Frequently Asked Questions

01. How big is the Europe Polylactic Acid market?

The Europe PLA market is valued at USD 520 million, driven by increasing demand for biodegradable plastics in packaging and other industries.

02. What are the challenges in the Europe Polylactic Acid market?

Challenges in Europe PLA market include high production costs, limited raw material availability, and competition from conventional plastic materials, which are often more cost-effective.

03. Who are the major players in the Europe Polylactic Acid market?

Key players in Europe PLA market include NatureWorks LLC, BASF SE, Total Corbion PLA, and Danimer Scientific, who dominate due to their advanced production technologies and strategic partnerships.

04. What are the growth drivers of the Europe Polylactic Acid market?

Growth drivers in Europe PLA market include government regulations promoting the use of biodegradable plastics, increasing consumer awareness about sustainability, and innovations in PLA production technology.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.