Europe Polymethyl Methacrylate Market Outlook to 2030

Region:Europe

Author(s):Meenakshi Bisht

Product Code:KROD7462

November 2024

85

About the Report

Europe Polymethyl Methacrylate Market Overview

- The Europe Polymethyl Methacrylate (PMMA) market, valued at USD 2.5 billion, is driven by its extensive applications across various industries. PMMA's properties, such as high transparency, UV resistance, and durability, make it a preferred material in sectors like automotive, construction, and electronics. The demand is further propelled by the automotive industry's shift towards lightweight materials and the construction sector's need for durable and aesthetically pleasing components.

- Germany and France are the dominant players in the European PMMA market. Germany's leadership stems from its robust automotive industry, which extensively utilizes PMMA for components like light covers and interior panels. France's dominance is attributed to its strong construction sector, where PMMA is used in applications such as windows, facades, and signage.

- European environmental standards, such as the EU Ecolabel, set criteria for the environmental performance of products, including PMMA. In September 2023, the European Commission established new EU Ecolabel criteria for various product groups, emphasizing reduced environmental impact throughout their life cycle. This initiative is part of a broader effort to enhance sustainability across different sectors, including absorbent hygiene products and reusable menstrual cups.

Europe Polymethyl Methacrylate Market Segmentation

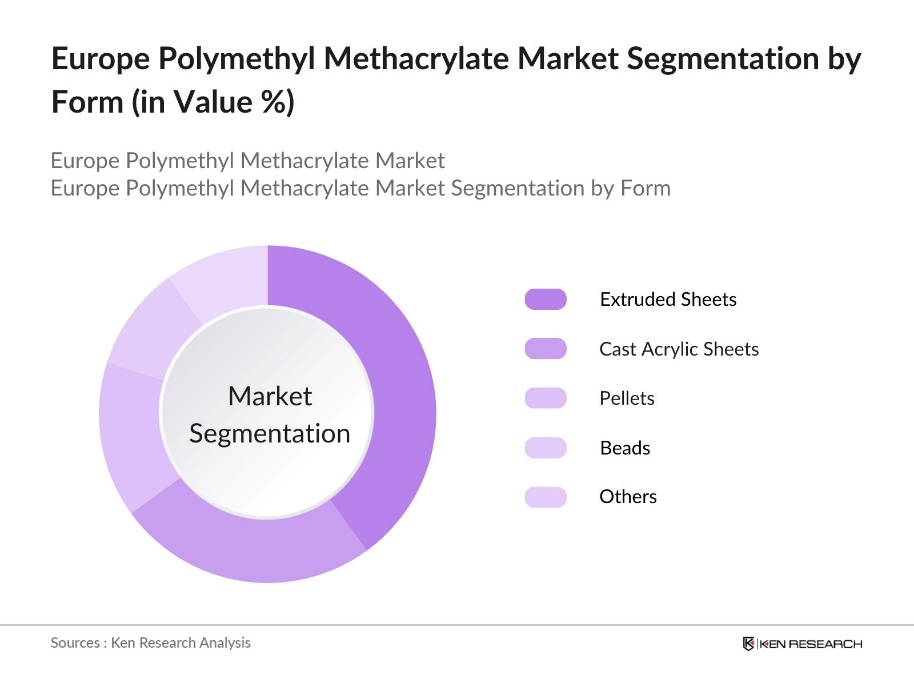

By Form: The market is segmented by form into extruded sheets, cast acrylic sheets, pellets, beads, and others. Extruded sheets hold a dominant market share due to their cost-effectiveness and versatility. They are widely used in applications like signage, displays, and glazing, where large, uniform sheets are required.

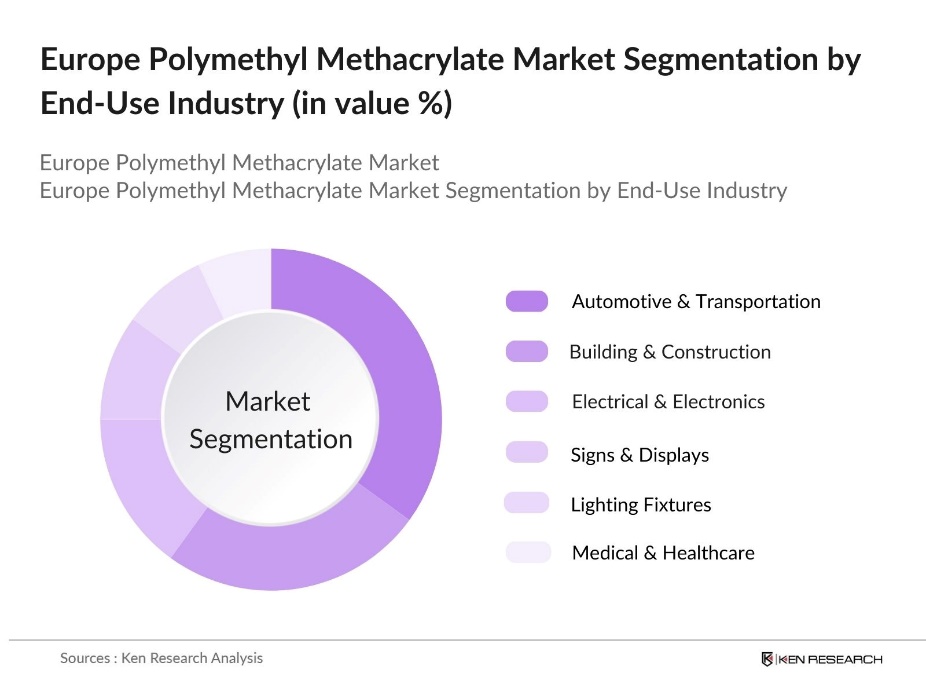

By End-Use Industry: The market is segmented by end-use industry into automotive & transportation, building & construction, electrical & electronics, signs & displays, lighting fixtures and medical & healthcare. The automotive & transportation segment leads the market, driven by the industry's focus on reducing vehicle weight to improve fuel efficiency and reduce emissions. PMMA's lightweight and durable properties make it ideal for automotive applications.

Europe Polymethyl Methacrylate Market Competitive Landscape

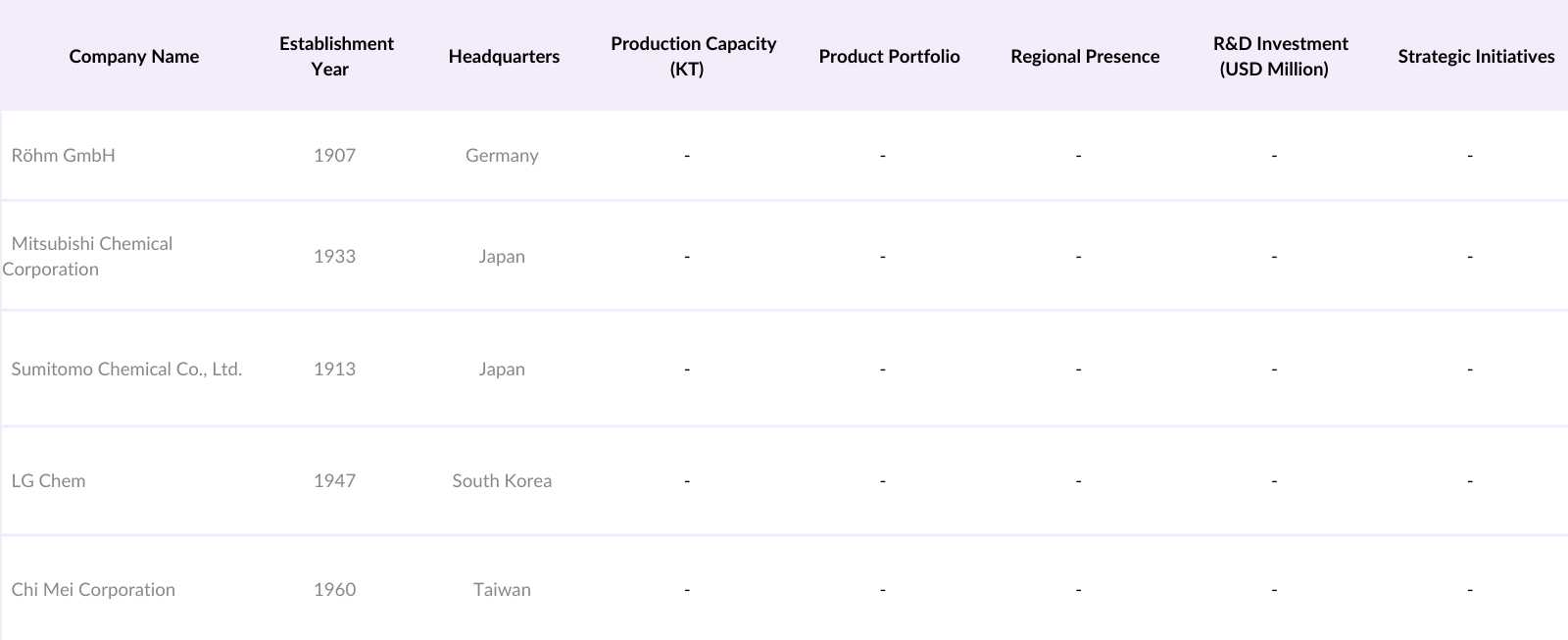

The Europe PMMA market is characterized by the presence of several key players who contribute significantly to the market dynamics. The market is dominated by established players such as Rhm GmbH and Mitsubishi Chemical Corporation, who have extensive production capacities and diverse product portfolios. These companies focus on strategic initiatives like mergers and acquisitions, product innovation, and capacity expansion to maintain their market positions.

Europe Polymethyl Methacrylate Industry Analysis

Growth Drivers

- Increasing Demand in Automotive Applications: The European automotive industry has been a significant consumer of Polymethyl Methacrylate (PMMA), utilizing it for components such as light covers, dashboards, and exterior panels due to its lightweight and durable properties. Germany produced approximately 4.1 million passenger cars in 2023. This substantial production volume underscores the automotive sector's reliance on PMMA for manufacturing lightweight and fuel-efficient vehicles.

- Expansion in Construction Activities: The construction sector in Europe has been a major driver for PMMA demand, particularly for applications like windows, skylights, and facades. The residential sector faced significant challenges in 2023, including a decline in new housebuilding by 6.2% and further expected declines of 8.6% in 2024. This growth reflects the increasing adoption of PMMA in building materials, driven by its durability and aesthetic appeal.

- Advancements in Electronics and Consumer Goods: The European electronics sector has embraced PMMA for products like LED screens, smartphones, and appliances due to its optical clarity and impact resistance. These qualities enhance durability and visual quality, making PMMA ideal for consumer electronics. As the demand for high-performance materials grows, PMMAs role in improving both functionality and aesthetics keeps it integral to meeting industry needs in this rapidly expanding market.

Market Challenges

- Fluctuating Raw Material Prices: PMMA production relies significantly on raw materials like methyl methacrylate (MMA), which are subject to price volatility due to market and supply chain fluctuations. This instability challenges PMMA manufacturers in maintaining cost-effective production, as shifts in raw material prices directly impact production expenses and profitability, pushing companies to find ways to manage these variable costs.

- Environmental Regulations and Sustainability Concerns: The European Union has introduced stringent environmental regulations to reduce plastic waste and promote recycling, creating pressure on PMMA producers to adopt sustainable practices. These policies encourage the development of recyclable and eco-friendly PMMA products, compelling manufacturers to innovate in response to rising environmental standards and compliance requirements within the EU market.

Europe Polymethyl Methacrylate Market Future Outlook

Over the next five years, the Europe PMMA market is expected to experience significant growth, driven by continuous advancements in PMMA applications and increasing demand across various industries. The automotive sector's focus on lightweight materials, the construction industry's need for durable and aesthetic components, and the electronics sector's demand for high-quality display materials are key factors propelling this growth.

Market Opportunities

- Technological Innovations in PMMA Production: Advancements in PMMA production, including the development of bio-based PMMA and enhanced polymerization methods, offer new growth opportunities. These innovations aim to reduce environmental impact and improve performance, aligning with industry goals for sustainable production. As companies invest in these technologies, PMMA production is evolving to meet both market demands and environmental expectations.

- Growth in Emerging European Markets: Eastern European countries are experiencing industrial expansion, driving increased demand for PMMA, especially in the construction and automotive sectors. This growing industrial activity reflects a rising need for PMMA-based materials, supporting infrastructure development and manufacturing growth across the region. Emerging markets in Eastern Europe present significant opportunities for PMMA producers seeking new areas for expansion.

Scope of the Report

|

By Form |

Extruded Sheets |

|

By Grade |

General Purpose Grade |

|

By End-Use Industry |

Automotive & Transportation |

|

By Country |

Germany United Kingdom |

Products

Key Target Audience

Automotive Manufacturers

Construction Companies

Electronics Manufacturers

Medical Device Manufacturers

Signage and Display Companies

Lighting Fixture Manufacturers

Consumer Goods Manufacturers

Government and Regulatory Bodies (e.g., European Chemicals Agency)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Rhm GmbH

Mitsubishi Chemical Corporation

Sumitomo Chemical Co., Ltd.

LG Chem

Chi Mei Corporation

Trinseo S.A.

Kolon Industries, Inc.

Arkema S.A.

Evonik Industries AG

BASF SE

Table of Contents

1. Europe PMMA Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Europe PMMA Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Europe PMMA Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Demand in Automotive Applications

3.1.2 Expansion in Construction Activities

3.1.3 Advancements in Electronics and Consumer Goods

3.1.4 Rising Adoption in Medical and Healthcare Sectors

3.2 Market Challenges

3.2.1 Fluctuating Raw Material Prices

3.2.2 Environmental Regulations and Sustainability Concerns

3.2.3 Competition from Alternative Materials

3.3 Opportunities

3.3.1 Technological Innovations in PMMA Production

3.3.2 Growth in Emerging European Markets

3.3.3 Increasing Use in Renewable Energy Applications

3.4 Trends

3.4.1 Shift Towards Bio-based PMMA

3.4.2 Integration of PMMA in 3D Printing Technologies

3.4.3 Development of High-Performance PMMA Grades

3.5 Regulatory Landscape

3.5.1 European Union Directives Impacting PMMA Usage

3.5.2 National Regulations and Compliance Requirements

3.5.3 Environmental Standards and Certifications

3.6 SWOT Analysis

3.7 Value Chain Analysis

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape

4. Europe PMMA Market Segmentation

4.1 By Form (In Value %)

4.1.1 Extruded Sheets

4.1.2 Cast Acrylic Sheets

4.1.3 Pellets

4.1.4 Beads

4.1.5 Others

4.2 By Grade (In Value %)

4.2.1 General Purpose Grade

4.2.2 Optical Grade

4.3 By End-Use Industry (In Value %)

4.3.1 Automotive & Transportation

4.3.2 Building & Construction

4.3.3 Electrical & Electronics

4.3.4 Signs & Displays

4.3.5 Lighting Fixtures

4.3.6 Medical & Healthcare

4.3.7 Consumer Goods

4.3.8 Others

4.4 By Country (In Value %)

4.4.1 Germany

4.4.2 France

4.4.3 United Kingdom

4.4.4 Italy

4.4.5 Spain

4.4.6 Rest of Europe

5. Europe PMMA Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Rhm GmbH

5.1.2 Mitsubishi Chemical Corporation

5.1.3 Sumitomo Chemical Co., Ltd.

5.1.4 LG Chem

5.1.5 Chi Mei Corporation

5.1.6 Trinseo S.A.

5.1.7 Kolon Industries, Inc.

5.1.8 Arkema S.A.

5.1.9 Evonik Industries AG

5.1.10 BASF SE

5.1.11 SABIC

5.1.12 Plaskolite, Inc.

5.1.13 Asahi Kasei Corporation

5.1.14 Kuraray Co., Ltd.

5.1.15 Wanhua Chemical Group Co., Ltd.

5.2 Cross Comparison Parameters (Revenue, Production Capacity, Product Portfolio, Regional Presence, R&D Investments, Strategic Initiatives, Market Share, Employee Strength)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Europe PMMA Market Regulatory Framework

6.1 Environmental Standards

6.2 Compliance Requirements

6.3 Certification Processes

7. Europe PMMA Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Europe PMMA Future Market Segmentation

8.1 By Form (In Value %)

8.2 By Grade (In Value %)

8.3 By End-Use Industry (In Value %)

8.4 By Country (In Value %)

9. Europe PMMA Market Analysts Recommendations

9.1 Total Addressable Market (TAM), Serviceable Available Market (SAM), Serviceable Obtainable Market (SOM) Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Europe PMMA Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Europe PMMA Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics is conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies and stakeholders. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple PMMA manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Europe PMMA market.

Frequently Asked Questions

01. How big is the Europe Polymethyl Methacrylate (PMMA) Market?

The Europe PMMA market is valued at USD 2.5 billion. It is driven by the materials extensive application across industries such as automotive, construction, and electronics, where PMMA is prized for its durability, transparency, and UV resistance.

02. What are the primary applications of PMMA in Europe?

Europe PMMA market is widely used in the automotive, construction, and electronics sectors. In the automotive industry, it serves as a lightweight, durable material for components like light covers and interior panels. In construction, PMMA is used for windows, facades, and signage due to its high transparency and UV resistance.

03. What are the growth drivers of the Europe PMMA Market?

The Europe PMMA market is primarily driven by increased demand from the automotive industry for lightweight materials and the construction industrys need for durable and aesthetically pleasing materials. Additionally, advancements in PMMA applications and sustainability initiatives are contributing to its growth.

04. Who are the major players in the Europe PMMA Market?

Key players in the Europe PMMA market include Rhm GmbH, Mitsubishi Chemical Corporation, Sumitomo Chemical Co., Ltd., LG Chem, and Chi Mei Corporation. These companies dominate the market through extensive production capacities, diverse product portfolios, and strategic investments in innovation and expansion.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.