Europe Quick Service Restaurants Market Outlook to 2030

Region:Europe

Author(s):Shreya Garg

Product Code:KROD6611

December 2024

98

About the Report

Europe Quick Service Restaurants Market Overview

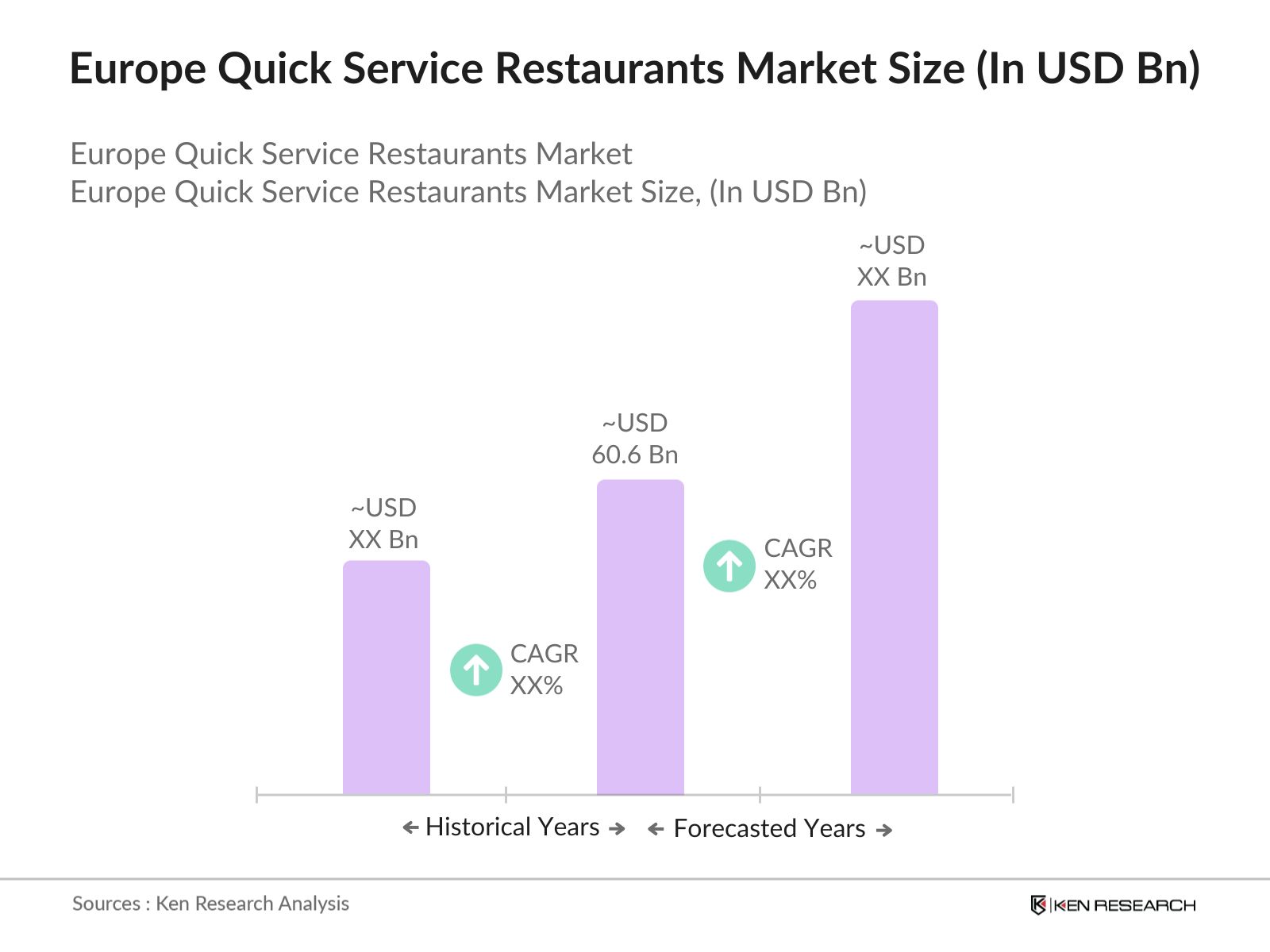

- The Europe Quick Service Restaurants (QSR) market is valued at USD 60.6 billion based on a five-year historical analysis. It is driven by a growing demand for convenience foods, the increasing popularity of digital platforms for food ordering, and the changing consumer lifestyles favoring quick meals. The demand for contactless payment solutions and enhanced hygiene standards post-pandemic further propels the markets expansion, along with urbanization and a fast-paced work culture.

- Countries like the United Kingdom, Germany, and France dominate the market, largely due to their well-established infrastructure for fast food outlets and a robust franchise presence. The cultural affinity for fast food in these nations, coupled with high disposable incomes and busy urban lifestyles, has made them leaders in this sector. Additionally, these countries host key global and local QSR brands, further cementing their dominance.

- Labor regulations across Europe, including minimum wage laws and restrictions on working hours, have a direct impact on QSR operations. In 2023, the European Commission introduced new wage regulations, including an increase in minimum wage rates in countries such as France, Germany, and Spain. These regulatory changes are designed to improve worker welfare but also present cost challenges for QSR operators, particularly in highly competitive markets.

Europe Quick Service Restaurants Market Segmentation

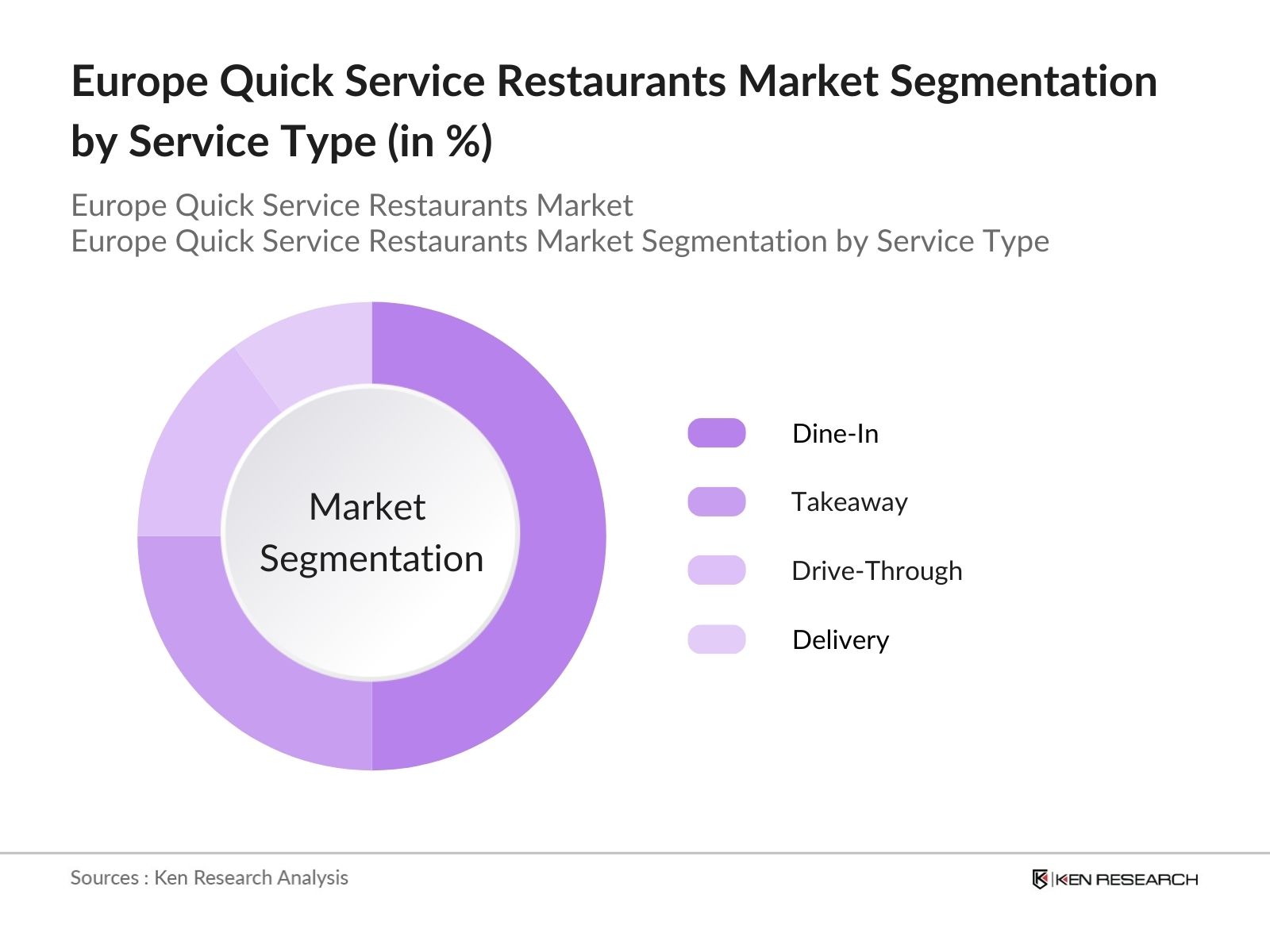

By Service Type: The market is segmented by service type into dine-in, takeaway, drive-through, and delivery. Recently, delivery services have gained a dominant market share, especially due to the rise of online food delivery platforms like Uber Eats, Deliveroo, and Just Eat. The convenience of ordering food from the comfort of home or office, paired with fast delivery services, has led to an increase in the preference for delivery options. The integration of AI and predictive technologies in these platforms, along with the growing inclination for contactless transactions, has solidified the delivery segment's leadership in the market.

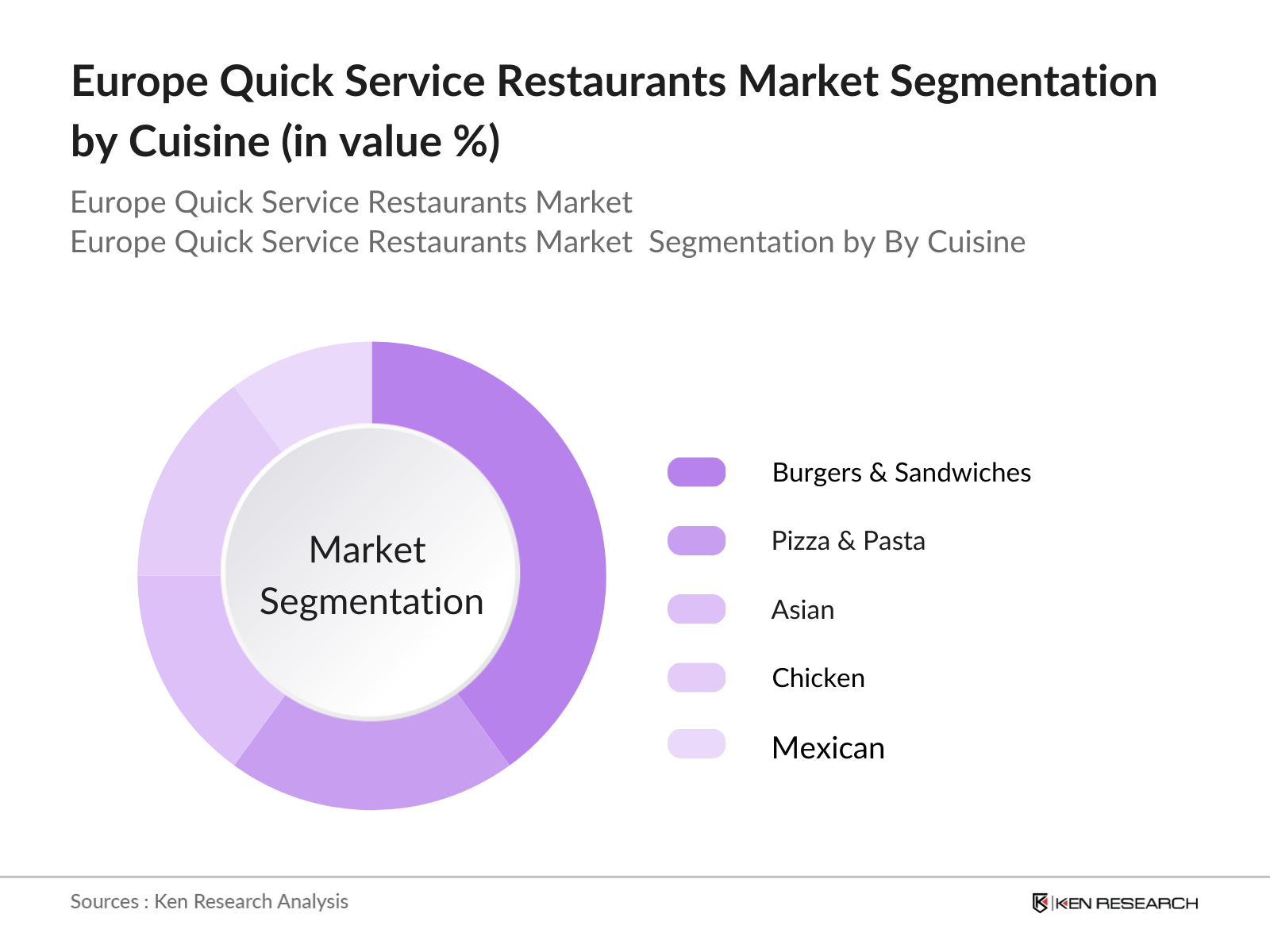

By Cuisine Type: In terms of cuisine type, burgers and sandwiches dominate the QSR market in Europe, with brands like McDonalds, Burger King, and Subway driving the segments growth. The widespread appeal of these food items, their affordability, and their convenient packaging have ensured their lasting popularity. Furthermore, consumers perceive burgers and sandwiches as ideal "on-the-go" options, making them particularly suitable for the fast-paced urban lifestyle. The wide availability of plant-based alternatives has also fueled this segments growth, attracting health-conscious consumers.

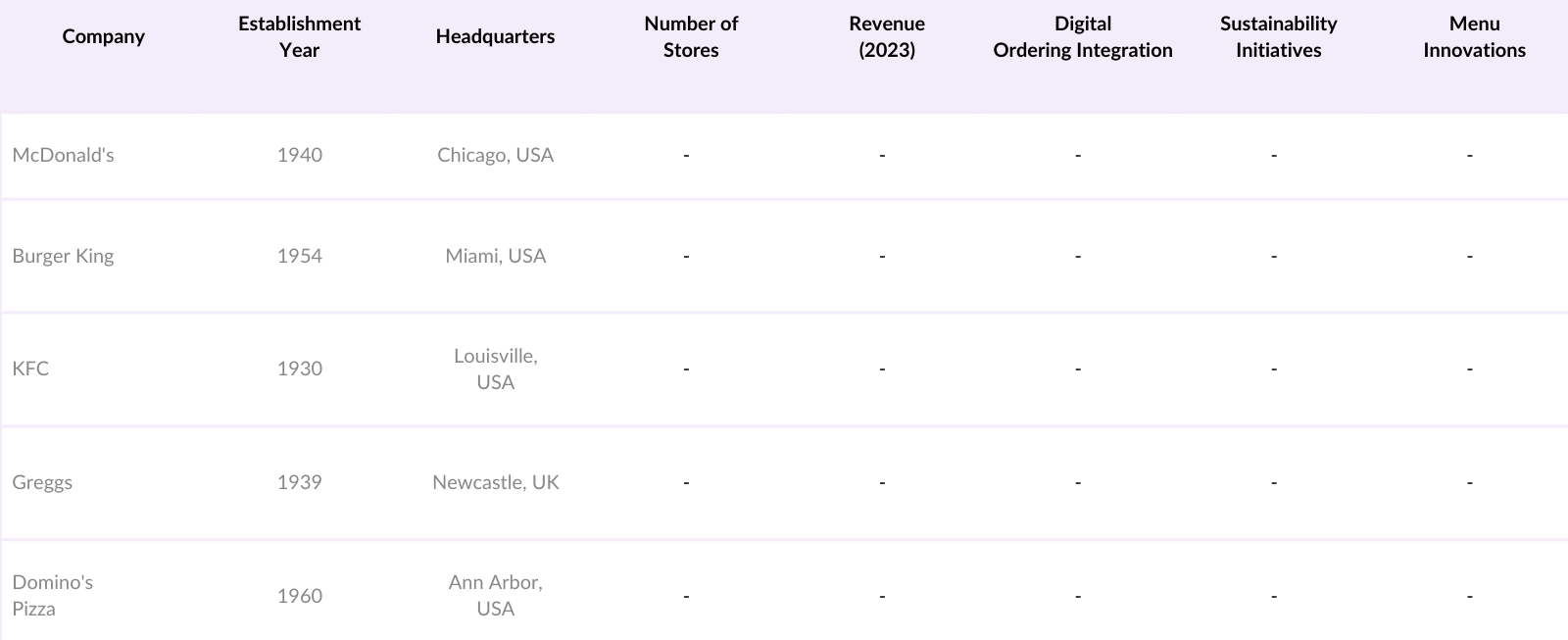

Europe Quick Service Restaurants Market Competitive Landscape

The Europe QSR market is dominated by global fast-food giants and a few regional players. This consolidation highlights the significant influence of these key companies, which benefit from strong brand loyalty, widespread franchise networks, and an emphasis on innovation, particularly in the digital space. Leading players like McDonalds and KFC have also adopted eco-friendly packaging and sustainability measures, addressing increasing consumer demand for responsible practices.

Europe Quick Service Restaurants Industry Analysis

Growth Drivers

- Urbanization and Shifting Consumer Preferences: Urbanization has accelerated across Europe, with over 80% of Europeans living in urban areas as of 2023, according to the World Bank. This urban growth has led to shifting consumer preferences, as people increasingly demand fast, convenient food options that cater to their busy lifestyles. Quick service restaurants (QSRs) have become a preferred choice in densely populated urban areas where time constraints and the need for affordable meals are paramount. The urban population is expected to continue growing steadily in 2024, intensifying the demand for QSRs to cater to this evolving consumer base.

- Expansion of Digital Ordering Platforms: Europe has seen a surge in digital ordering, with the penetration of online food ordering platforms growing exponentially. In 2023, over 30 million Europeans used online food delivery services, reflecting a substantial shift towards digital platforms. Countries like the UK, Germany, and France have adopted digital ordering technologies, where mobile apps and websites offer ease of ordering, payment, and delivery tracking. The European QSR market has integrated these technologies, capitalizing on the growing preference for digital ordering in urbanized and suburban regions.

- Growing Demand for Convenience Foods: The demand for convenience foods has grown due to shifting lifestyles across Europe, with more consumers prioritizing time efficiency in their daily routines. According to Eurostat, approximately 40% of Europeans were working over 40 hours per week in 2023, limiting time for meal preparation. Quick service restaurants provide an affordable and time-saving solution, appealing to the working-class population that values convenience. The European QSR market is benefitting from this shift, particularly in urban and high-traffic regions where on-the-go food options are crucial.

Market Challenges

- Increasing Competition from Delivery-Only Restaurants: The rise of delivery-only restaurants, often known as ghost kitchens, is creating significant competition for traditional QSRs across Europe. In 2023, approximately 10,000 ghost kitchens were operating in Europe, offering consumers a wide variety of delivery-only options. These establishments often have lower operating costs and are more adaptable to market demands, threatening the market share of brick-and-mortar QSRs. This shift is most prominent in densely populated urban centers like London, Paris, and Berlin, where delivery platforms are thriving.

- Fluctuating Input Costs: Volatility in raw material prices has become a persistent issue for European QSRs, particularly due to global supply chain disruptions caused by events like the Ukraine-Russia conflict. As of 2023, food commodity prices had increased by 20% in key European markets, including wheat and meat, which are core ingredients for many QSR products. This increase has squeezed profit margins and posed challenges for price-sensitive consumers, compelling QSRs to adopt cost-saving measures or adjust menu prices.

Europe Quick Service Restaurants Market Future Outlook

The Europe Quick Service Restaurants market is expected to continue its upward trajectory over the coming years, propelled by continuous advancements in technology, rising consumer demand for fast and convenient food solutions, and a shift toward healthier and sustainable menu options. Increasing investments in automation, AI, and robotics for streamlining kitchen operations and delivery services will also play a crucial role in shaping the market's future.

Future Market Opportunities

- Expansion into Emerging European Markets: As Western European markets approach saturation, QSR chains are exploring expansion into Eastern European markets, which present new opportunities for growth. Countries such as Poland, Romania, and Hungary have seen rising disposable incomes, with GDP per capita growing by over 5,000 USD between 2022 and 2024, according to the IMF. This economic growth has created a favorable environment for QSRs to expand their footprint in these regions, where consumer preferences are also evolving towards fast, affordable dining options.

- Growing Demand for Plant-Based and Sustainable Options: The demand for plant-based and sustainable menu options has seen a significant rise in Europe. As of 2024, the number of QSRs offering plant-based alternatives has increased by 35%, with countries like Germany and the UK leading the charge in sustainability. Additionally, the European Green Deal has set clear targets for reducing carbon emissions and promoting sustainable food practices, driving QSRs to adopt eco-friendly packaging and locally sourced ingredients to meet consumer demands and regulatory requirements.

Scope of the Report

|

Service Type |

Dine-In, Takeaway Drive-Through, Delivery |

|

Cuisine Type |

Burgers & Sandwiches Pizza & Pasta Asian Chicken Mexican |

|

Distribution Channel |

Franchised Stores Independent Stores Company-Owned Stores |

|

Pricing Level |

Premium Mid-Range Budget |

|

Country |

Germany France United Kingdom Italy Spain |

Products

Key Target Audience

Quick Service Restaurant Franchise Owners

Restaurant Equipment Suppliers

Food Delivery Platform Operators

Venture Capital and Private Equity Firms

Government and Regulatory Bodies (European Food Safety Authority, Local Health Departments)

Sustainable Packaging Suppliers

Plant-Based Food Producers

Consumer Electronics and Payment Solutions Providers

Companies

Major Players

McDonald's Corporation

Burger King

KFC

Subway

Domino's Pizza

Starbucks

Tim Hortons

Dunkin Donuts

Five Guys

Greggs

Pret A Manger

Pizza Hut

Costa Coffee

Vapiano

Leon Restaurants

Table of Contents

1. Europe Quick Service Restaurants Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Europe Quick Service Restaurants Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Europe Quick Service Restaurants Market Analysis

3.1. Growth Drivers

3.1.1. Urbanization and Shifting Consumer Preferences (Urbanization Trends, Consumption Patterns)

3.1.2. Expansion of Digital Ordering Platforms (Technology Adoption, Online Ordering Penetration)

3.1.3. Growing Demand for Convenience Foods (Changing Lifestyles, Time Constraints)

3.1.4. Innovations in Menu Offerings (Product Differentiation, Health and Sustainability Focus)

3.2. Market Challenges

3.2.1. Increasing Competition from Delivery-Only Restaurants (Market Saturation, Competitive Dynamics)

3.2.2. Fluctuating Input Costs (Raw Material Price Volatility, Supply Chain Disruptions)

3.2.3. Labor Shortages (Hiring Challenges, Regulatory Pressures)

3.3. Opportunities

3.3.1. Expansion into Emerging European Markets (Geographical Expansion, New Market Opportunities)

3.3.2. Integration of AI for Customer Experience Enhancement (Artificial Intelligence, Personalization)

3.3.3. Growing Demand for Plant-Based and Sustainable Options (Health & Sustainability Trends)

3.4. Trends

3.4.1. Sustainability Initiatives in Packaging and Ingredients (Eco-Friendly Packaging, Carbon Footprint Reduction)

3.4.2. Rise of Ghost Kitchens and Delivery-Only Models (Operational Efficiencies, Delivery Preferences)

3.4.3. Mobile and Contactless Payment Adoption (FinTech Integration, Seamless Customer Experience)

3.5. Government Regulation

3.5.1. Food Safety Standards (Hygiene and Safety Compliance)

3.5.2. Labor Laws and Wage Regulations (Minimum Wage Policies, Working Hours)

3.5.3. Sustainability and Environmental Regulations (Carbon Emission Targets, Packaging Restrictions)

3.6. SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

3.7. Stake Ecosystem (Stakeholders, Relationships, and Networks)

3.8. Porters Five Forces (Competitive Rivalry, Supplier and Buyer Power, Threat of New Entrants, Substitutes)

3.9. Competition Ecosystem (Market Structure, Industry Consolidation)

4. Europe Quick Service Restaurants Market Segmentation

4.1. By Service Type (In Value %)

4.1.1. Dine-In

4.1.2. Takeaway

4.1.3. Drive-Through

4.1.4. Delivery

4.2. By Cuisine Type (In Value %)

4.2.1. Burgers & Sandwiches

4.2.2. Pizza & Pasta

4.2.3. Asian

4.2.4. Chicken

4.2.5. Mexican

4.3. By Distribution Channel (In Value %)

4.3.1. Franchised Stores

4.3.2. Independent Stores

4.3.3. Company-Owned Stores

4.4. By Pricing Level (In Value %)

4.4.1. Premium

4.4.2. Mid-Range

4.4.3. Budget

4.5. By Country (In Value %)

4.5.1. Germany

4.5.2. France

4.5.3. United Kingdom

4.5.4. Italy

4.5.5. Spain

5. Europe Quick Service Restaurants Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. McDonald's Corporation

5.1.2. Burger King

5.1.3. KFC

5.1.4. Subway

5.1.5. Pizza Hut

5.1.6. Dominos Pizza

5.1.7. Starbucks

5.1.8. Costa Coffee

5.1.9. Tim Hortons

5.1.10. Dunkin Donuts

5.1.11. Taco Bell

5.1.12. Five Guys

5.1.13. Greggs

5.1.14. Pret A Manger

5.1.15. Vapiano

5.2. Cross Comparison Parameters (Number of Employees, Headquarters, Revenue, Store Locations, Regional Presence, Menu Innovation, Delivery Partners, Sustainability Practices)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Europe Quick Service Restaurants Market Regulatory Framework

6.1. Food Safety Standards and Compliance

6.2. Labor Law Compliance

6.3. Sustainability and Environmental Impact

7. Europe Quick Service Restaurants Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Europe Quick Service Restaurants Future Market Segmentation

8.1. By Service Type (In Value %)

8.2. By Cuisine Type (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Pricing Level (In Value %)

8.5. By Country (In Value %)

9. Europe Quick Service Restaurants Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research begins by mapping the entire ecosystem of the Europe Quick Service Restaurants market, identifying key stakeholders, including restaurant owners, franchise operators, delivery platforms, and regulatory bodies. This stage relies on both secondary research and proprietary databases to ensure accurate and up-to-date data collection.

Step 2: Market Analysis and Construction

The next step involves compiling historical data and current market trends in the QSR industry. This includes analyzing the penetration of QSR chains, delivery platforms, and the total revenue generated by these players. Service performance indicators and customer satisfaction ratings are also reviewed to ensure comprehensive market assessments.

Step 3: Hypothesis Validation and Expert Consultation

Key industry hypotheses are tested through consultations with industry professionals, including QSR chain managers, digital platform providers, and food service equipment suppliers. These interviews, conducted through CATIs, provide insight into operational efficiency and market dynamics.

Step 4: Research Synthesis and Final Output

In the final stage, the data from QSR chains and delivery platforms is synthesized to provide a comprehensive overview of the market. Information on emerging trends, customer preferences, and technology adoption helps form a validated and detailed report, ensuring accuracy in market analysis and segmentation.

Frequently Asked Questions

01. How big is the Europe Quick Service Restaurants market?

The Europe Quick Service Restaurants market is valued at USD 60.6 billion, driven by rising consumer demand for fast food options, the increasing use of digital ordering platforms, and a shift towards healthier and sustainable menu offerings.

02. What are the key challenges in the Europe QSR market?

Challenges in the QSR market include rising raw material costs, labor shortages, and the growing competition from delivery-only restaurants. Adapting to consumer preferences for healthier and eco-friendly options also presents a challenge for many traditional fast-food chains.

03. Who are the major players in the Europe QSR market?

Key players in the market include McDonald's Corporation, Burger King, KFC, Subway, and Domino's Pizza. These companies dominate due to their extensive franchise networks, strong brand recognition, and significant digital investments.

04. What are the growth drivers of the Europe QSR market?

The market is propelled by factors such as urbanization, rising disposable incomes, and increasing consumer demand for convenience. The proliferation of digital food ordering platforms and the adoption of contactless payment solutions also drive market growth.

05. What trends are shaping the Europe QSR market?

Key trends in the market include the rise of ghost kitchens, the growing demand for plant-based menu options, and the increasing focus on sustainability, particularly in terms of packaging and waste reduction.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.